Balance sheet asset sections

Table 1. Balance sheet asset (abbreviated)

| Section number | Name of sections | Group of articles |

| I | Fixed assets | Intangible assets Fixed assets Long-term financial investments Construction in progress |

| Total for section 1 | ||

| II | Current assets | Reserves Accounts receivable Cash |

| Total for Section II | ||

| Balance |

Section I of the balance sheet asset “Non-current assets” presents all long-term assets of an economic entity: intangible assets, fixed assets, long-term financial investments, capital investments.

Items in the “Intangible assets” group are valued in the balance sheet at their residual value. The residual value of this group of assets is determined as the difference between the original (replacement) cost and the amount of accrued depreciation.

The articles of the group “Fixed assets” are also evaluated, with the exception of the article “Land”. Depreciation is not accrued for this type of asset. In the balance sheet, all fixed assets and intangible assets are presented in the water section, regardless of the field of operation.

The items in the “Financial Investments” group reflect investments of funds and other property in other economic bodies for a period of more than one year; under the item “Capital investments” - actual costs in unfinished construction.

Section II of the balance sheet asset “Current assets” reflects current assets combined into several groups. In the “Inventories” group, current assets of the production sector are presented as separate items. Raw materials and supplies are valued in the balance sheet at the actual procurement cost. Costs in work in progress can be assessed at standard cost, at the amount of direct costs, or at actual production cost. This section also reflects items of circulation: finished products and goods shipped, deferred expenses, which should be assessed at actual cost.

The second group of current assets consists of short-term financial investments in other organizations. The “Cash” group is represented by the articles “Cash”, “Cash Accounts”, “Currency Accounts”, “Other Cash”.

This same section of the asset also reflects receivables from both other organizations and individuals, as well as employees of a given business entity.

Reserves

Regulated by PBU 5/01 “Accounting for inventories”

Inventories are a very voluminous item that includes the following main assets:

- raw materials and supplies used in the production of products, as well as intended for sale or use for the management needs of the organization;

- fuel,

- semi-finished products

- workwear,

- finished products;

- goods;

- animals being raised and fattened.

Chart of Accounts

| Account name | Account number | Subaccount number and name |

| Section 1. Non-current assets | ||

| Fixed assets | 01 | By type of fixed assets |

| Depreciation of fixed assets | 02 | |

| Profitable investments in material assets | 03 | By type of material assets |

| Intangible assets | 04 | By type of intangible assets and by expenses for research, development and technical work |

| Amortization of intangible assets | 05 | |

| 06 | ||

| Equipment for installation | 07 | |

| Investments in non-current assets | 08 |

|

| Deferred tax assets | 09 | |

| Section 2. Inventory | ||

| Section 3. Production costs | ||

| Section 4. Finished products and goods | ||

| Section 5. Cash | ||

| Section 6. Calculations | ||

| Settlements with suppliers and contractors | 60 | |

| … | 61 | |

| Settlements with buyers and customers | 62 | |

| Provisions for doubtful debts | 63 | |

| … | 64 | |

| … | 65 | |

| Calculations for short-term loans and borrowings | 66 | By type of credits and loans |

| Calculations for long-term loans and borrowings | 67 | By type of credits and loans |

| Calculation of taxes and fees | 68 | By type of taxes and fees |

| Calculations for social insurance and security | 69 |

|

| Payments to personnel regarding wages | 70 | |

| Calculations with accountable persons | 71 | |

| … | 72 | |

| Settlements with personnel for other operations | 73 |

|

| … | 74 | |

| Settlements with founders | 75 |

|

| Settlements with various debtors and creditors | 76 |

|

| Deferred tax liabilities | 77 | |

| … | 78 | |

| On-farm settlements | 79 |

|

| Section 7. Capital | ||

| Authorized capital (P) | 80 | |

| Own shares (shares) | 81 | |

| Reserve capital | 82 | |

| Extra capital | 83 | |

| Retained earnings (uncovered loss) | 84 | |

| … | 85 | |

| Special-purpose financing | 86 | By type of financing |

| … | 87 | |

| … | 88 | |

| … | 89 | |

| Section 8. Financial results | ||

| Off-balance sheet accounts | ||

| . |

Attached files

| Title / Download | Description | Size | Downloaded times: |

| Balance sheet | 9 KB | 29115 |

Accounting

Financial investments (excluding cash equivalents)

Section II “Current assets” reflects financial investments whose circulation (maturity) period does not exceed 12 months.

Financial investments include:

- state and municipal securities;

- securities of other organizations, including debt securities in which the date and cost of repayment are determined (bonds, bills);

- contributions to the authorized (share) capital of other organizations (including subsidiaries and dependent business companies);

- loans provided to other organizations;

- deposits in credit institutions;

- receivables acquired on the basis of assignment of the right of claim;

- other similar investments.

Rules for drawing up a balance sheet

Let's look at what accounting indicators should be reflected in the active part of the balance sheet. Here is a breakdown of the accounts and indicators of the reporting form:

Structure

What to include

I. NON-CURRENT

Intangible assets

The residual value of the enterprise's intangible assets should be reflected here. Determine the value as the difference between account 04 “Intangible assets” and 05 “Depreciation of intangible assets”.

When calculating, exclude values corresponding to data on the results of research and development, as well as information on intangible exploration assets.

Research and development results

If an organization conducts research activities and the results of R&D are listed on the balance sheet, then in this section of the balance sheet reflect the residual value of R&D in account 04.

Intangible search assets

Filled out by organizations that conduct natural resource development and exploration activities.

Economic entities reflect information about such objects on account 08

If an object has a tangible-material shell, then it is a material search asset, intangible assets have no form, shell, or structure.

Please note that for search assets, depreciation is calculated on accounts 02 and 05.

Material prospecting assets

Fixed assets

Residual value of fixed assets. Determine the difference between the initial cost of account 01 and accrued depreciation, the balance of account 02.

Profitable investments in material assets

Reflect the difference between the balances on account 03 and the accrued depreciation for the corresponding accounting objects (account 02).

Financial investments

These are long-term financial investments, the duration of which is at least 12 months.

For example, reflect the account balance 55 if there are deposits opened for a period of more than 12 months.

Also reflect long-term investments in accounts 58 (financial investments) and 73 (loans to employees of the institution).

Reduce the balance on account 58 if the organization has created a reserve for the account. 59.

Deferred tax assets

Reflect the account balance. 09. Indicators are reflected in accordance with PBU 18/02.

Other noncurrent assets

Reflect other types of non-current assets that are not included in the group presented above. Also in this section you can reflect those objects about which it is not necessary to indicate information, but the company considers it necessary to include information in the balance sheet.

Total for Section I

The total for the corresponding section is generated.

II. NEGOTIABLE

Reserves

Reflect the amount of balances on accounts 10, 11 (minus the reserve recorded on account 14), 15, 16, 20, 21, 23, 28, 29, 41 (minus account 42, if goods are recorded with a markup), 43, 44, 45, 46, 97.

Value added tax on purchased assets

Include information about the ending account balance. 19 "VAT".

Accounts receivable

To obtain the indicator, debit balances on accounts 60, 62 (both accounts minus the reserves formed on account 63), 66, 67, 68, 69, 70, 71, 73 (minus the data recorded under the item “Financial investments”) are summed up. , 75, 76.

Do not include the credit balance in the calculation.

Financial investments (excluding cash equivalents)

These are deposits, financial investments, loans to employees with a maturity of less than 12 months. We form account balances. 55, 58, 73. We take into account the reserve on the account. 59, we subtract it if there is a balance.

Cash and cash equivalents

The actual money of the company listed in accounts 50, 51, 55 (except for the deposit), 52, 57 as of the reporting date. We reflect the amount of the debit balance.

Other current assets

Reflect other types of current assets that are not included in the group presented above. Also in this section you can reflect those objects about which it is not necessary to indicate information, but the company considers it necessary to include information in the balance sheet.

Total for Section II

The total value of the section indicators.

BALANCE

Sum of section 1 and 2.

What is a balance sheet

Buh.

A balance sheet is a report that shows the financial performance of a company, namely the balances of its accounts as of any date. Most often, organizations prepare the following types of balance sheets:

- introductory (at the time of commencement of activity);

- current (as of a certain date, usually at the end of the year);

- liquidation (at the time of liquidation of the company);

- dividing (during reorganization in the form of division or separation);

- unification (in case of reorganization in the form of affiliation or merger; this balance sheet is introductory at the time the newly created legal entity begins its activities).

The balance sheet clearly shows the financial condition of the company. If you compare it with a similar report compiled, for example, a year ago, you can track the dynamics of the organization’s development.

Check the financial condition of your organization and its counterparties

The history of the appearance of the balance sheet

In the accounting sense, the word “balance sheet” has been around for approximately 600 years. In the historical literature there are various versions regarding the period of appearance of this term, which dates back to the end of the 14th - beginning of the 15th centuries. There is information that the word “balance sheet” was first applied to financial statements in 1427.

The origin of the term is often associated with the Italian mathematician Luca Pacioli. Here are its main postulates:

– the amounts of debit and credit turnovers are always identical;

– the sum of debit balances is always equal to the sum of credit balances of the same system of accounts.

According to Pacioli, a balance sheet is a structured document consisting of assets and liabilities. All accounts with a debit balance were included in the asset, but the meaning of debit and credit was not explained. Debit was the left side of any account, and credit was the right side. Therefore, along with truly active items, the asset also included loss items that were classified as liabilities from an economic point of view. In liabilities, along with accounts payable, profit and capital were reflected.

With the advent in the 19th century. balance science, the founder of which was I.F. Cher, the next stage of balance development is connected. Sher argued that accounting takes into account only accomplished internal and external economic facts. The basis of accounting, according to Sher, is the balance sheet. In this regard, the theory of its accounting is called balance sheet, and capital equality (the amount of capital of an organization is equal to the difference between the volume of property and its accounts payable) is called Scher’s postulate.

At the next stage of development of the balance sheet, models began to be used in accounting that cover all its components. In the 1920s, modeling was actively developed and promoted as a record-keeping tool.

One of the significant accounting models can be called the development of the largest scientist in the field of accounting - Professor N.A. Blatova. His main idea was the accounting axiom - double entry. Blatov believed that the accounting algorithm is built from account to balance sheet. Thus, the balance is a consequence of double entry in the accounts.

Within the framework of balance science, theories of statistical and dynamic balances have developed. According to statistical theory, the main purpose of accounting is to record property and determine its reliable value. Within the framework of the dynamic theory, capital accounting and accurate calculation of financial results were placed at the head of accounting. By the way, the latter approach became widespread at the end of the 20th century.

Balance structure

Before we begin to consider such issues, it should be noted that the balance sheet allows you to make a forecast of the development of the enterprise for the short and long term. In other words, using the balance sheet, the financial viability of the company and its economic status, the stability of the organization and the level of its interaction with other companies are determined.

The balance sheet has a certain structure. The document contains two tables. The first table is the company's assets, and the second is the liabilities:

An asset can include all the property of an enterprise that can be converted into monetary terms. The group of such assets includes: equipment, vehicles, buildings that are owned by the company. The company's assets also include amounts owed to it by other legal entities. All indicated indicators are displayed in the balance sheet in monetary terms. In other words, an asset is all the property and property that an enterprise has at its disposal.

Get 267 video lessons on 1C for free:

The asset has its own structure, within which non-current assets are indicated. This group includes the means that the enterprise uses for a long time to carry out business activities - these are buildings, structures, equipment. The second section of assets is current assets, which denote the amount of funds that are used by the company for a short period and constantly need replenishment - these are materials, inventories, raw materials:

The liability is used to display the sources of funds that are indicated in the Asset of the balance sheet. This section also has its own structure and includes the following blocks: the authorized and equity capital of the company, loans and credits, external liabilities. The three main sections are called:

- funds belonging to the company;

- the amount of long-term liabilities;

- wages and accounts payable to suppliers.

The main task in drawing up a balance is to achieve equality between these two parts. The document is drawn up according to Form 1, approved back in 2010. This form is rather a recommended document and can be modified due to the specifics of the enterprise. To make it clear how the balance is calculated, we give a simple example:

Explanation of balance sheet asset lines

| Indicator name | Code | Which account data is used? | Algorithm for calculating the indicator |

| Intangible assets | 1110 | 04 “Intangible assets”, 05 “Amortization of intangible assets” | D04 (excluding R&D expenses) – K05 |

| Research and development results | 1120 | 04 | D04 (in terms of R&D expenses) |

| Intangible search assets | 1130 | 08 “Investments in non-current assets”, 05 | D08 – K05 (all regarding intangible exploration assets) |

| Material prospecting assets | 1140 | 08, 02 “Depreciation of fixed assets” | D08 – K02 (all regarding material exploration assets) |

| Fixed assets | 01 “Fixed assets”, 02 | D01 – K02 (except for depreciation of fixed assets accounted for in account 03 “Income-generating investments in tangible assets” | |

| Profitable investments in material assets | 1160 | 03, 02 | D03 – K02 (except for depreciation of fixed assets accounted for on account 01) |

| Financial investments | 1170 | 58 “Financial investments”, 55-3 “Deposit accounts”, 59 “Provisions for impairment of financial investments”, 73-1 “Settlements on loans provided” | D58 – K59 (in terms of long-term financial investments) + D73-1 (in terms of long-term interest-bearing loans) |

| Deferred tax assets | 1180 | 09 “Deferred tax assets” | D09 |

| Other noncurrent assets | 1190 | 07 “Equipment for installation”, 08, 97 “Deferred expenses” | D07 + D08 (except for exploration assets) + D97 (in terms of expenses with a write-off period of more than 12 months after the reporting date) |

| Reserves | 10 “Materials”, 11 “Animals for growing and fattening”, 14 “Reserves for reducing the cost of material assets”, 15 “Procurement and acquisition of material assets”, 16 “Deviation in the cost of material assets”, 20 “Main production”, 21 “Semi-finished products own production”, 23 “Auxiliary production”, 28 “Defects in production”, 29 “Service production and facilities”, 41 “Goods”, 42 “Trade margin”, 43 “Finished products”, 44 “Sales expenses”, 45 “Goods shipped”, 97 | D10 + D11 – K14 + D15 + D16 + D20 + D21 + D23 + D28 + D29 + D41 – K42 + D43 + D44 + D45 + D97 (for expenses with a write-off period of no more than 12 months after the reporting date) | |

| Value added tax on purchased assets | 1220 | 19 “Value added tax on acquired assets” | D19 |

| Accounts receivable | 1230 | 46 “Completed stages of work in progress”, 60 “Settlements with suppliers and contractors”, 62 “Settlements with buyers and customers”, 63 “Provisions for doubtful debts”, 68 “Settlements for taxes and duties”, 69 “Settlements for social insurance and security", 70 "Settlements with personnel for wages", 71 "Settlements with accountable persons", 73 "Settlements with personnel for other operations", 75 "Settlements with founders", 76 "Settlements with various debtors and creditors" | D46 + D60 + D62 – K63 + D68 + D69 + D70 + D71 + D73 (except for interest-bearing loans accounted for in subaccount 73-1) + D75 + D76 (minus VAT calculations reflected in the accounts on advances issued and received) |

| Financial investments (excluding cash equivalents) | 1240 | 58, 55-3, 59, 73-1 | D58 – K59 (in terms of short-term financial investments) + D55-3 + D73-1 (in terms of short-term interest-bearing loans) |

| Cash and cash equivalents | 50 “Cash”, 51 “Current accounts”, 52 “Currency accounts”, 55 “Special bank accounts”, 57 “Transfers in transit”, | D50 (except for subaccount 50-3) + D51 + D52 + D55 (except for the balance of subaccount 55-3) + D57 | |

| Other current assets | 1260 | 50-3 “Money documents”, 94 “Shortages and losses from damage to valuables” | D50-3 + D94 |

Other current assets

Other current assets include:

- the cost of missing or damaged material assets, in respect of which a decision has not been made to write them off as production costs (sales costs) or to the guilty parties;

- VAT amounts calculated on advances and prepayments (partial payments);

- amounts of excise taxes subject to subsequent deductions;

- amounts of overpaid (collected) taxes and fees, penalties and fines, contributions for compulsory insurance, for which no decision has been made on offset (refund from the budget);

- amounts of VAT accrued upon shipment of goods (products, other valuables), the proceeds from the sale of which cannot be recognized in accounting for a certain time;

- own shares (shares) purchased from shareholders (participants) for the purpose of resale.

Balance sheet diagram.

Rule: Asset Total = Liability Total = Balance Sheet Currency.

Balance sheet structure.

In each of the indicated 5 sections of the balance sheet, in separate lines (balance sheet items, each item corresponds to a digital code) the corresponding homogeneous types of property and the sources of their formation are reflected in monetary terms (usually in thousands of rubles).

Let's look at a hypothetical example:

The company received cash in the cash in the amount of 10,000 rubles to pay wages. As a result of this business transaction, the funds in the cash register increased by 10,000 rubles, and in the current account they decreased by 10,000 rubles.

The balance takes the following form

The transaction caused the movement of funds from one Asset item to another. There are 4 types of operations, they can cause changes only in assets or liabilities, while the balance sheet currency (total) does not change, as in our case, but can change the balance sheet currency up or down. In lesson 3 we will look at the impact of business operations on the balance sheet. But remember!

In any business transaction, the equality between Asset and Liability of the balance sheet is not violated!

1. Correct errors in the balance, draw up the correct balance, indicate the names of the accounts.

2. Draw up a balance sheet based on the initial data. Property of the enterprise and sources of its formation.

- Machine - 10,000

- Debt to the budget - 15,000

- Raw materials - 2,000

- Debt to personnel - 12,000

- Fuel - 5,000

- Furniture - 20,000

- Building - 40,000

- Authorized capital - 50,000

Poke the buttons

careless accountant: Can you find out the meaning of writing articles for accounting? accounting I would understand if this were not a banal reprint from a textbook. Buh. accounting, 1C8.2, like CEO, can be taught in such a way that it is not clear, but it can be taught in such a way that the complex is explained in simple terms. Buh. accounting must be understood and not crammed words that have nothing to say. And in order to understand, you need someone to describe in detail and in simple language, for example, why income is a liability and not an asset, etc. Here Maxim writes about CEO in a clear and understandable way, even for me, a person far from SEO and other Internet wisdom. And thank you for your desire to enlighten.

And who exactly are you?) If you don’t need accounting, pass by)) If you have a specific question about bu, you can ask, I’ll chew it and put it in my mouth, I won’t digest it for you, okay?)) p.s. I would like to see the URL field filled in, *wink.

Structure and structure of the balance sheet

The balance sheet is a table consisting of two interrelated sides. The left side is called an asset and reflects the composition and placement of economic assets, the right side is called a liability and reflects the sources of formation of economic assets.

Separate indicators (lines) of assets and liabilities are called balance sheet items. Asset items reflect the state of certain types of economic assets, liability items reflect the state of the sources of these funds. The totals of asset and liability items are always equal to each other, since they reflect the same set of funds, but in two different groups. The structure of the balance sheet is based on the classification of funds discussed in the previous chapter.

Equality of the totals of assets and liabilities of the balance sheet is a prerequisite for the correctness of its preparation. It is not for nothing that the word “balance” translated from French means scales, i.e. equilibrium. Therefore, the two sides of the balance sheet (active and passive), like a scale, must be balanced and equal to each other.

The total balance sheet is called currency.

Balance sheet items are combined into economically homogeneous sections (groups) and subsections (subgroups). Currently, as one of the main forms of financial statements of an organization, the balance sheet form is used - net, which is established by the Accounting Regulations “Accounting Statements” PBU 4/99 dated 07/06/99 No. 43n. The form of the balance sheet - net is determined in such a way as to best meet the requirements of international financial reporting standards.

In the balance sheet, assets (funds) and liabilities (liabilities) are presented with a division depending on the maturity period into short-term and long-term. Assets and liabilities are presented as short-term if their maturity (maturity) period is no more than 12 months after the reporting date or the duration of the operating cycle, if it does not exceed 12 months. All other assets and liabilities are presented as non-current.

Thus, the balance sheet – net has two sections in the asset (“Non-current assets”, “Current assets”), and in the liability – three (“Capital and reserves”, “Long-term liabilities”, “Short-term liabilities”) and is as follows (Table 4.1).

In the asset balance sheet, property is listed by degree of liquidity: hard-to-sell assets (items in section 1 of the balance sheet); slowly selling assets (subsection “inventories” of section 2, except for the article “Expenses of future periods”); quickly realizable assets (accounts receivable, other assets); the most liquid assets (cash and short-term financial investments in securities).

In the liabilities side of the balance sheet, the sources are located depending on the urgency of their repayment: permanent liabilities (authorized capital, reserve capital, etc.); long-term liabilities (long-term loans, borrowings, etc.); short-term liabilities (short-term loans, borrowings, etc.); the most urgent obligations (accounts payable). This grouping of assets and liabilities is used to assess the liquidity of the balance sheet.

According to accounting terminology, the funds (property) of an organization, as is already known, are considered as assets (A), and the sources of funds are considered as attracted capital - liabilities (P) and equity capital (K).

Assets are resources (property) controlled by an organization as a result of past events from which the organization expects economic benefits in the future. Obligations (liabilities) are the current debt of an organization arising from events of past periods, the settlement of which will lead to the withdrawal of resources from the organization that bring economic benefits.

Did not you find what you were looking for?

Teachers rush to help

Diploma

Tests

Coursework

Abstracts

Shareholders' equity is the portion of a company's assets remaining after deducting all its liabilities.

Dividing the asset side of the balance sheet into two sections has important economic implications. Thus, the asset sections of the balance sheet reflect how the funds are allocated, what is their composition, structure and how they are used in current activities or can be used in the event of liquidation of an economic entity, etc. Dividing the balance sheet liability into three sections allows us to judge: from what sources were the funds formed? funds (own or borrowed); what purpose they have for each source; on the degree of autonomy and the ratio of borrowed and own funds of the organization, etc.

The first section of the balance sheet , “Non-current assets,” contains information about intangible assets, movable and immovable property represented as part of fixed assets, as well as long-term investments.

The second section of the balance sheet , “Current assets,” provides information on inventories and costs, the organization’s receivables, its cash, as well as short-term financial investments of an economic entity.

The third section of the balance sheet , “Capital and Reserves,” reflects information about the organization’s equity capital, as well as uncovered losses and losses at the end of the reporting period.

The fourth section of the balance sheet, “Long-term liabilities,” contains information about the organization’s debt on long-term bank loans received and loans from organizations and individuals, as well as on other long-term liabilities.

The fifth section of the balance sheet , “Short-term liabilities,” reflects information about the organization’s debt for short-term bank loans received and loans from organizations and individuals, as well as current accounts payable (to suppliers, the budget, etc.), deferred income, reserves for future expenses and payments of this economic entity, etc.

Building a balance sheet based on the above grouping of economic assets (property) and the sources of their formation serves the purposes of control, analysis and management of the organization’s property.

However, the balance sheet can only provide a real reflection of the property status of the organization when its correct structure is combined with the correct assessment of all asset and liability items. For the purpose of comparability, the assessment of property and its sources for reflection in the balance sheet must be carried out uniformly in all organizations, which is achieved by complying with the established provisions and rules of assessment.

Differences between own and borrowed liability objects using an example

It was already indicated above that the structure of the balance sheet gives an idea of the stability of the company. Availability of own funds is a serious advantage of the enterprise. Proper use of liabilities will ensure independence and well-being.

An example of using your own funds. The company bought premises for offices. The property is for rent. Rental funds continuously flow into the company's budget. The organization receives net profit that does not imply liabilities. Funds can be used both for capital formation and for increasing turnover. Profits do not decrease due to inflation, since office rental prices are constantly rising.

An example of the use of borrowed funds. The company took out a million rubles on credit to rent retail space and purchase a batch of products. The loan was short-term. The premises were rented. Products are displayed on the trading platform. The product became popular among consumers. In just a few months, we managed to receive more than 2 million rubles. The million was used to repay the loan.

But another situation is also possible. The company took out a million rubles on credit. The money was also used for rent and purchase of products. However, the product was not successful with the consumer. In a few months we managed to get 200,000 rubles. There was not enough money for the subsequent rent of the retail space, as well as for repaying the loan on time. Creditors went to court to collect the debt. The company had to declare itself bankrupt.

ATTENTION! Based on the examples given, it becomes clear that it is beneficial for an enterprise to have its own reserves. However, most enterprises also have borrowed funds

This is completely normal. The main thing is to monitor the proportions between your own and borrowed funds.

Secrets of the Balance Sheet Liability

In the liability, the lines are arranged in a special way: the lower the line, the faster the specified obligation must be returned (to counterparties, bankers, owners or other creditors).

The line “Retained earnings” shows an annual growth trend, but its rate has noticeably decreased (from 52% to 7%). Perhaps the effectiveness of managers has fallen, and therefore there is reason to think about the reasons. The presence and growth of reserve capital are assessed positively (the company's equity capital is strengthened).

The significant amount of short-term debts (46% of the balance sheet currency) is alarming. If this is arrears of wages and taxes, there is cause for concern: this is a sign of the company’s insolvency, and material losses are possible (sanctions for late payment).

Attention! If a company delays wages for more than 3 months, it may go bankrupt. Such amendments were made by law dated June 29, 2015 No. 186-FZ in paragraph

2 tbsp. 183.19 of the Law of October 26, 2002 No. 127-FZ “On Insolvency (Bankruptcy)”.

There are many ways to read a balance sheet. Some people trust only numbers: they calculate special coefficients, conduct horizontal and vertical analysis. But for some it is more important to research and compare different indicators and see how assets relate to liabilities and where reserves and losses are hidden. And to do this, you need to read the balance sheet with reference to other reports and explanations.

Each user builds a suitable methodology for himself and draws conclusions. The main thing is to see the overall picture of the company’s property and financial position and, using all available methods of analysis, to correctly assess possible prospects and threats.

Now we know what a count is. In Lesson 2 we will look at what a balance sheet is and look at its content and structure.

The balance sheet is a table consisting of 2 parts - an asset and a liability; the asset reflects the property of the organization, and the liability reflects the sources of formation of this property.

For an accountant, the balance sheet is one of the most important forms of reporting, so it is simply necessary to know it, in addition, by analyzing the books. the balance sheet allows you to understand the financial and economic state of the enterprise and predict its future. We will learn how to analyze the balance sheet later.

Who needs a balance sheet?

The totality of the balance sheet values literally reflects the financial appearance of the organization.

First of all, the balance sheet is necessary for the organization itself in order to have an accurate picture of the results of its core activities that were obtained for a certain period (year, quarter, month).

The balance sheet shows how steadily the company is developing, both in relation to personal activities and in relation to cooperation with other organizations, which is characterized by two total balance sheet indicators, Asset and Liability.

Moreover, the main sign that the balance sheet is drawn up correctly is the equality of the final results of the company’s Assets and Liabilities.

Also, a company's balance sheet is required for any legal entities that cooperate or intend to establish a business relationship with this company.

The balance sheet can be used to determine the financial position of the organization and whether it will be able to function properly in the near future.

The balance sheet of an enterprise is very important for banks, which will be able to assess, based on the indicators of this form, how creditworthy the future client is, and what is the maximum loan amount that can be provided to him.

Each company is forced to provide a balance sheet to shareholders, statistical authorities and tax authorities at a fixed frequency.

Types of balances

In addition to the classic balance sheet, there are:

The balance of income and expenses of an enterprise is a financial and economic document independently developed by an enterprise for a year or quarter in order to ensure balance and consistency in the movement of material and financial resources, the production and social development of the enterprise, and to most fully satisfy the interests of the team. The balance of income and expenses characterizes the financial relationship of the enterprise with creditors; contains the calculation of income, expenses, payments to the budget, distribution of net profit, formation of funds and reserves of the enterprise;

Gross balance sheet is a balance sheet that includes regulatory items. The gross balance is used for scientific research and improvement of the information functions of the balance;

Net balance is a balance sheet without regulatory items. The net balance allows you to determine the real value of the enterprise’s property;

The opening balance sheet is the first balance sheet that is drawn up at the beginning of the company’s activities. The assets of such a balance sheet reflect the composition of the enterprise’s property received during its organization, and the liabilities reflect the sources of its origin. Usually, before drawing up the opening balance sheet, an inventory and assessment of existing property is carried out;

The final balance sheet is a reporting document on the production and financial activities of an enterprise for a certain period of time. The closing balance sheet is prepared based on the audited accounting records;

Consolidated balance sheet is a consolidated accounting report on the activities and financial results of the parent and subsidiaries as a whole. The mutual turnover of subsidiaries is excluded from the consolidated balance sheet;

Liquidation balance sheet is an accounting balance sheet that characterizes the property status of an enterprise on the date of termination of its existence as a legal entity. The liquidation balance sheet shows the amount and sources of funds, as well as the state of the enterprise’s settlements after the end of the liquidation period;

The current balance sheet is a balance sheet that contains data on the movement of property (debit and credit turnover) for the reporting period, as well as the balances of funds and sources of property at the beginning and end of the period. The current balance sheet is used as an intermediate working document in the preparation of opening, closing and liquidation balance sheets;

Preliminary balance sheet is a balance sheet prepared in advance at the end of the reporting period, taking into account expected changes in the composition of the enterprise's property. In this case, actual and expected data on business transactions are used;

Trial balance - checking the correct accounting of company funds by monthly balancing of assets and liabilities;

Interim balance sheet - a balance sheet prepared before the end of the financial year;

Interim liquidation balance sheet (in the Russian Federation) - a balance sheet containing the composition of the property of a legal entity being liquidated; a list of claims submitted by creditors and the results of their consideration. The interim liquidation balance sheet is compiled by the liquidation commission;

A separation balance sheet is a document according to which, when a legal entity is divided, its rights and obligations are transferred to the newly formed legal entities. The separation balance sheet must contain provisions on the succession of all obligations of the reorganized legal entity in relation to all its creditors and debtors, including obligations disputed by the parties;

Balance sheet is a balance sheet that characterizes the property of an economic entity and the sources of formation of property as of a certain date in monetary value. The balance sheet is compiled by counting account balances;

Summary consolidated balance sheet is a balance sheet that is compiled by combining the balance sheets of legally independent enterprises that are economically interconnected. Such balance sheets are used by holding companies;

Consolidated balance sheet is a balance sheet that is prepared by combining the individual closing balance sheets. Consolidated balance sheets are used by ministries, departments and concerns.

Accounting

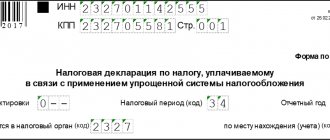

How to fill out a balance sheet using Form 1

In each balance line you must indicate the balance of the corresponding account, or the sum of the balances of several accounts. For example, in the line “Value added tax on purchased assets” the balance of account 19 with the same name is entered. In the line “Cash and cash equivalents” - the amount of balances in accounts 50 “Cash”, 51 “Cash accounts”, 52 “Currency accounts” and some others.

There are several basic rules that must be followed when filling out your balance:

- show debit and credit account balances in detail (do not “collapse”);

- fixed assets and intangible assets should be reflected at their residual value (that is, at their original cost minus depreciation);

- Show goods for resale at the purchase price (without trade markup), even if they are accounted for at the sales price;

- data on property and liabilities in the annual balance sheet must be confirmed by inventory results.

REFERENCE. Starting with reporting for 2021, data on balance sheet items is filled out strictly in thousands of rubles (previously it was possible in both thousands and millions). These amendments to order No. 66n were made by order of the Ministry of Finance dated 04/19/19 No. 61n.

About assets in simple words

Assets are the totality of all property, property rights that are the property of the enterprise, which have undergone appropriate assessment and are put on the balance sheet. This includes means of production and fixed assets (fixed assets), accounts receivable and everything that may constitute the overall property picture of the organization.

An asset cannot be negative, since these are real available funds for conducting business activities. They can be counted, measured or weighed because they have a quantitative basis.

The most reliable assets are those that can easily be converted into cash without a serious loss of value. Therefore, these assets are called liquid:

- cash,

- finished product inventories,

- short-term investments and more.

Accordingly, illiquid assets can be called those property that acquires a monetary form with a very significant loss of current value or can be repaid only after a long time:

- means of production,

- fixed assets,

- overdue debts of debtors, etc.

Using assets, the management of an enterprise can receive benefits, control them, and direct them in the right direction in order to increase the level of financial flows.

Balance sheet structure

Each part of the balance sheet groups assets and liabilities into sections. So, on the left side there are two sections - non-current and current assets, and the right side consists of three sections, separately combining capital and reserves, long-term as well as short-term liabilities.

In turn, the positions in each section are encoded with special four-digit codes established by Appendix No. 4 to Order No. 66n. Encryption of lines is necessary in reporting submitted to regulatory authorities - the legislator approved this procedure in order to systematize statistical data when generating information in general for an industry, region or country. A balance sheet compiled to review results within an enterprise may not contain codes - there is no need for them, but it is more convenient to generate a report and post accounting data, correlating them with the code number. Let's figure out how the current balance line codes are deciphered, what information is grouped in each of them, and how the indicators are formed.

How to prepare a balance sheet?

The essence of creating a balance sheet is to fill out all lines of the approved Form No. 1, the composition of which the enterprise has the right to adjust in accordance with the peculiarities of conducting business activities and the property used.

Both the Asset and Liability balance sheet consist of a sequence of lines, each of which records a certain indicator of the financial condition of the organization.

Each line has the name of an indicator and a fixed serial number, which reflects the position of the indicator in the hierarchical structure of the table.

So, for example, in the “Non-current assets” section in the Balance Sheet, the first line corresponds to number 110 (if the management of the enterprise increases the number of lines in form No. 1, the number may have a larger number) and is called “Intangible assets”.

The value of this row is usually obtained by adding the values of rows numbered 111 to 119, if such exist.

After all the rows in the Asset table are filled in, to obtain the final value, it is necessary to add up the results of the first two sections of the balance sheet, which were obtained by summing the other rows in a hierarchical sequence.

Consignment note – sample filling. How to write an explanatory note to the balance sheet?

The same principle works in the Passive table.

The first section of this table, “Capital and Reserves,” has serial number 310, since it is the third main section of the entire balance sheet and is formed by adding the rows that are in its subgroup of the hierarchy, that is, rows numbered from 311 to 319.

Filling out the balance sheet can be done starting from any table (Liability or Asset)

The main condition for the correct preparation of a balance sheet table is the exact correspondence of the value of each line and the indicator entered into it, as well as the presence of monetary values in all lines established by the enterprise.

There are exceptions when the amount for some indicator may be zero, in which case it is necessary to provide explanations for this item in the financial report.

As a rule, all indicators are displayed in numbers that mean thousands of rubles, for example, if the value of an organization’s real estate is 10,000,000 rubles, then 10,000 must be written in the balance sheet asset in the corresponding line.

Of course, if the company has a larger scale, and their cash turnover is mainly in the millions, then you can enter numbers by removing the last six digits, and indicate the numerical unit million rubles in the title of the indicator column.

The final numbers of the Asset and Liability balance sheets must coincide, since, in fact, the Asset reflects everything that the organization has, and the Liability balance sheet provides a description of where all the listed Assets were obtained from.

For a more detailed description of the preparation of the balance sheet, we will consider the principle of filling out each line of the Liability and Asset tables.