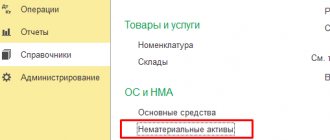

What applies to intangible assets

Under certain conditions, intellectual property objects (results of intellectual activity) can be taken into account as part of intangible assets. In particular:

- inventions, industrial designs, utility models;

- computer programs, Internet sites;

- trademarks and service marks;

- production secrets (know-how);

- breeding achievements (for example, for a grown plant variety or a bred animal breed).

In addition, the business reputation of the organization can be taken into account as part of intangible assets.

This is stated in paragraph 4 of PBU 14/2007.

The intangible assets of an enterprise cannot include:

- organizational expenses;

- intellectual and business qualities of personnel, their qualifications and ability to work.

Such rules are established by paragraph 4 of PBU 14/2007.

Specific signs

What are intangible assets? What does this mean? A novice accountant is probably tormented by such questions. If the image of material property emerges immediately, then how can one imagine something else?

Let us analyze the main conditions for classifying funds into the group of intangible assets. So, representatives of this category must meet the following criteria:

- lack physical fitness;

- used in the production and sales processes of the enterprise or for management needs;

- be in circulation for 12 months or more;

- bring profit in the present or forecast time;

- comply with legal documentation requirements;

- have the opportunity to transfer ownership to another individual or legal entity.

In order to use intangible assets in its activities, the enterprise itself must have ownership rights to them.

Conditions for classification as intangible assets

An object of intellectual property can be taken into account as part of intangible assets if the following conditions are simultaneously met:

- the organization is the holder of exclusive rights to the intangible asset. At the same time, the existence of the object itself and the exclusive rights to it must be documented;

- the organization has the right to receive economic benefits from the use of the facility;

- the period of use of the object exceeds 12 months, and the organization does not intend to resell it for at least 12 months;

- the original (actual) cost can be reliably determined.

This is stated in paragraph 3 of PBU 14/2007.

The conditions for recognizing intellectual property objects as intangible assets are presented in more detail in the table.

If the conditions for recognizing an object of intellectual property as an intangible asset are not met (for example, if the organization has not received a patent for an invention or the useful life of the object is less than 12 months), then its value can be taken into account as part of:

- expenses for research, development and technological work (R&D);

- deferred expenses;

- current expenses.

Reflection of intangible assets in accounting and financial statements

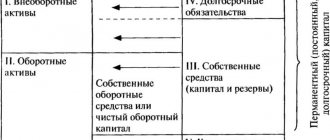

Intangible assets are recorded on account 04 “Intangible assets”, amortized and reflected in the balance sheet at their residual (book) value as part of non-current assets on line 1110 “Intangible assets”.

A breakdown of the information on intangible assets is given in tables 1.1 – 1.5 of the Explanations to the balance sheet and financial results statement (Appendix No. 3 to Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n).

Rights to the created object

If an organization has created an object of intellectual property on its own, then the exclusive rights to it must be documented. Most intellectual property objects (results of intellectual activity) must be registered with Rospatent or the State Commission for Testing and Protection of Selection Achievements. Documents confirming exclusive rights to the created object are:

- certificate for a trademark (service mark) (Articles 1480 and 1481 of the Civil Code of the Russian Federation);

- certificate of exclusive right to the appellation of origin of goods (clause 2 of Article 1518 and Article 1530 of the Civil Code of the Russian Federation);

- patent for an invention, industrial design, utility model (Articles 1353 and 1354 of the Civil Code of the Russian Federation);

- patent for a selection achievement (Articles 1414 and 1415 of the Civil Code of the Russian Federation).

If the organization has received the necessary security documents, the created intellectual property object can be taken into account as part of intangible assets.

Some intellectual property objects are registered voluntarily, for example, the exclusive right to a computer program (Article 1262 of the Civil Code of the Russian Federation).

Goodwill

The classification of intangible assets provides for the formation of such property as business reputation. It is considered only if the company is sold. Goodwill is understood as the difference between the market and book value of a company, taking into account the accumulated reputation (positive or negative). It turns out that goodwill has its own price, which means it is bought and sold in the same way as any other property.

In the case of the formation of a positive business reputation, they speak of an additional amount of premium that must be paid to the seller, since in the future the presence of goodwill will bring economic benefits to the new owner. Negative characteristics of a company in the market can lead to problems and difficulties that hinder activity and profit. This happens due to poor management, lack of an established sales system, marketing plan, regular customers and connections, and other reasons. This situation reduces the value of the enterprise and requires a discount from the seller.

Rights to the transferred object

In addition to creating intellectual property on its own, an organization can obtain rights to them:

- under an agreement (license or alienation of an exclusive right) (Article 1233 of the Civil Code of the Russian Federation);

- in a non-contractual manner on the basis of the law (for example, during reorganization, foreclosure on the property of the copyright holder) (Article 1241 of the Civil Code of the Russian Federation).

In each of these cases, the organization acquires the rights to use the intellectual property. These rights may be exclusive or non-exclusive.

Depending on the type of agreement, an organization may receive all exclusive rights to an intellectual property object or only part of them.

To transfer all rights to an object of intellectual property, an agreement on the alienation of exclusive rights is concluded. In this case, the organization becomes the only one who can use the resulting intellectual property. This is stated in Article 1234 of the Civil Code of the Russian Federation.

If part of the exclusive rights to the result of intellectual activity is transferred, a license agreement is concluded. The license agreement can be of two types:

- simple (non-exclusive) license;

- exclusive license.

In the first case, the original owner of the exclusive right (licensor) reserves the right to issue licenses to other parties. That is, other organizations can also use this result of intellectual activity (means of individualization). In the second case, the organization is the only one who uses the object within the framework of the rights transferred to it. Such rules are established in Article 1236 of the Civil Code of the Russian Federation.

For example, a program for management accounting was developed at the request of an organization. According to the agreement, the organization has exclusive rights to use the program in its business activities, and the developer has exclusive rights to modify it. In such a situation, the developer does not have the right to provide the computer program for use by other persons, and the organization does not have the right to enter into agreements for modifying the computer program with other developers.

An object of intellectual property can be included in the intangible assets of a company only if the organization owns all the exclusive rights (for example, if an agreement on the alienation of an exclusive right was concluded or the organization became the copyright holder after reorganization). This follows from the provisions of paragraphs 38 and 39 of PBU 14/2007. To include the received object among intangible assets, you must have documents confirming exclusive rights. For example it could be:

- agreement on alienation of exclusive rights;

- transfer act (in case of reorganization in the form of transformation, merger or accession) or separation balance sheet (in case of division or separation of an organization) (Article 58 of the Civil Code of the Russian Federation).

The agreement must be registered with Rospatent (State Commission for Testing and Protection of Selection Achievements) in cases where the result of intellectual activity itself was registered (clause 2 of Article 1232, clause 7 of Article 1452, clause 5 of Article 1262 of the Civil Code of the Russian Federation) .

If only part of the exclusive rights to an intellectual property object has been received, then such an object is recognized as an intangible asset received for use. Since intellectual property objects received for use are not included in the organization’s balance sheet, it is necessary to maintain off-balance sheet accounting for them. This procedure follows from paragraphs 38 and 39 of PBU 14/2007.

The cost of the enterprise's intangible assets recorded on the balance sheet should be repaid by calculating depreciation (clause 23 of PBU 14/2007).

Valuation of intangible assets

The principles for valuing intangible assets were invented by economist Leonard Nakamura, working in the United States. He proposed three main criteria for assessment:

- Estimated financial result. That is, you need to calculate how much profit the acquired or developed asset will bring.

- Costs associated with the creation or acquisition of intangible assets.

- Increase in operating profit due to the introduction of intangible assets.

IMPORTANT! The cost is determined based on the price of the item at the time of its receipt. Typically, the primary cost can be determined based on the concluded contract for the transfer of rights. They can be transferred to the company free of charge. In this case, the assessment is carried out based on the market value of similar objects.

The basis for the assessment may be the totality of costs associated with obtaining the asset. The list of expenses may include:

- amount paid to the seller;

- payment for intermediary services;

- receiving advice related to the acquisition of an asset;

- customs duties.

It will be more difficult to evaluate assets that were created by the enterprise itself. The price will include the following expenses:

- developer salaries;

- social Security contributions;

- material costs for carrying out development activities.

The original cost can only change when revalued or depreciated. For example, an organization bought a patent, the market value of which jumped. However, later there was a sharp decline. The value of the asset indicated in the accounting documents should be brought into line with its actual value.

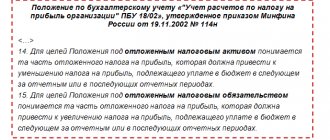

R&D

The costs of acquiring (creating) an object of intellectual property should be reflected as part of R&D if the following conditions are simultaneously met:

- the object was developed in-house by the organization or on its order;

- work to create an object can be classified as research or scientific and technical activities. The criteria for such activities are defined in Article 2 of the Law of August 23, 1996 No. 127-FZ;

- the result of R&D is not subject to legal protection or legal protection is not properly formalized (for example, if the invention does not require a patent or the organization for some reason did not patent its invention).

This follows from paragraph 2 of paragraph 1 and paragraph 2 of PBU 17/02.

Correspondence with other accounts

Knowing what intangible assets are and what relates to them, we can assume which accounting accounts account 04 will interact with. Based on the characteristics of the active account, debit transactions characterize the acceptance of intangible assets for accounting through purchase, receipt, exchange. The interconnected accounts become 04 and 08, 50-52, 55, 75-76, 87-88. The write-off of intangible assets in particular cases of sale, liquidation, exchange leads to an entry in the credit of account 04. In this case, interaction occurs with the debit of accounts 06, 48, 58, 87.

Future expenses

If the cost of an intellectual property item cannot be reflected as part of R&D expenses, then the costs of its creation (purchase) should be included either in deferred expenses or in current expenses. The costs of acquiring (creating) an object of intellectual property that will be used in several reporting periods are considered as deferred expenses. For example, do this if, when purchasing the rights to use an object of intellectual property, the organization paid a fixed amount at a time. If this condition is not met, the costs of acquiring (creating) an object of intellectual property should be taken into account as part of current expenses. For example, do this if the organization makes periodic payments for the use of intellectual property. This procedure follows from paragraph 18 of PBU 10/99.

Costs for the acquisition (creation) of an intellectual property item, recorded as deferred expenses, are subject to write-off. The organization independently establishes the procedure for writing off expenses relating to several reporting periods. For example, an organization can write off a one-time one-time payment for the use of an object of intellectual property evenly over the period for which it was received. Fix the applied option for writing off deferred expenses in the accounting policy for accounting purposes. This is stated in paragraph 18 of PBU 10/99 and paragraphs 7 and 8 of PBU 1/2008.

An example of reflecting in accounting the costs of acquiring part of the exclusive rights to use a patented invention. For the use of a patented invention, the organization pays a fixed amount at a time

In January 2021, Alpha LLC entered into a license agreement with Proizvodstvennaya LLC (patent holder). Under the agreement, the organization receives part of the exclusive rights to use the patented invention for 2 years (24 months) - from February 1, 2021 to January 31, 2021.

Under the terms of the agreement, in January 2021, the “Master” is paid a remuneration in the form of a fixed one-time payment in the amount of 169,920 rubles, including VAT - 25,920 rubles.

Alpha's accounting policy states that deferred expenses are written off as current expenses evenly over the period to which they relate. In this case, during the validity period of the license agreement.

In accounting, Alpha's accountant made the following entries.

In January 2021:

Debit 012 – 169,920 rub. – the cost of an intangible asset received for use is taken into account;

Debit 97 Credit 60 – 144,000 rub. (RUB 169,920 – RUB 25,920) – remuneration accrued under the license agreement;

Debit 19 Credit 60 – 25,920 rub. – VAT on remuneration under the license agreement is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 25,920 rub. – accepted for deduction of VAT on remuneration under the license agreement;

Debit 60 Credit 51 – 169,920 rub. – remuneration under the license agreement is transferred.

Every month from February 2021, the accountant writes off (in proportion to the number of calendar days) part of the remuneration under the license agreement, taken into account as part of deferred expenses.

In February 2021:

Debit 20 Credit 97 – 5713 rub. (RUB 144,000: 731 days × 29 days) – part of the remuneration under the license agreement, previously taken into account as deferred expenses, was written off.

In March 2021:

Debit 20 Credit 97 – 6107 rub. (RUB 144,000: 731 days × 31 days) – part of the remuneration under the license agreement, previously included in deferred expenses, was written off.

The accountant made similar entries for writing off royalties under the license agreement, included as deferred expenses, until January 2021 (inclusive).

In January 2021, upon expiration of the license agreement, the accountant wrote off the value of the intangible asset acquired for use:

Credit 012 – 169,920 rub. – the value of an intangible asset received for use is written off.

An example of reflecting in accounting the costs of acquiring part of the exclusive rights to use a patented invention. For the use of a patented invention, the organization transfers monthly license payments

In January 2021, Alpha LLC entered into a license agreement with Proizvodstvennaya LLC (patent holder). Under the agreement, the organization receives part of the exclusive rights to use the patented invention for 2 years (24 months) - from February 1, 2021 to January 31, 2021.

According to the agreement, the cost of the intangible asset received for use is 169,920 rubles. Under the terms of the agreement, the “Master” is paid a monthly remuneration in the amount of 7,080 rubles, including VAT – 1,080 rubles.

The following entries were made in Alpha's accounting.

In January 2021:

Debit 012 – 169,920 rub. – the cost of an intangible asset received for use is taken into account.

Every month from February 2021 to January 2021, the accountant makes the following entries:

Debit 20 Credit 60 – 6000 rub. (RUB 7,080 – RUB 1,080) – remuneration accrued under the license agreement;

Debit 19 Credit 60 – 1080 rub. – VAT on remuneration under the license agreement is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 1080 rub. – accepted for deduction of VAT on remuneration under the license agreement;

Debit 60 Credit 51 – 7080 rub. – remuneration under the license agreement is transferred.

In January 2021, upon expiration of the license agreement, the cost of the intangible asset acquired for use was written off by the accountant:

Credit 012 – 169,920 rub. – the value of an intangible asset received for use is written off.

Depreciation

There are two methods used to calculate depreciation:

- Linear. The linear method takes into account depreciation rates determined on the basis of the period of use of the object.

EXAMPLE. The company acquired assets in the amount of 12,000 rubles. The period of use is 4 years. To calculate annual deductions, you need to divide the amount by the terms. Get 3,000 rubles. This amount can be divided by 12. This will determine the monthly deductions.

- Declining balance. Deductions are calculated based on the residual value at the beginning of the reporting period.

EXAMPLE. Assets were purchased for the amount of 10,000 rubles. To determine the annual rate, you need to divide 10,000 rubles by 100%. It will be 10%. The annual depreciation amount will be 1,000 rubles (10,000 times 10%). The residual value will be 9,000 rubles (10,000 – 1,000).

Intangible assets, despite the lack of physical form, must be correctly reflected in accounting. To do this, you need to know the signs of intangible assets and the rules for calculating depreciation charges.