General rules for receiving a deduction

To apply for a tax deduction for children, the following prerequisites must be met:

1. The parent (guardian, trustee, adoptive parent, adoptive parent) must be a citizen of the Russian Federation and receive income taxed at a personal income tax rate of 13%.

The income of an individual must be subject to personal income tax. If an individual is an individual entrepreneur who applies special tax regimes, or belongs to the category of officially unemployed, or receives only state benefits, a pension, etc. as income, then, accordingly, the right to a deduction in such situations does not arise.

A free online course has been opened on “Clerk” about all other types of deductions . Sign up.

2. The presence of supported children, namely: minor children under the age of 18, children under the age of 24 who are studying full-time, disabled children under the age of 18 and disabled children of groups I, II in under 24 years of age, full-time students.

3. The cumulative amount of income from the beginning of the calendar year should not exceed 350,000 rubles. (for each parent separately), after exceeding this limit during the year, the deduction stops from the month in which the income exceeded the limit of 350,000 rubles.

Important!

- The child tax credit is provided for each calendar month from the date of eligibility.

- Deductions for children are summed up, that is, they are provided for each child separately.

- Both parents (guardians, trustees, etc.) have the same right to receive a deduction for each of their children.

Where are child tax deduction codes used?

The child tax deduction is the most common in practice. It is a kind of benefit for an individual in the form of a fixed amount that reduces the person’s tax base for personal income tax.

The right to deduction is established by Article 218 of the Tax Code. The benefit can be used by parents, their spouses, as well as guardians, foster parents, trustees, and adoptive parents. But at the same time, these persons must be tax residents. That is, the time they spent on the territory of the Russian Federation for 12 consecutive months must be 183 calendar days or more. Moreover, it is not interrupted when a person leaves for study, treatment for a period of less than 6 months, or to work in offshore oil fields. In addition, Russian military personnel performing military duty abroad and officials on foreign business trips are always residents.

Conditions for receiving a double deduction

A parent (adoptive parent, guardian, trustee) has the right to receive a tax deduction for a child (children) in double the amount, but only if there is one of two grounds:

1) if there is a refusal of one of the parents to receive a deduction;

2) if the parent (foster parent, guardian, adoptive parent) is the only one and this is documented.

In the first case, the second parent is required to provide a statement of his refusal to receive a deduction for the child (children), as well as a copy of the 2-NDFL certificate from his place of work, which will confirm that the second parent did not receive the deduction.

In the second case, the status of the only parent must be confirmed by a copy of the relevant document (Letter of the Ministry of Finance of the Russian Federation No. 03-04-05/1-657 dated May 23, 2012). Such documents may include:

to confirm the status of a single mother: a child’s birth certificate, in which the “Father” column is not filled in, a birth certificate in form 2 from the registry office if the mother independently entered information about the child’s father, as well as a notice of the absence of a civil status record from organs (the mother must not be married);

- to recognize a parent as missing or dead: a court decision to recognize one of the parents as missing or dead;

- to confirm the death of the second parent: his death certificate;

- to confirm the sole adoptive parent (guardian, trustee): an act of the guardianship and trusteeship authority on the appointment of a sole guardian (trustee).

Moreover, if a single mother or single father gets married (regardless of whether the child is adopted by the spouse or not), then it is necessary to stop providing double deductions from the month following the month of marriage registration. However, the fact of marriage does not apply to sole guardians, adoptive parents and trustees - this rule does not apply to them.

It is also important to note that no other cases are grounds for receiving a double deduction. For example, conditions under which the second parent is deprived or limited in parental rights or if he does not pay child support and does not participate in providing for the child will not be suitable.

What has changed in revenue codes?

For the most part, there have been no changes to the income codes, but the meaning of some of them has been updated. Including several new 2-NDFL codes. For example, two completely new codes have been introduced that must be indicated in certificates for many enterprises or individual entrepreneurs. In particular, in the 2-NDFL certificate, deduction code 2002 is used if the employee was given a bonus that is directly related to production results and in fact is an integral part of the salary. Information about deduction code 126 will be provided later.

Code 2003 - to display remunerations and bonuses paid from the net profit received by the enterprise.

For some of the new codes the name has been changed. For example, in codes 1532, 1533 and 1535, the whole essence of the change was to eliminate the concept of forward transactions, and it was also clarified that financial instruments are derivative in nature.

Code 1532 – reflects income from transactions related to financial instruments, namely stock indices, securities or other instruments that are traded on the market. Deduction code 501 in the 2-NDFL certificate is often used. We will look at it below.

Code 1533 – income related to financial instruments not related to stock indices, securities or other instruments that are traded on the market.

Code 1535 - with various financial documents that are traded on the market, but these are not securities.

In the 2-NDFL certificate, deduction code 2641 now has the following interpretation: “Material benefits received through the acquisition of various types of financial documents.

Deduction amounts and reflection of codes in the certificate

pp. 4 paragraphs 1 art. 218 of the Tax Code of the Russian Federation provides for the following amounts of deductions for children:

- 1400 rub. for the first child;

- 1400 rub. for a second child;

- 3000 rub. for the third and subsequent children;

- 12,000 rub. — additional deduction for a disabled child for parents, spouse of a parent, adoptive parents;

- 6000 rub. — additional deduction for a disabled child for guardians, trustees, adoptive parents, spouse of the adoptive parent.

Please note that the standard deduction for a disabled child is summed up with a deduction that depends on the type of child (first, second, etc.). What does this mean? For example, two parents have one disabled minor child. Accordingly, each parent is entitled to a deduction of 1,400 rubles for this child. as for the first child and as an additional deduction in the amount of 12,000 rubles. In total, one parent is entitled to a deduction for a month totaling 13,400 rubles. (the amount of cash deducted will be 13400×13%=1742 rubles). But again, do not forget about the established income limit of 350,000 rubles.

Each type of child deduction is reflected according to a separate code in section 4 of the 2-NDFL certificate. These codes are presented in the Order of the Federal Tax Service No. ММВ-7-11/387 dated September 10, 2015. In accordance with Art. 218 of the Tax Code of the Russian Federation provides codes 126-149 for children's deductions. Moreover, separate codes are provided for double deductions! Also, different codes have been approved for the parent (adoptive parent) and guardian (trustee) for the same deductions.

Example 1

Rumyantseva A.A. has three children, two of whom are minors and one child is a student aged 20, a full-time student.

Monthly income of Rumyantseva A.A. is 35,000 rubles. (including personal income tax of 4,550 rubles), in January 2021 she submitted documents to the employer for deduction. Accordingly, when receiving a deduction, her income will not be subject to personal income tax in the amount of 2,800 rubles. for a student child and a second child, and for the youngest - in the amount of 3,000 rubles. Based on the results for one month, Rumyantseva A.A. will receive a deduction in the amount of: (1400×2 3000)×13% = 754 rubles. She will receive this deduction amount for the first 10 months of 2021, and from November the deduction will stop, since, subject to a monthly salary of 35,000 rubles. her income in November will exceed the limit of 350,000 rubles.

Other new deduction codes for children

All tax deduction codes have undergone changes. The fact is that previously, different personal income tax reduction amounts were established for different categories of parents. Therefore, the Federal Tax Service has differentiated the categories of recipients. Thus, for parents and adoptive parents there are codes from 126 to 129. For adoptive parents, guardians and trustees from 130 to 133.

We present the changes in Table 1.

Table 1.

Old and new tax deduction codes

| New deduction code | Old deduction code | Who is entitled to the deduction and when? | Deduction amount |

| 126 | 114 | To the parent (including divorced), his spouse and adoptive parent for 1 child | 1400 |

| 127 | 115 | To the parent (including divorced), his spouse and adoptive parent for the 2nd child | |

| 128 | 116 | To the parent (including divorced), his spouse and adoptive parent for the 3rd child | |

| 129 | 117 | To a parent (including divorced), his spouse and adoptive parent for a child who is disabled | 12 000 |

| 130 | 114 | Adoptive parent, guardian, guardian for 1st child | 1400 |

| 131 | 115 | Adoptive parent, guardian, guardian for the 2nd child | |

| 132 | 116 | Adoptive parent, guardian, guardian for the 3rd child | |

| 133 | 117 | Adoptive parent, guardian, guardian for a child who is disabled | 6000 |

| 134 | 118 | To the only parent, his spouse and adoptive parent for 1 child | 2800 |

| 135 | To the only adoptive parent, guardian, guardian for the 1st child | ||

| 136 | 119 | To the single parent, his spouse and adoptive parent for the 2nd child | |

| 137 | To the only adoptive parent, guardian, guardian for the 2nd child | ||

| 138 | 120 | To the only parent, his spouse and adoptive parent for the 3rd child | 6000 |

| 139 | To the only adoptive parent, guardian, guardian for the 3rd child | ||

| 140 | 121 | To a parent (including divorced), his spouse and adoptive parent for a child who is a disabled person of the first and second groups | 24 000 |

| 141 | Adoptive parent, guardian, guardian for a child who is a disabled person of the first and second groups | 12 000 | |

| 142 | 122 | 1st parent for 1st child if 2nd parent refuses | 2800 |

| 143 | To the 1st adoptive parent for the 1st child if the 2nd parent refuses | ||

| 144 | 123 | 1st parent for 2nd child if 2nd parent refuses | |

| 145 | To the 1st adoptive parent for the 2nd child if the 2nd parent refuses | ||

| 146 | 124 | 1st parent for 3rd child if 2nd parent refuses | 6000 |

| 147 | To the 1st adoptive parent for the 3rd child if the 2nd parent refuses | ||

| 148 | 125 | To the 1st parent for a disabled child if the 2nd parent refuses | 24 000 |

| 149 | To the 1st adoptive parent for the 3rd child if the 2nd parent refuses | 12 000 |

- Download decoding of income codes for 2021

- Download Order of the Federal Tax Service dated December 24, 2017 No. ММВ-7-11/ [email protected]

How to get a child benefit

A deduction for a child can be obtained either through the employer, or immediately for the entire period at the end of the calendar year from the Federal Tax Service.

1. In order for the employer, as a tax agent, to provide you with a deduction, you must submit documents for each child:

- application for a deduction in free form;

- a copy of the child’s birth certificate (if he is a minor);

- a copy of a certificate from an educational institution (for a child under 24 years of age studying full-time);

- a copy of a document confirming the child’s disability (if he is disabled);

- a copy of the court decision on adoption or the decision to establish guardianship (trusteeship) - if the individual is an adoptive parent/guardian/trustee;

- a copy of a document confirming the status of a single parent (if the individual is a single parent and claims a double deduction);

- an application from one of the parents about refusal to receive a deduction and a 2-NDFL certificate from his place of work (if one of the parents claims a double deduction).

Moreover, note that when submitting documents, the employer cannot refuse to provide a deduction to his employee - this is one of the legal methods (clause 3 of Article 218 of the Tax Code of the Russian Federation).

2. To receive a deduction through the Federal Tax Service , in addition to the above documents, you must also submit a declaration in form 3-NDFL. Documents can be submitted either electronically through the taxpayer’s personal account, or in paper version. Documents are always submitted to the Federal Tax Service at the end of the tax period—the calendar year—and the deduction is provided immediately for the year or for the previous 3 years.

What documents will confirm the children's deduction?

The employee must write a statement by the end of the year (personal income tax tax period). The form is free.

He should also bring supporting documents to the accounting department. Their list is given in Table 2.

Table 2.

Documents for deduction

Receiving a deduction when changing jobs

Example 2

In February 2021 from Romanov I.I. a daughter was born. From January to July 2021 he worked at YuG LLC, and in August 2021. got a new job at Zvezda LLC.

At his first place of work, he was not provided with a child benefit. In order to receive a deduction for a second place of work, he needs to provide a 2-NDFL certificate from LLC “YUG” confirming that he has not received deductions, as well as an application for a deduction and a copy of the child’s birth certificate. Accordingly, from August 2021, an employee can receive a monthly deduction from the Zvezda LLC organization, and for the period from February to July 2021, subject to an income limit of 350,000 rubles. receive a deduction from the Federal Tax Service at the end of 2021.

Also, do not forget that when providing deductions, it is important for a new employer to take into account the receipt of deductions and the employee’s income limit in the 2-NDFL certificate from the previous place of work. This will avoid errors and all kinds of recalculations.

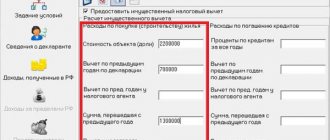

Samples of filling out the 2-NDFL certificate

Be sure to indicate the child deduction code in the Individual’s Income Certificate. Please note that deductions must be entered in section 4 of 2-NDFL. Do not complete Section 3. Enter the total amount separately for each code. If the employee is entitled to several child deductions, indicate the codes for each of them.

Below are examples of the correct use of codes.

Where to enter the deduction code

Sample 2-NDFL with codes 126 and 127

New 200 range codes reducing the base

Please note that range codes 205-207, as well as codes 209, 210 and 220, reflect losses from transactions with various securities that have financial value. Accordingly, their names were updated.

Also, the Federal Tax Service approved several new codes. One of them is 208.

Code 208 – reflects the amount of losses from transactions with instruments that are traded on the market, their underlying asset also being securities. The loss caused by the specified transactions performed during the tax period is taken into account.

Code 221 – expenses incurred as a result of transactions on a personal investment account – has been excluded from the list of deduction codes, however, a number of new ones have been added in the range from 225 to 241. These codes reflect deductions for actions with securities and other financial instruments, and differ from codes in 2-NDFL certificates 2016

Also, the Federal Tax Service introduced completely new types of deductions. These codes range from 250 to 252 and define deductions associated with an individual investment account and transactions on it. It is in connection with these changes that code 617 (reflecting income from transactions made on a personal account) was removed from the list of income and deduction codes.

Codes 250-252 reflect amounts that can reduce the size of the tax base on the basis of the Tax Code of the Russian Federation.

Increasing the “military” component

In addition to all this, the “military” component of code 2000 was increased. To the taxable payments made by the military, the Tax Service, in addition to salary, also added cash allowance. It is now also not exempt from tax. This should be taken into account when filling out Form 2-NDFL.

Code 3010 has undergone a name change. Previously, it looked like an article indicating income from winnings paid by the organizers of sweepstakes, lotteries and other risk games (including slot machines). Now it looks like “Income in the form of winnings that were received at the betting and at the bookmaker’s office.”

The Federal Tax Service also removed several income codes from the list. The current list does not include codes 2791 (reflection in the form of income of agricultural products that were issued to their employees by agricultural enterprises that used the Unified Agricultural Tax) and 1543 (income from transactions carried out on a personal investment account).

Who is eligible?

It should be remembered that deductions are provided only to that category of employees whose income is subject to income tax at the rate of 13%. To exercise the right to a tax deduction, the employee must draw up a written application, to which all the necessary papers (birth certificate) are attached. Accordingly, if the applicant has several children, then copies must be made of all certificates (the birth certificate of a deceased child or adult child is no exception).

In some situations, the employee must provide additional documents, such as, for example, evidence that the second parent has died if a deduction is issued for the only parent; or a certificate confirming that the child is studying, if a tax deduction is issued for an adult child who is undergoing training.