Accounting accounts for accounting of finished products

Information about manufactured products is stored in account 43 “Finished products”. This account is used by manufacturing enterprises that independently create products. In this case, the cost or complexity of the product does not play a role.

Finished products for one company may be raw materials for another. For example, for a flour mill, flour is a finished product. But for a gingerbread factory it is raw material.

Important! Trade enterprises do not use account 43. To account for goods for resale, they use account 41 “Goods”.

HIGHLIGHTS OF THE WEEK

05/21/20214:15 Accounting and reporting

New SZV-M from May 2021: differences from the previous form

24.05.202113:39

Business organization

The rules for issuing passports are changing - from July 1

24.05.202115:11

Personnel

We calculate salaries and advances for May 2021, taking into account non-working days

24.05.202113:33

Business organization

Will compensation be paid for damage during forced evacuation of a car?

26.05.202111:04

Personnel

New rules for calculating sick leave will be introduced - from 2022

PODCAST 4.12.2020

What has changed in taxes and reporting since 2021?

All episodes

Comments on documents for an accountant

How are dividends taxed after a company is reorganized in the form of a merger?

05/28/2021 A zero income tax rate is applied if the organization receiving dividends...

Is bankruptcy grounds for depriving an employee of bonuses?

05/28/2021 If the bonus is part of the remuneration system and is of a production nature, it cannot be deprived...

Recommendations for identifying unjustified tax benefits have been published

05/25/2021 Article 54.1 of the Tax Code of the Russian Federation contains provisions aimed at combating the receipt of unjustified tax...

‹Previous›Next All comments

Accounting for finished products

The manufactured products at any enterprise go through several stages: production, movement and sales. Production takes place in the workshop, then the GP moves from the workshop to the warehouse, and then goes to the buyer.

The production stage is the most important, since at this stage the cost of production is formed. It can be actual - calculated based on actual costs incurred, or normative - calculated based on write-off rates.

Accounting for finished products at actual cost

In this case, the cost of the GP is determined by the actual production costs incurred. When releasing, the accountant makes the following entry:

Dt 43 Kt 20 / 23 / 29—reflects the release of finished products

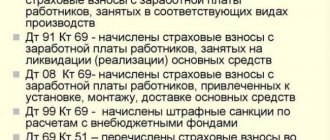

On account 20 “Main production”, all actually incurred costs are collected in the form of:

- spent raw materials - count 10;

- wages of production personnel - account 70;

- insurance premiums from wages of production personnel - account 69;

- depreciation of equipment used in production - account 02;

- services of third parties - count 60.

In addition, auxiliary production costs and defects may be written off on finished products.

In accordance with clause 23 of FSBU 5/2019, the real cost of production includes:

- material costs;

- labor costs;

- insurance contributions from salary;

- depreciation;

- other costs.

At the same time, in accordance with clause 26 of FSBU 5/2019, it is prohibited to include in the actual cost:

- costs resulting from natural disasters, fires, accidents, etc.;

- impairment of assets, even if they were used in production;

- administrative expenses not related to production;

- storage costs if storage is not part of the production cycle;

- advertising and promotion costs;

- and other costs that do not affect production.

Accounting for finished products at planned (standard) cost

Planned cost is the estimated cost of finished products for the planned period. To calculate it, write-off rates for raw materials, supplies, fuel, labor costs, and so on are used. The method is allowed to be used in mass or serial production (clause 27 of FSBU 5/2019).

The cost price according to the standard is recorded on account 40 “Output of products (works, services)”. In this case, when releasing products, the accounting department makes the following entries:

Dt 43 Kt 40 - manufactured products are accounted for at standard cost

And then they build wiring to account for the actual cost:

Dt 40 Kt 20 - manufactured products are accounted for at actual cost

The main difficulty of such accounting is that the actual and planned costs usually do not coincide. Therefore, the balance on account 40 is:

- debit - if the actual cost is higher than the planned cost;

- credit - if the actual cost is lower than planned.

At the end of the month, the balance of account 40 is written off using one of the entries, depending on what balance is formed:

Dt 90.2 Kt 40 - “overspend” is written off as expenses (debit balance)

Dt 90.2 Kt 40 - “savings” are reversed (credit balance)

Important! Account 40 has no balances at the end of the month.

To account for cost according to the standard, it is not necessary to use account 40. It is enough to open a sub-account “Finished products at accounting prices” to account 43. Product output is reflected in the following entries:

Dt 43.GP at accounting prices Kt 20 / 23 - products are accounted for at accounting cost

At the end of the month, the difference between the two types of cost is determined, which is reflected in the subaccount “Deviation of actual cost from accounting cost.” And then they build one of the wiring:

Dt 43. Deviation of actual cost from accounting Kt 20 / 23 - if the actual cost is higher (overspend)

Dt 43. Deviation of the actual cost from the accounting cost Kt 20 / 23 - reversal for the amount of excess of the planned cost over the actual (savings)

Postings

Postings to account 43 mean its correspondence with other accounts. Up to debit 43, the account corresponds with:

- Main production (20);

- Auxiliary production (23);

- Service industries (29);

- Product output (40);

- On-farm settlements (79);

- Authorized capital (80);

- Other income and expenses (91).

For loan 43, the account corresponds with:

- Materials (10);

- Main production (20);

- Auxiliary production (23);

- General production expenses (25);

- General expenses (26)

- Defects in production (28);

- Selling expenses (44);

- Shipped goods (45);

- Settlements with debtors and creditors (76);

- On-farm settlements (79);

- Authorized capital (80);

- Sales (90);

- Shortage and loss from damage to valuables (94);

- Expenses for future periods (97);

- Profit and loss (99);

Diagram showing the formation of the actual cost of GP

Accounting for sales of finished products

After the production is released, a balance is formed on account 43. This is the amount of finished products that the company has at its disposal and which can be sold. During implementation, the accounting department makes the following entries:

Dt 62 Kt 90.1 - income received from the sale of products

After this, the accountant writes off the cost of goods sold:

Dt 90.2 Kt 43 - cost of products sold is included in expenses

The cost of identical products may differ from each other. In order to determine at what cost to write off finished products upon sale, use one of three methods.

Write-off of finished products at the cost of each unit

This method is used for products that cannot replace each other. Therefore, upon sale, the cost of a specific unit is written off.

Write-off of product costs at average cost

To calculate the average cost per unit of production, the total cost of the GP is divided by the quantity. The average cost can be recalculated at regular intervals or as each new batch of products is released.

For example, within 3 days 300 loaves of bread were produced with different costs:

- on 1 day - 100 rolls, cost of 1 roll - 7 rubles;

- on day 2 - 100 rolls, cost of 1 roll - 6.8 rubles;

- on day 3 - 100 rolls, cost of 1 roll - 7.1 rubles.

The total cost of production is 2,090 rubles. Let's say we sold 230 buns.

We calculate the average unit cost using the formula:

(100 * 7 + 100 * 6.8 + 100 * 7.1) / (100 + 100+ 100) = 2,090 / 300 = 6.97 rub.

We calculate the cost of 230 rolls using the formula:

230 * 6.97 = 1,603.1 rub. — written-off cost.

Write-off of cost using the FIFO method

FIFO - first in, first out (First In, First Out). First of all, the cost of finished products that were previously produced is written off.

For example, within 3 days 300 loaves of bread were produced with different costs:

- on 1 day - 100 rolls, cost of 1 roll - 7 rubles;

- on day 2 - 100 rolls, cost of 1 roll - 6.8 rubles;

- on day 3 - 100 rolls, cost of 1 roll - 7.1 rubles.

The total cost of production is 2,090 rubles. 230 buns were sold. The cost price for write-off is calculated using the formula:

100 * 7 + 100 * 6.8 + 30 * 7.1 = 700 + 680 + 213 = 1,593 rub. — written-off cost.

Assessment and accounting of the movement of goods in trade organizations

D 90 - K 41 - the selling cost of goods excluding VAT is written off for sale;

D 90 - K 44 - expenses of a trading enterprise are written off (distribution costs);

D 50 - K 90 - revenue received at the cash desk in the amount of the sale price of goods;

D 90-K 68-2 - VAT is charged on the sales price (excluding VAT);

D 90 - K 42 - the amount of the trade margin was reversed;

D 90-K 99 - financial result (profit);

D 99-K 90 - financial result (loss).

The scheme for selling goods in retail trade (on account 90) is presented below.

To prepare a profit and loss statement, the following subaccounts are opened in account 90 “Sales”: 90-1 “Revenue”; 90-2 “Cost of sales”; 90-3 “Value added tax”; 90-4 “Excise taxes”, etc., 90-9 “Profit/loss from sales.

Tax accounting for the sale of goods in trade organizations is carried out using two profiling accounts:

• 41 “Goods” - to reflect the cost of purchased goods;

• 44 “Sales expenses” - to reflect distribution costs associated with the acquisition and sale of purchased goods.

The cost of goods in account 41 “Goods” is fixed either at the purchase price (in wholesale and retail trade) or at the selling price (in retail trade).

Receipt and release of goods can be reflected using one of the following methods, in accordance with the adopted accounting policy (see Article 268 of the Tax Code of the Russian Federation):

• at the cost of the first batches purchased (FIFO);

• at the cost of the most recently purchased lots (LIFO);

• at average cost;

• by cost of units of goods.

In accordance with Art. 320 of the Tax Code of the Russian Federation (as amended by Federal Law No. 58-FZ of June 6, 2005), distribution costs of trading firms are divided into direct and indirect costs. Direct costs include the current costs of delivering goods by a transport company to the warehouse of a trading organization, if they are not included in the price of the goods under the terms of the contract. Delivery costs (DC) include the following elements:

• payment for transportation of goods;

• cost of materials spent on equipment and (or) insulation of vehicles;

• cost of loading and unloading services;

• fees for temporary storage at loading and unloading sites;

• cost of forwarder services;

• payment to railway transport organizations for supplying wagons, securing cargo in wagons and maintaining access railway tracks to the warehouse of a trading company.

All other expenses of trading companies fall into the category of indirect costs. To maintain tax accounting, it is advisable to allocate two subaccounts on account 44 “Sales expenses”: 44-P “Direct expenses” and 44-K “Indirect expenses”.

When selling goods, in accordance with Art. 320 of the Tax Code of the Russian Federation, the cost of goods, part of direct expenses (i.e.

Accounting for shipped GP

Typically, title to the finished product passes to the buyer at the time of shipment. But the terms of the contract may establish a different procedure. In this case, finished products shipped to the buyer, but for which he does not have ownership rights, are recorded on account 45 “Goods shipped”. When shipping, accounting records the following:

Dt 45 Kt 43 - products shipped to the buyer

After the transfer of ownership, the cost of shipped products is written off:

Dt 90.2 Kt 45 - the cost of shipped products is expensed

When the entry is applied: Debit 43 Credit 43

Let's consider several situations.

Example 1

LLC "Choco Land" is engaged in the production of chocolate. When finished chocolate arrives from production to the warehouse, an entry is made in accounting: Debit 43 Credit 20 - means capitalization of finished products in the warehouse

The posting is registered on the basis of the invoice for the transfer of finished products to storage locations.

More information about how the invoice should be drawn up correctly is described in the article “Unified form No. MX-18 - form and sample.”

Example 2

Let’s say that during the crisis, plain chocolate began to be bought less frequently. Then Shoko Land LLC decided to produce chocolate with game inserts. To do this, we had to open additional production for the production of gaming inserts.

In this case, after receiving the main and additional products, the following postings are made:

- Dt 43 (subconto “Chocolate”) Kt 20 - ready-made chocolate arrived from the main production;

- Dt 43 (subconto “Inserts”) Kt 20 - manufactured gaming inserts were received from additional production to the warehouse.

Due to the fact that chocolate and inserts for it are planned to be sold as one product, a summary entry is made: Dt 43 (sub-account “Chocolate”) Kt 43 (sub-account “Inserts”), i.e. the cost of manufactured inserts is reflected in the main products - chocolate.

Finished products in the balance sheet

In the balance sheet, the balance of the state enterprise at the end of the period is recorded on line 1210 “Inventories” at actual or planned cost.

The organization independently determines the level of detail of this line. For example, you can separately highlight the cost of raw materials, finished goods and work in progress if the company recognizes such information as significant.

For accounting of finished products and inventories in general, we recommend the web service Kontur.Accounting. The program will suggest the correct transactions and help you register the GP in accounting. We give all newbies a free trial period of 14 days.

Wiring Dt 90 and Kt 90, 68, 43, 99, 20 (nuances)

costs for their delivery, if they are not included in the cost of goods), excluding direct costs for the balance of unsold goods, and the entire amount of indirect costs of the current period. If we are talking about wholesale trade, then the accounting can reflect both goods remaining in the warehouse and those shipped externally, but not sold in the current period. Such goods are written off for sale in subsequent periods, but for them there is no process for allocating a share of direct expenses, in contrast to accounting for the sale of finished products of industrial enterprises. This greatly simplifies accounting.

Accounting at wholesale trade enterprises can generally be reflected by a combination of the following entries.

Accounting for sales of goods in wholesale trade

| № P/P | Account correspondence | Contents of a business transaction | |

| Debit | Credit | ||

| 1 | 60 | 51 | Payment has been made to the supplier of goods |

| 2 | 41 | 60 | Goods are taken into account at the purchase price excluding VAT |

| 3 | 19 | 60 | VAT on purchased goods is reflected |

| 4 | 68 | 19 | The amount of VAT on paid goods has been accepted for deduction |

| 5 | 76 | 51 | Paid to transport companies for delivery of goods |

| 6 | 44-P | 76 | Delivery costs (RD) of goods excluding VAT are taken into account |

| 7 | 19 | 76 | VAT is reflected on the costs of delivery of goods |

| 8 | 68 | 19 | The amount of VAT on paid delivery of goods has been submitted for deduction |

| 9 | 44-K | 10,76 | Material costs taken into account |

| 10 | 44-K | 70 | Staff wages accrued |

| 11 | 44-K | 69 | The amount of unified social tax from personnel remuneration is taken into account |

| 12 | 44-K | 02 | Accrued depreciation of fixed assets |

| 13 | 44-K | 05,68, 69,76 | Other expenses are taken into account, including taxes, insurance costs, advertising costs, depreciation of intangible assets |

| 14 | 45 | 41 | Goods were shipped to the buyer without transfer of ownership |

| 15 | 90 | 45 | Sold goods written off at purchase prices |

| 16 | 90 | 45 | A part of goods previously (in previous periods) shipped to customers was written off after the transfer of ownership to them |

| 17 | 90 | 44-P | Direct expenses written off to sales minus the share attributable to the balance of unsold goods |

| 18 | 90 | 44-K | All indirect costs are written off for sales |

| 19 | 62 | 90 | Invoices presented to customers |

| 20 | 90 | 68 | VAT accrued on sales of goods |

| 21 | 90 | 99 | Financial result (profit) determined |

Go to page: 12

34