What are temporary tax differences (TDT)? PBU 18/02 gives us the answer to this question. They arise if the company's income or expenses are taken into account when determining the financial result in accounting in one reporting period, and for tax purposes, profits are recognized in another.

The second case of occurrence of IRR is if the results of operations are not taken into account when determining the financial result in accounting, but are recognized in tax accounting in another or other reporting periods.

Temporary differences in the formation of income tax lead to the formation of deferred tax - this is an amount that affects the amount of tax payable to the budget in the following reporting period or in subsequent reporting periods.

Temporary differences, depending on the nature of their effect on taxable profit or loss, are divided into taxable temporary differences and deductible temporary differences.

IT and SHE: what is it and how to calculate

Deferred tax assets (DTA) and deferred tax liabilities (DTL) are special concepts introduced into the accounting system to reflect the differences between accounting and tax profits.

The article “Calculating the difference between accounting and tax profit” will tell you why such differences arise.

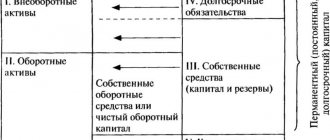

How accounting legislation deciphers the terms ONA and ONO, see the figure:

SHE and IT are determined based on the size of temporary differences, due to which differences arise between accounting and tax profits. The difference arises due to the fact that certain expenses and income are recognized in accounting in the reporting tax period, and in tax accounting in the next period and vice versa. To calculate the amount of SHE and IT, you need to multiply the temporary difference by the income tax rate.

What changes in income tax await us:

- “The list of income on which it is not necessary to pay income tax has been added”;

- “Disputes around the income tax rate: one less reason.”

Correct calculation of discrepancies in the amount of accounting and tax profits allows you to generate reliable indicators in reporting, as well as determine the amount of tax payments for the current and subsequent periods.

Examples of the occurrence of VNR

Temporary tax differences arise as a result, for example, of using different methods of calculating depreciation for accounting purposes and determining income tax: the amount of accrued expenses in accounting will be less than in tax accounting.

Another case: the use of bonus depreciation in tax accounting. Or in the case of applying different rules for reflecting interest paid by an organization for providing it with funds (credits, borrowings) for use for accounting and tax purposes.

There are other transactions that result in temporary differences.

Example 1. Depreciation

In January 2021, the organization accepted a fixed asset for accounting; it was put into operation with a cost of 600,000 rubles (including VAT 20% - 100,000 rubles).

In accounting, the method of calculating depreciation is determined - linear, in tax accounting - non-linear. The useful life of the OS is 5 years. For profit tax purposes, the organization classified the fixed asset into the fourth depreciation group, for which the monthly depreciation rate in a non-linear manner is 4.8 (clause 5 of Article 259.2 of the Tax Code of the Russian Federation). Depreciation begins to be accrued in accounting and accounting records from February 2019 (see table 1). The taxable temporary difference will be 15,666.67 (24,000 – 8,333.33) rubles. Because of the difference, tax profit becomes less than accounting profit (profit according to NU < Profit according to accounting), so the organization has a deferred tax liability in the amount of 3,133.33 (15,666.67 × 20%) rubles. The accountant needs to make the following entry: Debit 68, subaccount “Income Tax” Credit 77 “Deferred tax liability”

- 3,133.33 rubles, the amount of IT is reflected (15,666.67 rubles × 20%).

Example 2. Depreciation bonus

In January 2021, the organization accepted a fixed asset for accounting; it was put into operation with a cost of 1,320,000 rubles (including VAT 20% - 220,000 rubles).

In accounting, the method of calculating depreciation is determined - linear, in tax accounting it is also linear. The useful life of the fixed assets is 5 years, the depreciation rate is 0.01667. The organization's accounting policy for the third to seventh depreciation groups provides for the use of a depreciation bonus in the amount of 30% of the original cost. The initial cost is 1,100,000 (1,320,000 – 220,000) rubles. Depreciation begins to be accrued in accounting and accounting records from February 2019 (see table 2). The taxable temporary difference will be 324,522 (330,000 + 12,782 – 18,260) rubles. Due to the temporary difference, tax profit becomes less than accounting profit (profit according to NU < profit according to accounting), so the organization has a deferred tax liability in the amount of 64,904.4 (324,522 × 20%) rubles. The posting in this case will be as follows: Debit 68, subaccount “Income Tax” Credit 77 “Deferred tax liability”

- 64,904.4 rubles, the amount of IT is reflected (324,522 rubles × 20%).

Example 3. Cash method

An enterprise uses the cash method for tax purposes; the goods were delivered to the counterparty by the organization in February 2021 in the amount of 540,000 rubles (including VAT), and the money for it was received only in April 2021.

In accounting, the organization reflected income from the sale in February 2021, while in tax accounting, these income will be shown only in the income tax base for the first half of 2021 (see Table 3). The taxable temporary difference in February 2021 will be RUB 450,000. Because of it, the tax profit becomes less than the accounting profit (profit according to NU < profit according to accounting), so the organization has a deferred tax liability in the amount of 90,000 (450,000 × 20%) rubles. Debit 68, subaccount “Income Tax” Credit 77 “Deferred tax liability”

– 90,000 rubles, the amount of IT is reflected (450,000 rubles × 20%).

Table 1. Occurrence of IRR due to depreciation

| Conditions | Accounting | Tax accounting |

| Initial cost excluding VAT | 500 000 | 500 000 |

| Depreciation rate | 0.0166 (1/60 month) | 0,048 (4,8/100) |

| Amount of accrued depreciation | 8333,33 (500 000 × 0,0166) | 24 000 (500 000 × 0,048) |

Table 2. The occurrence of IRR due to depreciation bonus

| Conditions | Accounting | Tax accounting |

| Initial cost excluding VAT | 1100000 | 1100000 |

| Depreciation start date | February 2021 | February 2021 |

| Depreciation rate | 0.0166 (1/60 month) | 0.0166 (1/60 month) |

| Calculation of depreciation premium | 0 | 330 000 (1100 000 × 0,0166) |

| Amount of accrued depreciation | 18 260 (1 100 000 × 0,0166) | 12 782 ((1 100 000 – 330 000) × 0,0166) |

Table 3. Occurrence of IRR if the cash method is used

| Conditions | Accounting | Tax accounting |

| Initial cost excluding VAT | 450000 | 450000 |

| Recognition start date | February 2021 | April 2021 |

Table 4. Start date of depreciation

| Conditions | Accounting | Tax accounting |

| Initial cost | 200 000 | 200 000 |

| Depreciation start date | February 2021 | March 2021 |

| Method of calculating depreciation | Linear | Linear |

| Depreciation rate | 0.0166 (1/60 month) | 0.0166 (1/60 month) |

| Amount of accrued depreciation in February 2021 | 3320 (200 000 × 0,0166) | 0 |

Which entry should be used to record the amount of tax liabilities and assets?

SHE and IT are reflected in accounting in two ways:

- As differences arise in accounting and tax accounting;

- At the time of calculation of income tax at the end of the year or reporting period.

The first method is typical for automated accounting programs. The second method is used in conditions of manual calculations for income tax.

How the amount of a deferred tax asset can be reflected - the posting links the following accounting accounts:

How the amount of deferred tax liability can be reflected - the posting is as follows:

Thus, different accounting accounts are provided for ONO and ONA. At the same time, all information about the value of these indicators is collected in one subaccount “Calculations for income tax” to account 68. As a result, SHE and IT participate in determining the final amount of the current income tax.

The latest clarifications on legislative innovations can be found on our website:

- “Land tax: changes 2019”;

- “Starting from 2021, the sale of part of the property of individual entrepreneurs will be preferential”;

- “The deduction for Plato is cancelled.”

Deferred tax asset

Deductible temporary differences result from, for example, differences in the start date of depreciation;

application of various rules for reflecting interest paid by an organization for providing it with funds (credits, loans) for use for accounting and taxation purposes, creating reserves in accounting, but not in taxation. Example 1. Differences in the start date of depreciation

In January 2021, the organization accepted a fixed asset for accounting; it was put into operation in February 2021, its cost is 200,000 rubles.

In accounting and tax accounting, the method of calculating depreciation is defined as linear. The useful life of the OS is 5 years. For tax purposes, the useful life of fixed assets is also 5 years. Depreciation in accounting starts from February 2021, depreciation in tax accounting starts from March 2021, since an object as a fixed asset is accepted for accounting when it is brought into a condition suitable for use, that is, regardless of its commissioning. And in tax accounting, according to paragraph 4 of Article 259 of the Tax Code of the Russian Federation, the beginning of the calculation of depreciation of an object is determined to be the first day of the month following the month the object was put into operation. Table 4 shows when the difference occurred. The deductible temporary difference will be 3320 (3320 – 0) rubles. Due to the temporary difference, the tax profit becomes greater than the accounting profit (profit according to NU > profit according to accounting), so the company has a deferred tax asset in the amount of 664 (3320 × 20%) rubles. Debit 09, subaccount “Deferred Tax Asset” Credit 68, subaccount “Income Tax”

– 664 rubles, the amount OTA is reflected (3320 rubles × 20%).

Example 2. Application of different rules for recording interest

An organization uses the accrual method.

Under the loan agreement, the company must receive interest at the end of the contract period. In tax accounting, the accountant reflects monthly income in the form of interest in the amount of, for example, 90,000 rubles using the accrual method, while in accounting this income is not shown. A deductible temporary difference arises in the form of the amount of monthly interest income - 90,000 rubles. Due to the temporary difference, the tax profit becomes greater than the accounting profit (profit according to NU > profit according to accounting), so the organization has a deferred tax asset in the amount of 18,000 (90,000 × 20%) rubles. Debit 09, subaccount “Deferred Tax Asset” Credit 68, subaccount “Income Tax”

– 18,000 rubles, the amount OTA is reflected (90,000 rubles × 20%).

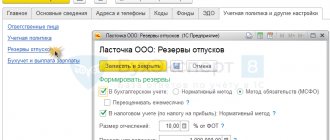

Example 3. Creation of reserves in accounting

The company reflected in its accounting policies that in 2019 it creates reserves for warranty repairs.

However, this reserve is not created for tax purposes. In February 2021, the organization created a reserve for warranty repairs in the amount of 230,000 rubles. A deductible temporary difference arises in the form of the amount of expenses for creating reserves for warranty repairs in the amount of 230,000 rubles. Due to the temporary difference, the tax profit becomes greater than the accounting profit (profit according to NU > profit according to accounting), so the organization has a deferred tax asset in the amount of 46,000 (230,000 × 20%) rubles. Debit 09, subaccount “Deferred Tax Asset” Credit 68, subaccount “Income Tax” – 46,000 rubles, the amount OTA is reflected (230,000 rubles × 20%).

Who does not need to understand the entries for accounting for deferred tax assets and liabilities

Organizations that are legally allowed to submit simplified reporting and keep records according to simplified rules, as well as a number of other entities, may not apply PBU 18/02 and, therefore, not reflect IT and ONA in accounting:

If NPOs, Skolkovo residents and small businesses decide to voluntarily apply PBU 18/02, they have the right to do so. The legislation does not contain any prohibitions in this regard. They need to consolidate their intention in their accounting policies.

Whether NPOs submit reports using the SZV-M form, we tell you here.

The meaning of SHE and IT in analysis

As mentioned earlier, the mere presence of such differences does not say anything good or bad about the company, it only characterizes the peculiarities of accounting. However, from an accounting perspective, such differences are undoubtedly related to the efficiency of cash distribution in the company.

SHE is a specific type of receivables, so to speak. The state, represented by the Federal Tax Service, actually owes this company, but is not going to repay this debt - the amount of tax will simply decrease in the future period. Of course, no interest is charged for this type of debt. Therefore, the formation of an excessive volume of IT is a diversion of the organization’s funds and a decrease in its profits, which in turn does not bring any income as an investment, and it turns out that the company is at a loss.

IT, in turn, represents a specific type of accounts payable. The company actually has to pay this money, but for now it keeps it on its balance sheet as a liability, a liability. On this obligation, she does not pay interest, but, as it were, attracts funds that do not belong to her, but which she uses.

Therefore, having IT in a reasonable size is beneficial for the company.

Will the accounting treatment of deferred tax assets and liabilities change in 2019-2020?

Taxpayers applying PBU 18/02 or planning to do so in the future should pay attention to the order of the Ministry of Finance of Russia “On Amendments...” dated November 20, 2018 No. 236n. He made adjustments to PBU 18/02, which are applied from reporting for 2021. Early application of the updated version of this PBU is also allowed if the taxpayer wants to introduce changes to accounting practices starting next year (clause 2 of Order No. 236n).

What are the adjustments:

- changes affected the terms used in the text;

- the list of temporary differences has been expanded;

- the composition of the information reflected in the reporting has been changed, etc.

We informed you about these changes in one of our publications.

Do the amendments affect the procedure for reflecting ONA and ONO in accounting? Do the current postings change due to adjustments to the accounting regulations? Law No. 236n does not contain any instructions for changing the entries used in accounting. Consequently, the wiring diagram for ONA and ONO remains the same.

Conclusions about what a change in indicator means

If the indicator is higher than normal

Not standardized

If the indicator is below normal

Not standardized

If the indicator increases

Usually a negative factor, but must be considered in conjunction with changes to line 1180.

If this indicator is difficult to understand, you can not focus on it during the analysis at all

If the indicator decreases

Usually a positive factor, but must be considered in conjunction with changes to line 1180.

If this indicator is difficult to understand, you can not focus on it during the analysis at all

Notes

The indicator in the article is considered from the point of view not of accounting, but of financial management. Therefore, sometimes it can be defined differently. It depends on the author's approach.

In most cases, universities accept any definition option, since deviations according to different approaches and formulas are usually within a maximum of a few percent.

The indicator is considered in the main free online financial analysis service and some other services

If you need conclusions after calculating the indicators, please look at this article: conclusions from financial analysis

If you see any inaccuracy or typo, please also indicate this in the comment. I try to write as simply as possible, but if something is still not clear, questions and clarifications can be written in the comments to any article on the site.

Best regards, Alexander Krylov,

The financial analysis:

- I. NON-CURRENT ASSETS Non-current assets are property used in the activities of an enterprise for more than a year. Its value is transferred in parts to the cost of finished products. A sign of assets is the ability to generate income for the organization.…

- III. CAPITAL AND RESERVES Section III Capital and Reserves is the third section of the balance sheet. But what is more important is the first section of financial sources, that is, the liability side of the balance sheet. By this he...

- Key performance indicators of an enterprise Key performance indicators of an enterprise are indicators that allow us to judge several things: The size of the enterprise and the scale of its activities The level of income and expenses About ...

- II. CURRENT ASSETS Current assets are property used in the activities of an enterprise for less than a year or used in one production cycle, which also does not exceed one year. Its entire cost...

- Absolute economic indicators of an enterprise's activity Absolute economic indicators of an enterprise's activity are indicators that allow us to judge several things: The size of the enterprise and the scale of its activities The level of income and expenses...

- IV. LONG-TERM LIABILITIES Section IV. Long-term liabilities are the fourth section of the balance sheet. At the same time, it is also the second section of the liability side of the balance sheet, which shows the sources of financing for the property. AND…

- V. CURRENT LIABILITIES Section V. Current liabilities is the fifth section of the balance sheet. At the same time, it is also the third section of the liability side of the balance sheet, which shows the sources of financing for the property. AND…

- Balance sheet asset A balance sheet asset is a part of the balance sheet containing data on the assets of the enterprise, that is, on its property. The balance sheet asset reflects property, property rights and cash...

- Relative economic indicators of the enterprise’s activity Relative indicators of the enterprise’s activity are indicators that allow one to judge the efficiency of work. The initial data for the preparation of such indicators can be taken from the balance sheet and report on ...

- Balance sheet liability The balance sheet liability is the second part of the balance sheet. It contains a list of those financial resources that were used to acquire property, that is, assets that...

Results

The posting for the reflection of a deferred tax asset is made to the debit of account 09 “Deferred tax assets” and the credit of the sub-account “Calculations for income tax” to account 68. The same sub-account corresponds by debit with the credit of account 77 “Deferred tax liabilities”, if it is formed in the accounting deferred tax liability.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

In connection with the reform of the domestic accounting system in accordance with IFRS, a need arose to increase the analyticality of financial reporting. The increasing differences between the indicators of accounting and taxable profit of domestic enterprises has led to the fact that reporting users are not able to understand the indicator of the current income tax reflected in the Profit and Loss Statement of the organization, without analyzing deferred tax assets and liabilities, as well as differences transforming accounting profit to tax.

In addition, indicators of deferred tax assets and liabilities are present in the organization’s balance sheet and thereby affect the procedure for calculating various financial analysis ratios determined from balance sheet data.

Deferred tax assets and liabilities make it possible to demonstrate information about the impact of certain groups of business transactions on the amount of accounting profit, the procedure for calculating current income tax due to differences in qualifications, assessments, and the moment of recognition of income and expenses in accordance with accounting rules and tax legislation[ 1, p.232].

The objectives of the analysis of deferred tax assets and liabilities are: a) study of the impact of indicators of deferred tax assets and liabilities on balance sheet indicators; b) study of the impact of indicators of deferred tax assets and liabilities on the amount of net profit of the organization; c) study of business transactions leading to the occurrence of deductible and taxable temporary differences, the factors and reasons that determined them; d) assessment of the impact of these differences on the current income tax and the amount of income tax payable to the budget in the following reporting period or in subsequent reporting periods.

In this regard, there is a need to classify sources of information to analyze deferred tax assets and liabilities.

The amount of the current income tax is formed on the basis of tax accounting indicators, and temporary and permanent differences only explain the reasons for the discrepancies with the amount of tax on accounting profits. Therefore, the sources of information for the analysis of deferred tax assets and liabilities are mainly accounting and tax accounting documents.

The classification of information used in the analysis of deferred tax assets and liabilities is presented in Table 1.

Table 1 - Grouping of information sources for economic analysis of deferred tax assets and liabilities

| Group of information sources | main sources | Contents of information for analysis purposes |

| Intra-company organizational and administrative documentation | Order on accounting policies for accounting purposes with the attachment of a working chart of accounts Order on accounting policies for tax purposes with the attachment of tax accounting register forms | The methods of maintaining accounting and tax records, the procedure for assessing assets and liabilities, the method for determining the amount of the current income tax, the procedure for forming the amount of income and expenses for the reporting and future periods are indicated. |

| Primary and summary documents for accounting for deferred tax assets and liabilities | Primary documents documenting business transactions leading to temporary deductible and taxable differences, accounting statements, analytical registers and transcripts for accounts 09 “Deferred tax assets” and 77 “Deferred tax liabilities” | Contains information on the amounts of accrued depreciation according to the rules of accounting and tax accounting, on the amounts of recognized expenses in accounting and tax accounting, on the amounts of losses carried forward to the future |

| Financial statements | Balance sheet, income statement, notes to financial statements | Show the amount of deferred tax assets and liabilities in the balance sheet; the amount of deferred taxes incurred and settled in the income statement; the amount of current income tax in the tax return; explanatory notes on the composition of temporary differences; about the amount of differences written off against profits and losses, about the reasons for their write-off |

| Tax reporting | Income tax return | Reveals the procedure for forming the tax base for income tax |

The main problem when conducting an economic analysis of deferred tax assets and liabilities is the absence in the scientific, educational and practical literature of any methodology for conducting their analysis. Modern research in the field of economic analysis methods often avoids using indicators of deferred and permanent tax assets and liabilities. The lack of specific methods for their analysis is also due to the fact that the indicators of deferred tax assets and liabilities were introduced into reporting relatively recently (in 2002). The analysis of deferred tax assets and liabilities is not given due attention in the scientific and periodical literature, although these objects of economic analysis are of particular value for external and internal users of reporting and can influence management decisions.

In this regard, in this scientific work an attempt was made to develop a methodology for the economic analysis of tax assets and liabilities.

The analysis should begin by examining the information about deferred tax assets and liabilities contained in the entity's financial statements.

The norms of PBU 18/02 “Accounting for calculations of corporate income tax” establish the composition of the information disclosed in the reporting about these objects of economic analysis, which we present in Table 2.

Table 2 - Disclosure of information about deferred tax assets and liabilities in financial (accounting) statements

| Reporting form | Section title and indicator name | Characteristics of reporting indicators |

| Balance sheet | Indicator “Deferred tax assets” in the section “Non-current assets” | Deferred tax assets in monetary terms as of the beginning and end of the reporting period |

| Balance sheet | Indicator “Deferred tax liabilities” in the section “Long-term liabilities” | Deferred tax liabilities in value terms as of the beginning and end of the reporting period |

| Gains and losses report | Change in deferred tax assets | The balance of deferred tax assets that influenced the calculation of current income tax is reflected. |

| Gains and losses report | Change in deferred tax liabilities | The balance of deferred tax liabilities that influenced the calculation of current income tax is reflected. |

| Text part of the notes to the financial statements | Compiled in any form | Temporary differences that arose in the reporting period and had an impact on the formation of the current income tax are reflected; the amount of deferred taxes written off to the profit and loss account; information is provided on the reasons for their write-off |

In accordance with the methodology we have developed, it is proposed to begin the analysis of deferred tax assets and liabilities by analyzing the share of deferred tax assets and liabilities in relation to the balance sheet currency to determine the significance of this object in the structure of all assets and liabilities of the organization.

Based on the consolidated financial statements of various companies around the world, we calculated the share of deferred tax assets and liabilities in the structure of the balance sheet currency as of December 31, 2009. Calculations are presented in Table 3.

Table 3 - Share of deferred tax assets and liabilities in the balance sheet currency of the world's largest companies as of December 31, 2009

| Company group | Share of deferred tax assets in balance sheet currency, % | Share of deferred tax liabilities in balance sheet currency, % |

| International companies | ||

| Telefonica Group | 5,52 | 2,85 |

| Alcatel-Lucent | 3,50 | 4,43 |

| Air France-KLM Group | 3,49 | 1,26 |

| FIAT Group | 3,84 | 0,23 |

| Siemens Group | 3,47 | 0,82 |

| Nestle Group | 1,99 | 1,27 |

| Domestic companies | ||

| KAMAZ Group | 3,17 | 1,79 |

| OJSC Razgulay Group | — | 1,81 |

| JSC Power Machines and Subsidiaries | 1,36 | 0,44 |

| X5Retail Group | 2,46 | 3,36 |

| OAO Gazprom Group | — | 3,83 |

As we can see from Table 3, many domestic and international companies reflect deferred tax assets and liabilities in their statements of financial position. At the same time, the share of deferred taxes in the balance sheet currency of companies averages 2-5%.

When analyzing the share of deferred taxes in the balance sheet currency, one should analyze the growth dynamics of deferred tax assets and liabilities by year and compare it with the growth dynamics of the balance sheet currency.

The analysis using the proposed methodology is presented in Table 4 and was carried out by us using data from Nefis Cosmetics OJSC on the basis of annual balance sheets.

Note. Due to the fact that the annual reporting of Nefis Cosmetics OJSC for 2010 has not yet been published, all analytical procedures performed during the study were carried out on the basis of reporting for 2008 and 2009.

Table 4 - Analysis of the impact of deferred tax assets and liabilities on the structure of assets and liabilities of the organization, thousand rubles.

| Indicators | As of 01/01/08 | As of 01/01/09 | As of 01/01/10 | Change 2009 compared to 2008 | Change 2010 compared to 2009 | ||

| Thousand roubles. | % | Thousand roubles. | % | ||||

| 1. Balance currency | 8309099 | 9555816 | 9567605 | +1246717 | +15,00 | +11789 | +0,12 |

| 2. Deferred tax assets | 790 | 3855 | 6319 | +3065 | 387,97 | +2464 | +63,92 |

| 3. Share of deferred tax assets in balance sheet currency (clause 2/clause 1), % | 0,0095 | 0,0403 | 0,0660 | +0,0308 | 324,21 | +0,0257 | +63,77 |

| 4. Deferred tax liabilities | 174 189 | 224 818 | 98 030 | +50629 | +29,07 | -126788 | -56,40 |

| 5. Share of deferred tax liabilities in balance sheet currency, (item 4 / item 1), % | 2,0964 | 2,3527 | 1,0246 | +0,2563 | +12,23 | -1,3281 | -56,45 |

As can be seen from Table 4, the growth rate of deferred tax assets (387.97%) and liabilities (29.07%) significantly exceeded the growth rate of the balance sheet currency (15%) in 2009 compared to 2008, which led to an increase in the share of deferred taxes in the structure of assets and liabilities of the enterprise. In 2010, a different situation took place: with a slight increase in the balance sheet currency (0.12%), there was a significant reduction in the balance of deferred tax liabilities (-56.4%), which was associated with the repayment of deferred liabilities in the reporting year.

Based on the calculation results presented in Table 4, it can be seen that in the practice of domestic enterprises, the share of deferred tax assets and liabilities as components of the balance sheet is small. For example, at Nefis Cosmetics OJSC over the past three years it has not exceeded 3%. However, their importance on the volume of current income taxes cannot be overestimated. If the balance on accounts 09 “Deferred tax assets” and 77 “Deferred tax liabilities” reflected in the balance sheet characterize the one-time states of deferred taxes, then for the activities of the organization the debit and credit turnovers on these accounts are much more important, having a direct impact on the size income tax and the amount of net profit remaining at the disposal of the organization.

Thus, at the stage of subsequent analysis, it is proposed to study the order of distribution of profit before taxation of the enterprise. Structurally, pre-tax profit can be used by an enterprise in the following areas of spending: a) for current income tax payments; b) for deferred income tax payments; c) fines and penalties from net tax profits; d) the remaining part of the profit before taxes, which is net profit.

An analysis of the impact of deferred taxes on the distribution of profit before tax using the example of Nefis Cosmetics OJSC is presented in Table 5.

Table 5 — Analysis of the impact of deferred taxes on the distribution of profit before tax

| Index | 2008 | year 2009 | ||

| In thousand rubles | IN % | In thousand rubles | IN % | |

| 1. Profit before tax | 563 807 | 100 | 254 123 | 100 |

| 2. Current income tax | 65 672 | 11,65 | 73 452 | 28,90 |

| 3. Deferred income taxes | 89 551 | 15,88 | (19 780) | (7,78) |

| 4. Net profit | 408 584 | 72,47 | 200 551 | 78,92 |

The analysis carried out in this way allows for a comparison of current and deferred taxes as a percentage of profit before taxes. For example, in 2008, more pre-tax profits were allocated to deferred taxes (15.88%) than to current taxes (11.65%), and in 2009 the opposite situation occurred: the current income tax was withdrawn from circulation 28. 90% of the enterprise's pre-tax profits, while deferred taxes saved 7.78% of pre-tax profits. In addition, such an analysis allows you to see how much of the pre-tax profit was retained for shareholders after deferred and current income taxes have been accrued. Thus, in 2009, 78.92% of profit before tax was at the disposal of shareholders, while in 2008 this figure was only 72.47%.

Table 6 presents quarterly data on the components of the current income tax of Nefis Cosmetics OJSC for 2008-2009. in absolute terms.

Table 6 - Initial data on the components of the current income tax in thousand rubles.

| Index | 1 sq. 2008 | 2 sq. 2008 | 3 sq. 2008 | 4 sq. 2008 | 1 sq. 2009 | 2 sq. 2009 | 3 sq. 2009 | 4 sq. 2009 |

| 1. Conditional income tax expense | 21148 | 36 175 | 55 662 | 22 329 | 4 581 | 9 223 | 9 891 | 27 130 |

| 2.Change in deferred tax assets | 171 | (19) | 2 855 | 58 | (19) | 1617 | 317 | 1191 |

| 3.Change in deferred tax liabilities | (9 455) | (20 831) | (50 082) | (12 248) | (9 435) | (18 546) | 41 673 | 3 082 |

| 4. Permanent tax liabilities (assets) | 3 619 | 629 | 8 566 | 7 095 | 4925 | 10 076 | 10 599 | 18 761 |

| 5. Current income tax (clause 1 + clause 2 + clause 3 + clause 4) | 15 483 | 15 954 | 17 001 | 17 234 | 52 | 2 370 | 20 866 | 50 164 |

In the temporal aspect, the change in the indicators presented in Table 6 occurred unevenly. For example, in the first, second and third quarters of 2009, the indicator of conditional income tax expense in absolute terms was minimal, which may indicate a decrease in the amount of accounting profit due to the economic crisis. At the same time, it is during these periods that the maximum amount of permanent tax liabilities occurs. In addition, the last two quarters mark the beginning of the repayment of taxable temporary differences.

Based on these data, we propose to analyze the structure of the current income tax, in which the share of each indicator discussed above is determined in relation to the amount of the current income tax. The results of such an analysis are presented in Table 7.

Table 7 — Analysis of the structure of the current income tax (as a percentage of the amount of the current income tax)

| Index | 1 sq. 2008 | 2 sq. 2008 | 3 sq. 2008 | 4 sq. 2008 | 1 sq. 2009 | 2 sq. 2009 | 3 sq. 2009 | 4 sq. 2009 |

| 1. Conditional income tax expense | 136,59 | 226,75 | 327,40 | 129,57 | 8809,62 | 389,16 | 47,40 | 54,08 |

| 2.Change in deferred tax assets | 1,10 | (0,12) | 16,79 | 0,34 | (36,54) | 68,23 | 1,52 | 2,37 |

| 3.Change in deferred tax liabilities | (61,07) | (130,57) | (294,58) | (71,07) | (18144,23) | (782,53) | 41 673 | 6,14 |

| 4. Permanent tax liabilities (assets) | 23,37 | 3,94 | 50,39 | 41,17 | 9471,15 | 425,15 | 50,8 | 37,4 |

| 5. Current income tax (clause 1 + clause 2 + clause 3 + clause 4) | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 |

According to Table 7, it can be seen that the conditional income tax expense in the analyzed period was the main structural component of the current income tax, ranging from 136.59% to 380.16% of the amount of the current income tax. However, in the third and fourth quarters of 2009, it accounted for only half of the current income tax. This was due to a significant increase in permanent tax liabilities at the enterprise and the beginning of repayment of taxable temporary differences. In addition, the role of deferred tax liabilities for the purposes of forming the current corporate income tax is more significant than the role of deferred tax assets. The maximum change in deferred tax assets was 68.23% of current income tax in the second quarter of 2009, while the maximum change in deferred tax liabilities was recorded at 18,144% of current income tax in the first quarter of 2009.

Next, it is necessary to calculate the real tax rate for income tax in relation to accounting profit, that is, the ratio of the current income tax paid by the organization to the amount of profit before tax. Calculations are made in table 8.

Table 8 — Analysis of the real income tax rate

| Index | 1 sq. 2008 | 2 sq. 2008 | 3 sq. 2008 | 4 sq. 2008 | 1 sq. 2009 | 2 sq. 2009 | 3 sq. 2009 | 4 sq. 2009 |

| 1.Current income tax | 15 483 | 15 954 | 17 001 | 17 234 | 52 | 2 370 | 20 866 | 50 164 |

| 2. Profit before tax | 88 116 | 150 730 | 231 923 | 93 038 | 22 907 | 46 113 | 49 453 | 135 650 |

| 3. Real income tax rate (item 1/item 2), % | 17,57 | 10,58 | 7,33 | 18,52 | 0,22 | 5,14 | 42,19 | 36,98 |

The calculations showed that the rules established by the Tax Code for calculating the corporate income tax can detract from the enterprise from 0.22 to 42.19% of the accounting profit before tax.

For management purposes, when carrying out calculations, in various application software products when determining the tax burden of an enterprise, as a rule, they use the profit tax rate established in the Tax Code of the Russian Federation and apply it to accounting profit, that is, 20% is simply multiplied by the amount of planned profit, which distorts predicted results. For this purpose, we recommend determining the real income tax rate in relation to accounting profits based on historical estimates. Thus, in the case discussed above for Nefis Cosmetics OJSC, the profit tax rate in relation to accounting profit was 65,672 / 563,807 = 11.65% in 2008, and in 2009 73,452 / 254,123 = 28.90%. Thus, comparing with the actual amounts of income tax liabilities, we see that in 2008 the company withdrew 11.65% of accounting profit to pay off income tax obligations, and in 2009 the withdrawals amounted to 28.90% of accounting profit.

The intensity of turnover of deferred tax assets and liabilities is also very important from an analytical standpoint. The very fact of the presence of balances in accounts 09 “Deferred tax assets” and 77 “Deferred tax liabilities” on the organization’s balance sheet is uninformative. An organization may have small deferred tax balances in absolute terms (compared to other balance sheet items), but there may be intensive generation and repayment of deferred taxes during the year. For another organization, movement in deferred tax accounts may be low-intensity.

For this purpose, we have developed indicators for analyzing the intensity of use of deferred taxes. Calculations were made based on data from Nefis Cosmetics OJSC for the fourth quarter of 2009.

We propose to calculate: a) the renewal coefficient (Kobn), characterizing the share of new deferred tax assets in their total value at the end of the period:

(1)

b) Retirement rate (Q): (2)

c) Growth coefficient (Kpr):

(3)

If internal accounting data of the enterprise is required to calculate the first two coefficients, then to calculate the growth rate of deferred taxes, the amount of deferred taxes reflected in the income statement can be used in the numerator, and the amount of deferred taxes taken from the balance sheet can be used in the denominator. The calculation of the coefficients for renewal, disposal and increase in deferred taxes is carried out in Table 9.

Table 9 — Analysis of the intensity of use of deferred taxes thousand rubles.

| Indicators | Calculation for deferred tax assets | Calculation for deferred tax liabilities |

| 1. Value of deferred taxes at the beginning of the period | 3 213 | 224 818 |

| 2. Cost of accrued deferred taxes for the period | 165 | 31 891 |

| 3. Value of deferred taxes settled for the period | 184 | 22 456 |

| 4. Value of deferred taxes at the end of the period | 3 194 | 234 253 |

| 5. Renewal rate (item 2/item 4) | 0,0517 | 0,1361 |

| 6. Retirement rate (clause 3/clause 1) | 0,0572 | 0,0998 |

| 7. The amount of increase in deferred taxes for the period (clause 2 – clause 3) | -19 | 9 435 |

| 8. Growth rate (item 7/item 1) | -0,0059 | 0,0420 |

Let's interpret the results of the analysis. The movement of deferred tax assets at the enterprise is characterized by a low degree of intensity, as evidenced by the renewal (5.17%) and disposal (5.72%) coefficients. Deferred tax liabilities are characterized by more dynamic rates of renewal (13.61%) and disposal (9.98%). A negative value for the growth rate of deferred tax assets (0.59%) and a positive value for deferred tax liabilities (4.2%) may affect fluctuations in the profit and profitability of the organization in the future. In addition, since deferred taxes lead in the future to an increase in economic benefits or to their decrease, it is recommended to trace the dynamics of the deferred tax coverage ratio (Kpok) that we developed:

(4)

This ratio shows how much future economic benefits in the form of possible income tax savings cover future resource outflows in the form of a possible increase in income tax liabilities. The calculation of the deferred tax coverage ratio is presented in Table 10.

Table 10 — Analysis of deferred tax coverage ratio

| Index | As of 01/01/08 | As of 01/01/09 | As of 01/01/10 |

| Value of deferred tax assets | 790 | 3 213 | 6 319 |

| Value of deferred tax liabilities | 174 189 | 224 818 | 98 030 |

| Deferred tax coverage ratio | 0,0045 | 0,0143 | 0,0645 |

| Coverage ratio growth rate compared to the previous period,% | — | 217,78 | 351,05 |

The value of the deferred tax coverage ratio greater than or equal to one, as well as the positive dynamics of the growth rate of the coverage ratio, should be considered positive in the organization’s activities. At the analyzed enterprise, deferred tax assets covered only 6.45% of the amount of deferred tax liabilities as of 01/01/10, which could lead to a significant increase in income tax liabilities in the future when deferred tax liabilities are repaid and the outflow of economic resources of the enterprise.

Table 11 presents calculations of the deferred tax coverage ratio of leading domestic and international companies based on consolidated financial statements as of December 31, 2009.

Table 11 — Calculation of deferred tax coverage ratios of the world's largest companies as of December 31, 2009

| Company group | Amount of deferred tax assets | Amount of deferred tax liabilities | Coverage ratio |

| Telefonica Group, million euros | 5 971 | 3 082 | 1,94 |

| Alcatel-Lucent, million euros | 836 | 1 058 | 0,79 |

| Air France-KLM Group, million euros | 942 | 418 | 2,25 |

| FIAT Group, million euros | 2 580 | 152 | 16,97 |

| Nestle Group, million Swiss. francs | 2 202 | 1 404 | 1,57 |

| KAMAZ Group, million rubles | 2 233 | 1 264 | 1,77 |

| JSC Power Machines and Subsidiaries, million dollars. | 32,748 | 10,764 | 3,04 |

| X5Retail Group, million dollars | 151,786 | 207,689 | 0,73 |

As can be seen from Table 11, in the practice of the largest international companies, the deferred tax coverage ratio fluctuates on average in the range from 0.7 to 3.0. The coverage coefficient calculated according to the data of Nefis Cosmetics OJSC (0.0645) is significantly lower than the values of the same indicator of the world's leading companies, which is a negative point in the activities of the analyzed enterprise.

Since the value of the balance of deferred tax liabilities in Nefis Cosmetics OJSC significantly exceeds the balance of deferred tax assets, which can be expressed in the outflow of economic resources due to an increase in income tax liabilities, it is recommended to calculate the Risk Ratio of a decrease in retained earnings due to deferred taxes using the formula:

The retained earnings downside risk ratio shows the portion of an entity's retained earnings that can be reduced in the future by settling deferred tax liabilities. The calculation of the loss risk ratio in relation to Nefis Cosmetics OJSC is presented in Table 12.

Table 12 — Analysis of the risk of reducing retained earnings due to deferred taxes

| Index | As of 01/01/08 | As of 01/01/09 | As of 01/01/10 |

| 1.Value of deferred tax liabilities | 174 189 | 224 818 | 98 030 |

| 2.Value of deferred tax assets | 790 | 3 213 | 6 319 |

| 3. The difference between the value of deferred tax liabilities and the value of deferred tax assets (clause 1 – clause 2) | 173 399 | 221 605 | 91 711 |

| 4. Balance of retained earnings | 1 018 628 | 1 383 968 | 1 584 519 |

| 5.Risk coefficient for reducing retained earnings due to deferred taxes, % (clause 3/clause 4) | 10,18 | 16,01 | 5,79 |

As can be seen from Table 12, Nefis Cosmetics OJSC observed a negative trend towards an increase in the risk coefficient for reducing retained earnings due to deferred taxes as of 01/01/09, as a result of which the company could lose 16% of retained earnings in the future. However, due to the repayment of deferred tax liabilities in 2009, the risk of loss of retained earnings decreased and amounted to 5.79% as of the beginning of 2010. This ratio should be calculated only if the deferred tax coverage ratio is less than one. If the value of deferred tax assets exceeds the value of deferred tax liabilities, then the settlement of deferred tax assets in the future will increase the amount of retained earnings (reduce the uncovered loss).

The calculation of the possible reduction of uncovered losses due to deferred taxes was carried out according to the consolidated statements of the KAMAZ group of companies and is presented in Table 13.

Table 13 — Analysis of the possible reduction of uncovered loss through deferred taxes

| Index | As of 12/31/08 | As of 12/31/09 |

| 1. Cost of deferred tax assets, million rubles. | 2 519 | 2 233 |

| 2. Cost of deferred tax liabilities, million rubles. | 1 994 | 1 264 |

| 3. The difference between the value of deferred tax assets and the value of deferred tax liabilities (clause 1 – clause 2) | 525 | 969 |

| 4. Balance of uncovered loss, million rubles. | 3 637 | 5 706 |

| 5. Coefficient of possible reduction of uncovered loss due to deferred taxes, % (clause 3/clause 4) | 14,43 | 16,98 |

As can be seen from Table 13, the KAMAZ group of companies has a reserve for reducing the uncovered loss in the event of repayment of deferred tax assets in the future in the amount of 16.98% of the amount of the uncovered loss. The increase in the ratio in the reporting period (from 14.43% to 16.98%) should be considered as a positive moment in the activities of the enterprise.

Deferred taxes may affect an increase (decrease) in retained earnings (uncovered loss) for reasons beyond the control of the enterprise. This may occur if the income tax rate changes. Let us analyze how the results of the revaluation of the balance of deferred taxes affected the amount of retained earnings of the enterprise in Table 14.

Table 14 — Analysis of the impact of revaluation of deferred taxes on the amount of retained earnings of the enterprise

| Index | Amount, thousand rubles |

| 1. Decrease in retained earnings due to revaluation of deferred tax assets | 642 |

| 2. Increase in retained earnings due to revaluation of deferred tax liabilities | 41 983 |

| 3. Net increase in retained earnings due to revaluation of deferred taxes (clause 2 – clause 1) | 41 341 |

| 4. Balance of retained earnings before revaluation | 1 370 396 |

| 5. Percentage of change in retained earnings as a result of revaluation of deferred taxes, % (clause 3/clause 4) | 3,02 |

The predominance of the amount of deferred tax liabilities over the amount of deferred tax assets led to an increase in the amount of retained earnings as a result of the revaluation of deferred assets at the analyzed enterprise by 3.02%. This is a positive moment in the company’s activities, since 41.3 million rubles were made available to shareholders. by reducing the income tax rate.

Thus, the algorithm for analyzing deferred tax assets and liabilities can be presented in the form of the following flowchart:

Fig.1. Flowchart for analyzing deferred tax assets and liabilities

As can be seen in the presented flowchart, it is advisable to begin the analysis of deferred taxes with a general assessment of deferred tax assets and liabilities for indicators of the property (financial) condition of the enterprise. In the course of deepening, it is necessary to analyze the impact of deferred taxes on profit before tax and net profit in dynamics, as well as search for opportunities to increase retained earnings through the possible repayment of deferred taxes in future reporting periods.

Types of differences that may arise during operation

Due to the fact that for accounting purposes all amounts of income and expenses are accepted, and for tax purposes only selectively, differences arise when calculating income tax. These differences can lead to either a tax decrease or an increase. Moreover, in both cases, the tax change can be either permanent or temporary . If such differences arise in the company, then the following entries are generated in accounting:

- Calculation of income tax, reflects the organization's debt to the budget D99 K68.04

- If there are differences that increase tax:

– constantly D99 K68

– temporarily D09 K68

- If there are differences that reduce tax:

– constantly D68 K99

– temporarily D68 K77

It must be taken into account that accounts 09 and 77 are subsequently closed with reverse entries.

| IMPORTANT! Temporary differences do not affect the company's net profit |

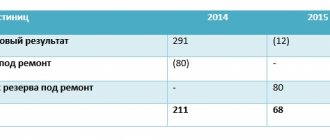

Let's look at what the differences look like using an example. Initial data:

revenue 150 thousand rubles, cost 50 thousand rubles, wage fund 20 thousand rubles, artificial fountain in the director’s office 30 thousand rubles, gratuitous receipt from the founder 50 thousand rubles, fines and penalties for taxes 30 thousand roubles.

| Index | Accounting | Tax accounting |

| Revenue | +150 | +150 |

| Cost price | -50 | -50 |

| Payroll fund | -20 | -20 |

| Fountain | -30 | – |

| Proceeds from the founders | +50 | – |

| Fines, penalties | -30 | |

| Profit before tax | +70 | +80 |

It turns out that according to accounting data, it would be necessary to pay less tax than required by tax accounting. Taking into account the differences, accounting data must be brought to the same level as tax accounting data.

It must be borne in mind that the amount of income tax for transfer to the budget is calculated as conditional income (that is, the profit before tax that is obtained according to accounting data), adjusted for all resulting differences. If everything is done correctly, the tax received by this calculation will coincide with the amount of tax according to the declaration.

Accounting for income tax calculations

The procedure for accounting for income tax calculations, as well as identifying the difference between the accounting profit tax recognized in accounting and the tax reflected in the income tax return, is established by the Accounting Regulations (PBU) 18/02, approved.

by order of the Ministry of Finance of the Russian Federation dated November 19, 2001 No. 114n. The Ministry of Finance has made a number of amendments to PBU 18/02, which must be applied starting with the reporting campaign for 2021. Find out exactly what amendments were made to the regulations and how to apply them in practice in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

PBU 18/02 introduced indicators into accounting practice, each of which increases or decreases taxable profit. Next we will look at these indicators.