The balance sheet reflects the composition of the organization's assets and liabilities as of the date of its formation. As a rule, the balance sheet is drawn up at the end of the reporting period (quarter, year). The asset reflects the property, that is, the assets of the enterprise, and the liability reflects the equity and liabilities. The balance sheet results are equal, therefore, by analyzing the data by calculating various indicators, it is possible to determine : – the structure and dynamics of individual indicators; – assess solvency and financial stability; – analyze the liquidity of the balance sheet.

Who needs to read the balance sheet and why?

A balance sheet is a basic accounting report that is only a few pages long.

There are no illustrations and little text; it is filled with many numbers. Nevertheless, the information hidden in the numbers brings a lot of benefits to those who know how to read it. This document is carefully studied by a huge number of people (managers and owners of companies, investors, bankers, tax authorities and other interested parties). The balance sheet is not a commercial secret, can be published in print for public viewing and is available to anyone.

You will find a line-by-line procedure for filling out a balance sheet with examples in the Guide from ConsultantPlus. If you do not already have access to this legal system, a full access trial is available for free.

Why read the balance sheet? The answer is obvious: to make the right financial decisions. And it doesn’t matter whether it is compiled in a traditional form or a simplified one - the usefulness of the information obtained from it does not decrease.

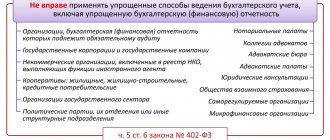

Read about who has the opportunity to prepare simplified reporting in this article.

Reading a balance sheet does not require higher financial education, but you cannot do without certain knowledge and techniques.

How to read a balance sheet

To be able to read means to know the basics of the alphabet. For financial statements, this basis is an understanding of the terms reflected on the balance sheet lines. Some of them are clear to many (for example, “fixed assets”, “inventories”, etc.), but some terms require additional explanation.

For example, deferred tax assets (DTA). The term ONA denotes a part of the income tax that is deferred in time: the income tax will be reduced by this amount in subsequent reporting periods (clause 14 of PBU 18/02, approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n). The reflection of IT in the first section of the balance sheet is due to the fact that for the company it is an asset, and its useful life is more than a year.

NOTE! Information about IT and IT (deferred tax liability) may not be shown on the balance sheet by companies that are classified as small (clause 2 of PBU 18/02).

You can find out more about how to apply PBU 18/02 from 2021 after changes have been made to it in the Ready-made solution from ConsultantPlus. Trial full access to the system can be obtained for free.

Or, for example, what does the phrase “cash equivalents” mean? This concept appeared on the balance sheet relatively recently and means highly liquid financial investments (demand deposits, short-term bills, etc.), which can quickly and easily be converted into money.

Thus, before you start reading the balance sheet, it is worth understanding what the indicators and its components are.

There are seven main types of losses.

1. Overproduction of materials or information. During overproduction, more parts are produced than are necessary, for example, to increase equipment utilization.

2. Lost time due to waiting.

Examples: waiting for material, waiting due to machine downtime, waiting for quality control, waiting for upstream or downstream processes, waiting for information.

3. Unnecessary transportation of materials or information.

- The movement of material does not create value;

- Short-term and intermediate storage and then moving to the work site does not create value.

4. Unnecessary processing steps (required due to equipment deficiencies or process imperfections). Poorly planned or poorly coordinated work processes and unnecessary movement of workers during processing are simply too expensive. In practice, the reasons are imperfect technology, poor organization of the process, and irrational placement of equipment. For example: idling cars; excessive machine movement (tool stroke too wide); safety devices that take too much time (eg double switch instead of light valve); the material used does not meet the requirements (products are defective or not at all).

5. Availability of any, except the minimum required, reserves. Unnecessary warehousing and too much inventory are capital freezes. Inventory incurs storage costs, produces poor quality, requires space, takes time to find, hides downtime, etc.

6. Unnecessary movement of people during work (for example, in search of parts, tools, documents, help, etc.).

7. Production of defective products. Producing defective items is wasteful due to extra inspection, extra transportation, extra rework, extra work space.

8. Loss of staff creative potential is the eighth type of loss; it is the most difficult to assess, but is key in building a continuous improvement process. If we do not use the talents, abilities and knowledge of our employees, this is also a loss!

The practical implementation of the loss elimination method consists of the following steps:

Step 1: Recognizing waste is based on understanding the crisis situation - analyzing everything that costs and does not work, regardless of whether it is people, information or mechanical equipment.

Step 2: Waste is made visible, unnecessary items are removed immediately, processes and movements are identified as a whole, activities are divided into value-creating and non-value-creating activities.

Step 3: Assess the types of losses, calculate the amount of losses and establish the sequence for their elimination.

Step 4: Development of measures to prevent individual losses - find out whether the cause of the losses is eliminated? – will the recurrence of losses be prevented after measures are taken? – will production costs decrease? what would be the size of the likely effect?

Step 5: Eliminate losses in accordance with activities.

Step 6: Standardize work to prevent obvious waste. If necessary, a flexible work schedule for performers and advanced training are being introduced.

Step 7: Check and then analyze the actions taken, describe and document the improved state, if necessary, set new goals and repeat steps 1-6.

See also: TPM - Total Equipment Maintenance.

Accounting for beginners from postings to balance sheet: reading a balance sheet using an example

How to read a balance sheet using an example? Let's look at this using the data from the report of Prestige LLC.

| Indicator name | Line code | As of 12/31/2020 | As of 12/31/2019 | As of 12/31/2018 |

| I. NON-CURRENT ASSETS | ||||

| Fixed assets | 1150 | 750 | 779 | 810 |

| Financial investments | 1170 | 50 | – | – |

| II. CURRENT ASSETS | ||||

| Reserves | 1210 | 112 | 118 | 116 |

| Accounts receivable | 1230 | 56 | 49 | 51 |

| Cash and cash equivalents | 1250 | – | 10 | 12 |

| BALANCE | 1600 | 968 | 956 | 989 |

| III. CAPITAL AND RESERVES | ||||

| Authorized capital | 1310 | 10 | 10 | 10 |

| Reserve capital | 1360 | 4 | 3 | 2 |

| retained earnings | 1370 | 511 | 478 | 315 |

| V. SHORT-TERM LIABILITIES | ||||

| Accounts payable | 1520 | 443 | 465 | 662 |

| BALANCE | 1700 | 968 | 956 | 989 |

A fleeting glance at the balance sheet - and the first conclusions: the company does not apply PBU 18/02 - SHE and IT are absent from the balance sheet (perhaps the legal entity is related to a small business). The balance sheet currency has not changed sharply over the past 3 years (fluctuation 1–3%), no borrowed funds were attracted, profits grew steadily, which indicates the financial stability of the organization.

SOS package

Available for tariffs with a subscription fee. As soon as the account balance becomes negative, it turns on automatically and operates:

- on tariffs with a daily fee - within 1 day;

- on tariffs with a monthly fee - within 3 days.

It allows you to use the Yandex.Maps and Yandex.Navigator applications for free and, what is especially important for those who are left without communication, the WhatsApp messenger.

You can find out whether the “SOS package” is available to you in the description of the tariff you use on the website, as well as in your personal account on the website or in the My Tele2 mobile application.

Attention - on the balance sheet asset

Basic asset principle: the lower the line, the faster the assets reflected in it can be converted into money (liquidity principle).

Among the assets, fixed assets turned out to be the most “heavy” - 77% of the balance sheet currency. It can be assumed that the company has significant overhead costs, and if sales volumes fall, it will be difficult for it to maintain its financial stability without borrowing funds.

A gradual decline in the indicators of the line “Fixed assets” (annually by 3–4%) may indicate that management is not investing in the modernization of production. As a result, demand for products may fall - they will be replaced by more advanced analogues of competitors. As a result, revenues and profits may decline.

Stable indicators in the “Inventories” line can confirm the good work of suppliers maintaining the necessary stock for production, or, conversely, indicate that there are unused raw materials and materials in warehouses.

An empty Cash and Cash Equivalents line should raise red flags, although an empty line does not always mean there is a complete shortage of cash. Perhaps financiers invested them profitably (the line “Financial investments” appeared), and soon you can expect good income (for example, in the form of interest).

For information on what conclusions an analysis of the movement of inventories can lead to, read the article “Analysis of the effectiveness of inventory management.”

Secrets of the Balance Sheet Liability

In the liability, the lines are arranged in a special way: the lower the line, the faster the specified obligation must be returned (to counterparties, bankers, owners or other creditors).

The line “Retained earnings” shows an annual growth trend, but its rate has noticeably decreased (from 52 to 7%). Perhaps the effectiveness of managers has fallen, and therefore there is reason to think about the reasons. The presence and growth of reserve capital are assessed positively (the company's equity capital is strengthened).

The significant amount of short-term debts (46% of the balance sheet currency) is alarming. If this is arrears of wages and taxes, there is cause for concern: this is a sign of the company’s insolvency, and material losses are possible (sanctions for late payment).

Read about how such sanctions are calculated in this material.

Results

There are many ways to read a balance sheet. Some people trust only numbers: they calculate special coefficients, conduct horizontal and vertical analysis. But for some it is more important to research and compare different indicators and see how assets relate to liabilities and where reserves and losses are hidden. And to do this, you need to read the balance sheet with reference to other reports and explanations.

Each user builds a suitable methodology for himself and draws conclusions.

The main thing is to see the overall picture of the company’s property and financial position and, using all available methods of analysis, to correctly assess possible prospects and threats. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Answers to frequently asked questions on the topic “Horizontal and vertical balance sheet analysis”

Question: What are the advantages and disadvantages of using vertical and horizontal analysis of financial statements?

Answer: The positive side of horizontal analysis is the ability to assess the dynamics of financial indicators by year. A significant drawback is the fact that this type of analysis is of little use for assessing the financial condition and making decisions by managers - it is rather a diagnostic method. As for vertical analysis, it makes it possible to track changes in the structure of A and P of the company, but also does not allow assessing its financial condition.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |