Review of the main changes in comparison with PBU 6/01

The Ministry of Finance approved two new standards - FSBU 6/2020 “Fixed assets” and FSBU 26/2020 “Capital investments”. They apply from reporting for 2022, but already in 2021 you can work on them voluntarily. There are significant differences between PBU 6/01 “Accounting for fixed assets” and the new rules. Let's look at the main ones.

| Accounting treatment element | As it was according to PBU 6/01 | What happened according to FSBU 6/2020 and FSBU 26/2020 |

| Acceptance of fixed assets for accounting | ||

| OS cost limit determined by the organization | No more than 40,000 rubles | Any amount that is determined taking into account the materiality of the information |

| The procedure for accounting for “low-value” OS | Reflected in inventories | The cost is charged directly to expenses |

| Capex in leased assets | Reflected as part of the OS | The accounting procedure is not established by the standard. In our opinion, their value is attributed to the increase in the value of the right to use the asset |

| Determination of the initial cost (PV) of the OS | ||

| Inclusion of a provision | Not directly provided (it had to be included according to PBU 8/2010) | expressly provided |

| Procedure for long-term deferment (installment plan) | The nominal amount of the obligation is included in the PS | The discounted amount of the liability is included in the PV, the difference is applied to interest expenses |

| Evaluation upon free receipt | At current market value | At fair value |

| Valuation for non-monetary settlements | Current (market) value applies | Fair value applies |

| OS revaluation | ||

| How is revalued value determined? | Current (replacement) cost of the OS | Fair value of fixed assets |

| Frequency of revaluation | Regularly, but not more than once a year | Regularly, no restrictions |

| Procedure for reflecting revaluation | One way: recalculation of the original cost and accumulated depreciation | Two ways:

|

| Depreciation of fixed assets | ||

| Checking depreciation elements | Revision of the useful life is possible only after modernization (reconstruction, etc.). The remaining elements do not change | Useful life, salvage value and depreciation method are reviewed annually and whenever there are signs of change. Change if necessary |

| Calculation of depreciation on fixed assets of non-profit organizations | No depreciation is charged (only depreciation on the balance sheet) | Depreciation is calculated in accordance with the general procedure |

| Start and end time of depreciation | From the 1st day of the month following the month of acceptance for accounting (disposal) | From the date of recognition (disposal) of fixed assets; acceptable - from the 1st day of the month following the month of acceptance for accounting (disposal) |

| Methods for calculating depreciation |

|

The method based on the sum of numbers of years of useful life is excluded |

| Application of the reducing balance method | The formula for calculating depreciation is determined by PBU; the organization chooses only the coefficient | The organization independently determines the formula for calculating depreciation (you can also use the option that was established by PBU 6/01) |

| Procedure for calculating depreciation during the year | Monthly in the amount of 1/12 of the annual amount, regardless of the method used | No such rule has been established |

| Base for calculating depreciation | Initial (replacement) cost | Difference between original and salvage value |

| Cases of suspension of depreciation accrual | Conservation for more than 3 months or restoration for more than 12 months | The period when the book value of an asset is equal to or less than the liquidation value |

| Profitable investments in assets / investment real estate | ||

| A special OS group is allocated | Profitable investments in assets - fixed assets intended for rental | Investment property is real estate intended for renting out or generating income from an increase in its value |

| Transfer of OS from a special group to the “main” group and back | Profitable investments in securities can be transferred to account 01; reverse transfer is not provided | OS can be reclassified from investment property to “non-investment” and back |

| Depreciation calculation | Depreciation is calculated in accordance with the general procedure | Investment properties that are valued at revalued amounts are not subject to depreciation. |

| Impairment | ||

| Checking capital investments for impairment | Not provided | It is mandatory to check according to IAS 36 “Impairment of Assets” |

| Checking fixed assets for impairment | Not provided | It is mandatory to check (except for investment property accounted for at revalued amounts) - according to IAS 36 “Impairment of Assets” |

Let's take a closer look at all the changes.

Get a sample accounting policy for a small LLC

Change No. 1 - the restriction on the OS cost limit has been removed

The organization has the right to determine the minimum value at which property is recognized as a fixed asset (clause 4 of FSBU 6/2020). Previously, according to PBU 6/01, there was a limit of 40 thousand rubles. Because of this, differences emerged between accounting and tax accounting, since for tax purposes, fixed assets do not include objects worth up to 100 thousand rubles inclusive.

According to the new standard, there are no restrictions; a company can set a limit in any amount, which is determined taking into account the materiality of the information. You can fix the limit at 100 thousand rubles - this will eliminate discrepancies between accounting and tax accounting. You can choose an even higher level if, taking into account the scale and nature of the activity, this does not affect the quality of information generated in accounting and reporting.

Information is significant if its absence or distortion in the financial statements may affect the decisions of users made on its basis (clause 3 of PBU 22/2010, clause 6.2.1 of the Accounting Concept in the Russian Market Economy).

Another innovation is related to the accounting procedure for “low-value fixed assets”: their cost should be attributed directly to expenses, whereas the previous procedure provided for their reflection in inventories. However, starting from 2021, classifying such assets as reserves contradicts clause 3 of FSBU 5/2019, therefore clause 5 of PBU 6/01 should not be applied in this part.

Change No. 2 - estimated liabilities were directly called part of the original cost of fixed assets

The initial cost of a fixed asset consists of the capital investments associated with it, made before it was reflected as part of the fixed asset.

The composition of costs included in the cost of capital investments has not changed compared to the standards of PBU 6/01. However, now their list directly indicates the estimated liability that arose when making capital investments. Previously, we understood that it should be included in the cost of the operating system, from clause 8 of PBU 6/01, clause 5, 8 of PBU 8/2010.

For example, the cost of a future OS object must include upcoming expenses for:

- dismantling and disposal;

- environmental restoration;

- payment of vacations to employees if they were involved in capital investments;

- registration of real estate or vehicle, if such expenses have not yet been incurred at the time of its transfer to the OS.

The estimated liability, if its execution period exceeds 12 months, is included in the cost of capital investments at a discounted value (clause 20 of PBU 8/2010). Obligations for dismantling, recycling, and environmental restoration are fulfilled after the main asset has been used. This means that they will always be discounted, since the useful life of the OS is always more than 12 months.

If in the future the amount of the estimated liability changes not in connection with the accrual of interest, such a change increases or decreases the value of the fixed asset. However, if as a result of such a change the book value of the fixed asset becomes zero, then there is nowhere to reduce it, so a further decrease in the estimated liability is charged to current income.

Change No. 3 - if there is a deferment (installment plan), not the entire amount is included in the capital investment

If, when making capital investments, an organization is granted a deferment (installment plan) of payment for at least 12 months, the cost of the capital investment includes the amount that would have to be paid in the absence of a deferment (installment plan) (clause 12 of FSBU 26/2020).

The difference is accrued according to the same rules as interest on loans (credits). An organization may establish in its accounting policy a shorter minimum deferment (installment) period for this rule.

Change No. 4 - fixed assets received free of charge and with non-cash payment must be valued at fair value

FSBU 26/2020 prescribes the use of the fair value of property in certain cases. It must be determined in accordance with IFRS 13 Fair Value Measurement.

So, if an organization receives a future fixed asset free of charge, it must be accounted for at fair value. If an object is paid for in kind, there are three ways to take it into account:

- Assess at fair value the transferred property, property rights, works, services.

- If the first option is not possible, evaluate the received property, property rights, works, and services at fair value.

- If both options are impossible, the book value of the transferred property and the actual costs of performing work or providing services are taken as acquisition costs.

Previously, in all these cases, the current (market) value was used instead of fair value.

Rules for assessing the fair value of assets under IFRS

Change No. 5 - revaluation of fixed assets

As before, an organization can select groups of fixed assets that it will account for at revalued values.

Property, plant and equipment are revalued at fair value. But the revaluation itself can be carried out in two ways:

- The historical cost and accumulated depreciation are restated so that the carrying amount after restatement is equal to the fair value of the asset.

- The original cost is reduced by accumulated depreciation and then recalculated to the fair value of the asset.

A single method of revaluation must be applied to each group of fixed assets.

If an organization decides to account for fixed assets at a revalued value, then it must be revalued regularly in the future so that the value of the fixed assets corresponds to or does not differ significantly from fair value. The company itself chooses the frequency of revaluation for each group of fixed assets, focusing on how susceptible the cost of such fixed assets is to change.

This also means that it is not necessary to reflect the results of revaluation in accounting if the changes turned out to be insignificant. It is better to establish the materiality criterion for revaluation in the accounting policy.

The procedure for reflecting revaluation (discount) amounts is generally the same as was established by PBU 6/01: as a rule, revaluation is applied to the total financial result without being included in the profit (loss) of the period.

Change No. 6 - the procedure for calculating depreciation of fixed assets

There are many changes in the rules for working with depreciation. Let's look at everything in order.

Checking depreciation elements . The useful life, salvage value and method of calculating depreciation must be regularly checked for compliance with the conditions of use of the fixed asset. The review is carried out at the end of each year, and during the year if there is evidence of a change in any element.

Based on the results of the check, a decision may be made to change one or more elements. Adjustments are reflected as a change in estimated values, that is, prospectively (without recalculating indicators from previous years).

List of non-depreciable fixed assets . The fixed assets of non-profit organizations are excluded from the list - depreciation is accrued for them in the general manner, whereas previously depreciation was only reflected on the balance sheet.

The point at which depreciation begins and ends . As a general rule, depreciation is accrued from the date of recognition of fixed assets. But the organization may decide to accrue it from the month following the month of recognition of the fixed asset. This decision must be reflected in the accounting policy.

The standard does not explain in what order the amount of depreciation for the first (incomplete) month is determined. Among the possible options is to charge depreciation in an amount proportional to the number of calendar days of use of the OS in the first month, or in the full amount, as for a full month. The chosen procedure is fixed in the accounting policy.

Similar rules are established for the end point of depreciation.

Methods for calculating depreciation . The new standard does not provide for the write-off of value based on the sum of the numbers of years of the useful life. Thus, if the useful life of an asset is determined by a period of time, depreciation can be calculated only by two methods: straight-line or declining balance.

If the useful life is determined by the quantity of products (volume of work in physical terms), it is only proportional to the quantity of products (volume of work).

The method is determined for each group of OS and should correspond as closely as possible to the distribution of future economic benefits from using the OS of this group.

Application of the reducing balance method . When calculating depreciation using the reducing balance method, the organization itself determines the formula for calculating depreciation. The only requirement is that the formula must provide a systematic reduction in the amount of depreciation in subsequent periods.

In particular, you can use a procedure that complies with PBU 6/01 and Guidelines 91n.

Monthly depreciation calculation . There is no longer a condition that during the year depreciation is accrued monthly in the amount of 1/12 of the annual amount, regardless of the method used for its calculation.

Base for calculating depreciation . Depreciation is not calculated on the full cost of fixed assets. The amount repaid by depreciation is equal to the difference between the book value and the liquidation value. Salvage value is the amount that an organization can receive for an item at the end of its useful life (in the condition characteristic of that moment), minus the costs of disposal.

Moreover, in most cases, the liquidation value will be zero, and its non-zero value may be a sign that the useful life is determined incorrectly (since it turns out that the object can still be used).

Suspension of depreciation . The new standard does not allow suspending the accrual of depreciation during conservation for more than 3 months and restoration for more than 12 months.

A new basis has emerged for suspending depreciation: it is not accrued if the liquidation value of a fixed asset becomes equal to or exceeds its book value. If in the future the liquidation value of the fixed assets becomes less than the book value, depreciation is resumed.

Get expert advice on the rules for working with the new Federal Accounting Standards

Change No. 7—investment real estate instead of profitable investments in material assets

To replace profitable investments in material assets, FSBU 6/2020 introduced a different concept - “investment real estate”. This is real estate that is intended for rental and (or) for generating income from an increase in its value.

Investment properties can also be carried at historical or revalued cost. However, if an object was purchased to receive income from an increase in its value, it should be valued precisely at its revalued value; any other procedure is incorrect.

Investment property carried at revalued amounts is not depreciated. In this case, the amount of revaluation or depreciation is included in the income or expenses of the current period in which the revaluation was made.

When an investment property is revalued, the cost of the property is restated so that it equals its fair value. There is no depreciation for such an object.

At the same time, it is possible that an object assessed at a revalued value, which was not previously classified as investment property, changes its purpose and begins to belong to this group. The opposite situation is also possible. In each of these cases, the book value on the date of change of purpose of the object becomes its original cost.

Change No. 8 - it is necessary to check for depreciation of fixed assets and capital investments

New standards require checking fixed assets and capital investments for impairment (clause 38 of FSBU 6/2020, clause 17 of FSBU 26/2020). The exception is investment property, which is accounted for at revalued amounts.

The rules for testing and reflecting impairment in accounting were approved by IAS 36 “Impairment of Assets”.

An impairment loss is recognized:

- for capital investments and fixed assets that are accounted for at historical cost - as part of the financial result of the current period;

- for fixed assets that are accounted for at a revalued value - as a decrease in the amount of the revaluation, and if the amount of the revaluation is not enough, then the difference is also reflected in the financial result of the current period.

Change No. 9 - investments in leased fixed assets

FSBU 6/2020, unlike PBU 6/01, does not list capital investments in leased fixed assets as fixed assets. How to reflect them according to the new standard?

Clause 7 of FSBU 6/2020 states that the accounting features of lease (sublease) agreements are established by FSBU 25/2018 “Lease Accounting”. But this standard does not provide a clear answer.

However, let us pay attention to clause 13 of FSBU 25/2018: the costs that the lessee incurred before using the leased asset are included in the cost of the right to use the asset. There is no justification for taking different approaches and treating such costs differently simply depending on when they are incurred.

In addition, by virtue of clause 10 of FAS 25/2018, a single accounting policy must be applied in relation to the right to use an asset and in relation to similar own assets. From this it is logical to draw the following conclusion: if capital investments in your own facility increase its initial cost as the cost of modernization (reconstruction, addition, additional equipment, etc.), then capital investments in a leased facility should also increase the cost of the corresponding right to use the asset.

However, since this procedure is not directly approved by accounting standards, we recommend that it be consolidated in the accounting policy on the basis of clause 7.1 of PBU 1/2008 “Accounting Policy of the Organization.”

Relaxations for small businesses

Organizations that use simplified accounting have the right to a number of relaxations and simplifications (clause 3 of FSBU 6/2020, clause 4 of FSBU 26/2020). Here are the main ones:

- it is possible to determine the amount of capital investments (i.e., essentially the cost of fixed assets) only in amounts payable to the supplier (contractor). In this case, other expenses associated with capital investments are included in the financial result of the current period;

- do not take into account discounts, bonuses, etc., that is, reflect the amounts stipulated by the relevant contracts as part of capital investments;

- do not discount costs incurred with a long delay (installment plan);

- when paying for capital investments with non-monetary funds, evaluate them at the book value of the transferred property, work, services, without determining fair value (however, in the case of receiving assets free of charge, determining their fair value is still mandatory);

- do not reflect a change in the estimated liability included in the cost of fixed assets as a change in the initial cost of fixed assets. Let us note that organizations that use simplified accounting most often do not recognize estimated liabilities in principle due to clause 3 of PBU 8/2010, and this removes the question of changing them;

- do not check fixed assets and capital investments for impairment;

- do not disclose a significant part of the information in the accounting reports.

In relation to each of the concessions, the organization can make an independent decision. For example, you can refuse to check fixed assets and capital investments for impairment and from the formation of estimated liabilities, but at the same time form a “full” initial cost of fixed assets so that it corresponds to the initial cost of fixed assets in tax accounting.

Keep records and submit reports online for free

Study of fixed assets, their statistics

Each production process is a process of transformation of labor objects, which can be carried out with the help of living labor, using labor means. The total set of means of labor can form the main production assets, which can be used in several production cycles at once, which have the peculiarity of gradually wearing out, transferring the cost to the product partially, throughout the entire service period.

Definition 1

The main assets of any production can include only those labor assets that are products of public labor and differ in their value. The main production assets can take part in the production of a material type, and as they wear out, their own value can be transferred to those products produced. The products that are produced with their help.

Just like production assets in the national economy, non-production assets are also capable of functioning, which can represent objects that have a long period of non-productive use, which will gradually increase in terms of value, while maintaining their natural form. Such funds may include funds that are responsible for the protection of health, science, economy, etc. These are the types of funds that are non-productive and they do not take part in creating the value of consumption.

Note 1

It is necessary to distinguish from fixed assets those types of funds that are circulating and to which labor items can be attributed. By consuming working capital, all this happens in one production cycle; they can significantly enter into the product and fully transfer their own value to it.

Any enterprise necessarily has both fixed and working capital.

In terms of the socio-economic significance of capital assets, they can determine the range of tasks using their statistical studies:

- Determine the availability and analysis of the composition of fixed assets for production;

- The condition, use, dynamics of the main production assets are studied;

- The enterprise's provision with main production assets is analyzed.

Did not you find what you were looking for?

Just write and we will help

Transitional provisions

By default, these standards must be applied retrospectively, that is, in accounting, the comparative indicators of previous years must be recalculated as if the new standards had been applied previously.

But this order is not necessary.

To account for capital investments, FSBU 26/2020 can be used prospectively, that is, without recalculating previously generated indicators.

In relation to fixed assets, you can not recalculate comparative indicators, but make a one-time adjustment to the book value of fixed assets at the beginning of the reporting period. In the reporting, the adjustment will be reflected at the end of the period preceding the reporting period. For example, if an organization decides to switch to the use of new standards in 2021, then the old rules still need to be applied in the reporting for 2021, and in the reporting for 2021 it will be necessary to reflect a one-time adjustment by changing the data as of December 31, 2021.

This procedure also applies to those fixed assets that, before the application of FAS 6/2020, were accounted for as assets of other types. For example, these could be special items that correspond to the characteristics of the operating system.

If some assets cease to be fixed assets under the new rules, their book value is written off as a one-time adjustment to retained earnings.

Revaluation of fixed assets that will be accounted for at the revalued value must be made on the date of transition to the use of FAS 6/2020.

Organizations that maintain simplified accounting may not make a one-time adjustment, but apply new rules only to subsequent facts of economic life.

Early use

In conclusion, we recall that FSBU 6/2020 and 26/2020 are mandatory for use from 2022. However, you can start using them ahead of schedule by reflecting this decision in your accounting policies and disclosing them in your financial statements.

FSB 6/2020 and 26/2020 are not applicable without each other, since the standard on capital investments now contains all the rules for forming the value of an asset, but the standard on OS does not have them. Therefore, if you decide to apply the standards ahead of schedule, you will need to use both at once.

Despite the many changes described in this material, for most organizations the main change is the abolition of the upper limit on the cost of “low-value OS”, that is, the opportunity for an organization to set it in an amount exceeding 40 thousand rubles.

Therefore, we can recommend that all organizations implement the new standards early from 2021. It should be borne in mind that in the event of early application of FSBU 6/2020 and FSBU 26/2020, FSBU 25/2018 “Lease Accounting” will become mandatory for early application, since FSBU 6/2020 has a direct reference to it. However, FSBU 25/2018 will in any case become mandatory from 2022, so such an “acceleration” can hardly be considered a significant difficulty.

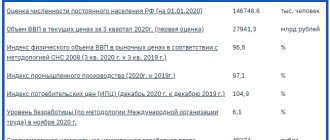

Structural indicators of main production assets, as well as its estimated types

Fixed assets, generally speaking, like some other individual types, can be characterized by both average and momentary indicators. Statistical reporting can usually contain data on the production assets at the initial and final stages of the reporting period, as well as on the annual value of fixed assets. As for information about these main funds and their usual quantity, they can be established using accounting reports.

Average annual cost of fixed assets

- F n Fn - we are talking about the value of production assets at the very beginning of the working year;

- F in Fv - tells about how much the production assets that were introduced throughout the year cost;

- F l Fl - the level of value of production assets that could be disposed of during the year;

- T in Tv is the time during which production assets that were introduced in a certain period function;

- Tl Tl is the time period that passed after the production assets were retired.

The main funds responsible for the national economy can be presented under different types. So, along with fixed assets that are divided into production and non-production, other classifications can be used. First of all, we are talking about grouping in terms of industries according to economic activity.

One very special significance in the study of statistics may be the grouping of fixed assets, being responsible for the natural and material composition. For any economic sector, we can consider a unified classification of fixed assets by type.

All this is the basis for analyzing the dynamics and structure of fixed assets in different sectors of production of a material nature, in order to draw up a balance. By grouping fixed assets, they can make it possible to determine the degree of labor equipment, energy and technical type, calculating depreciation rates, etc. It can also be used for the purpose of analyzing stock capacity and the return of goods in the stock. Different types of production assets can perform different roles in the production process. Some are considered active (for example, equipment), while others are considered passive, when they mean a building, various structures, and so on.

According to the structure of the main production assets, there may be some changes as technological progress occurs, and under the influence of certain factors, techniques, forms of organization of production, level of concentration, specialized level.

Did not you find what you were looking for?

Just write and we will help

In terms of accounting and statistical data, several estimated types of fixed assets can be used at once:

- Full original cost;

- Initial cost, taking into account wear and tear;

- Full replacement cost;

- Replacement cost, taking into account wear and tear.