New KBK for 2012

New BCCs in the Federal Tax Service and the Pension Fund for 2012 - the latest news.

Very often, individual entrepreneurs have difficulty choosing the correct BCC (budget classification code) when transferring taxes and contributions. Almost every year these codes change. And now, from January 1, 2012, new BCCs for 2012 for insurance contributions to the FFOMS and TFOMS and personal income tax. Despite the fact that the rest of the codes remained unchanged, I want to remind them once again:

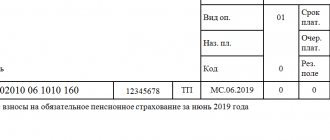

KBC pension contributions for 2012: - KBC contributions to the Pension Fund, based on the cost of the insurance year, “for yourself” (insurance part) - 39210202100061000160; — KBK of contributions to the Pension Fund, based on the cost of the insurance year, “for oneself” (funded part) – 39210202110061000160; — KBC contributions to the Pension Fund for its employees (insurance part) – 39210202010061000160; — KBC contributions to the Pension Fund for its employees (funded part) – 39210202020061000160; — BCC of insurance premiums to the FFOMS ( new BCC for 2012 , even if the debt for 2011 is paid) — 39210202101081011160; — BCC of insurance contributions to the TFOMS ( new BCC for 2012 when paying debts for 2011) – 39210202101081012160;

KBK of insurance contributions to the Social Insurance Fund: - KBK of insurance contributions in case of temporary disability and in connection with maternity – 39310202090071000160; — KBK of insurance premiums against accidents at work – 39310202050071000160;

KBK taxes: - KBK personal income tax (lists individual entrepreneurs as a tax agent from the wages of their employees) - 18210102010011000110; — new BCCs for personal income tax are presented in the news of the week (01/30/2012 - 02/05/2012); — KBK simplified tax system with taxation “income” — 18210501011011000110; — KBK simplified tax system with taxation “income minus expenses” — 18210501021011000110; - KBK UTII - 18210502010021000110; — KBK transport tax for 2011 – 18210604011021000110; — KBK land tax for 2011 depends on the location of the land plot: 18210606011031000110 – at the rate specified in paragraph 1 of paragraph 1 of Article 394 of the Tax Code of the Russian Federation (for Moscow and St. Petersburg); 18210606012041000110 – at the rate specified in clause 1, clause 1, article 394 of the Tax Code of the Russian Federation (borders of urban districts); 18210606013051000110 – at the rate specified in clause 1, clause 1, article 394 of the Tax Code of the Russian Federation (borders of inter-settlement territories); 18210606013101000110 – at the rate specified in clause 1, clause 1, article 394 of the Tax Code of the Russian Federation (settlement boundaries); 18210606021031000110 – at the rate specified in clause 2, clause 1, article 394 of the Tax Code of the Russian Federation (intra-city municipal district of Moscow and St. Petersburg); 18210606022041000110 – at the rate specified in clause 2, clause 1, article 394 of the Tax Code of the Russian Federation (borders of urban districts); 18210606023051000110 – at the rate specified in clause 2 of clause 1 of Article 394 of the Tax Code of the Russian Federation (borders of inter-settlement territories); 18210606023101000110 – at the rate specified in clause 2, clause 1, article 394 of the Tax Code of the Russian Federation (settlement boundaries); 18210904050031000110 – land tax that arose before 01/01/2006 (for Moscow and St. Petersburg); 18210904050041000110 – land tax that arose before 01/01/2006 (borders of urban districts); 18210904050051000110 – land tax that arose before 01/01/2006 (borders of inter-settlement territories); 18210904050101000110 – land tax that arose before 01/01/2006 (settlement boundaries).

If you found this article helpful, don't forget to leave a comment, retweet and tell your friends on social networks. Thank you.

Receive new blog articles directly to your email:

New budget classification codes (BCC) are applied from January 1, 2012

The Ministry of Finance officially stated that the BCC, approved by order of the Ministry of Finance of Russia dated December 21, 2011 No. 180n, should be applied from January 1, 2012.

Previously, registration of this document by the Ministry of Justice was expected. But the financial department published Letter No. 02-05-10/70 dated January 16, 2012 on its website. It says that order No. 180 does not need registration. In addition, it is considered that the norms of the order came into force on January 1, 2012.

Starting from 2012, the BCC for some payments to the budget will change. Among the most important is the new code for insurance contributions to the Federal Compulsory Medical Insurance Fund.

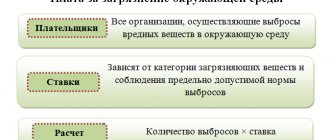

The updated list of KBK codes 2012 is given in the order of the Ministry of Finance of Russia dated December 21, 2011. No. 180n. In addition to “medical” fees, the update will also affect fees for environmental pollution: from January, instead of one code, there will be five - for different types of harmful effects. The codes for the fee for obtaining extracts from the Unified State Register of Legal Entities, Unified State Register of Individual Entrepreneurs, Unified State Register of Legal Entities, and the Unified State Register of Real Estate, as well as for providing information on rights to real estate, will also change.

The new BCCs will be applied from 2012, regardless of the period to which the payment relates. That is, contributions to the FFOMS for December, transferred in January, will have to be paid to the new CBK, the Ministry of Finance confirmed to us.

Since 2012, the budget classification codes for compulsory health insurance have changed, informs the Pension Fund of the Russian Federation.

New KBK:

- 392 1 02 02101 08 1011 160 - insurance premiums for compulsory health insurance of the working population, received from payers.

- 392 1 02 02101 08 1012 160 - insurance premiums for compulsory health insurance of the working population, previously credited to the budgets of territorial compulsory health insurance funds (for billing periods expired before January 1, 2012).

- 392 1 02 02101 08 2011 160 - penalties on insurance premiums for compulsory health insurance of the working population, received from payers.

- 392 1 02 02101 08 2012 160 - penalties on insurance premiums for compulsory health insurance of the working population, previously credited to the budgets of territorial compulsory health insurance funds (for billing periods expired before January 1, 2012).

- 392 1 02 02101 08 3011 160 - amounts of monetary penalties (fines) for insurance premiums for compulsory health insurance of the working population received from payers.

- 392 1 02 02101 08 3012 160 - amounts of monetary penalties (fines) for insurance premiums for compulsory health insurance of the working population, previously credited to the budgets of territorial compulsory health insurance funds (for billing periods expired before January 1, 2012).

| Personal income tax | |

| 18210102010011000110 | Personal income tax on income the source of which is a tax agent, with the exception of income in respect of which tax is calculated and paid in accordance with Articles 227, 227.1 and 228 of the Tax Code of the Russian Federation |

| 18210102020011000110 | Personal income tax on income received from the activities of individuals registered as individual entrepreneurs, notaries engaged in private practice, lawyers who have established law offices and other persons engaged in private practice in accordance with Article 227 of the Tax Code of the Russian Federation |

| 18210102030011000110 | Personal income tax on income received by individuals in accordance with Article 228 of the Tax Code of the Russian Federation |

| 18210102040011000110 | Tax on personal income in the form of fixed advance payments on income received by individuals who are foreign citizens employed by individuals on the basis of a patent in accordance with Article 227.1 of the Tax Code of the Russian Federation |

All KBK in 2012 - link

KBK USN 2012

What is KBC? KBK are budget classification codes, which are a sequence of 20 digits in which types of payments, recipients, etc. are encrypted. It would seem that the state can decide once and it will be possible to use the table with the BCC. What are budget classification codes for? And in order to be indicated in the recipient’s payments (this or that budget) using a set of numbers, and this must be done every time when paying taxes and contributions to the budget (to simplify, for example, these are quarterly advance payments of the simplified tax system, and for any business - These are quarterly contributions to the Pension Fund (although you can pay once a year). But officials and experts of Russian departments do not sleep, and change the BCC every year! Why? No good explanations for this can be found, as well as explanations for why the forms need to be changed every quarter reporting, and their number. And everyone is forced to look for the KBK of the simplified tax system for 2012 , or for another reporting period to look for which KBK were in effect (their classification code for the simplified tax system may also differ depending on the object of taxation).

It is not always convenient to keep track of new orders approving new BCCs for 2012 (or 2013, it doesn’t matter), and information does not always change promptly. Even specialized resources (like the Clerk) may not update information for several days, simply because reporting may coincide with weekends/holidays, and for several days the information will not be updated or correct. In addition, the new BCC and the old BCC are changed according to the date of entry into force of the changes, and not according to the date of signing of the Order. Accordingly, there can be many subtleties, and not only an entrepreneur who independently searches for the BCC of the simplified tax system for 2012 or for other periods, but also an experienced accountant can easily make a mistake. As a result, you can indicate the wrong BCC, which will cause trouble later. Unfortunately, the tax service does not provide clear services, although electronic services are constantly being developed. And it would be more convenient and correct when the KBK of the simplified tax system is updated centrally! Since 2010, this service began to be provided by the Elba Contour service.

Try it

which, when calculating taxes and contributions, prepares payments to the bank, automatically filling in the details of the taxpayer and the KBK. The relevance and instant updates of the service are monitored by accountants and experts from the largest specialized telecom operator - the SKB Kontur company, which has developed and is developing the Kontur Elba service (originally called the electronic accountant Elba) for business on the simplified tax system, patent and UTII.

Changes to the KBK of personal income tax in 2012

Tweet

Let's set our watches. New year and everything is new. With our legislation you won't get bored. On January 1, 2012, the BCC changed again

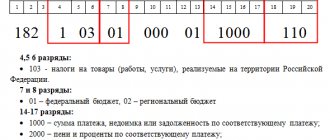

In particular, the new KBK Personal Income Tax 182 1 0100 110 “Tax on personal income on income the source of which is a tax agent, with the exception of income in respect of which the calculation and payment of tax is carried out in accordance with Articles 227, 227.1 and 228 of the Tax Code of the Russian Federation” applies in 2012 to pay personal income tax instead of the following BCC for personal income tax used in 2011:

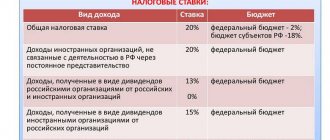

| 182 1 0100 110 personal income tax rate - 9% | Personal income tax on income received by individuals who are tax residents of the Russian Federation in the form of dividends from equity participation in the activities of organizations |

| 182 1 0100 110 personal income tax rate - 15% | Personal income tax on income received by individuals who are not tax residents of the Russian Federation in the form of dividends from equity participation in the activities of organizations |

| 182 1 0100 110 personal income tax rate - 13% | Personal income tax on income taxed at the tax rate established by paragraph 1 of Article 224 of the Tax Code of the Russian Federation |

| 182 1 0100 110 personal income tax rate -13% | Personal income tax on income taxed at the tax rate established by paragraph 1 of Article 224 of the Tax Code of the Russian Federation, with the exception of income received by individuals registered as individual entrepreneurs, private notaries and other persons engaged in private practice |

| 182 1 0100 110 Personal income tax rate - 30% | Personal income tax on income received by individuals who are not tax residents of the Russian Federation |

| 182 1 0100 110 personal income tax rate 35% | Tax on personal income on income received in the form of winnings and prizes in competitions, games and other events for the purpose of advertising goods, works and services, interest income on bank deposits, in the form of material benefits from savings on interest when receiving borrowed money ( credit) funds |

| 182 1 0100 110 personal income tax rate - 9% | Personal income tax on income received in the form of interest on mortgage-backed bonds issued before January 1, 2007, as well as on the income of the founders of trust management of mortgage coverage received on the basis of the acquisition of mortgage participation certificates issued by mortgage coverage managers before January 1 2007 |

| 182 1 0100 110 | Personal income tax on income received by individuals who are not tax residents of the Russian Federation, in respect of which the tax rates established in the Double Taxation Agreements are applied |

Taking into account these changes, the tax office recommends that in field 24 “Purpose of payment” of the payment order, indicate additional information necessary to identify the purpose of the payment.

Note! Transition tables for budget classification codes , prepared in accordance with the Instructions on the procedure for applying the budget classification of the Russian Federation, approved by Order of the Ministry of Finance of the Russian Federation of December 21, 2011 N 180n (the order is under state registration with the Ministry of Justice of the Russian Federation) are given in a letter from the Ministry of Finance of Russia dated December 27, 2011 No. 02-04-09/5996 and posted on the official website of the Ministry of Finance of the Russian Federation in the section “Budget classification, budget accounting and execution of budgets by income and sources of financing budget deficits”, subsection “Budget classification of the Russian Federation”.

You should also note that when paying off debt for previous periods in 2012, you need to use the new BCC 182 1 01 02010 01 1000 110 "

Please note that depending on the type of payment (tax, penalty, fine) 14-17 sign must be changed 182 1 0100 110 - tax 182 1 0100 110 - penalty 182 1 0100 110 - fine

The Ministry of Finance has published transition tables for the KBK-2012

The transition table for budget revenue classification codes applied from January 1, 2012 is posted on the ministry’s website. It takes up 115 sheets. New Instructions on the procedure for applying budget classification have been approved by the Ministry of Finance and are now being registered with the Ministry of Justice.

Content

The Ministry of Finance has published a transition table for budget revenue classification codes applied since January 1, 2012. The table is posted on the website of the Ministry of Finance in the heading “Budget classification of the Russian Federation and budget accounting”, subsection “Budget classification of the Russian Federation”. The transition table for the BCC is also attached to the letter of the financial department dated December 27, 2011 No. 02-04-09/5996. It takes up 115 sheets.

Letter from the Ministry of Finance and transition table for the KBK

(ZIP archive, 181 Kb)

As we have already reported, the Ministry of Finance has prepared a draft list of budget revenue classification codes (KBK) for 2012. The document was approved by order No. 180n dated December 21, 2011, which comes into force on January 1, 2012. The document is currently being registered with the Ministry of Justice.

In accordance with the Budget Code, the budget classification of the Russian Federation is a grouping of income, expenses and sources of financing budget deficits of the budget system of the Russian Federation, used for drawing up and executing budgets, preparing budget reporting, etc.

Please note that incorrect indication of the KBK does not cause damage to the budget, since the payment was actually received. If other correct data is available to identify the payment, it will be credited as intended. In the event of an erroneous indication of the BCC, the tax authority can clarify the payment by receiving a corresponding application from the taxpayer, rather than re-collecting tax and other payments to the budget. The form for making a decision to clarify payment was approved by Order of the Federal Tax Service dated April 2, 2007 N MM-3-10/ [email protected]

We would like to add that the KBK-2011 directory was published on the CADIS portal. Instructions on the procedure for applying the budget classification of the Russian Federation were approved by Order of the Ministry of Finance dated December 28, 2010 No. 190n.

Detailed information on issues related to paying taxes can be found on our website in the “Tax Handbook 2011” section. It provides information about the tax base, rates, benefits and tax deductions, etc. You can find the upcoming dates for paying taxes, submitting accounting and tax reporting, as well as information to extra-budgetary funds in the “Accountant’s Calendar” section.

Legal documents

- <Letter> Ministry of Finance of the Russian Federation dated December 27, 2011 N 02-04-09/5996

- Article 18 of the BC RF. Budget classification of the Russian Federation

- Order of the Federal Tax Service of Russia dated April 2, 2007 N MM-3-10/ [email protected]

- by order of the Ministry of Finance dated December 28, 2010 No. 190n