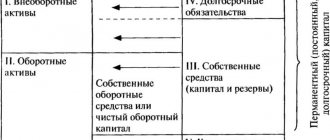

“Assets are equal to liabilities”—everyone who begins to get acquainted with management accounting hears these words. For many, such a statement raises a lot of questions: “why?”, “what’s the difference?”, “and if they are still not equal, then what?”

Yulia Musharapova outsourced financial director from the Neskuchnye Finance consulting bureau, which helps with management accounting for more than 100 companies from Ukraine, Russia, Kazakhstan, Belarus and Czech Republic.

Equality is an asset

The equality of assets and liabilities is also due to the double entry of transactions on accounts, according to which the total of the debit is equal to the total of the credit of the entire set of accounts.

[1] The equality of an asset to a liability is called balancing. [2]

The equality of Asset and Liability in a natural balance is possible only in a special case that is not of interest for theoretical research. [3]

What causes the equality of assets and liabilities of the balance sheet. [4]

What determines the equality of assets and liabilities of the balance sheet. [5]

When equality of assets and liabilities is achieved, the balance is considered liquid. [6]

CLOSED CURRENCY POSITION - equality of assets and liabilities, as well as off-balance sheet claims and liabilities, in a specific foreign currency. [7]

Duality in accounting provides for the mandatory equality of the organization's assets with the sources of their formation at any date of the organization's functioning. [8]

The use of dummy accounts leads to the equality of Asset and Liability. [9]

Andrew had heard of this principle of asset-liability equality before, but did not understand how it could apply to him personally. [10]

During various business transactions, specific amounts in certain accounts change, but the equality of assets and liabilities is not violated. For each account, a statement is kept that records the inflow and outflow of funds from this account. At the end of each month, on the basis of statements, order journals are compiled, which take into account the total inflow and outflow of funds for each account or group of accounts. Based on the journal orders, at the end of the reporting period, entries are made in the General Ledger and the balance sheet of the enterprise is compiled. [eleven]

LIQUIDITY OF THE BANK'S BALANCE SHEET - the ratio between the assets and liabilities of the bank's balance sheet for certain periods of time; when equality of assets and liabilities is achieved, the balance sheet is considered liquid. [12]

In this statement, the balance at the beginning of the month in debit must be equal to the balance at the beginning of the month in credit, which is due to the equality of the assets and liabilities of the balance sheet at the beginning of the month according to which the accounts were opened. [13]

Accountants are concerned with the fulfillment of Pacioli's postulates, because they control the correctness of the monetary valuation in which the balance sheet is prepared [3], hence its definition as the equality of assets and liabilities. [14]

As follows from the data in the table, the total balances at the beginning and end of transactions on the debit and credit of accounts are equal to each other, which follows from the equality of the assets and liabilities of the balance sheet. The totals of turnover in the debit and credit accounts are also equal, which follows from the double entry method. [15]

Why is Asset not equal to Liability?

1 page