“Simplers” can fill out this line with code 1220 if, according to the organization’s accounting policy, the amounts of “input” VAT are reflected in account 19 “Value added tax on acquired assets.”

Accounts receivable.

This line 1230 is intended for short-term receivables, that is, repayment of which is expected within 12 months after the reporting date.

Financial investments (excluding cash equivalents).

For these assets, line 1240 is provided, which, in particular, shows loans provided by the organization for a period of less than 12 months.

If you are determining the current market value of financial investments, use all sources of information available to you, including data from foreign organized markets or trade organizers. Such recommendations are contained in the Letter of the Ministry of Finance of Russia dated January 29, 200907-02-18/01. If at the reporting date you cannot determine the market value of a previously assessed object, reflect it at the cost of the last assessment.

Cash and cash equivalents.

To fill out the line, you need to sum up the cost of cash equivalents (the balance of the corresponding subaccounts of account 58) and the balances of cash accounts (50 “Cash”, 51 “Cash accounts”, 52 “Currency accounts”, 55 “Special accounts in banks” and 57 “Transfers” on my way").

The concept of cash equivalents, we recall, is contained in the Accounting Regulations “Cash Flow Statement” (PBU 23/2011), approved by Order of the Ministry of Finance of Russia dated 02.02.2011 No. 11n. Cash equivalents may include, for example, demand deposits opened with credit institutions.

Other current assets.

Here (line 1260) shows data on current assets that are not reflected in other lines of section. II balance.

Why do you need a balance sheet for three years?

In our fast-paced age, information quickly loses its relevance, and last year’s news is no longer of interest to anyone.

And here is a three-year period - why? The fact is that economic and management decisions are made on the basis of balance. In order for these decisions to be informed and effective, a number of requirements are imposed on the balance sheet. The need to reflect indicators for 3 years in it means ensuring the requirement of comparability (comparability) of information.

For more information about what requirements apply to the balance sheet, read the article “What requirements should accounting records satisfy?” .

Comparability of indicators for the same date allows us to identify differences in their values, evaluate them quantitatively and qualitatively, form an opinion about the financial position of the company at the reporting dates, and also determine its development trends.

But in order for the indicators to be compared, they must be comparable—formed according to the same rules. In this case, you can compare the indicators for the same date of previous periods, taking into account changes in legislation and the company’s accounting policies. If the accounting method has changed, adjustments to the balance sheet for previous periods are inevitable. Let's look at how this happens using an example.

ATTENTION! As of June 1, 2019, changes have been made to the form of the balance sheet and other accounting records.

For a sample of filling out a balance using the updated form, see ConsultantPlus. If you do not have access to the K+ system, get a trial demo access. It's free.

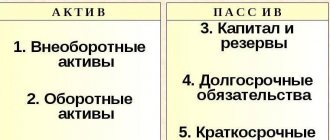

Opening balance structure

The balance must be formed on the date of state registration of the subject. Its balancing indicator is capital. This is due to the fact that at the time of the start of activities there is no other source of financing. There are no deposits from third parties or debts. Let's look at the structure of the opening balance.

What should be indicated in the opening balance sheet of an organization resulting from reorganization in the form of a merger (accession)?

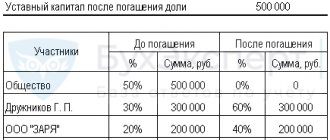

Authorized capital

The management company is formed on the basis of share contributions. Both the property of the founders (real estate, vehicles, materials and other objects) and money are accepted as contributions. This is true for commercial companies. The capital of state entities is formed from budget funds. The creation of a management company can be reflected in accounting only if there is an approved order of a corresponding nature, signed by the manager.

Reference! The law establishes a minimum capital amount for LLCs and JSCs. For an LLC this amount is 10,000 rubles, for a joint-stock company – 100,000 rubles.

Peculiarities of valuation of deposits in the form of property

Valuing capital contributions in the form of money is simple. The situation will be more complicated if property, resources, and various rights are used as a contribution. All these objects are subject to a certain monetary value. Its calculation is carried out in agreement with the founders.

If the amount of deposits is more than 20,000 rubles, the property must be assessed by an appraiser. The value fixed by the appraiser cannot be increased by the founders.

We adjust the balance sheet for 3 years using the example of LLC reporting

Balance adjustments may be required, for example, if errors are detected in accounting. In this case, there are special rules for making adjustments to the statements, as well as a special procedure for presenting the updated balance to users.

We have described in detail what errors and how they need to be corrected and how to submit updated reporting here.

Another case when the balance sheet is adjusted is a significant change in accounting policy. For example, Aria LLC draws up a balance sheet for 3 years, taking into account the fact that provisions were introduced into its accounting policy in 2021 that resulted in a significant change in the balance sheet indicators. In accordance with clause 15 of PBU 1/2008 “Accounting Policy of the Organization” (approved by Order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n), in this case a retrospective recalculation of these indicators is necessary.

The accountant of Aria LLC must recalculate the balance sheet indicators for the 2 previous periods, based on the assumption that such an accounting policy was applied by the company starting from 01/01/2018. Then you need to reflect in the balance sheet the result of recalculation of indicators of previous periods (clause 21 of PBU 1/2008). The result of the recalculation is reflected in account 84 “Retained earnings (uncovered loss)”.

In the explanations to the balance sheet, the accountant of Aria LLC must indicate what changes have been made to the accounting policy and why, how the consequences of these changes are reflected in the balance sheet, and also enter the amount of changes for all adjusted items for each period.

EXAMPLE from ConsulantPlus: In 2021, depreciation was incorrectly calculated on main production equipment - 10,000 rubles. instead of 1,000 rub. As of December 31, 2019, the balances of accounts 20 and 43 are zero. The error was discovered after the reporting was approved. Before the error was corrected, the capital was: as of December 31, 2018 - RUB 1,010,000. (including retained earnings - 1,000,000 rubles);... Read the continuation of the example by receiving a free trial demo access to the K+ system.

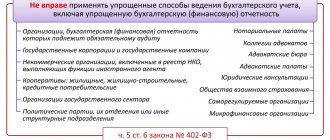

NOTE! Retrospective recalculation is not permitted for organizations that have access to simplified accounting (clause 15.1 of PBU 1/2008).

Read about what principles should be followed when simplifying reporting in the material “Simplified reporting for small businesses” .

Criteria for classifying firms as small businesses

An organization can be classified as a small business entity (SME) if it meets all the criteria specified in the table:

| No. | Criterion | Limit value | |

| Microenterprise | Small business | ||

| 1 | Total share of participation in the authorized capital of Russian LLC, constituent entities of the Russian Federation, municipalities, public, religious organizations, foundations | 25% | |

| 2 | Total share of participation in the authorized capital of other organizations that are not small and medium-sized businesses, as well as foreign organizations | 49% | |

| 3 | Average number of employees for the previous calendar year | 15 people | 100 people |

| 4 | Income from business activities (sum of revenue and non-operating income) excluding VAT for the previous calendar year | 120 million rub. | 800 million rub. |

In 2021, when entering information into the SMP register, the total share of participation in the authorized capital of the LLC of other organizations that are not SMP is not taken into account (Letter of the Federal Tax Service dated August 18, 2016 No. 14-2-04 / [email protected] (clause 2)).

For medium-sized businesses, criteria 1 and 2 are the same as for small and micro enterprises, while the average number of employees should not exceed 250 people, and income from business activities should not exceed 2 billion rubles.

In this case, such an organization must be included by the Federal Tax Service in the register of small and medium-sized businesses posted on its official website (part 1, paragraph “a”, paragraph 1, paragraphs 2, 3, part 1.1, part 3 of Art. 4, Article 4.1 of Law No. 209-FZ, clause 1 of the Decree of the Government of the Russian Federation of April 4, 2016 No. 265).

Therefore, small businesses can submit financial statements in a simplified manner, namely:

- simplified balance;

- simplified financial statements.

Thus, when preparing simplified financial statements, there is no need to fill out and submit appendices to the statements to the Federal Tax Service, i.e.:

- cash flow statement;

- statement of changes in equity;

- explanations (explanatory note).

However, if the organization believes that the information from these forms is necessary for reporting users, then the organization can fill them out (clause 26 of the Ministry of Finance Information No. PZ-3/2016).

Results

To draw up a balance sheet as of the reporting date means to reflect in it information not only of the current period, but also for the 2 previous years.

This will allow all interested users to conduct a qualitative analysis of balance sheet indicators and make the right economic decisions. When drawing up a balance sheet for 3 years, it is sometimes necessary to adjust its indicators, which makes the report data more comparable and the decisions made on its basis more effective. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Instructions for creating an opening balance

The balance sheet is drawn up on the basis of primary documentation. The primary record records the status of assets and liabilities, contributions from participants. The opening balance is compiled in accordance with this algorithm:

- First, the name of the paper “Opening balance” is drawn up. The date the document was issued is indicated at the bottom.

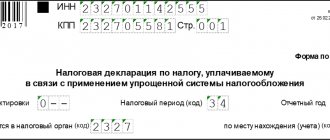

- Indication of the full organizational form (for example, LLC, JSC) and the name of the subject. On the right side, the codes are written in table form: OKUD, OKPO. You also need to provide your Taxpayer Identification Number (TIN).

- It is necessary to fix the direction of the subject’s work and the form of ownership (for example, commercial or state). The company address with zip code is entered.

- A table is formed. It indicates the assets that the subject currently has. The table consists of 4 columns. The first contains information about assets, the second contains value codes, the third contains the column “At the beginning of the period,” and the fourth contains the column “At the end of the reporting period.”

- The first column is filled in. It includes information about assets: both current and non-current. In a special way, it is necessary to consider the structure of non-current assets. These are fixed assets, deposits with long maturities, tax deferred assets. The column also needs to indicate in detail the composition of current assets: raw materials, materials, products for sale and finished products, expenses of the following periods, VAT, money, accounts receivable, short-term deposits.

- Information about assets (for example, their codes, amounts) is posted in the remaining columns. Information can be taken from primary papers. Then the totals for assets are determined.

- By analogy with the previous diagram, you need to fill out the “Liabilities” section. That is, the composition of liabilities is described in detail.

- Assets and liabilities are determined on the balance sheet.

The columns “At the beginning of the period” and “At the end” determine the total amounts and track their changes.

Additional Information

Based on the opening balance sheet, the economic position of the entity can be partially determined. However, a full analysis cannot be performed on the basis of this document, since the opening balance is created at the very beginning of the activity. It contains a minimum of information. For example, based on the balance sheet, it is impossible to establish the profitability of an enterprise, since the person has not yet started its activities.

Based on information from the opening balance sheet, information is entered into the General Ledger. In particular, the debit indicates the indicators from the “asset” line. Of particular note is the opening balance model. It is distinguished by the absence of debts to creditors.

The company may make changes to the opening balance sheet. However, this rule must be taken into account: adjustments relating to previous periods are recorded only in this balance sheet. That is, there is no need to make additional accounting entries for past periods of time. However, it is necessary to draw up an explanatory note indicating the reasons for the adjustments. The corresponding rule is contained in paragraph 22 of PBU 1/98.

Financial results report

The old profit and loss reporting form has been adjusted, but only slightly. The form must also indicate information about income received during the reporting period. And also provide information about all expenses that the company incurred in the calendar year.

Accounting data is indicated over time, that is, for the reporting and previous years. This structure allows you to immediately identify significant deviations and analyze them. Let us remind you that a detailed and thorough analysis of reporting indicators is the key to a successful business. It is the analysis that makes it possible to timely identify weaknesses in activities and make the right management decisions.

Current report form

Note that the unified financial reporting form itself contains the basic rules for filling it out. So, for example, the amount of revenue should be indicated minus value added tax and excise taxes (line 2110).

If necessary, the report data will have to be detailed in the explanatory note to the balance sheet.

Completed financial report

IMPORTANT! F. No. 2 is checked by tax authorities with the income tax return. If the data does not match, inspectors can request clarification or immediately initiate an on-site inspection.