Reflection of estimated liabilities in accounting is mandatory. Most often, accountants record a reserve for vacation pay. But this is not the only case where the obligations in question need to be taken into account. They are recorded only in reporting. The reserves will not appear on the tax return.

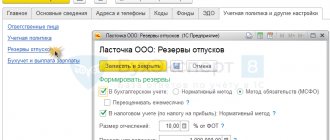

Question: How are the organization's estimated liabilities reflected in accounting and financial statements in connection with the emergence of employees' right to paid vacations in accordance with the legislation of the Russian Federation? According to the accounting policy of the organization, the formation of an estimated liability for payment of vacations to employees is carried out monthly on the last day of each month based on data on average earnings and the number of vacation days for each employee. Administrative expenses as semi-fixed expenses are recognized in the cost of sales in the period of their acceptance for accounting. In tax accounting, the organization does not create a reserve for upcoming vacation payments. View answer

What is an estimated liability?

Provisions are an existing obligation of an enterprise that has an uncertain amount or deadline. If available, a reserve must be created.

If the indicator does not appear in the reporting, this will lead to an overstatement of net profit. For this reason, financial statements will not provide objective information about the position of the enterprise. All this can lead to negative consequences: an increase in dividends and a deterioration in the financial condition of the organization.

Are provisions for doubtful debts classified as provisions?

Estimated liabilities differ significantly from other provisions. Let's look at examples:

- The company plans to repair equipment; this will require funds. A reserve of estimated liabilities will not be created for them, since repair work is not the responsibility of the organization. The company may change its mind about carrying out repairs.

- The reserve also does not need to be organized in the presence of ordinary obligations. The company ordered the goods. The products arrived, but the company did not pay for the contractor’s services. In this case, a reserve for estimated liabilities will not be created, since the existing debt is payable. It does not correspond to an important feature of an estimated liability - uncertainty of the amount and timing. In this example, the company knows how much money it owes and when it needs to be repaid.

- Estimated liabilities and estimated provisions differ. The latter represent an adjustment to the balance sheet indicators of assets associated with the receipt of new information. Valuation reserves are created in the presence of doubtful debts, a decrease in the value of inventories, and a decrease in prices for financial deposits. These indicators are not reflected in the balance sheet. The indicators under consideration will be recorded in the liability side of the balance sheet.

- Provisions that are created on the basis of undistributed earnings will also not be classified as provisions.

Difficulties often arise when fixing OO. To prevent errors, it is important to distinguish an estimated liability from other types of provisions.

Are estimated liabilities reflected in tax accounting ?

Methods for calculating vacation obligations

The company creating the vacation reserve is free to choose the methodology for calculating the amount of the vacation obligation. The only requirement is that the algorithm used must provide the most reliable result.

Among the techniques that have become widespread in practice are (for example):

- regulatory method (tax) - calculation of contributions to the reserve is carried out according to the rules of the Tax Code of the Russian Federation (Article 324.1 of the Tax Code of the Russian Federation);

- IFRS method (see example below);

- proportional method - it is based on the following scheme: for the first month worked after vacation or hiring, the company's obligation to the employee is approximately 1/11 of the salary accruals; similarly, at the end of subsequent months worked, the vacation obligation is calculated in proportion to the number of months worked: 2/11 , 3/11, 4/11, etc.;

- average daily (group or individual) method - the amount of vacation obligation is calculated for a group of employees or individually for each of them based on the number of earned unused vacation days for each reporting date and the amount of average daily earnings.

Let's look at an example of how to calculate the vacation liability using the IFRS method.

Example

The structure of Winsor LLC has 3 divisions:

- administrative and economic (AHP);

- production and technical (PTP);

- supply and sales (SSP).

The accounting policy of Winsor LLC establishes:

- the volume of contributions to the reserve for vacation pay is determined based on the salary accruals of each department (including insurance premiums);

- accruals to newly hired and resigned employees during the month are not included in the calculation;

- each month worked in full entitles the employee to 2.33 days of annual paid leave;

- the amount of contributions to the reserve is determined monthly, which allows you to take into account all salary changes (increase or decrease in salary);

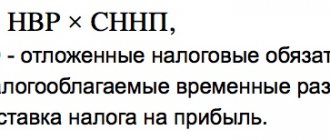

- formula for calculating contributions to the reserve for each division (OD):

OR = (payroll + insurance premiums per month) / 28 × 2.33.

For example, on October 31, entries were made in the accounting of Winsor LLC related to salary accruals and deductions to the vacation reserve:

| Debit | Credit | Amount, rub. | Decoding the wiring |

| 26 | 70,69 | 478 956 | Salaries accrued to AHP employees |

| 20 | 70,69 | 1 437 237 | Salaries accrued to PTP employees |

| 44 | 70,69 | 321 523 | Salaries accrued to SSP employees |

| 26 | 96 | 39 856 (478 956 / 28 × 2,33) | A reserve has been accrued for vacation pay for AHP employees |

| 20 | 96 | 119 599 (1 437 237 / 28 × 2,33) | A reserve has been accrued for vacation pay for PTP employees |

| 44 | 96 | 26 755 (321 523 / 28 × 2,33) | A reserve has been accrued for vacation pay for SSP employees |

For an example of calculating the vacation reserve in another way, see the material “Reflection of the reserve for vacation pay in accounting.”

Whether it is possible to use the reserve created in accounting to pay for vacation provided in advance or to pay for study leave, find out in the ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Find out in the next section whether it is possible to make vacation booking easier.

The emergence of estimated liabilities

Estimated liabilities may arise due to the following factors:

- Court decisions or agreements with relevant conditions. For example, a company enters into an agreement with its clients, according to which, if services are provided with insufficient quality, the money will be returned. Customers usually have complaints, so it makes sense to create a reserve. These will be estimated liabilities, since there is a high probability of their occurrence, but the exact amount is unknown.

- Actions that are not recorded in legal documents, but oblige the company to certain obligations. For example, a store posted an announcement that it would return money to customers if the purchased products turned out to be of poor quality. Despite the fact that this obligation is not formalized in any way, the store bears its consequences in connection with a public statement.

- A reserve has been formed for restructuring. It can be created only if the following conditions are met: there is a restructuring plan, interested parties are notified about the procedure.

- A deliberately unfavorable agreement was concluded. The company's managers are confident that they will suffer losses in connection with it. The LLC must be reflected in accounting in the same month in which the agreement is executed.

What are the features of inventory of estimated liabilities ?

Estimated liabilities are indicated in accounting only if the following conditions are met:

- Financial obligations cannot be avoided. For example, a company rents premises that, according to the lease agreement, need to be renovated. While repair work has not yet been carried out, it cannot be avoided.

- The probability of incurring expenses exceeds 50%.

- There is information that allows you to estimate the costs of fulfilling the obligation.

To form a reserve, all of the above conditions must be present. If one of them is not met, a contingent liability is recognized. This indicator does not need to be recorded. It is stated in the notes to the report.

Results

In accounting, reserves are formed for the purpose of reliable assessment of assets and the need to provide users with real reporting data on the company's liabilities. Methods for the formation of reserve amounts for accounting purposes are not regulated by law, so they must be developed independently.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting for estimated liabilities

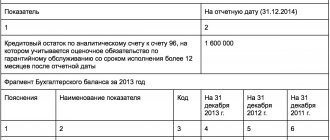

Estimated liabilities are recorded on account 96 “Reserves for future expenses”. The amount may be reflected both in the list of specific expenses (for example, expenses for repairs under warranty) and in the list of other expenses.

OO accrual transactions will look like this:

- DT 20 (23, 25, 26, 44) CT 96 “Reserves for future expenses”

Repayment of obligations will be reflected as follows:

- DT 96 “Reserves for future expenses” CT 10, 76, 70, 90

The selected accounts are determined by the transaction performed.

Example

The company is involved in litigation. It is expected that he will have to pay 80,000 rubles. This will be reflected as follows:

- DT 76 “Settlements with various debtors and creditors” CT 96 “Reserves for future expenses”

A court decision has been received. The company's calculations did not come true. The organization will need to pay 100,000 rubles. The operation can be reflected as follows:

- Repayment of OO: DT 96 “Reserves for future expenses” CT 76 “Settlements with creditors”, subaccount “Settlements for claims”. The transaction amount is indicated: 20,000 rubles.

- Amount that needs to be paid additionally: DT 91 “Other income and expenses”, subaccount “Other expenses” KT 76, subaccount “Calculations for claims”. The amount that needs to be paid is indicated: 20,000 rubles.

All specified transactions must be confirmed by primary documentation. From the accounting it is possible to clearly understand which transactions were carried out.

Background to the creation of IAS 37

Before IAS 37 came into force on 1 July 1999*, there was no clear regulation of provisions or provisions in international accounting. But in practice, companies quite often created accruals that reduced an asset or increased a liability. Accruals represented reserves for the management needs of the company, which could be created in one reporting period and abolished in the next at the discretion of management. Such manipulations made it possible to “even out” net profit for further reporting to company owners or potential investors.

*In April, the International Accounting Standards Board approved IAS 37, which was originally published in September 1998. The standard partially replaced sections of IAS 10 “Contingencies and Events” Occurring after the Balance Sheet Date”), released 1978.

Companies have developed many proprietary approaches to calculating and assessing such accruals, which often reduces the comparability of the reporting of companies (or Groups of companies) of a single industry. In Russian accounting practice, the standard came into force on January 1, 2018, and before that, IFRS (IAS 37) could be used for internal management reporting or for the purpose of transformation from RAS.

In order to create a positive image, manage customer loyalty, or simply operationally manage their business, companies often resort to public statements about refunds, warranty repairs, or compensation payments. And at the legislative level, the state can impose requirements on businesses to perform work, for example, to restore environmental objects or build infrastructure during the construction of residential buildings, etc. All of the above, one way or another, will lead to the fact that the organization will have to perform or pay something in the future. Before the standard appeared, it was not always obvious how to deal with such information:

- Should the notes (notes) to the financial statements describe the likelihood of these expenses, but not reflect them in the financial statements?

- Should these expenses be recognized immediately in full in the reporting period or accrued annually while the enterprise/plant/company is in operation?

- Or is it not worth mentioning such expenses, since their occurrence is a matter of the future, which is not yet directly related to current operating activities?

Is it necessary to reflect estimated liabilities in tax accounting?

Lack of information about a PA in tax accounting is not an error. You do not have to indicate reserves, as they do not affect the amount of taxes assessed. This information will not be required by the tax authorities. But it will be useful to banking institutions to which the enterprise applies, or to its investors.

Summary

Estimated liabilities require the creation of a reserve. In order for obligations to be recognized as valuation obligations, they must meet a number of conditions. The main signs are the inability to determine the exact amounts of accruals and the timing of their repayment. Commitments must be inevitable. For example, they appear on the basis of agreements with employees. If the obligation does not meet the established requirements, then it is taken into account in a different manner. OO are recorded only in accounting. There is no need to indicate them in the tax return, since the estimated expenses do not affect the amount of taxes. Their appearance in accounting is mandatory.

Vacation Obligations - Reservation Rules

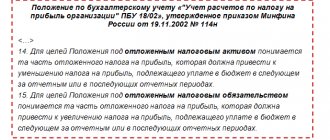

The estimated obligation to pay for upcoming vacations is one of the mandatory reserves in accounting. When forming it, it is important to remember that:

- the creation of an accounting vacation reserve is the responsibility of every company that has employees (except for representatives of small businesses that conduct simplified accounting (clause 3 of PBU 8/2010));

- the formation of a reserve is associated with the need to fulfill the requirements of labor legislation on the need to provide employees with paid leave (Articles 114–115 of the Labor Code of the Russian Federation);

- The amount of the vacation reserve reflected in the reporting allows its users to draw correct conclusions about the existence of vacation obligations at the reporting date.

The scheme for its formation is not regulated by law, however, when developing it, it is important to take into account several fundamental rules:

- periodicity rule - the vacation valuation liability is created for each reporting date;

- rule of rationality - the company has the right to choose a reservation criterion (separately for each employee, for divisions or for the company as a whole) depending on the size of the company and business conditions;

- rule of account identity - the expense items to which vacation reserves are allocated coincide with the expense item, which includes employee salaries.

The material “Accounting for wages in accounting (nuances)” will tell you which accounts and by what transactions the accrued salary is reflected.

Case study: obligation or manipulation?

The hotel chain created a reserve for updating the room stock in 2014. In 2015, due to the crisis and changes in the dollar exchange rate, room sales sharply decreased, and the hotel management decided to postpone the renovation and accordingly dissolve this reserve. The result was demonstrated in management reporting prepared according to IFRS standards for business owners.

At first glance, such a reversal seems logical. The financial department justified this adjustment to business requirements: to maintain hotels in working order, repairs are needed, but due to changes in the economic situation in the country, the company management decided not to carry out repairs, and, therefore, the reserve lost its relevance. As a result, reports were obtained that demonstrated that, despite the reduction in the scale of activity, the business seemed to be able to make a profit.

Is a repair reserve a liability where the hotel chain has no alternative but to meet the liability? No. As the decision in 2015 shows, they simply changed their mind about doing the repairs. Obligation exists regardless of the organizations' intentions. In other words, it is always relevant.

Within the framework of the scheme, could any future events affect the creation of this obligation? This is not obvious from the information provided. This means that such an accrual is neither estimated nor conditional, and its occurrence should not be justified by IAS 37. During a further audit of the statements, all such “reserves” were completely removed, and the statements for 2014 and 2015 were reissued.

The approach to creating a liability described above was quite often a common mistake or deliberate "creative accounting" in order to create an artificial airbag to smooth out the financial result of bad periods, as well as to manipulate many financial indicators - earnings per share, working capital, net assets, etc.

The main idea of a provision is that it is not created to cover general business risks. And its main feature, which distinguishes it from accounts payable, allows for the existence of an obligation without documents or even identification of a possible creditor.

Information disclosure

Information must be disclosed separately for each type of asset and liability.

In addition, the disclosure for each of them will contain the following information:

- Book value at the beginning/end of the period;

- Turnover for the period: Amounts of newly created estimated liabilities;

- An increase in existing provisions, including an increase in the discounted amount due to the effects of time or rate changes;

- Amounts of funds spent to pay off debt obligations;

- Unused amounts recovered during the period.