The essence of the test

Settlement of counterclaims should not be confused with barter.

Barter is a transaction based on the relationship of exchange. For example, you supplied the company with a batch of finished products, and they supplied you with components at the same cost. You can also exchange goods of unequal value, but with an additional payment. The exchange agreement is concluded in writing. In barter, a firm is simultaneously a seller of one product and a buyer of another.

Settlement is not a separate transaction. This is just a way of ending the obligations of two entities to each other.

Settlement is possible if there are obligations among persons who, in relation to each other, are both debtors and creditors. This is where the demands meet.

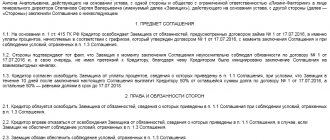

Offset makes it possible not to fulfill obligations to pay for the original contracts that gave rise to counterclaims. Settlement settlements are closed due to the fulfillment of the terms of the contract for the shipment of goods, performance of work, provision of services (Article 410 of the Civil Code of the Russian Federation).

For example, you transferred goods to a company under a supply agreement. And she, in turn, provided services under a fee-for-service agreement. You can agree to pay off your obligations to each other by offset, rather than paying with real money. For offset, a statement from one party is necessary and sufficient.

Reconciliation Act

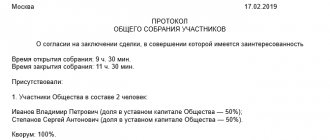

To reconcile mutual claims with the counterparty, it is necessary to draw up a reconciliation report of mutual settlements between organizations. Initially, it is necessary to draw up an act of approval of mutual settlements with a breakdown for each concluded contract (if there were several of them).

This will determine the exact amount of debt that can be paid off by offset. It is also necessary to draw up an act in the context of contracts concluded with the counterparty. This will determine the exact amount of debt that can be settled through offset. There is no need to put a stamp on the act. This is done in accordance with business customs.

The significance of this document is quite great. It reflects the reconciliation of calculations and recording the absence of debt. It also enables counterparties to protect themselves from further claims.

The legal end of the signing of the act can also be considered the reflection of the debt of one of the parties to the agreement to the other with the recognition of the debt.

Such an act does not apply to primary ones, since it does not meet all accounting requirements. It only confirms the existence of debt according to the primary documents of the counterparties.

Registration of an act of mutual settlements begins with an application sent to one of the organizations by the other. The debt itself can be determined on the basis of the act of reconciliation.

It is necessary to take into account two important points when drawing up a form for a reconciliation report between organizations:

- You can only pay in cash;

- these debts should not be related to the return of alimony and compensation for damage.

Requirements for the test

What was new was that, for practical uniformity, the Plenum of the Supreme Court, in Resolution No. 6 of June 11, 2021, recommended the use of concepts such as active and passive requirements.

An active claim is a claim by the person claiming credit. This person is the initiator of the offset. A passive requirement is a requirement for the applicant to whom an active requirement is read.

The judges formulated the characteristics of these requirements.

To carry out an offset, it is necessary that the deadline for the fulfillment of the obligation of the initiator of the offset, that is, according to an active demand, has come. Set-off is also possible when the deadline for fulfilling obligations is not specified or is determined by the moment of demand.

And vice versa, the onset of the deadline for the fulfillment of a passive claim, that is, the party to whom the initiator of the offset proposes to carry out the offset, is not necessary.

Offset cannot be carried out if the active claim has expired the statute of limitations. However, the expiration of the limitation period for a passive claim does not prevent offset. In other words, if you made a claim for offset, and the creditor’s debt has expired, the creditor can offset his expired debt with a new claim.

Characteristics of Sberbank bills

Let's take a closer look at what a Sberbank bill of exchange is for mutual settlements between organizations. Any bill of exchange, regardless of the purpose of its creation and the person who issued it, is primarily a valuable document. It acts as a significant fulfillment of an obligation, for which the debtor pays a certain amount of money to the creditor after a certain period of time.

The bill of exchange is used for mutual settlements between individuals and between organizations, including between financial institutions. Sberbank also belongs to them. Such bills act as a universal payment method. The bank issues them for quick payments for the supply, sale of goods or provision of services. In addition, the account can be used as collateral when obtaining a loan product from the bank. But the Sberbank bill of exchange is most often used for settlements between organizations.

Sberbank's bill of exchange for mutual settlements between organizations contains security that confirms the bank's obligation to the holder to pay a certain amount for a certain period. The bill of exchange is required for settlements; its registration can be carried out at any branch of Sberbank.

A bill of exchange is an A4 format document. It includes the amount that the client deposited. In addition, the city and date of issue are indicated.

A bank promissory note is a security that contains a written promissory note of a banking organization to the holder of the bill.

This tool provides the following benefits:

- convenient and fast payment for services, works and goods;

- profitable investments for profit;

- use as a guarantor when receiving credit funds or guarantees from a bank.

Promissory note programs provided by banks are similar to depository programs: the client invests funds, and in return receives something from the banking institution, similar to a promissory note. Thus, the bank confirms that the funds are accepted and undertakes to return them on the appointed day.

An interest-bearing bill means an indication of the interest that is charged on its amount. Nominal interest amounts can be expressed both in rubles and in other currencies. To obtain such a promissory note, you must deposit money, which is a nominal security promissory note.

This type of Sberbank bills is the most popular means because it is very similar to a deposit.

An ordinary discount bill does not specify the conditions for accrual of funds at face value, which can be used in rubles or foreign currency. To receive it, you need to deposit an amount equal to the value of the contract for the future sale of the security. The recipient's income is calculated as the difference between the sale price and the face value.

The bank account is paid by Sberbank units that are authorized to carry out such transactions. These may be branches of a banking organization.

Sberbank also provides other services for bills of exchange:

- Exchange of bills. Thus, the account holder can exchange one bill for several others that have a lower face value, or receive several bills for one higher face value

- Storage. Sberbank provides the opportunity for each recipient to store certificates of deposit and bank bills. The client determines the retention period.

- Delivery and issue of securities. To eliminate the risks associated with the self-movement of securities, you can entrust the bank with the issuance and delivery of purchased certificates of deposit and bills of exchange at your place of residence. This benefit can only be used by legal entities.

Moment of termination of the obligation

The Plenum clarified the moment when obligations are considered terminated by offset. And this is not the moment the relevant party receives an application for set-off, as is commonly believed. This is the point at which the obligations become offset.

This is where the effect of Article 410 of the Civil Code of the Russian Federation is manifested, when settlements are closed by offset due to the fulfillment of the terms of the contract for the shipment of goods, performance of work, and provision of services.

For example, if the deadline for fulfilling the requirements came before the statement of offset, then the obligations are still considered terminated by offset from the moment the deadline for fulfilling the obligation arrived.

Uniformity of requirements

How are we used to assessing the homogeneity of obligations? In the general case - according to the “money for money” formula, that is, when both agreements need to be settled in money. If initially one agreement states about cash payments, and the other - about bill payments, such requirements are no longer homogeneous. Settlement will not be possible.

The Plenum formulated the principle of homogeneity differently: for testing, it is enough that the requirements are homogeneous at the time of testing.

This means that the parties’ counterclaims may initially be heterogeneous. For example, one obligation is to repay the loan amount, and another is to transfer the thing. But by the time of offset they can become homogeneous: the requirement to repay the loan amount remains, and for violation of the obligation to transfer the thing, a monetary claim for damages has arisen. In such a situation, offset is possible.

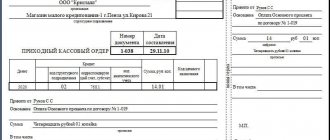

Mutual settlements for cash payments

Most often, non-cash payments are used between legal entities, since when paying for goods or services there is almost always a movement of large sums of money. Mutual settlements between organizations for cash have a number of features.

To pay in cash, you need to spend extra money on organizing payment security.

Another disadvantage of cash is that it is much more difficult to keep track of accounting accuracy.

In our legislation there is a restriction on cash payments in mutual settlements.

One of the rules for regulating money circulation between legal entities is Directive of the Central Bank of the Russian Federation 1843-U dated 06/20/07.

Based on paragraph 1 of the Instructions, the maximum allowable amount of cash payments between firms is 100,000 rubles under one contract.

This requirement does not apply to the following types of calculations:

- after payment of wages;

- when issuing accountable amounts.

A limit on the limit occurs when cash payments are made between:

- organizations;

- organization and individual entrepreneur;

- several individual entrepreneurs.

This limitation applies to payments under a single agreement.

For example, if two individual entrepreneurs have signed a contract for an amount of more than one hundred thousand rubles, it is impossible to pay cash in full; you will have to pay in two parts:

- one hundred thousand to pay in cash;

- pay the balance by bank transfer.