The Russian Ministry of Finance issued Order No. 35n of the Ministry of Finance dated February 28, 2018. It was officially published on April 23, 2021. This order changes the BCC for penalties and fines on insurance premiums. New BCCs have also been introduced for payments for the use of natural resources. According to the conclusion of the Ministry of Justice of Russia, this document does not require state registration - Letter of the Ministry of Justice of Russia dated April 19, 2018 N 01/53268-YUL. Therefore, apparently, the new BCCs need to be taken into account as early as April 23, 2021. We have prepared a short overview of the changes and a table with new codes.

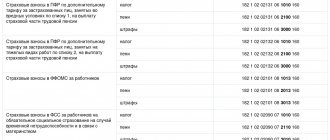

New BCCs for insurance contributions to the Pension Fund from April 23, 2021

On April 23, 2021, an order of the Russian Ministry of Finance adjusted the BCC for penalties, fines and interest on insurance pension contributions paid at additional tariffs.

Main changes in insurance premiums for employees entitled to early retirement. If the employer has not carried out a special assessment of working conditions at the workplaces of such employees, then the tariff is 9% or 6% depending on the category of employees. If there are results of a special assessment, then for each category of employee additional tariff differentiation is provided depending on the class and subclass of working conditions.

Until April 23, the dependence of the KBK on the conduct or non-conduct of a special assessment was established only for the payment of insurance premiums under the additional tariff and was unchanged for all categories of workers for whom such contributions are transferred. Whereas the budget classification differentiated penalties, fines, and interest on payments by periods (before and after January 1, 2021). From April 23, 2021, penalties, fines and interest are differentiated depending on whether the rate of insurance premiums depends on the results of a special assessment of working conditions.

Insurance premiums at an additional tariff for workers employed in underground work, in work with hazardous working conditions and in hot shops, for the payment of an insurance pension

KBK

Edition valid from 04/23/2018

182 1 0210 160

The contributions themselves, including arrears or recalculation, if the tariff does not depend on the results of a special labor assessment

182 1 0220 160

The contributions themselves, including arrears or recalculation if the tariff depends on the results of a special labor assessment

182 1 0200 160

Penalties if the additional tariff depends on the results of the special assessment

182 1 0210 160

Penalties if the additional tariff does not depend on the results of the special assessment

182 1 0200 160

Interest on payment if the additional tariff depends on the results of the special assessment

182 1 0210 160

Interest on payment if the additional tariff does not depend on the results of the special assessment

182 1 0282 160

Monetary penalties and fines if the additional tariff depends on the results of the special assessment

182 1 0210 160

Monetary penalties and fines if the additional tariff does not depend on the results of the special assessment

182 1 0282 160

182 1 0282 160

Interest on overpaid (collected) amounts, as well as when they are not returned on time, if the additional tariff depends on the results of the special assessment

182 1 0210 160

Interest on overpaid (collected) amounts, as well as when they are not returned on time, if the additional tariff does not depend on the results of the special assessment

Insurance premiums at an additional tariff for other employees entitled to early retirement for payment of an insurance pension

KBK

Edition valid from 04/23/2018

182 1 0210 160

The payment of contributions itself, including arrears or recalculation, if the tariff does not depend on the results of a special labor assessment

182 1 0220 160

The payment of contributions itself, including arrears or recalculation, if the tariff depends on the results of a special labor assessment

182 1 0200 160

Penalties if the additional tariff depends on the results of the special assessment

182 1 0210 160

Penalties if the additional tariff does not depend on the results of the special assessment

182 1 0200 160

Interest on payment if the additional tariff depends on the results of the special assessment

182 1 0210 160

Interest on payment if the additional tariff does not depend on the results of the special assessment

182 1 0282 160

Monetary penalties and fines if the additional tariff depends on the results of the special assessment

182 1 0210 160

Monetary penalties and fines if the additional tariff does not depend on the results of the special assessment

182 1 0282 160

182 1 0282 160

Interest on overpaid (collected) amounts, as well as when they are not returned on time, if the additional tariff depends on the results of the special assessment

182 1 0210 160

Interest on overpaid (collected) amounts, as well as when they are not returned on time, if the additional tariff does not depend on the results of the special assessment

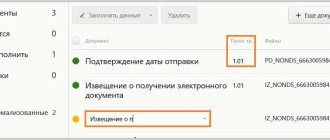

What's happened?

The Russian Ministry of Finance approved order No. 35n dated February 28, 2018, which contains 21 new BCCs, according to which penalties, fines and interest on insurance premiums for compulsory pension insurance, calculated at additional tariffs, are credited to the budget. In addition, the document contains several clarifications and the abolition of the BCC, which is used by individual entrepreneurs when transferring insurance premiums in a fixed amount, calculated from income received in excess of 300 thousand rubles. Another 4 BCCs are intended to transfer penalties and fines for additional contributions for injuries for organizations with hazardous working conditions. The document has already been registered by the Ministry of Justice and came into force on April 23, 2021. Therefore, entrepreneurs and employers must use the new BCCs in payment orders.

The Ministry of Finance approved 21 new BCCs for paying insurance premiums

The codes for payment of penalties, interest and fines in relation to pension contributions at an additional rate for employees engaged in “harmful” work have also changed. BCCs now depend on whether the policyholder has conducted a special assessment of working conditions. The codes for paying the fees themselves at the additional rate remain the same.

Individual entrepreneurs who pay fixed insurance premiums “for themselves,” as well as insurance organizations, need to pay special attention to the BCC when transferring them.

New BCCs for insurance premiums from April 23, 2021

Hello, in this article we will try to answer the question “New BCCs for insurance premiums from April 23, 2019.” You can also consult with lawyers online for free directly on the website.

If the individual entrepreneur’s income for the reporting period (for the year) did not exceed 300,000 rubles, then it is necessary to pay only the fixed amount of contributions specified in the law. If at the end of the year the entrepreneur receives an income of over 300,000 rubles, then 1% of the profit received is added to this fixed amount.

Insurance premiums for compulsory health insurance in 2018 must be transferred not to the Pension Fund of the Russian Federation, as before, but to the Federal Tax Service. Individual entrepreneurs pay contributions for compulsory health insurance for themselves in a fixed amount, and if there are employees, from the salaries of employees.

KBK on additional tariffs in the Pension Fund for employees

| KBK for insurance premiums for employees | ||

| Contributions to the Pension Fund of the Russian Federation for compulsory pension insurance (basic tariff) | ||

| contributions | penalties | fine |

| 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

| Social insurance contributions to the Social Insurance Fund for social insurance | ||

| contributions | penalties | fine |

| 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

| Contributions to health insurance in the Compulsory Medical Insurance Fund for health insurance | ||

| contributions | penalties | fine |

| 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

| Contributions for injuries to the Social Insurance Fund | ||

| contributions | penalties | fine |

| 393 1 0200 160 | 393 1 0200 160 | 393 1 0200 160 |

KBK are needed to fill out payment orders. For samples of payment slips, see the article Samples of payment slips for personal income tax and contributions from January 1, 2018

Table 1

table 2

KBK for taxes and insurance premiums - 2021

The list of codes is supplemented by two BCCs for penalties for non-payment of the recycling fee for self-propelled vehicles and trailers for them imported into the Russian Federation from Belarus and other countries (approved by order of the Ministry of Finance of the Russian Federation dated September 20, 2018 N 198n).

Let's use the previous example, only now imagine that in April 2021, Alfa JSC discovered an error in calculating the amounts of insurance premiums for 2021. After filling out the updated calculation, it became clear that the debt to the Pension Fund was equal to 6,554 rubles. Seizure of property for the purpose of its further sale to pay off tax debts (this action is used extremely rarely.

Starting from 2021, tax authorities will receive quarterly information from companies not only about personal income tax based on the 6-NDFL calculation, but also about insurance premiums based on a single calculation. If discrepancies in the database seem suspicious to tax authorities, they will ask for clarification.

Vestibulum eget tincidunt elit, viverra auctor turpis. Maecenas ut ultricies felis, vel tempus lacus. Donec efficitur gravida nunc, at mollis lacus rutrum porta. NULLam luctus aliquam faucibus.

Let us remind you that in past years, entrepreneurs also had the opportunity to reduce this tax according to different rules. Everything depended on whether entrepreneurs used hired labor in their work. However, adjustments were made in 2021 that will remain in effect this year.

For this payment, the state has set an upper limit, above which the amount of the contribution cannot be. This indicator is equal to eight times the fixed contribution to pension insurance, multiplied by the coefficient for contributions to the pension fund and multiplied by 12.

Individual entrepreneurs who apply a single tax on imputed income (UTII) have the opportunity to reduce the amount of tax on this payment. Simply put, it refers only to the estimated amount and not to the tax base or imputed income. This article will discuss how to reduce UTII by the amount of insurance premiums in 2021.

Payments must be made using the new KBK classifier codes. From 2021, the recipient of such payments is the tax office.

Over the course of two decades, it has turned into a developed structure with significant organizational and technical resources and highly professional human resources.

BCC (Budget Classification Code) is a required field that every accountant fills in when paying fees. If you make a mistake, the money will not end up in the company’s personal account with the tax office.

The goal of our company is to increase the efficiency and profitability of your business by transferring some functions to Caswell Group specialists.

Legislative acts on the topic of payment order to the Pension Fund of Russia

BCC for insurance premiums is a mandatory payment order detail that determines the group of budget revenues and is used to pay taxes and insurance contributions to the budget of the Russian Federation. We explain what is meant by insurance premiums and how insurance premiums will be transferred in 2021. We will present the BCC for basic payments in the form of tables.

A tax of 15% is paid quarterly. Back in 2014, a bill was put forward to transfer all taxpayers to the patent system and abolish UTII. The reason was the same tax payment conditions for entrepreneurs with different income levels. The final decision was made in 2021 and included the elimination of the tax in 2021.

For some, filling out a payment document online will seem like the easiest option due to the fact that you won’t have to look for forms and spend a lot of time dealing with new filling out rules.

Significant changes have been made to the BCC for contributions. They touched upon the KBC for transferring penalties and fines on insurance premiums. The new codes must be applied from April 14.

Payee in a payment order for insurance premiums

The order provides for a transition period during which it will be possible to choose from 2 BCCs (new and old), both of which will be considered valid.

The established deadline for paying contributions for employers is the 15th day of the month following the month of accrual; if it is a day off, then the first working day after it.

Insurance premium rates for 2021 are governed by the provisions of Articles 426–429 of the Tax Code. When setting the insurance premium rate for 2021, it is important to consider:

- what category of payers the company or individual entrepreneur belongs to (whether a general or reduced tariff will be applied);

- what category does the individual in whose favor the payments were made belong to;

- how much was paid to an individual during the year (whether the amount exceeds the maximum base or not).

Please note that all payments, except the last one, are made according to the BCC with the first three digits 182. This means that the recipient of the payment is the tax office.

KBK 2021, KBK budget classification codes for 2021

| Excise taxes on goods produced in Russia | |||

| ethyl alcohol from food raw materials. In addition to distillates of wine, grape, fruit, cognac, Calvados, whiskey | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| ethyl alcohol from non-food raw materials | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| wine, grape, fruit, cognac, calvados, whiskey distillates | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| alcohol-containing products | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| tobacco products | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| electronic nicotine delivery systems | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| nicotine-containing liquids | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| tobacco and tobacco products intended for consumption by heating | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| automobile gasoline | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| straight-run gasoline | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| cars and motorcycles | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| diesel fuel | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| motor oils for diesel, carburetor (injection) engines | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| fruit, sparkling (champagne) and other wines, wine drinks, without rectified ethyl alcohol | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| beer | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| alcoholic products with a volume fraction of ethyl alcohol over 9 percent. Except beer, wines, wine drinks, without rectified ethyl alcohol | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| alcoholic products with a volume fraction of ethyl alcohol up to 9 percent. Except beer, wines, wine drinks, without rectified ethyl alcohol | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| cider, poiret, mead | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| benzene, paraxylene, orthoxylene | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| aviation kerosene | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| middle distillates | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| wines with a protected geographical indication, with a protected designation of origin, except for sparkling wines (champagnes) | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| sparkling wines (champagnes) with a protected geographical indication, with a protected designation of origin | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise duties on goods imported from member states of the Customs Union (payment of excise duty through tax inspectorates) | |||

| ethyl alcohol from food raw materials. In addition to distillates of wine, grape, fruit, cognac, Calvados, whiskey | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| distillates – wine, grape, fruit, cognac, calvados, whiskey | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| cider, poiret, mead | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| ethyl alcohol from non-food raw materials | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| alcohol-containing products | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| tobacco products | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| electronic nicotine delivery systems | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| nicotine-containing liquids | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| tobacco and tobacco products intended for consumption by heating | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| automobile gasoline | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| cars and motorcycles | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| diesel fuel | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| motor oils for diesel, carburetor (injection) engines | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| fruit, sparkling (champagne) and other wines, wine drinks, without rectified ethyl alcohol | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| beer | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| alcoholic products with a volume fraction of ethyl alcohol over 9 percent. Except beer, wines, wine drinks, without rectified ethyl alcohol | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| alcoholic products with a volume fraction of ethyl alcohol up to 9 percent. Except beer, wines, wine drinks, without rectified ethyl alcohol | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| straight-run gasoline | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| middle distillates | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on goods imported from other countries (payment of excise duty at customs) | |||

| ethyl alcohol from food raw materials. In addition to distillates of wine, grape, fruit, cognac, Calvados, whiskey | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| distillates – wine, grape, fruit, cognac, calvados, whiskey | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| cider, poiret, mead | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| ethyl alcohol from non-food raw materials | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| alcohol-containing products | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| tobacco products | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| electronic nicotine delivery systems | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| nicotine-containing liquids | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| tobacco and tobacco products intended for consumption by heating | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| automobile gasoline | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| cars and motorcycles | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| diesel fuel | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| motor oils for diesel, carburetor (injection) engines | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| fruit, sparkling (champagne) and other wines, wine drinks, without rectified ethyl alcohol | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| beer | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| alcoholic products with a volume fraction of ethyl alcohol over 9 percent. Except beer, wines, wine drinks, without rectified ethyl alcohol | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| alcoholic products with a volume fraction of ethyl alcohol up to 9 percent. Except beer, wines, wine drinks, without rectified ethyl alcohol | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| straight-run gasoline | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| middle distillates | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

rf.biz

KBC for individual entrepreneurs' insurance premiums in 2021

Let us remind you that in past years, entrepreneurs did not have the legal right to reduce the amount of UTII payments. This was due to unequal conditions between individual entrepreneurs on the simplified taxation system (STS) and individual entrepreneurs on UTII. To bring justice, officials adopted a number of amendments to Federal Law No. 178-FZ.

The legislation establishes the following deadlines:

fixed contributions - until December 31 of the current year;

from 1% excess – until July 1 of the next year.

Let us remind you that from July 1, 2021, the “Direct Payments” project is being implemented in the Voronezh region, according to which benefits to working citizens are paid directly by the regional branch of the Social Insurance Fund of the Russian Federation. The new social security mechanism will allow employers not to divert working capital to pay benefits. When choosing a KBK, you should be guided by Order of the Ministry of Finance dated 06/08/2018 No. 132n. They mostly correspond to the codes used in 2021. When paying contributions for periods earlier than 01/01/2017, you must apply different BCCs - all of them are reflected in our tables below.

Payments for compulsory pension, medical and social (VNiM) insurance are transferred to the territorial tax inspectorates - the Federal Tax Service. According to the norms of 125-FZ, insurance against accidents at work and occupational diseases is sent to the local body of the Social Insurance Fund.

The calculation and payment of insurance premiums is regulated by the Tax Code of the Russian Federation (Chapter 34 of the Tax Code of the Russian Federation), 125-FZ of July 24, 1998, 179-FZ of December 22, 2005.

KBK 2021

| Excise taxes on goods produced in Russia | |||

| ethyl alcohol from food raw materials. In addition to distillates of wine, grape, fruit, cognac, Calvados, whiskey | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| ethyl alcohol from non-food raw materials | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| wine, grape, fruit, cognac, calvados, whiskey distillates | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| alcohol-containing products | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| tobacco products | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| electronic nicotine delivery systems | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| nicotine-containing liquids | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| tobacco and tobacco products intended for consumption by heating | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| automobile gasoline | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| straight-run gasoline | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| cars and motorcycles | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| diesel fuel | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| motor oils for diesel, carburetor (injection) engines | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| fruit, sparkling (champagne) and other wines, wine drinks, without rectified ethyl alcohol | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| beer | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| alcoholic products with a volume fraction of ethyl alcohol over 9 percent. Except beer, wines, wine drinks, without rectified ethyl alcohol | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| alcoholic products with a volume fraction of ethyl alcohol up to 9 percent. Except beer, wines, wine drinks, without rectified ethyl alcohol | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| cider, poiret, mead | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| benzene, paraxylene, orthoxylene | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| aviation kerosene | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| middle distillates | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| wines with a protected geographical indication, with a protected designation of origin, except for sparkling wines (champagnes) | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| sparkling wines (champagnes) with a protected geographical indication, with a protected designation of origin | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise duties on goods imported from member states of the Customs Union (payment of excise duty through tax inspectorates) | |||

| ethyl alcohol from food raw materials. In addition to distillates of wine, grape, fruit, cognac, Calvados, whiskey | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| distillates – wine, grape, fruit, cognac, calvados, whiskey | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| cider, poiret, mead | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| ethyl alcohol from non-food raw materials | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| alcohol-containing products | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| tobacco products | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| electronic nicotine delivery systems | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| nicotine-containing liquids | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| tobacco and tobacco products intended for consumption by heating | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| automobile gasoline | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| cars and motorcycles | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| diesel fuel | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| motor oils for diesel, carburetor (injection) engines | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| fruit, sparkling (champagne) and other wines, wine drinks, without rectified ethyl alcohol | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| beer | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| alcoholic products with a volume fraction of ethyl alcohol over 9 percent. Except beer, wines, wine drinks, without rectified ethyl alcohol | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| alcoholic products with a volume fraction of ethyl alcohol up to 9 percent. Except beer, wines, wine drinks, without rectified ethyl alcohol | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| straight-run gasoline | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| middle distillates | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on goods imported from other countries (payment of excise duty at customs) | |||

| ethyl alcohol from food raw materials. In addition to distillates of wine, grape, fruit, cognac, Calvados, whiskey | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| distillates – wine, grape, fruit, cognac, calvados, whiskey | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| cider, poiret, mead | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| ethyl alcohol from non-food raw materials | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| alcohol-containing products | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| tobacco products | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| electronic nicotine delivery systems | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| nicotine-containing liquids | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| tobacco and tobacco products intended for consumption by heating | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| automobile gasoline | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| cars and motorcycles | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| diesel fuel | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| motor oils for diesel, carburetor (injection) engines | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| fruit, sparkling (champagne) and other wines, wine drinks, without rectified ethyl alcohol | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| beer | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| alcoholic products with a volume fraction of ethyl alcohol over 9 percent. Except beer, wines, wine drinks, without rectified ethyl alcohol | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| alcoholic products with a volume fraction of ethyl alcohol up to 9 percent. Except beer, wines, wine drinks, without rectified ethyl alcohol | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| straight-run gasoline | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| middle distillates | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

nalog7.ru

What needs to be indicated in a new way in the payment for contributions 2021: fields 101, 104, 106 - 109

According to the magazine “Uproshchenka”, the order came into force on February 28, that is, all payments will have to be clarified from this date. Details will be in the magazine soon.

The second change is renamed KBK 182 1 0200 160 (insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions).

Next, it’s worth figuring out how to reduce UTII:

- The amount of insurance premiums for employees in the 1st quarter will be 94,500 rubles;

- For himself, the entrepreneur will pay 36,238 rubles.

Injuries

| Payment type | KBK |

| Contributions | 393 1 0200 160 |

| Penalty | 393 1 0200 160 |

| Fines | 393 1 0200 160 |

| Payment | KBK |

| Contributions | 393 1 0200 160 |

| Penalty | 393 1 0200 160 |

| Fines | 393 1 0200 160 |