We submit the VAT return for the first quarter of 2021 using an updated form. For the first time, it was reported for the fourth quarter of 2021. We take the form from the Federal Tax Service order No. MMV-7-3/558 dated October 29, 2014, as amended No. ED-7-3/591 dated August 19, 2020. The declaration is submitted by all tax payers, including intermediaries and tax agents (clause 5 of Article 174, subclause 1 of clause 5 of Article 173 of the Tax Code of the Russian Federation). Let's see what you need to pay attention to in order to report without errors.

- Composition of the VAT return for the first quarter of 2021

- Reporting of separate companies

- General requirements

- Required sheets. New in the VAT declaration form

- VAT declaration sheets filled out depending on the situation

- VAT reporting deadlines for the first quarter in 2021

- Responsibility for delay

Composition of the VAT return for the first quarter of 2021

If you have zero reporting, fill out the title page and the first section.

For a non-zero declaration, select from the remaining 11 sections only those for which there is data. Blank sheets are not included in the declaration.

You will find a convenient overview of the declaration sheets that are filled out depending on the situation at the end of our article.

Most companies fill out:

- title page;

- section 1;

- sections 8 and 9;

- appendices 1 to sections 8 and 9;

- section 12.

Organizations that are not VAT payers or tax agents, but issue invoices with allocated tax, fill out:

- title page;

- section 1;

- section 12.

Economic opportunities after the country's protracted crisis in 2018

It is known that the economic crisis that affected the country in 2014 significantly undermined the situation in the Russian Federation. Today, a significant improvement in the post-crisis situation does not exclude the implementation of some reforms.

The government plans to make some changes to the tax system that will help improve the country's economy.

In addition to issues related to increasing profits going to the federal budget, the government is obliged to pay attention to the financial situation of each region of the country, most of which, it is worth noting, are in unsatisfactory condition.

If the economic situation in certain regions continues to deteriorate, then local authorities will not be able to fulfill all their obligations. This, in turn, is a sign of default.

It is obvious that the country's economy requires global tax reform. The authorities are considering revising the current benefits.

The issue of reforming the insurance system is also being considered. Thus, rates for some types of taxes may increase.

General requirements

Fill out the report in a specialized program in printed capital letters.

We put only one character in each cell. This can be a letter, number, punctuation mark or space.

In sections 1–7, amounts are reflected in full rubles. We round up rubles and kopecks according to Art. 52 of the Tax Code of the Russian Federation.

In sections 8–12 - in rubles and kopecks (clause 15 of the Procedure for filling out the declaration).

If you report on paper, please note: double-sided printing is not permitted. You cannot use corrections, strike-throughs, or corrections in your report. True, only a few can report on paper:

- tax agents who are not VAT payers and do not conduct intermediary activities with the issuance of invoices on their own behalf (clause 5 of Article 174 and clause 3 of Article 80 of the Tax Code). Tax agents who purchase recyclable materials do not fall under this exception; they submit declarations electronically (clause 5 of Article 174 of the Tax Code);

- foreign organizations that provide electronic services in Russia, and foreign tax agents.

As a general rule, organizations submit VAT returns only in electronic form through authorized special operators, regardless of the number of employees. This rule also applies to updates for any periods (Clause 7, Article 5 of Law No. 347-FZ dated November 4, 2014).

If you submit a declaration in paper form, but should do so electronically, it will be considered unsubmitted (clause 5 of Article 174 of the Tax Code of the Russian Federation). Fine - 200 rubles. (Article 119.1 Tax Code).

Distribution of incoming funds to the federal and regional budgets

According to the government, the new reform may also affect income tax, which will facilitate the distribution of incoming funds to the federal and regional budgets.

It is worth noting that the decrease in financial revenues to regional budgets will force local authorities to look for ways to obtain additional funding.

According to experts, future innovations in the tax system in 2021 will have an impact on the development of business activity in the country.

But we should not forget that the increase in taxes will affect the activities of businessmen who were unable to restore the state of their business after the economic crisis of 2014. To bring the country's economy out of crisis, new reforms are needed.

Required sheets. New in the VAT declaration form

New ciphers

To be sure that you are using the current form, check the barcode at least on the title page. It should be 0031 2011.

Changes to transaction codes

The names of individual operations were brought in accordance with the wording of the Tax Code of the Russian Federation. For example, with code 1010267 (subclause 22, clause 2, article 149 of the Tax Code, appendix 1 to the Procedure for filling out the declaration).

Additionally, in Appendix 1 to the Procedure for filling out the declaration, the transaction codes that the Federal Tax Service recommended in its letters were prescribed. For example, 1011208 (subparagraph 36, paragraph 2, article 149 of the Tax Code). Initially, the Federal Tax Service provided this code in a letter dated October 29, 2019 No. SD-4-3/22175.

Title page without OKVED

The “OKVED” attribute was removed from the first sheet. We indicate (Fig. 1):

- TIN,

- checkpoint,

- company name or full name of the individual entrepreneur,

- contact phone number,

- Federal Tax Service code,

- reporting period code. For the first quarter - “21”,

- code at the place of registration. Usually - “214”. All possible codes are in Appendix 3 to the Procedure for filling out the declaration.

On a note:

The “Adjustment number” field is filled in according to the new rules. In the primary report we indicate 0. And we submit adjustments only in chronological order: the first clarification is numbered 1, the second is numbered 2, etc. If the number is not specified, the declaration will not pass format and logical control.

Important:

If you indicate an incorrect period or enter an adjustment number, inspectors will send a request for clarification or will not accept the report at all.

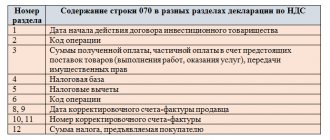

Section 1 with additions for SZPK participants

Those who have entered into an agreement on the protection and promotion of investments (SZPK) fill out a new line 085 “SPPK Sign”. This area is regulated by Law No. 69-FZ dated April 1, 2020.

On line 085 they put:

- 1 - if the taxpayer is a party to the SZPK included in the SZPK register;

- 2 - if the taxpayer is not a party to the SPA.

Separately indicate the tax amounts that relate to activities with SZPK:

- line 090 - to show the amount payable;

- 095 - for reimbursement.

Lines 090 and 095 are filled out on the basis of separate accounting data, which the participants of the SZPK are required to maintain (paragraph 10, clause 4.3, article 5 of the Tax Code). For activities within the framework of the SZPK and for other activities, the organization must ensure separate accounting of taxable objects, the tax base and VAT amounts.

If an organization participates in several SZPK, then lines 090 and 095 reflect the total indicators for all SZPK.

As before, the main control point remains line 020 - with KBK. If there is a mistake, the money will go to the wrong details, which may result in penalties and fines.

The inspection will definitely check lines 040 and 050 (Fig. 2). If you filled out line 050, that is, you entered the amounts to be reimbursed, the inspectors will order a desk audit.

Methods for calculating income taxes in 2021

Income tax refers to the payment of interest on the profits that an organization receives. Collection of such payments helps replenish the regional budget.

Based on current legislation, there are several ways to calculate the monetary amount of this tax:

- Using the cash method. The tax is calculated based on the financial transactions carried out. But it is worth noting that the law establishes restrictions on the use of this calculation method. Only a limited number of organizations whose quarterly profit is less than a million rubles can calculate the tax amount in this way.

- Calculate the tax amount using the accrual method. In this case, indicators of expenses and income are taken into account.

Income tax is calculated by organizations for the reporting period. However, many people use advance payments every quarter or monthly. Such an action is not prohibited by law.

A special feature of the calculation of income tax is the fixed rate applied to certain types of activities of organizations.

VAT declaration sheets filled out depending on the situation

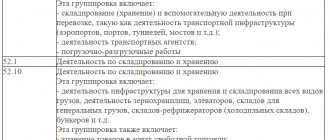

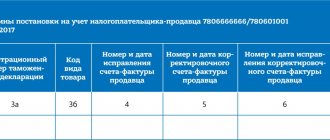

| Section number of the VAT declaration | What to pay attention to |

| 2 | Fill in the information for each VAT tax agent. Put dashes if there is no data. For example, TIN. Enter the amount of tax payable to the budget for the tax agent on line 060. |

| 3 | Provide data on transactions for the sale of goods, works, and services at rates of 10% and 20%. Appendix 1 to Section 3 is filled out separately for each real estate item. Relevant for companies that performed transactions taxed at rates of 10% and 20%. |

| 4 | Fill in the companies that shipped goods for export, justify and confirm the application of the 0% rate with documents. |

| 5 | Fill in organizations that carried out transactions taxed at a 0% rate. At the same time, the calculation for the first quarter reflects deductions that actually occurred in the fourth quarter. For example, the company collected all the documents confirming the zero rate in the previous quarter, but fulfilled all the conditions only in the current one. |

| 6 | Fill in if you were unable to confirm your right to a 0% rate. We remind you: the law gives 180 days to submit supporting documents. |

| 7 | Fill in if there were operations that are not subject to VAT:

|

| 8 | In electronic form, the section is a purchase book in a tabular format. We present most of the data from invoices that we received from suppliers and generated ourselves when restoring the tax. In the paper report, we fill out a separate sheet of Section 8 for each invoice. Filled out by organizations that claim tax deductions. |

| 9 | Here is information from the sales book. The procedure for filling out is similar to the rules for filling out section 8. In electronic format, section 9 is provided in the form of a table from the sales book. The paper report requires data from each invoice issued to buyers and customers. Namely, these are invoices for sales and advances received, incl. formed when VAT is offset. Filled out by those who registered invoices in the sales book. Important: Indicators in the books of purchases and sales are reflected in rubles and kopecks. In the declaration, the VAT accrued for payment is rounded to the nearest ruble. The difference with the sales book is not recognized as arrears (letter of the Ministry of Finance of the Russian Federation dated October 15, 2019 No. 02-07-10/79001). To check sections 8 and 9, the Federal Tax Service uses the ASK VAT-2 program. |

| 10 | Filled out by intermediaries, incl. commission agents, agents, developers, forwarders who received invoices in the interests of another person. Enter the details of the invoices received. |

| 11 | Filled out by intermediaries, incl. commission agents, agents, developers, forwarders who issued invoices in the interests of another person. Enter information on issued invoices. |

| 12 | A section for companies in special regimes, who do not have to pay VAT, but issue invoices with the allocated amount of tax (clause 5 of Article 173 of the Tax Code). It is also filled out by general regime officers when issuing invoices for non-taxable transactions. |

Interest rates of income tax from the new year 2021

In 2021, legal entities will pay income tax at the same rate - 20 percent. But the authorities decided to make significant changes regarding the distribution of tax revenues.

The estimates that will go to the federal budget have been increased to three percent. And it was decided to reduce the incoming funds to regional budgets to seventeen percent.

In addition, it will be possible to reduce rates at the discretion of local authorities. Similar innovations have already been introduced into the Tax Code of the Russian Federation back in 1616.

Starting from the new year, the government will reduce the minimum rates for certain categories of taxpayers. If earlier the figure was 13.5 percent, then from 2021 it will be one percent less.

Video news of changes in income taxes

2018 does not provide for changes to special income tax rates. But the receipt of income from securities is planned to be subject to a 15 percent tax.

A tax holiday period will be introduced for organizations involved in the implementation of some projects aimed at the economic development of the Far East.

The distribution of funds received from organizations in 2021 for income taxes, according to officials, will help improve the country's economy.