Income tax under a leasing agreement

We save within the law: the pitfalls of leasing.

Article navigation

- Property on the lessor's balance sheet

- Property on the balance sheet of the lessee

- Leasing advance and income tax

To successfully conduct economic activities, most enterprises need high-quality production equipment. The acquisition of fixed assets (machines, cars, real estate) requires considerable expenses. Leasing is one of the available ways to obtain the necessary property in installments.

The obvious advantages of the acquisition include savings on income taxes. Payments for the use of property are included in eligible expenses. The calculation of income tax under a leasing agreement depends on who owns the object.

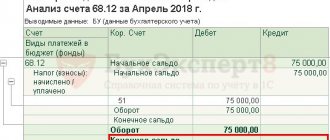

Accounting for VAT on advance payments in accounting entries

Entries for an advance payment under a leasing agreement, which the accountant must use to reflect transactions related to accounting, restoration and refund of VAT:

| Contents of operation | Dt | CT |

| The advance payment from the leasing recipient (first transfer, then offset) is carried out simultaneously with the offset of this advance from the lessor. The prepayment is a component of the amount of leasing payments (according to the conditions specified in the contract). | 76, subaccount for advances issued | 51 |

| Reflection in the balance sheet of the amount of VAT on the transaction | 68, subaccount for VAT accounting | 76, subaccount where VAT on advances issued is taken into account |

| After receiving the leased object (according to the invoice, acceptance certificate, etc.), the previously allocated VAT is subject to restoration | 76, subaccount for accounting for VAT on advances issued | 68, subaccount for VAT accounting |

| An advance payment loses its prepayment status at the time of official purchase of the goods. Basis – transfer and acceptance act, invoice | 76, subaccount for accounting for rental obligations | 76, subaccount for accounting for advances issued |

| According to the invoice, invoice or acceptance certificate, the accountant charges VAT | 19 | 76, subaccount for accounting for rental obligations |

| The amount is to be deducted | 68 | 19 |

Upon receipt of an advance payment to the current account, the lessor is obliged to issue an invoice within 5 days (clause 3 of Article 168 of the Tax Code). Until that moment, the recipient organization has no basis for accepting the VAT amount for reimbursement as part of the advance payment (clause 12 of Article 171 and clause 1 of Article 172 of the Tax Code).

The amount of the advance issued is reflected in the balance sheet minus VAT. After receiving the invoice, the accountant will be able to reflect it as follows:

| Contents of operation | Dt | CT |

| Fixed assets are reflected upon receipt on the balance sheet (using the acquisition subaccount under a leasing agreement) | 08 | 76 |

| Acceptance of fixed assets for accounting as property acquired on lease | 01 | 08 |

Property on the lessor's balance sheet

When concluding a leasing agreement, the parties must decide who will have the property on their balance sheet. Two options are allowed: the object is transferred to the lessee or remains registered with the lessor. In any case, existing leasing reduces income tax. But a number of nuances should be taken into account.

If the property remains on the lessor's balance sheet, the process of recognizing expenses when calculating income tax is almost the same as when concluding a lease agreement. Cost accounting is carried out depending on the accrual method adopted in the organization:

- Under the cash method, lease payments are accepted as expenses as they are actually paid.

- If the accrual method is used, payments are counted as expenses on a monthly basis, regardless of whether the funds were transferred to the recipient or not. Amounts must be in accordance with the current payment schedule.

Example. An organization using the accrual method of accounting purchased a car on lease for a period of 3 years. The monthly payment is 28,800 rubles, including 20% VAT - 4,800 rubles. The object remained on the balance sheet of the lessor. Every month, during the term of the agreement, the lessee makes the following entries in the balance sheet:

- Dt 20 (25, 26, 41) Kt 60 (76) – 28,550 rubles – the accrued lease payment is reflected in expenses.

- Dt 19 – Kt 60 (76) – 4,800 rubles – accepted for VAT deduction.

The tax base is also reduced by penalties accrued by the lessor for late payment. In accounting, they are formed on the date of their recognition by the guilty person or after actual payment. Classified as other expenses:

- Dt 76 – Kt 91.2 – penalties under the leasing agreement are recognized by the lessee;

- Dt 91.2 – Kt 51 – payment of penalties.

Accounting Features

An advance is provided for in most leasing transactions. It can be credited in various ways:

- The full amount of the advance when paying the first payment for leasing;

- Evenly in monthly payments in the “body” of the principal debt;

- In the final payment on a leasing transaction.

In case of partial payment of the advance, the borrower cannot immediately attribute the advance payments to expenses, since the amount of the down payment will be considered an expense. The same conditions apply if the lessor accepts the advance payment not according to the agreed schedule.

Property on the balance sheet of the lessee

A reduction in income tax occurs due to leasing payments even if the property is on the balance sheet of the lessee. But some restrictions apply.

According to accounting requirements, property accepted on the balance sheet, including those received under a leasing agreement, should be depreciated. Depreciation amounts are accrued from the next month. The useful life is determined in accordance with the general procedure. Factors such as expected use and physical wear and tear are taken into account. If the terms of the contract do not provide for the repurchase of the fixed asset, the depreciation period may be set only for the period of the lease. That is, the useful life will be equal to the rental period.

How is the lessee's income tax calculated? Payments should be taken into account minus the amounts of accrued depreciation (clause 10, clause 1, article 264 of the Tax Code of the Russian Federation). Otherwise, illegal tax savings will occur, since depreciation deductions are already taken into account when determining the taxable base.

If the company uses the cash method in accounting, then the entire amount of lease payments is taken into account as expenses. And it doesn’t matter who has the property on their balance sheet. Any amount of the lease payment transferred is recognized as expenses. This factor is explained by the fact that in an organization, using the cash method, depreciation can only be charged on property owned. If this condition is not provided for in the leasing agreement, payments are considered as expenses in full.

The lessee's income tax can be reduced through the use of accelerated depreciation. But for this it is necessary that the useful life of the object exceeds 5 years. That is, the property received must belong to the 4th and higher depreciation groups. The permissible accelerated coefficient should not be higher than 3.

In some situations, leased property requires modernization and inseparable improvements. For the purpose of determining income tax, such costs incurred by the lessee depend on the terms of the agreement:

- If the costs incurred by the lessor are not compensated, then the lessee has the right to increase the cost of depreciation property. Accordingly, the costs will be higher.

- If the costs are compensated, then they cannot be taken into account in tax accounting.

Separable improvements applied to the received object are the property of the lessee and can be carried out by him without the consent of the other party.

How to take into account expenses for uneven leasing payments?

Under a leasing (financial lease) agreement, one party - the lessor - undertakes to acquire ownership from a certain seller of the property specified by the other party - the lessee, and then transfer it to the lessee for a fee for temporary possession and use for business purposes.

From a civil legal point of view, leasing is one of the forms of long-term rental relations in which the lessor (lessor), the lessee (lessee) and the seller (Article 665 of the Civil Code of the Russian Federation) participate, the relationships of which are built according to the following scheme. The lessor, on behalf of the lessee, acquires ownership of the property from the seller and provides it for temporary possession and use to the lessee for a set fee with the return or subsequent purchase of the leased property. The seller and the leased item can be chosen by the lessee or the lessor. At the same time, the Civil Code of the Russian Federation does not allow non-profit organizations to use leasing.

Currently, leasing operations are not subject to licensing.

Operations for the receipt or provision of movable property under a financial lease (leasing) agreement are subject to mandatory control if the amount for which it is carried out is equal to or exceeds 600,000 rubles. (Clause 1 of Article 6 of the Federal Law of August 7, 2001 No. 115-FZ “On Combating the Legalization (Laundering) of Proceeds from Crime and the Financing of Terrorism" (as amended on November 8, 2011). In the relevant In cases, leasing companies report information to the Federal Service for Financial Monitoring. Payments under the leasing agreement are not subject to control (information letter of the Bank of Russia dated February 29, 2008 No. 13, resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 14, 2007 No. 13570/06 on the case No. A40-79527/05-130-657).

The tax benefits of leasing are generally obvious: the ability to take into account larger amounts in expenses compared to depreciation and apply accelerated depreciation.

In accordance with Art. 28 of the Federal Law of October 29, 1998 No. 164-FZ “On financial lease (leasing)” (as amended on May 8, 2010), lease payments mean the total amount of payments under the leasing agreement for the entire term of the leasing agreement, including which includes reimbursement of the lessor's costs associated with the acquisition and transfer of the leased asset to the lessee, reimbursement of costs associated with the provision of other services provided for in the leasing agreement, as well as the lessor's income. The total amount of the leasing agreement may include the redemption price of the leased asset if the leasing agreement provides for the transfer of ownership of the leased asset to the lessee. The size, method of implementation and frequency of leasing payments are determined by the leasing agreement.

The lease payment schedule may be uniform or uneven. With a uniform schedule for transferring leasing payments throughout the entire term of the leasing agreement, the amount of each leasing payment is the same.

The uneven schedule is built using the method of decreasing lease payments, i.e. unevenly distributed over time. In this case, the main amount of payments is paid in the first months of using the leased asset, when each subsequent lease payment is less than the previous one.

When calculating income tax, accounting for leasing payments depends on whose balance sheet the leased asset is listed on - on the balance sheet of the lessor or on the balance sheet of the lessee (this follows from the provisions of clause 10, clause 1, article 264 of the Tax Code of the Russian Federation).

If the leased asset remains on the lessor’s balance sheet, then each lease payment (in its entirety) from the lessee is included in other costs associated with production and sales. If the property is transferred to the balance of the lessee, then each lease payment is taken into account minus the amounts of accrued depreciation; if leased property is received on the balance sheet and its initial cost exceeds 40,000 rubles, then depreciation should be charged on it (clause 10 of article 258 of the Tax Code of the Russian Federation), i.e. property received on the balance sheet is recognized as depreciable. By calculating depreciation on such property, the lessee already takes into account a certain part of the lease payment in its expenses. Therefore, when calculating income tax for other expenses, you should write off only the remaining part of the leasing fee (minus the amount of accrued depreciation) (clause 10, clause 1, article 264 of the Tax Code of the Russian Federation), otherwise the tax cost may unlawfully increase (clause 5 Article 252 of the Tax Code of the Russian Federation).

An exception is provided for organizations that use the cash method of tax accounting - they should not adjust the amount of leasing payments to accrued depreciation. The above is explained by the fact that under the cash method, depreciation is allowed only for paid property received into ownership (clause 2, clause 3, Article 273 of the Tax Code of the Russian Federation), since leased property can become the property of the lessee only if its redemption is provided for, It is not possible to depreciate the received object until this moment. Consequently, regardless of whose balance sheet the leased asset is taken into account, under the cash method the entire amount of lease payments is included in other expenses as they are paid (clause 10, clause 1, article 264 of the Tax Code of the Russian Federation).

Costs for leasing property of service industries and farms are taken into account separately (Article 275.1 of the Tax Code of the Russian Federation). The costs of leasing non-production objects are not taken into account when calculating income tax. This is due to the fact that all expenses that reduce the tax base must be economically justified (clause 1 of Article 252 of the Tax Code of the Russian Federation), i.e. related to the production activities of the organization.

Both lessors and lessees, when reflecting income or expenses in the form of uneven lease payments, are guided by signed schedules, based on which the amounts of payments are reflected, respectively, in income or expenses unevenly.

Accounting with the lessee

According to paragraphs. 3 paragraph 7 art. 272 of the Tax Code of the Russian Federation, when using the accrual method in tax accounting, the date of expenses in the form of leasing payments is recognized as the date of settlement in accordance with the terms of the concluded agreements. Thus, if a payment schedule is approved in the leasing agreement, then they must be included in expenses according to the terms of the concluded agreement (even if they are unevenly distributed throughout the entire term of the agreement).

As a rule, leasing payments begin to be paid from the calendar month following the date of receipt of the equipment under the acceptance certificate.

In the tax accounting of the lessee, lease payments for leased property in accordance with paragraphs. 10 p. 1 art. 264 of the Tax Code of the Russian Federation are included in other expenses. If the property received under a leasing agreement is on the balance sheet of the lessee, then lease payments minus the amount of depreciation on this property accrued in accordance with Art. 259–259.2 Tax Code of the Russian Federation. Thus, if the amount of depreciation on leased property exceeds the amount of the lease payment for the corresponding month, then the lease payments paid to the lessor are not taken into account as expenses for tax purposes. And vice versa, if the amount of the lease payment exceeds the amount of accrued depreciation, then the lessee has the right to additionally take this difference into account as part of other expenses of the reporting period.

Thus, if the monthly depreciation amount exceeds the lease payment amount, then only the amount of accrued depreciation is included in expenses.

Consequently, the amounts included by the lessee in the expenses of leasing payments are each time divided into two components:

the amount of accrued depreciation;

the difference between the lease payment and the amount of accrued depreciation.

If, when drawing up a schedule of leasing payments, the method of decreasing payments is used, then in the first months of the leasing transaction the lessee attributes the entire amount of lease payments, reduced by accrued depreciation, to expenses; in subsequent periods, the amount of leasing payments may be less than the amount of accrued depreciation. However, the lessee continues to depreciate the property until the end of the lease term. The amount of accrued depreciation should be included monthly in expenses.

The remaining part of the lease payment during this period will be a negative value. The lessee must adjust the amount of accrued depreciation by this amount. At the end of the leasing agreement, the amount of tax expenses must be adjusted, since taxable profit cannot be reduced by an amount exceeding the price of the agreement (clause 5 of Article 252 of the Tax Code of the Russian Federation).

A lessee who does not make this adjustment underestimates the tax base for income tax due to the fact that the total amount of costs that he will attribute to expenses for the entire period of validity of the leasing agreement will exceed the total amount of lease payments provided for by the agreement.

In this case, you should pay attention to the fact that it is the amount of accrued depreciation that is reduced, and not the amount of other expenses of the lessee.

These rules apply only to organizations that calculate income tax using the accrual method. Organizations that use the cash method do not have the right to include accrued depreciation as tax expenses. This is due to the fact that the cash method allows depreciation only of paid property received into ownership (clause 2, clause 3, Article 273 of the Tax Code of the Russian Federation), and since leased property can become the property of the lessee only upon expiration of the contract, and then only in the event that its redemption is envisaged, it is impossible to depreciate the received object until this moment. Thus, organizations operating on a cash basis must include all repaid lease payments as tax expenses without adjusting them for accrued depreciation (clause 10, clause 1, article 264 of the Tax Code of the Russian Federation).

EXAMPLE

Kommersant LLC operates on an accrual basis. On December 15, 2010, Kommersant LLC signed a refrigeration equipment leasing agreement with the leasing company. The contract period is one year. Calculations are carried out in accordance with an uneven schedule of leasing payments. The schedule provides for the following payment terms for these payments: in January - 400,000 rubles, in February - 380,000 rubles, in March - 360,000 rubles, in April - 340,000 rubles, in May - 320,000 rubles, in June – 300,000 rubles, in July – 250,000 rubles, in August – 200,000 rubles, in September – 155,000 rubles, in October – 115,000 rubles, in November and December 90,000 rubles each. based on the total amount of RUB 3,000,000. (excluding VAT).

According to the terms of the agreement, the leased asset is recorded on the balance sheet of Kommersant LLC (lessee). The initial cost of the leased asset in the tax accounting of the lessee is RUB 2,330,000.

Kommersant LLC has established in its accounting policy for tax purposes that depreciation for all fixed assets, including those accepted for leasing, is calculated using the straight-line method. Moreover, for leased property, an increasing factor of 3 is applied to the depreciation rate.

The useful life of refrigeration equipment received from the leasing company is 61 months.

The property was put into operation on December 20, 2010. Consequently, from January 2011, Kommersant LLC begins to charge depreciation on it. Amount of monthly accrued depreciation: RUB 2,330,000. : 61 months x 3 = 114,590 rub.

By the specified amount, Kommersant LLC must reduce the amount of the lease payment taken into account as part of other expenses associated with production and sales. For the period from January to October, the difference between the monthly lease payment and accrued depreciation will be positive (400,000 rubles - 114,590 rubles = 285,410 rubles; 380,000 rubles - 114,590 rubles = 265,410 rubles, etc. .). In November and December, the amount of accrued depreciation will exceed the amount of the lease payment provided for in the schedule (by 24,590 rubles). A negative difference will reduce the amount of accrued depreciation. In November and December, Kommersant LLC took into account depreciation of refrigeration equipment in the amount of 90,000 rubles. instead of 114,590 rub. If the lessee had not taken this negative difference into account, then the total amount of costs recognized by him under the agreement would not have been 3,000,000 rubles, but 3,049,180 rubles.

If the lessee uses the accrual method, then he can include the amounts of lease payments in expenses either on the date of settlements under the financial lease agreement (according to the lease payment schedule), or on the last day of the reporting or tax period (clause 3, clause 7, Article 272 Tax Code of the Russian Federation).

The choice of one or another option for accounting for leasing payments can depend on how the schedule for their payment is formed, which may provide for different prices for the same periods (for example, per month or quarter) established for the entire term of the leasing agreement, or a single price for the entire the period of validity of the leasing agreement and the date of payment. In the first case, the amounts of lease payments are taken into account on the corresponding date of payment according to the lease payment schedule, in the second case - evenly throughout the term of the agreement (on the last day of each reporting (tax) period).

If the lessee calculates income tax on an accrual basis, then the amounts of lease payments are included in expenses monthly (quarterly) in the amounts determined by the lease payment schedule. It does not matter what order of payment of lease payments is provided for in the contract: uniform or uneven.

Since the recognition of leasing payments under the accrual method does not depend on the fact of payment, the advance payment transferred to the lessor should not be included in tax expenses (clause 1 of Article 272 of the Tax Code of the Russian Federation). Expenses include only that part of the advance that relates to the service already provided.

If an organization uses the cash method, then lease payments must be reflected in the reporting period in which payment for services rendered is actually transferred (clause 3 of Article 273 of the Tax Code of the Russian Federation). If an advance payment is made against lease payments, then its amount should not be included in the reduction of taxable profit.

If a “simplified” organization pays a single tax on income, then it is impossible to take into account expenses, including leasing payments (Clause 1, Article 346.14 of the Tax Code of the Russian Federation). If a “simplified” organization pays a single tax on the difference between income and expenses, then the amount of leasing payments can be taken into account in reducing the tax base (clause 4, clause 1, Article 346.16 of the Tax Code of the Russian Federation). To do this, leasing costs must meet all the requirements that the law imposes on expenses taken into account when taxing profits (clause 2 of article 346.16 and clause 1 of article 252 of the Tax Code of the Russian Federation).

Expenses in the form of leasing payments should be written off when calculating the single tax under the simplified tax system after the provision of leasing services and their payment (clause 2 of article 346.17 of the Tax Code of the Russian Federation). In turn, “input” VAT paid in the amount of leasing payments recognized as expenses is also included in the reduction of the tax base (clause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation).

The amount of payments must be confirmed by primary documents, as well as documents evidencing the transfer of funds to the lessor (acts, payment orders, etc.) (Article 346.24 of the Tax Code of the Russian Federation, clause 1.1 of the Procedure for filling out the Book of Income and Expenses of organizations and individual entrepreneurs using simplified taxation system, approved by order of the Ministry of Finance of Russia dated December 31, 2008 No. 154n).

The Russian Ministry of Finance does not question the fact that expenses in the form of leasing payments are recognized in those amounts determined by the payment schedule, even if this schedule is uneven (letter of the Russian Ministry of Finance dated October 15, 2008 No. 03-03-05/131) .

The Ministry of Finance of Russia confirms expenses in the form of leasing payments; if their payment schedule is uneven, they are recognized by the lessee for profit tax purposes on the basis of paragraphs. 3 paragraph 7 art. 272 of the Tax Code of the Russian Federation based on the amount of lease payments and payment terms approved by the relevant schedule. The legality of this procedure for tax accounting of leasing payments with their uneven schedule was confirmed in letters of the Ministry of Finance of Russia dated April 17, 2009, No. 03-03-06/1/258, dated October 15, 2008, No. 03-03-05/131.

However, a dispute with tax authorities on this matter cannot be ruled out.

If, for example, a leasing agreement is concluded for a period of one year and it states that the total amount of the lease payment for the entire period of the agreement is 1,200,000 rubles. without a “breakdown” by month, then whatever the payment schedule, the lease payment should be recognized as an expense evenly over the term of the contract - 100,000 rubles each. per month (RUB 1,200,000: 12 months). If in the leasing agreement the total amount of the lease payment is “broken down” by month, i.e. If the cost of the service is indicated for each month separately, then (even in the case of an uneven “split” of this amount) the leasing payment for that month will be recognized in the expenses of each specific month in the amount established by the contract. This point must be taken into account when drawing up a leasing agreement in order to minimize the risk of a dispute with the tax authority.

A leasing agreement that provides for an initial payment of a significantly larger amount than subsequent ones may be regarded by the tax authorities as a sham transaction covering up a purchase and sale transaction. In accordance with Art. 170 of the Civil Code of the Russian Federation, a sham transaction, i.e. a transaction that is made to cover up another transaction is void. In this case, the tax authority may proceed from the fact that a relationship of purchase and sale of property with installment payment has arisen between the parties. Thus, we may be talking about re-qualifying the transaction. This, in turn, may lead to a change or distortion of the tax base for income tax and property tax. In this case, additional amounts of taxes can be recovered from the taxpayer only in court (clause 1, clause 1, article 45 of the Tax Code of the Russian Federation), and the tax authority will be required to prove that the leasing agreement is a sham transaction and was concluded for the purpose of tax reduction.

In order to avoid the risk of requalification of the transaction (to reduce such risk), the terms of the leasing agreement should provide for the reasons (grounds) for the unevenness of leasing payments (for example, the provision by the lessee of additional services during the first year of the agreement, etc.).

Accounting with the lessor

At the time of transfer of the leased asset, the lessor does not generate income. He will reflect income upon receipt of leasing payments in accordance with the schedule (clause 1 of Article 271 of the Tax Code of the Russian Federation).

If the leasing agreement provides for an uneven schedule for payment of lease payments, then the lessor using the accrual method, based on paragraphs. 3 p. 4 art. 271 of the Tax Code of the Russian Federation recognizes income in the form of amounts of leasing payments on the date of settlements in accordance with the terms of the concluded agreement or on the last day of the reporting (tax) period based on the amounts provided for by the schedule of leasing payments (letter of the Ministry of Finance of Russia No. 03-03-05/131) .

In accordance with Art. 28 of Law No. 164-FZ, the procedure for calculating lease payments can be determined by the parties. In other words, the parties to a leasing agreement can set an arbitrary start date for accrual of lease payments, which can be either later or earlier than the date of acceptance for accounting (transfer or commissioning date) of the leased asset. That is why depreciation on fixed assets that are the subject of leasing can be calculated regardless of the start date of accrual of leasing payments.

If the leased asset is subject to depreciation in the tax accounting of the lessor, the moment of putting the leased asset into operation for corporate profit tax purposes is determined by the date of transfer of the leased asset to the lessee.

Accounting of leasing payments

In accounting, leasing payments must be reflected in expenses on a monthly basis and recognized regardless of the fact of their payment (clause 18, accounting provisions “Expenses of the organization” PBU 10/99, approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n (in edited on November 8, 2010. All business transactions of an organization, including leasing payments, must be documented in primary accounting documents.

The use of accounting accounts to reflect settlements under a leasing agreement depends on whose balance sheet the leased asset is on.

If, under the terms of the agreement, the leased property remains on the lessor’s balance sheet, then settlements for lease payments should be made on account 60 “Settlements with suppliers and contractors” (or on account 76 “Settlements with various debtors and creditors”). Depending on the nature of the use of the property (in core activities, for management needs, etc.), the lease payment is reflected in the following accounting entries:

Debit 20 (23, 25, 26, 29), Credit 60 (76) - accrued lease payment on property that is used in the main activities of the production organization;

Debit 44, Credit 60 (76) – accrued lease payment on property that is used in the main activities of the trading organization;

Debit 91-2, Credit 60 (76) – lease payment has been accrued for property that is used for non-production purposes.

At the time of repayment of the debt to the lessor, the following accounting entry is made:

Debit 60 (76), Credit 51 – lease payment paid.

If the leased property is taken into account on the balance sheet of the lessee, then the accrual of the next lease payment must be reflected as follows: by transferring the debt to the lessor from the subaccount opened to account 76 (60) - “Rental obligations” (which reflects the total amount of debt under the agreement), to a sub-account opened for the same account - “Debt on leasing payments”.

However, with this method of accounting for calculations, the lease payment is not reflected as part of the lessee's expenses, while such expenses comply with all the conditions for recognizing expenses in accounting established in clause 16 of PBU 10/99. At the same time, along with the accrual of leasing payments, the lessee must reflect the accrual of depreciation, the amounts of which can also be included in expenses (clause 5 of PBU 10/99). In this regard, in order to avoid controversial issues, the accrual of lease payments and depreciation for the current month in accounting must be reflected as follows:

Debit 76 (60), Credit 02, subaccount “Depreciation on property received under lease” – depreciation for the current month has been calculated on property received under lease;

Debit 20 (25, 26, 44, 91-2), Credit 60 (76) lease payment accrued for the current month;

Debit 60 (76), Credit 51 – lease payment for the current month is transferred.

If the lessee makes payments under the agreement in advance, then the advance payment is reflected in a separate subaccount to account 60 (76) “Settlements for advances issued” as follows:

Debit 60 (76), subaccount “Settlements for advances issued”, Credit 51 – leasing payment transferred in advance.

After the service for which the prepayment amount has been paid is provided, the following entries are made in the accounting records:

Debit 20 (23, 25, 29, 44, 91-2), Credit 60 (76) – lease payment accrued;

Debit 60 (76), subaccount “Settlements under the leasing agreement”, Credit 60 (76), subaccount “Settlements for advances issued” - the advance issued is credited to repay the debt to the lessor. This procedure is based on the provisions of clause 3 of PBU 10/99 and the Instructions for the Chart of Accounts.

Arguments against equal accounting of uneven lease payments

If the parties have agreed on an uneven schedule of lease payments, then for tax purposes lease payments are recognized according to the schedule, i.e. unevenly. The conclusion can be confirmed by arbitration practice. Thus, the Federal Antimonopoly Service of the Volga Region in its resolution dated June 25, 2009 No. A55-17520/2008 indicated: if the leasing agreement provides for an uneven schedule for payment of lease payments, then the lessee using the accrual method recognizes expenses in the form of lease payments for profit tax purposes in the manner , provided for in paragraphs. 3 paragraph 7 art. 272 of the Tax Code of the Russian Federation, based on the amount of lease payments and payment terms approved by the corresponding schedule of lease payments.

For profit tax purposes, expenses in the form of lease payments with an uneven payment schedule are recognized by the lessee using the accrual method, based on the amount of lease payments and payment terms approved by the relevant schedule (clause 3, clause 7, article 272 of the Tax Code of the Russian Federation).

The lessor includes received lease payments in income according to the same principle: on the dates of settlements in accordance with the terms of the agreement or on the last day of the period based on the amounts provided for in the lease payment schedule.

Particular attention should be paid to clause 8.1 of Art. 272 of the Tax Code of the Russian Federation, which provides that the costs of acquiring leased property specified in paragraphs. 10 p. 1 art. 264 of the Tax Code of the Russian Federation are recognized as an expense in those reporting (tax) periods in which leasing payments are provided for in accordance with the terms of the agreement. When formulating this provision, the legislator proceeded from the fact that lease payments are recognized for tax purposes in accordance with the terms of the agreement. Otherwise, it would not make sense to link the date of recognition of expenses for the acquisition of leased property for tax purposes with the periods of receipt of lease payments in accordance with the terms of the agreement.

At the same time, clause 8.1 of Art. 272 of the Tax Code of the Russian Federation requires that expenses for the acquisition of leased property be taken into account in proportion to the amount of leasing payments. If the legislator had in mind exclusively uniform recognition of leasing payments for tax purposes, then we would be talking not only about the proportionality of expenses to leasing payments, but also about their uniformity.

Consequently, the provisions of clause 8.1 of Art. 272 of the Tax Code of the Russian Federation are additional confirmation that lease payments may not be recognized for tax purposes evenly, but in accordance with the terms of the agreement.

As for the possibility of applying Art. 40 of the Tax Code of the Russian Federation, if lease payments accrued for different periods within the framework of one leasing agreement deviate from each other, the tax authority has the right to compare for the purpose of applying Art. 40 of the Tax Code of the Russian Federation only the total amount of leasing payments, as the final price of the service under a leasing agreement, with the total amount of leasing payments under another comparable leasing agreement. Leasing payments accrued for different time periods within the framework of one leasing agreement are not subject to control by the tax authorities for compliance with Art. 40 of the Tax Code of the Russian Federation, since such individual payments are not independent transactions (service agreements - Articles 153 and 154 of the Civil Code of the Russian Federation) (clauses 2 and 3 of Article 40 of the Tax Code of the Russian Federation).

* * *

Consequently, when concluding a leasing agreement, the parties have the right to agree on any terms of payment and the amount of leasing payments, including an uneven schedule for their transfer (clause 2 of Article 28 of Law No. 164-FZ).

Thus, we can state the following: the position shared today by the Russian Ministry of Finance that the amount of the lease payment can be included in expenses (income) in the amount agreed upon by the parties according to the schedule is fully consistent with the norms of the law.

However, if a specific payment schedule is inexplicably disproportionate, then claims from tax specialists regarding the receipt of unjustified tax benefits are almost inevitable.

It is possible to substantiate such unevenness in some cases, for example, due to the need to match leasing payments to the amounts of accrued depreciation, which, using the non-linear method, in the first periods of the equipment’s service life can be significantly higher than in the latter.

Taisa Panchenko,

auditor