What are the features of concluding a contract (agreement) for the supply of auto parts? How are spare parts purchased for a fee, as well as those obtained as a result of dismantling, liquidation and repair of vehicles, reflected in accounting? In what cases should auto parts be included on the balance sheet?

In the modern world, a car has long ceased to be a luxury, turning into a necessary means of transportation. Therefore, the issues of accounting for the costs of maintaining it in a condition suitable for operation are always relevant. In this article we will talk about the acquisition and accounting of spare parts intended for repair and replacement of worn-out car parts.

- 1 Features of concluding a contract (agreement) for the supply of auto parts

- 2 Accounting for auto parts in accounting (budget) accounting

- 3 Acceptance for accounting of spare parts obtained as a result of disassembly, recycling (liquidation), and repair of vehicles.

- 4 Installation of spare parts for transport

How to write off spare parts for car repairs on your own in a budget organization

The organization of accounting for spare parts on this account is due to the fact that the cost of batteries and tires is included in the inventory cost of the vehicle, and their useful life is several times shorter than the vehicle itself.

The need to purchase spare parts for vehicles arises, as a rule, as the original set of vehicle parts, which were installed at the time of purchase and included in the initial cost, wear out or fail.

Fuel accounting is carried out on account 235 “Fuel, combustibles and lubricants” It keeps records of all types of fuel, fuels and lubricants located in warehouses or storerooms (firewood, coal, peat, gasoline, gas, fuel oil, etc.) , as well as directly from materially responsible osіb.

Subaccount 238 “Spare parts for vehicles, machines and equipment” takes into account spare parts intended for the repair and replacement of worn parts of machines (medical, electronic computers, etc.), equipment, tractors, combines, vehicles (motors, car tires, including tires, tubes and rim strips, etc.) regardless of their cost. For example, if an organization has the necessary parts, they can be used for repairs, which requires them to be written off as a separate object. If a faulty spare part that is not suitable for restoration is written off, a defective statement is issued.

Wiring used

IMPORTANT! Regulations on the operation and accounting of tires from ConsultantPlus are available at the link

The purchase of tires, their placement into operation and other operations must be recorded using postings. These entries are used:

- DT60 KT51. Transfer of funds for purchased tires.

- DT10 KT60. Debt incurred on purchased items.

- DT19 KT60. VAT on the cost of products.

- DT68 KT19. VAT deductible.

- DT10 KT10. The elements have been put into operation.

- DT20, 26, 44 KT10. Disposal of tires.

The cost of items taken to replace worn tires is recorded on account 10. Already used and spare tires must be recorded on the same account. For separate accounting, you need to create additional accounts to the “Spare” subaccount.

Recording wear and other operations

Replacing worn elements can be considered part of the repair. Write-offs are made for production costs and OS repair costs. Repair expenses must be recorded as a debit for production cost accounting, and as a credit for cost accounting. Worn elements are repaired and restored. They are taken into account in the subaccount “Spare parts subject to restoration”.

Replacing seasonal tires is included in the OS. Related expenses are considered expenses for core activities. When replacing, the cost is charged to a decrease in operating expenses.

Let's look at the wiring used:

- DT20, 26, 44 KT10. The cost of seasonal parts (after their wear and tear) in the expenses of the main activity.

- DT10 KT91/1. Worn tires that need to be rebuilt.

- DT20, 26, 44 KT10. Replacement of elements and sending them to the warehouse. The cost of spare parts is used to reduce expenses for current activities.

- DT10 KT10. Assembly of winter tires put into use.

- DT10 (sub-account “Spare parts”) KT10. Removing winter elements.

The accountant must create subaccounts. They are needed for separate accounting.

41 Primary accounting for the purchase and write-off of spare parts

Therefore, an organization can approve an independently developed template. The prototype can be unified forms, namely an invoice of form M-15 or a demand invoice in form M-11.

When spare parts are put into use - no matter whether they are sold or put into operation, you need to correctly assess their cost. To do this, you need to determine in the accounting policy which method will be adopted by the company:

- the cost of each part is taken into account separately;

- average cost of spare parts;

- FIFO method - reflection of cost in the order in which spare parts are received on the balance sheet, the so-called “first to come, first to leave.”

Accounting for the write-off of spare parts for repairs Write-off of parts is carried out on the basis of form M-11 or a record of the consumption of materials in card No. M-17. Before writing off spare parts, the commission draws up a free-form defective statement.

Organizations that pay a single tax on the difference between income and expenses recognize any expenses only after they are actually paid. Payment is recognized as the termination of obligations to suppliers by transfer of funds or otherwise.

On January 1, 2010, Order of the Ministry of Finance of Russia dated December 30, 2009 N 152n “On amendments to the Instructions for Budget Accounting approved by Order of the Ministry of Finance of the Russian Federation dated December 30, 2008 N 148n” came into force, which introduced additions to the interpretation of the application of account 09 .

The document is signed by the commission members and the director. The presence of a statement allows you to confirm the economic feasibility of the repair and separate the purpose of the work from modernization or restoration. The importance of separating modernization from repair is determined by the taxation procedure. The act is the primary document confirming the fact of the transaction. Thus, the act of writing off car spare parts certifies the fact of writing off certain values from the organization’s accounting records.

Based on the application for the report, funds were issued to KRB 2 20822 560 KIF 2 20101 610 1500.00 Spare parts were received at the warehouse KRB 2 10506 340 KRB 2 20822 660 1500.00 Spare parts were transferred to the garage KRB 2 10506 340 KRB 2 10506 340 1500.00 According to the act, spare parts used during repairs were written off as expenses KRB 2 10604 340 KIF 2 20101 610 1500.00 Example 3.

Rules for off-balance sheet accounting in budgetary institutions

The purchased spare part, in accordance with the mechanic’s memo, is transferred to replace the faulty part. After this, the old spare part can be written off. The write-off is documented by a defective statement and an inventory write-off act.

Read about forms M-11 and M-15 in the articles:

- “Procedure for filling out form M-11 requirement-invoice”;

- "Unified form No. M-15 - form and sample."

When car repairs are carried out by a third party, spare parts can be written off on the basis of an invoice for the release of materials to the third party in the M-15 form.

Read about forms M-11 and M-15 in the articles:

- “Procedure for filling out form M-11 requirement-invoice”;

- "Unified form No. M-15 - form and sample."

When car repairs are carried out by a third party, spare parts can be written off on the basis of an invoice for the release of materials to the third party in the M-15 form.

Analytical accounting of spare parts is carried out regardless of their cost by names of spare parts, brands, serial numbers, quantity, cost...

When installing a tire, its cost is immediately written off as actual expenses and at the same time a “Car Tire Mileage Card” is compiled, and a record is made:. Dt 801, 802, 811-813.

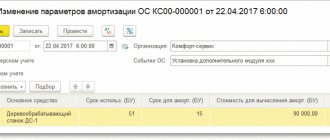

Material assets are reflected in off-balance sheet accounting at the time they are written off for the purpose of repairing vehicles and are taken into account during the period of their operation (use) as part of the vehicle.

Tax Code of the Russian Federation). When using the accrual method, include the cost of spare parts as expenses in the reporting (tax) period in which the car was repaired (clause 5 of Article 272, clause 1 of Article 260 of the Tax Code of the Russian Federation). That is, when a document was signed indicating the actual replacement of the spare part (act in form No. OS-3, act of replacement of the spare part).

In the case of purchasing the necessary spare parts, the write-off act becomes a justification for the expenses incurred by the organization. Legal grounds If the organization has at least one car, then accounting of transactions reflecting the accounting of spare parts is carried out regularly. In this case, such basic operations are recorded as:

- posting of spare parts;

- movement of spare parts between departments;

- writing off spare parts for repairs.

Tire registration card

Enterprises must keep track of consumables needed to operate their vehicles. One of the areas of accounting is control over the movement of tires. The accounting card records the receipt, operation and disposal of spare parts. It needs to reflect information about each unit of elements. It is written down which vehicle the part is assigned to. Monthly monitoring of operation is carried out. To do this, marks about the mileage of the car are placed. These marks allow you to track the technical condition of the elements. Based on this, it is determined whether the spare parts can be used further.

The card is filled out by the designated person. All information is entered based on the decisions of the expert commission. The composition of the latter is determined by the head of the enterprise.

FOR YOUR INFORMATION! Is it necessary to have a card? Yes, this is a mandatory requirement for all businesses. Only those who transport cargo or passengers for personal needs may not have cards.

Write-off of spare parts for car repairs

Thus, in the Resolution of the Federal Antimonopoly Service of the North-Western District dated August 21, 2007 in case No. A56-20587/2006, the power of the new engine was twice as high as the power of the one that had fallen into disrepair. The conclusion of the regulatory authorities is predictable: modernization, technical re-equipment of the fixed assets facility was carried out, and not repairs. Temporary standards for the operational mileage of vehicle tires RD 3112199-1085-02, approved by the Ministry of Transport of Russia on April 4, 2002.

There is no repair team at the enterprise; replacement of spare parts is carried out by a contractor - a service center.

When a vehicle is disposed of, the spare parts installed on it and accounted for in off-balance sheet account 09 are written off from off-balance sheet accounting.

Auto parts purchased by an autonomous institution using funds from income-generating activities in the amount of RUB 50,000 are installed on the vehicle. Worn-out spare parts listed on off-balance sheet account 09 are written off in the amount of RUB 35,000. and capitalized on the balance sheet at an estimated value (RUB 12,000) for subsequent scrapping.

Depending on the availability of a repair base in the institution, car repairs or replacement of spare parts can be done on your own or using the services of a third-party organization.

There are several similar automotive gearboxes in stock. They arrived at different times, so their prices are different. One of them is taken away for use in the main production.

Each of these facts must be documented. This is especially important when writing off parts. What are the features of the act for writing off automobile parts in Russia?

Accounting for spare parts for vehicles issued to replace worn-out ones

N 148n (hereinafter referred to as Instruction N 148n). The actual cost of inventories acquired for a fee includes, among other things, amounts paid to organizations for information and consulting services, as well as for the delivery of inventories to the place of their use.

This system should determine the procedure for servicing vehicles, carrying out their current or medium repairs, as well as major and particularly complex repairs of individual objects.

Moreover, identifying spare parts does not incur any costs at all, since the economic benefits of the organization do not decrease. The further use of used spare parts in production or their sale will also not affect the calculation of the single tax. Medium repairs are done for the same purpose as current repairs: they are needed to prevent vehicles from wearing out ahead of time. The difference between an average repair and a current one is that it is performed less frequently, usually once a year. In this case, some of the main parts in the object being repaired are replaced.

Write-off of auto parts in a budget organization

In accounting, spare parts are accounted for at their actual cost, taking into account VAT charged to the institution by the supplier, if the spare parts are intended to be used in activities that are not subject to VAT. This is stated in paragraph 52 of the Instructions on Budget Accounting, approved by Order of the Ministry of Finance of Russia dated December 30, 2008 N 148n (hereinafter referred to as Instruction N 148n).

During operation, the property gradually wears out. Cars that periodically require repairs are no exception. How are car parts written off in Russia, what are the features of drawing up the corresponding act?

According to the Instructions for Budget Accounting, account 09 “Spare parts for vehicles” must take into account spare parts issued to replace worn-out ones. Please tell me: does account 09 take into account all the spare parts issued or only some of them? Is there a list of such spare parts and where can they be found?

When writing off, we indicate the vehicle on which the spare part is installed. Postings generated by the document “Write-off of materials”: After this spare part on the vehicle fails, it will need to be written off from account 09.

Budget accounting. Repairing a car is a troublesome business

Organizing car repairs is not a problem today. But it is not an easy task for a public accountant to correctly determine which expense item to attribute the expenses made to. Moreover, Instruction No. 25n introduced some changes to the accounts used to reflect such transactions.

Budget magazine A car has long ceased to be a luxury, but has acquired the status of an indispensable means of transportation.

And when it breaks down, the work of any institution goes out of its usual rhythm. If the car requires minor repairs, then, as a rule, they are carried out on their own. When the breakdown is serious, or the vehicle needs major repairs, then in this case the institution turns to a third-party organization, for example, a car service center. The way in which the repair work is carried out determines which expense item the funds spent will be allocated to. We repair on our own

To carry out repairs on its own, the institution purchases spare parts from suppliers. Such a purchase, like any other, is documented with a delivery note and invoice. They indicate the name of the purchased spare parts, their quantity, price and amount. Upon receipt of the purchased parts at the warehouse, on the basis of the received invoice, the financially responsible person enters the “Book (card) of accounting for material assets” by name and quantity.

In accounting, spare parts are accounted for at their actual cost, taking into account VAT charged to the institution by the supplier, if the spare parts are intended to be used in activities that are not subject to value added tax. This is stated in paragraph 49 of the Instructions on Budget Accounting, approved by order of the Ministry of Finance of Russia dated February 10, 2006 (hereinafter referred to as Instruction No. 25n). Spare parts are taken into account on the analytical account 1 105 06 340 “Increase in the cost of other material inventories”. Please note that the analytical account code in the named account has changed. In Instruction No. 70n it looked like this: 1 105 05 340 “Increase in the cost of other inventories.”

The debit of account 1 105 06 340 “Increase in the cost of other material inventories” reflects the cost of received spare parts, and the credit reflects the cost of spare parts transferred to the department that carries out repairs. Such movement within the organization occurs on the basis of a demand invoice (f. 0315006).

When purchasing spare parts from an institution, some other costs may also arise, for example: the cost of transportation services if the spare parts are delivered by the supplier at the expense of the buyer. Or a rare part was needed for repairs. To find it, you need the services of an organization that, for a fee, will provide information on where you can purchase this spare part. An accountant may wonder whether such costs should be taken into account when determining the actual cost of spare parts. The answer to this question is given in paragraph 49 of Instruction No. 25n. It states, in particular, that the actual cost of inventories acquired for a fee includes, among other things, amounts paid to organizations for information and consulting services, as well as for the delivery of inventories to the place of their use. It should also be noted that if separate contracts are concluded for the provision of these services, the actual cost of inventories is formed on the basis of costs incurred using account 0 106 04 340 “Increase in the cost of manufacturing materials, finished products (works, services)” (p. 73 Instructions No. 25n).

The main document for attributing to expenses the cost of spare parts used during repairs is the “Act on the write-off of inventories” (f. 0504230). This document should indicate which vehicle was repaired and what spare parts were used. The cost of written-off spare parts is debited to account 1 401 01 272 “Consumption of inventories”.

Example 1 An institution has a car on its balance sheet.

To carry out repairs on its own, the institution purchased spare parts in the amount of 8,000 rubles. (including VAT - 1220 rubles 34 kopecks). The parts were entered into the warehouse by the financially responsible person M.I. Petrenko. Further, the spare parts, as requested by the invoice, were transferred to the garage and reported to the driver V.Yu. Kirillov for car repairs. Upon completion of the work, a certificate of completion of work was issued. The accountant will record all transactions performed in accounting with the following entries: Debit 1,105 06,340 “Increase in the cost of other inventories” Credit 1,302 22,730 “Increase in accounts payable for the acquisition of inventories” - spare parts are capitalized - 8,000 rubles; Debit 1 105 06 340 “Increase in the cost of other inventory” Credit 1 105 06 340 “Increase in the cost of other inventory” - spare parts were transferred from the warehouse (m.o.l. M.I. Petrenko) to the garage (m.o.l. V.Yu. Kirillov) for repairs - 8000 rubles;Debit 1 401 01 272 “Consumption of inventories” Credit 1 105 06 440 “Decrease in the value of other inventories” - spare parts used for repairs are written off as expenses - 8000 rubles.

Who should repair a rented car? The institution, along with its own transport, can also use rented ones. At the same time, rental cars also require repairs. In this situation, the question arises: who is responsible for repairing such vehicles? The answer to this question will depend on the terms of the vehicle rental agreement. It is in it that the parties to the transaction must provide for who bears the costs associated with car repairs. If the contract (agreement) between the tenant and the landlord does not provide for reimbursement of these expenses by the landlord, then the costs of repairs will be taken into account by the tenant. The procedure for recording repair operations for your own vehicles also applies to leased vehicles. We repair a car at a service center If a serious breakdown occurs in the car, the elimination of which requires a specialist and special equipment, then the institution, as a rule, turns to a specialized workshop.

To do this, an agreement must be concluded with a third-party organization, in which the cost of the work must be specified. In accordance with Order of the Ministry of Finance of Russia dated December 21, 2005 No. 152n (hereinafter referred to as Order No. 152n), the costs of paying for repair services are included in subarticle 225 “Costs for property maintenance services” of the economic classifier of expenses (ECR). However, in this situation, the question arises: to which sub-article of the ECR should the cost of the spare parts specified in the contract be attributed? It would be logical to assume that if the subject of the contract is the provision of car repair services, then the cost of spare parts (allocated or not allocated in the contract), as well as the repair service itself, should be taken into account in subarticle 225 “Costs for property maintenance services.” However, not everything is so simple in this matter, and the discussion that unfolded among public accountants on the site’s forum is a clear confirmation of this. The fact is that the Treasury refuses to accept payment orders under subarticle 225 of the ECR for contracts that specify the spare parts necessary for repairs. They justify their actions by Order No. 152n.

The repair organization is obliged to highlight in its documents the cost of work, spare parts and materials used in repair work. But the institution in this situation acts as a consumer of the service in the form of car repair and does not buy spare parts separately. In other words, the financially responsible person does not receive them on the basis of a power of attorney using the TORG-12 invoice and the details are not credited to account 1,105,06,000 “Other inventories.” But in order for the accountant to be able to attribute costs to subsection 225 of the ECR and the Treasury has no reason to refuse to accept the payment, it is necessary for the workshop to draw up an agreement, an invoice, a certificate of work performed and an invoice for repair services or routine maintenance indicating the specific type of work . For example, changing engine oil costs 1,500 rubles, replacing rear struts costs 7,000 rubles. In the payment order, in the purpose of payment column, you should indicate “for car repairs on account...”.

Example 2 An institution entered into an agreement with a repair shop to repair a car.

The contractual cost of repairs is 50,000 rubles. According to the estimate, the cost of repair work was 20,000 rubles. (including VAT - 3050 rubles 85 kopecks), cost of spare parts - 30,000 rubles. (including VAT - 4576 rubles 27 kopecks). Upon completion of the repair, a certificate of completion of work was signed. In accounting, these transactions will be reflected in the following entries: Debit 1 401 01 225 “Expenses for property maintenance services” Credit 1 302 08 730 “Increase in accounts payable for settlements with suppliers and contractors for payment for property maintenance services” - services of a third-party organization are reflected for car repairs – 50,000 rubles.

The repair is yours, the spare parts are ours. In addition to the above methods, you can organize the repair of a vehicle, for example, this way: the repair work is carried out by a third-party organization, and all the necessary spare parts are purchased by the institution. In this case, the costs of repair services should be charged to subsection 225 of the ECR, and installed spare parts – to account 1 105 06 340 “Increase in the cost of other material inventories” .

Example 3 An institution entered into an agreement with a workshop to repair a car.

The cost of work is 5900 rubles. (including VAT - 900 rubles). The institution purchased spare parts for repairs on its own in the amount of 9,440 rubles. (including VAT - 1440 rubles). The spare parts were received into the warehouse (m.o.l. M.I. Petrenko). Then they were handed over to the driver V.Yu. for operation in accordance with the invoice requirement. Kirillov, who delivered them to the car service center. Upon completion of the repair, a certificate of completion of work was signed. All these business transactions in accounting will be recorded in the following entries: Debit 1,105 06,340 “Increase in the cost of other inventories” Credit 1,302 22,730 “Increase in accounts payable for the acquisition of inventories” - spare parts are capitalized - 9,440 rubles;Debit 1 105 06 340 “Increase in the cost of other inventory” Credit 1 105 06 340 “Increase in the cost of other inventory” - spare parts were transferred from the warehouse (m.o.l. M.I. Petrenko) to the division (m.o.l. V. Yu. Kirillov) – 9440 rubles;

Debit 1 401 01 225 “Expenses for property maintenance services” Credit 1 302 08 730 “Increase in accounts payable for settlements with suppliers and contractors for payment for property maintenance services” - services of a third-party organization for car repair are reflected - 5900 rubles; Debit 1 401 01 272 “Consumption of inventories” Credit 1 105 06 440 “Decrease in the cost of other inventories” - the amount of used spare parts is written off as expenses - 9440 rubles.

O. V. GORSHENINA, expert editor of the magazine “Budget Accounting”

Write-off of spare parts in a budget organization

Therefore, VAT is not charged on the cost of spare parts used to repair these vehicles. The cost of repairing a bus assigned to a recreation center does not reduce the taxable profit of the factory.

In the process of processing livestock, meat products, fish products and dairy products, the need arises...

The list of material assets accounted for in off-balance sheet account 09 is determined by the institution independently and is reflected in its accounting policies. In particular, off-balance sheet account 09 can account for engines, batteries, tires, tires and other spare parts issued for vehicle repairs.

Tax accounting

When purchasing a vehicle, the cost of used and spare tires is included in the initial cost of the car on the basis of Article 257 of the Tax Code of the Russian Federation. Tires are not indicated as separate elements. Spare parts purchased separately are not included in the purchased vehicle. They are not included in the price. Let's consider the articles that regulate accounting:

- Article 254 (payer’s expenses for household needs).

- Article 260 (restoration of OS).

- Article 264 (maintenance of official vehicles).

Separately purchased tires can be taken into account as material costs for maintaining the operating system. In this case, accounting is carried out at the cost of the elements. Repair costs are included in other expenses. Expenses will be recognized on the date of assembly of tires on the vehicle. Items removed from the vehicle will not be considered returnable waste.