What accounting data will be needed when filling out line 1420

Enterprises, when preparing financial statements, have the legal right to reflect the balanced (i.e., rolled up) amount of deferred assets/liabilities in their balance sheet. In any case, the value of deferred tax liabilities is entered in the line, which is relevant as of the reporting date, as of December 31, the previous and previous periods. To enter information in line 1420 you will need to look at:

- credit balance on account 77,

- debit balance for account 09.

So, depending on which method of reflecting the amount of deferred liabilities the organization’s management chooses, additional actions may be required. A couple of points to consider:

- In any case, the indicators on line 1420 are transferred from the balance sheet for the previous year to December 31 – the previous and previous periods.

- If in the balance sheet for the reporting year, the indicators as of December 31, 2019, and the previous periods preceding the previous one, the amounts of deferred assets/liabilities were indicated in expanded form, and the enterprise customarily reflects the amounts of deferred tax assets/liabilities as of the reporting date in a collapsed form, the indicators as of December 31. - those periods will have to be recalculated before reflecting them in the balance sheet for the reporting period - this will ensure the comparability of the reporting data. The same applies to the reverse situation, when the information was reflected in a collapsed manner, but in the reporting period it was decided to indicate the indicators in an expanded manner.

- It is necessary to compare the balance on account 09 with the balance on account 77 - depending on which value is greater, the indicator on line 1420 can be calculated differently (formulas will be given below in the article).

Conclusions about what a change in indicator means

If the indicator is higher than normal

Not standardized

If the indicator is below normal

Not standardized

If the indicator increases

Usually a negative factor

If the indicator decreases

Usually a positive factor

Notes

The indicator in the article is considered from the point of view not of accounting, but of financial management. Therefore, sometimes it can be defined differently. It depends on the author's approach.

In most cases, universities accept any definition option, since deviations according to different approaches and formulas are usually within a maximum of a few percent.

The indicator is considered in the main free online financial analysis service and some other services

If you need conclusions after calculating the indicators, please look at this article: conclusions from financial analysis

If you see any inaccuracy or typo, please also indicate this in the comment. I try to write as simply as possible, but if something is still not clear, questions and clarifications can be written in the comments to any article on the site.

Best regards, Alexander Krylov,

The financial analysis:

- IV. LONG-TERM LIABILITIES Section IV. Long-term liabilities are the fourth section of the balance sheet. At the same time, it is also the second section of the liability side of the balance sheet, which shows the sources of financing for the property. AND…

- Balance sheet liability The balance sheet liability is the second part of the balance sheet. It contains a list of those financial resources that were used to acquire property, that is, assets that...

- I. NON-CURRENT ASSETS Non-current assets are property used in the activities of an enterprise for more than a year. Its value is transferred in parts to the cost of finished products. A sign of assets is the ability to generate income for the organization.…

- V. CURRENT LIABILITIES Section V. Current liabilities is the fifth section of the balance sheet. At the same time, it is also the third section of the liability side of the balance sheet, which shows the sources of financing for the property. AND…

- Absolute economic indicators of an enterprise's activity Absolute economic indicators of an enterprise's activity are indicators that allow us to judge several things: The size of the enterprise and the scale of its activities The level of income and expenses...

- III. CAPITAL AND RESERVES Section III Capital and Reserves is the third section of the balance sheet. But what is more important is the first section of financial sources, that is, the liability side of the balance sheet. By this he...

- Key performance indicators of an enterprise Key performance indicators of an enterprise are indicators that allow us to judge several things: The size of the enterprise and the scale of its activities The level of income and expenses About ...

- Balance sheet asset A balance sheet asset is a part of the balance sheet containing data on the assets of the enterprise, that is, on its property. The balance sheet asset reflects property, property rights and cash...

- Relative economic indicators of the enterprise’s activity Relative indicators of the enterprise’s activity are indicators that allow one to judge the efficiency of work. The initial data for the preparation of such indicators can be taken from the balance sheet and report on ...

- II. CURRENT ASSETS Current assets are property used in the activities of an enterprise for less than a year or used in one production cycle, which also does not exceed one year. Its entire cost...

How to find the amount of deferred tax liabilities (general formula)

The formation of deferred tax liabilities is observed in cases where taxable temporary differences arise. This means that expenses in tax accounting are higher than in accounting. Now it becomes clear why the general formula for calculating deferred tax liabilities is as follows:

How are liabilities accounted for?

IT accumulations are formed according to the product formula:

Temporary differences * income tax rate in%.

In other words, liabilities (abbreviated as IT) appear if expenses are accepted later in accounting. Income, on the contrary, is recognized earlier. Therefore, they can be considered debt.

How is IT formed?

For example, an organization calculates depreciation in accounting using a linear method, but in tax accounting using a non-linear method. Let’s say a company bought a fixed asset “High-voltage line” worth 200,000 rubles. Since it costs more than 100,000, it is legally subject to depreciation in tax accounting, according to Art.

Reasons for the occurrence of taxable temporary differences

When taxable temporary differences result in taxable profit (loss), this gives rise to deferred income tax, which, in turn, will increase the amount of income tax payable to the budget in the year following the reporting period or in the subsequent year. Let's look at the reasons why taxable temporary differences may arise:

- The use by an enterprise accountant of different procedures for reflecting the interest that the company pays to creditors for the use of borrowed funds for tax and accounting purposes.

- Recognition in the reporting period of income from the sale of manufactured products, goods, services and works in the form of income from ordinary activities.

- Application of various methods of calculating depreciation for calculating income tax and accounting purposes.

- Recognition of interest income of a company for accounting purposes based on the assumption of temporary certainty of facts of economic activity, and for tax purposes - on a cash basis.

- Other similar differences between accounting and tax accounting.

Recommendation R-123/2020-KpR “Deferred income tax on assets received from owners”

FUND "NATIONAL NON-STATE

ACCOUNTING REGULATOR

"ACCOUNTING METHODOLOGICAL CENTER"

(FUND “NRBU “BMC”)

Adopted by the Committee on Recommendations (CR) 2020-12-11

RECOMMENDATION R-123/2020-KpR

“DEFERRED INCOME TAX ON ASSETS RECEIVED FROM OWNERS»

DESCRIPTION OF THE PROBLEM

In accordance with the changes made by order of the Ministry of Finance of Russia dated November 20, 2021 No. 236n to the Accounting Regulations “Accounting for calculations of corporate income tax” PBU 18/02 (hereinafter referred to as PBU 18), approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n, the procedure for classifying differences that arise has been clarified.

The current version of PBU 18, with amendments that came into force starting with the accounting (financial) statements for 2021, does not directly describe the issue of the nature of the difference between the accounting and tax value of fixed assets, intangible assets or other assets received from shareholders (owners, participants , founders) as a contribution to the authorized capital, as a contribution to property or on other grounds.

At the same time, this edition of PBU 18 in paragraph 10 indicates that temporary differences are formed as a result of the application of different rules for assessing the initial cost and depreciation of non-current assets for accounting and tax purposes, which indicates the temporary nature of the difference between the accounting and tax values assets received from shareholders (owners, participants, founders) as a contribution to the authorized capital, as a contribution to property or on other grounds.

At the same time, PBU 18 does not contain the so-called exception for the initial recognition of deferred tax, which is contained in IAS 12 “Income Taxes” paragraphs 15 and 24:

A deferred tax liability is recognized for all taxable temporary differences, except when the tax liability arises as a result of:

(a) the initial recognition of goodwill; or

(b) the initial recognition of an asset or liability in a transaction that:

(i) is not a business combination; And

(ii) at the time it occurs, it has no effect on either accounting profit or taxable profit (tax loss).

A deferred tax asset shall be recognized for all deductible temporary differences to the extent that it is probable that taxable profit will be available against which the deductible temporary difference can be utilised, unless the deferred tax asset arises from the initial recognition of an asset or liability in a transaction , which:

(a) is not a business combination; And

(b) at the time it occurs, it affects neither accounting profit nor taxable profit (tax loss).

Subject to the deferred tax recognition exception described above, in practice IFRS either recognizes the related deferred tax or does not recognize it, depending on the entity's accounting policy choices. However, IFRS does not contain any restrictions regarding the recognition of deferred tax liabilities as part of equity items.

Consultations held with leading auditing companies indicate that there are different positions regarding the recognition of these differences and regarding their nature (permanent/temporary). As a result, in practice, when changing the audit company, a situation may arise in which the new auditor may have an opposite position in relation to these differences reflected in the accounting financial statements of the organization, confirmed by the previous auditor.

It is necessary to characterize the nature of the difference arising and determine whether a deferred tax liability or asset should be recognized in respect of the difference.

SOLUTION

1. This Recommendation is applied for the purpose of determining the difference in income tax arising as a result of an organization receiving property recognized as an asset from shareholders (owners, founders, participants) with or without increasing the authorized capital (hereinafter referred to as an equity transaction), and reflecting the consequences of such a difference in accounting .

2. The income tax difference arising from an equity transaction is a temporary difference.

3. An organization recognizes a deferred tax liability in respect of a taxable temporary difference arising as a result of an equity transaction or a deferred tax asset in respect of a deductible temporary difference, unless otherwise provided by paragraph 4 of this Recommendation.

4. Based on the second paragraph of paragraph 7 of PBU 1/2008 “Accounting Policies of an Organization,” an organization may not recognize a deferred tax liability or a deferred tax asset in relation to a temporary difference arising as a result of an equity transaction, guided by the exceptions provided for in paragraphs 15 and 24 of IAS 12 “ Income taxes." It is recommended to limit the application of these exceptions to cases when the resulting temporary difference amounts to the entire cost of the asset (i.e., the asset is recognized only in one type of accounting, but not in another), as well as other cases when the resulting temporary difference is the only temporary difference for this asset, and the asset is not depreciated.

5. The recognition of a deferred tax liability or asset as a result of an equity transaction is not included in the financial result for the period. Information regarding the recognition of such a deferred tax liability or asset is presented in the statement of changes in equity and in the notes as part of the information about the equity transaction itself.

BASIS FOR CONCLUSIONS

In accordance with paragraph 8 of the Accounting Regulations “Accounting for calculations of income tax of organizations” PBU 18/02 (hereinafter referred to as PBU 18), the temporary difference as of the reporting date is defined as the difference between the book value of an asset (liability) and its value assumed for tax purposes. At the same time, the Regulations do not link the specified procedure for determining temporary differences with the reasons for their occurrence; in particular, they do not contain exceptions for temporary differences arising as a result of receiving assets from shareholders (owners, participants, founders). In accordance with paragraph 3 of PBU 18, in analytical accounting, temporary differences are taken into account differentially according to the types of assets and liabilities in the valuation of which the temporary difference arose.

The tax difference that arises when receiving assets from shareholders (owners, participants, founders) corresponds to the concept of a temporary difference both from the point of view of PBU 18 and IAS 12. The potential impact of this difference on future periods in terms of the ratio of accounting profit to the tax base does not differ from any other temporary differences in the tax and accounting values of assets that arise for other reasons, for example, due to the inclusion/non-inclusion of different amounts in the initial cost of fixed assets, or due to depreciation in different ways or over different useful lives .

In accordance with paragraph 15 of PBU 18, deferred tax liabilities are recognized in the reporting period in which taxable temporary differences arise. Also, in accordance with paragraph 14 of PBU 18, the organization recognizes deferred tax assets in the reporting period in which deductible temporary differences arise, provided that it is probable that the organization will receive taxable profit in subsequent reporting periods. PBU 18 does not provide exceptions for the recognition of deferred tax liabilities or assets depending on the nature of the facts that resulted in the corresponding temporary differences.

However, such exceptions are provided for in paragraphs 15 and 24 of IAS 12 “Income Taxes”. Noteworthy is the fact that the provisions of these paragraphs provide exceptions for the recognition of deferred tax liabilities or assets in relation to TEMPORARY differences arising in connection with specific facts of economic life defined in these paragraphs. Thus, IFRS does not question the nature of these differences, directly calling them temporary. The exceptions provided by IFRS relate to the issue of whether or not to recognize deferred tax liabilities or assets in relation to these temporary differences, but do not relate to the issue of qualifying these differences as temporary or any other (for example, permanent).

Regarding the issue of recognition/non-recognition of deferred tax liabilities or assets in relation to these temporary differences, due to the absence of similar exceptions in PBU 18, refusal of such recognition within the framework of PBU 18 can be justified by the provision of the second paragraph of paragraph 7 of PBU 1/2008 “Accounting Policies of the Organization” , allowing for organizations publishing reports under IFRS not to use accounting methods determined by the Federal Accounting Standards Service in cases where without this it is impossible to comply with the accounting policies of IFRS.

However, the applicability of the exceptions provided for in paragraphs 15 and 24 of IAS 12 for the situation under consideration is not confirmed in all cases. Based on the basis for the conclusions in these paragraphs, and the recent discussion surrounding the amendments to IAS 12, these exceptions primarily apply to situations where the temporary difference is 100% of the cost of the asset on initial recognition. In this situation, the temporary difference is usually part of the cost of the asset, and it may be supplemented by other temporary differences not directly related to the equity transaction. In such a case, the accounting treatment depends on the interpretation of the phrase “at initial recognition of the asset”, recognizing that the initial recognition process is not limited to the fact of the equity transaction and continues as the asset is prepared for use, when other temporary differences may arise.

In addition, further depreciation on the asset is usually applied not to profit/loss, but to inventories (work in progress). The temporary difference contained in the cost of a fixed asset is transferred through depreciation to the cost of inventories, which in turn are written off to profit/loss only at the time the proceeds from the sale are recognized. Thus, the process of “initial asset recognition” breaks down into the initial recognition of property, plant and equipment and the initial recognition of inventory. The temporary difference caused by the equity transaction arises upon initial recognition of both assets, which makes it impossible to unequivocally state that it has no impact on both accounting and taxable profit.

Meanwhile, regardless of the interpretation of the concept “at initial recognition of an asset,” dividing the temporary difference for one asset into parts, when deferred tax is recognized in relation to one part and not recognized in relation to the other, will lead to significant accounting difficulties, especially when calculating depreciation on such a fixed asset, and will complicate the understanding of the nature of income tax indicators by the user of financial statements. In particular, it is impossible to formalize clear explanations for why, in relation to a temporary difference on one asset, the deferred tax liability (or asset) is recognized only in part, while in relation to another part of the same difference it is not recognized. This defeats the purpose of the exemptions in IAS 12.

In this regard, the provisions of paragraphs 15 and 24 of IAS 12 should be considered relevant in relation to situations where the resulting temporary difference is 100% of the cost of the asset (i.e. the asset is recognized only in one type of accounting, but not in another). If the difference is only part of the cost of the asset (not 100%), then the applicability of these paragraphs is also justified when this temporary difference is the only temporary difference for this asset, and the asset is not depreciated. In other cases, the application of these exceptions will lead, on the one hand, to unjustifiably complicate accounting and, on the other hand, to make it difficult for the user of financial statements to understand the information on taxation of profits presented in these statements.

An example of how a deferred tax liability is created

Important! The income tax rate and distribution by shares depend on the field of activity and the region of location of the company. The example will consider randomly selected values.

Let's imagine a hypothetical company, BukhDukh LLC. An accounting employee, by decision of his superiors, calculates depreciation in accounting using the straight-line method . However, tax accounting uses a non-linear method . The company acquired a certain fixed asset, which cost the owners 320 thousand rubles . Since its cost turned out to be more than one hundred thousand rubles, the Tax Code requires the taxpayer to depreciate this fixed asset in tax accounting.

The accountant found the depreciation period for this fixed asset in the All-Russian Classifier of Fixed Assets, and it turned out that it belongs to the tenth group (for fixed assets of this depreciation group, a useful life of 361 months - 30 years at 12 months). Recall that the accountant is instructed to use the straight-line method, and therefore depreciation will be calculated as shown below:

310,000 rub. : 361 months = 858.72 rubles/month.

The economic interpretation of the obtained value is that every month 858 rubles 72 kopecks of depreciation must be written off from the cost of the new OS. The fact that this object belongs to the tenth depreciation group implies a monthly depreciation rate of 0.7%:

310,000 rub. x 0.7% = 2170 rub.

This means that depreciation deductions in the amount of 2,170 rubles .

Let us present the obtained values in tabular form for clarity:

Let's calculate the amount of the temporary taxable difference:

2170 rub. – 858.72 rub. = 1311.28 rubles.

Let's calculate what value of deferred tax liabilities will be transferred to account 77:

RUB 1,311.28 x 20% = 262.25 rubles

(20% is the tax rate for income tax, taking into account the regional and federal shares).

The accountant will make the following entry:

Dt 68.4 “Calculations for income tax” Kt 77 – 262.25 rubles.

Transition to the balance sheet method

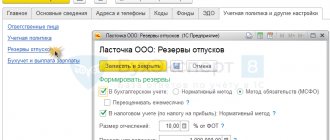

In order to switch to the balance sheet method, you need to select it in “1C” in the switch in the accounting policy from 2021. Next, you need to close the month for January 2021, and also make sure that a retrospective recalculation is not needed.

The first execution of the month-end close will bring the amounts in accounts 09 and 77 in accordance with the balance sheet data as of January 31, 2021. Such a correction may require a retrospective restatement if:

- the result of the recalculation is significant;

- the organization does not have the right to use simplified accounting methods (clause 15 of PBU 1 “Accounting Policy of the Organization”, clause 9 of PBU 22 “Correcting Errors in Accounting and Reporting”).

The essence of retrospective recalculation is that the data at the beginning of the period must be adjusted as if the new method had always been applied. To do this, after the release of reports for 2019, you need to change the accounting policy settings for 2021 and close the month for December 2021. As a result, as of 01/01/2020, the data on accounts 09 and 77 will be calculated using the balance sheet method, and the difference will be reflected in account 84 " Retained earnings".

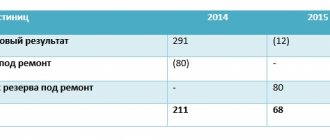

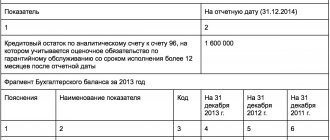

Example of formation of line 1420 “Deferred tax liabilities”

Let's analyze the situation with filling out line 1420 of the Balance Sheet using the example of a hypothetical commercial organization Smart Finance LLC. It is known that management made a decision to reflect the amount of deferred tax assets/liabilities in expanded form. The indicators for accounts 77 and 09 in the company’s accounting are as follows:

Fragment of the Balance Sheet for 2013:

If it were decided to show deferred tax liabilities/assets on a net basis:

The solution of the problem.

- If a company chooses to report the net amount of deferred tax assets/liabilities on its balance sheet:

The balance of deferred tax assets/liabilities as of December 31, 2014 will be equal to:

66 tr. – 396 tr. = -330 tr.

Since the amount of deferred tax assets turned out to be less than the amount of deferred tax liabilities, column 4 on page 1420 will indicate the amount of the excess, namely 330 tr.

Fragment of the Balance Sheet for this case:

- If the company reflects the amount of deferred tax assets (it will not roll up the balance on accounts 77 and 09):

The amount of deferred tax liabilities as of December 31, 2014 will be equal to 396 tr.

Fragment of the Balance Sheet:

How to reflect liabilities on the balance sheet (postings)

In the balance sheet of companies, deferred debts will be reflected in the Liability section of the “Long-term liabilities” section on page 1420 (if the balance on the 77th account is credit). The balance sheet rules 18/02 allow:

- show the balance on line 1420 in expanded form (you need to demonstrate the balance on Kt account 77 on line 1420 and the balance on Dt account 09 in the Balance Sheet on line 1180 of the section “Non-current assets”);

- reflect the balance in a collapsed form (you need to reduce the credit balance on account 77 by Dt account 09).

Change in deferred liability indicator (posting)

Movements by account 77 are carried out within strictly limited limits, operations can be carried out to reduce or increase the indicator:

| Operation | DEBIT | CREDIT |

| Reduction or full settlement of deferred tax liabilities | 77 “Deferred obligations” | 68.4 “Calculations for income tax” |

| Increasing the cost of debt to increase the amount of income tax | 68.4 | 77 |

| Removal of deferred tax liability from the balance sheet | 77 | 99 “Profits and losses” |

Not only the amount of debt, but also the temporary difference is subject to write-off.

Example of writing off a deferred liability (posting)

The company decided to sell its fixed asset to a partner. At the date of sale the following depreciation charges were observed:

- in accounting – 295 thousand rubles,

- in tax accounting – 387 thousand rubles.

The accountant checks the deferred tax savings in account 77:

- RUB 387,000 – 295,000 rub. = 92,000 rubles,

- 92,000 rub. x 20% = 18,400 rubles.

The following is written off from the balance sheet:

Dt 77 Kt 99 – 18,400 rubles for the amount of the deferred liability.

Support in 1C

decided to support the option of the balance sheet method based on the BMC recommendation (without taking into account permanent and temporary differences). At the same time, the existing options for using PBU 18/02 in the program remain. In 2020, in the accounting policy settings (section “Main”) of “1C: Accounting 8”, the user is given the following options for accounting for corporate income tax calculations:

- Not in progress.

- It is carried out using the balance sheet method.

- It is maintained using the balance sheet method reflecting permanent and temporary differences.

- It is carried out using the costly method (delay method).

Answers to frequently asked questions about deferred tax liabilities (line 1420)

Question: Is it necessary to recalculate deferred liabilities if the income tax rate has changed?

Answer: Yes, according to PBU 18/02, if the tax rate has changed, deferred liabilities must be recalculated again. The change in value is then reflected in the balance sheet in the year following the reporting year.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

Procedure for calculating deferred tax

1. Calculation of temporary differences:

Book value - Tax value

2. Calculation of deferred tax:

Balance of temporary differences * Tax rate

3. Formation of postings:

Deferred tax at the reporting date - Deferred tax at the beginning of the year

When performing the regulatory operation “Calculation of deferred tax according to PBU 18/02”, temporary differences are determined for each type of asset and liability - as the difference between the book value and tax value of the asset (liability) at the reporting date.

Deferred tax amounts are then calculated. Deferred tax at the reporting date is calculated as the product of the balance of temporary differences by type of asset (liability) and the current tax rate. In this case, transactions are formed based on a comparison of deferred tax calculated as of the reporting date and deferred tax calculated at the beginning of the year.

In the 1C program you can generate a certificate calculating deferred tax.