Taxes and Law

Have you ever heard about some accountant Maria Petrovna, a wonderful woman who bakes pies for everyone for the holiday and talks kindly with every employee? But by the end of the year her balance doesn’t add up, and she’ll recalculate everything at least a hundred times. It seems that she has experience, and Maria Petrovna is trying, she sits over papers until the night. But you still need an eye for balance.

Why is this happening? Because one accountant checks the balance, and the other does not.

Drawing up a balance sheet is the final stage of the procedure for processing accounting information, summarizing it into an information model of the financial position of the organization as of a certain date.

Accordingly, if the balance does not converge, it is necessary to check the correctness of processing and recording of accounting information.

Before preparing reports, you must:

— make sure that all accounting transactions are completed correctly and in a timely manner;

— make sure that not a single fact of the organization’s economic activity remains unreflected;

— conduct an inventory of property and liabilities and document its results;

— make corrections to the accounting if errors were made;

— carry out balance sheet reformation;

— reflect certain transactions that occurred after December 31 of the reporting year (events after the reporting date).

Thus, the balance sheet reformation, which involves closing the accounts as of December 31, is carried out after a number of mandatory procedures have been carried out and the last business transaction has been reflected.

The balance sheet reform consists of two stages:

1) closing accounts in which the income, expenses and financial results of the organization’s activities were recorded during the year;

2) inclusion of the financial result obtained by the organization over the past year as part of retained earnings or uncovered losses.

To form the final financial result in the reporting year, accounting account 99 “Profits and losses” is used. The final financial result consists of the financial result from insurance operations, as well as other income and expenses.

Thus, in account 99 “Profits and losses” during the reporting year the insurer reflects:

— balance on account 22 “Insurance payments under insurance, co-insurance and reinsurance contracts”;

— debit balance on account 26 “General business expenses”;

— balance on account 91 “Other income and expenses”;

— balance on account 92 “Insurance premiums (contributions)”;

— balance on account 95 “Insurance reserves”;

- the amount of deductions from insurance premiums taken into account in the credit of account 96 “Reserves for future expenses”;

— the amount of accrued income tax (conditional income tax expense or income), the amount of permanent tax assets and liabilities, write-off of deferred tax assets and liabilities;

— payments for recalculation of income tax from actual profit;

— the amount of tax penalties due;

- losses, expenses due to emergency circumstances of economic activity (natural disaster, fire, accident, etc.).

At the end of the reporting period, the accounts on which insurance transactions are recorded are closed in the following order:

account 22 “Insurance payments under insurance, co-insurance and reinsurance contracts”:

— the debit balance of subaccounts 22.1, 22.2, 22.3, 22.5 is written off to the debit of account 99 “Profits and losses”;

— the credit balance of subaccounts 22.4, 22.6 is written off to the credit of account 99 “Profits and losses”;

account 92 “Insurance premiums (contributions)”:

— the credit balance of subaccounts 92.1, 92.2, 92.3 is written off to the credit of account 99 “Profits and losses”;

— the debit balance of subaccount 92.4 is written off to the debit of account 99 “Profits and losses”[1].

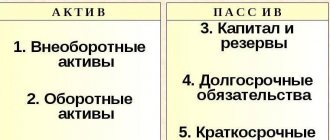

The structure of the balance sheet is a two-sided table, the left side is an asset, the right side is a liability. The asset reflects the subject composition, placement, and use of the organization’s property. In liabilities - the amount of funds invested in the financial and economic activities of the organization.

If the balance does not converge, then you need to check the left side first, and then the right.

If the balance does not converge, then the balance check must be carried out sequentially.

Basically, balance sheet items traditionally follow each other in order of liquidity, although there are exceptions. The main property of the report is that total assets are always equal to total liabilities. This is due to the fact that when reflecting transactions on accounts in the balance sheet, the principle of double entry, familiar to you, is observed.

A comparison of debit and credit turnover shows the final financial result of the reporting period:

— if the credit turnover of an account is greater than its debit turnover, the final financial result of the organization’s activities in the reporting year is profit;

— if the credit turnover of an account is less than its debit turnover, the final financial result of the organization’s activities in the reporting year is a loss.

The balance formed on account 99 before the accrual of income tax reflects the financial result based on the results of the organization’s economic activities.

When drawing up a balance sheet, the following must be taken into account.

The cost of property, as well as the sources from which it was formed, is reflected in thousands of rubles (without decimal places). If the volumes of assets and liabilities are significant, balance sheet lines can be filled out in millions of rubles.

There are no rules for rounding accounting indicators in the legislation. In this regard, the company itself determines how to do this. The corresponding procedure is prescribed in the accounting policy. Most often they round according to the rules of arithmetic: numbers from 0 to 499 are discarded, from 500 to 999 they are rounded to the nearest thousand[2].

If your balance doesn't add up, here's what you need to consider:

There are fixed assets that are not subject to depreciation (for example, land, natural resources, etc.). They should be reflected in line 1150 at their original (replacement) cost. The cost of fixed assets is transferred to line 1150 from account 01.

Let's say a company has assets intended to be provided to others for a fee for temporary possession and use or for temporary use. That is, for rent, leasing or rental. These types of property also belong to fixed assets according to clause 4 of PBU 6/01. But fixed assets intended exclusively for transfer for temporary possession and (or) use for the purpose of generating income are reflected in accounting and reporting as part of profitable investments in tangible assets (clause 5 of PBU 6/01).

To account for such objects, account 03 is provided. In the balance sheet, their value is also reflected in special line 1160. It does not matter whether the transfer of such valuables for temporary possession and (or) use to third parties is the main activity of the company. The only important thing is whether fixed assets are leased, leased or rented, as well as whether the organization uses these objects for its own production or management needs.

If the company has property that is accounted for on account 03, line 1150 is filled out in a special way. It is necessary to deduct not the entire amount of depreciation from account 02, but only in part of those fixed assets that are listed on account 01. In other words, depreciation on objects listed on account 03 is discarded.

Let's move on to line 1170. It reflects information about long-term financial investments. Let us remind you that investments are considered long-term if their maturity (circulation) period exceeds one year. Trade notes, own shares purchased by a joint stock company for resale or cancellation, real estate or other property intended for rental are not considered financial investments. These are the requirements of PBU 19/02.

Finally, a few words about line 1190, dedicated to other non-current assets. If you believe officials from the Russian Ministry of Finance, it only needs to contain information about non-essential indicators (see Letter dated January 24, 2011 N 07-02-18/01). For example, these may be costs associated with unfinished R&D, expenses for repairs of fixed assets, advances issued for the construction of buildings, etc.

Let's move on to the passive. Let's immediately talk about line 1370, which reflects retained earnings (uncovered loss) of previous years and retained earnings (uncovered loss) of the reporting year. To do this, transfer to line 1370 from account 84 “Retained earnings (uncovered loss)”:

- debit balance (it must be indicated in brackets, that is, when calculating the value of the final line 1300 “Total for Section III”, this amount will be deducted), if losses are not covered;

— credit balance (if there is retained earnings).

There may be difficulties with line 1310 if the founders have not fully paid the authorized capital. However, in fact, the amount in line 1310 of the balance sheet fully corresponds to the size of the charter capital, which is stated in the constituent documents. It does not matter whether the capital is fully paid or not. The debt of the founders is included in line 1230. The amount of the authorized capital is transferred to line 1310 from account 80. By the way, the meeting of shareholders may decide to increase or decrease the authorized capital. Such innovations must be reflected in the balance sheet after registering the corresponding changes in the constituent documents.

It is impossible not to mention line 1360, which reflects information about reserve capital. It consists of reserves formed in accordance with legislation and reserves created in accordance with constituent documents.

The law requires only joint-stock companies to form reserves. OJSC and CJSC transfer to line 1360 the balance of account 82 in terms of reserves formed in accordance with the law.

Nobody prohibits other organizations from creating reserve capital. The main thing is to write down the relevant provisions in the charter. The amounts of such reserves are reflected in the subaccount “Reserves formed in accordance with constituent documents” of account 82, from where they are transferred to line 1360.

Another possible problematic situation relates to advances received against rent for rented property. There are two approaches to reflecting such an advance payment in accounting and reporting. Thus, some accountants believe that such advances should be reflected in account 98. Accordingly, the balance of this account should be transferred to line 1530 “Deferred income” of the balance sheet. The explanation is simple: according to the Instructions for the Chart of Accounts (account 98), the prepayment of rent is reflected in account 98. The posting is as follows:

Debit 51 (50) Credit 98, subaccount “Income received for future periods”,

— prepayment of rent has been received.

The second approach boils down to the following. Amounts received in payment for products (work, services) that cannot be recognized as revenue at the reporting date are accounts payable in accordance with clause 12 of PBU 9/99 (approved by Order of the Ministry of Finance of Russia dated May 6, 1999 32n). And if so, then in the balance sheet advances for rent will form an indicator in line 1520 “Accounts payable”.

We would like to add that this approach looks more correct and logical. After all, it is PBU 9/99 that establishes the rules on the basis of which information about the company’s income should be generated and reflected. Therefore, when receiving an advance payment of rent, you must make the following entry:

Debit 51 (50) Credit 62, subaccount “Received prepayment for rent”,

- advance payment of rent received.

Finally, we note that the indicator on line 1520 forms all accounts payable. That is, if a company fills out a balance sheet using a standard form, then in this line it is necessary to reflect information about debts to tax authorities and funds, and to the founders (for example, accrued but not yet paid dividends), as well as to personnel, etc.

[1] Lisenkovskaya G.N. Balance sheet reformation: procedure // Taxation, accounting and reporting in an insurance company. 2012. N 2. P. 26 - 31.

[2] Dubinin V. Balance sheet for 9 months of 2012 // Information bulletin “Express accounting”. 2012. N 39. P. 16 - 21.

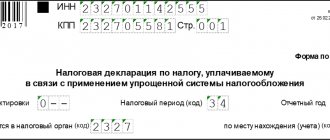

Please wait until the system is updated to resend the report.

Also, a corresponding update of the automatic tax reporting verification systems operating in the Federal Tax Service may be a panacea. Considering the many errors recorded in the system, errors 0400400010, technical support of the Federal Tax Service may release an update that will solve the error in the difference in calculating the balance amount. But there is no exact data on the release of such an update yet.

Wait for the appropriate system update

This may be useful: Error generating a certificate in the taxpayer’s personal account - what to do?

Above, we looked at why error code 0400400010 occurs, which means: “The control ratio of the NBO form indicator is violated.” Since this problem is caused by the peculiarities of calculating the summed values, we recommend either writing an explanatory note on your numbers, or recalculating your balance as the Federal Tax Service itself considers. After this, the error will be resolved.

Why "the balance doesn't fit"

There are three main reasons why the program “refuses to balance”, provided that the transactions entered manually were generated absolutely correctly: The “Month Closing” document for the period under review was not generated; P after the formation of the “Month Closing” document on the “cost” accounts and there remains an “unauthorized” final balance; A “fatal error” has crept into mutual settlements with suppliers or customers and the balance shows amounts with a “minus” sign. The costs are closed by the “Month Closing” document, which relates to regulatory documents and should be generated at the end of the month. Without this document it is premature to talk about balance. The “authorized balance” means the balance on account 20, which was specified by the “Work in Progress” document. This does not spoil the balance sheet. Let's look at the reasons why costs are not covered. In directories in which a cost account is specified, any subaccount of the selected account is filled out incorrectly or not filled in at all. These directories include: “Employees” (Salary Accrual tab, group “Account for the allocation of costs for accrued wages” and “Cost item for deductions from “Fixed assets” (Depreciation tab, all fields); “Intangible assets” ( Depreciation tab, all fields); in the “Nomenclature” directory, the “Type” field is critical for filling in. In documents in which a cost account is specified, any sub-account of the selected account is filled in incorrectly or not filled in at all. These documents include: "Advance report" (if you select account 25, 26 or 44); "Transfer of materials to production" (if you select account 20 or 40); "Provision of services to third parties" (if you select account 25, 26 or 44). policy when the flag "Use Method" is turned off, the item for which the expenses were posted was not included in the list of indirect expenses items. Let us recall that the accounting policy is set in the Accounting policy item of the Service menu of the main menu of the program. P Features of filling in the "Employees" directory of the "Attribution account" group costs for accrued wages" and "Cost item for deductions from the payroll" will be discussed in the next section. P A “fatal error” in mutual settlements with suppliers and customers is understood as a situation where a debit balance remains on the active account (account 60.2 “Advances issued in rubles” or account 62.1 “Settlements with customers in rubles”). For example, a receipt was registered on the bank account from the buyer to account 62.1, but there was no shipment of goods (provision of services, performance of work). Such amounts are highlighted in red in the balance sheet.