Personalized accounting since 2017

From January 1, 2021, the calculation and payment of insurance premiums, except for contributions for injuries, are controlled by tax inspectorates (Chapter 34 of the Tax Code of the Russian Federation). But information about the insurance period is still controlled by the Pension Fund of the Russian Federation and its territorial bodies. In this regard, two reports must be submitted to the Pension Fund:

- monthly report SZV-M;

- annual report on insurance experience.

Until 2021, policyholders showed information about their length of service in section 6 of the quarterly calculation of RSV-1. However, from 2021, the RSV-1 calculation is no longer applied. His form has lost its power. Instead, information about your experience will need to be submitted as part of your annual reporting.

Results

Form SZV-1 is important in the procedure for generating the information necessary for calculating a future pension.

Particular attention is paid to the reliability of its data, and therefore their adjustment is possible. Filling out SZV-1 is subject to certain rules and is carried out on a form approved by the Pension Fund of Russia. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What new reporting forms have been approved?

Organizations and individual entrepreneurs became familiar with the SVZ-M form back in 2021. This form was approved by Resolution of the Pension Fund Board of February 1, 2016 No. 83p. Using the SZV-M form, organizations and individual entrepreneurs are required to submit monthly information about their employees to the territorial offices of the Pension Fund:

- last name, first name and patronymic;

- SNILS;

- TIN.

Monthly SZV-M reports in 2021 must be submitted to the Pension Fund no later than the 15th day of the month following the reporting month. See “SZV-M in 2017: new deadlines for submitting initial, corrective and updated reports.”

At the same time, Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 3p approved completely new personalized accounting documents, which policyholders have not previously encountered. These regulatory documents are approved:

- form “Information on the insurance experience of insured persons (SZV-STAZH)”;

- form “Information on the policyholder transferred to the Pension Fund of the Russian Federation for maintaining individual (personalized) records (EDV-1)”;

- form “Data on the adjustment of information recorded on the individual personal account of the insured person (SZV-KORR)”;

- form “Information on earnings (remuneration), income, amount of payments and other remunerations, accrued and paid insurance premiums, periods of labor and other activities counted in the insurance period of the insured person (SZV-ISH).”

Also, Resolution of the Board of the Pension Fund of January 11, 2017 No. 3p approved the Procedure for filling out the above document forms and the format of information necessary for transmitting the forms to the divisions of the Pension Fund in electronic form.

Next, we will explain why these forms are required, to whom and when they will need to be submitted to the Pension Fund units. These forms are not submitted to the Federal Tax Service. You can also download the new forms and familiarize yourself with their samples. However, this article does not contain detailed instructions. Later we will publish a special article in which we will consider all the main aspects related to the formation of new personalized reporting.

From what date do they apply?

By Resolution of the Board of the Pension Fund of January 11, 2017 No. 3p, it was registered by the Ministry of Justice of Russia on February 21, 2017 No. 45735. This document was officially published on February 22, 2017 on the official Internet platform. The document comes into force 10 calendar days after the date of publication. Therefore, it is necessary to apply new forms of individual (personalized) accounting documents from March 4, 2017.

Filling out a new SZV-M form

The SZV-M submission for May 2021 will be in June, by which time Resolution No. 103p will have already entered into force, so the report must be filled out according to the new sample. The document can be issued electronically or on paper. The information included in the report is certified by the signature of the manager, indicating his last name, first name, patronymic, and the seal of the employer (if any). It is imperative to indicate the job title of the person who signed the report.

In the SZV-M information in May 2021, all fields of section 1 must be filled in - this block is devoted to information about the employer. The possibility of identifying the policyholder by the Pension Fund depends on the correctness of the entered registration data. List of required details for the first part of the report:

- registration number in the Pension Fund, which is assigned to all payers of insurance contributions for pension insurance upon registration with the Pension Fund;

- employer's name - can be full or abbreviated;

- codes: TIN (enter both legal entities and individuals), KPP (relevant only for legal entities).

Further, in the SZV-M for May 2021, which falls in June, the reporting period is indicated. When preparing a report for May, you must enter the serial number of the month in the reporting period field - “05”, and in the calendar year column - “2021”. The details that characterize the type of form being submitted must be entered:

- during the initial submission of data, it is stated that SZV-M is “initial”;

- if the report has already been accepted by the Pension Fund of Russia, but there is a need to add new information about the insured persons to it, the type of form will be designated by the word “supplementary”;

- if it is necessary to cancel incorrect information about insured persons previously accepted by the Pension Fund, it is indicated that the form is “cancelling”.

The last information block is dedicated to the personal data of the insured persons - it consists of a table with 4 columns:

- the first column indicates the row numbering in order;

- the second is the full name of the insured, this detail must be entered without abbreviations, that is, not the surname with initials, but the surname, full name of the person and patronymic (if any);

- the third column is the SNILS number, it can be displayed in two formats (all fragments separated by a hyphen ХХХ-ХХХ-ХХХ-СС or with a space at the end ХХХ-ХХХ-ХХХ СС);

- the last column is filled in only if data is available - the TIN number of the insured person is indicated if the employer has such information on a specific person.

Then the document remains to be signed, sealed and dated.

Form SZV-STAZH

The SZV-STAZH form was approved as Appendix No. 1 to Resolution of the Pension Fund Board of January 11, 2017 No. 3p. This form is a report on work experience, which must be submitted annually - no later than March 1 after the reporting year. For the first time, such a report will have to be submitted for 2021 (subclause 10, clause 2, article 11 of the Federal Law of 04/01/1996 No. 27-FZ).

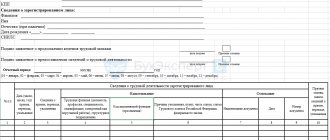

The SZV-M length of service form must be generated by insurers for all insured persons who are in an employment relationship with the policyholder (including those with whom employment contracts have been concluded) or who have entered into civil law contracts with him (clause 1.5 of the Procedure for filling out the form “Information on insurance experience insured persons (SZV-STAZH)", approved by Resolution of the Board of the Pension Fund of January 11, 2017 No. 3p). This form looks like this:

As you can see, section 3 of the new SZV-STAZH form is similar to section 6 of the RSV-1 calculation, which previously included information about the length of service of individuals. In section 3 of the SZV-STAZH report you will also need to show:

- Last name, first name and patronymic of each insured person (columns 2,3 and 4);

- work periods (columns 6 and 7);

- SNILS (column 5);

- codes for territorial and special working conditions (columns 8 and 9);

- calculation of insurance experience (columns 10 and 11);

- conditions for early assignment of an insurance pension (columns 12 and 13);

- information about the dismissal of the insured person (column 14).

Codes for experience

As before, when filling out section 6 of the RSV-1 calculation, the periods of work of insured persons in the SZV-STAZH form will need to be accompanied by various explanatory codes. Here are a few examples of acceptable “experience” encoding of section 11 of the new personalized report:

| Some codes for column 11 of section 3 of the SZV-STAZH form | |

| Code | Application |

| “AGREEMENT”, “NEOPLDOG”, “NEOPLAUT”. | These codes indicate the period of work of the insured person under a civil contract. If payment under the agreement was made during the reporting period, then the code “AGREEMENT” is indicated. If there is no payment in the reporting period, then the code “NEOLDOG” or “NEOLPAVT” is indicated. |

| "CHILDREN" | Holiday to care for the child. |

| "NEOPL" | Vacation without pay, downtime due to the fault of the employee, unpaid periods of suspension from work (preclusion from work) and other unpaid periods. |

| "QUALIF" | Advanced training with a break from production. |

| "UCHOTVUSK" | Additional holidays for those who combine work and study |

| "SDKROV" | Days for donating blood and providing leave in connection with this |

| "DLCHILDREN" | Otpksk for child care from 1.5 to 3 years |

| "DOPVIKH" | Additional days off for persons caring for disabled children. |

| "CHILDREN" | If parental leave until the age of 3 is granted to grandparents, other relatives or guardians |

Codes of territorial and special working conditions in columns 8 and 9 of section 3 of the SZV-V experience form will need to be filled out based on the Parameter Classifier used when filling out information for maintaining individual (personalized) records. Such a Classifier is drawn up as an appendix to the Procedure for filling out the form “Information on the insurance experience of insured persons (SZV-STAZH)”, approved. By Resolution of the Board of the Pension Fund of January 11, 2017 No. 3p. Next you can:

- SZV-STAZH form in Excel format;

- Classifier of parameters used when filling out information for maintaining individual (personalized) accounting.

Deadline for submitting SZV-STAZH

For the first time, the SZV-STAZH report must be submitted for 2021: no later than March 1, 2021. Before this date, you must submit a report with the “Initial” information type to the Pension Fund. This type of information means that the report for 2017 is being submitted for the first time.

You can also submit the SZV-STAZH report with the “Corrective” information type. Such a report will need to be submitted in a situation where there were errors in the report with the “Initial” type that did not allow the data to be posted to individual personal accounts of insured persons (for example, if there were errors in SNILS).

We believe it is advisable to pay special attention to the type of information “Pension assignment”. The SZV-STAZH report with this type of information will need to be submitted to the Pension Fund of the Russian Federation for a person entering an insurance pension - within three calendar days from the date the insured person contacts the policyholder. This is provided for in paragraph 2 of Article 11 of the Federal Law of 04/01/1996 No. 27-FZ.

The SPV-2 form is no longer needed

Personalized accounting documents previously included form SPV-2 “Information on the insurance experience of the insured person for establishing a labor pension.” It had to be submitted to the territorial offices of the Pension Fund for those employees who are retiring. See Form SPV-2: sample filling."

The SPV-2 form has been canceled since 2021. In fact, the SPV-2 form was replaced with the SZV-STAZH form, which contains the type of information “Pension assignment”.

SZV-M for May: submission deadlines

The report is submitted by all employers, legal entities and individual entrepreneurs who had at least one employment or author's contract, or civil process agreement, in force during the reporting month. The presence or absence of payments in favor of the insured persons in the reporting month does not affect the procedure for filling out the report.

The deadline for submitting the SZV-M in June 2021 is determined according to the previous rules - in accordance with clause 2.2 of Art. 11 of the Law of 04/01/1996 No. 27-FZ, the deadline for submitting information on insured persons is the 15th day of the month following the reporting month. Since SZV-M is a monthly form, you must report for May before June 15 inclusive, for June - before July 15, etc.

Form SZV-KORR

The SZV-KORR form will need to be filled out and submitted to the Pension Fund of Russia divisions to adjust the data recorded on the individual personal accounts of insured persons based on previously submitted reports. This is stated in paragraph 4.1 of the Procedure for filling out the SZV-KORR form, approved by Resolution of the Pension Fund Board of January 11, 2017 No. 3p. This form has a “telling” name – “Data on the adjustment of information recorded on the individual personal account of the insured person.” This form looks like this:

The SZV-KORR form is submitted by the policyholder to make changes to previously submitted data. This form may be submitted at the initiative of the policyholder at any time. There are no deadlines for submitting this form. The SZV-KORR form can be generated with different types of information:

- CORR - if you need to adjust the information on the individual personal account of the insured person as follows (for example, replace data on earnings (remuneration), income, amount of payments and other remunerations of the insured person or supplement data on accrued and paid insurance premiums).

- OTMN - based on the cancellation form, the data recorded on the ILS (individual personal account of the insured person) on the basis of reporting, the data of which is being adjusted, will be canceled;

- SPECIAL - a special type of information with which it will be possible to submit data on the insured person, whose information was completely absent in the previously submitted reports.

The SZV-KORR form can be submitted to the territorial division of the Pension Fund for adjustment of any period until 2021.

Next, you can create a new SZV-KORR form in Excel format.

Changing the SZV-TD report form

From July 1, 2021, the SZV-TD report form and the procedure for filling it out will be changed.

Until July 1, 2021, it is necessary to use the previous form and procedure for filling out the SZV-TD (Resolution of the Board of the Pension Fund of the Russian Federation dated December 25, 2019 No. 730p). For example, if in June an employer sends a SZV-TD for a new or dismissed employee, he should use the usual report form. If the employment order was issued on June 30, and the SZV-TD is sent on July 1, you must use a new form approved by Resolution of the Pension Fund Board of October 27, 2020 No. 769p.

The monthly SZV-TD report for June, which must be submitted to the Pension Fund by July 15, 2021, should also be filled out using the new form.

The following changes have been made to the report form:

1.

The section “Information about the employer, whose legal successor is the insured” will need to be filled out in the case where it is necessary to provide (correct) information about the work activity of an employee whose employer is currently deregistered. The legal successor must provide information about the former employer:

- registration number in the Pension Fund of Russia;

- employer (name);

- TIN;

- Checkpoint.

2.

The report form is supplemented with the column “Work in the regions of the Far North/Work in areas equated to the regions of the Far North”, the completion of which is provided by the codes:

- RKS - work in the Far North;

- ISS - work in areas equated to the regions of the Far North.

The column is filled in for registered persons who work in these territories.

The new form does not provide for the inclusion of information about work in other areas with special climatic conditions (including in the southern regions of Siberia and the Far East, where regional coefficients and northern allowances are applied).

3.

The procedure for filling out the “Function Code” column has been changed. Now it will be mandatory for all organizations, and not just those that apply professional standards, to indicate the code designation of the occupation, consisting of 5 digital characters.

The first four characters are the code for the name of the occupation group in OK 010-2014 (ISCO-08). All-Russian classifier of occupations" (Order of Rosstandart dated December 12, 2014 N 2020-st) (OKZ). The fifth character is the check number.

Employers - legal entities and individuals - independently determine the code of the classification object using the all-Russian classifier.

In order to correctly reflect ZUP in 1C and timely submission of SZV-TD reports from July 2021, it is necessary to assign code designations to the positions available in your company now.

Comments on the definition of the code designation:

• the all-Russian classifier of occupations OK 010-2014 (MSKZ-08) was published on the official website of the Federal Agency for Technical Regulation and Metrology, which can be found here;

• ICH uses a hierarchical classification method. The general coding scheme in OKZ is: XXXX.X, where:

- X - main group;

- XX - subgroup;

- XXX - small group;

- XXXX - initial group;

- X is the check number.

• there are no employee positions in the directory. The objects of classification in OKZ are occupations. Occupation refers to the type of work activity that an employee performs at the workplace;

• when determining the code, qualifications matter. The OKZ accepts 4 types of qualifications:

- higher education and academic degree;

- secondary vocational education;

- professional education;

- basic general education and secondary general education.

• when determining the labor function, it is necessary to focus specifically on the actual work, and not the name of the employee’s position;

• if an occupation covers a wide range of labor functions, then its classification is carried out using the principle of priority.

Code definition sequence:

1.

To determine the code, it is necessary to determine the main group of occupations that reflects the qualifications of the employee and his position in the company structure.

2.

Next, we find a subgroup, and in it a small group (responsibilities), we determine the initial group - a specific type of occupation, taking into account deeper specialization. At this stage, you will need to analyze what the employee does in order to assign the correct code. The OKZ Directory contains a description of the groups and examples of activities assigned to this group, which can be used to check the correctness of the code assignment.

An example of coding classes for the “Accountant” group:

- 2 — belonging to the main group “Specialists of the highest level of qualification”;

- 24 — belonging to the subgroup “Specialists in the field of business and administration”;

- 241 — belonging to the small group “Financial Activities Specialists”;

- 2411.6 - Belonging to the initial group “Accountants”.

3.

When determining the required labor function, a four-digit code and a control number will be indicated opposite it, which must be entered into the table.

We recommend recording the decisions made in the company regarding the assigned OKZ codes in an organizational and administrative document

, For example:

- Many companies have a grading system. As a rule, positions are distributed by grade depending on the content of the job function, skill level, level of managerial responsibility, etc. If the gradation order is fixed in any organizational document, then this document can also be used to determine OKZ codes by making the necessary additions to it.

- You can issue an order on the main activity, in which each position is assigned a specific code. When including each new position in the staffing table, indicate the OKZ code in the order to amend the staffing table.

A local regulation is not required in this case.

From January 1, 2021, the Code of Administrative Offenses establishes liability for failure to submit, violation of deadlines or errors in the SZV-TD. The official responsible for providing the form may be given a warning or a fine of 300 to 500 rubles. (Part 2 of Article 15.33.2 of the Code of Administrative Offenses as amended by the Law dated 04/01/2020 No. 90-FZ, paragraph 2 of Article 2 of the Law dated 04/01/2020 No. 90-FZ). Labor inspectorates received the authority to issue these fines from January 1, 2021 (Rostrud order No. 170 dated August 31, 2020).

Form SZV-ISH

The form “Information on earnings (remuneration), income, amount of payments and other remuneration, accrued and paid insurance premiums, periods of labor and other activities counted in the insurance period of the insured person (SZV-ISH)” is filled out by the policyholder only for reporting periods until 2021 year (inclusive). And only in a situation where reporting deadlines were violated during these periods. This is stated in paragraph 5.1 of the Procedure for filling out the SZV-ISH form, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 3p. We are talking about situations where an individual did not submit reports at all, and now the policyholder has decided to report for past periods. This form looks like this:

In the SZV-ISH form for past periods you will need to indicate:

- information about the policyholder;

- information about the insured person;

- reporting period;

- information on the amount of payments and other remuneration accrued in favor of an individual;

- information on accrued insurance premiums for the reporting period.

There are no deadlines for submitting the temporary storage warehouse-iskh form. The policyholder may submit this form at any time he deems necessary.

Form SZV-1: purpose and types

Form SZV-1 is a form of data on individual information in the Pension Fund of the Russian Federation about a person who received income in the reporting period from the employer generating this information. The document is extremely important in terms of the influence of the information it contains on the calculation of a future pension, since it provides data:

- about actual work experience;

- special working conditions;

- accrued income;

- amounts of insurance premiums paid.

The importance of these data necessitates a high degree of reliability. Therefore, the SZV-1 form allows for the existence of several types:

- original form - intended for the initial submission of information;

- corrective - formed according to updated data, if an error was made in the original form;

- canceling - allowing you to completely cancel incorrect data on the original form;

- compiled for a person retiring - used for additional submission of information necessary for calculating the pension before the end of the reporting period.

Corrective and canceling forms can only be accepted if the original form for the same period is available. When accepted, the original data is completely replaced with new ones. For this reason, all information on the correction and cancellation forms must be completed to the same completeness as the original data, but with the correct information on it.

Submitting incorrect data to the Pension Fund of Russia can result in a fine for the employer - read the material “What is the responsibility for failure to provide or submission of incomplete (inaccurate) accounting information.”

Form EDV-1

Form EDV-1 “Information on the policyholder transferred to the Pension Fund for maintaining individual (personalized) records” is an accompanying form. In paragraph 1.7 of the filling procedure approved by the Resolution of the Board of the Pension Fund of the Russian Federation from Resolution of the Board of the Pension Fund of January 11, 2017 No. 3p it is said “Information in the form SZV-STAZH, SZV-ISKH, SZV-KORR is formed into packages of documents. One package contains one file and is submitted simultaneously with the EDV-1 form.” At the same time, it is clarified that document packages can include documents of only one name and one type.

In this case, EDV-1 is a document containing information on the policyholder as a whole. So, for example, in this form you need to summarize information about the total amount of accrued and paid insurance premiums for the reporting period. EFA-1 includes the following sections:

- Details of the policyholder submitting the documents;

- Reporting period;

- List of incoming documents;

- Data in general for the policyholder;

- The basis for reflecting data on periods of work of the insured person in conditions that give the right to early assignment of a pension in accordance with Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”.

This form looks like this:

This form may contain the following types of information:

- original;

- corrective – submitted if you need to correct the data in section 5 of the EFA-1 form;

- canceling – submitted if it was necessary to cancel the data in section 5 of the EFA-1 form. You can find EFA-1 forms in Excel format in the “Documents” section on our website.

There is no need to talk about the deadlines for submitting the EFA-1 form, since it accompanies incoming documents. In other words, if, for example, the SZV-STAZH report is submitted, then it must be sent to the fund along with the EDV-1 form.

PFR Forms SZV-STAZH, ODV-1, SZV-KORR, SZV-ISH Download

Pension this year

Reporting ADV and SZV PFR Reporting SZV-M Fines PFR KBK for payment

Pension Fund Reporting

SZV-STAZH, ODV-1, SZV-KORR, SZV-ISKH

(forms for downloading and filling out forms are at the bottom of the page)

Reporting to the Social Insurance Fund

New form of STD - R

New Form of SZI-ILS

A new form “Information on the status of the individual personal account of the insured person” (form SZI-ILS) has been approved.

The new form was approved due to the fact that from January 1, 2021, the procedure for providing information to insured persons by the Pension Fund of the Russian Federation has been clarified.

Order of the Ministry of Labor of Russia dated January 9, 2019 N 2n “On approval of the form of information on the status of the individual personal account of the insured person” comes into force on March 17, 2021.

Form SZI-ILS.docx Download Form SZI-ILS.pdf

NEW FORMS in the Pension Fund of Russia

The Pension Fund has updated the forms of information used to maintain personalized records of insured persons

These are the forms:

— “Information on the insurance experience of insured persons (SZV-STAZH)”,

— Information on the policyholder transferred to the Pension Fund of the Russian Federation for maintaining individual (personalized) records (EFV-1),”

- “Data on the adjustment of information recorded on the individual personal account of the insured person (SZV-KORR)”,

- “Information on earnings (remuneration), income, amount of payments and other remuneration, accrued and paid insurance premiums,

— On periods of labor and other activities counted in the insurance period of the insured person (SZV-ISH).”

Resolution of the Board of the Pension Fund of December 6, 2018 No. 507p

. .

SZV-STAZH

In particular, the name of column 14 “Information on the dismissal of the insured person” of the SZV-STAZH form has changed. Now this column is called “Information about the dismissal of the insured person / information about the periods counted in the insurance period of the unemployed.”

It has been clarified that the code “DLOTPUSK” is indicated in SZV-STAZH only for periods of work of the insured person under special working conditions, for which there is no data on the calculation of insurance premiums at the additional tariff.

Previously, in column 14, the symbol “X” marked those employees who quit on December 31. Now, instead of the “X” symbol, the date of dismissal is indicated, for example, 12/31/2018 (clause 2.3.36 of Procedure No. 507p).

Example

The employee worked for the organization from January 10 to December 31, 2018. In the period from July 21 to July 29, he was on sick leave.

The period of incapacity for work is in column 11.

| Box 6 | Column 7 | Box 11 |

| 10.01.2018 | 20.07.2018 | |

| 21.07.2018 | 29.07.2018 | VRNE LABOR |

| 30.07.2018 | 31.07.2018 |

SZV - EXPERIENCE and EFA - 1 - Details

DATES FOR DELIVERY OF SZV-STAZH

All employers submit this form in 2021 based on the results of 2021.

There are several cases when SZV-STAZH is presented earlier:

1) if the company is liquidated before the end of the reporting year;

2) if there are employees who are retiring in 2021.

SZV-STAZH includes all insured persons with whom the company has entered into employment or civil contracts for the performance of work and provision of services.

For insured persons recognized as unemployed, a new form of information on the insurance period is submitted by the employment service authorities.

SZV - EXPERIENCE and EDV - 1

Frequently used codes for experience

| Code | Application |

| “AGREEMENT”, “NEOPLDOG”, “NEOPLAUT”. | These codes indicate the period of work of the insured person under a civil contract. If payment under the agreement was made during the reporting period, then the code “AGREEMENT” is indicated. If there is no payment in the reporting period, then the code “NEOLDOG” or “NEOLPAVT” is indicated. |

| "CHILDREN" | Leave to care for a child up to one and a half years old. |

| "NEOPL" | Vacation without pay, downtime due to the fault of the employee, unpaid periods of suspension from work (preclusion from work) and other unpaid periods. |

| "QUALIF" | Advanced training with a break from production. |

| "UCHOTVUSK" | Additional holidays for those who combine work and study |

| "SDKROV" | Days of blood donation and rest days provided in connection with this |

| "DLCHILDREN" | Parental leave from 1.5 to 3 years |

| "DOPVIKH" | Additional days off for persons caring for disabled children. |

| "CHILDREN" | If parental leave until the child reaches the age of 3 years is granted to grandparents, other relatives or guardians |

. .

Form SZV-ISH

The SZV-ISH form is filled out only for reporting periods up to and including 2021 when

these periods the reporting deadlines were violated if the employee

no reporting was submitted at all, but now it is necessary to report for past periods.

In the SZV-ISH form for past periods you must indicate:

— information about the policyholder;

— information about the insured person;

— reporting period;

— information on the amount of payments and other remunerations accrued in favor of the insured person;

— information on accrued insurance premiums for the reporting period.

There is no deadline for submitting the temporary storage warehouse-iskh form and the company can submit this form at any time if necessary.

Reporting to the Pension Fund of Russia ADV forms Reporting to the Social Insurance Fund

Form SZV-KORR

This form is filled out when adjusting the data recorded on the individual personal accounts of insured persons based on previously submitted reports.

The SZV-KORR form is submitted by the organization to make changes to previously submitted data and can be submitted on the company’s own initiative at any time.

Therefore, there are no deadlines for delivery here.

The form can be generated with different types of information:

CORR - if you need to adjust the information on the individual personal account of the insured person as follows (for example, replace data on earnings (remuneration), income, amount of payments and other remunerations of the insured person or supplement data on accrued and paid insurance premiums).

OTMN - based on the cancellation form, the data recorded on the ILS (individual personal account of the insured person) on the basis of reporting, the data of which is being adjusted, will be canceled;

SPECIAL - a special type of information with which it will be possible to submit data on the insured person, information about whom was completely absent in the previously submitted reports.

Form EDV-1

Form EDV-1 “Information on the policyholder transferred to the Pension Fund for maintaining individual (personalized) records” is accompanying.

Information in the form SZV-STAZH, SZV-ISKH, SZV-KORR is formed into packages of documents.

One package contains one file and is submitted at the same time as the EDV-1 form.

Document packages may include documents of only one name and one type.

EFA-1 is a document containing information as a whole. This form summarizes information about the total amount of accrued and paid insurance premiums for the reporting period.

EFA-1 includes the following sections:

- Details of the policyholder submitting the documents;

- Reporting period;

- List of incoming documents;

- Data in general for the policyholder;

- The basis for reflecting data on the periods of work of the insured person under conditions that give the right to early assignment of a pension.

The EFA-1 form may contain the following types of information:

- original;

— corrective – submitted when adjusting the data in section 5 of the EFA-1 form;

- canceling - surrendered if you need to cancel the data in section 5 of the EFA-1 form.

There is no deadline for submitting the EFA-1 form, since it is an accompanying document. In other words, if the SZV-STAZH form is submitted, then EDV-1 is also submitted.

SZV - EXPERIENCE and EDV - 1

. .

Filling out Forms

Forms SZV-STAZH, SZV-KORR and SZV-ISKH have continuous page numbering within each form (SZV-STAZH) or each form for the insured person (SZV-KORR and SZV-ISKH) starting from the title page.

In the “Page” field, which has 3 familiar places, the page number is written as follows: for the first page - “001”, for the thirty-third - “033”.

In the “Page” field, which has 5 characters, the page number is written as follows: for the first page - “00001”, for the thirty-third - “00033”.

Information on the forms SZV-STAZH, SZV-ISKH and SZV-KORR is formed into packages of documents.

One package contains one file and is submitted together with the EDV-1 form, that is, the package is generated for each form (SZV-STAZH or SZV-KORR or SZV-ISKH) with the same type of information.

For a package of SZV-ISH forms - one name and one type of information and for one reporting period.

Packages of incoming documents can be submitted on paper (including accompanied by magnetic media) or in electronic form.

Documents are signed by the manager or another person authorized to do so and certified by the seal of the organization (if any).

The policyholder, who is not a legal entity, certifies incoming documents with a personal signature.

The fields “Name of manager’s position”, “Signature”, “Decoding of signature” (full full name must be indicated) are required.

FORMS AND COMPLETION

Form SZV - Experience.xls Sample SZV-STAZH.xls Procedure for filling out SZV-STAZH.docx

Form EDV-1.XLS Procedure for filling out EDV-1.docx

SZV - CORR.XLS SZV - REF.XLS

Reporting ADV and SZV PFR Reporting SZV-M Fines PFR

What other forms exist for accounting?

Let us recall that quite recently officials from the Pension Fund of the Russian Federation approved another set of personalized accounting forms, which are necessary, first of all, for registration as insured persons. See “New forms of personalized accounting documents have been approved.” These forms, in fact, are not reporting. These forms are simply necessary for the policyholder to fulfill his obligation to issue insurance certificates to employees, clarify information in the personalized accounting system, etc.

Among the approved forms:

- “Questionnaire of the insured person (ADV-1)”;

- “Insurance certificate of state pension insurance (ADI-1)”;

- “Insurance certificate of compulsory pension insurance (ADI-7)”;

- “Application for exchange of insurance certificate (ADV-2)”;

- “Application for issuance of a duplicate insurance certificate (ADV-3)”;

- “Request for clarification of information (ADI-2)”;

- “Inventory of documents submitted by the policyholder to the Pension Fund of the Russian Federation (ADV-6-1)”;

- “Accompanying statement (ADI-5)”;

- “Information on the work experience of the insured person for the period before registration in the compulsory pension insurance system (SZV-K).”