Is a forklift a primary asset?

According to paragraph 1 of Art. 256, paragraph 1, art. 257 of the Tax Code of the Russian Federation, property is recognized as a depreciable item of fixed assets if:

- is owned by the taxpayer;

- used to generate income as means of labor for the production and sale of goods (performance of work, provision of services) or to manage an organization;

- its cost is repaid by depreciation;

- its useful life is more than 12 months, and the initial cost is more than 40,000 rubles.

The forklift fully meets the listed criteria. The possibility of classifying it as a fixed asset is also confirmed by the fact that forklifts are the object of classification in OKOF <1>. They are included in the subsection “Machinery and Equipment” (code 14 0000000) under code 14 2915540. In addition, in the Classification of fixed assets included in depreciation groups <2>, taking into account which taxpayers determine the useful life of fixed assets, forklifts are classified as fourth depreciation group. This group includes property with a useful life of more than five to seven years inclusive.

<1> All-Russian classifier of fixed assets OK 013-94, approved. Decree of the State Standard of Russia dated December 26, 1994 N 359. <2> Approved by Decree of the Government of the Russian Federation dated January 1, 2002 N 1.

Note! Forklifts do not belong to vehicles, which in OKOF are allocated in a separate subsection “Vehicles” (code 15 0000000).

Until 2021

Code OKOF 14 2915070 Other lifting and transport equipment (forklifts). This class of fixed assets includes the following types:

14 2915070 Other lifting and transport equipment

14 2915540 Forklifts

14 2915541 Forklifts for loading and unloading and stacking long cargo

14 2915542 Special forklifts

14 2915549 Other forklifts

An example from judicial practice

The agricultural forklift Manitou Maniscopic MLT-X 735 T LSU belongs to the 4th depreciation group (Resolution of the Arbitration Court of the West Siberian District dated 01.08.2017 N F04-2570/2017 in case N A70-12797/2016, Resolution of the Supreme Court of the Russian Federation dated 25.10 .2017 N 304-KG17-15109 refused to be transferred to the Judicial Collegium for Economic Disputes of the RF Armed Forces)

Categories:

When does depreciation start?

According to paragraph 1 of Art. 258 of the Tax Code of the Russian Federation, in accordance with the established useful lives, depreciable property is distributed into depreciation groups. In this case, the useful life is determined by the taxpayer independently on the date of commissioning of the relevant facility. Thus, the forklift is included in the fourth depreciation group on the date of its commissioning. From the 1st day of the month following the month in which the object was put into operation (included in the corresponding depreciation group), depreciation begins to be calculated (clause 4 of Article 259 of the Tax Code of the Russian Federation).

Please note that clause 11 of Art. does not apply to a forklift. 258 of the Tax Code of the Russian Federation, according to which fixed assets, the rights to which are subject to state registration under the legislation of the Russian Federation, are included in the corresponding depreciation group from the moment of the documented fact of filing documents for registration of these rights. We are talking about state registration of rights to property. By virtue of Art. 131 of the Civil Code of the Russian Federation, rights to real estate are subject to state registration. As for rights to movable property, they do not need to be registered, except in cases specified in the law. The law does not require registering a transaction with a forklift. At the same time, it is necessary to remember: the forklift itself (the working volume of the internal combustion engine of which is more than 50 cubic cm (0.05 l)), despite the fact that it is not intended for driving on public roads, is subject to state registration with the authorities Gostekhnadzor during the validity period of the “Transit” registration plate or five days after acquisition, customs clearance, deregistration, replacement of license plate units or the occurrence of other circumstances requiring changes to the registration data. This requirement is established by Decree of the Government of the Russian Federation of August 12, 1994 N 938 “On state registration of motor vehicles and other types of self-propelled equipment on the territory of the Russian Federation.”

Work of the company Equipment for Warehouse in April 2021

We increase the capacity of your warehouse by 50% LEMA towers with a 10% discount!

LemaZowell self-propelled stackers are 15% cheaper!

Up to 50% discount on trolley wheels

Pallet racks from 1037 rub. per pallet space

According to Art. 258 of the Tax Code of the Russian Federation, additionally taking into account the classification of fixed assets (classification approved by Government Decree No. 1 of 01/01/2002) when introducing fixed assets (fixed assets) into use, the taxpayer sets their useful life independently. The depreciation group of fixed assets is determined in accordance with their useful life.

Useful life of a depreciation group

When establishing the useful life for various types of warehouse equipment, you can use the appropriate codes:

for stackers, OKOF code 14 2921030 /3/ can be used, - “loading and unloading equipment and machinery, equipment for laboratories, transport and agricultural equipment”, which corresponds to code 14 2921030 of the classification of fixed assets in the section “Machinery and Equipment”, this is the third depreciation group (property that has a useful life of more than 3 - 5 years, including this period);

for electric forklifts - OKOF 15 3599030 /9/ can be used - “in-house transport vehicles based on electric traction (electric cars, electric carts, electric forklifts, etc.), which correspond to code 15 3599301 “electric forklifts” of the classification of fixed assets in the section “Vehicles” , this is the third depreciation group (property that has a useful life of 3 - 5 years including this period).

Attention! The sequence of operations when determining the useful life, as a rule, is fixed in the accounting policy of the organization, since it is its integral component.

Forklift: how to account for costs?

264 of the Tax Code of the Russian Federation, expenses for the maintenance of official transport (road, rail, air and other types of transport) are considered other expenses related to production and sales taken into account for profit tax purposes. However, a forklift is not a vehicle, so this rule does not apply in our case. At the same time, in paragraph 1 of Art. 264 provides an open list of costs. In addition, according to paragraphs. 2 p. 1 art. 254 of the Tax Code of the Russian Federation, material costs include costs for the acquisition of materials used for other production and economic needs (testing, control, maintenance, operation of fixed assets and other similar purposes). According to officials, expenses for the purchase of fuel and lubricants can also be taken into account for profit tax purposes as part of material expenses in accordance with paragraphs. 5 p. 1 art. 254 of the Tax Code of the Russian Federation as costs for the purchase of fuel, water, energy of all types spent for technological purposes, production (including by the taxpayer himself for production needs) of all types of energy, heating of buildings, as well as costs for production and (or) acquisition of power, costs for transformation and transmission of energy (Letters of the Ministry of Finance of Russia dated June 22, 2010 N 03-03-06/4/61, Federal Tax Service of Russia dated July 16, 2010 N ShS-37-3/6848). Therefore, fuel costs for a forklift can be taken into account for the purpose of calculating income tax, but only if the requirements of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation.

Let us remind you that the taxpayer has the right to reduce the income received by the amount of expenses incurred, with the exception of those specified in Art. 270 Tax Code of the Russian Federation. In this case, expenses are recognized as justified and documented expenses incurred (incurred) by the taxpayer, provided that they were incurred to carry out activities aimed at generating income. Justified include economically justified costs, the assessment of which is expressed in monetary form (in other words, the amount of expenses must be economically justified), and documented costs include costs supported by documents drawn up in accordance with the legislation of the Russian Federation or business customs applied in a foreign country , on whose territory the corresponding expenses were incurred. Documentary evidence also includes documents that indirectly confirm expenses incurred (including a customs declaration, a business trip order, travel documents, a report on work performed in accordance with the contract).

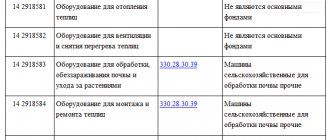

Determination of depreciation group using OKOF code

How to determine the depreciation group using the OKOF code?

The structure of the OKOF code (OK 013-2014) is XXX.XX.XX.XX.XXX. To determine the depreciation group to which a fixed asset belongs using the OKOF code, you must proceed as follows:

Using OKOF, determine the code of the type of property to which your fixed asset belongs. The code is indicated in the first column of the OKOF table. For example, a trailer, the technically permissible maximum weight of which is more than 0.75 tons, but not more than 3.5 tons, according to OKOF, has code 310.29.20.23.112.

Check if the code you found is in the first column of the OS Classification.

If it is there, then look at which depreciation group it belongs to.

If this code is not in the Classification of fixed assets, then the depreciation group of fixed assets must be determined by the code of the group in which the property is included. By replacing the last character of the code with a zero, you get a higher level grouping code. If this doesn't help, remove the last three characters. And so on until you find a higher level grouping code in the Classification.

Example. Determination of depreciation group using OKOF code

Such a code is not specified in the OS Classification. It also does not contain the grouping code 310.29.20.23.110 “Trailers (semi-trailers) for cars and trucks, motorcycles, scooters and quadricycles.” However, the Classification has a grouping code 310.29.20.23 “Other trailers and semi-trailers.” It belongs to the fifth depreciation group (property with a useful life of more than seven years up to ten years inclusive).

This means that the trailer must be included in the fifth depreciation group.

Pay attention to the notes on the names of fixed assets (they are given in the third column of the Classification of fixed assets) - property that is excluded from the corresponding depreciation group or additionally included in it may be listed there. For example, a forklift, according to OKOF, has code 330.28.22.15.110. There is no such code in the OS classification. However, it has lifts that are not included in other groups, with the code OKOF 330.28.22.11.190. They are included in the fourth depreciation group (property with a useful life of more than five years up to seven years inclusive). Forklifts are listed in the notes. It turns out that a forklift is included in the fourth depreciation group.

Documentary evidence of expenses

What does the phrase “documents drawn up in accordance with the legislation of the Russian Federation” mean? In Art. 313 of the Tax Code of the Russian Federation states: tax accounting is a system of summarizing information to determine the tax base for a tax based on data from primary documents, grouped in accordance with the procedure provided for by the Tax Code. Primary accounting documents also serve as confirmation of tax accounting data. By virtue of paragraph 1 of Art. 9 of the Federal Law of November 21, 1996 N 129-FZ “On Accounting”, all business transactions carried out by the organization must be documented with supporting documents. These documents serve as primary accounting documents on the basis of which accounting is conducted. From this, the Ministry of Finance concluded: the same primary accounting documents serve as the basis for maintaining both accounting and tax accounting (Letter dated November 16, 2010 N 03-03-06/1/726). The financiers also reminded that primary accounting documents are accepted for accounting if they are drawn up in the form contained in the albums of unified forms of primary accounting documentation, and if the corresponding form of the document is not provided in the album, the document must contain the mandatory details listed in paragraph 2 of Art. 9 of the above Law.

At the same time, for example, the Federal Antimonopoly Service does not agree with this approach. The Tax Code does not contain a list of primary documents that must be drawn up when a taxpayer carries out certain business transactions, and does not impose any special requirements for their execution (filling out). Consequently, tax accounting of expenses for the purchase of fuel and lubricants can be carried out on the basis of both unified and other forms of primary documents (Resolution dated June 16, 2010 N F03-3840/2010). This approach is not alien to officials either.

As a rule, waybills are used to document the costs of purchasing fuel. Unified forms of waybills are approved by Resolution of the State Statistics Committee of Russia dated November 28, 1997 N 78, they are used by legal entities of all forms of ownership that operate construction machinery, mechanisms, vehicles and are senders and recipients of goods transported by road transport, that is, in specialized organizations . At the same time, Order of the Ministry of Transport of Russia dated September 18, 2008 N 152 approved the Mandatory details and procedure for filling out waybills. This document, developed in accordance with the requirements of paragraph 1 of Art. 6 of the Federal Law of November 8, 2007 N 259-FZ “Charter of Automobile Transport and Urban Ground Electric Transport”, legal entities and individual entrepreneurs operating cars and trucks, as well as buses, trolleybuses and trams are required to follow. Without issuing a waybill for the appropriate vehicle, transportation of passengers, luggage, and cargo by buses, trams, trolleybuses, cars and trucks is prohibited. Financiers recognized: a waybill, independently developed by an organization, can be one of the documents confirming the costs of purchasing fuel and lubricants, if it contains the Mandatory details approved by Order of the Ministry of Transport of Russia N 152 (Letter dated 08/25/2009 N 03-03-06/2/ 161). At the same time, in their opinion, organizations to which the provisions of this Order do not apply can use a waybill as one of the documents confirming the costs of purchasing fuel and lubricants, securing this procedure in their accounting policies for tax purposes. However, the taxpayer has the right to confirm expenses incurred with other documents drawn up in accordance with the legislation of the Russian Federation (Letter dated June 16, 2011 N 03-03-06/1/354).

It turns out that a food industry enterprise whose employees work on forklifts is not obliged to use the unified forms approved by Resolution of the State Statistics Committee of Russia N 78, and also to comply with the requirements of Order of the Ministry of Transport of Russia N 152. Therefore, as documentary evidence, it can use the waybill form given in the Appendix 6 to the Inter-industry rules for labor protection during the operation of industrial transport (floor-mounted trackless wheeled vehicles), approved by Resolution of the Ministry of Labor of Russia dated 07.07.1999 N 18, including additional details if necessary. These Rules apply to workers operating or ensuring the operation of industrial floor-mounted trackless wheeled vehicles (cars, tractors, forklifts , electric forklifts and other trackless wheeled vehicles, including cargo trolleys) used in technological transport operations within the organization (between buildings, workshops, areas, branches, services, warehouses, trading floors and other facilities).

For example , a waybill for a forklift can be supplemented with the following details:

- date of document preparation;

- hour meter readings when the forklift leaves the “garage” and returns; in other words, information about the operating time of the forklift will appear on the waybill (mileage data is not recorded, since the forklift is not equipped with an odometer);

- fuel movement data.

OKOF 330.28.22.15.120 – Other loaders

OKOF 330.28.22.15.120 – Other loaders

- OKOF - All-Russian Classifier of Fixed Assets

- 300.00.00.00.000 - Machinery and equipment, including household equipment, and other objects

- 330.00.00.00.000 - Other machinery and equipment, including household equipment, and other objects

- 330.28 - Machinery and equipment not included in other groups

- 330.28.2 - Other general purpose machinery and equipment

- 330.28.22.1 — Lifting and transport equipment

- 330.28.22.15 - Forklifts, other loaders; tractors used on railway station platforms

- 330.28.22.15.120 — Other loaders

330.28.22.15.120 — Other loaders

Classifier: OKOF OK 013-2014 Code: 330.28.22.15.120 Name: Other loaders Subsidiary elements: 0 Depreciation groups: 1 Direct adapter keys: 8

Grouping 330.28.22.15.120 in OKOF is final and does not contain subgroups.

Shock absorber group for backhoe loader

Mar 5, 2012 — I noticed that the forklift was kept by a former accountant in the Machinery group... I couldn’t find any funds included in the depreciation groups of forklifts. ... the property belongs to the group “Machinery and Equipment” (part... Tax on movable property acquired after 01.01...

Depending on the useful life (SPI), depreciable property (fixed assets and intangible assets) is distributed into depreciation groups (clause 1 of Article 258 of the Tax Code of the Russian Federation). We will tell you which depreciation groups vehicles belong to in our consultation.

Motor vehicles, in accordance with the Classification of fixed assets, are classified into III-V depreciation groups. Let us recall that the SPI for them is set as follows:

- III - over 3 to 5 years inclusive;

- IV - over 5 to 7 years inclusive;

- V - over 7 to 10 years inclusive.

| Depreciation group | Name of the vehicle |

| III | Passenger cars (with an engine capacity of no more than 3.5 liters); Buses are especially small and small, up to 7.5 m long inclusive; Trucks with a diesel or gasoline engine, having a technically permissible maximum weight of not more than 3.5 tons |

| IV | Small class passenger cars for disabled people; Extra large city buses (bus trains) with a length of over 16.5 to 24 m inclusive; Long distance buses; Buses are medium and large, up to 12 m long inclusive; Trucks, road tractors for semi-trailers (general purpose vehicles: flatbeds, vans, tractors; dump trucks); Hearses; Concrete trucks; Timber trucks; Vehicles for public utilities and road maintenance |

| V | Large class passenger cars (with engine displacement over 3.5 liters) and high class; Other especially large buses (bus trains) with a length of over 16.5 to 24 m inclusive; Trucks with a diesel engine having a technically permissible maximum weight of over 3.5 tons; Truck tractors; Automotive hydraulic lifts; Garbage trucks |

If the vehicle falls into one of these groups, then the organization determines the SPI within the period provided for the corresponding group. For example, for a passenger car with an engine capacity of over 3.5 liters, the SPI can be set from 85 months to 120 months inclusive.

And, for example, what is the depreciation group for a car crane?

The truck crane is located in the “Vehicles” section with code 310.29.10.51. According to the Tax Classification, special-purpose motor vehicles with code according to OKOF 310.29.10.5 are assigned to depreciation groups IV and V. Therefore, an organization can independently classify a truck crane into any of these groups.

Please note that in addition to truck cranes, the Classification also contains mention of other cranes that are not classified as vehicles. Thus, lifting cranes are generally assigned to depreciation group VII (SPI over 15 to 20 years inclusive). Also in certain groups of the Classification you can find other references to cranes.