Audio version of the article, listen

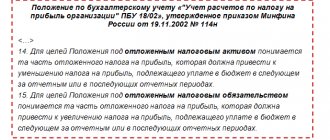

09 the accounting account is closed at the end of the month:

- deferred tax assets are calculated from account 68;

- when switching to the simplified tax system, it is necessary to write off the balances;

- upon liquidation of the company, it is written off at 99;

- in 1C, at the end of the year, a transfer of current losses to future expenses is created.

Closing a period is a cycle of events designed to summarize the economic activities of an enterprise. To understand the financial result, it is necessary to combine all income and expenses. To do this, the accountant needs to do a number of manipulations with the accounts.

Principles of calculations

Account 09 “Deferred tax assets” is one of the most problematic, since it has no direct connection with primary documents. It is intended to reflect the portion of income taxes that the organization expects to pay in the future, which is why it is called deferred.

To calculate the tax share, you must first find deductible temporary differences (DTD), which are formed due to the difference between:

- accounting and tax value;

- time of acceptance of income and expenses in tax and accounting.

In turn, temporary differences are credited to account 09 not in pure form, but solely at the income tax rate adopted in the region of the company’s location. That is, if the tax rate is 20%, then on 09 the amount is recognized according to the formula:

VVR * 20%.

For a temporary difference to be included in an asset, it must be significant.

From the author! The main value in the calculation is the information reflected in the accounting records. This means that the amounts in tax accounting should be less than in accounting.

If, as a result of such calculation, the temporary difference turns out to be negative, then it is taken into account in account 77 “Deferred tax liabilities”.

The essence of temporary differences and their types

Uneven regulation of the recognition of costs and income causes the generation of several types of differences. Namely:

- Temporary (TP).

- Permanent (PR).

When in financial calculations certain amounts of income received (costs incurred) are accepted in the same amounts for both types of accounting, but, nevertheless, a difference is obtained due to a discrepancy in the time of their recognition, then it is called “temporary” and automatically generates a certain value of ONP. VR serves as the basis for the emergence of this volume of SNP.

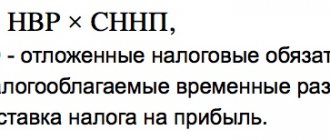

SNP can be determined using the formula:

The firm or company will definitely transfer this deferred tax to the budget. Its volume in the current period of time affects (increases or, on the contrary, decreases) the amount of tax payable in reporting periods of business that have not yet occurred.

Temporary differences may be:

- Deductible.

- Taxable.

Under the influence of deductible SNP, it grows, and the second (taxable) – decreases.

The first type of VR occurs if costs in tax accounting are recorded a little later, and income received is recorded a little earlier than in accounting.

Deductible differences include, in particular:

– depreciation amounts (according to fixed assets) – when their value in accounting exceeds the calculated volume in tax accounting;

– tax loss carried forward to a future business period;

– costs with income arising as a result of exchange rate differences inevitable when conducting foreign exchange transactions.

Taxable differences are the amounts of costs and income that positively affect the amount of earned profit:

– in accounting – if we mean the current period;

– taxable – in periods that occur later.

This type of difference can appear:

| Index | Accounting type | |

| tax | accounting | |

| Depreciation amounts for fully worn-out fixed assets | taken into account | – |

| Customs duties | apply completely | are written off gradually - in proportion to the sale of goods |

| Services provided by the broker | are included in direct costs immediately | Write-off occurs in proportion to sales volume |

How are records kept?

Accounting for 09 occurs by type of assets and liabilities. Typically, several standard types are used, but the list can be expanded if new differences arise:

- Fixed assets.

- Estimated liabilities and provisions.

- Future expenses.

- Loss of the current period.

- Depreciation of fixed assets.

- Materials.

- Special equipment and special clothing.

In order for the VVR to be included in account 09, it is necessary to carry out the following posting:

- Dt 09 Kt 68.04 “Calculations for income tax.”

Examples of conducting 09 can be found in the video

1C to help

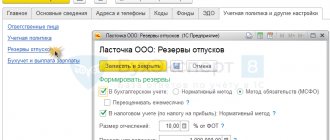

Calculating temporary differences is a labor-intensive and confusing task, therefore 1C software products version 8 provide “Period Closing” processing. It can be found in the “Accounting, taxes and reporting” menu. In the “Month Closing” processing, the last regulatory operation will be “Calculation of income tax”, which, among other things, collects shares of deferred tax on account 09.

The operation calculates all VVR suitable for accounting ONA, and during the year collects them on debit by type of assets and liabilities. At the end of the month, account 09 can be closed partially if a profit is received, which offsets the loss by posting:

- Dt 68.04 Kt 09.

In version 1C, UPP-1 “Calculation of income tax” is also valid for the accrual and repayment of deferred tax assets. To understand how this operation works, you can generate a calculation certificate. But it does not show all sources of differences. In particular, it is impossible to see how VVR is calculated from depreciation.

At the end of the year, the write-off of losses from previous years is added to the closing transactions of account 09. This action is performed in a routine operation, which was specially added to version 1C 8.3. It is not available in earlier configurations.

This processing has become necessary in 2021, since according to the new rules, losses from previous years can be carried forward indefinitely. Enterprises can also use them to reduce profits of current periods, but not by more than 50%.

Before starting this processing on account 09, it is necessary to change the type of asset, in other words, “Loss of the current period” will move to “Expenditures of future periods”. Transfer of losses can only be done manually in the “Accounting” menu, subsection “Operations entered manually”:

- Dt 09 subconto “Future expenses” Kt 09 subconto “Loss of the current period.

Important point! When creating a deferred expense type, you can not fill in the period for writing off losses from previous years in order to use them when necessary, and not in the next year.

The absence of a transfer operation leads to errors in total accounting and the program. Without it, it will not be possible to close January next year. The program will reject the income tax calculation, warning that the loss has not been carried forward. After completing the work, it is necessary to re-translate the documents for December and perform a balance sheet reformation.

Balance sheet method of accounting for deferred tax assets and liabilities in 1C: Accounting 8 edition 3.0

By its Order No. 236n dated November 20, 2018, the Russian Ministry of Finance amended PBU 18/02 “Accounting for corporate income tax calculations.” The new edition of the PBU, with the changes provided for by this order, must be applied by organizations, starting with the financial statements for 2021, that is, from January 2021 (although, at their discretion, organizations could apply the new edition before this date). In connection with this upcoming event, I decided to devote this article to PBU 18/02. We, as always, will use specific examples to see how the new edition of the above-mentioned PBU works in the 1C: Accounting 8 edition 3.0 program, and how it differs from the old edition.

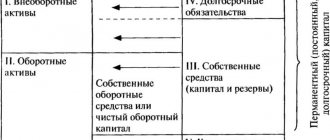

The first thing that organizations applying PBU 18/02 need to do in the program is to change the accounting policies for accounting from January 1 of the new year. In the accounting policy form, it is necessary to indicate that accounting for deferred tax assets and liabilities, in accordance with PBU 18/02, is carried out using the balance sheet method. This term appeared due to the fact that, in accordance with clause 8 of the new edition of PBU 18/02, a temporary difference as of the reporting date is defined as the difference between the book value of an asset (liability) and its value accepted for tax purposes. In my opinion, the balance sheet method has always been used in the program. Let's remember the formula for the ratio of amounts for various indicators in an accounting entry: BU = NU + PR + BP. Setting up the accounting policy regarding the application of PBU 18/02 is shown in Fig. 1.

Picture 1.

As we know, PBU 18/02 establishes the rules for the formation in accounting and the procedure for disclosing in the financial statements information on calculations of corporate income tax, and also determines the relationship of the indicator reflecting profit (loss), calculated in the manner established by regulatory legal acts on accounting (accounting profit (loss)), and the tax base for income tax (taxable profit (loss)), calculated in the manner established by the legislation on taxes and fees (clause 1 of PBU 18/02). PBU deals with the differences between accounting and tax accounting. Fortunately, the differences remain the same: permanent and temporary.

Let's look at a simple example.

The Rassvet organization applies the general taxation regime - the accrual method and PBU 18/02 “Accounting for calculations of corporate income tax”, and from 2021 it applies its new edition. In November 2021, the organization had three business transactions that were directly related to PBU 18/02. Firstly, expenses were recognized that were not taken into account for profit tax purposes, which amounted to 20,000 rubles. Secondly, the property was insured for a year. The insurance premium was 72,000 rubles. Moreover, in accounting, expenses are recognized at a time, and for tax purposes they are recognized evenly over the period corresponding to the insurance contract. Thirdly, a fixed asset item with an initial cost of 50,000 rubles was accepted for accounting and put into operation.

Let's perform the above operations and see what has changed in accounting, in accordance with PBU 18/02, in the program. For simplicity, all expenses recognized in accounting will be classified as general expenses and will be accounted for in account 26.

Let's start with the permanent differences. With permanent differences, no significant changes occurred in the new edition of PBU 18/02; only permanent tax liabilities and assets turned into permanent tax expenses and income, respectively.

Permanent differences are understood as income and expenses that form the accounting profit (loss) of the reporting period, but are not taken into account when determining the tax base for income tax, both the reporting and subsequent reporting periods, or vice versa, taken into account when determining the tax base for income tax , but not recognized for accounting purposes (clause 4 of PBU 18/02).

Permanent differences result in a permanent tax expense (income). Constant tax expense (income) is understood as the amount of tax that leads to an increase (decrease) in tax payments for income tax in the reporting period (clause 7 of PBU 18/02).

In order for the program to automatically register a permanent difference, it is necessary to specify an expense item with the type Not taken into account for tax purposes as an analytics of the expense account, and when using account 91, an item of other income and expenses with the Accepted for tax accounting checkbox turned off.

To reflect non-accepted expenses in the program, we will use the Receipt document with the transaction type Services.

In the tabular part of the document we will indicate the nomenclature of the service and its cost. As a cost attribution account, we will select account 26 “General business expenses”. As an account analytic, we will select a cost item with the type Not taken into account for tax purposes.

When posting the document in accounting, the amount of expenses will be taken into account in the debit of account 26; there are no expenses in tax accounting, so the corresponding constant difference will be recorded. The Receipt document and the result of its implementation are shown in Fig. 2.

Figure 2.

Now let's deal with time differences. Temporary differences mean income and expenses that form accounting profit (loss) in one reporting period, and the tax base for income tax in another or other reporting periods, as well as results of operations that are not included in accounting profit (loss), but form tax base for income tax in another or other reporting periods. The temporary difference as of the reporting date is defined as the difference between the book value of an asset (liability) and its value accepted for tax purposes (clause 8 of PBU 18/02).

Temporary differences result in deferred income taxes. Deferred income tax is understood as an amount that affects the amount of income tax payable to the budget in the following or subsequent reporting periods (clause 9 of PBU 18/02).

For automatic registration of temporary differences in the program, it is necessary that the operation in accounting and tax accounting is reflected in different accounting accounts.

First, let's look at the situation with property insurance. In this case, insurance refers to compulsory types of insurance and there is a one-time payment.

Costs for property insurance incurred by an organization in the course of ordinary activities are included in expenses for ordinary activities. The procedure for recognizing expenses in the form of an insurance premium is not established by law. The procedure adopted by an organization for accounting for insurance costs may be enshrined in its accounting policies. In our case, the insurance premium is recognized as a lump sum expense.

In accordance with paragraphs. 5 p. 1 art. 253 of the Tax Code of the Russian Federation, property insurance costs are classified as other costs associated with production and sales. If the terms of the insurance contract provide for payment of the insurance premium in a one-time payment, then under contracts concluded for a period of more than one reporting period, expenses are recognized evenly over the period corresponding to payment, in proportion to the number of calendar days (clause 6 of Article 272 of the Tax Code of the Russian Federation). Thus, in accounting, insurance costs are recognized as a lump sum, and for profit tax purposes they are classified as future expenses in the program. Therefore, we experience temporary differences. Temporary differences, depending on the nature of their impact on taxable profit (loss), are divided into deductible temporary differences and taxable temporary differences (clause 10 of PBU 18/02). If expenses are recognized in accounting in the current period, and in tax accounting in subsequent periods, we can confidently say that these are deductible temporary differences. But, just in case, let’s check PBU 18/02. Deductible temporary differences lead to the formation of deferred income tax, which should reduce the amount of income tax payable to the budget in the following reporting periods (clause 11 of PBU 18/02). That's right. Today there are expenses in accounting, but there are no expenses in taxation - we pay more tax. Tomorrow there are expenses in tax accounting, no expenses in accounting - we pay less tax. To reflect this operation in the program, you can again use the document Receipt with the transaction type Services.

In the tabular part of the document we will indicate the nomenclature of the service and its cost. As an account for allocating expenses in accounting, we will again select account 26 with the cost item Mandatory and voluntary property insurance. In tax accounting, select account 97.21 “Other deferred expenses” and create an account analytics - an element of the Deferred Expenses directory.

When posting the document in accounting, it will take into account insurance costs in the debit of account 26, that is, it recognizes the costs at a time. In tax accounting, it will take into account expenses in the debit of account 97.21, that is, it recognizes expenses of future periods. The document will register positive temporary differences in the debit of account 26, and negative temporary differences in the debit of account 97.21. And we already know that these are deductible temporary differences. The Receipt document and the result of its implementation are shown in Fig. 3.

Figure 3.

Let's look at the basic tools. In accounting, the acquired asset fully complies with the necessary criteria for acceptance for accounting as a fixed asset and has a cost of more than 40,000 rubles. This is depreciable property.

For tax purposes, in accordance with paragraph 1 of Art. 256 of the Tax Code of the Russian Federation, depreciable property is property with an original cost of more than 100,000 rubles. Thus, in accounting, an object of fixed assets will be depreciated, and for profit tax purposes, the cost of the object must be recognized as part of material expenses at a time when commissioning. Consequently, we again have time differences.

If expenses are recognized in tax accounting in the current period, and in accounting in subsequent periods, we can confidently say that these are taxable temporary differences. Let's check PBU 18/02. Taxable temporary differences lead to the formation of deferred income tax, which should increase the amount of income tax payable to the budget in the following reporting periods (clause 11 of PBU 18/02). True again. Today there are expenses in tax accounting, but there are no expenses in accounting - we pay less tax. Tomorrow there are expenses in accounting, no expenses in taxation - we pay more tax.

To reflect the receipt of a fixed asset item, its acceptance for accounting and commissioning, you can use the document Receipt with the type of transaction Fixed Assets. The header of the document indicates the method of reflecting depreciation expenses and the asset accounting group to which the acquired object belongs. In the tabular part of the document, an object of fixed assets is selected (item of the Fixed Assets directory), its cost, accounting account, depreciation account and useful life are indicated.

When conducting a document in accounting and tax accounting, the object is credited to the debit of account 08.04.2 “Acquisition of fixed assets” and will immediately take it into account, writing off the initial cost of the object from the credit of account 08.04.2 to the debit of account 01.01 “Fixed assets in the organization.” But since the cost of the object is less than 100,000 rubles, for profit tax purposes the cost will be written off from the credit of account 01.01 as part of material expenses to the debit of account 26 (the account corresponds to the method of reflecting depreciation expenses) under the item Non-depreciable property. Accordingly, negative temporary differences will be reflected in accounts 26 and 01.01. And we already know that these are taxable temporary differences. The Receipt document and the result of its implementation are shown in Fig. 4.

Figure 4.

As we can see, nothing has changed in the primary documents. The documents make exactly the same entries as when applying the old edition of PBU 18/02.

Now let's see what happens to the differences we recorded on account 26 when closing the month. The Rassvet organization's accounting policy stipulates the use of the direct costing method. Therefore, the routine operation Closing accounts 20, 23, 25, 26 will write off account 26 along with permanent and temporary differences to the debit of account 90.08.1 “Administrative expenses”. The postings of the routine operation are shown in Fig. 5.

Figure 5.

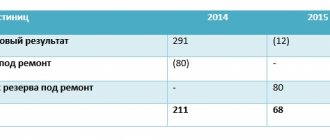

Regular operation Closing accounts 90, 91, through account 90.09, will transfer the differences with the opposite sign to the credit (we have profit) of account 99.01.1 “Profits and losses”. In accounting, in our example, the transaction amount is 355,920 rubles, and in tax accounting - 397,920 rubles. That is, tax profit is 42,000 rubles more than accounting profit. This difference was made up of a permanent difference (20,000 rubles, expenses not accepted for tax purposes) and a temporary difference (72,000 rubles of deductible temporary differences minus 50,000 rubles of taxable temporary differences). The posting of the scheduled operation is shown in Fig. 6.

Figure 6.

Now let's move on to the regulatory operation Calculation of income tax. When applying the new edition of PBU 18/02, the regulatory operation is no longer concerned with this PBU. It only, on the basis of tax profit (account 99.01.1 amount NU), calculates income tax, distributes it among budgets and charges it for payment in whole rubles. The postings of the routine operation are shown in Fig. 7.

Figure 7.

For the new edition of PBU 18/02, a new regulatory operation has appeared: Calculation of deferred tax according to PBU 18. Now it calculates and accrues conditional income tax expense/income, constant tax expense/income and deferred income tax (deferred tax assets and liabilities). With constant tax expense/income everything is simple, only the name has changed. Positive permanent differences (PD) lead to constant tax expense, negative ones lead to constant tax income. Permanent tax expenditure (FTR) increases the current tax, and permanent tax income (FIT), respectively, reduces the current tax. Moreover, the current tax is affected only by those permanent differences that “reached” the accounting accounts up to account 99.01.1.

The constant tax expense (income) is equal to the product of the constant difference and the profit tax rate (clause 7 of PBU 18/02).

PNR = PR * STnp = 20,000 rubles * 20% = 4,000 rubles

Thus, we can say that, taking into account the constant differences, nothing has changed. Only for some reason the regulatory operation does not have a certificate calculating permanent tax expense/income, but I hope that it will appear soon.

Now let's look at how deferred tax is calculated. There have been some changes here. Deferred tax consists of deferred tax assets (DTA) and deferred tax liabilities (DTL). ONA is understood as that part of deferred income tax that should lead to a reduction in income tax payable to the budget in subsequent reporting periods. IT refers to that part of deferred income tax that should lead to an increase in income tax payable to the budget in subsequent reporting periods. IT is recognized when deductible temporary differences (DTD) arise, IT is recognized when taxable temporary differences (TDT) arise (clause 14 and clause 15 of PBU 18/02). The program takes account balances by type of accounting (temporary differences) at the beginning of the year and at the end of the current month. The program determines the type of temporary difference based on account activity. If the account is active and the difference is greater than zero, this is an NVR; if the difference is less than zero, this is an IVR. If the account is passive, then the opposite is true. An increase in the corresponding differences leads to an accrual, and a decrease in the corresponding differences leads to a decrease or repayment of IT and IT. When recognized, ONA increases the current income tax, and when redeemed, it reduces it. With IT, it’s the other way around: upon recognition, it reduces the current income tax, and upon repayment, it increases.

When calculating in the ONA and ONO program, accounts 25, 26 do not participate (since these accounts in accounting must be closed at the end of the month without a balance and these accounts cannot have a balance for temporary differences), accounts 90, 91, 99 (since this current income and expenses in accounting and tax accounting). Thus, PBU 18/02 in our example will only be interested in temporary differences that we took into account on accounts 01.01 and 97.21. In accordance with the program algorithm, on account 01.01 we took into account NVR, and on account 97.21 we took into account VVR, which corresponds to reality.

The change in the value of IT and IT in the reporting period is equal to the product of the corresponding temporary differences that arose (settled) in the reporting period by the income tax rate (clause 14 and clause 15 of PBU 18/02).

SHE = VVR * STnp = 72,000 rubles * 20% = 14,400 rubles ONO = NVR * STnp = 50,000 rubles * 20% = 10,000 rubles

Deferred assets and liabilities are accrued by type of asset and liability. The information register used by the regulatory transaction to calculate deferred tax is shown in Fig. 8.

Figure 8.

The routine operation generated all the necessary entries: calculated and accrued a contingent income tax expense (accounting profit * STnp), accrued a permanent tax expense, accrued a deferred tax asset and a deferred tax liability. Accounts for accounting objects PBU 18/02, of course, remained the same. The postings of the new routine operation are shown in Fig. 9.

Figure 9.

This routine operation has two new and one old calculation certificates. Help calculation Deferred income tax shows us deductible and taxable temporary differences, recognized deferred tax assets and liabilities by type of assets and liabilities at the beginning of the year and on the first day of the month following the current one. The calculation certificate also shows the recognition and repayment of deferred tax assets and liabilities for the reporting period. The calculations in the certificate are correct. The certificate fully complies with the new provision of PBU 18/02 that deferred income tax for the reporting period is determined as the total change in deferred tax assets and deferred tax liabilities for this period (clause 20 of PBU 18/02). The calculation certificate is presented in Fig. 10.

Figure 10.

The second new calculation certificate is called the Effect of changes in income tax rates. It was created in accordance with the new edition of PBU 18/02 in case of a change in the income tax rate. Fortunately, the tax rate does not change very often.

Help-calculation The calculation of income tax is well known to us. In it we can see the calculation of PBU 18/02 of the current income tax. The formula for calculating the current income tax has not changed.

TNP = URNP - UDNP + PNR - PND + ONA - linear. SHE - IT + pog. IT

The calculation certificate is presented in Fig. eleven.

Figure 11.

Now let's see what will happen to the deferred income tax next, since in December in our example two events will occur that are directly related to PBU 18/02.

Firstly, accounting will begin accruing depreciation on the fixed asset item accepted for accounting last month. There are no expenses in tax accounting, since the cost of the object was recognized as an expense upon commissioning. Therefore, the routine operation Accrual of depreciation will record temporary differences in the posting on the debit of account 26 and on the credit of account 02.01 “Depreciation of fixed assets”. The amount of depreciation in accounting is 2,000 rubles, therefore, the corresponding temporary difference will be recorded in account 02. The fixed asset is accounted for in two accounts. The residual value of an item of fixed assets is calculated as the difference between the amounts of account 01 (book value) and account 02 (accrued depreciation). Thus, along with the residual value, the amount of temporary differences also decreases. Secondly, tax accounting will begin to write off future expenses. There are no expenses in accounting, since insurance expenses were recognized as a lump sum. Therefore, the routine operation Write-off of deferred expenses will write off from the credit of account 97.21 to the debit of account 26 only expenses in tax accounting and the corresponding temporary difference with a minus sign (in our example -6,098.36 rubles). Thus, the amount of temporary differences by type of asset Deferred expenses will also decrease. The postings of the corresponding routine operations are presented in Fig. 12.

Figure 12.

Now let's see how the regulatory operation Calculation of deferred tax under PBU 18 behaves. In the old version of PBU, such events clearly led to the repayment of IT and IT. In the new edition, calculations are made differently.

The program takes account balances for the type of accounting BP at the end of the current month (now December) and sees that the amounts of temporary differences have decreased. By type of asset Fixed assets, the amount of taxable temporary differences is now 48,000 rubles (50,000 rubles - 2,000 rubles), and by type of asset Deferred expenses, the amount of deductible temporary differences is now 65,901.64 rubles (72,000 rubles - 6,098.36 rubles). Accordingly, new deferred tax is calculated. The register for calculating a routine operation is shown in Fig. 13.

Figure 13.

We see that compared to the previous month, the amount of differences has decreased, but if we compare with the beginning of the reporting year, this is not the case. Since the beginning of the reporting year, there has been an increase in the amounts of temporary differences. Therefore, the regulatory operation does not extinguish deferred assets and liabilities, but adjusts them. And since this is an adjustment, we see a reversal in the postings. The postings of the routine operation are shown in Fig. 14.

Figure 14.

Let's look at the help-calculation Deferred income tax for December. It simply shows us the new amounts of deductible and taxable temporary differences, the new amounts of deferred tax assets and liabilities. We don’t see any details or transcripts here.

Figure 15.

The new edition of PBU 18/02 introduced the concept of income tax expense (income). Profit tax expense (income) is understood as the amount of profit tax recognized in the income statement as an amount that reduces pre-tax profit when calculating net profit for the reporting period. Profit tax expense (income) is determined as the sum of current profit tax and deferred profit tax (clause 20 of PBU 18/02).

The current income tax is now recognized as income tax for tax purposes, determined in accordance with the legislation of the Russian Federation on taxes and fees (clause 21 of PBU 18/02).

Deferred income tax for the reporting period is determined as the total change in deferred tax assets and deferred tax liabilities for this period (clause 20 of PBU 18/02). A fragment of the financial results statement with a breakdown of deferred income tax is presented in Fig. 16.

Figure 16.

And finally, let's look at when deferred tax assets and liabilities will begin to be repaid. In our example, this will happen in 2020.

In January 2021, accounting will continue to accrue depreciation on fixed assets and write off deferred expenses in tax accounting. On the credit of account 02.01 another 2,000 rubles of temporary differences will be registered, and from the credit of account 97.21 -6,098.36 rubles of temporary differences will again be written off.

Regular operation Calculation of deferred tax according to PBU 18, as always, will take the balance of accounts according to the type of accounting BP at the beginning of the year and at the end of the current month. By type of asset Fixed assets, the amount of taxable temporary differences since the beginning of the year has decreased by 2,000 rubles. and for the asset type Deferred Expenses, the amount of deductible temporary differences decreased by 6,098.36 rubles.

Since the decrease in temporary differences occurred relative to the beginning of the reporting year, previously accrued tax assets and liabilities are subject to repayment. Therefore, this month we will see wiring familiar to us. The postings of the routine operation are shown in Fig. 17.

Figure 17.

Let's look at the help-calculation Deferred income tax. Now it shows us the new amounts of deductible and taxable temporary differences, the new amounts of deferred tax assets and liabilities and the amount of their settlement for the reporting period. The calculation certificate is presented in Fig. 18.

Figure 18.

As we see, when applying the new edition of PBU 18/02, all the total indicators we received coincide with the old edition.

Accrual example

For example, Fialka LLC received revenue of 500,000 rubles, expenses for core activities amounted to 600,000 rubles. In order to summarize the results, the turnover in subaccounts 90 “Sales” fell to 90.09.

Also during the period, income from other activities was received in the amount of 100,000 rubles and expenses were incurred in the amount of 50,000 rubles. Turnovers from other activities are maintained on account 91 “Other income and expenses”. By analogy with account 90, a balance was formed on subaccount 91.9.

In turn, 90.09 and 91.09 are closed by transferring to account 99. A calculation is made to see what result the company got.

Table 1. Movements by revolutions

| RAS number | Debit amount | Loan amount |

| 90.09 | 600 000,00 | 500 000,00 |

| 91.09 | 50 000,00 | 100 000,00 |

| Account turnover 99 | 650 000,00 | 600 000,00 |

| Account balance 99 | 50 000,00 |

Consequently, the company incurred a loss on account 99 in the amount of 50,000 rubles. When calculating income tax in the program, the following will be recognized from this amount:

- 50,000 * 20% = 10,000 rubles;

- Dt 68.04 Kt 99 - income tax was reduced by 10,000 rubles;

- Dt 09 Kt 68.04 - reflected 10,000 rubles.

Before the balance sheet reformation, IT was transferred from a loss to deferred expenses:

- Dt 09 Kt 09 - 10,000 rubles.

At the same time, the accountant made an entry in tax accounting:

- Dt 97 “Future expenses” Kt 99 - in the amount of 50,000 rubles of transferred loss.

There is no need to record any amounts in this entry in accounting.

Accounts for reflecting ONA and ONO

Transactions with ONA are recorded in accounting documents as follows:

| Debit | Credit | Explanation |

| 09 | 68 | The appearance of SHE |

| 68 | 09 | Complete write-off (or reduction) of IT |

The formation of the IT is recorded by correspondence:

Dt sch. 68 Kt. 77

In reporting periods that come later, the amounts of costs and income in accounting and tax accounting will gradually converge. IT will be canceled by reverse entry:

Dt sch. 77 Kt. 68

Special conditions for write-off

Important! When an enterprise switches to a simplified tax regime (STS), the accountant needs to know that the 09 account will no longer be maintained. Companies using the simplified tax system are not subject to income tax.

The conditions for transferring the regime are specified in Art. 346 clause 25 of the Tax Code of the Russian Federation. If before the transition the company was in general mode, then it is necessary to close all balances of ONA. Switching to a special regime is allowed from the beginning of the next reporting year. Accordingly, as of December 31, it is necessary to carry out the following operation:

- Dt 99 “Profits and losses” Kt 09.

The entry will close all SHE so that the account is closed on January 1st. When company 09 is liquidated, the account is written off with the same entry. The accounting department always has a question: when should it be written off during the liquidation process? Usually, before drawing up a liquidation balance sheet, a company tries to pay off its obligations as much as possible and collect receivables.

If all the necessary actions have been taken, but SHE will no longer be compensated, then you can write it off.