24.09.2019

When registering an individual entrepreneur, one OKVED code (all-Russian classifier of types of economic activities) is selected as the main one and an unlimited number as additional ones. The codes affect the possibility of applying a particular taxation regime, obtaining benefits and licenses, and the amount of contributions to the Social Insurance Fund for injuries. In order not to pay more fees and not to submit additional reports, indicate only the necessary OKVED codes.

Important information

Not all types of activities are available to individual entrepreneurs: some activities are prohibited, and some require special permission.

Expense accounting

A problem may arise when carrying out activities with a selected taxation regime, in which costs are taken into account. If the assigned codes do not have the required value, then it will not be possible to write off the expenses.

To understand, let's consider a common situation. For example, when organizing a company, a code was specified that allowed retail trade. Subsequently, it was decided to engage in services. There is no code for the provision of services in the Unified State Register of Legal Entities. When providing data on costs for this area of activity, the tax service may refuse calculations. There is no data on such activities in the state register, and expenses cannot be taken into account.

Extra reporting

Many areas of activity require additional reporting. The necessary information is taken from the Unified State Register of Legal Entities, where OKVED codes are indicated. If, through inattention or error, you entered a code that involves space exploration, do not be surprised if you receive a notification about providing statistical data on this activity.

This applies not only to specific, but also to simple codes. For example, your organization has been assigned codes for retail trade and services. But in reality, you are only engaged in providing services. Rosstat will require reporting on retail trade. Your words that you do not carry out such activities will not have any meaning. The code is indicated, which means you must provide information to Rosstat. Do not forget that there are fines for failure to submit reports, and in some cases they can be significant. Simply ignoring reporting can result in unexpected expenses. In addition, if you want to fill out the documentation yourself, without the necessary experience and knowledge, you will have to spend a lot of time.

Additionally, with problems with Rosstat, troubles with tax services may arise. For example, when registering an LLC or individual entrepreneurship, you indicated UTII as taxation, but additionally indicated the codes for which OSNO reporting is required, then the tax service will require the submission of the necessary reports.

When checking, it will be taken into account that the organization or individual entrepreneur carries out activities not only in those areas that provide for UTII. If codes have been indicated that require additional reporting, then in order to avoid misunderstandings and troubles, provide zero reporting. If the necessary data is not available, the tax authorities may issue a fine and legal proceedings will be required. To prove you're right.

Classifier structure

As mentioned earlier, an entrepreneur should use the OKVED-2 classifier, which is a list of various types of activities, arranged in a hierarchical order and divided into sections, each of which is designated by a letter of the Latin alphabet. This structure looks like this:

- A – Agriculture, forestry, hunting, fishing and fish farming.

- B – Mining.

- C – Manufacturing industries.

- D – Providing electricity, gas and steam; air conditioning.

- E – Water supply, sanitation, organization of waste collection and disposal, pollution elimination activities.

- F – Construction.

- G – Wholesale and retail trade; repair of vehicles and motorcycles.

- H – Transportation and storage.

- I – Activities of hotels and catering establishments.

- J – Activities in the field of information and communications.

- K – Financial and insurance activities.

- L – Activities related to real estate transactions.

- M – Professional, scientific and technical activities.

- N – Administrative activities and related additional services.

- O – Public administration and military security; social Security.

- P – Education.

- Q – Health and social services activities.

- R – Activities in the field of culture, sports, leisure and entertainment.

- S – Provision of other types of services.

- T – Activities of households as employers; undifferentiated activities of private households in the production of goods and provision of services for their own consumption;

- U – Activities of extraterritorial organizations and bodies.

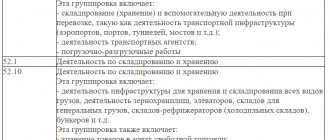

However, novice businessmen should know that Latin letters denoting a particular section are not used in the formation of codes. Their classification is as follows (each slash (/) is the number of digits):

- //. - Class;

- //./ – subclass;

- //.// - group;

- //.//./ – subgroup;

- //.//.// - view.

However, to correctly fill out the application, the entrepreneur does not need to indicate the code detailed down to the type. You just need to correctly indicate the first four numbers: class, subclass and activity group. Accordingly, all subgroups and activities are automatically included in the code.

Refusal of registration

In existing legislation there are certain restrictions on the implementation of certain types of activities. If you inadvertently indicate the wrong value, the relevant authorities will simply refuse registration.

It must be remembered that a new version of codes has been introduced since 2021. When specifying old options, non-acceptance of documents is most likely. Remember that the required code must consist of at least four characters and correspond to the group of activities. A small inaccuracy or error may result in refusal of registration. Correction will require spending additional time and possibly money.

What do the selected OKVED codes affect?

In fact, it seems that the OKVED code is such a trifle. But there are a lot of factors in accounting for your business that it can have a very significant impact on.

Let's look at the main ones.

Expense accounting

This problem is especially relevant for those who apply a tax regime that allows them to take into account costs. That is why it will be one of the most important factors from an economic point of view. If you don’t have the required code, then you can’t write off expenses for it.

Let's look at the situation using an example.

Let's say you declare only retail trade in the Unified State Register of Legal Entities (USRIP). But in the process of work, decide to also engage in services. Then, until the register contains data on OKVED codes for services, the tax office may well “exclude” the costs of these types of activities from the tax calculation. Since you have not officially declared them according to the state. register. In this connection, it is believed that you do not have such an activity, and as a result, the costs for it are not particularly economically justified.

Tax benefits

At the moment, the legislation provides for a lot of tax benefits (tax holidays, reduced rates) for certain types of activities (OKVED codes). Therefore, sometimes it is very important to choose one that is truly suitable for your job, allowing you to receive this “bonus” for yourself from the state.

Contribution benefits for employees

As with taxes, there are also benefits for contributions. That is, when carrying out work under certain OKVED codes, it is possible to pay contributions for employees in a smaller amount (i.e. at reduced rates). Thus, choosing the correct code can allow you to save not only on paying tax on the activities of an organization (IP), but also on the cost of payroll taxes for employees.

Tariff for contributions for injuries by employees

The tariff for these contributions is determined by the FSS, based on the data on the report confirming the main type of activity from the LLC (if it does not submit one, then the tariff is determined by the Unified State Register of Legal Entities, according to the code with the maximum tariff) and data on the Unified State Register of Individual Entrepreneurs. Thus, here too it is important to select the OKVED code correctly initially, so as not to pay these fees later in a larger amount.

Extra reporting, requests for clarification from the tax office

Some activities require additional types of reporting. As one of the options, statistical, mandatory only for certain areas of business. Since one of Rosstat’s selection criteria for submitting this or that industry reporting is the OKVED codes you declared in the Unified State Register of Legal Entities (USRLE). And, if in a hurry you indicate, for example, the OKVED code for some work on space exploration, then you don’t have to wonder why Rosstat asks you for a statistical report on its exploration.

A similar situation can occur with simpler codes. Let’s say you indicated OKVED codes for trade and services, but in fact you only manage services. Then it is possible that Rosstat will “torture” you with reports on both areas of business. At the same time, there are fines for failure to submit statistical reports (and quite small ones). Thus, the refusal to submit it will not pass without leaving a trace.

And if you still decide to fill it out, then you will obviously have to spend more than one day figuring out the order in which to fill it out.

Also, in addition to Rosstat, there may be problems with the tax authorities. So, for example, in the case of an LLC (IP), which was registered only on UTII, but indicated types of activities other than those that will be used in this regime, the tax office may request you to report on OSNO. Since it will be considered that not all the work of an individual entrepreneur (LLC) will be carried out within the framework of UTII. Therefore, the optimal and safe option would be to submit at least zero reports for other types of activities within the framework of the general regime. Otherwise, there may be tax requirements for its submission and fines. And you will have to prove your case in court.

Possibility of applying a certain tax regime

Not all types of activities are subject to one or another taxation regime. That is, the OKVED code you choose, in a way, gives you options for choosing systems or, on the contrary, can deprive you of it. So, for example, only certain OKVED codes fall under UTII and Patent. And if you choose the code incorrectly, you can say goodbye to the ability to use these modes.

Refusal of registration

The law also provides for restrictions on the types of activities that individual entrepreneurs and LLCs are not entitled to engage in. That is, if you inadvertently indicate a code that is unacceptable for maintaining within the framework of the work of an individual entrepreneur or within the framework of a regular LLC, a refusal to register will be more than likely.

There are also subtleties of specifying codes. Firstly, starting from 2021, a new version of the code classifier is being used, and the use of codes from the old classifier is no longer acceptable. Moreover, each code, even from a new classifier, must consist of at least four digital characters, that is, correspond to a group of activities. Otherwise, refusal is also possible. And as a result, loss of time and money.

Permits, licenses

Individual entrepreneurs (LLC) have the right to engage in some types of activities only if they have a license, permits, etc. That is, if you indicate them, but do not actually keep track of them, there is a possibility that there may be requests from inspection agencies regarding the existence of licenses, permits, etc.

Notice of commencement of activity

For certain OKVED codes, according to the government list, it is necessary to notify about the start of activity. Therefore, at the time of selection, you need to clearly understand that the code you have declared is fully suitable. If you choose the wrong code, it is possible that you will have to notify Rospotrebnadzor or other departments using it. And if you fail to fulfill this obligation, you may receive a fine.

Time

At the time of registration, it is optimal to immediately enter all the OKVED codes necessary for work. Since if this is not done immediately, then in the future you will have to make changes to the Unified State Register of Legal Entities (USRLE) in order to avoid at least the factors listed above. And filling out the necessary documents and submitting them to the inspectorate will take up that extra time that you could spend on your business.

Considering all of the above, it is better to entrust the choice of codes to a professional. He will be ready to make a choice taking into account the main factors that can have a significant impact on your business later. This is especially important in financial terms, and of course this option will make your business less labor-intensive in the future and will allow you to keep records and generate income with less effort.

This kind of optimizes your work and wallet already at the time of registration.

Time

When sending documents to the registration authorities, it is necessary to correctly understand what activities the organization will be engaged in. If further development is not provided for in time, then after some time it will be necessary to make changes to existing documents.

It may take some time to complete the required applications, submit documents to the IRS, and make changes. Any inaccuracy may result in refusal. Before making a decision, we advise you to contact specialists who will help you choose codes and fill out the necessary documents. This will help you avoid mistakes and achieve the desired result with less effort.

Features of some areas of business

On the territory of the Russian Federation, some areas of enterprise activity are subject to mandatory licensing. Therefore, before choosing an OKVED code, you should familiarize yourself with the list of services that require a license. It was approved by Federal Law No. 99 “On Compulsory Licensing” dated May 4, 2011.

The most common types of services for which you need to obtain a license are medical practice and the sale of alcoholic beverages, as well as the work of tourism operators.

Due to all the reasons listed above, the issue of choosing the correct OKVED code is very relevant for beginning entrepreneurs. After all, if you choose it incorrectly, you can receive a fine from the inspection authorities instead of profit.

Responsibility

In existing legislation there is no punishment for activities that do not comply with the codes. Adopted court decisions prove that if an organization carries out activities according to unspecified codes, then it does not bear any responsibility for such actions.

But on the other hand, it is worth considering that with such actions, an organization or an individual entrepreneur can be held liable in accordance with Art. 14.25 Code of Administrative Offenses of the Russian Federation. For failure to provide or provision of false information about an organization or entrepreneur, a fine may be imposed on the culprit. The amount can reach five thousand rubles.

If for some reason you had to start an activity or you forgot to indicate any code, we recommend that you submit an application to make the necessary changes or additions within three days. In this case, no punishment or fine is provided.