Part-time work is performed only in free time from the main job.

Part-time work can be performed in the same organization where the employee works, or in another organization.

Part-time work is not allowed:

- workers under 18 years of age;

- in hard work, work with harmful or dangerous working conditions, if the main work involves the same conditions;

- in other cases established by federal laws.

Recruitment

Hiring for part-time work is formalized by order in form No. T-1 (if one employee is hired) or No. T-1a (if several employees are hired).

These forms were approved by Decree of the State Statistics Committee of Russia dated January 5, 2004 No. 1.

A sample of filling out form No. T-1 for a part-time worker is given on the next page.

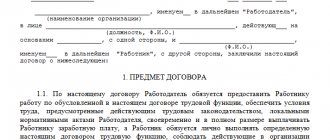

An employment contract is concluded with an employee who has entered a part-time job. To work part-time, the consent of the manager from the main place of work is not required.

Payment of benefits to a part-time employee.

In accordance with Art. 287 of the Labor Code of the Russian Federation, part-time workers have the right to receive all guarantees and compensation provided for by current legislation, collective agreements and local regulations of institutions.

If necessary, a part-time worker is entitled to benefits for temporary disability and in connection with maternity, which are assigned and paid in accordance with the generally established procedure. So, paragraph 2 of Art. 13 of Federal Law No. 255-FZ[2] determines that if the insured person is employed by several policyholders at the time of the insured event and was employed by the same policyholders in the two previous calendar years, then he is assigned and paid:

| Photo: www.ru.123rf.com |

- benefits for temporary disability, pregnancy and childbirth - by policyholders for all places of work (service, other activities);

- monthly child care benefit - the insured for one place of work (service, other activity) at the choice of the insured person.

These benefits are calculated based on average earnings, determined in accordance with Art. 14 of this law.

Please note that, by virtue of Part 2 of Art. 13, part 1 art. 14 of Federal Law No. 255-FZ, to calculate the average earnings of part-time workers, earnings are taken into account only at the place of work where the benefit will be assigned. In this case, the average earnings during part-time work with another employer are not taken into account if temporary disability benefits are paid for all places of work.

The basis for payment of temporary disability benefits is a temporary disability certificate for each place of work. By virtue of clause 4 of Order No. 624n[3], if a citizen at the time of temporary disability, maternity leave is employed by several employers and in the two previous calendar years before the issuance of sick leave was employed by the same employers, he is issued several certificates of incapacity for work for each place of work.

To calculate benefits, the payment of which is carried out at the expense of the Social Insurance Fund, you must remember the following:

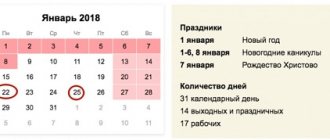

- the calculation period is two years preceding the year of the onset of temporary disability (clause 1, part 2, article 1.3, part 1, article 14 of Federal Law No. 255-FZ);

- the average earnings include payments in favor of the insured person, for which insurance premiums are calculated in accordance with Federal Law No. 212-FZ[4] (clause 6, part 1, article 1.2, part 2, article 14 of Federal Law No. 255-FZ );

- the number of calendar days into which average earnings are divided is 730 (Part 3, Article 14 of Federal Law No. 255-FZ).

Average earnings are taken into account for each calendar year in an amount not exceeding the maximum base for calculating insurance contributions to the Social Insurance Fund established on the basis of Federal Law No. 212-FZ for the corresponding calendar year. Moreover, if the appointment and payment of benefits to the insured person are carried out by several insurers, then the average earnings, on the basis of which the benefits are calculated, are taken into account for each calendar year in an amount not exceeding the maximum amount when calculating benefits for each of these insurers (Part 3.2 of Article 14 Federal Law No. 255-FZ).

The size of the maximum base, taking into account indexation for 2014, is 624,000 rubles. (Resolution of the Government of the Russian Federation dated November 30, 2013 No. 1101), and for 2013 - 568,000 rubles. (Resolution of the Government of the Russian Federation dated December 10, 2012 No. 1276).

Example 2.

Let’s assume that external part-time worker L.A. Petrova, working as a cleaner in a budgetary educational institution, fell ill in September 2015. A certificate of incapacity for work was issued for five days. Her average earnings for the billing period (from January 1, 2013 to December 31, 2014) amounted to 110,000 rubles. Insurance experience – 10 years. Payment for sick leave is carried out according to activity code 2 “Income-generating activities”. Benefits are paid for all places of work without submitting certificates from other employers. Benefits are issued through the cash desk.

We will calculate the amount of temporary disability benefits.

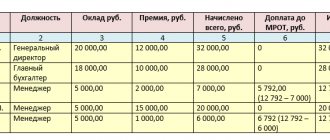

The average earnings for calculating temporary disability benefits cannot be less than the minimum wage (Part 1.1, Article 14 of Federal Law No. 255-FZ). Therefore, if the insured person had no earnings during the billing period or the average earnings calculated for these periods, calculated for a full calendar month, are lower than the minimum wage established by federal law on the day the insured event occurred, then the average earnings for calculating benefits are taken equal to the minimum wage provided for by federal law on day of occurrence of the insured event.

From January 1, 2015, the minimum wage is 5,965 rubles.

The average daily earnings in this case will be 150.68 rubles. (RUB 110,000 / 730 cal days).

Let's determine the amount of average daily earnings based on the minimum wage. It will be 196.11 rubles. (RUB 5,965 x 24 months / 730 cal days).

The amount of temporary disability benefits will be equal to 980.55 rubles. (RUB 196.11 x 5 cal days). At the expense of the Social Insurance Fund, 392.22 rubles were accrued, at the expense of the employer - 588.33 rubles.

In the accounting records of the institution, in accordance with Instruction No. 174n[5], the following entries were made:

| Contents of operation | Debit | Credit | Amount, rub. |

| Temporary disability benefits accrued at the expense of the employer | 2 109 60 211 | 2 302 11 730 | 588,33 |

| Temporary disability benefits accrued at the expense of the Social Insurance Fund | 2 303 02 830 | 2 302 13 730 | 392,22 |

| Personal income tax withheld from the amount of accrued benefits (RUB 588.33 x 13%) (RUB 392.22 x 13%) | 2 302 11 830 2 302 13 830 | 2 303 01 730 2 303 01 730 | 76 51 |

| The amount of temporary disability benefits to the employee was issued from the cash register | 2 302 11 830 2 302 13 830 | 2 201 34 610 2 201 34 610 | 512,33 341,22 |

Working hours

The duration of part-time working hours should not exceed 4 hours a day and half the standard working time for the accounting period (Article 284 of the Labor Code of the Russian Federation).

If the organization is not able to comply with the daily standard of working time for part-time workers (4 hours), then the organization can keep a summary record of their working time.

At the same time, the working time of an employee performing part-time work for the accounting period (month, quarter) should not exceed the standard working time for part-time workers established by Article 284 of the Labor Code of the Russian Federation.

The following commentary to Article 285 of the Labor Code of the Russian Federation

If you have questions regarding Art. 285 TK, you can get legal advice.

1. The Labor Code does not establish any specifics in the payment of part-time workers. With a time-based remuneration system, wages are determined in proportion to the time worked, with a piece-rate system - depending on output or on other conditions determined by the employment contract. If, when paying a part-time worker on a time basis, standardized tasks are established, payment is made based on the final results for the amount of work actually completed. The minimum wage for part-time workers is adjusted taking into account the fact that they do not work the full working time, but only part of it.

2. Payment for labor in cases where a part-time worker performs work under special conditions, in conditions deviating from normal ones, is made in an increased amount (Articles 146 - 154 of the Labor Code). Part-time workers working in areas where regional coefficients and wage bonuses are established are paid taking into account these coefficients and bonuses. Thus, in the regions of the Far North and equivalent areas, regional coefficients and percentage bonuses for work experience in these areas and areas have been established (see Articles 316, 317 of the Labor Code and the commentary thereto). Part-time workers have the right to both.

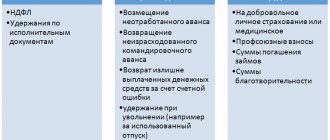

Personal income tax

When calculating personal income tax, part-time workers are also entitled to standard deductions.

This is possible if they do not use deductions at their main place of work. In this case, the part-time worker must submit an application to the accounting department to receive them. It is compiled in any form. The application must indicate that such deductions are not provided at the main place of work. Example:

Passive LLC employee S.S. Petrov works part-time. The hourly wage rate for the profession he combines is 75 rubles/hour. In February of the reporting year, Petrov worked hours. He submitted an application for the deduction at his main job. Petrov’s salary for February of the reporting year will be: 75 rubles / hour x 60 hours = 4500 rubles. The amount of income tax that should be withheld from Petrov’s salary will be: 4500 rubles. x 13% = 585 rubles. 25 rubles/hour x 60 hours = 1500 rubles. Petrov should be given a salary in the amount of: 4500 - 585 = 3915 rubles.

Remuneration for persons working part-time

Wages (employee remuneration) are defined in Article 129 of the Labor Code of the Russian Federation as remuneration for work depending on the employee’s qualifications, complexity, quantity, quality and conditions of work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal, work in special climatic conditions and in areas exposed to radioactive contamination, and other compensation payments) and incentive payments (additional payments and incentive allowances, bonuses and other incentive payments).

The Labor Code of the Russian Federation (Article 130) establishes a system of basic state guarantees for remuneration of workers, which includes:

— the minimum wage in the Russian Federation;

— measures to ensure an increase in the level of real wages;

— limiting the list of grounds and amounts of deductions from wages by order of the employer, as well as the amount of taxation of income from wages;

— limitation of remuneration in kind;

— ensuring that the employee receives wages in the event of termination of the employer’s activities and its insolvency in accordance with federal laws;

— state supervision and control over the full and timely payment of wages and the implementation of state guarantees for wages;

— responsibility of employers for violation of the requirements established by labor legislation and other regulatory legal acts containing labor law norms, collective agreements, and agreements;

— timing and order of payment of wages.

Payment of wages is made in cash in the currency of the Russian Federation (in rubles). In accordance with a collective agreement or an employment contract, upon a written application from an employee, remuneration may be made in other forms that do not contradict the legislation of the Russian Federation and international treaties of the Russian Federation. The share of wages paid in non-monetary form cannot exceed 20 percent of the accrued monthly wage.

The salary of each employee depends on his qualifications, the complexity of the work performed, the quantity and quality of labor expended, and is not limited to a maximum amount.

Any kind of discrimination in establishing or changing wage conditions is prohibited.

In accordance with Article 285 of the Labor Code of the Russian Federation, remuneration for persons working part-time is made in proportion to the time worked, depending on output or on other conditions determined by the employment contract. At the same time, due to the requirements of Article 135 of the Labor Code of the Russian Federation, the terms of remuneration determined by the employment contract cannot be worsened in comparison with those established by labor legislation and other regulatory legal acts containing labor law norms, collective agreements, agreements, and local regulations.

When setting standard assignments for persons working part-time with time-based wages, wages are paid based on the final results for the amount of work actually completed.

Persons working part-time in areas where regional coefficients and wage allowances have been established are paid taking into account these coefficients and allowances.

The employee’s salary is established by the employment contract in accordance with the current employer’s remuneration systems. Remuneration systems, including tariff rates, salaries (official salaries), additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal, systems of additional payments and incentive allowances and bonus systems, are established by collective agreements, agreements, local regulatory acts in accordance with labor legislation and other regulatory legal acts containing labor law norms.

When paying wages, the employer, in accordance with Article 136 of the Labor Code of the Russian Federation, is obliged to notify each employee in writing about the components of wages due to him for the relevant period, the size and grounds of deductions made, as well as the total amount of money to be paid.

The form of the pay slip is approved by the employer, taking into account the opinion of the representative body of employees in the manner established by Article 372 of the Labor Code of the Russian Federation for the adoption of local regulations.

Wages are paid to the employee, as a rule, at the place where he performs the work or transferred to the bank account specified by the employee under the conditions determined by the collective agreement or employment contract. The place and timing of payment of wages in non-monetary form are determined by a collective agreement or employment contract.

Wages are paid directly to the employee, except in cases where another method of payment is provided for by federal law or an employment contract.

Wages are paid at least every half month on the day established by the internal labor regulations, collective agreement, or employment contract. For certain categories of employees, federal law may establish other terms for payment of wages. If the payment day coincides with a weekend or non-working holiday, wages are paid on the eve of this day.

Work on a weekend or a non-working holiday is paid at least double the amount:

- piece workers - no less than double piece rates;

- employees whose work is paid at daily and hourly tariff rates - in the amount of at least double the daily or hourly tariff rate;

- employees receiving a salary (official salary) - in the amount of at least a single daily or hourly rate (part of the salary (official salary) for a day or hour of work) in excess of the salary (official salary), if work on a day off or a non-working holiday was carried out on within the limits of the monthly working time standard, and in an amount of at least double the daily or hourly rate (part of the salary (official salary) for a day or hour of work) in excess of the salary (official salary), if the work was performed in excess of the monthly working time standard.

Specific amounts of payment for work on a day off or a non-working holiday may be established by a collective agreement, a local regulatory act adopted taking into account the opinion of the representative body of employees, or an employment contract.

At the request of an employee who worked on a day off or a non-working holiday, he may be given another day of rest. In this case, work on a weekend or a non-working holiday is paid in a single amount, and a day of rest is not subject to payment.

Remuneration for work on weekends and non-working holidays of creative workers of the media, cinematography organizations, television and video crews, theaters, theatrical and concert organizations, circuses and other persons involved in the creation and (or) performance (exhibition) of works, in accordance with lists of jobs, professions, positions of these workers, approved by the Government of the Russian Federation, taking into account the opinion of the Russian Tripartite Commission for the Regulation of Social and Labor Relations, can be determined on the basis of a collective agreement, a local regulatory act, or an employment contract.

Each hour of work at night is paid at an increased rate compared to work under normal conditions, but not lower than the amounts established by labor legislation and other regulatory legal acts containing labor law norms.

The minimum increases in wages for night work are established by the Government of the Russian Federation, taking into account the opinion of the Russian Tripartite Commission for the Regulation of Social and Labor Relations.

The specific amounts of increased wages for night work are established by a collective agreement, a local regulatory act adopted taking into account the opinion of the representative body of workers, and an employment contract.

In case of failure to comply with labor standards or failure to fulfill labor (official) duties through the fault of the employer, remuneration is made in an amount not lower than the average salary of the employee, calculated in proportion to the time actually worked.

In case of failure to comply with labor standards, failure to fulfill labor (official) duties for reasons beyond the control of the employer and employee, the employee retains at least two-thirds of the tariff rate, salary (official salary), calculated in proportion to the time actually worked.

In case of failure to comply with labor standards or failure to fulfill labor (official) duties due to the fault of the employee, payment of the standardized part of the salary is made in accordance with the volume of work performed.

Remuneration for labor in the manufacture of products that turn out to be defective is determined in accordance with Article 156 of the Labor Code of the Russian Federation. Defects not caused by the employee are paid on an equal basis with suitable products. Complete defects caused by the employee are not subject to payment. Partial defects due to the fault of the employee are paid at reduced rates depending on the degree of suitability of the product.

Downtime caused by the employer is paid in the amount of at least two-thirds of the employee’s average salary. Downtime due to reasons beyond the control of the employer and employee is paid in the amount of at least two-thirds of the tariff rate, salary (official salary), calculated in proportion to downtime. Downtime caused by the employee is not paid.

If creative workers of the media, cinematography organizations, television and video filming groups, theaters, theatrical and concert organizations, circuses and other persons involved in the creation and (or) performance (exhibition) of works, in accordance with the lists of works, professions, positions these workers, approved by the Government of the Russian Federation taking into account the opinion of the Russian Tripartite Commission for the Regulation of Social and Labor Relations, for any period of time do not participate in the creation and (or) performance (exhibition) of works or do not perform, then the specified time is not idle time and may be paid in the amount and manner established by the collective agreement, local regulations, or employment contract.

Article 137 of the Labor Code of the Russian Federation establishes restrictions on deductions from wages. Deductions from an employee’s salary to pay off his debt to the employer can be made:

- to reimburse an unearned advance payment issued to an employee on account of wages;

- to repay an unspent and not returned timely advance payment issued in connection with a business trip or transfer to another job in another area, as well as in other cases;

- to return amounts overpaid to the employee due to accounting errors, as well as amounts overpaid to the employee, if the body for the consideration of individual labor disputes recognizes the employee’s guilt in failure to comply with labor standards or downtime;

- upon dismissal of an employee before the end of the working year for which he has already received annual paid leave for unworked vacation days. Deductions for these days are not made if the employee is dismissed on the grounds provided for in paragraph 8 of part one of Article 77 or paragraphs 1, 2 or 4 of part one of Article 81, paragraphs 1, 2, 5, 6 and 7 of part 1 of Article 83 of the Labor Code of the Russian Federation.

Wages overpaid to an employee (including in the event of incorrect application of labor legislation or other regulatory legal acts containing labor law norms) cannot be recovered from him, except in the following cases:

— counting error;

- if the body for the consideration of individual labor disputes recognizes the employee’s guilt in failure to comply with labor standards or downtime;

- if the wages were overpaid to the employee in connection with his unlawful actions established by the court.

The total amount of all deductions for each payment of wages cannot exceed 20 percent, and in cases provided for by federal laws, 50 percent of wages due to the employee.

These restrictions do not apply to deductions from wages when serving correctional labor, collection of alimony for minor children, compensation for harm caused to the health of another person, compensation for harm to persons who suffered damage due to the death of the breadwinner, and compensation for damage caused by a crime. The amount of deductions from wages in these cases cannot exceed 70 percent.

Upon termination of an employment contract, including an employment contract providing for part-time work, payment of all amounts due to the employee from the employer is made on the day of the employee’s dismissal. If the employee did not work on the day of dismissal, then the corresponding amounts must be paid no later than the next day after the dismissed employee submits a request for payment. In the event of a dispute about the amount of amounts due to the employee upon dismissal, the employer is obliged to pay the amount not disputed by him within the period specified in Article 140 of the Labor Code of the Russian Federation.

In the event of the death of an employee, wages that have not been received by the day of the employee’s death are issued to members of his family or to a person who was dependent on the deceased on the day of his death. Payment of wages is made no later than a week from the date of submission of the relevant documents to the employer.

In the event of a delay in the payment of wages, the employer and (or) representatives authorized by him in the prescribed manner, who caused a delay in the payment of wages to employees and other violations of wages, are liable in accordance with the Labor Code of the Russian Federation and other federal laws.

Part-time work: legal aspects

V. A. Ershov

part-time salary