In this article we will analyze the concept of goods and materials, what they are, what types of products belong to this term, how the issue is related to accounting, what checks need to be carried out.

We will also use specific examples to see at what stages of the production cycle such elements may be present. It is often assumed that this term refers to a certain stock of property, which is reflected in accounting. But in fact, the concept is much broader and includes many different objects.

Before starting, I would like to note that, contrary to popular belief, this area is, in principle, controlled by a mass of laws, and not by one specific norm. These are the Federal Law “On Accounting”, and acts of the Ministry of Finance, and presidential decrees.

What is inventory material, decoding

First, let's look at the definition. It means all the assets of a particular enterprise that participate in the turnover process and are profitable. This is both a product and consumables that accompany the sale. So, this includes a roll of bags, which is used in grocery stores to buy vegetables or bulk products. It itself has no value, is transferred free of charge, but is aimed at simplifying the sale of certain objects. A kind of catalyst, also exhaustible. It is part of working capital. But the machine on which products are produced does not belong to the cycle, but is an element of direct capital. And it is not included in the concept being discussed. In addition, this term may also include liability if it is income-oriented. For example, a credit obligation of a counterparty.

Let's look at how the abbreviation TMC stands for inventory items. It immediately becomes clear that, first of all, these are products that are currently being sold. As well as other objects that either only accompany the product or are its unformed form. Unfinished product. But it still belongs to the company’s property and must also be subject to accounting and control. For example, a car that has not yet acquired optics (headlights) remains a car. It cannot be sold, but it is already important to the organization. Although it will be sent for sale only after the completion of the production process. For now, this is just a particle of the future product.

So, TMC (abbreviation decoding) is what it is: values of a commodity nature in the first place, but at the same time also of a material nature. And this means that intangible assets, copyrights, trademarks, programs, patents - all this no longer applies to this area.

Calculating net asset value

Order of the Ministry of Finance of Russia “On approval of the procedure for determining the value of net assets” dated August 28, 2014 No. 84n approved the basic rules for calculating their value.

However, this act does not apply to:

- to credit organizations;

- joint stock investment funds.

Limited liability companies that are not credit institutions, when establishing the value of their net assets, use the procedure approved by Order No. 84n (hereinafter referred to as the procedure).

According to clause 4 of the procedure for determining the value of net assets, their size is calculated using the formula:

The assets of an enterprise are its liabilities.

In this case, the following are not included in the assets (item 4 of the order):

- Accounting objects on off-balance sheet accounts.

- Receivables from founders for contributions to the authorized capital or payment for shares.

The obligations do not include (clause 6 of the order):

- Income received with the help of government subsidies.

- Free receipt of property.

Note! The value of assets is formed according to accounting data and is reflected in the balance sheet (clause 7 of the procedure).

Formula for calculating net assets

The key procedure for calculating the value of net assets on the balance sheet is determined by the Ministry of Finance of the Russian Federation and is presented in a separate order No. 84n dated August 28, 2014. Please note that previously a different procedure was in effect, but it is not currently used.

This formula for net assets on the balance sheet is applicable to the following range of economic entities:

- public or non-public joint stock companies;

- state or municipal unitary enterprises;

- limited liability companies;

- production cooperatives or housing cooperatives;

- business partnerships.

Net assets formula:

- JSC - the amount of non-current and current assets of an economic entity as of the reporting date;

- DE - debt of the founder incurred to the enterprise for the formation of the authorized capital;

- FOR - debt on own shares generated upon issue;

- OB - the sum of the company's short-term and long-term liabilities;

- DBP - future income in the form of state financial support or gratuitous transfer of property assets.

How to calculate net assets according to balance sheet lines?

To calculate the net asset value on the balance sheet, the calculation lines use the following:

Calculating the amount of net assets in the balance sheet (the lines indicated above) using a pencil calculator is not enough. This calculation must be documented. However, a unified form for reflecting calculated data is not provided for in Order No. 84n. Organizations are required to independently develop a form and regulate it in their accounting policies.

Note that before the approval of Order No. 84n, the old form was in force (Order of the Ministry of Finance of the Russian Federation No. 10 and the Federal Commission for the Securities Market of Russia dated January 29, 2003 No. 03-6/pz). In the new instructions, the Russian Ministry of Finance has not prohibited the use of this form, therefore, firms can use it to prepare calculations of net assets in the balance sheet (the document lines contain all the necessary information).

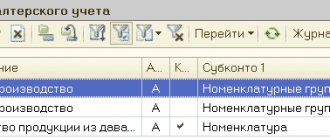

What does this mean in accounting?

Since it is both a means of production and a product for sale, the category needs strict control. This is actually the main resource of the company, which it appeals to. In accounting, the term has a broad interpretation. According to one version, this is that part of the company’s property that is directly involved and responsible for the process within the organization. According to another, this is, in principle, the property share of an economic entity, which is necessary for normal activities, expansion and development of the enterprise. There is a third view of what goods and materials are and what belongs to them: this is a tool of labor, which in its material form constitutes a future product. And it necessarily belongs to the production cycle.

That is, there are narrower and broader interpretations. But the importance of this category is brought to the fore everywhere. Equally, the importance of scrupulous accounting is fundamental. This is why there are a lot of different checks. And in particular, the key one is inventory.

Results

A certificate of the book value of fixed assets is an optional document when submitting financial statements.

It contains information about the cost of fixed assets that are listed on the organization’s balance sheet. Therefore, the certificate may be of interest to potential investors, banking and insurance organizations. A certificate of the book value of an enterprise's assets is filled out in any form due to the lack of a legally established form. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting for inventory items at an enterprise

There are two main points when such values are taken into account. Fixation occurs upon receipt and upon departure. That is, first of all, the posting of goods is subject to accounting, which for now may only represent material, raw material for future processing. All parish nomenclature, sales and purchase agreements, supplies, and accompanying documentation are recorded. Moreover, even if the source was not a third-party contractor, a supplier, but the company itself. After all, many factories have a very long production chain. When products come from one object to another in a more processed form. And all sites are part of a single enterprise.

Loss is the second stage, which also needs to be fixed. A similar outcome is possible in two variations. The first is product sales. That is, the creation of the object was successfully completed, and it went to the buyer, be it a legal entity or an individual, for a fee. The second option is loss due to various circumstances: damage, expiration date, defects, force majeure circumstances, theft in a warehouse or loss without identified reasons.

What is included in goods and materials

First, let's go through the general categories. Let's look at the varieties:

- Objects for implementation. The finished ones, which no longer require any processing, can only be sent for sale.

- Related materials necessary to complete the creation cycle, but not part of it. This is also the company's property, which must be scrupulously controlled.

- Raw materials, necessary resources. Sometimes these are just constituent elements, in other cases, this is, in principle, the entire basis of the created object. In fact, there is no serious difference for accounting.

Now let's move on to a more specific classification. And let's see what inventory items are:

- Inventories used to create new products.

- Raw materials.

- Fuel.

- Containers, consumables.

- Spare parts.

- Directly products for sale.

Species diversity

There are a huge number of classifications from various sources. But in order to most accurately understand the essence, it is enough to distinguish three main groups.

- Raw materials. This is the part of material assets that will be completely used for processing. However, these funds have not yet participated in the production process.

- Unfinished materials. Here the degree of readiness is not determined. This could be just the frame of an equipment or product, or, on the contrary, an almost completed item that is missing a couple of touches. The main criterion is that the object cannot yet be realized.

- Finished goods. You can send it to the counter or to your counterparty right now.

To make it clearer what is included in inventory, let’s give an example. Milk received from a supplier to create ice cream is still only a raw material. But if it has undergone at least some processing, it is already unfinished material.

Let us consider further in more detail.

Compilation rules

The legislation does not provide a unified form for drawing up this document, so each enterprise independently chooses a template and issues a certificate using it. Often the guideline is the requirements of the institution for which it is being formed. For example, the bank may require adding a clause regarding the availability of transport.

The certificate must include the following points:

The last point is the most important of all. The accountant must describe in detail everything related to the company's assets. If there is too much information, it is recommended to put it in a table. The signature of the director and chief accountant is required, otherwise the certificate will not be considered valid.

Registration of a certificate

The certificate can be written by hand or typed on a computer, on an ordinary A4 sheet or on the company’s letterhead (the latter option is preferable because it a priori includes the company’s details).

It is important to strictly observe only one condition - the document must be signed by the head of the organization (or a person who is his official representative), as well as the chief accountant. In this case, the signatures must be “live” - the use of facsimile autographs, i.e. printed in any way is unacceptable.

Today it is not necessary to certify a certificate using various types of stamps - this should be done only when the norm for the use of seals and stamps for endorsing papers is enshrined in the internal local legal acts of the company.

The certificate is usually made in one original copy, but if there is any need, additional certified copies can be made.

Information about the certificate is entered in a special accounting journal, and if it is intended for a third-party institution, also in the outgoing documentation journal.

Raw materials

Can only be used by an organization to create a product. This is the material material from which the product will consist in the future. Moreover, it becomes clear that as a result of work there is a lot of waste. And the final product will be much less than the initial one. Moreover, often a product item is produced in only one type. But the raw materials supplied are varied. To create a car you need steel, plastic, microchips and much more.

And inventory assets are the total part of various products, regardless of the specific stage at which they are used.

Unfinished production

As has already become clear, this is the most difficult group. After all, keeping records of these objects is extremely problematic if you give your name at each stage. Roughly speaking, they are constantly in process, changing somewhere every day, somewhere every hour. Now this is just the frame of the product, tomorrow it will be overgrown with mechanisms, then plastic and packaging. Tracking at each stage is problematic. Therefore, everything that does not belong to basic raw materials, and is also not a product that can already be sent to the counter, belongs to this group.

Finished Products

As we have already found out, goods and materials are what is included in the cycle. And as a result, many mean that they will no longer participate in production. Which can only be used. But this is not always true. After all, companies, in principle, often specialize in unfinished products. And if a given company at the end of the cycle only has a chip for a cell phone, this does not mean that it belongs to unfinished products in accounting during verification. And it doesn’t matter that the buyer will then perform many manipulations with it before turning it into a full-fledged smartphone.

Assessing values in an enterprise

One of the most important tasks during capitalization is to identify the cost factor. It will be necessary to focus on it in the future in a lot of different processes. But in this case the task becomes somewhat more complex. According to general rules, it is customary to focus exclusively on the physical cost of an object when it comes to inventory items. But its identification will depend on the source of receipt. And the difficulty of verification will also directly correlate with this factor.

Let's look at how this technique works using a table to make everything as clear as possible.

So, how are trade and material assets valued?

| Source | Methods for identifying costs |

| Purchased from the supplier when paying according to the standard scheme in monetary units | The entire amount of money that was allocated for the purchase is recalculated, and this includes delivery, if it had a cost. But VAT is excluded from the total amount |

| Which the company produced on its own | A new term appears here - MPZ, we will touch on it later. These are expenses aimed directly at the production process. |

| Accepted free of charge, as a result of promotions, discounts, gifts | It will be necessary to identify the current market price at the time of capitalization and focus strictly on it. If the determination of cost also involves a certain level of costs, they are also recorded in the cost price. |

| Directly allocated to capital by the founders | The price factor is identified using the recommendations of the founders. |

| Received as a result of barter | The full cost of the spent property is revealed. If there is no way to accurately determine the figure, then you should rely on the market price of the assets already received. |

| For sale | Depending on the regulations of the company itself. There are two options, either look at the price of receipt, or at the price at which it is planned to sell goods during business activities. |

Where can I find a form for a certificate of book value?

The form of a certificate of the book value of fixed assets is not approved at the legislative level. This means that you can use any form of this document. Let us remind you that business entities have the right to develop forms of certain documents based on their needs and characteristics of their activities. Therefore, the enterprise can also approve the form and type of this document independently, securing it with the appropriate order.

Fixed assets in the certificate can be listed by name (if there are a small number of them) or divided into groups: non-residential buildings, machinery, inventory and equipment for production needs, and so on.

You can see an example of preparing such a certificate on our website. We offer two options for formatting this document (they are shown in the file, which you can download from the link below):

The need for inventory

While we were analyzing what inventory materials mean, we often mentioned this particular type of verification. And for good reason, because it is fundamentally important in this area.

The meaning of inventory is the constant control of all current assets. Often this involves planned control, which is designed to verify the actual availability and records in documents. The manager personally hands over documentation and inventories that indicate the number of balances at the moment. And the commission he formed is conducting an inspection. They identify whether there are any shortcomings or, on the contrary, an unaccounted surplus.

In addition to scheduled inspections, an inventory is often carried out when there is a change in responsible persons, company reorganization, or various types of emergencies, such as fire. In addition, if theft was detected in a warehouse, then the inventory must calculate the volume of the criminal act.

It is worth understanding that with a large turnover of assets, this procedure is lengthy and very difficult. You can simplify it to a minimum using software solutions from Cleverence. They not only turn a routine audit into a quick and easy action for employees, but also eliminate excess human costs. After all, just one employee with a smartphone, or better yet, a TSD, is enough, because the phone is not always reliable, and the data collection terminal is much more secure for working, for example, in a warehouse, to carry out the procedure. In addition, various types of solutions are offered: both individual offers that are personalized specifically for the type of business activity and all the features of the “internal kitchen” of a legal entity, and packaged solutions for any company.

When is a certificate of net asset value required?

To date, there is no unified form of this document. It is drawn up in the form of an accounting certificate and approved by order of the head of the enterprise (Part 4, Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ).

A certificate of net asset value is not mandatory for regular submission of financial statements, but its execution is necessary in some cases:

- for the purpose of providing information on the general financial condition and solvency of the enterprise to banks and insurers;

- to compare the value of the authorized capital and net assets (the authorized capital must be reduced to the value of net assets in accordance with paragraph 4 of Article 30 of the Law “On Limited Liability Companies” dated 02/08/1998 No. 14-FZ, hereinafter referred to as the LLC Law), etc. .

Purpose of the certificate

Business entities in the course of their activities must regularly assess the state of their net assets. The value of this indicator must be compared with the size of the authorized capital. The optimal situation is when the amount of capital is lower than the value of the firm's resource base. If the balance is upset and the imbalance persists in the long term, the enterprise may be subject to forced liquidation.

Data on the results of the analysis of the asset structure of the company's balance sheet are reflected in the certificate of net assets. Purpose of the document:

- prompt adjustment of business tactics and timely introduction of changes to the action plan in the financial sector of the enterprise;

- achieving an optimal ratio between asset and liability indicators.

Filling out the certificate

A certificate of net asset value is drawn up in free form and contains the following information in accordance with Part 2 of Art. 9 of Law No. 402-FZ:

- Name of company.

- TIN of the enterprise.

- Organizational and legal form of activity, namely: limited liability company.

- Main activities according to OKVED.

- Enterprise address.

- Date of preparation of the certificate.

- An indication that the document was issued on the basis of accounting data from a certain date (for example, according to Part 1 of Article 29 of the Law on LLCs, in order to distribute profits among the company's participants, it is necessary to find out the value of net assets at the time the decision is made).

- In the tabular section, if desired, it is possible to provide a detailed breakdown of assets. It is possible to issue an abbreviated version indicating the total value of the enterprise's assets.

Note! The certificate is signed by the head of the enterprise, the chief accountant.

The statement of net assets of an enterprise provides information regarding the value of its property and cash minus the value of its liabilities. There is no unified form for this document. It must include an indication of the date of compilation and the name of the organization.

https://rusjurist.ru/ooo/imuwestvo_ooo/obrazec_spravki_o_stoimosti_chistyh_aktivov_ooo/

Display in accounting

Primary documentation and other accounting registers constantly record the state of balances at the beginning of new periods. Changes and edits are made only due to the identification of inconsistencies during inspections.

If there were no deviations, then arrival and departure are processed as usual in the form of balances for two key dates. This is the beginning and end of the year. It is considered inappropriate to withdraw the full balance more often. But this does not mean that data is not collected in other periods. It just doesn't display a full report.

Examples for FSBU “Fixed Assets”

Application

to Federal Accounting Standard (FSBU) No. 1

"Fixed assets"

Example No. 1 Determination of the object of accounting for fixed assets

Example 1. Definition of an accounting object using the example of an overhead line (hereinafter referred to as VL 110-35).

An overhead line (overhead line) is a single, separately identifiable object of real estate, having independent inventory and cadastral numbers. A separate technical passport is issued for the overhead line. Overhead lines consist of wires attached using traverses (brackets), insulators and fittings to supports. Supports, in turn, are structures for holding wires and lightning protection cables of overhead power lines and fiber optic communication lines, if any. The supports are attached directly to the ground or to a special foundation on land plots designated specifically for these purposes. Overhead lines are classified by voltage level.

When forming objects of accounting for fixed assets, depreciable components of fixed assets and inventory objects of fixed assets, the organization applies the provisions of paragraphs 9 and 39 of this Standard.

It is rational to consider wires along the entire length of the overhead line as a separate depreciable component of fixed assets. These objects are difficult to identify in individual areas. Thus, it is advisable to group overhead line wires, divided into sections, and often insignificant in cost, and accounted for as a separate depreciable component of fixed assets.

It is also rational to select supports as a separate shock-absorbing component, subdividing them into reinforced concrete and anchor ones.

With respect to overhead line elements such as lightning protection cables, professional judgment must be applied to identify them as separate depreciable components of fixed assets, group them into a separate depreciable component of fixed assets, or include them in another depreciable component of fixed assets. All of these overhead line elements can be considered components of the overhead line support and combined with it into a single shock-absorbing component with the overhead line support. They constitute an insignificant cost of the cost of an overhead line support, and separating them into separate depreciable components would be irrational.

The object of real estate is the object named in the Certificate of Ownership, for example, “Power grid complex VL 110KV Moskovskaya”.

In the accounting (financial) statements, this object is reflected in the group of items “fixed assets” as “VL” or “Transmission devices”.

In accounting, on the basis of the professional judgment of an economic entity, the following objects are recognized.

Fixed asset accounting object:

– VL 110 KV (this object includes all real estate objects reflected in the Certificates of ownership of this economic entity).

Depreciable components of a recognized accounting object – option 1:

— Component 1 – “Wires”;

— Component 2 – “Overhead line supports, including cross-arms and insulators”;

— Component 3 – “Lightning wire”.

Depreciable components

of a recognized accounting object

– option 2:

— Component 1 – “Wires and lightning cables”;

— Component 2 – “Cross beams”;

— Component 3 – “Insulators”;

— Component 4 – “Reinforcement”;

— Component 5 – “Supports”.

Example 2. Isolation of depreciable components, accounting for repairs and maintenance, calculation of depreciable value.

The airline company purchased and put into operation the aircraft at the beginning of 2009 for 14.16 million rubles. (including VAT 18%). The organization had no other costs associated with receiving the aircraft, other than the purchase price. The organization plans to use the aircraft for 12 years, after which it intends to sell the used aircraft to a training center for use as a stand for 826 thousand rubles. (including VAT 18%), which is agreed upon with the training center. Presumably, the benefits from operating the aircraft will be uniform throughout the entire service life.

For the planned operation of the aircraft for 12 years, the following significant costs must be incurred:

- replace the power plant once (after 6 years of operation);

- replace engines twice (every 4 years of operation);

- update the interior equipment three times (every 3 years of operation);

- Carry out maintenance five times (every 2 years of operation).

All of these replacements and activities are planned to be implemented at the beginning of the year. At the time of acquisition of the aircraft, the costs of these replacements and measures carried out on other aircraft of the same model were as follows (including 18% VAT):

- power plant - 2,124 thousand rubles;

- engines – 2,832 thousand rubles;

- interior equipment – 1,770 thousand rubles;

maintenance – 944 thousand rubles.

The organization accrues depreciation for 2009 in the amount of 2,200 thousand rubles. based on the following allocated depreciable components:

| №№ AK | Dedicated damping components (hereinafter referred to as AK) | SPI AK (years) | Amortized cost of AK without VAT (thousand rubles) | AK depreciation (thousand rubles) |

| 1 | power point | 6 | 1800 | 300 |

| 2 | engine | 4 | 2400 | 600 |

| 3 | interior equipment | 3 | 1500 | 500 |

| 4 | THAT | 2 | 800 | 400 |

| 5 | fuselage and so on | 12 | 4800 | 400 |

| Total | 2200 |

To calculate the depreciation of the aircraft, the following data was used: the useful life is 12 years, the non-depreciable balance is 826 thousand rubles. (including VAT 18%), the depreciable cost of unidentified components is 4800 thousand rubles, obtained as follows: 12000- (1800+2400+1500+800)-700=4800.

Example 3. Accounting for the acquisition of fixed assets in case of installment payment.

The cost of property recognized in accounting as a fixed asset, taking into account installments, is 1,200,000 rubles. The cost of this object in the absence of installments is 1,000,000 rubles. This value is accepted as the nominal value. Installment plan is provided for 2 years. Interest rate = 9.5445% per annum.

The accounting procedure for this object is as follows:

The difference between 1,200,000 rub. and 1,000,000 rub. represents interest costs that must be taken into account in the cost of a fixed asset or recognized as expenses of the period, depending on the qualification of this fixed asset as an investment asset.

The fixed asset upon initial recognition is valued at RUB 1,000,000.

In the first year, the debt to the counterparty increases by an interest amount of 95,445 rubles, and in the second year - by 104,555 rubles. The total amount of interest for 2 years is 200,000 rubles, the amount of debt to the counterparty at the end of the second year is 1,200,000 rubles.

Example 4. Changes in depreciation characteristics of fixed assets.

At the beginning of year 00, the organization purchased a car for 300 thousand rubles, which it will reflect in accounting as a fixed asset. The non-depreciable cost of this car is 60 thousand rubles. The organization set the useful life at 150 thousand km. During the first year of operation, the car traveled 50 thousand km.

For the first year of operation of the car, the organization recognized an expense in the form of depreciation in the amount of 80 thousand rubles: (300-60) * 50/150.

From the second year of operation, the organization revised the useful life, setting a new period of 7 years. As a result, the non-depreciable cost has changed. It amounted to 40 thousand rubles.

For the second year of operation of the car, she recognized depreciation expense in the amount of 30 thousand rubles: (300-40-80)/6.

The organization's balance sheet during the operation of the vehicle is as follows:

| 31.12.02 | 31.12.01 | 31.12.00 | |

| The main thing | 190=300-(80+30) | 300-80=220 | 300 |

Example 5. Application of methods for revaluation of fixed assets.

1.

Proportional method

The cost of a fixed asset upon recognition is 1,000,000 rubles; the useful life of the fixed asset is 20 years; costs for reconstruction carried out after 7 years of use - 150,000 rubles; market value as of the reporting date – RUB 1,200,000.

After 7 years of using the fixed asset:

accumulated depreciation will be 1,000,000/20*7 = 350,000 rubles.

the cost of the fixed asset will be 1,000,000 + 150,000 = 1,150,000 rubles.

the book value of the fixed asset before revaluation will be 1,150,000 – 350,000 = 800,000 rubles.

The ratio between the market value and the book value of the fixed asset = 1.5 times.

Cost of fixed assets taking into account revaluation = 1,150,000 * 1.5 = 1,725,000 rubles.

Depreciation of fixed assets taking into account revaluation = 350,000 * 1.5 = 525,000 rubles.

Book value of the fixed asset after revaluation = 1,725,000 – 525,000 = 1,200,000 rubles.

2.

Method of changing depreciation

The cost of a fixed asset upon recognition is 1,000,000 rubles.

Useful life of fixed assets – 20 years

The cost of reconstruction carried out after 7 years of use is 150,000 rubles.

The market value of the fixed asset as of the reporting date is RUB 1,050,000.

After 7 years of using the fixed asset:

accumulated depreciation will be = 1,000,000/20*7 = 350,000 rubles.

the cost of the fixed asset will be 1,000,000 + 150,000 = 1,150,000 rubles; the cost is not recalculated with this revaluation method.

Depreciation taking into account revaluation will be: 1,150,000 – 1,050,000 = 100,000 rubles.

The book value of the fixed asset after revaluation (should not be higher than the market value) will be 1,050,000 rubles.

3.

Method of zeroing depreciation

The cost of a fixed asset upon recognition is 1,000,000 rubles. The useful life of the fixed asset is 20 years. The cost of reconstruction carried out after 7 years of use is 150,000 rubles. The market value of the fixed asset as of the reporting date is RUB 1,200,000.

After 7 years of using the fixed asset:

accumulated depreciation will be 1,000,000/20*7 = 350,000 rubles.

the cost of the fixed asset will be 1,000,000 + 150,000 = 1,150,000 rubles.

book value of the fixed asset before revaluation = 1,150,000 – 350,000 = 800,000 rubles.

The cost of the fixed asset is reduced by the entire amount of accumulated depreciation = RUB 1,150,000. — 350,000 rub. = 800,000 rub.

The cost of a fixed asset is recognized as equal to its market value = 1,200,000 rubles. Depreciation of a fixed asset taking into account revaluation is equal to 0.

The book value of the fixed asset after revaluation will be 1,200,000 – 0 = 1,200,000 rubles.

The remaining revaluation equal to 5 * 17 5000 rub. = 87,500 rubles, written off at a time: D83 K84 87,500 rubles. (October 1).

Example 6. Determination of the cost of the retiring part during partial liquidation of a fixed asset.

In the event of partial liquidation of a fixed asset, the cost of the fixed asset is reduced in the amount of the book value of the disposed part of the fixed asset. If the book value of the disposed part is not known, then it is determined by the organization by calculation.

The book value of the liquidated part of the fixed asset subject to write-off can be determined by any reasonable methods set forth in the Accounting Policy of the Organization. For example:

Option 1:

— the share of the liquidated part of the fixed asset is determined in proportion to the physical indicator characteristic of this fixed asset. For example, in the case of partial liquidation of an extended property (communication line, power line, highway, other similar object), the length of the object can be used as such an indicator; in the case of partial liquidation of a system consisting of a number of homogeneous elements, the number of such elements, etc. P.

— the cost of the liquidated part of the fixed asset is determined as the product of the cost of the fixed asset and the share of the liquidated part of the fixed asset;

— the degree of depreciation (depreciation) of a partially liquidated fixed asset is determined (the ratio of accrued depreciation to the cost of the fixed asset);

— based on the cost of the liquidated part of the fixed asset and the degree of wear and tear (depreciation), the accrued depreciation for the liquidated part of the fixed asset is determined.

Let the cost of a communication line upon recognition be 1,000,000 den. units

The length of the communication line is 100 km.

Accrued depreciation on the communication line is 500,000 den. units

The length of the retiring part (a separate section of the communication line is being taken out of service) is 20 km.

The share of the retiring part (based on the physical indicator) is equal to 20/100 = 0.2

The cost of the retiring part is equal to = 0.2 * 1,000,000 = 200,000 den. units

The wear rate of the communication line is 500,000/1,000,000 = 0.5

Depreciation on the disposal portion is equal to 0.5 * 200,000 = 100,000 den. units

Option 2:

-The percentage (%) of the cost of the liquidated part of the fixed asset in the original cost is determined (by expert means);

The organization uses an excavator.

The cost of an excavator upon recognition is 300,000 monetary units.

The useful life established by the organization is 5 years.

10 months after the start of operation, the excavator bucket broke. The organization's technical services decided to replace the bucket.

Accrued depreciation for the period of use is 50,000 den. units

The cost of the bucket in the cost of the excavator is 40%

We determine the cost of the bucket when recognizing 300,000*40%=120,000,

We calculate the depreciation of the bucket at the time of liquidation - 20,000 monetary units. (120,000 /60*10)

Cost of the bucket at the time of disposal -100,000 monetary units (120,000 – 20,000)

If it is not practical for an economic entity to calculate the book value of the retiring part of a fixed asset (replaced part), then the book value of the replaced part can be determined as the cost of the replacement part. The costs of dismantling the replaced part are recognized as expenses of the current period from the disposal of fixed assets.

Differences between inventories and inventories

Inventory is inventories. We have already mentioned them above. And modern sources on the network, indeed, are trying to identify some difference between them. But all such opinions are wrong. After all, in reality, they are completely the same thing. The difference is simply in terminology, nothing more. And also in the fact that now MPZ is considered a more modern option, which is more often used in young companies, startups and new projects. Often, the MPZ does not take the goods themselves, but only raw materials, materials and other consumables.