We tell you under what conditions the use of OSNO will be beneficial for a businessman, and when this option is required by law.

Individual entrepreneurs most often choose special tax regimes. However, in some situations, the general tax system (OSNO) may be convenient for individual entrepreneurs. Last week, the editors of Clerk made a review of cloud accounting for individual entrepreneurs on OSNO, in which they noted that there are at least 200 thousand such entrepreneurs in Russia. We decided to supplement our colleagues with the arguments for choosing this tax regime. And be sure to read the review - it’s written about us there too.

Features of OSNO (features of taxation)

The general tax system has many names. For the prostate it is called OSN or OSNO. If an organization has chosen a general system of deductions to the budget, it is obliged to pay the following taxes:

- at a profit;

- VAT;

- property tax.

Individual entrepreneurs are required to provide personal income tax, but only if the entrepreneur is a tax resident of the Russian Federation in the reporting year. Additionally, you must pay VAT and property tax. However, the rates differ. A taxpayer can choose OSNO based on one of a whole list of reasons. Typically, the general mode is used in the following situations:

- a businessman initially cannot apply a different taxation system due to non-compliance with established requirements;

- non-compliance with the requirements arose subsequently, and the entrepreneur is forced to change the current regime to OSNO;

- the entrepreneur must pay VAT for any reason;

- the company is entitled to income tax benefits;

- the businessman does not know that there are other taxation systems;

- There are other compelling reasons that prompted the entrepreneur to choose the general regime.

Failure to comply with restrictions for the application of special tax regimes

After the abolition of UTII from the beginning of 2021, there are three main special tax regimes left for entrepreneurs: the unified agricultural tax (UAT), the simplified taxation system (STS) and the patent taxation system (PTS). Unified agricultural tax is available only to those individual entrepreneurs whose income from agricultural activities exceeds 70%. Let's consider restrictions on the scale of business for two other, more common tax regimes: simplified taxation and the patent system.

*to switch to the simplified system, income for 9 months of the previous year must be no more than 112.5 million rubles.

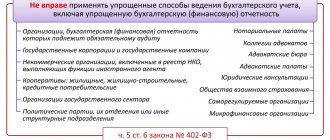

All non-agricultural entrepreneurs will have to use OSNO if they exceed the limits indicated in the table. In addition, there are also restrictions on the type of activity. In particular, you cannot use the simplified tax system and the PSN (clause 3 of article 346.12 and clause 6 of article 346.43 of the Tax Code of the Russian Federation):

- when providing various financial services - insurance, banking, etc.;

- when running a gambling business;

- in the production of excisable goods, except for wine from own grapes;

- during the extraction and sale of minerals, except for commonly used ones.

However, in principle, individual entrepreneurs cannot engage in financial activities or organize a gambling business. Therefore, only restrictions on excisable goods and minerals are relevant for entrepreneurs.

How to switch to OSNO (what needs to be done to switch to OSNO)

To switch to OSNO, you do not need to write an application at the time of registration. The fact is that the general tax system is considered the default regime. There is also no restriction on the types of activities that can be introduced at OSNO.

The transition to the common system is possible automatically. Let's say an entrepreneur has the right to use the patent system, but he did not make the required payment on time. In this situation, all income received from patent activities is recorded in a specialized ledger. They are used as a tax base and will subsequently be taxed based on the exhibitions established at OSNO.

There are also no restrictions on the amount of income or the number of employees. Most large enterprises use this mode. VAT payers prefer to work with companies that make VAT payments to the budget.

Advantages of working with VAT for individual entrepreneurs

An individual entrepreneur receives the following advantages when working with VAT.

Invoices can be issued

This is important for other companies on OSNO, since they have the right to accept “input” VAT for deduction.

For example, Alpha LLC is engaged in the production of tables. The price of the table is 12,000 rubles, including VAT - 2,000 rubles. Alpha has an individual entrepreneur who sells raw materials for the manufacture of one table for 5,000 rubles, including VAT - 1,000 rubles. In this case, VAT payable by Alpha LLC will be:

2,000 - 1,000 = 1,000 rubles.

But if Alpha LLC buys raw materials from an entrepreneur on a simplified basis, the company will not be able to receive an invoice and accept VAT for the shipment as a deduction. The tax payable will be 2,000 rubles.

VAT can be deducted

The VAT deduction rule also works in reverse. The individual entrepreneur himself can receive invoices from his suppliers and contractors and accept VAT for deduction.

Any type of activity can be carried out

Any special regime has restrictions on the type of activity, revenue, number of employees, cost of fixed assets, and so on. On OSNO, an individual entrepreneur can do whatever he wants. Exceptions are types of activities that are closed to all entrepreneurs, regardless of the taxation system:

- production and sale of alcohol;

- production of medicines;

- issuing microloans to citizens;

- organization of pawnshops;

- Banking services;

- insurance services;

- investment fund management;

- repair, development and testing of aviation equipment;

- development, repair, disposal, production and trade in military goods and so on.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Brief description of taxes paid on OSNO (what taxes to pay on OSNO)

If you have chosen OSN, submitting reports without the involvement of specialists is problematic. It will be possible to get a complete picture of the features of using the mode after a detailed acquaintance with it. This requires experience and knowledge.

We are ready to provide our services to companies using the common taxation system. Each tax included in the OSN must be considered separately. VAT deserves special attention. There are benefits for some contributions to the state. However, not everyone can use them. Additionally, it is important to understand the specifics of reporting and the deadline for its submission.

Corporate income tax (what are the income taxes)

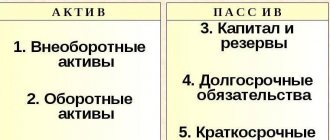

When doing accounting under the OSN, you need to remember that the object of taxation is profit. It represents the difference between income and expenses. The indicator includes income from sales and so-called unrealized income. But expenses that reduce the tax base are controversial. The more expenses a company can confirm, the less amount it will have to transfer to the budget.

Federal Tax Service employees evaluate cost data as meticulously as possible. According to current legislation, expenses must be economically justified and documented.

The first category includes the costs that the company incurred to make a profit. However, in practice, enterprises do not always manage to make money. The question of justification of expenses in this situation often becomes a subject of debate. Moreover, tax proceedings often lead to disputes in the highest courts.

Very often, the court takes the side of the taxpayer, upholding the principles of freedom of entrepreneurial activity and allowing the company to independently assess the effectiveness of the business. However, experts advise preparing in advance for the fact that the Federal Tax Service may try to challenge any expenses and call them unreasonable.

A similar situation arises with documentary evidence. To confirm the presence of expenses, it is necessary to provide so-called primary documents, contracts and invoices. If there are filling errors or inaccuracies, the expenses will not be recognized as documented.

As a general rule, the income tax rate is 20%. However, sometimes the indicator may be 0%. The benefit is available to companies operating in the fields of education and medicine. When it comes to taxation of dividends that a company receives from participation in other companies, the rate ranges from 0 to 30%.

Personal income tax (what taxes are for individuals)

Preparation of reports on SST may include determining the amount of deductions for personal income tax. Entrepreneurs operating on the general taxation system are required to pay it. The tax is also considered complex. The fact is that it is taxed not only on income from business activities, but also on funds received by an individual entrepreneur as an ordinary individual. Personal income tax rates vary from 9 to 35%. Each case has its own procedure for determining the tax base.

If we are talking about those deductions that entrepreneurs are required to make, they are actually similar to the corporate income tax. However, the rate is significantly lower. It is only 13%. If an individual entrepreneur works for OSN, he can receive professional deductions. This means that the amount of income can be reduced by the amount of expenses that need to be justified and confirmed. If the relevant documentation is missing, it will be possible to reduce the amount of income only by 20%.

If we consider this tax, it is necessary to separately mention the status of a tax resident of the Russian Federation. The final personal income tax rate depends on it. A person is recognized as a resident if he has actually been on the territory of the Russian Federation for at least 183 calendar days for 12 consecutive months. If the person is not a tax resident of the Russian Federation, the rate will be significantly higher. It will be 30%.

Property tax (what property taxes)

The types of contributions to the state are also divided into 2 types - for the property of individuals and organizations. The first category also includes individual entrepreneurs. However, in reality the difference is small. The object of taxation is movable and immovable property, which is reflected on the company’s balance sheet as fixed assets. If an object falls into the first or second depreciation group, it is not subject to tax. The tax base is the average annual value of the property. The maximum rate does not exceed 2.2%.

When it comes to property tax for individuals, deductions to the state are made only from real estate. If an entrepreneur uses real estate that he owns in his activities, payments to the state will have to be made on a general basis. In fact, in this situation, an individual entrepreneur is recognized as an ordinary individual.

If an entrepreneur operates under specialized tax regimes, he may be exempt from paying contributions to the state, but only in relation to the property that is used for business purposes. When the general system is used, there is no corresponding benefit. The rate does not exceed 2%. It is calculated from the inventory value of the property.

Value added tax for individual entrepreneurs and organizations on OSNO (which value added tax is required)

The most difficult thing to deal with is VAT. Contributions to the state are considered indirect. The tax burden falls on the final consumers of goods and services. VAT is calculated when:

- sale of goods and services in the Russian Federation;

- provision of goods or services free of charge;

- transfer of property rights;

- import of products;

- transfer of work or services for the needs of the company.

The basis for calculating personal income tax is the cost of products sold. The tax amount can be reduced using deductions. Their quality takes into account the VAT that was presented by suppliers or paid at customs during the import process. VAT rates vary from 0 to 20%. In some situations, paying VAT can be avoided. The relevant provisions are enshrined in Article 445 of the Tax Code of the Russian Federation. The corresponding benefits are provided if the amount of revenue does not exceed 2 million rubles.

Using personal income tax deductions

A sole proprietor is both a business unit and an individual. Therefore, an individual entrepreneur can reduce the taxable base for personal income tax by all standard, social and property tax deductions due to an individual.

The most interesting is the property deduction when purchasing or constructing real estate (clauses 3 and 4 of Article 220 of the Tax Code of the Russian Federation). The amount of this deduction is up to 2 million rubles. for purchase (construction) costs and up to 3 million rubles. for payment of mortgage interest. Thus, with a long-term mortgage loan, you can save up to 650 thousand rubles on personal income tax: up to 260 thousand rubles. due to the cost of the object itself and up to 390 thousand rubles. - by paying interest.

By the way, online accounting “My Business” is perfect for keeping records of individual entrepreneurs on OSNO. Generation of KUDiR, 3-NDFL, VAT reporting, automated payroll calculation, free electronic reporting and other technological solutions make working in the service convenient and not time-consuming. Try it, now you can get up to six months free!

Reporting and tax payments of organizations on OSNO (what are the reporting forms)

If OSN is selected, reporting is submitted in accordance with the following tax calendar:

- VAT returns are submitted every quarter. It must be prepared by the 25th day of the month following the reporting period. The tax payment procedure is also different. The quarterly amount is divided into three equal shares. They must be paid by the 25th of each month of the next quarter.

- Profit. Payment features depend on the method of transferring advance payments that the company initially chose. If the company's income does not exceed 15 million rubles. per quarter, the declaration is submitted for the first quarter, half a year and 9 months. Documentation must be submitted on April 28, July, October, and the paper for the year must be prepared before March 28. However, you can choose to calculate advance payments based on actual profits. In this case, declarations must be submitted monthly. Advance payments themselves are due by the 28th. In this case, the accounting procedure changes. In quarterly reporting, payments are calculated based on information received in the previous quarter. Subsequently, it is permissible to perform recalculation. In the second situation, advance payments are made based on the actual profit received during the reporting month.

- Property tax. The report is submitted quarterly, six months, 9 months. The declaration must be submitted by the 30th day of the month following the reporting quarter. At the same time, local legislation may indicate that the document must be provided only once a year. Features of reporting have an impact on payments. If documentation is required to be provided quarterly, advance payments will need to be made during the same period. If the deadlines are not fixed, funds must be provided once a year.

Disadvantages of working with VAT for individual entrepreneurs

Having chosen OSNO, the individual entrepreneur will be faced with the following disadvantages of this system.

Increase in tax burden

VAT is an additional tax. Even despite the right to accept “input” VAT as a deduction, you will still pay part of the tax to the budget. In addition, on OSNO, together with VAT, you will be faced with personal income tax at a rate of 13%.

Complication of document flow

In general mode, you will issue an invoice. Its completion has its own peculiarities, which are listed in the Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. You cannot refuse to issue an invoice.

Complicating accounting

Individual entrepreneurs with VAT are required to submit VAT returns quarterly. This can only be done electronically, which means there will be additional costs for electronic document management. In addition, the entrepreneur is required to maintain a Book of Purchases and Sales.

More fines

The more reporting and taxes an individual entrepreneur has to pay, the greater the likelihood of facing fines. For example, for late submission of a declaration or non-payment of VAT.

Reporting and tax payments of individual entrepreneurs on OSNO (what are the reporting forms for individual entrepreneurs)

If a general taxation system is used, services for preparing a declaration and submitting reports to the authorized body may also be required for an individual entrepreneur. Payments are provided in the following order:

- According to VAT. The declaration is submitted every quarter. Documents must be submitted no later than the 25th day of the month following the reporting period. The amount is divided into three equal parts, each of which is paid no later than the next month.

- Personal income tax. The declaration is drawn up and submitted no later than April 30 of the year following the reporting period. Usually the document is drawn up in form 3-NDFL. However, if the amount of income differs from the previous period by more than 50%, a 4-NDFL may be required.

- Property tax. The calculation takes into account the inventory value of the property. There is no need to submit a declaration. The Federal Tax Service sends a notification to the owners. Tax must be paid no later than November 1 of the year following the reporting period.

Cost of services

If you need to prepare financial statements for OSN, use our services. We will carry out all the necessary actions for you, fill out the documentation in a timely manner and contact the Federal Tax Service. The cost of services starts from 15,000 rubles. You can find out the price by contacting our representatives and getting advice.

Salary reports for individual entrepreneurs: when they are submitted and what is included in them

An individual entrepreneur can start a business and manage all the affairs independently. However, it often happens that a person ceases to cope with the work alone and he has to hire people under employment contracts or civil contracts. In this case, the individual entrepreneur begins to act as an employer, which is associated with the payment of wages, the calculation and withholding of personal income tax, and the calculation of insurance premiums on all payments made in favor of employees. In such situations, the scope of the individual entrepreneur’s reporting on the OSN is significantly expanded. We will tell you what it includes further.

Reports to the tax office

The reporting intended for submission by the individual entrepreneur to the tax authorities will consist of:

- based on the 6-NDFL calculation, introduced into circulation by order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected] It contains general information about income accrued to employees and the amounts of personal income tax calculated and withheld from such income. The reporting periods are: 1st quarter, half year, 9 months and year. Payments for the first three listed periods must be completed and submitted by the last day of the month following the reporting period. The annual must be submitted before March 1 of the next year, quarterly - no later than the last day of the month following the corresponding period;

Until the end of 2021, together with 6-NDFL, individual entrepreneurs had to submit 2-NDFL certificates. But from 2021 they are cancelled. Information from certificates from the 1st quarter is included in 6-NDFL.

- A unified calculation of insurance premiums, approved by order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected] as amended by order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected] The report contains information on payments in benefits of employees and calculated contributions to compulsory health insurance, compulsory health insurance, VNiM. It is very voluminous and consists of a title page, three sections, ten appendices to section 1 and one appendix to section 2. But only those parts in which data are entered must be submitted. The calculation is submitted based on the results of the 1st quarter, half a year, 9 months and a year. The deadline for submission is the 30th day of the month following the reporting period.

Reporting to the Pension Fund

The main reports that the Pension Fund expects from employers, including individual entrepreneurs, are:

- monthly SZV-M—sent to the Pension Fund at the end of each month until the 15th day of the next. The form of this report was approved by Resolution of the Pension Fund Board of February 1, 2016 No. 83p. It contains information about persons with whom the employer entered into contracts (labor and civil law). Here are the full name, SNILS, and INN for each employee;

- annual SZV-STAZH together with the EDV-1 form - submitted at the end of the year until March 1 of the following year. For 2021, you must report in the form approved by Resolution of the Pension Fund Board of December 6, 2018 No. 507p. The report is intended to provide information about the length of service of insured persons. It must also be handed over by the entrepreneur when his employees retire;

- from 2021 - form SZV-TD (approved by Resolution of the Pension Fund Board of December 25, 2019 No. 730p).

In addition to those listed, there are also reports such as SZV-KORR, SZV-ISKH, DSV-3 and SZV-K, which are submitted when errors are detected or when additional information is provided.

Report to the Social Insurance Fund

All reporting that must be submitted to the Social Insurance Fund for entrepreneurs who use hired labor consists of one single form 4-FSS for insurance premiums for industrial accidents and occupational diseases. The form of the specified report was fixed by order of the FSS of the Russian Federation dated September 26, 2016 No. 381 and edited by order dated June 7, 2017 No. 275.

From the reporting for the quarter of 2021, amendments to Form 4-FSS are expected in connection with the transition of all regions to direct payments. The draft form and instructions for filling it out can be viewed on the Federal portal of draft legal acts.

The form includes a title page and 6 tables, but you must submit only the title page and tables 1, 2, 5. They contain information:

- on payments that form the basis for calculating NS and PP contributions;

- payments for which contributions are not calculated;

- tariffs of contributions assigned by the Social Insurance Fund based on the types of activities included in the extract from the Unified State Register of Individual Entrepreneurs;

- the amount of calculated contributions;

- employees of the entrepreneur undergoing medical examinations and conducting a special assessment of working conditions at the individual entrepreneur.

Tables 1.1, 3 and 4 are prepared and submitted only if data is available.

A report is presented based on the results of the reporting periods: 1st quarter, half year, 9 months, year. The deadline for submitting the report depends on the form of submission. If the report is submitted on paper, then the report must be submitted by the 20th day of the month following the reporting period; if the report is transmitted electronically, then until the 25th.

Cost of accounting services

| Service | Price |

| Accounting services for organizations on OSN - general mode | from 8000 rub./month. |

| Accounting services | from 4000 rub. |

| Accounting services for organizations and individual entrepreneurs using the simplified tax system | from 4000 rub./month. |

| HR and payroll accounting | from 3000 rub./month. |

| Accounting for cash transactions | from 3000 rub./month. |

| Electronic reporting | from 2000 rub./month. |

| Zero reporting, simplified tax system | 3500 rub. |

| Zero reporting, OSN | 3600 rub. |

| Accounting restoration, simplified tax system 6% | from 4000 rub. |

| Accounting restoration, simplified tax system 15% | from 7000 rub. |

| Accounting restoration, OSN | 10,000 rub. |

| Accounting services in retail trade | Calculator |

| Accounting services in wholesale trade | Calculator |

| Accounting services in production | Calculator |

| Accounting services in construction | Calculator |

| Preparation and submission of one report (to the Federal Tax Service, Pension Fund, Social Insurance Fund) | from 1500 rub. |

| Preparation and submission of all quarterly reports for organizations and individual entrepreneurs | from 2000 rub. |

| Accounting setup | from 3000 rub. |

| Registration (removal) on the simplified tax system | 1500 rub. |

| Registration (removal) on UTII | 1500 rub. |

| Application (removal) of a Patent | 1500 rub. |