Starting this year, employers must keep work books electronically. In this regard, a new type of reporting is being introduced to the Pension Fund of the Russian Federation - information about the labor activity of a registered person in the SZV-TD form. Corresponding changes to the Labor Code of the Russian Federation and the law on persuance accounting were made at the end of 2021. The transition to ETC is planned for 2021. In addition to new reporting to the Pension Fund, employers need to take certain actions. 1C experts tell you more in the article.

Working with ETC in 1C

To switch to electronic work books (EPR), the employer must take a number of actions and make changes to some local documents. Let's talk in more detail.

About SZV-TD

As previously reported, the SZV-TD report is submitted not for all employees, but only for those personnel (both main employees and part-time employees) who had changes during the reporting period. Reports must be submitted no later than the 15th day of the month following the current one, for example, for January 2021 - before February 17 (since February 15 is a Saturday).

If the number of employees is 25 or more people, the SZV-TD report can only be submitted electronically; we recommend submitting it through 1C-Reporting. For up to 25 people, you can submit it in paper or electronic form.

Electronic SNILS

From April 2021, the Pension Fund began issuing information about the insurance number of an individual personal account (SNILS) in the form of electronic documents. Corresponding changes were made to pension legislation by Law dated April 1, 2019 No. 48-FZ.

All citizens who apply for SNILS for the first time now receive it only in the form of an electronic document. However, it won’t be possible without “paperwork” at all: at the Pension Fund of Russia branch, the insured person will be given a certificate confirming registration in the ADI-REG form (Resolution of the Pension Fund of the Russian Federation Board of June 13, 2019 No. 335p).

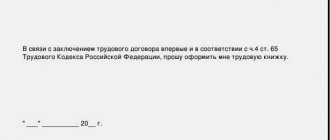

For an employee who is just starting to work, SNILS is usually issued by his first employer. The documents required for this remain the same: the businessman must submit to the Pension Fund office the ADV-1 form signed by the employee and the inventory according to the ADV-6-1 form.

However, the familiar green cards will not disappear anywhere. There will be no mass replacement of paper SNILS with electronic ones. When concluding an employment contract, the employer is obliged to accept information about SNILS from the employee in any of the formats: both a regular card and a certificate of electronic registration (Article 65 of the Labor Code of the Russian Federation).

Any owner of a SNILS card has the right to voluntarily replace it with an electronic document. This can be done on the State Services portal, as well as by contacting the MFC in person or the Pension Fund branch. If the SNILS card is damaged or lost, an electronic certificate will also be issued instead.

The personal account number will not change when converting SNILS into electronic format.

What should others do / New application “1C: Electronic work books”

We recommend that managers of small firms, HR officers, accountants, accountants and HR managers try out the new free cloud service “1C: Electronic Work Books” if you:

- you work in older versions of 1C programs and do not want/cannot connect a new report through external reports;

- are not ready to keep full records, for example, they have just registered an organization, and a report on the hiring of the first employees (including the director) must immediately be submitted to the Pension Fund of the Russian Federation;

- do not work in 1C programs.

Change in acts

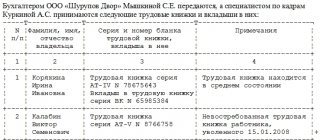

First of all, let's take care of the documents. After employees have abandoned their usual work, you need to enter information into the labor movement record book. It indicates the date of issue, which is confirmed by the signature of the owner.

Some organizations draw up an act on the storage and maintenance of labor records. It is not mandatory, but if it is compiled, it must be indicated that the work book can be not only paper, but also electronic. This work will have to be done with employment contracts, as well as with regulations and other documents, if there is a record of the procedure for maintaining labor. Now let's move on to reporting.

Advantages of the new application “1C: Electronic work books”

The 1C: Electronic Work Books application has an intuitive interface. Anyone can easily enter data into the required fields; the SZV-TD report will be filled out and generated automatically. There is no need to search for the report form on the Internet and check its relevance.

The main advantage of the 1C: Electronic Work Books product over well-known free analogues is the ability to conduct simple personnel document flow - print orders for hiring and dismissal, statements on personnel events, etc. – all the necessary forms of personnel documents are in the appendix.

In addition, the application:

- reliable - prepared by the developers of the 1C: Accounting program;

- and safe - the program is in the cloud.

Submission of employee data to the Pension Fund

In connection with the introduction of electronic work books, employers are required to submit a new type of reporting to the Pension Fund of Russia from 01/01/2020 - the SZV-TD form “Information on the employee’s labor activity”. The introduction of the new form is associated with the transition to electronic work books. Corresponding changes were made to the legislation on transfer accounting by Federal Law dated December 16, 2019 No. 436-FZ.

From 01/01/2020, employers must submit information to the Pension Fund of the Russian Federation no later than the 15th day of the month following the month in which any of the following events took place (clause 7 of Article 1 of Law No. 436-FZ):

- recruitment;

- transfer to another permanent job;

- dismissal;

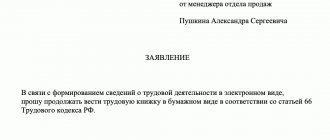

- the employee submits a statement that he asks to continue to keep a paper work record book for him;

- an employee’s application to provide him with information about his work activity.

Taking into account the postponement of holidays, information will need to be submitted to the Pension Fund for the first time no later than 02/17/2020 for January 2021 (see letter from the Pension Fund of December 28, 2016 No. 08-19/19045).

From 01/01/2021, a personal reporting form will have to be sent to the Pension Fund each time after hiring or dismissing an employee, but no later than the working day following the day the order on hiring or dismissal is issued.

In addition to submitting information to the Pension Fund of the Russian Federation, the employer is also obliged to provide information about the employee’s work activities to the employee himself during the period of work and upon dismissal.

In addition, the employee will have the right to request such information from the database of the Pension Fund of the Russian Federation. Information about the employee’s work activity will be provided upon request using a separate form. Initially it was planned that this would be the SZI-TD form, the draft of which the Pension Fund had previously published on its website, but later the Ministry of Labor published draft orders approving other forms:

- for filling out by the employer - form STD-R “Information on labor activity provided to the employee by the employer”;

- for filling out by the Pension Fund of Russia - form STD-PFR “Information on labor activity provided from the information resources of the Pension Fund of the Russian Federation.”

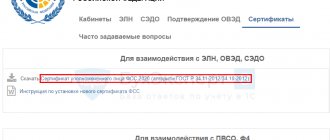

In connection with the transition to the ETC, the Pension Fund of the Russian Federation has prepared a new procedure for electronic document management with employers. Electronic document flow between the employer and the Pension Fund is carried out using the new generation automated information system of the Pension Fund of the Russian Federation (AIS PFR-2). The operator of this system is the Pension Fund of Russia.

The new procedure will be in effect starting with SZV-TD reporting, therefore, in order for the Pension Fund to be able to accept the SZV-TD form, it is necessary to send a special application from the program to the Pension Fund and wait for a positive result of its consideration.

After the update, your program will prompt you to send these applications.

If you miss the notification, then:

- in programs using managed forms, in the Notifications section of the 1C-Reporting form, click the Create button and select Application for connection to the Pension Fund of Russia e-document flow;

- in other programs - in the form Journal of exchange with regulatory authorities, open the Pension Fund section, the Outgoing documents tab. Here you need to switch the display mode to PFR EDF Applications and click the New button.

In “1C:Enterprise 8”, the draft form “Information on the work activity of a registered person (SZV-TD)”, the electronic format SZV-TD, the STD-R form are supported with the release of subsequent versions (see table).

Table

| Program | Information about the registered person’s work activity (SZV-TD) (according to project) | “Information about labor activity provided to the employee by the employer” (STD-R) |

| Version release (planned) | ||

| “1C: Salaries and personnel management 8” (ed. 3) (PROF, KORP, basic) | 3.1.12.113 from 01/10/2020 | 3.1.12.113 from 01/10/2020 |

| "1C: Salaries and personnel management 8" (rev. 2.5) (CORP) | Scheduled 2.5.14.x from 01/31/2020 | 2.5.14.x from 01/31/2020 |

| "1C:ERP Enterprise Management 2" | Scheduled 2.4.11.70 from 02/05/2020 | Scheduled 2.4.11.70 from 02/05/2020 |

| "1C: Integrated Automation 8" (rev. 2.0) | Scheduled 2.4.11.70 from 02/05/2020 | Scheduled 2.4.11.70 from 02/05/2020 |

| "1C:Manufacturing Enterprise Management 8" (rev. 1.3) | Scheduled 1.3.132 from 01/30/2020 | Scheduled 1.3.133 from 02/27/2020 |

| "1C:Taxpayer 8" | Planned 3.0.175 from 01/30/2020 | Not required |

| "1C: Accounting 8" (rev. 3.0) (PROF, KORP and basic) | Scheduled 3.0.75.66 from 01/22/2020 | Scheduled 3.0.75.66 from 01/22/2020 |

| "1C: Accounting 8" (rev. 2.0) (PROF, KORP and basic) | Planned 2.0.66.110 from 01/31/2020 | Planned 2.0.66.110 from 01/31/2020 |

More information about implementation deadlines can be found in “Monitoring changes in legislation” in the “Remuneration” section.

The 1C: Salary and Personnel Management 8 program, edition 3, provides for the preparation and automatic completion of SZV-TD and STD-R reports, saving report files and uploading to the Pension Fund of Russia in the required format.

To automatically fill in information about the work activities of STD-R and SZV-TD employees in personnel documents (Hiring, Personnel transfer, Dismissal), the Reflect in work book flag is provided (Fig. 2).

Rice. 2. Personnel document “Hiring”

When the Reflect in work book flag is selected, the Labor function field is available.

This field has been added to personnel documents in accordance with the requirements of the Labor Code of the Russian Federation on registration of changes in labor functions. A change in a job function, for example, during a personnel transfer, may differ from a change in position.

Personnel documents intended to be reflected in the work book are registered as Activities (Fig. 3) in the documents STD-R and SZV-TD.

Rice. 3. Tabular part “Events” of the document “Information on the work activities of employees, SZV-TD”

The document Information on the work activities of employees, STD-R (Fig. 4) is generated in the Personnel - Electronic work books menu using the Create button, and is intended for printing and handing over to the employee upon his dismissal.

Rice. 4. Document “Information on the work activities of employees, STD-R”

The document Information on the work activities of employees, SZV-TD (Fig. 5) is generated in the Personnel - Electronic work books menu using the Create button, and is intended for sending as a report to the Pension Fund of the Russian Federation.

Rice. 5. Document “Information on the work activities of employees, SZV-TD”

You can prepare and send STD-R and SZV-TD reports to the Pension Fund from the program using the 1C-Reporting service.

Tariff "Free"

This:

- access to the “1C: Electronic Work Books” application – one information base for one legal entity or individual entrepreneur for one user;

- auto-filling of TIN details;

- filling out and generating a SZV-TD report in the form established by the Pension Fund of Russia for one legal entity or individual entrepreneur;

- saving the report to a file, printing it on a printer;

- the ability to maintain simple personnel document flow.

The tariff involves submitting a report to the Pension Fund yourself in a user-friendly way, including submitting the report on paper in printed form (take it to the Pension Fund yourself).

Responsibility for non-compliance with the rules for maintaining ETC

Failure to provide information about work activity or submitting it in violation of the deadline threatens with administrative liability for violation of labor legislation, that is, under Article 5.27 of the Code of Administrative Offenses of the Russian Federation (clause 9 of Article 1 of Law No. 436-FZ).

In particular, violation of labor legislation and other regulatory legal acts containing labor law norms entails a warning or the imposition of an administrative fine:

- for officials and individual entrepreneurs - from 1 to 5 thousand rubles;

- for legal entities - from 30 to 50 thousand rubles.

| 1C:ITS Read about the preparation of employee work books in electronic form in the “HR Directory” section of the “Legislative Consultations” section. |

From the editor. Lecture “Electronic work books: legal regulation, preparation of a report in “1C: Salary and Personnel Management 8” (ed. 3)” with the participation of N.A. Belyantseva (PFR) and 1C experts took place at 1C: Lecture Hall on January 30, 2020.

Pros and cons of ETC

The advantages of entering work books in electronic form are obvious:

- ETC cannot be lost or damaged;

- It is impossible to falsify the data specified in the database;

- Cancellation of costs for its acquisition;

- It is impossible to make a grammatical error when entering, for example, information about the name of the enterprise;

- Access to information via the Internet or mobile phone will become easier and more accessible; there will be no need to copy and certify data on work experience, for example, when applying for a pension (and other government services);

- If the HR department is located in another city, you will not have to send the technical documentation there for storage, that is, the process of applying for a job will become easier for both the employer and the employee;

- The level of employee protection from an unscrupulous employer will increase;

- The level of analytics on the labor activity of citizens will increase significantly thanks to the centralization of data.

The disadvantages include:

- Risk of personal data leakage. However, since 1997, the Pension Fund of Russia has been storing data of individuals in a database specially certified for recording and processing high-level personalized information, the reliability of which has been tested by time;

- Increasing the volume of reporting;

- The need to improve the qualifications of personnel services employees. Chairman of the Board of the Pension Fund Anton Drozdov, in an interview with Komsomolskaya Pravda, announced a pilot project with the largest employers “to assess how ready their personnel services and information systems of the Pension Fund are”;

- The need to purchase the appropriate software product;

- Lack of awards data in the new digital version;

- Difficulties may also arise for employees, especially those who are not very “friendly” with computers. But practice shows that even those users who were very afraid of the computer mastered it perfectly when the need arose. Therefore, “there are no fortresses in the world that the working people could not take.”

Video review of the ETC rules for 2021

Get a recording of the webinar with the stages of work in 1C and recommended actions for this year

What will the ETC look like?

In general, a digital book is a report on the work history of a citizen of the Russian Federation, stored in the Pension Fund of the Russian Federation.

This report will be available:

- At the place of work - only at the same place in both versions (form SZV-TD);

- In multifunctional centers (MFC) at all places of work, but only in paper version;

- In the PF for all places of work in both versions;

- On public services (gosuslugi.ru) for all places of work only in a digital version.

The employee has the right to request this report and receive it within three days, and upon leaving, on the day of dismissal, if he had previously refused the paper version.

How to reflect cancellation and adjustment of employment information

If information about the employee’s work activity has been cancelled, it is necessary to fill out the appropriate section of the STD-R form. It should indicate all canceled information, and in the column “Indication of cancellation of recording information about admission, transfer, dismissal”, put the sign “X”.

If the information has been corrected, you should fill out the STD-R form with two lines:

- the first line - with information before the adjustment and with the sign “X” in the column “Indication of cancellation of recording information about admission, transfer, dismissal”;

- the second line contains information after adjustments.