What is included in other income?

Accounting for other income is regulated by PBU 9/99 “Income of the organization” (approved by order of the Ministry of Finance dated May 6, 1999 No. 32n). The regulation divides the organization's income into income from ordinary activities and other income. Income from ordinary activities means revenue from the sale of goods and services (work), that is, income from the daily activities of a commercial organization. It is important to note that ordinary activities are not limited to the main activities (which are indicated in the application when registering a company and require annual confirmation). The main criterion for classifying an activity as a regular type is that it:

- carried out systematically;

- is of an entrepreneurial nature (the goal is to generate income);

- the income received as a result of the activity meets the criterion of materiality in the total income of the company (5% or more) - this is explained by the Ministry of Finance, in particular, in a letter dated September 24. 2001 No. 04-05-11/71 on the application of PBU 9/99.

Everything that is not classified as income from ordinary activities is included in other income. The regulation provides a list of income that must be included in the “other” category:

- income from leasing property, if leasing is not the subject of the organization’s activities;

- income as patent payments for the provision of intellectual property rights (license payments), if this is not the subject of the organization’s activities;

- income from ownership of shares in the authorized capital of a third-party organization, including interest income on securities, if this is not the subject of the organization’s activities;

- income from joint activities (under a simple partnership agreement);

- income from the sale of company property;

- income in the form of interest accrued by the bank for the use of company funds;

- penalties due under the contract;

- gratuitous receipts of property;

- funds received as compensation for losses caused to the organization;

- income from previous periods (discovered in the current year);

- debt to creditors with an expired statute of limitations;

- positive exchange rate difference;

- results of property revaluation.

Cost accounts and their number

For a commercial company, other expenses, as well as costs associated with its main activity, are an important part of the accounting system, since this information influences the adoption of correct management decisions.

When entering a new element into the directory, you must fill in the “Name” attribute - this is the short name of the reporting form, which will be displayed in the list of regulated reports.

The subsystem for the preparation of regulated reporting is intended for the preparation of various reports, the forms and procedure for presentation of which are established by various legislative bodies. At the end of the year, accounting account 91 is completely closed, the balance for each subaccount should be equal to 0. Closing account 91 occurs in the same way as in the case of account 90: each subaccount is closed to account 91/9 by internal postings.

At what cost should other income be taken into account?

Receipts recognized as other income are taken into account at actual cost, except for the following cases:

- property transferred free of charge is accounted for at market value, and the value must be confirmed by documents or by an independent appraiser;

- accounts payable with an expired statute of limitations are taken into account in the same terms in which they were reflected in accounting;

- revaluation of property is accounted for according to the method approved in the accounting policy;

- penalties for non-compliance with contractual terms, compensation for the company's losses are taken into account at the cost approved by a court decision or accepted by the violating counterparty;

- proceeds from the sale of property are accounted for in the same way as proceeds from sales (clause 10.1 of PBU 9/99).

Many organizations have received a number of subsidies from the government due to restrictions due to COVID-19. They also apply to other income. But they are taken into account somewhat differently. Why? The answer to this question is in ConsultantPlus. Study the material by getting trial access to the K+ system for free.

Account 91 “Other income and expenses”

Under the cash method, other expenses are recognized when they are actually paid. In accounting, other expenses are considered to be all expenses that are not expenses for ordinary activities.

Distribution bases can also exist for the functional services of an enterprise (management apparatus). In this case, they characterize, as a rule, the quantitative aspect of one of the main functions performed by the service of the management apparatus.

In October, the company received a profit from the sale of written-off fixed assets in the amount of 36,000 rubles; in the same month, other expenses amounted to 16,000 rubles.

Distribution bases can also exist for the functional services of an enterprise (management apparatus). In this case, they characterize, as a rule, the quantitative aspect of one of the main functions performed by the service of the management apparatus.

Thus, account 91 does not have a final balance; the final data is written off to account 99 and forms the financial result.

Not all expenses of an organization reflected in accounting can be taken into account when maintaining tax records. This creates temporary differences that must be taken into account in accordance with PBU 18/02.

When can other income be recognized?

The conditions for accepting other income into account vary depending on the specific type of income:

- proceeds from penalties from the counterparty are recognized on the date of the court decision or recognition by the counterparty-debtor;

- debt to creditors - as of the date of expiration of the limitation period;

- proceeds from positive revaluation of property - on the date of the revaluation procedure.

To accept proceeds from the sale of assets as other income, the following conditions must be met:

- there is a purchase and sale agreement or other documentary evidence of the company’s right to this receipt;

- you can determine the amount of income in monetary terms;

- the sale brought economic benefit to the company;

- there has been a transfer of ownership from the seller to the buyer;

- you can determine the amount of expenses associated with the sale.

If at least one of the listed criteria is missing, the received payment cannot be recognized as income; instead, accounts payable are formed.

Account 91 “Other Income and Expenses” Postings and Examples

Sales volume is an additional distribution base for those departments whose activities are aimed at sales promotion. This could be, for example, the marketing department or the shipping department.

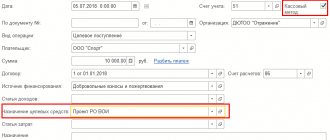

Another example is a transfer to an organization’s account. In the “Type of operation” field, the value will be “Other receipt”. We indicate 91.01 as the settlement account.

In some cases, expenses need to be distributed over several reporting (tax) periods (clause 1 of Article 272 of the Tax Code of the Russian Federation). Let's take an example of a service implementation document. We will be interested in the data in the “Accounts” column. Using the hyperlink inside the column, you can open a window with accounting accounts.

Differences in income classification in accounting and tax accounting

In tax accounting, the division into operating and non-operating income is practiced, and this classification does not entirely correspond to the division used for accounting purposes. Thus, some income recognized in accounting cannot be accepted in tax accounting, resulting in permanent differences. Such income will supplement accounting profit, but will not affect the tax indicator. For example:

- the difference between the value of property received as a contribution by a company participant and its value when allocating a share (when a participant leaves the company);

- interest income received from budget funds;

- debt to the budget, written off by decision of the authorities;

- positive revaluation of securities.

You can read about the features of accounting for non-operating income for tax profit in the material “How to take into account non-operating income when calculating income tax?”.

Other (non-operating) income and expenses - what are the features?

It is recommended to keep analytical accounting of other expenses in account 91 separately for each of the operations in order to have before your eyes a complete picture of their impact on the results of the company’s work.

Each accounting account, being an accounting tool, contains a number of properties. The account code, as well as its subaccount, determines the purpose of the account and the type of information stored on it. The subconto of the account shows “how in detail” the information is stored. Look at the master list of cost accounts.

The account does not have a final balance; it is closed at the end of the reporting period using account 99 “Profit and Loss”.

Costs are collected according to the names of cost items (sub-accounts of the account). Thanks to this, it becomes possible to generate a detailed report, for example, a balance sheet for an account.

Why is other income an important component of the income statement?

Other income may affect the financial result of the enterprise. Thus, in case of losses from ordinary activities in combination with other income, the financial result may turn out to be positive.

For example, an organization can issue invoices in dollars and receive payment in rubles at the exchange rate on the day of payment. When the ruble falls, as, for example, during the recent crisis, a significant positive exchange rate difference is formed, which can cover the loss on the usual type of activity.

The opposite situation may arise when accounting for expenses related to other income. Despite the profitability of the main business during the year, due to the high importance of other expenses (related to other income), the income statement will give a negative result. The final report will form a negative impression about the state of affairs at the enterprise for third-party users (bankers, investors, shareholders, potential counterparties).

What other income can be classified as other and how to correctly display them in the financial statements, ConsultantPlus experts explained in detail. Get trial access to the K+ system and go to the Tax Guide for free.

You can read about the features of accounting for other income and expenses in the material “Accounting for other income and expenses (nuances).”

Subaccounts to account 91

In order to correctly carry out analytical accounting, additional sub-accounts can be opened to account 91:

- 91.1. The name of the subaccount is other income. The company receives such profit not from the main direction, but from additional activities.

- 91.2. The name of the subaccount is other expenses. In this case, all additional expenses that are in no way related to the main activity of the enterprise are taken into account.

- 91.9. The name of the subaccount is the balance of other income/expenses. This is the difference between profit and expenses on main account 91. This amount is written off to account 99. The procedure is performed every month.

The listed subaccounts in some accounting programs are designated 91.01, 91.02 and 91.09, respectively.

Results

The list of income that an accountant must classify as other is given in PBU 9/99, Ch. 3. Among them, in business one often has to deal with income from the sale of assets, from the rental of property, positive exchange rate differences and positive revaluation of property. In most cases, income is taken into account in the amount of actual cash receipts.

To recognize other income, a number of conditions must be met, the main ones being confirmation of the right to income and the measurability of income. There are nuances between accounting and tax accounting of income, when income is recognized in accounting, but does not in any way affect tax profit, as a result of which permanent differences appear.

Recognizing and accurately classifying income is important for correctly determining a company's profit and, as a result, correctly assessing its financial health.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Impact of Cost Accounts on Accounting Areas

The situation is similar with the recognition of other expenses. That is, other expenses are derived from activities that are not normal for the firm. Steam. III PBU 10/99 contains an open list of expenses that should be classified as other. So the company can determine the type of expense itself, taking into account the provisions of the regulatory framework. Account 91 is an account included in section VIII (which is called “Financial Results”) of the Chart of Accounts. Analytics for account 91 is based on the types of disposals and receipts.

Fines, penalties, penalties for violation of the terms of contracts, as well as compensation for losses caused by the organization are accepted for accounting in amounts awarded by the court or recognized by the organization.

In most cases, there is no difference when determining the amount of income for accounting and tax purposes.

In addition, when applying the accrual method, one or another other expense must be written off depending on whether it relates to direct or indirect expenses (Clause 1, Article 272, Articles 318 - 320 of the Tax Code of the Russian Federation).

In order to see the decoding of 91 accounts in 1C, you need to go to the “Main” section and then the “Chart of Accounts” item. In the search window, for convenience, you can set the value to 91 and the program will automatically select a list of accounts containing this code. In accordance with the Tax Code, all expenses that are taken into account when calculating income tax and that are not direct or non-operating are considered indirect expenses associated with production and sales.

How can 1C help an accountant?

Automation of final operations significantly saves time when compiling reports. Therefore, 1C.8 versions 2.0 and 3.0 provide for a whole cycle of regulatory operations. They must be carried out gradually, strictly in the sequence in which they were conceived.

Important point! Violation of the sequence of routine operations leads to incorrect data in analytical reports. We must remember that some of the operations are interconnected. It is impossible to calculate profit if cost accounts are not reset.

Regular operations are located in the “Accounting, Taxes and Reporting” menu, “Period Closing” section, “Month Closing” subsection. Here in the third stage you can see “Closing 90, 91 accounts”.

This processing deals with zeroing the required account. 91, just like other accounts, is not closed if there are errors. Incomplete cost items and other analytical sub-contos may result in the transaction being rejected. You can learn more about how the operation works from the video:

Empty subcontos form negative balances in analytics, which confuse the balance sheet, leading movements into chaos. Therefore, it is necessary to fill out the analytics very carefully and thoughtfully, entering primary operations in the program.

How to close a period?

At the end of the month, it is necessary to close account 91. For this, the third subaccount 91.09 is constantly used, which is designed to reduce turnover at the synthetic level to zero.

From the author! It shows the interim financial result from the turnover of other activities of the company, showing a profit on debit or a loss on credit.

After the positive or negative balance becomes known, the posting is made:

- Dt 91.09 Kt 99 “Profits and losses” - profit is reflected;

- Dt 99 Kt 91.09 – loss from the company’s activities is taken into account.

For example, Bubbles LLC at the end of the month accumulated amounts in subaccounts, which are more convenient to view in tabular form:

Table 1. Analytics for subaccounts

| Name of income | Amount of income | Name of expense | Expense amount |

| Scrap metal obtained from the liquidation of OS | 6 000,00 | Reserve accrued for PDZ | 50 000,00 |

| Overdue accounts payable with expired statute of limitations | 98 000,00 | Vacation reserve accrued | 300 000,00 |

| Sold a refrigerated display case made from our own OS | 1 000 000,00 | Received a fine from the Federal Tax Service | 2 000,00 |

| Penalty received under the contract | 400,00 | Bank service fee | 3 000,00 |

| TOTAL | 1 104 400,00 | 355 000,00 |

So, the balance at the end of the month is:

- 91.01 – in the amount of 1,104,400 rubles accrued to other income;

- 91.02 – in the amount of 355,000 rubles included in other expenses.

Thus, you can calculate the balance 91.09:

- 1,104,400 – 355,000 = 749,400 rubles profit received.

When closing the month, the accountant will make an entry in the program:

- Dt 91.09 Kt 99 – in the amount of 749,400 rubles.

Or you can show a simple double entry accounting:

Table 2. Balances in accounting

| Subaccount number | Turnover by debit | Loan turnover |

| 91.01 | 1 104 400,00 | |

| 91.02 | 355 00,00 | |

| 91.09 | 749 400,00 | |

| Total revolutions | 1 104 400,00 | 1 104 100,00 |

| Total account balance 91 | 0,00 | 0,00 |