It is impossible to imagine business today without a current account. Therefore, tax authorities use partial or complete blocking of accounts as a measure of influence on taxpayers. If an organization has several accounts, then all are blocked.

It is clear that the inability to carry out operations paralyzes activities.

It will not be possible to open a new account in another bank and redirect financial flows. Before opening an account, any bank must check the client for suspension of debit transactions on accounts through the service on the Federal Tax Service website. If there are seized accounts, the bank will refuse to open a new account (Clause 12 of Article 76 of the Tax Code of the Russian Federation). It is impossible to close a blocked account.

Reasons for blocking a current account by the tax office

As one of the measures to influence a taxpayer or tax agent (legal entity or individual entrepreneur) who violates the requirements of tax legislation, a procedure such as blocking current accounts is applied, which is a ban on the use of funds belonging to the taxpayer.

Such a ban is imposed by the tax authority, and the same body lifts it when the grounds that served as the reason for the blocking disappear. The blocking rules are set out in Art. 76 of the Tax Code of the Russian Federation, included in Chapter. 11 of this document, dedicated to the methods used to ensure payment of tax payments. However, non-payment of taxes is not the only reason for banning the use of accounts.

In addition to unpaid tax (penalties, fines), the following are grounds for freezing settlement transactions (clause 3 of Article 76 of the Tax Code of the Russian Federation):

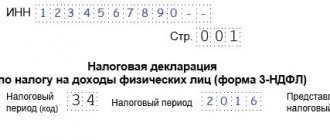

- failure to submit a tax return within 10 working days from the end of the period allotted for its submission - in this case, the account can be blocked for a 3-year period, counted from the date corresponding to the 10th working day from the date of expiration of the period allotted to submit a declaration;

ATTENTION! From 07/01/2021, the period for blocking accounts for late reporting has been changed to 20 days. In this case, tax authorities must notify the taxpayer about the upcoming blocking at least 14 days before making the relevant decision. Read more about the innovations here.

- unrealized obligation to provide an electronic method of interaction with the tax service - liability here arises if the taxpayer has not taken any action within 10 business days from the date the Federal Tax Service Inspectorate discovered such a violation;

- failure to send an electronic confirmation receipt to the Federal Tax Service Inspectorate in response to information received from the tax authority within 10 working days from the date of expiration of the deadline established for sending such a document (it is 6 working days).

In addition, the following may lead to account blocking:

- failure to send a 6-NDFL calculation or a calculation of insurance premiums within 10 working days from the end date (after 07/01/2021 - 20 days) allotted for its submission (clause 3.2 of Article 76 of the Tax Code of the Russian Federation);

- the need to ensure guaranteed implementation of decisions on the payment of additional assessments made during the tax audit (clause 10 of Article 101 of the Tax Code of the Russian Federation).

Responsibility in the form of freezing an account can be applied not only to a taxpayer (payer of insurance premiums) or a tax agent, but also to a tax evader if he is required to file declarations or reports on contributions (subclause 3, clause 11, article 76 of the Tax Code of the Russian Federation).

A credit organization does not have the opportunity not to comply with the decision of the tax authority to block an account (clause 6 of Article 76 of the Tax Code of the Russian Federation). At the same time, she is obliged to inform the tax authority about the balances on blocked accounts (clause 5 of Article 76 of the Tax Code of the Russian Federation).

ConsultantPlus experts explained how to unblock a current account if the Federal Tax Service has made a decision to suspend operations. If you don't already have access, get a free trial of online legal access.

Powers of banks when fulfilling obligations under 115-FZ

This issue is also explained in the guidelines for businessmen.

Actions of the bank upon detection of a suspicious transaction:

- send a request for documents explaining the operation;

- set a deadline for submitting documents;

- ask for verbal explanations of suspicious activities;

- travel to the place of business;

- give advice on conducting banking operations;

- review the client's risk level.

So, if suspicious actions are detected, the bank blocks the transaction and asks for clarification of the reasons for the suspicious behavior. At this stage, the client’s task is to justify himself as convincingly as possible and prove that the company’s activities are legal.

For example, an individual entrepreneur works alone, he does not have a material base, and he does not pay business expenses. But millions pass through the checking account. As soon as he receives money from one company, he transfers it to the account of another and partially withdraws it. By all accounts, the company is suspicious. But this entrepreneur can provide the bank with an agreement with a large factory for the provision of services for the manufacture of parts. He himself cannot make them, so he entered into an agreement with another individual entrepreneur for production - he acted as an intermediary. If the entrepreneur proves the transparency and legality of the scheme, the bank will withdraw all claims. But at the same time, the chain of intermediaries can be longer than you to me - I to you, and the transactions are carried out through shell companies. In this case, it will be more difficult to justify yourself.

Actions of the bank after the deadline for reviewing documents:

- refuse payment or account opening and send the data to Rosfinmonitoring;

- carry out the operation, but send the data to Rosfinmonitoring;

- review the client's risk level.

Actions of the bank in relation to a client with an increased level of risk:

- limit or limit the use of remote banking services and cards;

- strengthen control, including requesting documents for each transaction.

The bank is not an investigative body. It is not their task to prove the illegality of their clients’ actions, much less punish them for it. The bank’s task is to identify suspicious cases, stop them and send data to Rosfinmonitoring.

Account blocking options

A ban on expense transactions can be imposed on any of the accounts belonging to the guilty taxpayer, including an account opened in foreign currency or precious metals. An exception to this rule applies to special election accounts and special accounts of referendum funds - they cannot be blocked (clause 1 of Article 76 of the Tax Code of the Russian Federation).

Read about whether it is possible to block a collateral account here.

Either a specific amount or the entire balance on the account may be blocked on the account, regardless of its value and its change during the blocking period. That is, in the first case, using the account is possible, but there must always be an amount on it that is equal to or greater than the blocked one. It is permissible to use the funds forming the blocked amount only to repay tax payments or those whose transfer order turns out to be higher than that of taxes (Clause 1 of Article 76 of the Tax Code of the Russian Federation).

A limit on a certain amount is adopted by the tax authority in order to collect unpaid tax payments (taxes, contributions, penalties, fines), the specific amount of which is easy to determine. In this situation, the decision to block must be preceded by a decision to collect the relevant payment(s). It will contain a ruble amount, by the amount of which, when a foreign currency account or an account in precious metals is frozen, the blocked amount of currency (at its exchange rate) or precious metals (at the discount price) will be recalculated, respectively. Both the exchange rate and the discount price of precious metals are determined by their value corresponding to the day the ban on the use of funds begins (clause 2 of Article 76 of the Tax Code of the Russian Federation).

Blocking the accounts of an investment partnership if there are insufficient funds in the general account can lead to a limitation in the ability to use the account with the managing partner, and if this turns out to be insufficient, then liability will be proportionally imposed on ordinary partners (clause 2.1 of Article 76 of the Tax Code of the Russian Federation). In a consolidated group of taxpayers, similar measures are applied first to the responsible participant, and then to others (clause 13 of Article 76, clause 11 of Article 46 of the Tax Code of the Russian Federation), and the sequence of this involvement is determined by the tax authority.

When blocking is carried out due to violations that are not assessed in monetary terms (failure to submit reports, failure to provide electronic communication with the Federal Tax Service, or violation of the procedure for confirming the receipt of information from the tax authority), the account cannot be used for any expense transactions. For a consolidated group of taxpayers that has not submitted a profit declaration, liability in the form of account blocking may arise simultaneously for all participants (clause 13 of Article 76 of the Tax Code of the Russian Federation).

Read about the situations in which freezing an account would be illegal here.

A bank can also block an account within the framework of anti-money laundering regulations. Find out what to do in such a situation by getting trial online access to ConsultantPlus for free.

Where to view the decision on collection by number

Situations often arise when a person is aware of the decision regarding his order, but for some reason does not receive it. The debtor is interested in the timely execution of this order (so as not to receive an additional fine) or appealing it (if there is evidence of his innocence).

The Federal Tax Service website operates a service that allows third parties to obtain information about organizations that have not submitted tax reports for more than a year; there you can also view tax debts over 1,000 rubles, aimed at collection by bailiffs. To do this, just indicate the TIN of the organization you are interested in.

How is information about account freezing communicated to the taxpayer?

The Tax Code of the Russian Federation (clause 4 of Article 76) instructs the tax authority to inform the taxpayer about the freezing of an account no later than the first business day following the day such a decision was made. This is done by sending him a copy of the document reflecting the decision to block, in a way that allows him to confirm the fact and date of receipt.

At the same time, the deadlines for sending a decision to suspend operations on an account to the bank are not specified in the Tax Code of the Russian Federation. Only regulated (Article 76):

- the method of sending this document is electronic (clause 4);

- the moment of the blocking itself - it coincides with the moment the bank receives the decision of the tax authority (clause 7).

Obviously, the tax authority is not interested in delaying the sending of the blocking decision for execution, and it is sent to the bank immediately after adoption. At the same time, an additional day is given to notify the taxpayer of the application of this procedure. Therefore, most often he learns about the freezing of an account from the bank that received the information earlier.

At the same time, there is a way that makes it possible to independently check whether an account is blocked by the tax office and find out about it at least simultaneously with the bank.

Where to view the decision on collection by number

It is not necessary to check the writ of execution by its number. The site's database is equipped with an advanced search, where you can specify all the data about the case you are looking for or some of the information known to it without having the enforcement proceedings number, and the search will produce a list of cases that match the information in the request.

Signing of the declaration by an unauthorized person. The inspection interviewed the head of the one-day company, who said that he did not sign the company’s declarations. From this, the Federal Tax Service Inspectorate concluded: the declarations were signed by an unauthorized person, that is, they were not signed, that is, they were not submitted. And on the basis of clause 3 of Art. 76 The Tax Code of the Russian Federation blocked the account. The court overturned the inspection decision, since the manager was included in the Unified State Register of Legal Entities, the interviewee did not indicate a specific declaration, the company recognizes the reporting, etc. (see resolution of the Federal Antimonopoly Service of the Ural District dated March 21, 2014 N F09-1036/14).

What else is blocking fraught with and how to find out about it online

What kind of method is this? The fact is that you can check the account blocking on the website of the tax service, which has created a special service for quickly monitoring the status of document flow between tax authorities and credit institutions.

This service allows you to see on the tax website not only information about account blocking. It also displays information about other documents sent to and from the bank. Therefore, the option to check account blocking on the Federal Tax Service website is one of several. However, it plays a crucial role, allowing a credit institution to check online whether the current account has been blocked by the tax inspectorate for its potential client in other banks. And precisely for the purpose of providing this information necessary to fulfill the requirement of the Tax Code of the Russian Federation (clause 12 of Article 76), which prohibits the opening of a new account for a client who has blocked accounts, an option was created that makes it possible to quickly and free of charge obtain information about the availability (absence) of a solution about blocking from the original source.

Information about the suspension of account transactions is posted on the website immediately after the Federal Tax Service Inspectorate makes a decision to block it. Access to them is free. Therefore, any person can check information about account blocking on the tax service website: both the taxpayer himself, who is aware of his misconduct and is awaiting appropriate sanctions, and his counterparty, who intends to transfer funds to the account specified in the agreement.

The data from this service may also be of interest to potential clients considering a draft contract proposed for conclusion, since the presence of blocking of the account of a future counterparty most often indicates that he has problems with funds.

The legislative framework

Blocking of accounts on the website of the Federal Tax Service is visible even if there is no information about debts in the bailiff database.

This body is one of the few who can collect arrears directly. Article 76 of the Tax Code of the Russian Federation gives him the right to establish restrictions on expense transactions if:

- the taxpayer has not paid taxes and fees;

- as a result, it became necessary to collect penalties and fines;

- the declaration was not provided;

- the taxpayer did not comply with the requirements for explanatory documents.

If it is decided to apply a measure such as account blocking to the violator, you can check its availability on the Federal Tax Service website the very next day. The decision of the authority is sent to the bank directly and is satisfied in third place, but ahead of other requirements of the same priority.

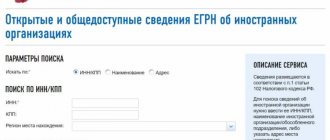

Procedure for checking account blocking on the Federal Tax Service website

What is the procedure for checking account blocking on the tax service website? It is extremely simple and takes just a few steps:

- Of the proposed types of requests, you should note the request for decisions on suspension.

- Indicate in the field provided for this purpose the TIN of the person for whom information is needed.

- In the field reserved for displaying the BIC, enter the BIC of a bank.

- Send a request.

After a short processing, the service will issue a response to the request, which will either indicate the absence of valid decisions to suspend transactions on accounts, or a table will appear containing data on the numbers and dates of decisions made on blocking, the code of the tax authority that made the decision, the BIC of the bank, in which it was sent, and information about the date and time of posting information about the blocking on the service.

The generated data can be downloaded in .pdf format and printed.

State Registration Bulletin

In the "Bulletin" you can see publications about bankruptcy, revocation of a power of attorney and existing facts of the company:

- We go to the official website.

- Scroll down to “Search for publications.”

- Select “Bankruptcy Information”.

- We enter the TIN, OGRN or full name of the company.

- Are looking for.

We are transferred to the website kartoteka.ru, which shows basic information about, “Notices of liquidation and reorganization” and “Pledges of movable property”.

Results

Blocking a current account is one of the measures to influence tax payers who violate the requirements of the Tax Code of the Russian Federation. The main reason for its use is non-payment of taxes. However, there are other reasons why an account may be frozen. Due to non-payment of taxes, accounts are blocked for the amount of the existing debt. In this case, the ability to use the account remains, but is subject to the presence of a minimum balance on it. In other situations, the account is frozen completely.

The presence of a block on at least one of the taxpayer's accounts entails a ban on opening new ones. In order to quickly provide banks with such information, the Federal Tax Service has created a special service that allows you to find out about account blocking on the tax service website. Access to the service is free and free, which allows any interested person to use it. The procedure itself for checking an account for blocking at the tax office presupposes knowledge of the TIN of the person being checked and does not present any technical difficulties.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Federal Bailiff Service

FSSP is a repository of all debts of companies, individuals and entrepreneurs. Anyone can find information on a company of interest, and here's how to do it:

- We go to the official website of the Federal Bailiff Service.

- In the “Find out about your debts” column, enter the TIN or the name of the company or entrepreneur.

- We indicate the region; if you don’t know, select “All regions”.

- Click “Find”.

The site will search its database for business debt information and show it to you. If it is not there, it will display the following window:

If a company owes someone

, will show a list of debts. As an example, we took Sberbank PJSC.

The decision on collection where to look by number

There is nothing complicated about using this service. It can be freely used by anyone who is interested in how to find a writ of execution by name and find out about existing debts. Let us remind you that information about the debtor, the writ of execution, and the initiated proceedings is entered into the database. Therefore, knowing only the last name of the debtor, you can get a complete picture of from whom, in what volume and on what grounds the collection is being made.

It is also possible to view the data through social networks using special applications. By subscribing to these applications, you can constantly receive information about the initiation of new individual entrepreneurs. Applications on mobile devices provide a similar opportunity. But first you need to find them, install them, and register. Not everyone wants to spend time installing various applications.

Repayment of a debt

An entrepreneur can pay his tax debt through Internet banking or by contacting a bank branch with a payment order. Payment via an electronic terminal is also possible.

When using the latter option, you must save the receipt to confirm the deposit of funds.

An individual entrepreneur has the right to apply to the tax authority for a deferment or installment plan on the following grounds:

- damage caused by an emergency;

- the threat of bankruptcy with a lump sum tax payment;

- A businessman's activities are seasonal.

There are also other reasons enshrined in Article 64 of the NKRF. A deferment or installment plan is provided for a period of no more than one year, and in some cases this period can be extended to three years.

Paying taxes is an important step in running a business. Therefore, every businessman needs to track the accruals and payment deadlines for all tax contributions. Timely receipt of information about the formation of debt will help to avoid serious consequences.

Suspension of transactions on taxpayer accounts

Suspension of transactions on accounts is the cessation by the bank servicing the taxpayer of expenditure activities on his account in full or within a limited amount determined by the decision of the tax authority on suspension for a legal entity. Blocking occurs only for expenses. Funds continue to flow into the account.

- Compensation for harm caused to life and health, and payment of alimony;

- Settlement with dismissing employees, which includes the balance of the last month’s salary, compensation, severance pay, and remuneration for authors for intellectual products;

- Fulfillment of duties regarding taxes, fees, insurance premiums, penalties and fines.