Selecting a reward code

Employers pay bonuses to employees based on their own local regulations. The reason for payments can be different (for exceeding specified volumes, improving the quantity and quality of products, etc.), the frequency of accrual also varies - one-time incentive, monthly payments, annual bonus. The personal income tax code for different types of premiums may differ.

A complete breakdown of all income codes is given in Appendix 1 to the Federal Tax Service order dated September 10, 2015 No. ММВ-7-11/ [email protected] (the last changes were made to the reference book on October 24, 2017). For bonuses, income codes (codes 2002 and 2003) were introduced by order of the Federal Tax Service dated November 22, 2016 No. ММВ-7-11 / [email protected] They are also valid for certificates for 2021.

The bonus code in 2-NDFL depends on the source and reason for payment of bonuses. The tax agent himself chooses the desired value based on the actual circumstances of the accrual. For one-time bonuses, the income code may also vary.

Remuneration for the performance of labor duties is indicated in 2-NDFL by code 2000. But for bonuses, code 2000 is not suitable, because it is intended for wages and amounts of monetary allowance or maintenance during the performance of labor/official duties. Awards should be reflected in the certificate under codes 2002 and 2003.

Coding of payments to individuals for personal income tax

Each remuneration paid to an individual has a corresponding coding. The full list is contained in Appendix 1 of the Federal Tax Service order No. ММВ-7-11 dated September 10, 2015. What code the bonus has in 2-NDFL depends on what it was accrued for: for production results or on other grounds.

The certificate indicates the income code bonus for production results 2002, if the remuneration is related to the employee’s performance of his job duties: for performing certain work, for exceeding the plan, etc. Thus, if a monthly, quarterly or annual bonus is paid, the personal income tax code is always will be 2002 (letter of the Federal Tax Service dated 08/07/2017 No. SA-4-1/).

If a one-time bonus is paid that is not related to the performance of work duties: for a holiday, a bonus for an anniversary date, indicate a different income code - 2003.

Table: income code bonus in the 2-NDFL certificate

| Code | Type of payment |

| 2002 | Bonus for labor performance:

|

| 2003 | Bonus due to profit:

|

Table of other income in certificate 2-NDFL

| Encoding | Type of payment |

| 2000 | Wage |

| 2010 | Payments under contract agreements |

| 2012 | Vacation pay |

| 2013 | Compensation for unused vacation |

| 2300 | Payment of sick leave |

Explanations from the Federal Tax Service

When choosing a bonus code in the 2-NDFL certificate for 2021, you can be guided by the Federal Tax Service letter No. SA-4-11 / [email protected] dated 08/07/2017. It explains what types of rewards can be attributed to a particular code.

For a bonus in 2-NDFL, income code 2002 is selected in the case when the reward is accrued:

- based on the results of work activity for a certain period of time (month, year, quarter);

- for particularly important assignments or assignments;

- in connection with the conferment of an honorary title;

- in connection with receiving awards for production achievements.

The certificate contains personal income tax code 2003 if the premium:

- issued for the anniversary;

- accrued for the holiday;

- designed for additional stimulation;

- refers to other payments not related to the performance of labor or official duties.

Sometimes it is not possible to unambiguously attribute income to one or another indicator. In difficult cases of choosing an income code for a bonus in 2020, the tax agent is recommended to submit a detailed request to the Federal Tax Service of Russia.

Example 4

The employee was awarded a bonus for length of service. The company was faced with a question: which award code should be specified: 2000 or 2002? The additional payment does not directly depend on the employee’s production results, and at the same time is associated with a long period of his working activity. In letter No. SA-4-11/ [email protected] the Federal Tax Service explained that the long service bonus should be included in income with the coding 2000.

Thus, for different types of bonuses, the personal income tax code may differ. Moreover, the indicator does not depend on the frequency of payment. The tax agent independently determines which code to assign the accrued remuneration to, guided by the current income coding directory and its own Regulations on Bonuses (or other local document), which makes it possible to determine the source and procedure for assigning incentive amounts. For bonuses, personal income tax codes in 2020 are 2002 or 2003, depending on the reason for payment.

Under what conditions is a premium recognized as an expense?

As is known, labor costs include any accruals to employees in cash and (or) in kind, incentive accruals provided for by legislation, labor and (or) collective agreements (Article 255 of the Tax Code of the Russian Federation). At the same time, paragraph 2 of Article 255 of the Tax Code of the Russian Federation directly states that labor costs include accruals of an incentive nature, including bonuses for production results. Bonuses are included in labor costs if the following conditions are simultaneously met:

- the bonus is provided for by an employment agreement (contract) and (or) a collective agreement, or a local regulatory act (regulations on remuneration, regulations on bonuses for employees), provided that the employment contracts contain a reference to this act (Article 255, paragraph 21 of Art. 270 Tax Code of the Russian Federation). The corresponding clarifications are given in letters of the Ministry of Finance of Russia dated 02/12/16 No. 03-03-06/3/7522 and dated 06/03/14 No. 03-03-06/4/26582 (see “The Ministry of Finance recalled under what conditions remuneration paid to employees at the end of the year, may reduce taxable profit” and “The Ministry of Finance announced when the cost of bonuses for holidays can be taken into account when calculating income tax”). At the same time, it is important that the document establishes specific indicators taken into account when assigning a bonus, the procedure for determining the bonus, the conditions for paying the bonus, etc. This is stated in the letter of the Federal Tax Service of Russia dated 04/01/11 No. KE-4-3/5165 (see “The Federal Tax Service recognized bonuses, the amount of which was provided only in the bonus order, as a labor expense”).

Compose HR documents using ready-made templates for free

- a bonus (regardless of its name) is paid for labor performance, that is, for production results, professional excellence, high achievements in work, etc. (Clause 2 of Article 255 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated July 22, 2016 No. 03-03-06/1/42954, see “Non-production bonuses do not reduce taxable profit”). It does not matter whether such a bonus is periodic or one-time, whether it is in the nature of wages or is an incentive not included in the salary. This means that as part of expenses, you can take into account both a one-time bonus for special achievements in work or for performing certain work, and a bonus for vacation, if these payments are correctly established in the relevant local acts and employment contracts;

- there is a document confirming that the employee fulfills the bonus conditions established by the organization (memo, justification calculation, etc.). If the bonus is paid based on the results of work in each month, then it should be obvious that in each month the employee fulfills the production indicators for which it is awarded: actual time worked, the amount of material assets created, the amount of income received through labor, etc. (letter of the Federal Tax Service of Russia dated 04/01/11 No. KE-4-3/5165, see “The Federal Tax Service recognized bonuses, the amount of which was provided only in the bonus order, as a labor expense”).

- there is an order to pay the bonus (clause 1 of Article 252 of the Tax Code of the Russian Federation).

All of the above is relevant both for those taxpayers who are on the OSNO and for those who pay a single tax under the simplified tax system. After all, the “simplified people” who have chosen the object of taxation “income minus expenses” take into account labor costs according to the rules of Article 255 of the Tax Code of the Russian Federation (subclause 6 of clause 1 of Article 346.16 and clause 2 of Article 346.16 of the Tax Code of the Russian Federation).

Keep records, prepare and submit income tax and VAT reports

As for non-production bonuses (in connection with retirement, for a birthday or anniversary, for a holiday, including professional ones), they are not taken into account when taxing profits on the basis of paragraph 21 of Article 270 of the Tax Code of the Russian Federation. This conclusion is confirmed in letters from the Ministry of Finance of Russia (for example, dated 04.24.13 No. 03-03-06/1/14283, dated 03.20.13 No. 03-04-06/8592, see “The Ministry of Finance clarified the procedure for taxation of one-time benefits when employees leave for retirement” and dated 02.21.11 No. 03-03-06/1/111, see “A one-time payment upon retirement of any employee is not taken into account in expenses”). A similar approach is followed by courts of various instances (see, for example, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 03/01/11 No. 13018/10, Resolution of the Federal Antimonopoly Service of the West Siberian District dated 03/05/13 No. A81-1945/2012, East Siberian District dated 05/02. 12 No. A74-2038/2011, Northwestern District dated 09.07.09 No. A56-20637/2008 and Volga District dated 10.17.06 No. A65-3412/2006-SA2-41, resolution of the Arbitration Court of the North Caucasus District dated 15.04. 15 No. Ф08-894/2015).

Note that the ban on writing off non-production bonuses also applies to “simplified” workers, since, by virtue of the direct indication of paragraph 2 of Article 346.16 of the Tax Code of the Russian Federation, such taxpayers, when accounting for expenses, act according to the rules of paragraph 1 of Article 252 of the Tax Code of the Russian Federation. And this norm, in turn, does not allow taking into account the expenses specified in Article 270 of the Tax Code of the Russian Federation.

Keep records, prepare and submit reports according to the simplified tax system in the web service

What can bonuses be paid for?

Bonuses for certain results or volumes of work for different employees can take into account completely different indicators. So, for example, for programmers it could be:

- uninterrupted operation of servers,

- high repair speed,

- implementation of new solutions,

- development or modification of certain software products to increase operational efficiency with their help.

For HR and accounting department employees, you can enter indicators such as:

- performing an increased number of operations,

- no comments on inspections,

- timely, error-free preparation and submission of reports, and so on.

Sales department employees can be rewarded for:

- number of new contracts concluded,

- small percentage or absence of terminated contractual obligations with regular customers,

- achieving a certain sales volume,

- absence or a certain number of complaints and claims regarding services and product quality.

It should be noted that bonuses cannot be awarded for those functions and volumes that are included in job responsibilities. Accordingly, in order to award an employee a bonus, these indicators must be higher and more effective, which must be specified in the bonus regulations.

You should also pay attention that often the bonus is paid only to the manager. This should not be done. This will certainly raise questions from the inspection authorities.

For top managers, it is necessary to think through a specific sales plan for the entire department, for example, or the entire enterprise. You can include surcharges for

- increasing marketing efficiency,

- reduction in claims from buyers,

- achieving sales volumes for the entire team,

- improving the performance of a department or the entire enterprise.

For the general director, any remuneration and bonuses are established by agreement with the founders of the company, therefore, payments are made on the basis of such a decision. If the director himself is the sole founder of the enterprise, then all the expenses in question are also taken into account according to the general rule under Art. 255 and 346.16 of the Tax Code of the Russian Federation.

When developing motivational additional payments, it is recommended that company management agree on all indicators and amounts with human resources and accounting. To ensure that all legislation is complied with.

Income codes that are always subject to personal income tax

Income code 2000 is wages, including additional payments and allowances (for harmful and dangerous work, for night work or combined work).

Income code 2002 is a bonus for production and similar results that are provided for in employment contracts, collective agreements or legal norms.

Income code 2003 – remunerations paid from the organization’s profits, special-purpose funds or targeted revenues.

Income code 2010 – income from civil contracts, excluding copyright contracts.

Income code 2012 – vacation pay.

Income code 2013 - to compensate for unused vacation.

Income code 2014 - severance pay, compensation payments in the form of average monthly earnings for the period of employment after dismissal, compensation to managers, deputy managers, chief accountants in excess of earnings for 3 or 6 months (regions of the Far North and equivalent areas).

Income code 2300 – sick leave benefit. It is subject to personal income tax, so the amount is included in the certificate. At the same time, maternity and child benefits are not subject to income tax, and they do not need to be indicated in the certificate.

Income code 2301 – fines and penalties paid by the company by court decision for failure to voluntarily satisfy consumer demands.

Income code 2610 - denotes the employee’s material benefit received from savings on interest on loans.

Income code 2001 is remuneration of directors and other similar payments received by members of the organization's management body (board of directors, etc.).

Income code 1400 – an individual’s income from leasing or other use of property (if it is not transport, communications or computer networks).

Income code 2400 – income of an individual from leasing vehicles for transportation, pipelines, power lines and other means of communication, including computer networks.

Income code 2520 – income in kind received in the form of full or partial payment for goods, work, services performed in the interests of the taxpayer.

Code 2530 – remuneration in kind.

Income code 2611 - bad debts written off from the balance sheet..

Income code 1010 – transfer of dividends.

Income code 3020 – interest on bank deposits.

Income code 3023 – income in the form of interest (coupon) received by taxpayers from ruble bonds of domestic organizations issued after January 1, 2017.

Income code 4800 is a “universal” code for other employee income that is not assigned special codes. For example, daily allowances in excess of the tax-free limit, additional sick pay, stipends.

See the full list of income and deduction codes for the 2-NDFL reference.

Accrual of a one-time bonus in 1C: ZUP

For other one-time accruals, the program uses a special document, which is called that and is located in the “Salary” menu.

It creates various allowances, compensation payments, etc. You can also display a one-time document from the “All Accruals” journal. To see how everything works, it is recommended to first set up the appropriate accrual. Suppose you want to create a one-time incentive payment for the National Unity Day holiday.

If you create such an accrual as “Premium”, then personal income tax and insurance premiums will be charged from it. However, we are looking at a premium that is paid out of net profit. Therefore, you should select, for example, “Other accruals and payments.” Please note that the accrual is carried out on a separate document.

Set the switch to the “Result is displayed as a fixed amount” position. Uncheck the positions

- “Include in payroll” on the “Basic” tab,

- “Include in the accrual base when calculating average earnings” for vacations and business trips and for calculating benefits on the “Average earnings” tab.

On the “Personal Income Tax” tab, you should set a marker on what is taxed according to income code 2003. You can also set code 4800 “Other income”. It all depends on the established order in the company.

The income category is important in organizations where foreigners work - preferential non-residents; the percentage of personal income tax depends on it. In this case, this is not important; you can select “Other income from employment.” Set markers:

- the payment is fully subject to insurance contributions,

- statistical reporting is not taken into account,

- is not included in labor costs for income tax purposes,

- in accounting “As specified for accrual”.

Select the appropriate subaccount, or it will be set automatically.

Finally, press the “Record and close” button to activate the accrual.

In what cases is the code 2002 entered?

For bonuses, code 2002 is used for remunerations accrued for production results or other indicators provided for by the laws of the Russian Federation and/or paid to employees in accordance with labor and collective agreements. Typically, these payments are included in labor costs.

Example 1

The company accrues additional remuneration to each sales department employee who completes the volume of transactions specified in the Bonus Regulations during the month. The bonus amount is 10,000 rubles for each employee who has concluded contracts with customers in a month worth more than 150,000 rubles. For such a monthly premium, the income code in the 2-NDFL certificate is 2002.

Example 2

Based on the results of the calendar year, all employees of the enterprise are paid bonuses if the total volume of production increased by more than 5%. What bonus code should I use at the end of the year? The payment is directly related to production activities, therefore, when the annual bonus is calculated, the income code must be selected - 2002.

Documentation of additional payments

It should be noted that such payments must always be documented. There are several ways to do this.

The simplest of them is to stipulate in the employment contract the terms of payment, procedure and size. But, if the bonus is specified in the employment contract and is indicated, for example, as a percentage of wages, then it becomes periodic and mandatory. The organization will not be able to pay it on a “whim” if the employee has fulfilled all the necessary conditions. Moreover, when you need to change the amount of such payments, you will have to make changes to the employment contract itself and enter into an additional agreement, which is impractical.

Therefore, the most rational way would be to create an internal local act at the enterprise. This may be the Regulations on remuneration and bonuses. Or a separate Regulation on bonuses, which will spell out all the cases and conditions for the accrual and payment of certain remunerations to employees, as well as their regularity and frequency. And the employment contract will need to indicate that the company may pay bonuses in accordance with the Regulations on Bonuses.

A memo from the head of the unit, approved by the director, is the basis for drawing up an order for the enterprise.

Coding of personal income tax deductions

The 2-NDFL certificate encodes not only payments to individuals, but also deductions provided.

Currently, an employee has the right to receive standard, property and social deductions from the employer. Tax deduction coding table

| Encoding | Deduction |

| Standard | |

| 126 | For the first child |

| 127 | For a second child |

| 128 | For the third and subsequent children |

| Property | |

| 311 | For the purchase of housing |

| 312 | For mortgage interest |

| Social | |

| 320 | For your training |

| 321 | For a child's education |

| 324 | For treatment |

A complete list of deduction codings is contained in Appendix 2 of the Federal Tax Service order dated September 10, 2015 No. ММВ-7-11/

What premiums should insurance premiums be calculated for?

Article 420 of the Tax Code of the Russian Federation recognizes as the object of taxation of insurance premiums for organizations payments and other remuneration that are made within the framework of labor relations in favor of employees. This means that the key point when deciding whether to include bonus amounts in the base for calculating contributions is the connection of these payments with the employee’s performance of work duties, as well as whether these payments have an incentive nature (rulings of the Supreme Court of the Russian Federation dated January 26, 2018 No. 307-KG17-21301 and dated 12/27/17 No. 310-KG17-19622, see “Holiday Bonuses: The Supreme Court clarified when such payments are not subject to contributions”).

Taking into account these criteria, production bonuses (both periodic and one-time; both bonuses that are part of the salary and incentive bonuses) should be subject to insurance premiums on a general basis. As for non-production premiums, there is no need to charge insurance premiums for them. This conclusion is confirmed by the rulings of the Supreme Court of the Russian Federation dated 09/01/15 No. 304-KG15-10018 (see “Supreme Court: employee anniversary bonuses are not subject to insurance contributions”) and dated 01/16/18 No. 303-KG17-20493 (see “Contributions for payment upon retirement of an employee: the position of the Supreme Court"), by resolution of the Arbitration Court of the Volga District dated September 27, 2016 No. F06-13612/2016). Let us note that for now the Ministry of Finance of Russia does not agree with this interpretation of the provisions of Article 420 of the Tax Code of the Russian Federation, and insists on the payment of insurance premiums on non-production premiums (letter dated 02/07/17 No. 03-15-05/6368, see “Ministry of Finance: bonuses to employees for holidays and anniversaries are subject to insurance premiums").

Fill out, check and submit insurance premium calculations online

Creating an accrual

Now you should create a document “Calculation of salaries and contributions” for September 2021 from the “Salary” menu. In the form that opens, select the organization, the month of accrual and click the “Fill” button. As you can see, for a specific employee Bulatov, both salary accruals and bonuses were reflected.

The “Personal Income Tax” tab will reflect the total tax amount of 11,700 rubles, calculated from 90,000 rubles. If in doubt, click on the amount and the transcript will open.

On the “Contributions” tab, you can click on the hyperlink “For more details, see the Insurance Contributions Accounting Card” and see all the information for the selected employee regarding accruals and contributions from them for the last year.

Codes of income that are subject to personal income tax when the limit is exceeded

Income code 2720 – cash gifts to the employee. If the amount exceeds 4,000 rubles, then tax is charged on the excess. In the certificate, the amount of the gift is shown with income code 2720 and at the same time with deduction code 501 .

Income code 2760 – financial assistance to an employee or former employee who retired due to disability or age. If the amount of assistance exceeds 4,000 rubles, then a tax is levied on the excess. In the certificate, the amount of financial assistance is shown with the income code 2760 and at the same time the deduction code 503 .

Income code 2762 – one-time payment in connection with the birth or adoption of a child. If the amount exceeds 50,000 for each child, but for both parents, then tax is charged on the excess amount. In the certificate, this amount is shown with income code 2762 and deduction code 504 .

When does code 2003 apply?

The withholding agent provides premium code 2003 only in certain cases. Such operations include:

- payment of bonuses from the company’s net profit;

- payment of bonuses to employees from special-purpose funds or from targeted revenues.

Example 3

In a company engaged in the construction of residential buildings, for Builder’s Day they decided to give out 3,000 rubles from the company’s profits. bonuses for all employees. The holiday bonus income code that the accountant will indicate in the 2-NDFL certificates is 2003, since the payment is not directly related to labor results, and its source is the company’s net profit.

Key points for awarding bonuses

To summarize the above, several main points can be highlighted.

- Bonuses can be of a production or non-production nature. The former depend on the results of labor and affect taxable profit. The latter are paid for anniversaries and for other non-productive achievements from net profit.

- All possible remunerations must be recorded in the company’s internal local regulations.

- Payment of the bonus is made on the basis of an order based on the submitted memo.

- Codes are used to indicate the award

- 2002 (2000) for performance awards

- and 2003 for payments not tied to performance.

- All accruals in the 1C: Salary and personnel management program are entered using documents:

- for production bonuses, personnel documents on hiring, transfers, and salary changes are used;

- other payments are entered in the “One-time accrual” document.

- Personal income tax and insurance premiums are withheld from the premium. The dates for accrual and withholding of tax depend on the type of premium.

The input process in the program itself is not complicated, but if you have questions, you can always ask our specialists.

Deadline for submitting 2-NDFL in 2020

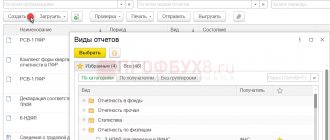

Employers report to the tax authorities on amounts paid to employees and personal income tax withheld from them in the form approved by Order of the Federal Tax Service dated October 2, 2018 No. ММВ-7-11/

Each type of employee remuneration corresponds to a four-digit digital coding. What income code the premium has depends on what the reward was paid for.

Starting with reporting for 2021, new deadlines for submitting certificates in form 2-NFDL have been established. Now there is one month less time allotted for reporting preparation. Previously, certificates were submitted no later than April 1. Now it is required to submit reports no later than March 1 (clause 2 of Article 230 of the Tax Code of the Russian Federation). If the due date falls on a weekend, the due date is postponed to the first next working day. So, in 2021, March 1 falls on a Sunday, so certificates of payments and taxes for employees are submitted no later than 03/02/2020.

Previously, before March 1, it was necessary to report only if income was paid to an individual from which it was impossible to withhold tax. This order has continued in 2021.

Thus, starting from 2021, one deadline has been set for all cases - no later than March 1.

Selecting a premium in the document

Now in the “One-time accrual” document you can select the created bonus.” By clicking the “Fill” button, you can specify the amount if it is the same for everyone. Otherwise, you will need to enter manually for each employee.

When the payment is one-time and non-productive in nature, then the directly planned date should be indicated under the table “Payment during the inter-settlement period”. The tax is calculated immediately in the document on the date of payment. By clicking on the tax amount, a transcript will open in which you can open the accounting register. It indicates exactly this date - November 3, 2021 - payment and transfer.

This document is a settlement document and does not require anyone’s approval in the program, therefore it is carried out immediately and is displayed in the journal without bold highlighting. This means that it is immediately taken into account.

Personal income tax: we determine the date of actual receipt of bonuses

Regarding personal income tax, the main problem is determining the date of actual receipt of income in the form of bonuses for production results. (Note that with non-production bonuses such a problem practically does not arise, since these incentives definitely do not relate to wages, which means that the provisions of paragraph 2 of Article 223 of the Tax Code of the Russian Federation are not applicable to them).

The date of actual receipt of income is important for several reasons. Thus, both personal income tax reporting forms are “tied” to it (calculation 6-NDFL and certificate 2-NDFL), incorrect completion of which threatens the tax agent with a fine of 500 rubles for each such document (clause 1 of Article 126.1 of the Tax Code of the Russian Federation).

Fill out and submit 6‑NDFL and 2‑NDFL via the Internet

In addition, the date of actual receipt of income is important when deciding on the provision of “children’s” deductions. If, as a result of an accountant’s mistake, an employee is accrued an excessive amount of deductions, then for the company this may result in a more significant fine in the amount of 20% of untimely withheld personal income tax amounts (Article 123 of the Tax Code of the Russian Federation).

Let us remind you that the right to a “children’s” deduction is retained by the employee only until his income from the beginning of the year exceeds 350,000 rubles (subclause 4, clause 1, article 218 of the Tax Code of the Russian Federation). And according to paragraph 3 of Article 226 of the Tax Code of the Russian Federation, the calculation of personal income tax amounts is carried out by tax agents on the date of actual receipt of income, determined in accordance with Article 223 of the Tax Code of the Russian Federation. The inclusion of income in the tax base for the purposes of calculating the amount of personal income tax is also carried out taking into account the provisions of Article 223 of the Tax Code of the Russian Federation (clause 3 of Article 225 of the Tax Code of the Russian Federation). This means that the amount of income for the purposes of applying the provisions of subparagraph 4 of paragraph 1 of Article 218 of the Tax Code of the Russian Federation should also be determined on the basis of Article 223 of the Tax Code of the Russian Federation.

Calculate your salary and personal income tax with standard deductions for free in the web service

So, let's look at the rules for determining the date of actual receipt of bonus payments. Let us note that recently the regulatory authorities have apparently managed to come to some kind of consensus on this issue. The rules are as follows.

- Non-production bonuses for the purposes of calculating personal income tax are considered to be actually received on the day of payment (transfer) of funds. That is, these payments are subject to the rules of subparagraph 1 of paragraph 1 of Article 223 of the Tax Code of the Russian Federation.

- The same rule of subclause 1 of clause 1 of Article 223 of the Tax Code of the Russian Federation applies to production bonuses (both bonuses that are part of the salary and incentive bonuses), which are paid for production results determined over a period of time exceeding one month (i.e. for a quarter, half a year, year, etc.). In these cases, the date of actual receipt of income will be considered the day of payment (transfer) of the relevant funds. This conclusion is contained in letters from the Ministry of Finance of Russia dated October 23, 2017 No. 03-04-06/69115 and dated September 29, 2017 No. 03-04-07/63400 (see “The Ministry of Finance spoke on how to determine the date of receipt of income in the form of an annual bonus "). A similar approach is followed by the Federal Tax Service of Russia (letters dated October 6, 2017 No. GD-4-11/20217 and dated October 26, 2017 No. GD-4-11/217685, see “Annual bonus in 6-NDFL: tax authorities reminded how to determine date of actual receipt of income").

- As for monthly production bonuses (both bonuses that are part of the salary and incentive bonuses), a different principle applies to these payments: they, like salaries, are considered received on the last day of the corresponding month. Such clarifications are given in the letter of the Ministry of Finance of Russia dated 04.04.17 No. 03-04-07/19708 (see “The Ministry of Finance announced which day is recognized as the date of receipt of income in the form of a bonus for the purpose of paying personal income tax”) and the letter of the Federal Tax Service of Russia dated 14.09.17 No. BS-4-11/18391 (see “Explained how to fill out 6-NDFL if the bonus based on monthly performance is paid in the next reporting period”).

Based on these rules, it turns out that an accrued but unpaid monthly bonus increases the taxpayer’s income in the month based on the results of work in which the accrual occurred, and in the same month should be reflected in the 2-NDFL certificate and section 1 of the 6-NDFL calculation. This means that if, taking into account such a bonus, an employee’s income from the beginning of the year exceeds 350,000 rubles, then for the current month he is no longer entitled to a “children’s” deduction. Moreover, even if the bonus is actually paid later.

But all other bonuses (production bonuses based on work results for periods exceeding one month, as well as non-production bonuses) increase the employee’s income and are reflected in personal income tax reporting only in the month of actual payment of money. This means that, for example, an employee with a salary of 65,000 rubles, to whom an annual bonus in the amount of 250,000 rubles was accrued in February, but will actually be paid only in June, will be able to receive “children’s” deductions until May.

Reflection of rewards in 6-NDFL

Based on all of the above, the developers of 1C: ZUP 8 made it possible to set the date of actual receipt of income so that everything is reflected correctly in the 6-NDFL report.

Accordingly, in 1C: ZUP the income category can be either wages, other income and other income from labor activities. Accordingly, if the income category “Wages” is considered, then the default date will be the date of actual receipt of income - the last day of the month.

In accordance with the law, for all other accruals, the date of actual receipt of income for the 6-NDFL report will be the day of actual payment of the employee’s income.

Let's assume that the company has a monthly bonus with income code 2000 in the wage category. It was accrued on October 31 - the last day of the month. In fact, the salary and bonus were paid on November 10, and personal income tax was withheld and transferred at the same time. The accrued payment can be a separate document or reflected immediately in the payroll.

Second example: a one-time bonus in a certain amount was accrued and paid during the inter-settlement period. For example, November 16, then in the 6-NDFL report it will be reflected as the date of direct payment on the corresponding lines. The bonus for code 2003, paid from net profit, will be reflected similarly in the report.

2-NDFL income codes for 2021, introduced in the latest edition of the order

The list of income codes of the Federal Tax Service is going to be supplemented for the last time in 2021. The draft with amendments was prepared by the Federal Tax Service dated November 20, 2020 - Order on amendments to appendices No. 1 and No. 2 to the order of the Federal Tax Service of Russia dated September 10, 2015 No. MMV-7-11 / [email protected] “On approval of codes for types of income and deductions” . New income and deduction codes were introduced, and some existing codes were canceled and adjusted.

The Federal Tax Service reports that the new codes will not need to be used when compiling 2-personal income tax for 2021, even if the Ministry of Justice registers the order and it comes into force in December 2021. Organizations can spend this time updating software. But in a similar situation at the end of 2021, the Federal Tax Service obligated everyone to fill out reports taking into account the changes.

The new version of the order will cancel codes 1400 and 2400, which are intended for rental income, but will instead add seven new codes for types of income:

Income code 1401 - income received from rental or other use of residential real estate.

Income code 1402 - income from rental or other use of property, except income related to group 1401.

Income code 1500 - income from contracts for the purchase and sale (exchange) of securities, which are taxed on the basis of paragraph. 2 p. 1 art. 226 Tax Code of the Russian Federation.

Income code 2004 - monthly cash rewards from the federal budget to teachers - class teachers from state and municipal educational organizations.

Income code 2017 - daily allowance over 700 rubles for each day of a business trip in the Russian Federation and no more than 2,500 rubles for each day of a business trip outside the Russian Federation.

Income code 2763 - the amount of financial assistance provided by an organization carrying out educational activities in basic professional educational programs, students (cadets), graduate students, adjuncts, residents and assistant trainees.

Income code 3011 - winnings from participation in the lottery.

The description of three codes will also be adjusted:

| Code | Description 2020 | Description 2021 |

| 2611 | The amount of bad debt written off in accordance with the established procedure from the organization’s balance sheet | Amounts of terminated obligations to pay debt in connection with the recognition of such debt as uncollectible, except for the cases listed in clause 62.1 of Art. 217 Tax Code of the Russian Federation |

| 3010 | Income in the form of winnings received in the bookmaker's office and betting | Income in the form of winnings received from participation in gambling conducted in a bookmaker's office and totalizator |

| 2790 | The amount of assistance (in cash and in kind), as well as the value of gifts received by veterans of the Great Patriotic War, disabled people of the Great Patriotic War, widows of military personnel who died during the war with Finland, the Great Patriotic War, the war with Japan, widows of deceased disabled people of the Great Patriotic War and former prisoners of Nazi concentration camps, prisons and ghettos, as well as former minor prisoners of concentration camps, ghettos and other places of forced detention created by the Nazis and their allies during the Second World War | The amount of assistance (in cash and in kind), as well as the value of gifts received by veterans of the Great Patriotic War, home front workers of the Great Patriotic War , disabled people of the Great Patriotic War, widows of military personnel who died during the war with Finland, the Great Patriotic War, the war with Japan, widows of deceased disabled veterans of the Great Patriotic War and former prisoners of Nazi concentration camps, prisons and ghettos, as well as former minor prisoners of concentration camps, ghettos and other places of forced detention created by the Nazis and their allies during the Second World War |

Generate a 2-NDFL certificate automatically in the online service Kontur.Accounting. Here you can keep records, pay salaries and submit reports.

Reflection of monthly bonus accrual in 1C: Salary and personnel management

Let’s assume that the company introduced monthly bonuses in the amount of 20% of salary from September 1, 2021, due to an increase in sales volumes. To create this bonus, go to the “Settings” - “Accruals” menu. Clicking the “Create” button will open the creation of a new accrual.

Basic information should be filled in by analogy with the type of income described above, and on the “Basic” tab you need to specify the calculation formula. To do this, you can take the formula for existing charges:

Percentage of Monthly Premium / 100 * Calculation Base

and correct it.

Or set it up yourself. In the case under consideration - 20% of the salary. Accordingly, you should click the “Edit formula” hyperlink. In the window that opens, select the appropriate indicator, enter the calculation and press the “Check” button. After passing the verification, click “OK”.

On the “Average Earnings” tab, you should also determine how remuneration is included in the accrual base. Here you need to understand whether, in the event of an incomplete month of work, the bonus will be equal to 20% of the salary. Or should it also be taken into account partially. Recommended by Fr.

On the “Taxes and Contributions” tab, everything is indicated in the same way as in the case discussed above.

After making all the settings, you should write down the accrual using the button of the same name. For clarity, we suggest creating a document Change of employee pay from the “Salary” menu. In the created document you need to add a bonus, for example, for Bulatov I.V.

After adding the corresponding line, the payroll will change from 75,000 rubles. (salary), for 90,000 rubles. (salary plus bonus). The document must be dated September 1, 2021. After entering the information, click the “Post and Close” button.

How to fill out a 2-NDFL certificate in 2021

The reporting form consists of a general part, three sections and an appendix. The bonus code in 2-NDFL, as well as other payments, is indicated in the application. Filling should be done in the following order:

- A common part. It indicates the details of the organization and the Federal Tax Service, the certificate number, and the reporting period.

- Section 1. It is intended to reflect the data of an individual: full name, taxpayer status, passport details.

- Application. It contains information about income and the corresponding tax deductions, including the bonus income code in 2-NDFL.

- Section 3 reflects the annual amounts of tax deductions provided.

- Section 2 is intended to reflect the total amount of payments to an individual, the calculated tax base, calculated, withheld and transferred to the budget tax