From January 1, 2021, payment orders for the payment of insurance premiums, penalties and interest on them will need to indicate new budget classification codes (BCC). Moreover, payments for insurance premiums will need to be sent to tax authorities, and not to funds. Should I pay insurance premiums for one or more KBK in 2021? Do I need to prepare several payment orders for payment? What happens if you send contributions to the “old” KBK? You will find more details about the new codes, their application, as well as a table with the new BCCs in this article.

What are fixed individual contributions

Fixed contributions are payments made by individual entrepreneurs “for themselves.” A fixed payment is established annually and is mandatory for all registered individual entrepreneurs.

In 2021, the mandatory payment consists of two parts - the first, which is paid mandatory (contributions to pension insurance (26%) and health insurance (5.1%) from the current minimum wage for each month of the year), the second - upon receipt of income in amount over 300 thousand rubles.

In 2021, the amount of fixed contributions for individual entrepreneurs is RUB 27,990.

And from income exceeding 300,000 rubles. per year, in addition to the fixed payment, the individual entrepreneur pays an additional contribution of 1%.

The income taken into account in the calculation is determined:

- for OSNO, all income of an individual entrepreneur received by him both in cash and in kind, as well as income in the form of material benefits, taking into account professional deductions, are taken into account. In this case, you can reduce income for expenses, i.e. for the calculation, the same base is taken as for calculating personal income tax;

- for the simplified tax system, income is taken into account in accordance with Art. 346.15 Tax Code of the Russian Federation. The ability to reduce income for expenses is not provided, but the courts think otherwise;

- for UTII, the object of taxation is the taxpayer’s imputed income (Article 346.29 of the Tax Code of the Russian Federation);

- for PSN, the object of taxation is the potential income of an individual entrepreneur for the corresponding type of business activity from which the patent is calculated (Article 346.47 of the Tax Code of the Russian Federation);

- For insurance premium payers applying more than one tax regime, insurance premiums are calculated based on the total amount of taxable income received from all types of activities.

Pension contributions from payments to employees

Note!

From January 1, 2021, new BCCs for insurance contributions to the Federal Tax Service are in effect. In particular, the administrator codes (the first three digits of the KBK) have changed - 182 instead of 392. All contributions must be paid to the tax office, and not to funds (except for contributions for injuries).

Basic payments

Pension insurance contributions from payments to employees within the limit (for 2021 it is 876,000 rubles) are charged at a rate of 22%, and from payments above the limit - at a rate of 10%. See “Limit value of the base for calculating insurance premiums for 2021: table.”

Such tariffs for 2021 have been determined and established for most organizations and individual entrepreneurs. To pay pension insurance contributions in 2021 from payments within the limit and from payments accrued in excess of the base limit, the same BCC is used - 182 1 0210 160. This is a new code.

Please note that pension insurance contributions for December 2021 must be transferred to a “special” KBK. Even if insurance premiums are transferred in January 2021 and later. For December contributions use code 182 1 0200 160.

Penalties and fines

If you pay pension insurance contributions in 2021 later than established by the Tax Code of the Russian Federation, you will have to pay a penalty. Also, payers of insurance premiums may face the need to pay fines. New BCCs are provided for these payments. However, in 2021, you may have to pay interest and penalties for the period before 2021. Then you need to use other codes. We present in the table the new BCCs for penalties and fines.

| Payment type | KBK 2021 | KBK 2021 |

| Penalties on pension insurance contributions | 182 1 0200 160 | 182 1 0210 160 |

| Penalties on pension insurance contributions | 182 1 0200 160 | 182 1 0210 160 |

Deadline for payment of fixed contributions IP-2017

For 2021, a fixed payment of 27,990 rubles. must be paid by the end of the year. That is, for 2021 - no later than January 9, 2021 (because December 31, 2021 is a day off). You can pay in installments throughout the year or in one lump sum. For those who pay taxes quarterly, it is often more profitable to pay contributions every quarter to reduce taxes

Deadline for paying an additional contribution for yourself on income over 300 thousand rubles. for the year - no later than July 1 of the year following the reporting year. For 2021 - no later than July 2, 2021 (because July 2 is a day off).

Insurance premiums for disability and maternity in favor of employees

Basic payments

In 2021, insurance premiums for temporary disability and maternity in favor of employees must be transferred to the Federal Tax Service. These contributions are paid until payments to employees exceed the limit of 755,000 rubles. See “Limit value of the base for calculating insurance premiums for 2021: table.”

To do this, you need to draw up a separate payment order. And you need to indicate the new BCC - 182 1 0210 160.

Insurance premiums for disability and maternity for December 2016 must be transferred to a “special” CBC. Even if insurance premiums for 2021 are transferred in January 2021 and later. For December contributions, use the new code 182 1 02 02090 07 1000 160.

Penalties and fines

If you pay insurance premiums for temporary disability and maternity in 2021 at a later date than established by the Tax Code of the Russian Federation, you will have to pay a penalty. Also, payers of insurance premiums may face the need to pay fines. The codes for these payments depend on the period for which penalties and fines are transferred.

| Payment type | KBK 2021 | KBK 2021 |

| Penalties for social insurance contributions | 182 1 0200 160 | 182 1 0210 160 |

| Penalties for social insurance contributions | 182 1 0200 160 | 182 1 0210 160 |

Fixed contributions IP-2018

In 2021, fixed contributions of individual entrepreneurs will be “unlinked” from the minimum wage . The amount of the fixed part of contributions will be established annually by government decree. The annual amount of contributions must provide the entrepreneur with at least 1 point of the individual pension coefficient.

For 2021, the fixed part of insurance pension contributions will be established by law itself and will amount to 26,545 rubles. per year (i.e. calculated based on the amount of 8,508 rubles per month), you will have to pay 5,840 rubles for health insurance.

That is, 2018 individual entrepreneurs will be paid 32,385 rubles. This is 4395 rubles. more than in 2021.

No changes are provided for contributions in the form of 1% on income over 300 thousand rubles.

Medical contributions from payments to employees

Basic payments

From 2021, insurance premiums for compulsory health insurance must also be transferred to the Federal Tax Service. Limits on medical contributions are not approved, so they must be calculated and paid from all amounts made in favor of employees. At the same time, from 2021, for medical contributions, you also need to use the new BCC - 182 1 0213 160.

Please note that medical insurance premiums for December 2021 must also be transferred to a “special” KBC. Even if insurance premiums are transferred in January 2021 and later. For December contributions, use the new code 182 1 0211 160.

Penalties and fines

If you pay medical insurance premiums in 2021 later than established by the Tax Code of the Russian Federation, you will have to pay a penalty. Also, payers of insurance premiums may face the need to pay fines. New codes apply for these payments. For payments until 2021, the codes are different. Let's list them in the table.

| Payment type | KBK 2021 | KBK 2021 |

| Penalties for medical insurance premiums | 182 1 0211 160 | 182 1 0213 160 |

| Penalties for medical insurance premiums | 182 1 0211 160 | 182 1 0213 160 |

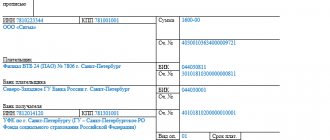

How to fill out a payment form for individual entrepreneurs to pay contributions

We have provided instructions for filling out payment slips for contributions for individual entrepreneurs.

Our invented entrepreneur Apollo Buevy decided to pay the insurance premiums himself, without turning to an accountant for help. I went to the Federal Tax Service website, started filling out receipts and got confused in the KBK. We decided to help him and other individual entrepreneurs and compiled step-by-step instructions for filling out payment documents.

See detailed instructions.

Insurance premiums for injuries

In 2021, insurance premiums for accidents at work and occupational diseases must, as before, be transferred to the Social Insurance Fund as a separate payment account. The BCC for this type of contribution did not change in 2017.

| Payment type | KBK 2021 | KBK 2021 |

| Insurance premiums for injuries | 393 1 0200 160 | 393 1 0200 160 |

| Penalty | 393 1 0200 160 | 393 1 0200 160 |

| Fines | 393 1 0200 160 | 393 1 0200 160 |

IP pensioners

The Ministry of Finance, in its letter No. 03-15-09/9884 dated February 21, 2017, criticized the proposal to exempt entrepreneurs of retirement age from fixed contributions.

As noted by the Ministry of Finance, this could lead to abuses in the re-registration of business activities for pensioners, which, on the one hand, will negatively affect the collection of insurance premiums and the balance of the budget system of the Russian Federation, and on the other hand, will lead to the loss of a targeted approach when providing such a preference.

Officials recalled that individual entrepreneurs pay insurance premiums regardless of age and type of activity.

We also have important material about fixed contributions of individual entrepreneurs in simplified form.

Novyk KBK on insurance contributions to the Federal Tax Service in 2021

In order for contributions to reach the correct addressee, the correct budget classification code must be indicated in the payment slip (field 104). Since the Tax Service has become this addressee since 2021, the BCC has changed. Back in December last year, the Russian Ministry of Finance issued Order No. 230n dated December 7, 2016 (hereinafter referred to as Order No. 230n), establishing new BCCs , including for the payment of insurance premiums in 2021 , and submitted it for registration to the Ministry of Justice . On January 12, 2017, the Order on the BCC was recognized as not requiring registration and came into force from the date of its signing (Order of the Ministry of Finance of Russia dated January 10, 2017 No. 2n).

Note! To pay insurance premiums in 2021 for December 2021, as well as periods that expired before 01/01/2017, one KBK is used, and for periods starting from 2021 (January, February, etc.) - other KBK.

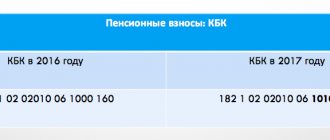

New KBK differ from old ones, first of all, in the administrator code. Previously, when transferring contributions to the Pension Fund, you indicated the first three digits of the KBK “392”, and in the Social Insurance Fund - “393”. Now they have been replaced by the Russian Federal Tax Service code - “182”.

In addition, for KBK intended for payments for periods starting from 2017, the code of the income subtype group has changed (14 - 17 digits of KBK). You can see all this in the tables below.

Table 1 - BCC for employers to pay insurance premiums for employees in 2021

| Payment | KBC for payment of insurance premiums for periods until 2021 | KBC for payment of insurance premiums for periods from the beginning of 2017 |

| Mandatory pension insurance | ||

| Contributions | 182 1 02 02010 06 1000 160 | 182 1 02 02010 06 1010 160 |

| Penalty | 182 1 02 02010 06 2100 160 | 182 1 02 02010 06 2110 160 |

| Fines | 182 1 02 02010 06 3000 160 | 182 1 02 02010 06 3010 160 |

| Compulsory health insurance | ||

| Contributions | 182 1 02 02101 08 1011 160 | 182 1 02 02101 08 1013 160 |

| Penalty | 182 1 02 02101 08 2011 160 | 182 1 02 02101 08 2013 160 |

| Fines | 182 1 02 02101 08 3011 160 | 182 1 02 02101 08 3013 160 |

| Compulsory social insurance | ||

| Contributions | 182 1 02 02090 07 1000 160 | 182 1 02 02090 07 1010 160 |

| Penalty | 182 1 02 02090 07 2100 160 | 182 1 02 02090 07 2110 160 |

| Fines | 182 1 02 02090 07 3000 160 | 182 1 02 02090 07 3010 160 |

Also, in Order No. 230n, the Russian Ministry of Finance provided for new BCCs for the payment of pension contributions at an additional rate for “harmful” workers. Please note that employers who have carried out a special assessment of working conditions use different codes than those who have not carried out a special assessment.

Table 2 - BCC for payment by employers of pension contributions for employees at an additional tariff in 2021

| Payment | The tariff does not depend on the special assessment | The tariff depends on the special assessment |

| Contributions at an additional rate for insured persons employed in the work specified in clause 1, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ (list 1) | 182 1 0210 160 | 182 1 0220 160 |

| Contributions at an additional rate for insured persons employed in the work specified in paragraphs. 2-18 Part 1 Article 30 of the Federal Law of December 28, 2013 No. 400-FZ (list 2) | 182 1 0210 160 | 182 1 0220 160 |

Table 3 – BCC for individual entrepreneurs paying insurance premiums “for themselves” in 2017

| Payment | KBC for payment of insurance premiums for periods until 2021 | KBC for payment of insurance premiums for periods from the beginning of 2017 |

| Mandatory pension insurance | ||

| Contributions in a fixed amount (minimum wage* x 26%) | 182 1 02 02140 06 1100 160 | 182 1 02 02140 06 1110 160 |

| Contributions of 1% on income over RUB 300,000. | 182 1 02 02140 06 1200 160 | |

| Penalty | 182 1 02 02140 06 2100 160 | 182 1 02 02140 06 2110 160 |

| Fines | 182 1 02 02140 06 3000 160 | 182 1 02 02140 06 3010 160 |

| Compulsory health insurance | ||

| Contributions in a fixed amount (minimum wage* x 5.1%) | 182 1 02 02103 08 1011 160 | 182 1 02 02103 08 1013 160 |

| Penalty | 182 1 02 02103 08 2011 160 | 182 1 02 02103 08 2013 160 |

| Fines | 182 1 02 02103 08 3011 160 | 182 1 02 02103 08 3013 160 |

<*> For the purpose of calculating fixed insurance premiums by entrepreneurs, from January 1, 2017, a minimum wage of 7,500 rubles is applied.

Notice! In 2021, payments for insurance premiums against industrial accidents and occupational diseases, as well as penalties and fines for them, as before, must be sent to Social Insurance. Therefore, the BCC for their payment has not changed.

Table 4 – BCC for payment of “injury” contributions for employees (penalties and fines on them) in 2021

| Payment | KBC for payment of insurance premiums for periods from the beginning of 2017 |

| Contributions | 393 1 0200 160 |

| Penalty | 393 1 0200 160 |

| Fines | 393 1 0200 160 |

Federal Tax Service vs Pension Fund: after submitting the declaration, the maximum contributions of individual entrepreneurs must be recalculated

As mentioned above, individual entrepreneurs were required to pay fixed contributions in the amount of 1% on income over 300 thousand rubles. To calculate these contributions, data on the income of entrepreneurs was transferred by tax authorities to the Pension Fund.

If the individual entrepreneur did not submit reports and, accordingly, there was no data on income, his contributions are calculated to the maximum, based on 8 minimum wages.

But if the reporting is ultimately submitted to the Federal Tax Service (regardless of the date of its submission), the amount of the insurance premium for compulsory health insurance is determined in accordance with the provisions of Part 1.1 of Article 14 of Federal Law N 212-FZ based on the amount of annual income indicated in such reporting. And if the Pension Fund has collected insurance premiums from the payer based on 8 minimum wages, a recalculation must be made.

But the Pension Fund is against it. And in July 2021, mass refusals began. The Pension Fund issued a sensational letter dated July 10, 2017 No. NP-30-26/9994, in which “pensioners” refused to recalculate the fixed contributions of individual entrepreneurs who submitted their declarations late.

This information shocked many individual entrepreneurs, who began to apply en masse to the Federal Tax Service. The tax authorities stood up for the individual entrepreneur and in their letter No. BS-4-11/ [email protected] dated September 1, 2017, they reported that the Pension Fund of the Russian Federation was wrong and the law does not contain restrictions on recalculation.

Introductory information

The budget classification code (BCC) is part of the group of details that allow you to determine the ownership of the payment. Therefore, when transferring insurance premiums in 2021 to the tax inspectorates, you must fill out the payment slips correctly. New BCCs for insurance premiums from 2021 must be indicated in field 104 of the payment order. KBK consists of 20 digits. If you send insurance premiums to the old KBK in 2021, the payment will be attributed to unidentified revenues. And then you will need to clarify the payment, contact the funds and, possibly, undergo reconciliation.

New BCCs from 2021 are provided for pension, medical contributions and contributions for temporary disability and in connection with maternity. To transfer these contributions, you will need to draw up different payment orders and make payments to the tax inspectorates.

For whom have the updated BCCs been introduced?

Private entrepreneurs are required to make insurance payments for themselves every year. The businessman pays a specific amount depending on the established minimum wage. For 2021, funds had to be sent before January 9, 2021 (the constant date is December 31, but due to the holidays it was shifted). If income exceeds the established limit, you have to send an additional amount from the amount exceeding 1%. For the previous year, they can be paid until April 3.

But where exactly should individual entrepreneurs’ fixed payments go in 2017? Which KBK administrator should he use? If a businessman managed to send money in 2021, then he had to make payments to the Pension Fund and the Federal Compulsory Medical Insurance Fund using the old codes. When transferring funds in the current period, he will have to enter new values, and the recipient of the contribution will be the Federal Tax Service. It is no longer possible to draw up and send payments under compulsory medical insurance and compulsory medical insurance in favor of the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund.