Despite the development of the global banking market, opening a ruble account abroad is not so easy. Some banks fundamentally do not work with domestic currency, others require a bunch of documents confirming the legality of the source of money.

Meanwhile, the demand for such services is still high. Deposit insurance played an important role: abroad, the amount of payments in the event of bankruptcy, revocation of a license or other unpleasant situations is much higher than in Russia.

For example, in the event of an emergency with a domestic bank, the state will return a maximum of 1,400,000 rubles. French, Austrian, German or Dutch banks will return €100,000: at the current exchange rate this is more than 7 million rubles. In the USA, the amount is even higher - $250,000 (more than 15 million rubles).

Paying an invoice in foreign currency: nuances and limitations

There are 4 ways to make paying an invoice in foreign currency as simple as possible:

- Opening a special foreign currency account in a credit (banking) organization.

- Payment without a special invoice directly to the specified addressee.

- Transfer via electronic banking system.

- Using the terminal.

When using remote banking, it is necessary to take into account the commission directly for the transaction performed, % for transferring money between wallets (for exchange transactions).

Remember, anyone can top up a card account, but you can top up a foreign currency account.

In which currency is it more profitable to open an account?

Factors that have a direct impact on the upcoming choice of currency servicing the account:

- output tools;

- service centers;

- the purpose of the account;

- price for exchange and other transactions.

When going to Europe, consider which currency is in priority in the selected country, understanding in which currency to open an account? It is better to navigate by the duration of use of the currency.

In Poland, both dollars and euros are equally useful to you, in France – dollars, in Germany – euros. The manager of the financial institution will justify several proposals and you will make significant savings.

Where to open an account in foreign currency?

You can legally open an account in foreign currency at any accredited bank. Prepare:

- Passport.

- Template statement.

- Amount for the minimum deposit.

You may need less money, but usually around $5 is required. They are the account activator and belong to the account owner. The procedure takes 2-7 minutes.

A universal account may be offered. Thanks to this, you will have trouble-free payments in foreign boutiques, shops, and salons. Remember, you must receive the appropriate card (Visa, Master Card).

Based on the law, you have the right to create several personal accounts. The use of different accounts serves as a risk diversifier and is often practiced by domestic entrepreneurs.

Converting salaries into foreign currency

Let us immediately draw attention to two important provisions of labor legislation: 1. Terms of remuneration (including the size of the tariff rate or official salary, additional payments, allowances and incentive payments) must be included in the employment contract (Part 1 of Article 57 of the Labor Code of the Russian Federation) ; 2. Payment of wages is made in cash in the currency of the Russian Federation, that is, in rubles (Article 131 of the Labor Code of the Russian Federation).

However, there is no prohibition on setting the payment in currency (for example, dollars or euros). It turns out that you can pay wages in rubles, for example, at the dollar exchange rate on the day of payment.

Risks

If we talk about risks, then it is worth mentioning one more requirement of the Labor Code of the Russian Federation: “the employer is obliged to provide employees with equal pay for work of equal value” (paragraph 6, part 2, article 22 of the Labor Code of the Russian Federation). It would seem, how does this relate to currency? However, imagine that one employee has a salary in euros, and another in rubles. With the same functionality at the end of the month, they should, in theory, receive the same amount. But if the exchange rate changes, it may turn out that ruble earnings will differ significantly.

By the way, official bodies also believe that setting wages not in rubles does not comply with labor legislation and infringes on the rights of workers (letter of Rostrud dated March 11, 2009 No. 1145-TZ). The rationale is this: a change in the exchange rate of the ruble against a foreign currency can lead to a deterioration in the employee’s remuneration conditions (for example, if the exchange rate depreciates and wages in rubles become less).

In this regard, setting wages in foreign currency is dangerous. It cannot be completely ruled out that the employer may be held administratively liable under Art. 5.27 of the Code of Administrative Offenses of the Russian Federation (which provides for fines or suspension of activities).

What to do if the account is in foreign currency, payment is in rubles?

A similar question may arise not only when settling with a regular seller, but also with a supplier during wholesale shipments. The contract may provide for various payment options convenient for legal entities.

As a rule, the technique is used during a crisis or force majeure. You have been provided with an account in foreign currency, and payment in rubles is more convenient for the company. Pay for the goods at the current rate.

A separate clause of the contract may provide for other conditions with the exchange rate fixed at a specific date. Thus, the difference in the payment amount occurs when the payment is divided into parts and does not exist when making a one-time prepayment.

An enterprise can reflect the difference in revenue in the “Amount Differences” subaccount, helping the accountant see the source of discrepancies in tax and business accounting.

Transition to payments in rubles instead of dollars. Is this real?

Due to the sharp deterioration in political relations between Russia and the West, an additional factor arose in the weakening of the already falling ruble. In an attempt to somehow prevent the negative trend, VTB head Andrei Kostin called on Russian exporters to sell their goods exclusively for rubles. According to the banker, such a measure will make it possible to use all the advantages of the ruble, which in recent years has allegedly become a completely “convertible currency.”

The economy of the Primorsky Territory, like the country as a whole, is based mainly on the export of natural resources. But if the main article of the sovereign export is hydrocarbons, then the coastal one is primarily fish and timber. Scrap ferrous metals are also moving relatively quickly abroad. “K” decided to ask representatives of the region’s export industries whether they were ready to follow the call of the head of VTB and transfer all their contracts with foreigners to rubles.

Vladimir Shcherbakov, General Director of OJSC Terneyles: “For our enterprise, I don’t see any point in switching to ruble payments. We take loans from foreign banks because... there are more favorable lending conditions compared to domestic banks. Loans abroad cost us three to four times cheaper than ruble or foreign currency loans here. Of course, loans must also be paid in foreign currency. Therefore, the requirement for foreign contractors to pay for timber supplies in rubles is akin to absurd. Although I admit that Russian state corporations, whose headquarters are in Moscow, can afford this.”

Viktor Kalinovsky, Deputy General Director of JSC Les Export: “In the 90s, barter payments with foreigners were common. We sent them raw materials, and they sent us Doshirak noodles and chicken legs. Then American dollars became the main form of payment. Negotiations are currently underway with China to use only interconvertible ruble and yuan in trade between our countries. It is possible that this will happen against the backdrop of the fact that our relations with the United States and the West as a whole are increasingly deteriorating.”

According to K, some Far Eastern companies involved in the sale of fish products abroad, in particular to China, are already switching to payments in yuan. But, unfortunately, their representatives refused to comment on the topic of this material.

Georgy Martynov, President of the Association of Fishery Enterprises of Primorye: “In principle, the transition to the ruble form of payments in the fishing industry with both domestic and foreign buyers of fish products is a good thing. But to implement this measure, an appropriate system infrastructure is required that is convenient for market players in all respects. In particular, the domestic banking system should turn its face to the fishermen. But is VTB today ready to provide loans to the industry, for example, for the construction of ships or their repair, at reasonable interest rates, without exhausting bureaucratic approvals and essentially impossible (since fishing enterprises have few such assets) requirements to secure loans with real estate in as collateral? Alas, such a situation still seems unrealistic. In general, I and many of my colleagues in the industry are in favor of making all payments in rubles.”

Konstantin Kodolev, commercial director of OJSC Dalryba: “Fish is not a product for which foreigners can be required to pay in rubles. Our country does not have a monopoly on this resource, unlike gas. Therefore, our foreign counterparties, accustomed to the dollar as a means of payment, may not want to bother buying rubles and will simply switch to other suppliers, not Russian.”

Sergey Saksin, Chairman of the Board of Directors of Preobrazhenskaya Trawling Fleet Base OJSC: “Today, Russian companies practically do not produce anything that is necessary for work and in demand by our enterprise. Therefore, the main suppliers of PBTF are located abroad, and payment of costs for maintaining the fleet (ship repair, fuel, spare parts) and the acquisition of fixed assets is carried out in foreign currency. This means that when we export our fish for rubles, we will at the same time be forced to buy dollars to pay suppliers and, accordingly, incur losses on bank commission expenses.

In addition, the company will not be insured against additional costs that will necessarily arise due to fluctuations in the ruble exchange rate. After all, for example, having sold products in the evening at one rate, the next morning we may be faced with the need to pay for the goods and services provided to us at a completely different, much higher rate. It is no coincidence, by the way, that Russian suppliers enter into contracts with us in the national currency, while tying it to the dollar exchange rate.

So, in today’s conditions, the proposal to transfer export supplies to rubles is not in the interests of the Preobrazhenskaya Trawling Fleet Base, since this will increase the costs of the enterprise and reduce the efficiency of its work.”

Andrey Neprienko, General Director of Primorsky MetalloExport LLC: “I don’t see anything bad for our company if our customers from South Korea, India and Thailand pay in rubles for the scrap metal we supply. Our contracts are short: the billing period is within a month. I don’t know, however, whether our partners will be able to get rubles for payments. And I’m not particularly sure that they will even want to bother purchasing Russian currency. But, of course, you can try.”

A COMMENT

Alexey Isakov, director of BKS Premier in Vladivostok: “From the technical side, switching with buyers of our exports to payments in rubles is quite easy and simple. But economic questions arise about the profitability of this action. Buyers are located abroad of the Russian Federation. Those. they will have to buy Russian rubles for dollars, euros, yuan, francs, etc., paying an exchange fee. And there are no guarantees that our economic partners are willing to bear additional transaction costs. In addition, the beginning of the year showed us very clearly that the ruble exchange rate, unlike the dollar and euro, for example, cannot be called stable. Are both buyers and sellers ready to bear such additional currency risks? It is difficult to give a definite answer.

It is also important to understand that prices for raw materials (oil, timber, fish, etc.) are formed on world markets in dollars and euros. Those. You will still have to first convert from the dollar/euro to your national currency, and then also to the currency of the concluded agreement. This is a rather labor-intensive process, and besides, the values will change over time, more precisely, every second, with changes in the price on the exchange. Therefore, most contracts, even if they become ruble contracts, will refer in separate clauses to world prices in dollars/euros.

We can say that every situation is unique. And if it is beneficial for all parties to the agreement to switch to settlements in one currency, then why not do it. Such situations occur in the market. However, if at least one of the factors described above works, then one of the parties to the contract may lose. And switching to alternative payments in such situations can be difficult.”

Who can make a currency transfer without opening an account?

Any citizen can make a currency transfer without opening an account in the Russian Federation. However, only non-residents can transfer foreign capital. For the latter persons, the transaction amount is unlimited.

Russians transfer foreign currency using a special foreign currency account.

For a regular internal translation, it is enough to know:

- recipient details;

- bank details;

- department number.

Remember, payments between legal entities, non-residents and residents can only be made by non-cash method.

Bank proposals for foreign currency deposits in 2021

Let's consider the offers of some banks indicating specific characteristics.

Sberbank

If a citizen is thinking about opening a deposit, then most often he initially considers Sberbank’s offers. This is the largest and most reliable bank in the Russian Federation, which offers various options for placing funds, including in foreign currency. But when choosing this bank, you need to take into account that large banks always offer the lowest profitability.

Depositors may be interested in Sberbank’s “Replenish” program. This is a universal product; funds can be placed in rubles, euros or dollars. Regardless of the currency, the deposit program options do not change. The advantage of the deposit is the possibility of regular replenishment. Moreover, by increasing the deposited amount, the investor increases the interest rate and the income becomes higher.

Program characteristics:

- to open an account you must deposit at least 100 dollars/euro;

- deposit term – 3–36 months, in euros – 1–3 years;

- replenishment of the deposit without restrictions with amounts starting from $100;

- You cannot partially withdraw funds from a deposit account;

- Interest is accrued monthly, they can be received in person and or subject to capitalization - this is chosen by the client.

The interest rate depends on the duration and amount of the deposit. The annual rate is 0.01–1.15% when opening an account at a branch of Sberbank PJSC. If you make a deposit remotely, through Internet banking, the percentage will be increased: from 0.35% to 1.45%.

The bank also offers other programs for saving funds in US dollars. You can choose the “Save” deposit, with a minimum amount of $100 and a rate from 0.01% to 1.55% (when registering online from 0.15% to 1.85%) or the “Manage” product, which requires a minimum investment of $1000 and the maximum possible percentage is 1.35%.

Rosselkhozbank

You can open a deposit in euros or dollars using the classic Rosselkhozbank program, the “Profitable” deposit. A citizen places funds for a certain period and receives money back along with accrued income at the end of the contract or every month. This program provides the same options, regardless of the placement currency. You can maintain an account in euros and dollars.

Program characteristics:

- to open a deposit, you need to deposit at least 50 $/€;

- the program can be short-term or long-term, the client chooses the period for placing money within 31–1460 days;

- replenishment operations are not provided;

- it is impossible to withdraw money from the deposit partially while maintaining the interest rate;

- The client will receive interest at the end of the deposit term or he can choose to receive income monthly.

Interest rates at Rosselkhozbank depend not only on the parameters for placing funds, but also on the method of opening a deposit. If you open a deposit remotely via online banking, the rate will be slightly higher. Also, the annual rate depends on the amount in the deposit account and the duration of the deposit chosen by the client: the longer the term, the higher the profitability. The frequency and method of receiving accrued interest affects the profitability.

If you place funds in dollars, the rate will be 0.15–3% if the investor has chosen to receive income at the end of the term, and 0.15–2.85% if the client will receive accruals monthly. When opening a deposit remotely, the rate increases by 0.5 points. If the account is kept in euros, then regardless of the frequency of receipt of income, the rate will be 0.01–0.7%. When opening a deposit remotely, the maximum rate limit is 0.75%.

Another interesting offer from Rosselkhozbank, which allows you to invest foreign currency, is the “Save for a Dream” deposit. You can deposit from $100 into your account and hope for a rate of 2.3%, or from €100 with an annual rate of 0.55%. The duration of the investment is 730 days. Other deposits that involve saving currency are “Investment”, “Replenishable”, “Comfort”.

Alfa Bank

A large private bank that also offers placement of funds in deposit accounts in different currencies. Among its programs, one can highlight the “Potential+” contribution. Its advantage is that during the placement period the client can partially withdraw funds from the account. When concluding an agreement, a minimum balance amount is assigned; up to its limit, debit transactions can be made. In addition, you can top up your account. In fact, the investor receives freedom of action; he can always make incoming and outgoing transactions.

Deposit characteristics:

- The minimum placement amount to open an account is 500 euros/dollars;

- the period is chosen by the client within 92–1095 days;

- You can top up your account with amounts starting from 200 $/€;

- partial withdrawal up to the minimum balance, the level of which is determined individually for each client;

- monthly interest accrual with further capitalization; the client receives income after the expiration of the deposit.

When maintaining an account in dollars under standard conditions, Alfa Bank will set a rate of 0.75–1.7%. If the account is opened in euros, the yield will be 0.01%. The bank offers connection of additional services as part of package offers. Connecting service packages increases interest rates. As a result, the yield on dollar deposits can reach up to 1.8%.

Another option for a foreign currency deposit is “Victory +”. The minimum contribution amount will be similar, and the interest rate, when connecting service packages, can be up to 3.03% for dollar investments, up to 0.30% for savings in euros.

Absolut Bank

For example, consider the proposal of a smaller, but still large Absolut Bank, which occupies 35th place in the rating among Russian banks. Among its programs, a good proposal for placing funds in foreign currency is the “Absolute Maximum+” deposit. This is a classic deposit option with income received at the end of the contract. Carrying out incoming and outgoing transactions is unacceptable.

Deposit characteristics:

- to open a deposit, you need to immediately deposit 1000 euros/dollars;

- there are no restrictions on the maximum amount;

- the period is chosen by the client within 91–1080 days;

- You cannot top up your account;

- You cannot withdraw money partially;

- income is paid at the end of the placement period.

Interest rates will vary depending on the length of the contract and the size of the investment. Thus, annual rates on dollar deposits fluctuate in the range of 0.8–2.2%. Interest accrued on investments in euros will range from 0.01% to 0.5%.

Paypal: account currency and conversion features

When engaging in trading on online platforms, entrepreneurs and individuals are often faced with the fact that payments are quoted only in USD.

Our compatriot has to pay twice for purchasing currency in Paypal:

- When debiting an amount from a ruble account.

- When performing a mutual settlement transaction between counterparties.

There are three ways to avoid loss:

- offer your partner another option for mutual settlement;

- write to Paypal technical support: the account currency is not identified correctly;

- include the difference in the price or receive a discount equal to the financial loss from the transaction.

Account currency designation

There are many currency classifiers. They can be global, interstate (for example, between the countries of the Customs Union), national, or sectoral. The global designation of account currency is regulated by the ISO 4217 standard. The standard establishes a three-character designation. For currencies, three letters and three numbers are used (for example, RUB and 643 for Russian currency, USD and 840 for American currency). ISO4217 is used in international transactions, as well as documents and related messages, in banking and simply commercial activities as an abbreviation. The current standard is designated ISO 4217:2008.

Transactions on a foreign currency account

Operations on a foreign currency account can be carried out by its owner or a representative (authorized representative) of the owner. These include:

- transfer of funds to another person (legal or individual);

- receiving funds from a resident or non-resident of the state;

- transfer of funds from one currency to another.

Article 9 of Law No. 173 of December 10, 2003 defines cases of legal

conducting transactions with foreign currencies between residents of the Russian Federation. Operations in other situations are considered illegal. Transactions between a resident and a non-resident are possible.

Price tags in e. or currency

Let's assume that the seller decides to indicate prices in currency or conventional units. However, information about goods (works, services) must necessarily contain the price in rubles. This is the requirement of paragraph 4, paragraph 2, art. 10 of the Law of the Russian Federation dated 02/07/92 No. 2300-1 “On the protection of consumer rights.”

At the same time, regarding the question of indicating prices in foreign currency or currency. e. there are different approaches. On the one hand, Rospotrebnadzor (Information dated December 17, 2014) does not exclude the possibility of establishing the contract price in rubles in an amount equivalent to a certain amount in foreign currency (cu).

On the other hand, there are precedents in judicial practice when indicating prices in foreign currency or currency. e. was recognized as contrary to the requirements of the legislation on the protection of consumer rights (see, for example, resolution of the Federal Antimonopoly Service of the Ural District dated March 13, 2007 No. F09-1474/07-S1). And for this, administrative liability is possible on the basis of Article 14.8 of the Code of Administrative Offenses of the Russian Federation. In this regard, setting prices in currencies or conventional units is quite risky.

Purpose of a foreign currency account

The main purpose of a foreign currency account is transactions with foreign currency. This may include accepting payments and paying for services/goods to a resident or non-resident of the Russian Federation, lending, accumulating funds, or playing on exchange rate differences. In the business sphere, it is opened for transactions with foreign counterparties, short-term lending (up to 180 days), direct or portfolio investment in business projects, as well as for other purposes.

The account can be intended only for transferring funds, or for accumulating and receiving dividends from the bank.

Types of currency accounts

There is no separate group for foreign currencies, and banks can open any accounts in rubles, dollars, and euros. The main types of foreign currency accounts are current (for individuals), settlement, budget, correspondent, deposit - for individual organizations, special. There are also trust management accounts, separate ones for courts, notaries, bailiffs, and law enforcement agencies.

Accounts for deposits are opened for storing and accounting for funds placed in the bank for the purpose of accumulating and generating income.

Bank account structure

A current account consists of 20 numbers, each of which has its own purpose. All numbers included in the number are divided into groups. A separate group reflects a certain characteristic of the account. At the same time, externally, the invoice on the payment document or in the company details looks like one long number without any spaces or dots.

If we consider the meaning of the account, it is more convenient to do this by dividing the number into groups: 111.22.333.4.5555.6666666. Each section has its own definition:

- 111 - account of the 1st order of the bank balance (using these numbers you can find out who opened the account and for what purposes);

- 22 - account of the 2nd order of the bank balance (the numbers make it clear the specifics of the account owner’s activities);

- 333 — currency in which the funds in the account are stored;

- 4 — verification code;

- 5555 - combination indicating the bank branch in which the account is opened;

- 6666666 - serial number of the bank account.

Bank accounts are opened for individuals, various organizations and government agencies. Therefore, there are very different combinations of account numbers. It is important not to make the wrong numbers when sending a payment, otherwise the funds will go to another recipient. What combinations of numbers can there be within one account? We talk about this below.

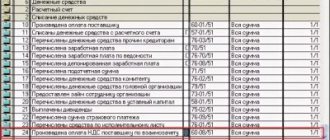

Account 52 “Currency accounts”

Account 52 “Currency accounts” is used in accounting to designate accounts opened in foreign currency and record the movement of funds on them. They are used for transactions with foreign counterparties and repayment of loans. Cash can only be used to pay for business trips abroad. With some exceptions, foreign currency accounts can only be used for transactions with residents of other countries.

Legal entities registered in the Russian Federation may have a foreign currency account in any foreign bank. Transactions on it are also recorded in reporting.

Financial reporting abroad

Ruble accounts opened outside of Russia are considered foreign. If their owner is a tax resident of the Russian Federation (that is, has lived in the country for more than 183 days out of the past 12 months), you must report to the regulatory authorities:

- report the opening and closing of an account, changes in its details;

- annually (before June 1) report on the movement of funds over the past period;

- pay 13% personal income tax on income (including interest) on foreign accounts.

Failure to comply with the requirements of the Federal Tax Service specified in Federal Law No. 173-FZ entails fines from 1,000 to 5,000 rubles, as well as possible problems with servicing foreign accounts if relevant requests are received from regulatory authorities.

CRS system: interbank information exchange

In the fall of 2021, Russia ratified all the necessary documents to participate in the information exchange program according to CRS (Common Reporting Standard) standards. This means that foreign banks are required to send information about private and commercial current, savings and investment accounts opened by Russians to the Russian tax service. Domestic banking structures do the same.

The following information is sent:

- passport details;

- TIN, BIN;

- account numbers;

- statement of balance at the end of the period (or at the time of closing);

- information about assets.

Today, information exchange occurs between 60 countries, including almost all EU states.

Foreign currency accounts of legal entities

Foreign currency accounts of legal entities can be opened in Russian or foreign banks. These include settlement, correspondent, special, deposit, and transit accounts. The main types of special accounts: “F” (for granting and receiving loans from non-residents), “P1” (for loans and borrowings, purchase and sale of securities, bills), “P2” (for sale and purchase of securities, as well as additional calculations).

A legal entity has the right to issue a line of credit in a foreign or Russian bank in foreign currency.

Sequence of actions when opening a foreign account

Once a bank has been selected, you need to study the application procedure. In some institutions, a personal visit to an office or representative office is required to talk with a bank employee, in others (Swiss, Latvian, Cyprus) all operations can be carried out remotely.

A mandatory item is filling out bank forms, as well as providing information about an individual or legal entity. Depending on the internal policy of the financial institution, the specific list of documents may vary:

- for individual entrepreneurs and legal entities - statutory documents, information about beneficiaries and counterparties, information about annual turnover, types and directions of monetary transactions, account balance;

- for individuals - documents confirming identity and place of residence, information on income, work activity, availability of accounts in Russia, certificates of family composition and lack of criminal record.

The bank has the right to collect additional information on future clients and check their connections with persons from the sanctions lists. Therefore, making a decision on opening a deposit may take up to 2 months.

Foreign currency accounts of individuals

Foreign currency accounts of individuals can be current or deposit, and if the person is an individual entrepreneur - also settlement. In addition, there are multi-currency accounts that allow you to exchange currencies without fees or delays.

They use this banking instrument to save funds, make a profit on a deposit or by playing on the difference in rates, to obtain and pay a loan, and various calculations. You can withdraw cash in rubles, after conversion at the current rate, and in some cases - in foreign currency.

Individuals also have the right to open an account in a foreign bank.

“Pitfalls” of ruble accounts abroad

The easiest way to open an account in rubles abroad is for large companies, as well as individuals with high incomes. Almost all foreign banks are ready to create individual offers for deposits of more than 15 million rubles.

With such an amount, problems will arise when transferring funds - you will have to explain to local and foreign regulatory authorities, as well as employees of a foreign bank, the origin of the money. Bankers often request other information: for example, the purpose of opening an account, the direction of transfers from it in the future, the types and volumes of planned operations, etc.

Ordinary citizens choosing banking structures of “old Europe” can be recommended multi-currency accounts in Germany, France or Italy (transactions in domestic banknotes are available through them).

Baltic banks

Financial companies in Estonia and Latvia (including subsidiaries of Scandinavian and European banking structures) are more loyal to domestic rubles. You can open current accounts and time deposits without any problems (but without high interest).

Depending on the specific bank, a new client may be offered different conditions: for example, Danske Bank in Estonia does not open a savings account for less than €5,000, and the interest rate will have to be negotiated individually. But a branch of the Swedish Swedbank in the same country promptly considers applications for opening accounts for Russians.

Note! Experts recommend taking a closer look at the branches of European banks in the Baltics. Despite Estonian or Lithuanian registration, the guarantees provided are quite European. This is the difference from “foreign” banks in our country - in the Baltics, banking institutions are registered as branches, and not subsidiaries.

It is also worth remembering that ruble (or multi-currency) accounts are more expensive to maintain: the Latvian Rietumu will charge at least €150 for opening, about €25 monthly for maintenance, and will also charge a commission of 0.5% for issuing funds in rubles.

Polish and Czech banks

The Polish branch of Deutsche Bank operates ruble accounts. True, it does not charge interest on the balance, but it also does not require a minimum balance at the end of the reporting period. Conveniently, if necessary, Russian currency can be exchanged there for any other currency - from euros and dollars to forints and yen.

In the Czech Republic, there are many more opportunities for Russian citizens: many local banks not only open accounts in rubles, but also offer interesting conditions with reasonable rates, small commissions and even interest on the balance.

For example, ERB offers from 10 to 12.5% per annum for a deposit of 100,000 rubles (depending on the urgency), and for a deposit of 500,000 rubles - from 12% to 14.5%. Raiffeisen Bank opens accounts for a year, does not require a minimum amount, but practically does not charge interest.

Important! According to European laws, the Czech and Serbian “subsidiaries” of Sberbank are local banks, not Russian. Therefore, if there are no other options, you should not refuse.

![My business [CPS] RU](https://nvvku.ru/wp-content/uploads/moe-delo-cps-ru-330x140.jpg)