The history of the appearance of the balance sheet

In the accounting sense, the word “balance sheet” has been around for approximately 600 years. In the historical literature there are various versions regarding the period of appearance of this term, which dates back to the end of the 14th - beginning of the 15th centuries. There is information that the word “balance sheet” was first applied to financial statements in 1427.

The origin of the term is often associated with the Italian mathematician Luca Pacioli. Here are its main postulates:

– the amounts of debit and credit turnovers are always identical;

– the sum of debit balances is always equal to the sum of credit balances of the same system of accounts.

According to Pacioli, a balance sheet is a structured document consisting of assets and liabilities . All accounts with a debit balance were included in the asset, but the meaning of debit and credit was not explained. Debit was the left side of any account, and credit was the right side. Therefore, along with truly active items, the asset also included loss items that were classified as liabilities from an economic point of view. In liabilities, along with accounts payable, profit and capital were reflected.

With the advent in the 19th century. balance science, the founder of which was I.F. Cher, the next stage of balance development is connected. Sher argued that accounting takes into account only accomplished internal and external economic facts. The basis of accounting, according to Sher, is the balance sheet. In this regard, the theory of its accounting is called balance sheet, and capital equality (the amount of capital of an organization is equal to the difference between the volume of property and its accounts payable) is called Scher’s postulate.

At the next stage of development of the balance sheet, models began to be used in accounting that cover all its components. In the 1920s, modeling was actively developed and promoted as a record-keeping tool.

One of the significant accounting models can be called the development of the largest scientist in the field of accounting - Professor N.A. Blatova. His main idea was the accounting axiom - double entry. Blatov believed that the accounting algorithm is built from account to balance sheet. Thus, the balance is a consequence of double entry in the accounts.

Within the framework of balance science, theories of statistical and dynamic balances have developed. According to statistical theory, the main purpose of accounting is to record property and determine its reliable value. Within the framework of the dynamic theory, capital accounting and accurate calculation of financial results were placed at the head of accounting. By the way, the latter approach became widespread at the end of the 20th century.

Structure

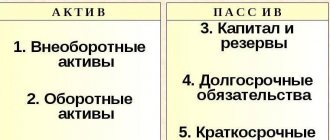

The structure of the balance sheet is simple and consists of two parts: Asset and Liability. The data in them should always be equal, hence the name of the report. An asset shows the property that an organization owns. The liability reflects the sources of formation of this property.

Active-Passive

The asset includes two sections:

- Fixed assets. Property of the company, the period of use and operation of which is more than 12 months. These could be buildings, long-term investments.

- Current assets. All equipment and inventory that has been used for less than 12 months. This includes materials, accounts receivable, raw materials, etc.

The passive contains three sections:

- Reserves and capital, consisting of the own funds of the company's owners.

- Long-term liabilities may include loans and borrowings with a repayment period of more than 12 months.

- Short-term liabilities. This includes arrears of payment to employees, settlements with suppliers with a repayment period of less than 12 months.

There are two ways to build a balance:

- Vertical. In this case, all balance sheet items are located vertically below each other. The equation looks like this: Asset - Liabilities = Owner's Equity.

- Horizontally. A more familiar type of report for Russian companies. In it, balance sheet items are located on opposite sides: liabilities (liabilities, capital) on the right side, assets on the left. The equation in this case will look like this: Asset = Liabilities + Capital.

The organization determines the method of forming the balance sheet independently and reflects this in its accounting policies.

For your information! Current assets are more liquid than non-current assets. They can be quickly turned into real money.

What is a balance sheet?

The concept of “balance” (from the Latin “bis” and “lans” - two weighing bowls) means balance and balancing.

A balance sheet is a way of summarizing and grouping property and the sources of its formation as of a specific date in monetary terms.

In fact, the balance sheet is a table consisting of two columns: in the left column the property is grouped by composition and location, and in the right column the same property is grouped depending on the sources of its formation. The structure of the balance sheet is based on the principle of double entry as a fundamental accounting concept. The main element of the balance sheet is its item - a line that characterizes certain types of property, sources of its formation and obligations of the organization. Based on the economic content, balance sheet items are combined into groups, and groups into sections.

The balance sheet is drawn up as of a certain date (usually the end of the reporting period) and reflects the state of the property and its sources at the moment.

Definition

The balance sheet is, first of all, a summary of the financial viability of an organization. With its help, you can understand the actual state of affairs in the company, how profitable or unprofitable it is. It is formed by grouping and generalized reflection of data on the company’s property and the sources of its formation.

Classification

This information will be useful both to the management of the enterprise and to possible creditors and investors. The balance sheet shows the state of assets, liabilities to third parties and equity as of a certain date. As a rule, the balance sheet is formed on an accrual basis for one year, broken down into quarters. The balance must also be submitted to the tax office and statistical authorities.

Structure and procedure for drawing up the balance sheet

As already written above, the balance sheet is a way of economically grouping and summarizing information about the organization’s property by composition, location and sources of its formation in cash as of the reporting date. The main purpose of drawing up a balance sheet is the final synthesis of accounting information.

Balance sheet items are divided into assets, equity and liabilities.

Assets contain information about the organization’s property, which is divided into groups based on composition and location. Such assets are divided into long-term and short-term.

The group of items of equity and liabilities contains data on the same property, but distributed according to the principle of the source of its receipt, i.e. from whom and in what amount the property was received. In this case, liabilities are divided into long-term and short-term.

Note that the left and right sections of the balance sheet must be equal to each other. This is due to the fact that the balance sheet describes the same property.

In our country, the structure of the balance sheet, the names of all its sections, and the procedure for filling out are determined by the National Accounting and Reporting Standard “Individual Accounting Statements”, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated December 12, 2016 No. 104.

Changes in the composition of the organization’s property, and therefore the filling of the balance sheet, are influenced by business transactions. They are divided into 4 types:

– operations affecting balance sheet assets: one item increases, and the second decreases proportionally. In this case, the balance sheet does not change;

– transactions that similarly occur within equity capital and liabilities and do not change the overall balance sheet;

– transactions that increase both sections of the balance sheet by the same amount. The balance sheet in this case changes, but equality remains;

– transactions that simultaneously reduce assets, equity and liabilities by an equal amount.

Thus, depending on the business transactions that are carried out in the organization, the balance of debit (assets) and credit (equity and liabilities) of the balance sheet may increase, decrease or remain unchanged. In this case, the equality of the sections must always be preserved.>>>

Types of balance

There are several types of balance sheets. They are divided depending on the time of their compilation (opening balance, initial, intermediate, final) and the completeness of the information reflected (general, private).

The opening balance is drawn up after the registration of a new organization.

The initial balance sheet is drawn up every year to determine the property status of the organization after the work done for the year and the qualitative composition of the property. The balance drawn up at the end of the year is final in relation to the past year and initial in relation to the coming one.

The interim balance is drawn up every quarter. It may be adjusted at the end of the financial year.

The final or liquidation balance sheet is drawn up in the event of liquidation of an organization.

The general balance sheet contains information about the property, rights, and obligations of the organization as a whole.

The private balance sheet includes information about the property, rights, and obligations of a separate part of the organization.

Classification

It is customary to distinguish two main types of balance:

- Statistical. Reflects indicators on the date of formation. They are classified according to the following criteria: current, opening, separation, final, liquidation, balance sheet, separate, consolidated, sanitized, consolidated, inventory.

- Dynamic. Shows financial data for the company by turnover for a given period. This could be a chess balance sheet and a turnover sheet.

All balance sheets differ from each other in the purpose of their preparation. It is customary to classify them according to the following criteria:

- by source of compilation;

- by the nature of the activity;

- by reflection object;

- by time of compilation;

- by volume of information;

- by form of ownership;

- according to the cleaning method.

Balance form

The balance sheet is one of the forms of individual accounting statements (clause 3 of NAS “Individual Accounting Statements”, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated December 12, 2016 No. 104).

The value of assets, equity capital and liabilities is reflected in gr. 3 and 4 forms of balance sheet. In gr. 3 – at the end of the reporting year, in gr. 4 – at the end of the previous year (opening balance).

Section I “Long-term assets” contains data on the balances of fixed assets, intangible assets, profitable investments in tangible assets, investments in long-term assets, equipment for installation and construction materials, long-term financial investments, long-term receivables, deferred tax assets and other long-term assets.

In Sect. II “Short-term assets” reflects information on the balances of inventories, long-term assets intended for sale, deferred expenses, “input” VAT, short-term receivables, short-term financial investments, cash and cash equivalents, and other short-term assets.

Line 300 of the balance sheet reflects the total amount of the organization's assets and characterizes the balance sheet currency.

Section III “Equity Capital” reflects the size of the organization’s own capital, including:

– funds and reserves;

– receivables of the founders for deposits in the UV;

– the cost of the organization’s own shares (shares in the UV);

– the amount of retained profit/uncovered loss;

– balances of target financing funds unused as of December 31.

Section IV “Long-term liabilities” of the balance sheet contains data on liabilities, the repayment of which is planned no earlier than 1 year after December 31.

Section V “Current Liabilities” reflects information about liabilities that will be repaid during the next reporting year.

The indicator on page 700 of the balance sheet corresponds to the size of the organization’s equity capital and its liabilities, and also characterizes the balance sheet currency. The data on page 700 must be identical to the data on page 300. If there is no equality, then errors were made when filling out the balance.>>>

Example of a completed balance:

| Assets | Line code | As of December 31, 2021 | As of December 31, 2021 |

| 1 | 2 | 3 | 4 |

| I. LONG-TERM ASSETS | |||

| Fixed assets | 110 | 20 193 | 25 319 |

| Intangible assets | 120 | – | – |

| Profitable investments in tangible assets | 130 | 196 | 149 |

| including: | |||

| investment property | 131 | – | – |

| items of financial lease (leasing) | 132 | – | – |

| other profitable investments in tangible assets | 133 | 196 | 149 |

| Investments in long-term assets | 140 | 296 | 190 |

| Long-term financial investments | 150 | 585 | 360 |

| Deferred tax assets | 160 | – | – |

| Long-term accounts receivable | 170 | 14 571 | 3 704 |

| Other long-term assets | 180 | 1 | 7 |

| TOTAL for section I | 190 | 35 842 | 29 765 |

| II. SHORT-TERM ASSETS | |||

| Reserves | 210 | 15 810 | 38 965 |

| including: | |||

| materials | 211 | 5220 | 14925 |

| animals for growing and fattening | 212 | – | – |

| unfinished production | 213 | 101 | 128 |

| finished products and goods | 214 | 10489 | 23912 |

| goods shipped | 215 | – | – |

| other supplies | 216 | – | – |

| Long-term assets intended for sale | 220 | – | – |

| Future expenses | 230 | 5 | 9 |

| Value added tax on purchased goods, works, services | 240 | 3 | 11 |

| Short-term receivables | 250 | 120 236 | 63 211 |

| Short-term financial investments | 260 | – | – |

| Cash and cash equivalents | 270 | 103 736 | 22 114 |

| Other current assets | 280 | – | – |

| TOTAL for section II | 290 | 239 790 | 124 310 |

| BALANCE | 300 | 275 632 | 154 075 |

| Own capital and liabilities | Line code | As of December 31, 2021 | As of December 31, 2021 |

| 1 | 2 | 3 | 4 |

| III. EQUITY | |||

| Authorized capital | 410 | 520 | 535 |

| Unpaid part of the authorized capital | 420 | – | (20) |

| Own shares (shares in the authorized capital) | 430 | – | (7) |

| Reserve capital | 440 | 7 450 | – |

| Extra capital | 450 | 10 000 | – |

| Retained earnings (uncovered loss) | 460 | 107 175 | 4 877 |

| Net profit (loss) of the reporting period | 470 | – | – |

| Special-purpose financing | 480 | – | – |

| TOTAL for section III | 490 | 125 145 | 5 385 |

| IV. LONG TERM DUTIES | |||

| Long-term loans and borrowings | 510 | 7 200 | – |

| Long-term obligations for leasing payments | 520 | – | 10 |

| Deferred tax liabilities | 530 | 1 | – |

| revenue of the future periods | 540 | – | – |

| Reserves for upcoming payments | 550 | – | – |

| Other long-term liabilities | 560 | 22 412 | 69 890 |

| TOTAL for section IV | 590 | 29 613 | 69 900 |

| V. SHORT-TERM LIABILITIES | |||

| Short-term loans and borrowings | 610 | 50 | 113 |

| Short-term portion of long-term liabilities | 620 | – | – |

| Short-term accounts payable | 630 | 120 822 | 78 677 |

| including: | |||

| suppliers, contractors, performers | 631 | 113 242 | 71 902 |

| on advances received | 632 | 1 000 | 2 256 |

| on taxes and fees | 633 | 4 613 | 3 005 |

| on social insurance and security | 634 | 330 | 100 |

| on wages | 635 | 650 | 520 |

| on leasing payments | 636 | – | – |

| property owner (founders, participants) | 637 | – | – |

| other creditors | 638 | 987 | 894 |

| Obligations intended for implementation | 640 | – | – |

| revenue of the future periods | 650 | 2 | – |

| Reserves for upcoming payments | 660 | – | – |

| Other current liabilities | 670 | – | – |

| TOTAL for Section V | 690 | 120 874 | 78 790 |

| BALANCE | 700 | 275 632 | 154 075 |

Question 13

Note 9 to section 5.3 of the Explanations (form 0710005) recommends disclosing data minus accounts payable received and repaid (written off) in one reporting period. At the same time, the Explanations separately reflect long-term (including by type) and short-term accounts payable (including by type). Accounts payable for settlements with the budget (balance sheet account 68), for social insurance and security (balance sheet account 69) and for settlements with personnel (balance sheet accounts 70, 71, 73) refer to short-term debt.

When reflecting accounts payable for settlements with the budget, net turnover can be determined by type of taxes and fees, for settlements for social insurance and security - by type of extra-budgetary funds, for settlements with personnel - by type of settlement.

To determine the net turnover for accounts 68 and 69, it is enough to use information from the balance sheet for the reporting period, compiled by subaccounts. To determine net turnover for settlements with personnel in cases of an expanded balance, you will also need analytical accounting data.

Note. According to clause 34 of PBU 4/99, offsetting between items of assets and liabilities is not allowed in the financial statements. This means that if, according to analytical accounting data, there are both receivables and payables in the settlement accounts, the balance of such an account should be reflected in detail in the balance sheet. For example, the collapsed account balance as of December 31, 2011 is 2,500,000 rubles, and in analytical accounting (for employees) there are accounts receivable for employees in the amount of 150,000 rubles. and accounts payable to employees in the amount of RUB 2,650,000. Therefore, in the balance sheet as of December 31, 2011, the balance of account 70 should be expanded, namely:

— 150 thousand rubles. reflected in accounts receivable;

— 2,650 thousand rubles. reflected in accounts payable.

Table 1 shows a fragment of the balance sheet for account 68 and accounts for settlements with personnel.

Table 2 shows the algorithm for determining net turnover by type of tax, and Table 3 - by type of settlements with personnel.

Table 4 shows a fragment of section 5.3 of the Explanations (form 0710005).

Table 1. Fragment of the balance sheet for 2011

| Check | Name | Opening balance | Period transactions | Closing balance | |||

| Debit | Credit | Debit | Credit | Debit | Credit | ||

| 68 | Taxes and fees | 100 000 | 1 700 000 | 12 450 000 | 11 550 000 | 500 000 | 1 200 000 |

| 68.1 | Personal income tax | 200 000 | 2 800 000 | 3 300 000 | 700 000 | ||

| 68.2 | VAT | 1 500 000 | 6 000 000 | 5 000 000 | 500 000 | ||

| 68.3 | Income tax | 100 000 | 3 500 000 | 3 100 000 | 500 000 | ||

| 68.8 | State duty | — | 150 000 | 150 000 | — | ||

| 70 | Salary | 150 000 | 2 650 000 | 28 000 000 | 29 000 000 | 3 500 000 | |

| 71 | Calculations with accountable persons | 100 000 | 1 300 000 | 1 450 000 | 50 000 | ||

Table 2. Determination of indicators for filling out section 5.3 of the Explanations (form 0710005)

| Check | Name | Opening balance | Period transactions | Closing balance | |||

| Debit | Credit | Debit | Credit | Debit | Credit | ||

| 68.1 | Personal income tax | 200 000 | 2 800 000 | 3 300 000 | 700 000 | ||

| accounts payable formed in 2010 were repaid | 200 000 | ||||||

| accounts payable formed in 20111 were repaid | — 2 600 000 | -2 600 000 | |||||

| balance and turnover for form 0710005 | 200 000 | 200 000 | 700 000 | 700 000 | |||

| 68.2 | VAT | 1 500 000 | 6 000 000 | 5 000 000 | 500 000 | ||

| accounts payable formed in 2010 were repaid | 1 500 000 | ||||||

| accounts payable formed in 20112 were repaid | — 4 500 000 | — 4 500 000 | |||||

| balance and turnover for form 0710005 | 1 500 000 | 1 500 000 | 500 000 | 500 000 | |||

| Total for reflection on line 5554 of form 0710005 | 1 700 000 | 1 700 000 | 1 200 000 | 1 200 000 | |||

| 68.3 | Income tax | Reflected in the “Accounts receivable” section | |||||

| 68.5 | State duty | It is not reflected in the form 0710005, because beginning and ending balances are zero | |||||

Notes.

1) In order to determine the amount of accounts payable, which was formed and repaid in 2011, from the debit turnover (2,800,000 rubles), we subtract the accounts payable of 2010, repaid in 2011 (200,000 rubles). Then compare the debit turnover minus repaid accounts payable (2,800,000 – 200,000 = 2,600,000 rubles) with the credit turnover (3,300,000 rubles). The smaller amount is accounts payable formed and repaid in 2011. To fill out section 5.3 of the Explanations, we will adjust the debit and credit turnover in subaccount 68.1 for this amount.

2) In order to determine the amount of accounts payable, which was formed and repaid in 2011, from the debit turnover (6,000,000 rubles), we subtract the accounts payable of 2010, repaid in 2011 (1,500,000 rubles). Then compare the debit turnover minus repaid accounts payable (6,000,000 – 1,500,000 = 4,500,000 rubles) with the credit turnover (5,000,000 rubles). The smaller amount is accounts payable formed and repaid in 2011. To fill out section 5.3 of the Explanations, we will adjust the debit and credit turnover in subaccount 68.2 for this amount.

Table 3. Determination of indicators for filling out section 5.3 of the Explanations (form 0710005)

| Check | Name | Opening balance | Period transactions | Closing balance | |||

| Debit | Credit | Debit | Credit | Debit | Credit | ||

| 70 | Payroll calculations | 150 000 | 2 650 000 | 28 000 000 | 29 000 000 | 3 500 000 | |

| incl. Ivanov, Petrov, Sidorov | 150 000 | 950 000 | 1 200 000 | 100 000 | |||

| Reflected in section 5.1 “Accounts receivable” | 150 000 | 150 000 | — | ||||

| accounts payable formed in 20111 were repaid | — 950 000 | — 950 000 | |||||

| revolutions for form 0710005 section 5.3 | — | 100 000 | |||||

| Other employees | 2 650 000 | 27 050 000 | 27 800 000 | 3 400 000 | |||

| accounts payable formed in 2010 were repaid | 2 650 000 | ||||||

| accounts payable formed in 20112 were repaid | -24 400 000 | -24 400 000 | |||||

| revolutions for form 0710005 section 5.3 | 2 650 000 | 3 400 000 | |||||

| total according to wage calculations for section 5.3 | 2 650 000 | 2 650 000 | 3 500 000 | 3 500 000 | |||

| 71 | Calculations with accountable persons | 100 000 | 1 300 000 | 1 450 000 | 50 000 | ||

| Reflected in section 5.1 “Accounts receivable” | 100 000 | 100 000 | |||||

| accounts payable formed in 20113 were repaid | — 1 300 000 | — 1 300 000 | |||||

| total for settlements with accountable persons for section 5.3 | — | 50 000 | 50 000 | ||||

| Total balance and turnover to be reflected on line 5556 of form 0710005 | 2 650 000 | 2 650 000 | 3 550 000 | 3 550 000 | |||

Notes.

1) In order to determine the amount of accounts payable in the analytics , which were both formed and repaid in 2011, you first need to subtract from the credit turnover on account 70 (RUB 1,200,000) the accounts receivable formed in 2010 and repaid in 2011 year (RUB 150,000). Then you should compare the debit turnover on account 70 (950,000 rubles) with the credit turnover on account 70 minus repaid receivables (1,200,000 - 150,000 = 1,050,000 rubles). Let's get the amount of accounts payable that was formed and repaid in 2011 (950,000 rubles). To reflect in section 5.3 of the Explanations, we will adjust the debit and credit (minus the repaid receivables of 2010) turnover of 2011 by 950,000 rubles.

2) In order to determine the amount of accounts payable in the analytics , which was both formed and repaid in 2011, you first need to subtract from the debit turnover on account 70 (RUB 27,050,000) the accounts payable formed in 2010 and repaid in 2011 year (RUB 2,650,000). Then you should compare the debit turnover on account 70 minus repaid accounts payable (27,050,000 - 2,650,000 = 24,400,000 rubles) with the credit turnover on account 70 (27,800,000 rubles). Let's get the amount of accounts payable that was formed and repaid in 2011 (RUB 24,400,000). To reflect in section 5.3 of the Explanations, we will adjust the debit (minus repaid accounts payable of 2010) and debit turnover of 2011 by RUB 24,400,000.

3) In order to determine the amount of accounts payable, which were both formed and repaid in 2011, you first need to subtract from the credit turnover on account 71 (RUB 1,450,000) the accounts receivable formed in 2010 and repaid in 2011 ( 100,000 rub.). Then you should compare the debit turnover on account 71 (1,300,000 rubles) with the credit turnover on account 71 minus receivables (1,450,000 - 100,000 = 1,350,000 rubles). Let's get the amount of accounts payable that was formed and repaid in 2011 (RUB 1,300,000). To reflect in section 5.3 of the Explanations, we will adjust the debit and credit (minus the repaid receivables of 2010) turnover of 2011 by 1,300,000 rubles.

Table 4. Fragment of section 5.3 “Availability and movement of accounts payable” Explanations (form 0710005)

| Indicator name | Code | Period | Balance at the beginning of the year | Admission | Redemption | Balance at the end of the period |

| including: budget calculations | 5554 | for 2011 | 1 700 | 1 200 | (1 700) | 1 200 |

| settlements with personnel | 5556 | for 2011 | 2 650 | 3 550 | (2 650) | 3 550 |

Deadline for submitting balance sheets in Belarus

Organizations must submit a balance sheet as part of their annual individual reporting in the year following the reporting year, but no later than March 31 (clause 2 of Article 16 of the Law of the Republic of Belarus dated July 12, 2013 No. 57-Z “On Accounting and Reporting”).

If the average number of employees of an organization for the previous calendar year is 15 or more people, then the balance sheet of such an organization must be submitted to the tax authorities in the form of an electronic document (subclause 1.4.2, clause 1, article 22, paragraph 2, clause 4, article 40 NK-2019).

Please note that in case of reorganization of an organization, a copy of its separation balance sheet is transferred to the Tax Inspectorate within 5 working days from the date of reorganization (subclause 1.4.3, clause 1, article 22 of the Tax Code of 2019).

Who needs a balance sheet

The benefit of the balance sheet is that it characterizes the economic capabilities of the organization and its financial position. In other words, the composition and structure of assets and their sources.

Using its indicators, specialists from partner organizations, as well as potential counterparties, can assess the financial position of a given organization. Bank employees examine the balance sheet to assess the borrower's solvency. Tax specialists receive data from the payer’s balance sheet about his profit, the amount of net assets, accounts receivable and other information. Owners of organizations, using the balance sheet, determine the final financial result of the organization in the form of an increase in equity capital for the reporting period and judge the ability of managers to preserve and increase the material and monetary resources entrusted to them.

Drawing up and filling out the BB

To draw up and fill out a balance sheet, you need to enter data into two parts: Asset and Liability. In the form, they are presented in the form of two tables and are intended to display financial transactions within the company and in interaction with other enterprises.

Example of completed data on an Asset

To draw up a balance, you must fill out all lines of the form. They need to include data characterizing the financial position of the organization. Each line has its own serial number. It contains the name of the indicator that should be reflected in it. The total amount is derived by summing sequentially all the rows of the first two sections.

The Passive lines are filled in in a similar way:

Example of entering data on Passive

The balance line should not be left blank. If the amount to be deposited is zero, this fact is explained in the accompanying documents. All figures must be in thousands and millions and reduced by three or six zeros. For example, the cost of a building on the company’s balance sheet is 20,000,000 rubles. In the report, this amount should be recorded as 20,000 thousand rubles. The choice of indicators that will be used when filling out should be made in the header of the form.

Don't underestimate the importance of the balance sheet. It is a direct reflection of the financial viability of the company. On its basis, significant management decisions can be made that affect its life, uninterrupted operation and further economic development.