- offline — the system is installed on the computer (copy on an external hard drive or flash drive);

- online - cloud technologies, work from any computer on the Internet.

From the table above it can be seen that the first group includes such software products as: VLSI++, 1C-Reporting and Astral Report. The second group is a little more difficult. Not all online programs allow access from any device. For example, Kontur.Extern allows you to generate and send a VAT return directly on its portal in cloud mode, but you can only access the information from the computer on which the cryptographic information protection tool (CIPF) is installed. Therefore, Contour can be considered an online program only conditionally. Completely “cloud” programs are Bukhsoft, Moe Delo, Otchet.ru and Nebo.

To select a special operator, it is important to evaluate the ratio of the functions and options offered to their price among similar operators. More expensive options usually include additional services, such as checking the declaration before sending. In addition, users can even receive a regulatory framework for accounting and reporting, as well as advice from experienced accountants. Ease of connection and configuration, as well as feedback from the Federal Tax Service of Russia, play an important role. After all, in addition to sending the VAT return itself, you must receive from the Federal Tax Service a receipt of its receipt, as well as other requirements and notifications.

Checking the electronic VAT return

Before sending it to the Federal Tax Service, it is necessary to check the declaration: whether it is filled out in accordance with the format, whether the control ratios are met, whether the transaction type codes are indicated correctly, and it is also possible to check the counterparties for their reliability. The taxpayer himself can do this with the help of control ratios, which are also used by the tax authorities during a desk audit. Therefore, such testing before sending the declaration to the Federal Tax Service will allow taxpayers to avoid submitting an incorrect report containing errors, eliminate unnecessary correspondence with the tax authority and the need to submit updated declarations to correct errors.

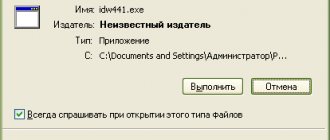

Of course, such checks are carried out using specialized testing programs. However, the online service of the tax service does not provide such an opportunity. Among the most understandable and convenient programs for electronically sending VAT returns in this regard, we should highlight Kontur and Bukhsoft - only their report verification protocol contains transcripts that are understandable to most users. For example, Bukhsoft sends the following transcripts when testing a VAT return:

Obviously, even a novice user will be able to understand such decodings and eliminate all shortcomings before the VAT report is received by the tax office.

How to provide explanations for a VAT return

Desk audit of VAT payment has its own characteristics.

Please note: the period for a desk audit of a VAT return has been reduced to two months. Most companies submit electronic reporting for this tax.

As stated in paragraph 3 of Art. 33 of the Tax Code of the Russian Federation, explanations to the virtual declaration requested by the inspection must be sent only in electronic form via TKS in the approved format. Explanations on paper are not considered provided.

If the explanations or an updated declaration requested during the camera meeting are not submitted within 5 days, then a fine will follow under Art. 129.1 of the Tax Code of the Russian Federation in the amount of 5 thousand rubles, for a repeated offense in the same calendar year it will increase to 20 thousand rubles.

Recently, a higher tax authority considered a dispute regarding the payment of a 5,000 fine in favor of the company.

In March, she received a request to provide explanations for the VAT return for the third quarter of last year. The explanations were sent to the inspection on time according to the TKS, but in a regular letter, to which the primary documents were attached.

Tax officials considered the explanations not provided, since the company did not comply with the letter format approved by Order of the Federal Tax Service of the Russian Federation dated December 16, 2016 No. ММВ-7-15/ [email protected] For this, she was fined 5 thousand rubles.

A higher tax authority overturned the inspector's decision. Since Article 88 of the Tax Code of the Russian Federation does not provide any indication that non-formalized electronic explanations are not considered submitted.

And the article. 129.1 of the Code punishes only for their failure to submit, and not for violation of the electronic format.

Therefore, a company that sent explanations to the Federal Tax Service by a simple letter under the TKS cannot be held liable under Art. 129.1 Tax Code of the Russian Federation.

Editor's note:

This decision will help organizations that find themselves in similar situations to avoid fines without going to court. It is enough to refer to it when the need arises. Let us remind you that the requirement to provide explanations for the VAT return will be sent if tax authorities identify contradictions or inconsistencies between the information contained in the declaration of the taxpayer and his counterparty or in the journal of received and issued invoices. The request is accompanied by a list of transactions for which discrepancies have been identified.

The algorithm for filling out the explanations depends on the fact that there are errors in the declaration that led to an understatement of tax.

If such an error has crept in, you must submit a “clarification” (clause 1 of Article 81 of the Tax Code of the Russian Federation). Whether or not to attach explanations revealing the reason for the inaccuracies is up to the organization itself, since the Tax Code of the Russian Federation does not prohibit this option for presenting documents.

If the company is confident that the reporting is completed correctly, then this must be conveyed to the controllers in the explanations. For example, reveal the reason for the discrepancies between the “profitable” base and the VAT base (there could be transactions exempt from VAT) or the reason for the discrepancy between the purchase book data and the sales book of the counterparty (after reconciliation with it). If necessary, copies of primary documents can be attached to the explanations.

Inaccuracies found in the report that did not affect the calculation of tax or did not underestimate its payment do not lead to the need to submit an “adjustment”. This should be reflected in the explanations.

Federal Tax Service requirements

The taxpayer not only must submit VAT via the Internet, he also has the following interrelated responsibilities (clause 5.1 of Article 23 of the Tax Code of the Russian Federation):

Tax authorities may request such explanations if errors and (or) contradictions are identified in the declaration between the information contained in the submitted documents, or if the information provided by the taxpayer does not correspond to the information contained in the documents held by the tax authority and received by it during tax control. The format for providing explanations was approved by order of the Federal Tax Service of Russia dated December 16, 2016 N ММВ-7-15/ [email protected] . If the specified explanations are submitted on paper, such explanations are not considered submitted. If these requirements are not met, the Federal Tax Service may block transactions on the payer’s account. Therefore, the special operator must provide such an opportunity.

m.ppt.ru

Selecting the format of documents for VAT accounting: on paper or electronically

Invoices, corrections to invoices, and adjustment invoices for one taxpayer can be filled out both electronically and on paper. This is due to the fact that the exchange of electronic invoices is possible only between those taxpayers who have compatible means of communication for organizing electronic document management. In addition, in case of technical problems, failures in the TCS, etc. The taxpayer issues invoices on paper. At the same time, re-issuance of these invoices in electronic form is not allowed (clause 4 of section II of Appendix No. 3 to Resolution No. 1137).

Invoices drawn up on paper must be signed (paragraph 1, clause 6, article 169 of the Tax Code of the Russian Federation):

— the head and chief accountant of the organization (other authorized persons);

- individual entrepreneur.

Invoices in electronic form must be signed with an electronic digital signature (paragraph 2, paragraph 6, article 169 of the Tax Code of the Russian Federation):

— head of the organization (other authorized person);

- individual entrepreneur.

On a note

The procedure for issuing and receiving invoices in electronic form via telecommunication channels is established by Order of the Ministry of Finance of the Russian Federation dated April 25, 2011 No. 50n.

Accounting journals, books of purchases and sales are maintained by one taxpayer either on paper or in electronic form.

Journal, purchase book and sales book, compiled on paper, until the 20th day of the month following the expired tax period:

a) must be signed by the head of the organization (his authorized person) or an individual entrepreneur;

b) the pages of each document must be numbered, laced and sealed with the organization’s seal.

Additional sheets of the purchase book and sales book, compiled on paper before the 20th day of the month following the expired tax period:

a) signed by the manager (his authorized person) or individual entrepreneur;

b) attached to the purchase book (sales book) for the tax period in which the invoice (adjustment invoice) was registered before corrections were made to it;

c) numbered with continuation of the continuous numbering of the pages of the purchase book (sales book) for the specified tax period;

d) laced, sealed with the seal of the organization.

Journal, purchase book and sales book, additional sheets of the purchase book and sales book compiled in electronic form:

must be signed with an electronic digital signature of the head of the organization (the person authorized by him) or an individual entrepreneur when transmitting the document to the tax authority in cases provided for by the Tax Code of the Russian Federation.

Note! An organization that sells (purchases) goods (work, services, property rights) through separate divisions maintains an accounting journal for the entire organization in the generally established manner.

Procedure for calculation and deadline for submitting VAT

VAT is a tax that must be calculated by business entities that apply general taxation rules. In certain situations, defaulters will also have to consider it.

About when such situations arise for non-payers, read the material “The procedure for VAT refund under the simplified tax system in 2017-2018.”

The calculation procedure, as a rule, does not cause difficulties. When selling inventory items (material assets) or services, the VAT payer increases the sales amount by the VAT rate, and takes the input tax as a deduction, thereby reducing the tax accrued upon the sale. In fact, VAT is calculated on the markup. For example, a company bought inventory items for 11,800 rubles. (10,000 for the goods and 1,800 for VAT), and sold them for 17,700 rubles. (15,000 - for goods and materials with a markup and 2,700 rubles - VAT). You must pay the difference between sales tax and input tax to the budget, that is, 900 rubles. (RUB 2,700 – RUB 1,800). Tax evaders are not entitled to use the deduction.

Information about input VAT should be recorded in the purchases ledger, and information about outgoing VAT in the sales ledger. The difference is displayed in the declaration at the end of the quarter. Purchase and sales ledger data is an integral part of this report. The declaration must be submitted to the Federal Tax Service at the place of registration of the taxpayer no later than the 25th day of the month following the reporting quarter (clause 5 of Article 174 of the Tax Code of the Russian Federation).

NOTE! The declaration to VAT payers can be sent to the Federal Tax Service only in electronic form via secure communication channels, having previously certified the file with an electronic digital signature. Defaulters can also submit this report on paper.

In case of late submission of VAT reports, there will be penalties in the amount of 5% of the tax amount for each month of delay, but not less than 1,000 rubles. and no more than 30% of the tax amount (clause 1 of Article 119 of the Tax Code of the Russian Federation).

Responsibility

For failure to submit a VAT return on time, liability is provided under Art.

119 of the Tax Code of the Russian Federation. For each full or partial month of delay in the declaration, a fine of 5 percent of the tax not paid on time is collected. The maximum penalty is 30 percent of the tax not paid on time on a late return. If the company did not pay the tax on time or violated the deadline for submitting the “zero” declaration, then the fine will be collected in the minimum amount - 1 thousand rubles. Do not forget that if the taxpayer submits a return on paper, it will be considered unsubmitted. In this case, a sanction will follow under Art. 119 of the Tax Code of the Russian Federation. Please note: an error in the VAT return format is not punishable by a fine. In the Resolution of the Arbitration Court of the North Caucasus District dated December 2, 2016 No. F08-9002/2016, the judges noted that clause 1 of Art. 119 of the Tax Code of the Russian Federation provides for a fine for failure to submit a declaration as such. Violation of the declaration format does not fall under this rule.

VAT return 2021

The new form of the VAT return for 2021 was approved by order of the Federal Tax Service of Russia dated December 20, 2016 No. ММВ-7-3/ [email protected] Taxpayers must provide a new form of the value added tax return, starting from the tax period for the first quarter of 2021.

The new VAT return for 2021 has several important and significant features. In our publication today, we will talk about what changes the value added tax return has undergone, what time frame it must be submitted, and also touch on the issue of how to correctly fill out the 2021 VAT return form.

How many VAT returns to file in 2018?

The reporting quarter has ended - there are 25 days to submit the declaration. This rule is prescribed by Article 174 of the Tax Code of the Russian Federation in paragraph 5. It turns out that the reporting form for the 4th quarter will be submitted first. 2021 by January 25, 2021. Further, for all those reporting quarterly, the reporting period will be the interval from January 1 to March 31, 2021. The form will need to be submitted strictly before April 25, 2021.

IMPORTANT: firms and entrepreneurs who import goods purchased in the EAEU countries report VAT every month, and are required to submit the form by the 20th of the next month, when the reporting month ends, which means that already in the 1st quarter of the current year they will have as many as 3 reports - for Dec. 17 (until 01/22/18), for Jan. 18 (until 02.20.18), for February. 18 (until March 20, 2018).

Features of the report of firms from EEC states can be found in the Treaty on the Eurasian Union No. 18 in paragraph 20.

Changes to VAT returns from 2021

Since 2015, the tax service has introduced an automatic system. The purpose of this system is to find discrepancies in the tax returns of counterparties. In accordance with Law No. 134-FZ, the tax inspectorate has the right to demand clarification from the taxpayer. Explanations in this situation are invoices for transactions.

Please note that today taxpayers submit all VAT returns electronically. Since 2015, a unified information data bank began operating throughout the Russian Federation, which makes it possible to track inconsistencies in the information provided.

The VAT return in 2021 must reflect information from the purchase book and sales book. Each line from the book of sales and purchases must correspond to an entry from the book of counterparties. Regardless of the volume, all data must be reflected in the declaration.

Intermediaries, who may or may not be VAT payers, must issue an invoice. The corresponding entry is made in the journal of received and issued invoices. However, this amount is not reflected in tax documents. Thus, the buyer has the right to make a deduction. The legality of such an action is reflected by the data of the principal.

VAT 20%: prepayment received in 2021, additional payment of 2% in 2021, shipment in 2021

The new rate of 20% applies from 01/01/2019, regardless of the date and conditions of the conclusion of contracts.

In accordance with Federal Law No. 303-FZ dated 08/03/2018, from January 1, 2021, the VAT tax rate is changing from 18% to 20% (from 18/118 to 20/120 and from 15.25% to 16.67%) . A VAT rate of 20% applies to goods (work, services), property rights shipped (performed, rendered), transferred from January 1, 2021, including on the basis of contracts concluded before 01/01/2019 (letters from the Ministry of Finance of Russia dated 09/07/2018 No. 03-07-11/64045, dated 09/07/2018 No. 03-07-11/64049, dated 09/10/2018 No. 03-07-11/64576, dated 10/16/2018 No. 03-07-11/ 74188).

The Federal Tax Service of Russia, in a letter dated October 23, 2018 No. SD-4-3/ [email protected] , clarified that the new rate of 20% applies from January 1, 2019, regardless of the date and conditions of the conclusion of contracts. Moreover, according to the Federal Tax Service of Russia, changing the VAT rate does not require amendments to contracts concluded before 01/01/2019. At the same time, the parties have the right to clarify the payment procedure and the cost of goods (work, services) sold and property rights.

Also in clause 1.1 of the letter, the tax service explained that if an advance payment for the upcoming shipment of goods (performance of work, provision of services), transfer of property rights was received before 01/01/2019, then the seller calculates VAT at the rate of 18/118 from the received advance payment amount. After shipment of the relevant goods from 01/01/2019, the seller charges VAT at a rate of 20% and claims a tax deduction for the amount of VAT previously calculated on the prepayment amount at the tax rate of 18/118.

If, by agreement of the parties, the buyer makes an additional payment of VAT in the amount of 2% from 01.01.2019, then such additional payment should not be considered as an additional payment of the cost on which VAT must be calculated at the rate of 20/120, but should be recognized as an additional payment of the tax amount. Therefore, the seller, upon receiving a VAT surcharge of 2%, should issue an adjustment invoice for the difference between the tax amount on the invoice previously drawn up using a tax rate of 18/118, and the tax amount calculated taking into account the amount of the surcharge. .

Thus, if the seller received an additional VAT payment of 2% and issued an adjustment invoice, then when shipping goods (works, services), property rights starting from 01/01/2019, he calculates VAT at a tax rate of 20%, and the amount of VAT, calculated on the basis of an adjustment invoice, is accepted for deduction from the date of shipment of the relevant goods (work, services), property rights in the manner prescribed by clause 6 of Art. 172 of the Tax Code of the Russian Federation.

Moreover, the seller also has the right to draw up a single adjustment invoice for two or more invoices drawn up earlier.

The procedure for filling out the indicators of the adjustment invoice is given in Example No. 1 of the appendix to the Letter.

The difference between the tax amounts indicated in the adjustment invoice is reflected on line 070 in column 5 of the VAT tax return and is taken into account when calculating the total tax amount calculated at the end of the tax period. In this case, on line 070 in column 3 of the VAT tax return, the number “0” (zero) is indicated.

As of October 1, 2017, changes have been made to the forms and rules for filling out (maintaining) invoices, purchase books and sales books, invoice journal, approved. Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137.

Example

In 2021, the organization Trading House LLC (seller) entered into an agreement with the organization Clothes and Shoes LLC (buyer) for the supply of goods on the terms of full advance payment.

On November 16, 2021, the seller issued an invoice to the buyer for payment.

On November 20, 2021, the seller received an advance payment from the buyer in the amount of RUB 177,000.00. (including VAT 18% - RUB 27,000.00).

On January 9, 2021, due to a delay in the delivery of goods, the seller and buyer entered into an additional agreement to the contract, according to which the cost of the goods began to amount to RUB 180,000.00. (including VAT 20% - RUB 30,000.00).

On January 11, 2021, the seller received from the buyer an additional payment of 2% VAT in the amount of RUB 3,000.00.

On February 15, 2021, the seller shipped the goods to the buyer.

Issuing an invoice for payment to the buyer in 1C: Accounting 8 (rev. 3.0)

To perform operation 1.1 “Issuing an invoice to the buyer” (section Sales - subsection Sales), you need to use the Create button to create a new document “Invoice to the buyer” (Fig. 1).

Rice. 1

Receiving advance payment from the buyer in 1C: Accounting 8 (rev. 3.0)

To perform operation 2.1 “Accounting for advance payment from the buyer”, on the basis of the document “Invoice to the buyer” (Fig. 1), a document “Receipt to the current account” is created with the type of operation “Payment from the buyer”.

The indicators of the document “Receipt to the current account” are filled in automatically based on the information in the document “Invoice to the buyer”.

In addition, in the document “Receipt to the current account” you must indicate (Fig. 2):

in the fields “According to document No.” and “from” - the number and date of the buyer’s payment order;

in the “Amount” field - the actual amount of the transferred prepayment.

Rice. 2

As a result of posting the document “Receipt to the current account”, an accounting entry will be generated (Fig. 3):

on the debit of account 51 and the credit of account 62.02 - for the amount of funds received by the seller from the buyer.

Rice. 3

In accordance with clause 1, clause 3 of Art. 168 of the Tax Code of the Russian Federation, the buyer of goods who has transferred the prepayment amount must be issued an invoice no later than 5 calendar days, counting from the date of receipt of the prepayment.

An invoice for the received prepayment amount (operation 2.2 “Creating an invoice for the amount of prepayment”; 2.3 “Calculation of VAT on the received prepayment”) in the program is generated on the basis of the document “Receipt to the current account” by clicking the Create based button (Fig. .2). Automatic generation of invoices for advances received from customers can also be done using the “Registration of invoices for advances” processing (section Banks and cash desk).

In the new document “Invoice issued” (Fig. 4), the basic information will be filled in automatically according to the base document:

in the “from” field - the date of preparation of the invoice, which by default is set to be similar to the date of generation of the document “Receipt to the current account”;

in the fields “Counterparty”, “Payment document No.” and “from” - the relevant information from the basis document;

in the “Type of invoice” field – the value “For advance”;

in the tabular part of the document - the amount of the received prepayment, the VAT rate and the VAT amount, respectively.

In addition, the following will be automatically entered:

in the field “Operation type code” - the value “02”, which corresponds to payment, partial payment (received or transferred) on account of upcoming deliveries of goods (work, services), property rights (appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. MMV- 7-3/ [email protected] );

the “Compiled” switch is set to “On paper” if there is no valid agreement on the exchange of electronic invoices, or “In electronic form” if such an agreement has been concluded;

the “Issued (transferred to the counterparty)” checkbox indicating the date - if the invoice is transferred to the buyer and is subject to registration. If there is an agreement on the exchange of electronic invoices before receiving confirmation from the EDI operator, the checkbox and date of issue will be absent. If the date of transfer of a paper invoice to the buyer is different from the date of preparation, then it must be adjusted;

fields “Manager” and “Chief Accountant” - data from the information register “Responsible Persons”. If the document is signed by other responsible persons, for example, on the basis of a power of attorney, then it is necessary to enter the relevant information from the directory “Individuals”.

For the correct preparation of an invoice, as well as the correct reflection of the document in the accounting system, it is necessary that in the “Nomenclature” field of the tabular part of the document the name (or generic name) of the goods supplied is indicated in accordance with the terms of the contract with the buyer.

This information is filled in automatically indicating:

names of specific item items from the document “Invoice to the buyer” (Fig. 1), if such an invoice was previously issued;

a generic name, if such a generic name was defined in the agreement with the buyer.

Rice. 4

By clicking the Print document “Invoice issued” button (Fig. 4), you can go to view the invoice form and then print it in two copies (Fig. 5).

According to the Rules for filling out an invoice, approved. By Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137, the invoice for the prepayment amount received indicates:

in line 5 - details (number and date of preparation) of the payment and settlement document (clause "h" clause 1 of the Filling Rules);

in column 1 - the name of the goods supplied (description of work, services), property rights (clause “a”, clause 2 of the Filling Rules);

in column 8 - the amount of tax calculated on the basis of the tax rate determined in accordance with clause 4 of Art. 164 of the Tax Code of the Russian Federation (clause “z”, clause 2 of the Rules for filling);

in column 9 - the amount of advance payment received (clauses “and” clause 2 of the Filling Rules);

in lines 3 and 4 and columns 2-6, 10 - 11 - dashes (clause 4 of the Filling Rules).

Rice. 5

As a result of posting the “Invoice issued” document, an accounting entry is generated (Fig. 6):

on the debit of account 76.AB and the credit of account 68.02 - for the amount of VAT calculated on the received advance payment from the buyer in the amount of RUB 27,000.00. (RUB 177,000.00 x 18/118).

Rice. 6

Based on the document “Invoice issued”, an entry is made in the information register “Invoice Log” (Fig. 7).

Despite the fact that since 01/01/2015, taxpayers who are not intermediaries (forwarders, developers) do not keep a log of received and issued invoices, the entries in the “Invoice Log” register are used to store the necessary information about the issued invoice - invoice.

Rice. 7

The document “Invoice issued” is registered in the accumulation register “VAT Sales” (Fig. 8).

Rice. 8

Based on the entries in the “VAT Sales” register, a sales book is generated for the fourth quarter of 2021 (Section Sales - VAT subsection) (Fig. 9).

Rice. 9

The amount of VAT accrued from the prepayment received is reflected in line 070 of section 3 of the VAT tax return for the fourth quarter of 2018 (approved by order of the Ministry of Finance of Russia dated October 15, 2009 No. 104n) (section Reports - subsection 1C-Reporting - hyperlink Regulated reports).

Receiving an additional payment of 2% VAT in 1C: Accounting 8 (rev. 3.0)

To perform operation 3.1 “Accounting for additional VAT payment from the buyer”, based on the document “Invoice to the buyer” (Fig. 1), a document “Receipt to the current account” is created with the type of operation “Payment from the buyer”.

The indicators of the document “Receipt to the current account” are filled in automatically based on the information in the document “Invoice to the buyer”.

In addition, in the document “Receipt to the current account” you must indicate (Fig. 10):

in the fields “According to document No.” and “from” - the number and date of the buyer’s payment order;

in the “Amount” field - the actual amount of the additional VAT payment received.

If, by agreement of the parties, the buyer makes an additional payment of VAT in the amount of 2% in 2021, then such an additional payment is recognized as an additional payment of the exact amount of tax (letter of the Federal Tax Service of Russia dated October 23, 2018 No. SD-4-3 / [email protected] ).

Rice. 10

As a result of posting the document “Receipt to the current account”, an accounting entry will be generated (Fig. 11):

on the debit of account 51 and the credit of account 62.02 - for the amount of funds received by the seller from the buyer as an additional payment of 2% VAT.

Rice. eleven

When receiving a VAT surcharge of 2% in 2021, the seller should issue an adjustment invoice for the difference between the tax amount on the invoice previously drawn up using a tax rate of 18/118 (Fig. 4) and the tax amount. , calculated taking into account the amount of the surcharge (letter of the Federal Tax Service of Russia dated October 23, 2018 No. SD-4-3 / [email protected] ).

An adjustment invoice for the received amount of additional VAT payment (operations 3.2 “Drawing up an adjustment invoice for the amount of additional VAT payment”, 3.3 “Calculation of VAT on the received additional payment”) in the program is generated on the basis of the document “Receipt to the current account” using the Create button (Fig. 10).

In the new document “Invoice issued” (Fig. 12), the basic information will be filled in automatically according to the base document:

in the “from” field - the date of preparation of the invoice, which by default is set to be similar to the date of generation of the document “Receipt to the current account”;

in the fields “Counterparty”, “Payment document No.” and “from” - the relevant information from the basis document;

In addition, the following will be automatically entered:

in the field “Operation type code” - the value “02”, which corresponds to payment, partial payment (received or transferred) on account of upcoming deliveries of goods (work, services), property rights (appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. MMV- 7-3/ [email protected] );

the “Compiled” switch is set to “On paper” if there is no valid agreement on the exchange of electronic invoices, or “In electronic form” if such an agreement has been concluded;

the “Issued (transferred to the counterparty)” checkbox indicating the date - if the invoice is transferred to the buyer and is subject to registration. If there is an agreement on the exchange of electronic invoices before receiving confirmation from the EDI operator, the checkbox and date of issue will be absent. If the date of transfer of a paper invoice to the buyer is different from the date of preparation, then it must be adjusted;

fields “Manager” and “Chief Accountant” - data from the information register “Responsible Persons”. If the document is signed by other responsible persons, for example, on the basis of a power of attorney, then it is necessary to enter the relevant information from the directory “Individuals”.

Since an adjustment invoice is issued for the amount of additional VAT payment, it is necessary to replace the default value “For advance” in the “Type of invoice” field with the new value “Adjustment for advance”.

In the modified tabular part of the document, it is necessary to indicate in the column “To the invoice” the details of the invoice for the advance payment (Fig. 4), for which the adjustment invoice is drawn up. After this, the cost indicators of the tabular section will be automatically filled in, both “before the change” and “after the change”.

Rice. 12

By clicking the Print document “Adjustment invoice issued” button (Fig. 12), you can go to view the form of the adjustment invoice and then print it in two copies (Fig. 13).

In accordance with Example No. 1, given in the appendix to the letter of the Federal Tax Service of Russia dated October 23, 2018 No. SD-4-3 / [email protected] , the adjustment invoice for the amount of additional VAT payment received in 2021 indicates:

in column 7 of line A (before the change) - tax rate 18/118;

in column 7 of line B (after the change) - tax rate 20/120;

in column 8 of line A (before the change) - the amount of VAT in the amount of 27,000.00 rubles, calculated from the amount of advance payment received (177,000.00 rubles x 18/118);

in column 8 of line B (after the change) - the amount of VAT in the amount of 30,000.00 rubles, which is the result of adding the amount of VAT calculated from the received advance payment (177,000.00 rubles x 18/118), and the amount of additional VAT payment ( RUB 3,000.00);

in column 8 of line B (increase) - the difference between the indicators of lines B (after the change) and A (before the change), amounting to RUB 3,000.00. (RUB 30,000.00 - RUB 27,000.00);

in column 9 of line A (before the change) - the amount of advance payment received in the amount of RUB 177,000.00;

in column 9 of line A (after the change) - the amount of advance payment received in the amount of RUB 177,000.00. and VAT surcharge in the amount of RUB 3,000.00;

in column 9 of line B (increase) - the difference between the indicators of lines B (after the change) and A (before the change) in the amount of 3,000.00 rubles, corresponding to the amount of the additional payment received.

Rice. 13

As a result of posting the document “Adjustment invoice issued”, an accounting entry is generated (Fig. 14):

on the debit of account 76.AB and the credit of account 68.02 - for the amount of the received additional payment of 2% VAT in the amount of RUB 3,000.00.

Rice. 14

Based on the document “Adjustment invoice issued,” an entry is made in the information register “Invoice Log” to store the necessary information about the issued adjustment invoice (Fig. 15).

Rice. 15

The document “Adjustment invoice issued” is registered in the accumulation register “VAT Sales” (Fig. 16).

Rice. 16

Based on the entries in the “VAT Sales” register, a sales book is generated for the first quarter of 2021 (Section Sales - VAT subsection) (Fig. 24).

Shipment of goods in 1C: Accounting 8 (rev. 3.0)

To perform operations 4.1 “Accounting for revenue from the sale of goods”; 4.2 “Calculation of VAT on the shipment of goods”; 4.3 “Write-off of cost of goods sold”; 4.4 “Credit for advance payment”, it is necessary to create a document “Sales (act, invoice)” with the type of operation “Goods (invoice)” based on the document “Invoice to buyer” (Fig. 1) using the Create based button (Fig. 17).

Before posting the document “Sales (act, invoice)” with the transaction type “Goods”, you must indicate the VAT rate of 20% (column “% VAT”). In this case, the amount of VAT (column “VAT”) and the cost of goods including VAT (column “Total”) will be recalculated automatically.

Rice. 17

As a result of posting the document, accounting entries will be generated (Fig. 18):

on the debit of account 90.02.1 and the credit of account 41.01 - for the cost of goods sold;

on the debit of account 62.02 and the credit of account 62.01 - for the amount of the prepayment and the amount of additional tax, counted against payment of shipped goods with VAT, in the amount of 180,000.00 rubles;

on the debit of account 62.01 and the credit of account 90.01.1 - for the cost of shipped goods including VAT in the amount of RUB 180,000.00;

on the debit of account 90.03 and the credit of account 68.02 - for the amount of VAT accrued upon shipment of goods in the amount of RUB 30,000.00. (RUB 150,000.00 x 20%).

Rice. 18

In addition, an entry will be made in the accumulation register “VAT Sales” (Fig. 19). Based on the entries in this register, a sales book for the first quarter of 2021 is formed.

Rice. 19

According to paragraph 3 of Art. 169 of the Tax Code of the Russian Federation, the taxpayer is obliged to draw up an invoice when performing transactions recognized as an object of taxation (with the exception of transactions that are not subject to taxation (exempt from taxation) in accordance with Article 149 of the Tax Code of the Russian Federation. When performing transactions for the sale of goods (works, services), property rights to persons who are not VAT taxpayers and taxpayers exempt from fulfilling taxpayer obligations related to the calculation and payment of tax, by written consent of the parties to the transaction, invoices are not drawn up.

In accordance with paragraph 3 of Art. 168 of the Tax Code of the Russian Federation, when selling goods (work, services), transferring property rights, the corresponding invoices are issued no later than five calendar days, counting from the day of shipment of the goods (performance of work, provision of services).

To create an invoice for goods shipped to the buyer (operation 4.5 “Creating an invoice for shipped goods”), you must click on the Write invoice button at the bottom of the document “Sales (act, invoice)” (Fig. 17). In this case, the document “Invoice issued” is automatically created, and a hyperlink to the created invoice appears in the form of the basis document.

In the new posted document “Invoice issued” (Fig. 20), which can be opened via a hyperlink, all fields will be filled in automatically based on the data in the document “Sales (act, invoice)”.

In this case, in the field “Operation type code” the value “01” will be indicated, which corresponds to the shipment (transfer) or acquisition of goods (work, services), property rights (appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] ).

Rice. 20

By clicking the Print document “Invoice issued” button (Fig. 20), you can go to view the invoice form and then print it in duplicate (Fig. 21).

All details of the compiled invoice will comply with the Rules for filling out invoices, approved. Resolution No. 1137. So, according to paragraphs. “z” clause 1 of the Rules for filling out an invoice, approved. Resolution No. 1137, line 5 of the invoice will indicate the details of two payment and settlement documents.

Rice. 21

As a result of posting the document “Invoice issued”, an entry is made in the information register “Invoice Log” to store the necessary information about the issued invoice (Fig. 22).

Rice. 22

Additional entries will also be generated in the accumulation register “VAT Sales” to store information about payment and settlement documents (Fig. 23).

Rice. 23

Based on the “VAT Sales” register entry, a sales book entry for the first quarter of 2021 is generated (Sales section - VAT subsection) (Fig. 24).

ATTENTION! The form of the sales book is provided in accordance with the Draft Amendments to the Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137.

Rice. 24

Amounts of tax calculated by the taxpayer from amounts of payment, partial payment received on account of future deliveries of goods (work, services) are subject to tax deduction from the date of shipment of the relevant goods (performance of work, provision of services), transfer of property rights in the amount of tax calculated from the cost shipped goods (work performed, services rendered), transferred property rights, in payment for which the amount of previously received payment, partial payment in accordance with the terms of the contract (if such conditions exist) are subject to offset (clause 8 of Article 171 of the Tax Code of the Russian Federation, clause 6 of Art. 172 of the Tax Code of the Russian Federation).

To reflect operation 4.6 “Deduction of VAT upon shipment of goods and offset of prepayment”, it is necessary to create the document “Creating purchase ledger entries” (section Operations - subsection Closing the period - hyperlink Regular VAT operations) (Fig. 25).

The document is automatically filled in by clicking the Fill button.

The “Advances received” tab will display information about the received amounts of prepayment and additional payment, as well as the amount of VAT previously calculated on these amounts and offset against the shipment of the relevant goods.

Rice. 25

As a result of posting the document “Creating purchase ledger entries,” an entry is made in the accounting register (Fig. 26):

on the debit of account 68.02 and the credit of account 76.AB - for the VAT amounts calculated upon receipt of an advance payment and additional payment and presented for deduction after shipment of the relevant goods, for which payment the amount of previously received payment is subject to offset.

Rice. 26

To register the document “Invoice issued” in the purchase book, an accumulation register “VAT Purchases” is provided (Fig. 27).

Rice. 27

Based on the entries in the “VAT Purchases” register, a purchase book is formed for the first quarter of 2021 (Purchases section - VAT subsection) (Fig. 28).

When registering the advance invoice and adjustment invoice in the purchase book, the following will be indicated:

in column 2 - transaction type code 22, which corresponds to deductions of tax amounts calculated by the taxpayer from amounts of payment, partial payment received on account of upcoming deliveries of goods (work, services), property rights (appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. MMV -7-3/ [email protected] );

in column 15 - the entire amount of the invoice from column 9 on the line “Total payable” (Fig. 5) (clause “t” of clause 6 of the Rules for maintaining a purchase ledger, approved by Resolution No. 1137) and the amount on the adjustment invoice - invoice from column 9 according to the line “Total increase” (Fig. 1);

in column 16 - the amount of VAT that the seller claims for tax deduction (clause “y” of clause 6 of the Rules for maintaining a purchase ledger, approved by Resolution No. 1137).

Rice. 28

The amount of tax accrued upon receipt of an additional payment of 2% VAT and upon shipment of goods, as well as the amount of VAT declared for tax deduction after shipment of goods and offset of the received prepayment amount, will be reflected in section 3 of the VAT return for the first quarter of 2021 (approved by order Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] ):

on line 010 - tax base in the amount of 150,000 rubles. and the amount of VAT accrued on the sale of goods in the amount of 30,000 rubles. (RUB 150,000.00 x 20%);

on line 070 - tax base in the amount of 0 rubles. and the amount of VAT in the amount of 3,000 rubles. (letter of the Federal Tax Service of Russia dated October 23, 2018 No. SD-4-3/ [email protected] );

on line 170 - the amount of VAT calculated from the amount of the prepayment and additional payment received and presented for deduction in the amount of 30,000 rubles. (RUB 27,000.00 + RUB 3,000.00).

Buh.ru

Electronic VAT return in 2021

The new VAT return for 2021 is provided by taxpayers through a special operator in electronic form. Only tax agents can provide a paper VAT return, but not all.

Please note that electronic reporting and electronic invoice are not the same thing. That is, filing a return electronically in 2021 is the responsibility of the taxpayer, and providing invoices electronically is a right.

A VAT return not in electronic form will not be considered submitted in accordance with paragraph 5 of Article 174 of the Tax Code of the Russian Federation.

In addition, the tax service has the right to block the bank accounts of an organization in accordance with subparagraph 1, paragraph 3, article 76 of the Tax Code of the Russian Federation.

Deadline for filing a VAT return

A VAT return is a quarterly report, and the deadline for its submission is established by Article 174 of the Tax Code of the Russian Federation. You must report no later than the 25th day of the month following the previous tax period.

That is, the VAT return for the 3rd quarter of 2021 must be submitted no later than October 25, 2018. This is a working day, so the deadline cannot be moved to another day.

The fine for violating the deadlines for submitting VAT tax reports is determined by Article 119 of the Tax Code of the Russian Federation. For each month of delay, including incomplete, a fine of 5% of the amount of tax unpaid on the basis of this declaration is collected. The maximum fine is 30% of the unpaid tax, and the minimum is 1000 rubles.

Moreover, the fine is collected even if the VAT payer did not have taxable transactions in the reporting period, so there is no tax arrears. In this case, the tax authorities fine the organization or individual entrepreneur a minimum amount of 1,000 rubles.

Some courts consider this approach to be unfair, because the norm of Article 119 of the Tax Code of the Russian Federation is based on a percentage recovery of arrears, and the minimum amount of the fine relates specifically to the unpaid amount of tax. And if the reporting indicators are zero, this sanction should not be applied.

However, it is better not to argue with the tax office, especially considering that if a declaration is not submitted within 10 days, the current account is blocked.

Free tax consultation

VAT return on paper in 2021

In 2021, tax agents who are not VAT payers (or are exempt from the obligation to pay this tax) have the right to file VAT returns on paper.

Let's give an example: a company uses a simplified taxation system (STS) and is exempt from paying VAT. At the same time, this company leased state (municipal) property. In this situation, the organization is obliged to pay VAT (as a tax agent). Providing a VAT return on paper is acceptable in this case.

If the taxpayer does not carry out transactions that result in the movement of funds in his bank accounts, and also does not have objects of taxation for VAT, then after the expiration of the reporting period he has the right to submit a single simplified tax return, which includes information on VAT.

VAT 2018: new types of goods and services

The legislator introduced the following innovations:

18% is now levied on imports of electronic services and goods.

Previously, only Russian suppliers of similar services paid VAT. Foreigners sold their electronic goods and services on the territory of the Russian Federation without VAT. The Russian government is seeking to increase the competitiveness of its own Internet companies. That is why new rules appeared.

How did the market react to the initiative of the Russian authorities?

Google’s reaction to changes in the pricing of their services in Russia is now known. The company simply increased the tariff so as not to lose profits.

Any clarifications, additional/amendment documents and calculations must be submitted remotely via EDI.

Previously, even if the VAT return was sent remotely through communication channels, explanations during the “camera meeting” could be transmitted in any way convenient for the taxpayer, even brought in person on paper. Now the law has tightened the rules: all documents must be sent electronically.

Failure to submit a VAT return correctly is now punishable by a fine.

Previously, errors in declarations made involuntarily or with malicious intent were also punishable by fines. But now submitting a VAT return with such inaccuracies will lead to significant fines, since their amount has changed upward. The regulations for conducting desk audits have changed. The new system has become tougher in relation to the taxpayer.

PLEASE NOTE: submission of explanations on paper is now equivalent to the absence of explanations as such, the fine for such a violation is 5,000 rubles; a similar repeated violation will entail a penalty of 20,000 rubles.

The changes affect the report form itself and the KBK used to pay the tax.

In a new way, you need to report starting from January 2021. Those who submit reports monthly have already been affected by this rule. Other VAT payers will learn about it in March-April 2021, when they will need to report for the 1st reporting period of this year.

An example of filling out a VAT return for 2021

When filling out the VAT form, taxpayers often encounter difficulties. As a rule, a rather controversial issue is determining the exact date from which it is necessary to begin calculating the tax burden. According to the law, the tax burden begins at the moment when the organization begins to provide services (within its competence), and at the moment of shipment of the products provided. But you need to pay attention to the fact that if an organization (firm, enterprise) operates on an advance payment basis, then the tax burden is calculated from the moment the funds are received.

We offer you the basic procedure for filling out the 2018 VAT return:

1. If a paper declaration is submitted, it must comply with a single machine-oriented form.

2. The colors of the ballpoint (or fountain) pen used to fill out the declaration must be only black, blue or lilac.

3. Duplex printing cannot be used on document sheets.

4. A declaration with corrected errors (corrections by any corrective means) cannot be accepted for consideration.

Procedure for filling out the 2021 VAT return

The VAT return in 2021 consists of 12 sections. Each section of the document has its own rules and order of completion.

Section 1 is the final section in which the VAT payer reflects the amounts subject to payment or reimbursement based on the results of accounting/tax accounting and according to information from sections 3-6 of the declaration.

Line 020 - KBK (budget classification code) is recorded for this type of tax. You can see the BCC for VAT in the text of this article.

Line 030 - is filled in exclusively by the taxpayer-beneficiary, exempt from VAT, who issued the invoice.

Line - 040 and 050 - amounts received for tax calculation. If the result is positive, line 040 is filled in; if the result is negative (subject to reimbursement from the budget), line 050 is filled in.

If during the reporting tax quarter transactions were carried out that were not subject to taxation and exclusively on the territory of the Russian Federation, the taxpayer fills out only the 1st and 7th sections of the declaration. Other sections are not filled in.

If a citizen is a tax agent, he fills out the 2nd section of the document (Article 161 of the Tax Code of the Russian Federation). If the taxpayer during the specified period performed transactions that were not specified in the second section, then other sections of the document are filled in that correspond to his activities.

This section is completed if the taxpayer performs operations subject to VAT (Article 164 of the Tax Code of the Russian Federation). The declaration provided by a foreign organization (firm or enterprise) must be supplemented with Appendix No. 2.

Section 3 is completed when calculating VAT amounts on transactions that are taxed at rates of 18, 10 percent or estimated rates.

Lines - 010–040 – sales amount, that is, the tax base.

Line - 070 - advances received for upcoming deliveries.

Line - 080 - the amount to be restored, including in relation to advances (line 090) and in relation to transactions at a 0% rate (line 100).

Line - 118 - total tax amount.

Lines - 120-190 - amounts to be deducted:

This section lists all transactions performed that have a zero VAT rate (in accordance with the Tax Code of the Russian Federation) or are not subject to taxation.

To avoid additional submission of documents confirming transactions with zero VAT, tax deductions in Section No. 5 of the declaration indicate all amounts of taxes that were paid under zero VAT.

The section contains information about all transactions carried out that do not have the status of zero VAT taxable. If such operations were not carried out during the specified period, section 6 does not need to be filled out.

This section should list all transactions that are not subject to tax. This includes a list of services, products, operations implemented and provided outside the Russian Federation.

In fields that are not filled in (if there is no data), a dash is placed.

Complete Section 7 if you carried out transactions during the period that are not subject to VAT under Article 149 of the Tax Code of the Russian Federation. It is still necessary to fill out a declaration for these transactions, despite the fact that organizations do not issue invoices for them.

Sections No. 8 and No. 9

These sections reflect the information specified in the purchase book and sales book.

Appendix 1 to Sections 8 and 9 is filled out in the same way as the additional sheets of the purchase book and sales book.

Section 10 and 11

These sections are filled out by tax agents, where they reflect information from the invoice journal.

This section is intended for those who are exempt from VAT but issue invoices with allocated tax.

Typical errors in the VAT return that tax authorities identify

As part of control activities, inspectors most often identify the following errors in VAT declarations: 1. Incorrect transaction code for the sale of goods (work, services) to buyers who are VAT payers.

Section 9 “Information from the sales book” of the declaration by taxpayer-sellers reflects transactions for the sale of goods (work) , services) to buyers who are VAT payers, using transaction type code 26 (“Sales of goods (work, services) to persons who are not VAT payers”). Invoices with code 26 do not participate in the process of comparing invoices from section 8 “Information from the purchase book” of the buyer’s declaration and invoices from section 9 of the seller, as a result of which auto claims are generated to taxpayers for identified discrepancies.

2. Errors when deducting VAT in parts

The right to deduction can be used within 3 years from the date of its occurrence, and the amount of tax on the invoice can be declared in installments over several tax periods (letter of the Ministry of Finance of the Russian Federation dated May 18, 2015 No. 03-07-RZ/28263). At the same time, taxpayers, when deducting VAT in parts, incorrectly fill out column 15 of the purchase book (cost of purchases according to the invoice) (line 170 of section 8).

Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 established that when accepting invoices for deduction in parts, column 16 of the purchase book (VAT amount on the invoice) (line 180 of the section reflects the part of the total tax amount that is accepted for deduction in the current quarter. And in column 15 of the purchase book (line 170 of the section)

reflects the part of the total tax amount that is accepted for deduction in the current quarter. And in column 15 of the purchase book (line 170 of the section) the cost of goods (work, services) is always indicated, indicated in column 9 on the line “Total payable” of the invoice, without dividing into parts.

the cost of goods (work, services) is always indicated, indicated in column 9 on the line “Total payable” of the invoice, without dividing into parts.

In addition, in column 13b of the sales book (invoice value of sales) (line 160 of section 9) and in column 14 of the invoice journal (cost of goods) (line 160 of section 10) it is also necessary to reflect the total cost of sales according to the invoice - invoice without division.

3. Incorrect recording of import transactions

Taxpayers in the purchase book and section 8 of the declaration incorrectly reflect import transactions from EAEU member countries (transaction type code 19) and from other countries (transaction type code 20).

Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 established that when reflecting in the purchase book a transaction for the import of goods from the EAEU, in column 3 “Number and date of the seller’s invoice” of the purchase book, the registration number of the application for the import of goods from the territories of the EAEU states, assigned tax authority, and the date of registration of the application for the import of goods and payment of indirect taxes.

When reflecting in the purchase book a transaction for the import of goods from other countries not included in the EAEU, in column 3 “Number and date of the seller’s invoice” of the purchase book the number and date of the customs declaration are indicated.

4. Incorrect completion of the title page of the declaration if it is submitted by the legal successor

When submitting a declaration for another organization as a legal successor, in the title page in the column “Code of the place of submission,” code 215 (“At the location of the legal successor who is not the largest taxpayer”) or 216 (“At the place of registration of the legal successor who is the largest taxpayer”) is indicated with indicating the code of the reorganization form, TIN and KPP of the reorganized company in the appropriate columns. If in this situation, on the title page in the column “Code of the place of submission” you indicate code 213 (“At the place of registration as the largest taxpayer”) or 214 (“At the location of the Russian organization that is not the largest taxpayer”), the declaration will be considered submitted for oneself . As a result, the previously submitted form receives the status “irrelevant”.

Thus, as a result of these errors, discrepancies arise, leading to increased paperwork and an undesirable burden on both the taxpayers themselves who committed violations and their counterparties.

LETTER from the Federal Tax Service of the Russian Federation for the Moscow Region dated December 9, 2016 No. 21-26/ [email protected] “About typical errors when filling out a VAT return”

Editor's note:

Let us remind you that as part of a desk audit, if contradictions are discovered, tax authorities have the right to request clarification. If a company has an obligation to submit a VAT return in electronic form, then explanations to it are submitted in the same form. In this regard, Order of the Federal Tax Service of the Russian Federation dated December 16, 2016 No. ММВ-7-15 / [email protected] approved the electronic format for submitting the specified explanations to the VAT return.

Thus, explanations on paper are not considered submitted.

A fine in the amount of 5 thousand rubles is collected in case of failure to submit (untimely submission) explanations to the tax authority when the updated tax return is not submitted on time (clause 1 of Article 129.1 of the Tax Code of the Russian Federation). In case of repeated violation - 20 thousand rubles.

KBK for payment of VAT in 2021

To pay VAT in 2021, the budget classification codes remained the same as for 2021:

VAT on goods (work, services) sold in Russia:

Tax 182 1 0300 110

Penalty 182 1 0300 110

Fine 182 1 0300 110

VAT on goods imported into Russia (from the Republics of Belarus and Kazakhstan):

Tax 182 1 0400 110

Penalty 182 1 0400 110

Fine 182 1 0400 110

VAT on goods imported into Russia (payment administrator - Federal Customs Service of Russia):

Tax 153 1 0400 110

Penalty 153 1 0400 110

Fine 153 1 0400 110

We consider it necessary to note that the BCC for some other taxes, as well as insurance premiums, have changed in 2021. They are published here: Current KBK 2021.

In particular, the details for paying insurance premiums in 2018 have changed. Therefore, be careful.

Paper VAT as a way to defer tax

I was prompted to write this note by Kira Gin’s article about “Paper VAT”.

The author’s message can be briefly described as follows: optimization through paper VAT is dangerous, the work scheme needs to be changed.

It is impossible to disagree with this opinion - optimizing value added tax through connections with garbage dumps is not the best idea in 2021. Russian business is gradually coming to the conclusion that taxes must be paid, and illegal optimization is punishable. However, paper VAT will continue to exist for some time.

Today, medium and large businesses receive quite serious sanctions for optimization using the above method; almost no tax audit passes without multimillion-dollar additional charges.

However, not everything is so bad for small businesses, since organizations with small annual turnover are not at all interesting to the tax authorities. And they can now consider paper VAT as a way of optimization. But that's it for now.

Paper VAT in 2021, in my opinion, should be considered as a way to defer the tax burden. The Tax Code of the Russian Federation has a rather interesting article 64 - Procedure and conditions for granting a deferment or installment plan for the payment of taxes, fees, and insurance contributions. I don’t see any point in rewriting in this article the grounds for tax deferment, the necessary conditions or documents that a taxpayer must submit to the tax authority to obtain a tax deferment; any accountant and lawyer should study this article to be quietly surprised.

For example, paragraph 10, clause 5.1 of Art. seemed particularly strange to me. 64 of the Tax Code of the Russian Federation “from the date of creation of an organization, registration of an individual as an individual entrepreneur until the day of filing an application for an installment plan for tax payment with the authorized body, at least one year has passed.” I remember when I studied various economic textbooks, they quite often indicated that the first two or three years of a loss for an enterprise is the norm.

In this regard, the question arises: can a new enterprise pay taxes in full without taking advantage of illegal optimization?

Most likely no. This is where paper VAT sellers await us. For a measly 2.5-3 percent, we will be saved from the tax burden for one or several quarters. And we will use the funds saved from the state and, perhaps, multiply them. Perhaps we will be lucky and the VAT will be buried in the ground and no one will dig up this corpse, or maybe on the contrary - we will not be lucky and our company will be completely screwed, squeezing all the juice out of it for illegal optimization.

It is also possible that the statements of a ridiculous counterparty will not be accepted and we will immediately be subject to VAT, which, however, also happens.

VAT return changes in 2021

In 2021, for the periods of 2021, it will be necessary to submit a VAT return using a new form. It is planned to adopt the declaration form by December of this year; it will be in effect from 2018.

The new declaration for the periods in 2021 will take into account:

In paragraph 2 of Art. 146 of the Tax Code of the Russian Federation a new sub-clause should appear. 16, which includes in the list of transactions not subject to VAT, the gratuitous transfer to government authorities of property from 100% state-owned joint-stock companies that were established to conduct activities in special economic zones.

Regulation of VAT in terms of tax refunds to foreign citizens exporting goods purchased in Russia abroad under the Tax Free scheme.

Simplification of the procedure for submitting documents to the Federal Tax Service certifying the right to apply the zero rate when exporting goods and services.

The State Duma is considering bill No. 19842-7, which proposes to expand the list of goods subject to a VAT rate of 10%. To date, the list of preferential goods is established by paragraphs. 1 item 2 art. 164 Tax Code of the Russian Federation. The bill is aimed at adding fruit and berry crops and grapes to the list of goods on the sale of which VAT is calculated at a rate of 10% instead of 18%.

In addition to the VAT return, VAT payers must provide the following reporting:

The deadline for filing a Tax Declaration for indirect taxes (value added tax and excise taxes) when importing goods into the territory of the Russian Federation from the territory of member states of the Customs Union is quarterly until the 20th day of the month following the reporting quarter. The form and procedure for filling out this declaration were approved by order of the Ministry of Finance of the Russian Federation No. 69 n dated July 7, 2010.

The deadline for submitting the Invoice Log is quarterly by the 20th day of the month following:

The form and Rules for filling out the invoice journal were approved by Decree of the Government of the Russian Federation No. 1137 of December 26, 2011. Invoice registers are handed over to intermediaries who are neither payers nor tax agents for VAT if they issue or receive invoices in the course of intermediary activities.

The material has been edited in accordance with changes in the legislation of the Russian Federation 12/19/2017

What tax reporting can be submitted on paper for 2021?

A.V. Nesterovich, author of the answer, Ascon consultant for accounting and taxation

QUESTION

What tax reporting can be submitted on paper for 2019?

ANSWER

You can submit a paper return for any tax except VAT, unless you are required to submit it electronically. All VAT payers are required to file a VAT return exclusively under the TKS. Other declarations are for organizations with an average number of employees over the past year of more than 100 people. New organizations - with more than 100 employees.

In addition, it is allowed to submit reports on paper using the following forms, subject to the conditions regarding the number of employees:

- Calculation of insurance premiums, 2-NDFL, 6-NDFL - when submitting reports for up to 10 people.

- 4-FSS - with an average number for the last year of less than 25 people.

- SZV-M, SZV-STAZH - when submitting reports for less than 25 people.

JUSTIFICATION

In accordance with clause 3 of Article 80 of the Tax Code of the Russian Federation, a tax return (calculation) is submitted to the tax authority at the place of registration of the taxpayer (fee payer, insurance premium payer, tax agent) in the established form on paper or in established formats in electronic form.

Tax returns (calculations) are submitted to the tax authority at the place of registration of the taxpayer (fee payer, insurance premium payer, tax agent) in established formats in electronic form via telecommunication channels through an electronic document management operator by the following categories of taxpayers (insurance premium payers):

- taxpayers (payers of insurance contributions) whose average number of employees for the previous calendar year exceeds 100 people;

- newly created (including during reorganization) organizations whose number of employees exceeds 100 people;

- taxpayers (payers of insurance premiums), for whom such an obligation is provided for by part two of the Tax Code of the Russian Federation in relation to a specific tax (insurance premiums).

For value added tax, taxpayers (including those who are tax agents), as well as persons specified in clause 8 of Article 161 and clause 5 of Article 173 of the Tax Code of the Russian Federation, are required to submit a tax return to the tax authorities at the place of their registration in accordance with the established format in electronic form via telecommunication channels through an electronic document management operator. An exception to this rule are some tax agents, as well as foreign organizations that pay the “Google tax” (clause 5 of Article 174 of the Tax Code of the Russian Federation).

A document containing information on the income of individuals of the expired tax period and the amounts of tax calculated, withheld and transferred to the budget system of the Russian Federation, and the calculation of the amounts of personal income tax calculated and withheld by the tax agent, is submitted by the tax agent in electronic form via telecommunication channels communications. If the number of individuals who received income in the tax period is up to 10 people, the tax agent can provide the specified information and calculation of tax amounts on paper (clause 2 of Article 230 of the Tax Code of the Russian Federation).

Payers whose number of individuals in whose favor payments and other remunerations are accrued for the billing (reporting) period exceeds 10 people, as well as newly created (including as a result of reorganization) organizations whose number of these individuals exceeds this limit , submit calculations for insurance premiums to the tax authority in electronic form using an enhanced qualified electronic signature via telecommunication channels. (Clause 10 of Article 431 of the Tax Code of the Russian Federation).

Insurers whose average number of individuals in whose favor payments and other remunerations are made for the previous billing period exceeds 25 people, and newly created (including during reorganization) organizations whose number of specified individuals exceeds this limit, submit calculations on accrued and paid insurance premiums in form 4-FSS to the territorial body of the insurer in the formats and in the manner established by the insurer, in the form of electronic documents (Clause 1, Article 24 of the Federal Law of July 24, 1998 N 125-FZ “On Mandatory Social insurance against accidents at work and occupational diseases").

The policyholder provides information on 25 or more insured persons working for him (including persons who have entered into contracts of a civil law nature, for remuneration for which insurance premiums are calculated in accordance with the legislation of the Russian Federation) for the previous reporting period in the form of an electronic document signed by an enhanced qualified electronic signature in the manner established by the Pension Fund of the Russian Federation (clause 2 of article 8 of the Federal Law of 01.04.1996 N 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system”). This standard refers, in particular, to the forms SZV-M, SZV-STAZH, SVZ-ISKH, SZV-K.

Thus, you can submit a paper return for any tax except VAT, unless you are required to submit it electronically. All VAT payers are required to file a VAT return exclusively under the TKS. Other declarations are for organizations with an average number of employees over the past year of more than 100 people. New organizations - with more than 100 employees.

In addition, it is allowed to submit reports on paper using the following forms, subject to the conditions regarding the number of employees:

- Calculation of insurance premiums, 2-NDFL, 6-NDFL - when submitting reports for up to 10 people.

- 4-FSS - with an average number for the last year of less than 25 people.

- SZV-M, SZV-STAZH - when submitting reports for less than 25 people.