We will not consider payroll calculations in detail, but will analyze the entries that are generated in accounting after the calculations are completed for each employee.

Stages of work on payroll accounting in an organization:

To record all transactions related to wages, account 70 “Settlements with personnel for wages” is used. The credit of this account reflects accruals, the debit - personal income tax, other deductions and salary payments. Postings for payroll, deductions, personal income tax and insurance contributions are usually made on the last day of the month for which wages are accrued. Postings for salary payments and personal income tax and contributions are made on the day of the actual transfer (issue) of funds.

Payroll

Wage expenses are written off against the cost of production or goods, therefore the following accounts correspond to account 70:

- for a manufacturing enterprise - 20 account “Main production” or 23 account “Auxiliary production”, 25 “General production expenses”, 26 “General (administrative) expenses”, 29 “Servicing production and facilities”;

- for a trading enterprise - account 44 “Sales expenses”.

The wiring looks like this:

D20 (44.26,…) K70

This posting is made for the total amount of accrued salary for the month, or for each employee, if accounting on account 70 is organized with analytics for employees.

Salary deductions

Deductions from salary reduce the amount of accruals and go through the debit of account 70. As a rule, all employees have one deduction - personal income tax. Here account 70 corresponds with account 68 “Calculations for taxes and fees”, posting:

D70 K68

In postings for other deductions, the credit account changes depending on where it goes. For example, when withholding under a writ of execution in favor of a third party, account 76 “Settlements with various debtors and creditors” is used, posting:

D70 K76

Codes of 54 types of payments 1990

By logging into LiveJournal using a third-party service, you accept the terms of the LiveJournal User Agreement

I’ll tell you more, I was faced with the privatization of one of the old enterprises (I don’t know how they weren’t torn to pieces before 2012) there, naturally, in production, accounting was kept in the old fashioned way, of the programs there was only a salary sail (with summary results on the heads inside), and even then only because everyone was required to submit their records to the Pension Fund electronically

UPD. Moscow, 10 minutes from the non-terminal metro.

Edited at 2013-09-16 18:40 (UTC)

no, there was a completely independent separate enterprise, where accounting was kept in ledgers in the second decade of the 21st century in Moscow

When I saw this, I was naturally shocked; the computers were standing still, and the accountants were surfing the Internet and posting their photos in one-eyed devices.

Source: https://soviet-life.livejournal.com/2103039.html

Transfer of personal income tax and contributions

No later than the day following the day of salary payment, the organization is obliged to pay personal income tax. Insurance premiums, including insurance premiums, are paid by the 15th of the following month. Payment is made from the current account (account 51), the debt to the Federal Tax Service and funds is closed (accounts 68 and 69). Postings:

D68 K51 - personal income tax paid

D69 K51 – fees paid

Example of payroll with postings

Employees were paid salaries for March 2021, personal income tax was withheld, and insurance premiums were calculated. Accounting for account 70 is carried out without analytics for employees, for account 69 - with subaccounts for each contribution. Expenses for salaries and contributions are included in account 20.

04/10/2019 – salary paid, personal income tax paid,

04/15/2019 – insurance contributions to the Pension Fund, Federal Migration Service, and Social Insurance Fund were paid.

| Full name | Accrued | Personal income tax | Paid |

| Ivanov I.I. | 25 000 | 3 250 | 21 750 |

| Petrov P.P. | 20 000 | 2 600 | 17 400 |

| Sidorov S.S. | 30 000 | 3 900 | 26 100 |

| Total | 75 000 | 9 750 | 65 250 |

- in the Pension Fund of Russia (22%) - 16,500 rubles

- to the Federal Migration Service (5.1%) - 3,825 rubles

- FSS (2.9%) - 2,175 rubles

- FSS injuries (0.9%) - 675 rubles

Postings for all operations:

| date | Wiring | Sum | Contents of operation |

| 31.03.2019 | D20 K70 | 75 000 | Salary accrued |

| D70 K68.NDFL | 9 750 | Personal income tax withheld | |

| Insurance premiums charged: | |||

| D20 K69.pfr | 16 500 | - to the Pension Fund of Russia | |

| D20 K69.fms | 3 825 | - to the FMS | |

| D20 K69.fss1 | 2 175 | - in the Social Insurance Fund (temporary disability) | |

| D20 K69.fss2 | 675 | — in the Social Insurance Fund (injuries) | |

| 10.04.2019 | D68.NDFL K51 | 9 750 | Personal income tax listed |

| D70 K50 | 65 250 | Employees' salaries were paid from the cash register | |

| 15.04.2019 | Insurance premiums listed: | ||

| D69.pfr K51 | 16 500 | - to the Pension Fund of Russia | |

| D69.fms K51 | 3 825 | - to the FMS | |

| D69.fss1 K51 | 2 175 | — FSS (temporary disability) | |

| D69.fss2 K51 | 675 | — FSS (injuries) | |

Keeping accounting records in the online service Kontur.Accounting is convenient. Quick establishment of a primary account, automatic payroll calculation, collaboration with the director.

Return to Payroll 2018

Codes of 54 types of payments 1990

The scanning device transmits information about the sale of a specific product to a computer, where information about its stocks on the sales floor and in the warehouse is stored. If the stock is less than the permissible standards, then a signal is transmitted through electronic communications about the need to replenish the goods in the warehouse. Scanners installed in the warehouse automatically identify the required goods, and with the help of special devices the goods are transported to the sales floor.

On the title page of the timesheet of form N T-12 and T-13, symbols of worked and unworked time are given. The number of days and hours is indicated with one decimal place.

However, since the book provided decryption of the entire message, attempts were always made to find the book used. It is no coincidence that when arresting and searching persons suspected of espionage, attention was first paid to their libraries. Note that book ciphers were widely used in Russia in the activities of illegal parties and groups, which we will discuss in more detail below.

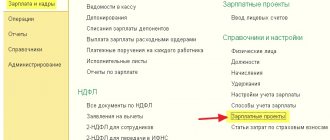

Automation of payroll calculations

For codes 530 a), b), 531 a), b) column 13. The cost of vouchers for sanatorium treatment of employees, summer holidays for children (the cost of vouchers to children's health camps) is not subject to income tax for individuals in cases where personalized confirmation is provided documents. 45. To code 531 e) columns 7, 8, 9 and 17. Payment of additional (personal) contributions to the non-state pension fund “Blagosostoyaniye” under agreements concluded by a division of JSC Russian Railways is accepted for the purpose of calculating income tax in cases where the specified payment is stipulated in the employee’s employment contract and subject to the maintenance of personalized records.

NOTES 1. To code 004, column 11. A bonus for time-based wages is accrued if this is provided for in the bonus regulations. When I fill out a checkbook, to receive money for wages, I indicate code 40 (this code implies the issuance of salary and social benefits). But if you need to pay for sick leave, then code 50 (this code includes payments of pensions, scholarships, and insurance benefits). Paying sick leave is insurance compensation, isn't it? What should I do if my organization must pay only three of the sick leaves, also use code 50? Will the entire amount be used for this code, or only the amount at the expense of the Social Insurance Fund?

A barcode is applied to shipping or consumer packaging of many imported and domestic goods by printing or by using a sticker or label that is adhesive. The bar code must be applied to the back wall of the package in the lower right corner at a distance of at least 20 mm from the edges. It can be applied to the side wall of the package, on the label in the lower right corner. On soft packages, choose a place where the strokes will be parallel to the bottom of the package. The barcode should not be placed where there are already other marking elements (text, pictures, perforation).

Is it mandatory to use forms T-54 and T-54a? Maintaining personal accounts using these forms is not mandatory (Clause 4, Article 9 of Federal Law No. 402-FZ dated December 6, 2011). The employer can independently develop a primary form to reflect information about wages paid during the calendar year. It is only necessary that independently developed forms contain the mandatory details of the primary accounting document (clause.

In relation to various conditions of production organization, the form can be supplemented with the necessary data, namely: for coal, mining and other industries, in order to control the presence of workers at work underground, it is advisable to include indicators of the time of descent into the mine and ascent from it. In the Chechen Republic, the salary of representatives of this profession is 50,000 rubles/1 month. Other factors on which the salary of Russian Railways depends are presented in the table. Factor Description Type of transportation Representatives of passenger transportation receive more than their colleagues in the profession engaged in cargo transportation. Type of train Salary of an electric train driver higher than the salary of a specialist working on the old train. Flight Most are paid to drivers who travel long distances.

Providing the national economy with forms of accounting and reporting documentation and instructions for filling them out by order of the Council of Ministers of the USSR dated April 4, 1972.

In accordance with paragraph 21 of Article 217 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), the amount of tuition fees for the taxpayer in basic and additional general and professional educational programs, his professional training and retraining in Russian educational institutions that have the appropriate license, or foreign educational institutions having the appropriate status are not subject to personal income tax (hereinafter referred to as personal income tax).

Dear lawyers, I ask for help in understanding symbolic codes. What cash symbol must be indicated if an individual cashes a bill? I am considering two options: either 60 or 53. Which one should I choose? Or are both characters not suitable for this operation?

Submitting SZV-M for the founding director: the Pension Fund has made its decision The Pension Fund has finally put an end to the debate about the need to submit the SZV-M form in relation to the director-sole founder.

Various complications were introduced into the permutation ciphers, such as: spiral writing, diagonal writing, slogan and distributor writing, and the use of figured vertical permutations (with columns of different lengths).

The simplest and most affordable devices for reading barcodes are pen readers, but they can be used when the operator can run a pencil over the label.

In small shops they can be used, but in large warehouses or supermarkets this is impractical. Organization of recording of working hours………….22 1.7.

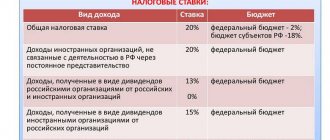

Duration of working hours………………………….23 Chapter 2. Taxes and deductions from wages…………………………24 2.1. Carrying out final activities, checking the correctness of calculation and payment of taxes calculated on income in favor of individuals……..……………………………………………..24 2.2. Application of tax rates……………………………25 2.3. The procedure for calculating and paying the unified social tax……26 2.4. It should be noted that this key was determined from memory (vertical rearrangement scale) by the number sequence of some easily memorized slogan. For example, the slogan “God Save the Tsar” was taken. Under this slogan, a number series was drawn up, which determined the order in which the columns were written. The D-500 cash register scanner is designed for use in supermarket cash registers. Fast code reading at a distance with any label orientation is achieved by multi-beam scanning, which ensures high productivity of customer service. The built-in decoder is configured for all known product coding systems. Due to the high cost, the use of this device is economically feasible only in large stores with a large flow of customers and turnover.

Dear Tatyana Vitalievna, there are many similar ambiguous situations when choosing the right code is very difficult or even impossible. For such cases, there is code 32, which implies all other receipts. Basic codes cannot be applied to other receipts. The timesheet is used to record the use of working time of all categories of workers, as well as to monitor compliance by workers and employees with the established working hours, to pay them wages and to obtain data on hours worked.

Dear Irina Vasilievna, symbol 40 must include wages and three for sick leave at the expense of your organization. Symbol 50 is payment for sick leave at the expense of the Social Insurance Fund.

If, when sending for training, the conditions of paragraph 21 of Article 217 of the Tax Code of the Russian Federation are not met (there is no license, status), personal income tax from the taxpayer sent for training is withheld in the manner established by the Tax Code of the Russian Federation. 3.

Vertical permutation ciphers with complications were often used as intelligence ciphers in Russia. The text of the message was recorded in a table with columns. Next, the text was written out in columns. The order in which columns were selected was determined by a key that users knew from memory. This key had to be changed quite often (for example, at least once every two months). Objects of insurance. Insurance risks. Exceptions from insurance coverage………….3 2. Valuation of property, determination of the insured amount………………………..12 3.

Reasons for filling out form T-54

It should be noted that for the first time a cipher close to the double permutation cipher was invented in Russia by the Narodnaya Volya member Mikhailov during the reign of Alexander II. Subtract the resulting number from 10. The resulting difference is the control number, which must coincide with what is indicated in the barcode.

But be careful: the procedure for paying for “children’s” sick leave remains the same! Codes of 54 types of payments in 1990

To facilitate the preparation of a labor report, the last page of the timesheet contains a table of daily time use and a total line for the month.

If the personal account is maintained on a computer Nowadays, it is rare that an accountant calculates wages manually. Much more often, he uses specialized accounting programs, which provide for maintaining, among other things, personal accounts of employees.

And if a certain part of it is subject to withholding, then he must provide the subordinate with an explanation - for what reason and where these funds were sent. As a rule, the salary codes in the payslip and the very form of this document are managed by the management of the enterprise. Information about the income received by the employee is entered into the form approved by the organization, since the current legislation does not provide for a mandatory form of the sheet. For more details, see.

Source: https://poznavaymir.ru/razvody/6110-shifry-54-vidov-oplat-1990-god.html

Income code "salary"

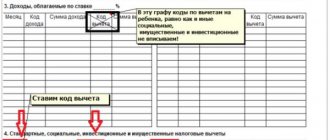

The employee's type of income must be completely clear to him. That is why it is necessary to decipher the codes on the payroll sheet. The employer can indicate it on each pay slip or familiarize employees with such information once.

The assignment of codes for each financial transaction to the accounting department is regulated by the order of the Federal Tax Service “On approval of codes for types of income and deductions” dated September 10, 2015 No. ММВ-7-11 / [email protected] According to it, funds paid to an employee as payment for his labor are assigned a code 2000.

Codes of 54 types of payments 1990

The order signed by the manager is announced to the employee against receipt, and a copy of it is transferred to the accounting department.

The indicated columns reflect the days (hours) worked by the employee in the reporting month. The data is taken from the working time sheet.

Shekmar Order 150. Circulation 635 Subscribed VNIIPI of the State Committee for Inventions and Discoveries at the State Committee for Science and Technology of the USSR 113035, Moscow, Zh., Raushskaya naba, 4/5. Production and publishing plant "Patent", Uzhgorod, st. Gagarina, 10 The table below shows the process parameters and technological characteristics of the resulting material, .5 Calcination at 1000 C, running in, running in, 64 cents...

How to fill out an employee's personal account

The data is entered on the basis of primary documents recording production, work performed, time worked and documents for various types of payments.

Then 8.6 g of solid catalyst is obtained into reactor 10, which contains, sat.: 1.1 T 1 solution of 63 ml of VPS 1 in 50 ml of hexane (4.4 T 1 C 1) over 2 hours at 65-6 °C ), 1.6 THF, the rest but (yol ratio BcC 1/Ia e 3), The reaction mixture is maintained at this temperature and stirring during the experiment. The experiment is carried out under Try-on conditions for 2 hours, then cooled. Dissolve, but use 0.033 g of the catalyst, the solvent is separated by decantation, the solid is prepared in example 2. The powdery precipitate is washed and treated with 42.4 g of polyethylene with an average of 200 ml... All letters are converted to lower case, the Russian alphabet is encrypted/decrypted, all non-alphabetic characters are not converted. When decoding, keep in mind that the numbers (from 1 to 33) must be separated from each other (by a line, a space, or whatever). To encrypt/decrypt using the English alphabet, switch the site language to English.

In this case, an order (instruction) to transfer the employee to another job (Form No. T-5) and an order (instruction) to transfer the employees to another job (Form No. T-5a) are issued, copies of which are also transferred to the accounting department. I protest! 96th is the “additional work” item, according to which calculations were made and unscheduled work was paid, for example, the installation of some kind of homemade electronic equipment.

Electrical mechanic of the Kazakhstanskaya mine Viktor Mazin became the Olympic champion in weightlifting at the XII Olympic Games on 08/06/1980. foreman of the integrated brigade of the Lenin mine construction department Gladyshev Petr Sergeevich p... Founded 1955. Former names - Tentek. Area 200 km. The climate type is sharply continental. Population 37,899 people (2013). National composition: Russians (59.23%), Kazakhs (15.45%), Ukrainians (7.00%), Tatars (5.36%), Germans (4 .33%), Belarusians (2.54%).

Employee's personal account (forms T-54 and T-54a)

Contains information about the employee’s vacation: the period for which the vacation was granted, duration, date and number of the order approving the vacation.

On the outer surface of the drum 3 there is an annular groove 13 of the corresponding cross-sectional profile (dimension b). At the bottom of the groove there is an annular protrusion 4, and pins 15 are evenly spaced on it to fix the profile in step d. The mandrel 10 is equipped with a spiral protrusion 6, along the 45 circumference of which pins 17 are evenly spaced with a circumferential pitch equal to the pitch of the profile. The heated profile is in constant contact with guide 7, and poleun 6 also has constant contact under the action of spring 18 with the surface of mandrel 10, poleun 6 and guide 7 are made of copper, and drum 3 is...

The diagnosis in the classification is represented by code and name. The codes are constructed using alphanumeric coding. The first character in the diagnosis code is a letter (A – Y), which corresponds to a specific class. The letters D and H are used in several classes. The letter U is not used (kept in reserve). Classes are divided into blocks of headings that describe “homogeneous” diseases and nosologies. Next, the blocks are divided into three-digit headings and four-digit sub-headings. Thus, the final diagnosis codes make it possible to characterize a particular disease as accurately as possible.

Yeah! At that time, our company had the rights of a legal entity and its own current account, and in the accounting department there were three little women with accounts and calculators. Now, of course, there are no rights of a legal entity, but in the accounting department (which is now called the service group) there are ten people, equipped with two computers each. This is despite the fact that the hardware (i.e. trains), in principle, remained the same.

Using the approved accounting Chart of Accounts 2021 with comments and subaccounts, commercial organizations approve their working chart of accounts, which will be applied and which must contain a complete list of synthetic and analytical accounts necessary for accounting. It ensures comparability of indicators across all budgets. With its help, systematization of information on the formation of budget revenues and expenditures is achieved.

Codes from ICD-10 are actively used in Russian medicine. Sick leave certificates indicate a diagnosis code, the explanation of which can be found in the electronic version of the classification on our website or on similar third-party resources. Our website contains easy navigation and comments on the classes and headings of ICD-10. To quickly jump to the description of the diagnosis code of interest, use the search form.

Based on the above functional classification, budgets of all levels are built. It is clear that the specifics of the budget at a particular level are taken into account.

This order indicates: the name of the structural unit, position (specialty, profession), probation period (if the employee is subject to a test upon hiring), as well as the conditions of employment and the nature of the upcoming work (part-time, in the order of transfer from another organization, to replace a temporarily absent employee, to perform certain work, etc.).

Below is a calculator that allows you to encrypt/decrypt text using the A1Z26 cipher. A simple substitution cipher, where each letter is replaced by its serial number in the alphabet.

The indicated columns reflect information about deductions in relation to the employee (according to writs of execution, order documents, etc.).

Reasons for filling out form T-54

ICD-10 contains 21 classes of diseases. Codes U00-U49 and U50-U99 constitute class 22 and are used for temporary designation and research purposes (not listed on our website). Otherwise, local sagging and distortion of the workpiece are possible due to uneven hardening. The entire flattening process, including intermediate annealing, must take place with a captive serpentine workpiece, which is very difficult to do. Extruding stops with subsequent calibration of the serpentine workpiece in width for the same reasons as flattening is labor-intensive operation. It is necessary to take into account that the height of the stops must be carried out with great accuracy (within 0.05 mm). The described method eliminates this drawback due to the fact that in order to improve the quality of manufacturing expanders, wire flattening is carried out before...

Such detailing makes it possible to take into account budget receipts of all types of income provided for by law. For each of them, the budget classification provides an independent code. ICD-10 is the international classification of diseases, Tenth Revision. It is a normative document with a generally accepted statistical classification of medical diagnoses, which is used in healthcare to unify methodological approaches and international comparability of materials.

Filling out the employee’s personal account form according to form T-54

The Federal Law “On the Budget Classification of the Russian Federation” was adopted by the State Duma of the Russian Federation on June 7, 1996. Currently, this law is in force with amendments and additions adopted by Federal Law No. 115-FZ of August 5, 2000. These documents, along with documents on the actual use of working time (time sheets, piecework orders, etc.), which will be discussed further, serve as the basis for the accountant to calculate the employee’s remuneration.

An employee's personal account is an internal document of the employer containing information about all types of payments and deductions from the employee's salary. Departmental classifications of budgets of the subjects of the Federation and local budgets are approved by the authorities of the subjects of the Federation and local governments, respectively.

Sample of filling out an employee's personal account

Mosquitoes are unique and ancient creatures of nature. Their fossilized bodies were found in excavations of the Cretaceous period. And their distribution area is so wide that sometimes it seems as if they were specially created to follow everywhere...

By the way, most likely the company about which you are writing did calculate the salaries and did the accounting, but somewhere in a higher organization. Previously, there were, for example, centralized accounting departments, where all records were kept.

Diamonds are made from the following: Using metallens, diamonds are coated with an active surface of equal high quality and are therefore a complete model. Notes (54) (57) 1. ALLIZED RIGHT CONSISTING ie body with a well-known metal bond, distinguishing the Disadvantages of such rollers are poor heat removal from the cutting zone, low strength of fastening of diamond grains. The proposed roller differs from the known ones in that between the body and The diamond layer contains a layer of metal with high thermal conductivity, 0.3-5 mm thick, and an adhesion-active alloy (for example, an alloy consisting of nickel, chromium, boron, tungsten) is used as the binder metal. This design of the roller improves heat removal from working area.On... The table below shows active and passive accounting accounts, where each account contains comments from the Instructions for Use, for example, the CHART OF ACCOUNTS.

Source: https://centrkids.ru/prava-potrebiteley/3169-shifry-54-vidov-oplat-1990-god.html

Salary codes in the payslip (or certificate 2-NDFL)

There are other salary codes that are also subject to indication in the 2-NDFL certificate:

2012 — vacation payments;

2300 — payment of sick leave;

2760 - payment of funds as financial assistance to a retired employee due to disability or age, as well as other material assistance provided by the employer;

4800 is a universal code that designates all payments that do not have a special code (for example, additional payments and compensation).

Wage type code: additional explanation

In addition to the listed salary codes, the order of the Federal Tax Service approved the following designations for income indicated in the 2-NDFL certificate:

2001 - remuneration or similar payment to the company’s management structure;

2010 - payment based on a civil contract;

2530 - remuneration in kind;

2720 - income received as a gift;

2762 - payment to employees at the birth, adoption of a child.