Advantages and disadvantages of contribution to net assets

A contribution to increase net assets (NA) is one of the tools for tax-free transfer of property in business, enshrined in paragraphs.

3.4 clause 1 art. 251 Tax Code of the Russian Federation. But like other tools, it has its advantages and disadvantages. For ease of understanding, we list them:

- Any participant in the company can make a contribution to net assets: a legal entity or an individual, regardless of the size of the share in the authorized capital (for comparison: a contribution to property on the basis of paragraph 11, paragraph 1, Article 251 of the Tax Code can only be made by a participant with a share of more than 50%) ;

- when contributing to a private equity fund, there are no restrictions on the subsequent disposal of property within a year from the date of transfer (the one-year limit is established by clause 11, clause 1, article 251 of the Tax Code);

- property, as well as property and non-property rights (including rights of claim under a loan, etc.) having a monetary value can be transferred;

- however, only a participant/shareholder can make a contribution in order to increase the NAV (a “child gift” is not possible - transfer of property from a subsidiary to the parent company);

- this instrument is applicable only to business partnerships and companies (JSC, LLC, etc., but not applicable to production cooperatives, business partnerships);

- When investing in a private equity fund, there is no increase in the authorized capital of the company.

Let's look at how this tool can work successfully using the example of a case study by experts from the taxCOACH Center for the retail sector.

Let's imagine a business that is conducted within a Group of companies. Retail stores are independent legal entities (and the area of each store allows the use of UTII). However, what about the profit of each operating point? You can use the contribution to the Cha that we already know! Retail companies establish a legal entity (let's designate it as an investment center) and make agreed funds received from the sale of products as contributions to property in order to increase the net value. There is no need to pay income tax and the investment center can freely manage the participants’ money, for example, by investing it in new areas of activity.

Thus, contributions to the company’s net assets are not taxed on the income of the receiving party (in this case, the debt in the form of the amount of interest on the loan, written off by debt forgiveness, on the basis of paragraph 18 of Article 250 of the Tax Code of the Russian Federation is subject to inclusion in the non-operating income of the debtor organization) .

Net worth: essence

Consists of various sources of capital that are mobilized by the participants of the institution and are their property. They are then transferred to the legal entity and become their own capital.

Based on the available funds, the need for capital to perform production activities or provide services is determined. It all depends on the field of activity of the enterprise. The main condition for normal functioning should be rational distribution without prejudice to work on other items.

Own capital - acts in the form of funds that are invested in current and non-current assets to maintain economic employment.

It may decrease or increase with the profitability of the enterprise or depend on changes in the composition of owners. It is the difference that is calculated between the total capital and all liabilities of the enterprise.

The structure of equity capital includes:

- Statutory.

- Share.

- Additional.

- Spare.

- Profit.

- Funds to cover future expenses.

This also conventionally includes targeted financial revenues that are transferred from government sources.

What if you transfer not money, but property?

But what will happen if a participant, for example a company on the OSN, transfers not money, but property as a contribution to the private equity?

Is this transaction subject to VAT? Yes and no. In the sense that the transferring party (if it is on the general taxation system) must restore VAT on the residual value of the property. In this case, the restored value added tax can be included in expenses. But the receiving party will not be able to deduct VAT, since it did not pay money for this property, because a contribution to property is a type of gratuitous transfer. So you can’t do without a fly in the ointment...

Now let's see what's interesting about using this tool in legal disputes.

How to make a payment

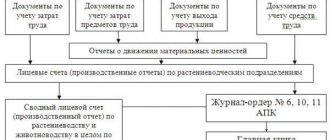

It should be taken into account that calculating net assets using the formula is not enough. This fact needs to be documented. Meanwhile, there is currently no legally approved document form for these purposes. Therefore, firms are required to develop their own form and adopt it as an addition to their accounting policies.

However, previously there was an order of the Ministry of Finance No. 10n and the Federal Commission for the Securities Market of the Russian Federation No. 03-6/pz dated January 29, 2003 with a similar form for joint-stock companies. Although it is no longer valid, any business can use it as a guide when developing their own uniform.

Arbitrage practice

Judicial practice on challenging tax authorities' application of benefits by paragraphs.

3.4 clause 1 art. 251 of the Tax Code of the Russian Federation is not very extensive. The main thing that tax authorities pay attention to is the reality of the transactions performed. Naturally, the actions of the parties must have a business goal, which is to improve the financial condition of the company. An increase in net assets and an increase in the profitability of the founder may indicate this. At the same time, the courts pay attention to the reality of the increase in the taxpayer’s net assets. For example, sending case No. A22-4288/2015 for a new trial to the court of first instance, the cassation court ordered the lower court to examine the taxpayer’s accounting and tax documentation confirming (or refuting) the actual increase in his net assets, and the reflection of this operation in the company’s balance sheet for the corresponding calendar year.

In another example, the tax authority challenged the reality of the founder’s contribution to net assets, which was stated to be the right of claim against the taxpayer purchased from the creditor (No. A53-31131/2015). The courts supported the tax authority that initially the services were provided fictitiously, in order to inflate VAT deductions, and the accumulated accounts payable were assigned to the founder only for show. Thus, the taxpayer tried to avoid non-operating income in the amount of unclaimed (bad) accounts payable.

Results

The amount of net assets is one of the most important indicators of the financial viability of an organization. The higher it is, the more successful the organization and the more attractive it is for investment. Only an organization with high net assets can guarantee the interests of its creditors. This is why it is necessary to be very careful when assessing the value of a company's net assets.

Sources:

- Order of the Ministry of Finance of Russia dated August 28, 2014 No. 84n

- Federal Law of 02/08/1998 No. 14-FZ “On Limited Liability Companies”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

More controversial points

Another controversial point in practice arose in connection with the transfer by a participant to the company on the basis of paragraphs.

3.4 clause 1 art. 251 of the Tax Code of the Russian Federation gratuitous right to use the property belonging to him. As the courts have indicated, supporting the position of the tax authorities, the property to which the right of use has been transferred must be accounted for separately from the organization’s own property in an off-balance sheet account (paragraph 2 of clause 5 of PBU 1/2008, Instructions for the use of the Chart of Accounts). Therefore, this property does not increase the organization's net assets. In this regard, income from the gratuitous temporary use of the property of a participant (shareholder) must be taken into account as non-operating on the basis of clause 8 of Art. 250 Tax Code of the Russian Federation. (See cases No. A66-9803/2015; A50-24058/2015). Finally, what happens if the founder decided to contribute to the private equity company, but at the time of the actual transfer of funds managed to withdraw from the membership? Such a dispute took place in court practice and ended in favor of the taxpayer! Let us note that the decision to contribute to the property in order to increase the NA was made by the only participant before he left the company. Whereas the contribution of 10 million rubles (in two tranches) was transferred two months after the composition of the LLC’s participants changed.

As the court of first instance indicated, the obligation to contribute to the property of the company, accepted by its sole participant, had to be fulfilled by this participant even if he alienated his share. The Court of Appeal, on the contrary, supported the tax authorities, insisting that the funds received by the taxpayer from the former participant were gratuitously received property.

The cassation court put an end to this dispute, in its opinion, the participant’s obligation to provide financial assistance to the company does not pass to the acquirer of the share, and the moment of the actual transfer of the amount of money to the taxpayer does not change the qualification of this contribution as income of the taxpayer received in the form of property transferred by the participant of the economic society in order to increase net assets (see case No. A40-21501/2014). Unfortunately, there is no more detailed information about the details of the transaction for the alienation of a participant’s share in the case materials (which would make it possible to assess whether the position of the cassation court in this case is an isolated case or this decision is justified).

The Ministry of Finance of the Russian Federation, meanwhile, takes the opposite position and regards the contribution of a former participant as non-operating income: if on the date of concluding the agreement on debt forgiveness (consider the date of making the contribution, and not making a decision about it) the person was not a participant in the company, then the benefit income tax does not apply.

Main differences

The main distinguishing feature of the two indicators will be assessment methods , which are developed taking into account individual characteristics.

One of the popular methods that helps estimate the value of an enterprise or business is the net asset method. It is based on the fact that the price of the enterprise will be equal to their price and considers it together with the costs incurred.

market and book value . Due to various fluctuations in the economy associated with such phenomena as inflation, changes in the behavior of subjects in the market, and an incorrectly selected accounting method, it is impossible to talk about their compliance.

As a consequence of this, there is a need to regulate the balance sheet of the enterprise, which is carried out in several stages:

- Preliminary analysis related to the reasonableness of the market value of all assets on the balance sheet.

- Determine the correspondence between the balance sheet amount and its market value.

- Calculate current liabilities from the principal market value of total assets.

The advantage of this method: it refers to the quote of assets that already exist. It is not subjective and is more transparent. But due to its persistence, it misses the assessment of the level of profitability and development prospects.

Regarding the cost of equity method, it is worth saying that it is used in financial statements, which are consolidated. It will also help to consider all lost profits, but then you should take into account the circumstances due to which the individual components are formed.

One of the most difficult points in working with the methodology is to set the price of share capital . This is due to the owners of the purchased shares, who expect to receive income after the net profit is distributed among the owners of the securities. The amount received for such owners is fixed. Since income from shares is expected to be received at the very last moment, this indicator is not fully known.

The method is the basis for the formation of various models that take part in the analysis of the company. These include: discounted cash flow model, economically added value.

Conclusion

Thus, in decisions of general meetings of participants and shareholders of organizations, do not forget to indicate that the transfer of property is carried out on the basis of paragraphs.

3.4 clause 1 art. 251 of the Tax Code of the Russian Federation precisely in order to increase net assets (so that the tax authorities have no reason to doubt the essence of the transaction). Remember: having forgiven a debt to the company, its new participant should not immediately leave the shareholders (participants). Otherwise, the tax authority will say that the lender did not intend to participate in the company’s activities and receive profit from this activity, and his only goal in entering the business was to forgive debt and exclude taxation for the company.

Place of the enterprise's net assets in the balance sheet

To see where net assets are on the balance sheet , you need to look at the eponymous Section 3 of the Statement of Changes in Equity. It looks like this:

As you can see, net assets on the balance sheet are a special separate indicator. According to the order of the Ministry of Finance dated July 2, 2010 No. 66n, the code for the line of net assets in the balance sheet is 3600.

Also see “Balance Sheet 2021: Due Date.”

How to calculate net assets on a balance sheet

To obtain the necessary information, you can use not only the net assets formula, but also calculate them line by line when the balance sheet has already been compiled.

Here's how to calculate net assets based on balance sheet lines :

| Option 1 | Line 1300 + Line 1530 – Line 1170 (debts of participants on deposits in the management company) |

| Option 2 | Line 1600 – (Line 1400 + Line 1500) + Line 1530 – Line 1170 (debts of participants on deposits in the management company) |

Analysis of the result

Obviously, after calculating the net asset value, it is desirable to obtain a positive result. Negative net assets will indicate that:

- the company does not make a profit;

- with a high probability of becoming bankrupt in the near future.

The only exception is a company that has not been open for a very long time, since during its existence the invested resources have not yet had time to pay for themselves due to understandable circumstances.

So after calculating net assets according to the lines of the balance sheet , we can talk about the economic condition of the enterprise.

Note that when calculating and assessing the net assets of an enterprise, the authorized capital of the organization occupies a significant place in the balance sheet (see table).

| № | Situation | Analysis |

| 1 | The amount of the organization's net assets is greater than the authorized capital | This indicates the good health of the organization |

| 2 | Net assets are less than the authorized capital | The company is unprofitable |

Let us emphasize: situation No. 2 is acceptable only for the first year of the company’s operation. If, after time, the situation does not change in a positive direction, management should reduce the volume of capital down to the value of net assets.

You should consider closing a business if the size of your net assets is equal to or less than the minimum required by law.