Increasingly, payments received from customers are made electronically and by bank cards. There are also frequent situations when buyers purchase goods on credit.

In this article we will look at:

- how to set up acquiring in 1C 8.3 Accounting;

- how to carry out acquiring in 1C 8.3;

- accounting for acquiring transactions in 1C 8.3;

- acquiring transactions in 1C 8.3;

- how to reflect revenues from sales on payment cards and bank loans in 1C 8.3;

- what accounting entries are generated for acquiring in retail trade;

- How to close account 57 in 1C 8.3.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from 18/118 to 20/120.

Acquiring settings in 1C

To set up acquiring in 1C 8.3 Accounting and reflect transactions on payment cards (bank loans):

- in the program functionality, check the Payment cards on the Bank and cash desk (section Main - Settings - Functionality).

- set up an acquiring agreement with a bank or other credit institution: Type of agreement - Other .

Transactions on payment cards and bank loans in 1C 8.3

The processing of payment by payment card and bank loan depends on the moment at which the payment occurred.

If you are reflecting an advance payment (for example, when purchasing in an online store) or receiving retail revenue from NTT on payment cards, use the Payment card transaction in the Bank and cash desk - Cash desk - Payment card transactions section.

Payment card transaction in 1C 8.3.

In this case the Operation Type according to the following principle:

- Payment from the buyer - upon receipt of an advance (even from a retail buyer);

- Retail revenue - capitalization of revenue from NTT.

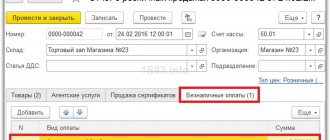

If payment is made at the time of purchase, indicate it on the Non-cash payments the Retail Sales Report document (section Sales – Retail Sales – Retail Sales Reports).

In each of the proposed methods, you need to configure the Payment type :

- Payment method : Payment card - payment is made by bank cards;

- Bank loan - the purchase was purchased on credit;

- Own gift certificate and third-party gift certificate - the purchase was paid for with a certificate or gift card;

As a rule, payment by payment card does not arrive immediately to the organization’s current account, but after 1-3 days, so it is accounted for in account 57.03 “Sales by payment cards.”

- Settlement account - 57.03 “Sales by payment cards”;

- Bank commission - the amount of the bank's commission, minus which payment will be received from the buyer to the account: Fixed amount - a fixed percentage of the commission;

- Depends on the transaction amount - set the amount interval and the commission amount for each interval.

Let's look step by step at how to process these two acquiring operations in 1C 8.3 using examples of how to carry out acquiring in 1C 8.3 Accounting.

Payment by card in retail

Now let’s make a retail sale and accept payment by card:

When paying, please indicate the customer card number:

After this, we make the payment at the terminal itself and, depending on its result, select the desired answer in the window that appears:

All that remains is to punch the check on the fiscal registrar:

Everything is OK, the card payment went through:

At the end of the day we close the shift, as a result a retail sales report is created:

The second tab indicates the payment amounts by payment cards in the context of acquiring terminals (we have one):

In the Statement of Cash You can see that in the place of storage of funds Sberbank

the amount has increased, i.e. The acquiring bank now owes us money (payment from the client was sent to the bank):

There is another good report in the Treasury section - Control of cash transactions

. It shows the correctness and completeness of payment processing, incl. according to acquiring:

We see a hint that it is necessary to issue an incoming payment from the bank and a bank acquiring report.

In the bank's acquiring report, fill in Receipts of payments from clients

, for the correctness of information we use the selection:

We see our payment recorded by the retail sales report, as well as the old payment processed outside the lesson. Select both and transfer to the document:

On the last tab, indicate the amount of the bank’s commission, fill out the article and expense analytics:

We see that all that remains is to process the incoming payment from the bank:

The payment will look something like this (pay attention to the type):

Now the control is empty:

We see that settlements with the bank are closed:

As a result, all funds from sales (minus bank commission) were transferred to our bank account.

Acquiring in 1C - Payment through a terminal in a retail store

The organization retails goods through an automated point of sale (ATP). Accounting is carried out without using account 42 “Trade margin”.

To receive payments via plastic cards, an acquiring agreement was concluded with VTB PJSC. The bank commission is 2% of the payment amount.

On June 11, the following goods were sold for a total amount of 88,500 rubles:

- Roller blind “BLACKOUT FIBER” – 10 pcs. at a price of 4,130 rubles.

- Thread curtains “Africa”—20 pcs. at a price of RUB 2,360.

Payment for goods was made by payment card.

On June 12, the payment made by payment card was credited to the bank account.

Retail sales of goods

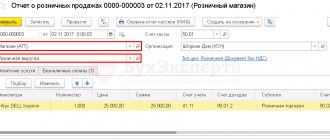

Fill out a detailed report on goods sold using the document Retail Sales Report, transaction type Retail in the Sales – Retail Sales – Retail Sales Reports section.

Please indicate:

- Warehouse is a retail outlet, selected from the Warehouses , type Retail store .

On the Products , fill in the products sold from the Nomenclature .

On the Non-cash payments , indicate all types of non-cash payments (payment card, electronic means, etc.):

- Payment type - setting up an acquiring agreement with the bank, selected from the Payment Types .

- Amount — the amount of non-cash payment.

Next, we will consider accounting entries in 1C when paying through the terminal.

Acquiring transactions in 1C

Crediting payment by payment card to the current account

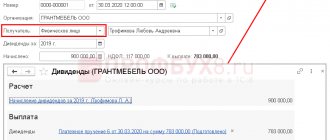

When the bank credits customers' payments via payment cards to the current account, document the document Receipt to the current account, transaction type Receipts from sales on payment cards and bank loans in the section Bank and Cash - Bank - Bank statements - Receipt.

Please indicate:

- Payer is the bank with which the acquiring agreement is concluded.

- Amount - the amount that the bank credited to the account according to the statement. This is the amount of payment from buyers minus the amount of remuneration from the acquiring bank.

- Settlement account - 57.03 “Sales by payment cards.”

- The amount of services is the acquiring bank's remuneration for transferring payment.

- Cost account - 91.02 “Other expenses”.

- Other income and expenses - Expenses for banking services , selected from the directory Other income and expenses with the Type of article - Expenses for banking services .

Postings under the acquiring agreement in 1C

Checking settlements on account 57.03

After the payment has been received into the organization’s account, there should be no balance on account 57.03. Account Analysis report in the Reports - Standard Reports - Account Analysis section.

The absence of a final balance on account 57.03 shows that the buyer’s payment was received in full minus the bank’s remuneration amounts. There is no debt to the bank.

Support for acquiring operations in 1C:Accounting 8 (rev. 3.0)

In order for the accounting of acquiring transactions to become available to the user, he will need to enable the appropriate functionality of the program. The functionality is configured using the hyperlink of the same name from the Main section. On the Bank and cash desk tab, you must set the Payment cards flag (Fig. 1).

This functionality enables customers to pay for goods and services not only using payment cards, but also through bank loans.

To enable the ability to use your own and third-party gift certificates, on the Trade tab, select the Gift Certificates flag.

Rice. 1. Setting up the program functionality

Payment by payment cards (payment using a bank loan) can be reflected in the accounting system using the following documents:

- Payment by payment card (section Bank and cash desk) with the types of transactions Payment from the buyer and Retail revenue.

- Retail sales report (Sales section).

The transaction type Payment from buyer is intended to reflect the payment made by a representative of the counterparty using a payment card under an agreement in the case of a wholesale sale. The total amount of payment received, reflected in the Payment by payment card document, can be distributed to be reflected in accounting across several agreements or across several settlement documents.

The type of transaction Retail revenue is intended to reflect the amounts of bank card payments accepted per day by a non-automated point of sale (NTT). The total amount of payment received can be distributed to be reflected in accounting at different VAT rates.

The Retail Sales Report document should be used to reflect payments by bank cards at an automated retail point of sale (ATP)

To reflect information about the acquiring bank and the acquiring agreement in the Payment Card Payment and Retail Sales Reports documents, use the Payment Type attribute, which is filled in from the directory of the same name.

The form of the directory element Payment type depends on the selected Payment method attribute, which can take one of the following values:

- Payment card;

- Bank loan;

- Own gift certificate;

- Third party gift certificate.

If the Payment card method is selected, then when creating a new directory element Payment type, you must enter the name of the new payment type as mandatory details, specify the counterparty (acquiring bank) and the acquiring agreement for servicing plastic card holders. The settlement account for payment cards is indicated automatically - 57.03 “Sales by payment cards”. In the form of the directory element Type of payment, you can specify the percentage of the acquiring bank's commission so that the reward is calculated automatically in the future.

Starting with version 3.0.44.102 of “1C: Accounting 8”, in the Payment Types directory it became possible to indicate the amount of the bank’s commission depending on the amount of transactions (revenue) per day.

A peculiarity of payment by bank cards (as well as with the use of bank loans) is that funds for completed transactions are received by the organization not from the buyer, but from the acquiring bank (or from the bank that issued the loan), and the moment of actual receipt of funds is The organization's current account, as a rule, differs from the moment of payment by the buyer. In other words, at the time of such payment, the debt of the retail or wholesale buyer is transferred to mutual settlements with the acquiring bank (the bank that issued the loan). Before funds are actually credited to the organization's current account, they are accounted for in transit account 57.03.

The actual receipt of funds to the company's current account is documented by the document Receipt to the current account (section Bank and cash desk - Bank statements) with the transaction type Receipts from sales on payment cards and bank loans. The acquiring bank acts as the payer, and the acquiring agreement is indicated as the agreement. Directly in the document form, in the Amount of services field, you can specify the amount of remuneration withheld by the acquiring bank, and the account and cost analytics for bank services are set by default.

In accordance with the data specified in the Payment Types directory, the Amount of services detail will be filled in automatically if the document Receipt to the current account:

- downloaded from “Client Bank” (via the 1C:DirectBank* service);

- is entered on the basis of the Payment by payment card document.

Note:

* About DirectBank technology - direct exchange with the servicing bank from the 1C program on-line - read the article "New features of 1C: Enterprise 8: DirectBank technology - exchange with the bank on-line." Also about the 1C:DirectBank service and how to work with a bank directly from 1C:Accounting 8 - see the video recording of the lecture “New features of 1C:Accounting 8 (rev. 3.0) for effective accounting”, which took place in 1C: Lectures 12/22/2016.

When manually entering the document Receipt to the current account, the bank commission will have to be calculated and indicated manually.

Acquiring accounting in 1C 8.3 with simplified tax system and UTII

How to carry out acquiring in 1C using the simplified tax system

The organization entered into an acquiring agreement with VTB PJSC to receive payments from customers using plastic cards. The bank commission is 2% of the payment amount.

On June 28, payment made by payment card in the amount of RUB 15,600. arrived in the bank account.

Income under the simplified tax system is reflected in KUDiR at the moment payment is received from the buyer to the organization’s account, i.e. when entering the document Receipt to the current account, the transaction type is Receipts from sales on payment cards and bank loans in the section Bank and Cash – Bank – Bank statements – Receipt.

Postings for acquiring in accounting under the simplified tax system in 1C 8.3

Reflection in KUDiR

How to carry out acquiring when combining simplified taxation system and UTII in 1C 8.3

If the retail store is located on UTII, then when selling, select the appropriate income account 90.01.2.

Thus, when payment is received, the program will reflect the income according to UTII. Let's consider the postings of the document Receipt to the current account type of operation Receipts from sales on payment cards and bank loans .

Acquiring - accounting entries when combining simplified taxation system and UTII in 1C 8.3

Reflection in KUDiR

We looked at setting up acquiring in 1C 8.3 Accounting, how to carry out acquiring transactions in 1C 8.3, and acquiring transactions in 1C 8.3.

Test yourself! Take the test:

- Test. Bank commission charged for settlement and cash services

- Test. Selling goods in an online store: payment via the Internet

- Test. Retail sales of goods: ATT, payment cards