The 3-NDFL personal income tax return is submitted to the Federal Tax Service by entrepreneurs who do not apply special tax regimes, private lawyers and notaries, as well as individuals who received income from which tax was not withheld by tax agents, or who wish to receive a tax deduction. The deadlines for filing tax returns 3-NDFL are established by law. Let's look at them in more detail, and also find out the dangers of submitting 3-NDFL at the wrong time and when the declaration can be submitted in violation of the deadline.

For whom is submitting documents to the tax office obligatory?

According to current legislation, submitting a 3rd personal income tax declaration is mandatory for civil servants, individuals engaged in individual entrepreneurship and private practice (lawyers, notaries, tutors), as well as citizens who received funds in the past year in certain ways. There are quite a lot of the latter. They will be discussed below.

Funds subject to declaration can be received through:

- Sales of movable and immovable property;

- Renting housing, non-residential premises, vehicles, specialized equipment;

- Inheritance of property representing a work of art, culture or science;

- Winning the lottery;

- Donations from a citizen who is not a relative.

Additionally, sometimes employers do not withhold taxes on the income their employees receive. If you are one of the latter, you will still have to file a return with the tax authorities. The most important thing is to familiarize yourself with all the necessary information that should be provided by your superiors.

We should not forget that in addition to responsibilities, Russians also have rights. In particular, a certain category of citizens has the right to receive back the money spent on paying income tax. To do this, you just need to submit a declaration that corresponds to the established state template. Details are below.

Self-payment of personal income tax by citizens

An exhaustive list of situations when an individual must pay the tax themselves is contained in Art. 228 Tax Code of the Russian Federation.

Cases and deadlines for paying personal income tax for the year for this group of citizens are collected in the table:

Deadlines for payment of personal income tax for 2021

Income received from citizens or organizations that are not tax agents

Income from the sale of property if it was owned for less than the minimum period of ownership (less than 3 years)

Income from foreign sources, if the recipient is a tax resident of the Russian Federation

Income from which tax agents did not withhold tax, although there was such an opportunity

Winnings for which the tax was not withheld by the tax agent or was not fully withheld

Copyright royalties received by heirs (successors) of copyright

Receipt by the donor of the cash equivalent of real estate and securities transferred to replenish the target capital of a non-profit organization

Income from which tax agents were unable to withhold tax and reported this to the Federal Tax Service

(deadline postponed since 12/01/2019 is a holiday)

The last situation is an exception to the general rule. In this case, there is no need to submit a declaration; the payment is made on the basis of a tax notice that the tax authorities must send to the citizen.

More information about property tax deduction

Most often, those citizens who bought real estate try to return previously paid taxes. In such cases, an amount of up to 260 thousand rubles is reimbursed from the state budget, which is 13% of 2 million. If the apartment was purchased with a mortgage, then the interest paid to the bank will be added to the refund amount. This means that in addition to the previously mentioned 260 thousand rubles, you can get another 390 thousand.

The described right has no statute of limitations. Simply put, even if the home was purchased more than 10 years ago, you can get the tax paid. Moreover, it is issued immediately within several years. The money given to the owner of residential property and the procedure for receiving it is called a property tax deduction.

What you need to know about social tax deductions?

Most often, Russians return 13% of income tax, which is included in the total cost of paid education. It is noteworthy that money is issued from the state budget to everyone who has received education on a paid basis before the age of 24. The only condition is that the form of training must be full-time.

A refund of income tax paid is possible in a number of cases. For example, in this way you can compensate for part of the costs of medicines and treatment. In the first case, in addition to the application, you must submit copies of prescriptions and receipts from pharmacies to the tax office, which is quite problematic. In the treatment situation, everything is much simpler, because any paid clinic will easily issue all the necessary papers.

Social tax deductions can be made even for paying for tuition at a driving school, educational courses, dance clubs, sports sections, etc. By the way, not all residents of our country know about this. In all the above cases, 13% of the total cost is refunded. The only thing you should remember is that only officially employed Russians retain the right to receive property and social deductions.

How to submit documents to the tax authorities?

There are 4 ways to submit documentation to the tax office. Each of them will be discussed in more detail below. The information provided will be useful to those citizens who remember that the deadline for filing the 3rd personal income tax return for 2021 will soon expire, but for some reason have not yet submitted the necessary papers to government agencies.

You can submit documents to the tax office, social security authorities, passport office and other authorities via the Internet.

In order to reduce “live” queues and provide convenience for citizens, the portal www.gosuslugi.ru was created. The presented option is good because you can solve your problem without leaving home. The only inconvenience is that you will have to register on the site.

The second method is similar to the first for the reason that the submission of documents is again carried out via the Internet, but this time you will need to use the official website of the Federal Tax Service, located at www.nalog.ru. Before sending papers, you must log into your personal account, which will require you to know your login and password. This is the main disadvantage of the described method, because authorization data is issued at the tax office at the place of residence.

The third method is personal submission of documents. To do this, you will need to visit the tax office with all the necessary papers. This is the most famous and simple option, which is familiar to everyone who has declared their income at least once.

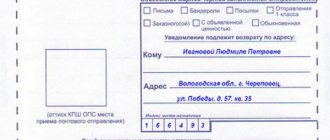

The fourth method is to send documents by mail, for example, by registered mail. This option is quite reliable, but it has certain disadvantages. First of all, it's quite slow. Secondly, you will not have the opportunity to track the verification process, as can be done if you submit documents through the website www.nalog.ru.

Tax transfer methods

A citizen has the right to transfer the fee in 4 ways:

- bank;

- cash desk of the local Federal Tax Service;

- Postal office;

- a non-bank credit enterprise with permission to conduct such operations, issued by the Central Bank.

It is recommended to pay taxes for other persons, including relatives, in cash. If the payer deposits tax funds through a bank card, without filling out a payment form, but using the details of the Federal Tax Service, the system will identify the card owner as the payer. In this situation, the person for whom the money was paid will face arrears and fines.

How to fill out a tax return correctly?

If you want to quickly create a document required by the tax authorities, then use the “Declaration” program. It's free. The only thing worth remembering is that you need to use the current version, i.e. If you want to declare income received for 2021, then only the “Declaration 2017” program is suitable for you.

After launching the application, proceed to creating a document. In the first step, you must set the conditions. This means you need to enter the number of the tax office to which you are going to submit papers.

Next, you should provide information about the declarant. There is nothing complicated about this, because you just need to enter your personal data. As a rule, full name, date of birth, address, passport number, TIN, etc. are indicated.

The next point concerns income received in the Russian Federation. In this case, you will need a certificate of income, which is issued at your place of work. Having it, you will easily cope with this part of filling out the tax return.

Next you need to provide information about deductions. This means you must indicate the number of children you are raising. If you don't have them, then skip this point.

Further filling out of the declaration depends on the given situation. If you are going to provide the tax authorities only with information about your income, then nothing more is required from you. If you plan to receive social deductions, then you will have to fill out a few more points.

The “Declaration” program is simple and convenient, but if you cannot figure it out, then contact an accountant who will create the necessary document for you for a small fee. Such a service costs about 500 rubles. Offices providing it are usually located next to tax offices.

Current form

The current 3-NDFL form in 2021, along with the electronic format and filling out rules, is still fixed by order of the Federal Tax Service of Russia dated December 24, 2014 No. ММВ-7-11/671, but in the new edition - order dated October 25, 2021 No. ММВ- 7-11/822 (hereinafter referred to as Order No. ММВ-7-11/822):

What happens if you don't submit your return on time?

If the deadline for filing a tax return was violated by a citizen, then it all depends on the circumstances. If a citizen was obliged to pay tax along with the papers, then he will be fined for being late. If it was necessary to provide only a document, then penalties for violating the deadlines in this case are not provided.

As for the declaration drawn up in Form 3 of personal income tax for property and social deductions, it is not necessary to submit it before a certain date. This document is of unlimited duration. It is accepted by tax authorities throughout the year.

If an individual entrepreneur violates the deadline for filing a tax return, he will have to pay a fine. If the indicators given in the document are zero, then the fine will be 1 thousand rubles. If an entrepreneur not only delays submitting documents, but also refuses to pay tax, then the measures will be more severe. In such a situation, the citizen repays the tax debt, pays a fine and interest for the delay.

Payment of taxes by foreign employees

Another category of additional profit tax payers are foreigners employed by Russian citizens. Two groups of foreign workers paying tax:

- who work for individuals and perform duties for personal, auxiliary and other needs, without carrying out entrepreneurial work;

- who work for legal entities, notaries, lawyers, other persons who conduct private practice or individual entrepreneurs under a GPC contract.

These citizens become tax residents after staying in Russia for more than 183 consecutive calendar days, but the fee is calculated from the moment the employment contract is signed. The date of payment of the fee depends on the mode of employment of the foreigner:

- “For yourself” or special modes (OSN, USN, UTII, Unified Agricultural Tax) - until July 15 of the year following the reporting year. Advances: July 15, October 15, January 15.

- Foreigners on PSN. The date of payment of advance funds is before the start of the patent term or its renewal.

If a foreign citizen stops working in Russia and plans to leave, then the tax authorities must be notified about this one month before departure.