Definition

Liabilities _

) are one of the three sections of the balance sheet besides assets and equity. This section reflects the company's debt obligations to its creditors that arose as a result of previous operations. By their economic essence, they, like equity capital, are a source of financing the company’s assets. In the event of default on debt obligations, creditors have the right to claim the company's assets to the extent of the outstanding debt to them.

Liabilities also include advances received that were paid for future goods, work or services. Since this amount has not yet been earned, it may be recorded as deferred income or customer deposits.

Composition of obligations

The obligations can be divided as follows:

- Related to current operations. This includes tax payments, advances and wages to employees, rent payments, payments for materials and goods supplied under the contract.

- Liabilities that are subject to liquidation within a year after the financial statements are prepared. These may be long-term obligations that must be repaid in the near future.

- Liabilities that must be settled within one year of the balance sheet. This includes payment of compensation for unused vacation, bonuses, etc.

The most common types include the following:

- Accounts payable is the amount that the debtor is obliged to pay as payment for goods delivered or services received that are necessary for the functioning of the enterprise. Its size is stipulated by the terms of the contract.

- Short-term bills are invoices for goods and services supplied that were not purchased for the main activities of the organization.

- The share of long-term debt that must be repaid in the next reporting period.

- Accrued payments. They include loan payments to the bank and employee salaries.

- Cash payments that an organization makes at the request of a creditor.

- An advance payment towards a future transaction. This also includes deposits.

- An advance payment received for a future supply of goods or for the provision of a service.

- Tax deductions to federal and local budgets.

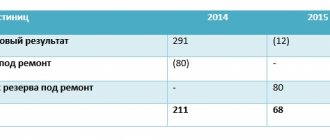

- Debt for employee vacations (so-called estimated liabilities). Its occurrence is a consequence of the reluctance of employees to go on vacation during the reporting period.

- Dividends that must be calculated for all owners of shares and bonds of the enterprise.

Current liabilities include debts that must be repaid in the near future

Structure of liabilities in the balance sheet

Liabilities have the same classification structure as assets: current liabilities and non-current liabilities. They are reflected in the balance sheet in order of increasing due date for their payment.

Current responsibility

Current liabilities are those that must be paid within 12 months or the operating cycle if its duration is more than one year. Their occurrence is usually associated with the use of current assets (English Current Assets), the creation of another current liability or the provision of any services.

Typically this section of the balance sheet includes the following items.

- Debt to banks

. Represents the amount of short-term debt owed to banks, for example, under a bank line of credit. - Accounts payable

. This is the amount of debt owed to suppliers of products and services that were provided on credit, but the payment period for which has not yet arrived. - Salaries, rent, taxes and utilities payable

. This reflects the amounts that the company must pay to its employees, landlords, government, etc. - Accrued liabilities (accrued expenses)

. These liabilities arise because expenses are incurred in a period prior to the period in which they are paid. This item covers a wide variety of expenses, for example, advances received from clients, dividends payable, arrears of accrued wages, etc. - Bills payable (short-term loans)

. These are the amounts that the company is obliged to pay to the creditor, which usually also includes the payment of interest. - Deferred income (customer prepayments)

. These are payments received from customers for goods and services that the company has not yet provided or has not yet begun to incur any costs associated with providing them. - Dividends payable

. It arises in a situation where a company has already announced dividends, but has not yet paid them to its owners. - The current portion of long-term debt

. This item reflects the portion of long-term debt that falls due in the next 12 months. In theory, any associated premiums or discounts should also be classified as current liabilities. - Current portion of finance lease obligations

. This is part of the long-term finance lease payments that are due over the next year.

long term duties

Long-term liabilities are those that must be repaid later than 12 months or after the operating cycle, if it is longer than one year. They should be reflected as the present value of future payments.

The most common examples of long-term liabilities are.

- Bills payable (long-term loans).

This is the amount that the company is required to pay the lender, which usually includes interest. - Long-term debt (bonds payable).

This is long-term debt minus the current portion. - Deferred tax liabilities.

They arise as a result of discrepancies between accounting and tax accounting standards in the case when the amount of tax payable in accounting exceeds the amount of tax payable in tax accounting. In other words, it is the amount of tax that the company will have to pay in the future. - Employee pension plan.

This is the company's obligation to pay pension benefits to its retired and active employees. Payments from this fund begin upon the employee's retirement. This item reflects the additional amount the company must contribute to its current pension fund to meet its future pension obligations. - Long-term finance lease obligations.

Financial balance sheet liability

In accordance with international standards of financial accounting and reporting, liabilities are understood as the sources of funds of an enterprise. The liabilities side of the balance sheet reflects decisions on the selection of sources of financing for the enterprise's investment decisions, the result of which are acquired assets. The main sections of the balance sheet liabilities are:

1) own capital;

2) long-term accounts payable (long-term liabilities, long-term borrowed capital);

3) short-term accounts payable (short-term liabilities, short-term borrowed capital).

The items “Long-term liabilities” and “Short-term liabilities” in the balance sheet of a Western enterprise can be combined under the name “external liabilities”. In accordance with international financial accounting and reporting standards, external liabilities are understood as future losses in economic benefits that may arise as a result of an enterprise's existing obligations to transfer funds or provide services to other enterprises as a result of concluded transactions or events.

Section "Equity". As mentioned above, the basic course of financial management examines the management of funds of a joint-stock enterprise. At the stage of creating a joint-stock enterprise, equity capital is equal to share capital. The equity capital of an operating enterprise includes:

1) invested capital, including:

— share capital;

- Extra capital;

— funds and reserves;

2) retained earnings.

Article "Share Capital". Typically, the balance sheet shows the authorized share capital and the number of shares actually issued at the balance sheet date (shares issued are treasury shares in the portfolio). Shares are reflected in the balance sheet according to their type in the items: “common shares” and “preferred shares”. Common shares give their owners the right to vote at shareholders' meetings. Unfixed dividends are accrued on common shares, the amount and payment of which depend on the financial results of the enterprise. Preferred shares do not give their owners voting rights at shareholders' meetings. Preferred shares accrue fixed dividends, the payment of which, in general, does not depend on the financial performance of the enterprise. Preferred shares may be cumulative or non-cumulative. Cumulation means the property of maintaining dividends. If in some year, due to the difficult financial situation of the enterprise, dividends on common and even preferred shares were not paid, the owners of cumulative shares will be able to receive them in subsequent periods. For non-cumulative shares, dividends not paid in the current period are not retained in subsequent periods.

Owners of preferred shares have a preferential right to receive dividends and return of invested capital in the event of liquidation of the enterprise. Shares have a par value, at which they are recorded on the balance sheet, and an exchange (market) value.

The item “Additional capital” is formed due to:

1) share premium from the sale of part of the shares at a price higher than the nominal price;

2) increase in the value of non-current assets (revaluation reserve);

3) positive exchange rate difference on foreign currency deposits in the authorized capital.

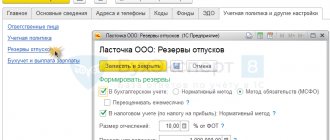

The item “Reserve capital” includes various funds and reserves that are created in case of unforeseen expenses and are considered as a reasonable precaution. Depending on the sources of formation and terms of use, funds and reserves can be reflected both in the “Equity” section and in the “Debt capital” section.

The following groups of reserves are distinguished:

1) upon establishment:

— reserves prescribed by law;

— voluntary reserves (formed in accordance with the constituent documents);

2) by character.

a) reserves that have the nature of additional capital;

b) reserves intended to cover current or future losses or expenses, including:

— reserve for doubtful debts;

— compensation funds (depreciation funds, etc.).

In the classification by nature, the first group of reserves represents reserve capital, the source of which is net profit. The second group of reserves represents estimated reserves. The source of their formation is gross profit. Valuation reserves are created in order to protect the enterprise from unstable market conditions and inflationary losses and are reflected in the statements in the form of discounts subject to deduction from the corresponding balance sheet asset items.

The item “Retained earnings” includes both retained earnings (uncovered loss) of previous years and retained earnings (uncovered loss) of the reporting period.

The article “Retained earnings” records the accumulated profit indicator calculated in the statement of accumulated profit.

As part of the accumulated profit, a profit reserve may be allocated, which is formed by annual deductions from net profit until the value of the reserve reaches a certain value (25% of the value of share capital). This reserve is not affected by the distribution of dividends, but can be used to maintain them at the proper level in unprofitable years or converted into share capital by resolution of the board of directors. The “Long-term liabilities” section includes liabilities that must be repaid within a period exceeding a year, including:

1) long-term accounts payable;

2) long-term bonds;

3) lease payments;

4) arrears of pension payments.

The item “Long-term accounts payable” includes liabilities for long-term loans received by the enterprise. Part of the long-term accounts payable, the payment of which comes due in the current period, is transferred to the “Short-term liabilities” section.

The item “Bonds” includes bonds issued in order to attract additional funds to finance the activities of the enterprise. Bonds are debt securities and represent a borrowing relationship. When purchasing a bond, an agreement is drawn up between the bondholder (creditor) and the issuing company (borrower), according to which the issuing company undertakes to repay the principal amount of the debt and pay accrued interest within a specified period (repayment period). Bonds may be sold at par, at a premium (above par), or at a discount (below par). Both the premium and discount, as well as the costs associated with issuing the bonds (classified as deferred expenses), are gradually written off (amortized) over the life of the loan.

The issuing enterprise, on the basis of an agreement with the bondholder, forms a bond redemption fund through periodic deductions from profits. The funds of the fund for the period until the bonds are redeemed can be invested in income-generating securities. Control over the receipt and expenditure of funds from the fund is exercised by the bondholders or the appointed principal of the loan. The presence of a bond sinking fund gives investors greater confidence in the securities of the issuing company.

The article “Rental payments” is recorded in the section of long-term liabilities if the company leases funds on a long-term (capital) lease. Lease means the fixed-term and paid possession and use of property, based on an agreement between the owner of the property - the lessor and the lessee.

A lease is recognized as long-term if at least one of the following conditions is met:

1) the lease term covers 75% or more of the useful life of the property;

2) upon expiration of the lease term, the leased assets become the property of the lessee;

3) the tenant has the opportunity, upon expiration of the lease term, to renew it at a minimum price (much lower than the market average);

4) the discounted value of the minimum lease payments is equal to or exceeds 90% of the current value of the property.

Funds rented under long-term lease terms are recorded in the Western balance sheet as their own, which demonstrates one of the principles of including data in reporting - the predominance of economic content over the legal norm. The liability side of the balance sheet records the entire amount of lease payments that the company must pay during the lease term.

Reserves and funds. As part of the section “Long-term liabilities”, funds and reserves that have the nature of debts can be created through deductions from pre-tax profits. These include: enterprise pension funds; long-term employee deposits; reserve for paying bonuses to staff, etc. Debt in pension payments arises if the enterprise has a pension fund. The source of formation of the enterprise pension fund are periodic contributions by the employer and employees. The fund's funds are used to pay pensions, disability benefits, or in the event of the death of an employee. The presence of a pension fund at first glance indicates a stable financial position of the enterprise. However, to complete the picture, it is necessary to find out how much pension obligations are funded.

The section “Current liabilities” includes liabilities that are covered by current assets or are repaid as a result of the formation of new short-term liabilities. The maturity of short-term liabilities does not exceed a year. Current liabilities are recorded on the balance sheet or at a current price that reflects future cash outflows; or at the price on the date of debt repayment. However, these estimates do not differ significantly from each other due to the short repayment period.

The “Current Liabilities” section includes the following items:

1) bills payable;

2) bills payable;

3) short-term debt certificates (certificates of receipt by the enterprise of short-term loans);

4) tax debt;

5) deferred taxes (tax credit);

6) arrears of wages;

7) advances received;

part of long-term liabilities to be repaid in the current period;

part of long-term liabilities to be repaid in the current period;

9) unforeseen obligations.

The item “Accounts payable” includes obligations arising from the purchase of goods or services on the terms of a commercial loan, i.e. with deferred payment, usually for a period of 30 to 60 days. In this case, a commercial loan is issued by an entry in an open account.

The item “Bills payable” includes bills payable for trade transactions, which are a written obligation of an enterprise to pay within a certain period of time for goods or services purchased on the terms of a commercial loan.

The article “Short-term debt certificates” includes short-term debt certificates resulting from the provision of cash loans to an enterprise by banks or other credit institutions. The repayment amount of a short-term loan includes the nominal amount and accrued interest.

Short-term debt certificates include part of long-term obligations, the payment period of which occurs in the current period in the following cases:

1) if the enterprise expects to pay off the corresponding debt at the expense of funds reflected in current assets;

2) if this debt should not be renewed;

3) if this debt is not repaid by issuing new shares;

4) if the enterprise has violated the terms of the agreement on the provision of borrowed funds, which gives the lender the right to claim his money ahead of schedule.

The item “Tax debt” reflects the enterprise’s debt to the budget.

The item “Deferred taxes” includes accrued but unpaid taxes. Deferred taxes are a kind of loan that the state provides to an enterprise.

The item “Wages arrears” includes wages accrued but not paid to employees.

The item “Advances received” includes various advances received by the enterprise. An advance is understood as an amount of money issued against future payments for goods, work, or services provided.

The item “Part of long-term liabilities” includes a part of long-term liabilities that are due for payment in the current period.

The item “Accumulated liabilities” includes liabilities accrued in the reporting year, but not yet paid at the balance sheet date.

The item "Unforeseen liabilities" includes obligations of the enterprise that may arise in the future as a result of transactions in the past. The reasons for possible losses should be disclosed in the notes to the financial statements. The inclusion of the item “Unforeseen liabilities” in the balance sheet is an expression of the principle of caution (prudence, conservatism), according to which, as mentioned above, the enterprise should take into account potential losses to a greater extent than potential profits.

Contingent liabilities

Contingent Liabilities

) are potentially possible obligations, the transformation of which into real ones depends on the development of certain events in the future. The most common examples of such liabilities are warranties and amounts of legal claims against the company.

It is necessary to reflect contingent liabilities on the balance sheet when there is a significant probability of their transformation into real liabilities and their amount can be accurately estimated. If the probability is remote, they should not be reflected in either the balance sheet or the notes to the financial statements. Interim positions should be disclosed in the notes to the financial statements.

- ← Balance sheet asset structure

- Balance sheet equity structure →