Introductory information

Modern VAT verification is a cross-check of suppliers and buyers participating in the same transaction.

Tax officials study the information entered in the purchase books and sales books, and in case of intermediary transactions, also in the journal of received and issued invoices. If the data for all counterparties is consistent, the inspectors admit that there were no violations. Otherwise, the transaction falls into the category of suspicious with all the ensuing consequences (read more about this in the articles “VAT “under the hood”, or a general cameral” and “VAT return for the 3rd quarter: what the tax authorities will check and how to avoid common mistakes when filling out the declaration"). Carry out automatic reconciliation of invoices with counterparties

As part of cross-control, inspectors, among other things, study such details as the type of operation code (KVO). The list of codes was approved by order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3 / [email protected] (see “From July 1, new transaction codes will need to be indicated in the books of purchases, sales and the invoice journal”).

The commented letter describes what values of the KVO and other “key” details must be indicated when transferring (receiving) an advance payment and when changing the initial delivery price. Let us dwell on each of these cases (we assume that suppliers and buyers are VAT payers and are not exempt from the obligations associated with the payment of this tax).

Filling out a purchase book when shipping goods after receiving an advance payment from the buyer

How to correctly fill out the buyer's advance in the purchase book for the first quarter of 2015, which was indicated in the sales book in the fourth quarter of 2014? The goods were shipped in the first quarter of 2015. Which columns should be filled in and what should be indicated correctly?

In accordance with paragraph 1 of Art. 168 of the Tax Code of the Russian Federation in case of receipt

taxpayer of

the amounts of payment, partial payment on account of the upcoming supply

of goods (performance of work, provision of services), transfer of property rights realized on the territory of the Russian Federation,

the taxpayer is obliged to present to the buyer of

these goods (work, services), property rights

the amount of tax

calculated in the manner established

clause 4 art.

164 Tax Code of the Russian Federation .

Upon receipt of payment amounts, partial payment

for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights,

appropriate invoices are issued no later than 5 calendar days

, counting

from the date of receipt of payment amounts

, partial payment for upcoming deliveries.

Upon receipt of funds in the form of payment, partial payment

for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights

, sellers register in the sales book invoices issued to the buyer

for the received amount of payment, partial payment (clause 17 of

the Rules for maintaining the sales book used in VAT calculations

, approved Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137).

Tax amounts calculated

the taxpayer

from the amounts of payment, partial payment

received on account of upcoming supplies of goods (work, services)

are subject to deductions

(

clause 8 of Article 171 of the Tax Code of the Russian Federation

).

These deductions are made from the date of shipment of the relevant goods

(performance of work, provision of services), transfer of property rights in the amount of tax calculated from the cost of goods shipped (work performed, services rendered), transferred property rights, in payment of which the amount of previously received payment, partial payment according to the terms of the contract (if any) such conditions).

Clause 22 of the Rules for maintaining a purchase book used in VAT calculations

, it has been established that

invoices registered by sellers in the sales book upon receipt of the payment amount, partial payment

for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights,

are registered by them in the purchase book upon shipment of goods

(performance of work, provision of services) services) against the received payment amount, partial payment indicating the corresponding VAT amount.

That is, entries in the sales book for the amount of the prepayment are transferred to the purchase book

.

You deduct VAT on your invoice

, issued to the buyer upon receipt of the advance payment.

This invoice lists you as the seller, not the buyer.

.

Therefore, in the line “Buyer”

You must

indicate the name of the real buyer

who transferred the advance to you.

In column 12 “Name of the seller”

You will indicate your name (full name of an individual entrepreneur).

Also in the column “TIN/KPP of the seller”

You will indicate

your details

.

According to clause 5.1 of Art. 169 of the Tax Code of the Russian Federation in the invoice

, issued upon receipt of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights,

must indicate

:

1)

serial number and date of invoice;

2)

name, address and taxpayer and buyer identification numbers;

3)

payment and settlement document number;

4)

name of the goods supplied (description of work, services), property rights;

4.1)

name of currency;

5)

amount of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights;

6)

tax rate;

7)

the amount of tax imposed on the buyer of goods (works, services), property rights, determined based on the applicable tax rates.

You do not fill out columns

: 4, 5, 6, 7, 8, 11, 12, 13.

In column 3

You will indicate the number and date

of your invoice

recorded in the sales ledger.

In column 15

indicates

the transferred amount of payment, partial payment on the invoice

, including VAT.

In column 16

–

the amount of VAT on the invoice, accepted for deduction

in the current tax period.

Prepayment

Transfer of advance payment

Upon receipt of an advance payment, the supplier must issue an “advance” invoice and charge tax payable to the budget. Based on the “advance” invoice, the buyer will be able to deduct the tax on prepayment. This follows from paragraph 9 of Article 172 of the Tax Code of the Russian Federation. The “advance” invoice is registered:

- in the supplier's sales book with code KVO 02;

- in the buyer's purchase book with code KVO 02

Shipment of goods against advance payment

After the seller makes a delivery on account of the advance received previously, he has the right to deduct VAT on the prepayment (clause 8 of Article 171 of the Tax Code of the Russian Federation). In this regard, the “advance” invoice is registered in the supplier’s purchase book with code KVO 22.

As for the buyer, he is obliged to restore the deduction that was previously accepted on an advance payment (subclause 3, clause 3, article 170 of the Tax Code of the Russian Federation). In this regard, the “advance” invoice is registered in the buyer’s sales book with code KVO 21. This entry in the sales book is made in the period when the delivery took place (and not in the period when the prepayment was transferred).

Also, when shipping goods (performing work, providing services) as an advance payment, the supplier must issue a “regular” invoice for sales. This document is registered: - in the supplier’s sales book with code KVO 01; - in the buyer’s purchase book with code KVO 01.

Example 1

In the second quarter of 2021, Buyer LLC transferred an advance payment in the amount of RUB 291,000 to the account of Supplier LLC. on account of future delivery of goods (the transfer was executed by payment order No. 7879 dated June 17, 2016).

Having received the money, the “Supplier” issued an “advance” invoice No. A100010331 for the amount of RUB 291,000, incl. VAT 18% in the amount of RUB 44,389.83. This document was registered with the “Supplier” and the “Buyer” (see Table 1).

Table 1

Registration of “advance” invoice No. A100010331

| In the sales book for the 2nd quarter of 2021 from Supplier LLC | |||||

| Column name | Operation type code | Buyer's name | Number and date of the document confirming payment | Sales cost on the invoice, cost difference on the adjustment invoice (including VAT) in the invoice currency in rubles and kopecks | The amount of VAT on the invoice, the difference in value on the adjustment invoice in rubles and kopecks, at the rate 18 percent |

| Column number | 2 | 7 | 11 | 13b | 17 |

| Meaning | 02 | LLC "Buyer" | 7879 from 06/17/2016 | 291 000,00 | 44 389,83 |

| In the purchase book for the 2nd quarter of 2021 from Buyer LLC | |||||

| Column name | Operation type code | Number and date of document confirming tax payment | Seller's name | Cost of purchases according to the invoice, difference in cost according to the adjustment invoice (including VAT) in the invoice currency | The amount of VAT on the invoice, the difference in the amount of VAT on the adjustment invoice, accepted for deduction, in rubles and kopecks |

| Column number | 2 | 7 | 9 | 15 | 16 |

| Meaning | 02 | 7879 from 06/17/2016 | LLC "Supplier" | 291 000,00 | 44 389,83 |

In the third quarter of 2021, the “Supplier” shipped the goods to the “Buyer” against the prepayment received. The cost of delivery was 177,000 rubles. (including VAT 18% - 27,000.00). The “Supplier” reflected this shipment in the “regular” invoice No. 10331. This document was registered with the “Supplier” and the “Buyer” (see Table 2).

table 2

Registration of “regular” invoice No. 10331

| In the sales book for the 3rd quarter of 2021 from Supplier LLC | |||||

| Column name | Operation type code | Buyer's name | Cost of sales according to the invoice, difference in value according to the adjustment invoice (including VAT) in the currency of the invoice in rubles and kopecks | The cost of taxable sales according to the invoice, the difference in value according to the adjustment invoice (excluding VAT) in rubles and kopecks, at the rate 18 percent | The amount of VAT on the invoice, the difference in value on the adjustment invoice in rubles and kopecks, at the rate 18 percent |

| Column number | 2 | 7 | 13b | 14 | 17 |

| Meaning | 01 | LLC "Buyer" | 177 000,00 | 150 000,00 | 27 000,00 |

| In the purchase book for the 3rd quarter of 2021 from Buyer LLC | |||||

| Column name | Operation type code | Seller's name | Cost of purchases according to the invoice, difference in cost according to the adjustment invoice (including VAT) in the invoice currency | The amount of VAT on the invoice, the difference in the amount of VAT on the adjustment invoice, accepted for deduction, in rubles and kopecks | |

| Column number | 2 | 9 | 15 | 16 | |

| Meaning | 01 | LLC "Supplier" | 177 000,00 | 27 000,00 | |

Also, the “Supplier” accepted for deduction the tax accrued on the prepayment, and the “Buyer” restored the deduction accepted on the prepayment. In this regard, the “advance” invoice was re-registered with the “Supplier” and with the “Buyer” (see Table 3).

Table 3

Re-registration of “advance” invoice No. A100010331

| In the purchase book for the 3rd quarter of 2021 from Seller LLC | |||||

| Column name | Operation type code | Seller's name | Cost of purchases according to the invoice, difference in cost according to the adjustment invoice (including VAT) in the invoice currency | The amount of VAT on the invoice, the difference in the amount of VAT on the adjustment invoice, accepted for deduction, in rubles and kopecks | |

| Column number | 2 | 9 | 15 | 16 | |

| Meaning | 22 | LLC "Supplier" | 291 000,00 | 27 000,00 | |

| In the sales book for the 3rd quarter of 2021 from Buyer LLC | |||||

| Column name | Operation type code | Buyer's name | Cost of sales according to the invoice, difference in value according to the adjustment invoice (including VAT) in the currency of the invoice in rubles and kopecks | The cost of taxable sales according to the invoice, the difference in value according to the adjustment invoice (excluding VAT) in rubles and kopecks, at the rate 18 percent | The amount of VAT on the invoice, the difference in value on the adjustment invoice in rubles and kopecks, at the rate 18 percent |

| Column number | 2 | 7 | 13b | 14 | 17 |

| Meaning | 21 | LLC "Buyer" | 291 000,00 | 150 000,00 | 27 000,00 |

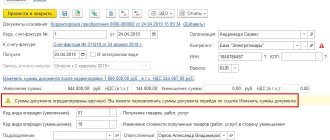

Invoice for advance payment in the purchase book in 1C

Hello!

Purchase book, offset of advances from buyers, code 22. Should column 8 “Date of registration of goods (work, services), property rights” be filled in or not? Now it is not filled in in 1C, but I look at old examples and it was filled in with the date of implementation.

It is clear that changes have been made - I would like to understand the reason. Based on what standards and recommendations? Or is it a release bug.

I searched for information on the Internet myself and found the following recommendations from consultants. I read all the links and points, but there is nothing specific in them - only general phrases that do not clarify the situation, i.e. it is not clear why such a conclusion should not be filled out. Previously, these points were in the same wording and column 8 was filled out in the program.

“As for the declaration, the deduction of VAT from the advance payment is reflected in line 170 of section 3, as well as in section 8 of the declaration (clause 3, 38.13, 45 of the Procedure for filling out the VAT declaration, approved by Order of the Federal Tax Service of Russia dated October 29, 2014 N MMV-7 -3/ [email protected] ).

In the purchase book, in column 2 the code “22” is indicated (Appendix to the Letter of the Federal Tax Service of Russia dated January 22, 2015 N GD-4-3 / [email protected] ), in column 3 - the number and date of the invoice for the advance payment (clause 22 (Clause 22 of the Rules for maintaining a purchase book, approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137), columns 7 and 8 are not filled in (clause “k” of Clause 6 of the Rules for maintaining a purchase book; Clause 6 of Article 172 of the Tax Code of the Russian Federation ), the details of your company are indicated in columns 9 and 10. When applying for a VAT deduction from an advance payment during the period of shipment of goods, the number and date of the invoice issued upon receipt of the advance are indicated in the purchase book, and the details of the invoice for the shipment of goods in the sales book are not are indicated (clause 22 of the Rules for maintaining a purchase book used in calculations of value added tax, approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137).”

Thank you!

Please rate this question:

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

You might be interested

Publication date: Jan 21, 2017

Please rate this article:

When there is no need to charge VAT on advances received

A taxpayer may not charge VAT on an advance received in the following cases:

- when receiving an advance on non-taxable transactions (Article 149 of the Tax Code of the Russian Federation);

- if advances are made for operations the place of implementation of which is not the territory of the Russian Federation (Article 147, Article 148 of the Tax Code of the Russian Federation);

- the seller does not pay VAT as a “special regime” (Chapter 26.1–26.5 of the Tax Code of the Russian Federation);

- the seller is exempt from paying VAT (Articles 145 - 145.1 of the Tax Code of the Russian Federation);

- an advance payment was made for transactions with a VAT rate of 0% (clause 1 of Article 164 of the Tax Code of the Russian Federation);

- the advance payment is transferred for operations for which a long production cycle is provided - more than six months (clause 13 of article 167 of the Tax Code of the Russian Federation).

For information about who is not considered a VAT payer, see the material “Who is a VAT payer?”