Small Business Criteria for 2020-2021

Every company is required to prepare a balance sheet.

But not everyone has the right to choose the form - traditional or simplified - for this report. In particular, small enterprises have this opportunity (subclause 1, clause 4, article 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ). The criteria for small enterprises are specified in the law “On the development of small and medium-sized enterprises...” dated July 24, 2007 No. 209-FZ. For 2020-2021, the criteria for a small enterprise are set as follows:

| № | Criteria for recognition as a small business entity | Limit value |

| 1 | Total share of participation in the authorized capital of an organization of the Russian Federation, constituent entities of the Russian Federation, municipalities, public, religious organizations, foundations | 25% |

| 2 | Total share of participation in the authorized capital of foreign organizations | 49% |

| 3 | Total share of participation in the authorized capital of other organizations that are not small and medium-sized businesses | 49% |

| 4 | Average number of employees for the previous calendar year | 100 people |

| 5 | Income received from business activities for the previous calendar year, which is determined in the manner established by the legislation of the Russian Federation on taxes and fees | 800 million rub. |

Read more about the criteria in the material “Small enterprise - criteria for inclusion in 2021 - 2021”.

Filling Features

What is the difference between filling out a balance sheet under the simplified tax system for 2021 and filling out a regular form? Of course, the amount of information processed and the form itself. If you carefully examine the form of this document, you will immediately see that the number of lines and sections in such a document is much less than the usual form. The simplified balance sheet form for 2021 is presented here.

The header itself is no different from the normal balance header; it requires the following information:

- Full name of the institution, its details;

- Its organizational and legal form;

- Reporting period;

- The currency in which the balance sheet is compiled, as well as the units of measurement;

- Field of activity;

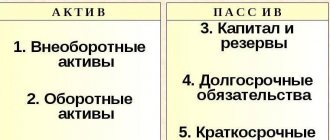

But then there are striking differences: the balance sheet itself does not have sections, but simply contains lines. There are 5 lines in the asset, but 6 in the liability. That's all. This is where the balance ends.

So the active part of the balance sheet for simplified people for 2021 contains the information:

- On the book value of non-current assets;

- About the value at the time of reporting of intangible assets, including financial ones;

- About the cost of inventories that are left in warehouses;

- About cash, as well as its equivalents, which are in the cash register and on the company’s current accounts;

- About financial current assets.

If we talk about liabilities, then here is information about the amount of equity capital, long-term and short-term borrowed funds, as well as other obligations of both long-term and long-term nature.

As for other features of filling out, they are no different from the features of filling out a regular form.

Filling features:

- The currency in which the valuation of all assets and liabilities is expressed must be presented in rubles. You cannot use other currencies as a measurement;

- Indicators are expressed exclusively in either thousands or millions. However, you cannot use fractional values, for example, 3.65 or 5.64. It is necessary to round everything according to the rules of mathematics - up or down. For example, if in one of the columns the value is only 350 rubles, then the total will be equal to 0, or rather the “-” sign will be indicated. Such rounding should not lead to significant differences in the balance sheet, but if necessary, you can clarify the information in the explanatory note to the balance sheet.

- Regarding the reporting period, the balance sheet for 2021 is also submitted for the year. In this case, the data is indicated for all three years, from 2015 to 2021. Sample of filling out a simplified balance sheet for 2017.

I would also like to note important information: as soon as an enterprise loses its small status, it must switch to filling out the full balance sheet form - Form 1. The use of Form 5 is strictly prohibited.

When can you replace a traditional balance sheet with a simplified one?

We’ll show you with numbers how to check whether a company is small.

| Index | LLC "Etude" | LLC "Uverture" | Sapphire LLC | Legal limit | Checking for compliance with EMS criteria |

| Revenue, rub. | 550 000 000 | 254 000 000 | 20 000 000 | 800 000 000 | Compliant |

| Number of people, people | 89 | 63 | 12 | 100 | Compliant |

| Share in the capital of other companies, % | — | — | 35 | 49 | Compliant |

The table shows that each of the organizations considered has the right to draw up a simplified balance sheet of a small enterprise.

NOTE! From 2021, financial statements, incl. simplified, submitted exclusively electronically. Paper forms will no longer be accepted. Read more about changes to the rules for presenting financial statements here.

For those who are not entitled to submit simplified reporting, see the diagram below:

conclusions

Economic entities officially classified as small businesses, non-profit structures and some other organizations have the right to generate and submit annual reports either in abbreviated form or in standard form.

The possibility of such a choice is clearly provided for by specific provisions of current legislation.

Simplification of reporting consists in the fact that the number of completed reports is reduced, and the information reflected in these documents is noticeably generalized (enlarged).

In some cases, however, it may be necessary to clarify some reporting data by properly detailing the compiled forms or filling out appropriate annexes to the main documents.

The deadlines for submitting simplified financial statements and their required recipients do not differ from the deadlines/addressees typical for submitting standard reporting forms.

Features of a simplified balance sheet for small businesses

A simplified balance sheet for a small business should be prepared taking into account the following:

- The simplified balance sheet form can be found in order No. 66n dated 07/02/2010 (Appendix No. 5). A simplified balance sheet can be drawn up by groups of items without detailing (clause 6 of order No. 66n).

NOTE! From June 1, 2021, changes have been made to the simplified balance sheet form. When preparing reports for 2021, you must use the form as amended on April 19, 2019. Key differences: the report can only be prepared in thousand rubles. Millions can no longer be used as a unit of measurement. OKVED has been replaced by OKVED 2. For other changes, see here.

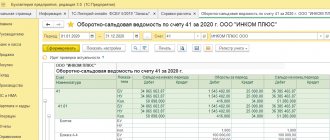

- To fill out the balance sheet, information is taken from accounting data, which small businesses can maintain in a simplified manner.

How to maintain simplified accounting can be found in the memo of the Ministry of Finance (information dated 06/03/2015 No. PZ-3/2015).

- The balance sheet will not contain lines reflecting deferred tax assets and liabilities if the company decides not to apply PBU 18/02 (clause 14 of the Ministry of Finance information No. PZ-3/2015).

NOTE! Small enterprises have the right not to apply PBU 18/02 in accordance with clause 2 of this provision.

- When generating information in a simplified balance sheet, it is important to remember that small enterprises may not create a number of reserves required for other companies (clause 11 of the Ministry of Finance information No. PZ-3/2015).

NOTE! Only a reserve for doubtful debts is required (clause 70 of the PBU on accounting and reporting, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).

A sample of filling out a simplified balance sheet for 2020 was prepared by ConsultantPlus experts. Get trial access to the K+ system and study the material for free:

For step-by-step instructions on filling out each line of the simplified balance sheet, see the manual on annual financial statements from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Small companies are also provided with other concessions that can affect the simplified balance sheet indicators. For example, you may not need to apply a retrospective recalculation of balance sheet indicators if errors from previous periods are identified. Profit (loss) from correcting such an error is included in other income (expenses) of the current period (clause 22 of the Ministry of Finance information No. PZ-3/2015). It is also possible to use the cash accrual method (clause 12 of PBU 9/99, clause 18 of PBU 10/99, clause 5 of the Ministry of Finance information No. PZ-3/2015).

Read about the composition of simplified accounting in this material..

Simplified form: who is eligible

Let's start with the fact that only some business structures have the right to create a simplified balance sheet for 2021. These categories of subjects include only representatives of small businesses. Small business is a segment of entrepreneurship that is entitled to certain benefits from the state, as well as a simplified taxation system. But to obtain such status, the subject must meet certain criteria.

Companies are considered small enterprises if they meet:

- The number of employees permitted by law;

- The amount of income for the year that is prescribed in the Tax Code;

- The maximum share in the authorized capital of those companies that are not classified as small and medium-sized.

It is these three criteria that allow an organization to either be classified as a small business or not. At the same time, small business itself is divided into such areas as microenterprises and small entrepreneurship. And the table shows the gradation of such companies and the limit of indicators considered for them.

| Type of business | Criteria for classification as small enterprises 2021 | ||

| Number of employees, people | Authorized share in the capital of non-small and non-medium enterprises, % | Amount of income, million rubles. | |

| Microenterprise | 15 | 49 | 120 |

| Small business | 100 | 49 | 800 |

Please note that an enterprise has the right to submit a balance sheet in a simplified form for 2021 even if it does not meet the criteria for a small business in the current reporting period. This is due to the provisions of the law that allow companies to operate as small businesses for three years after the fact of such non-compliance.

Results

Drawing up a simplified balance sheet is the right of any small enterprise. However, this report can also be prepared in the traditional form. The main thing is that the balance sheet form of a small enterprise is valid, and the information in it is complete, reliable and useful for users.

Sources:

- Law “On Accounting” dated December 6, 2011 No. 402-FZ

- Order of the Ministry of Finance dated July 2, 2010 No. 66n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Simplified balance sheet for small businesses in 2021.

The annual financial statements include:

§ Balance sheet;

§ Income statement;

§ Statement of changes in capital;

§ Cash flow statement;

§ Explanations to the Balance Sheet and the Statement of Financial Results.

Ø When small businesses have the right to draw up a simplified balance sheet in 2021.

Small businesses that use simplified accounting methods have the right to submit fewer forms - a balance sheet and a statement of financial results. In the table below, see how simplified accounting methods can be used.

o If a company is subject to mandatory audit, it cannot use a simplified balance sheet ( clause 1, part 6 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”).

o A simplified balance sheet cannot be used if the reporting requires additional information to assess the financial position of the company's financial results. After all, additions are not made to simplified forms. Then you will have to use common reporting forms.

| Simplified way of cost accounting | pros | Minuses | Base |

| MPZ | |||

| Goods and materials are accounted for at the supplier's price. Other costs associated with their purchase (delivery, commissions to intermediaries, etc.) are immediately included in expenses | There is no need to calculate the actual cost | — | Clause 13.1 PBU 5/01 |

| Raw materials, supplies, and other expenses for production and preparation for sales are included in expenses as purchased | There is no need to calculate the actual cost | The rule can be applied by: § micro-enterprises; § companies that do not have significant inventory balances | Clause 13.2 PBU 5/01 |

| Inventory for management needs is written off as acquired | There is no need to keep track of inventory movements. Such inventories can be registered and immediately written off | — | Clause 13.3 PBU 5/01 |

| Fixed assets | |||

| Fixed assets are taken into account: § upon purchase – at the seller’s price, taking into account installation costs; § during construction – at the price of the contract for the creation of the facility. For example, a construction contract. § Other costs that are associated with the purchase (construction) of fixed assets are immediately included in expenses | The list of expenses that are included in the initial cost of the operating system has been reduced | Leads to an understatement in the reporting period: § financial results due to a one-time write-off of expenses for the acquisition of OS; § asset value (not all expenses are included in the initial cost of fixed assets) | Clause 8.1 PBU 6/01 |

| The annual amount of depreciation for fixed assets can be calculated: § once a year as of December 31; § at a frequency that is more convenient for the company. For example, quarterly. | There is no need to charge depreciation monthly | Calculating depreciation of fixed assets once a year may hinder the transition to a simplified system. After all, the residual value of fixed assets as of October 1 may exceed the limit | P. 19 PBU 6/01 |

| Depreciation on production and business equipment is charged at a time in full on the date of acceptance for accounting. | No need to charge depreciation | Leads to an understatement in the reporting period: § financial results due to a one-time write-off of acquisition costs; § asset value | P. 19 PBU 6/01 |

| R&D | |||

| R&D costs are expensed as incurred. | There is no need to include fixed assets or intangible assets and calculate depreciation | Leads to an understatement in the reporting period: § financial results due to a one-time write-off of acquisition costs; § the value of assets as part of fixed assets or intangible assets | Clause 14 PBU 17/02 |

| NMA | |||

| The costs of purchasing (creating) intangible assets are included in expenses as they are incurred. | There is no need to include intangible assets and calculate depreciation | Leads to an understatement in the reporting period: § financial results due to a one-time write-off of acquisition costs; § asset value | Clause 3.1 PBU 14/2007 |

Ø Form of a simplified balance sheet for small enterprises for 2017.

o The simplified balance sheet is contained in Appendix No. 5 to Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010

. The balance sheet has 5 lines to reflect asset items and 6 for liability items.

o In a simplified balance sheet, the indicators are combined, so the lines indicate the code whose indicator has the largest share in the consolidated indicator. Take the codes from Appendix No. 4 to Order No. 66n of the Ministry of Finance

.

o You only need to number the lines if you submit reports to statistics or the inspectorate.

The table shows what to show for each line of the simplified balance sheet:

| Name of balance sheet items | Line code | Accounting accounts (in particular) |

| ASSETS | ||

| Tangible non-current assets. | § The difference between account balances: ü 01 “Fixed assets” ü 02 “Depreciation of fixed assets” (excluding depreciation accrued on objects of profitable investments in tangible assets) § The difference between account balances: ü 03 “Income-generating investments in tangible assets” ü 02 “Depreciation of fixed assets” (in terms of depreciation accrued on these objects) § Account balance: ü 07 “Equipment for installation”; ü 08 “Investments in non-current assets”, including the balance of account 08 in terms of expenses for the development of mineral resources (these expenses can later be qualified as fixed assets). With the exception of the balance on account 08 regarding expenses for the development of mineral resources, which in the future may be classified as intangible assets | |

| Intangible, financial and other non-current assets. | § The difference between account balances: ü 04 “Intangible assets” ü 05 “Amortization of intangible assets” § Account balances: ü 09 “Deferred tax assets” ü other non-current assets that are not reflected in other groups of items in the section “Non-current assets” ü Account balance 08 (in terms of expenses for the development of mineral resources). These expenses can later be qualified as intangible assets § Account balance: ü 58 “Financial investments” in terms of long-term investments (minus the balance of account 59 “Provisions for impairment of financial investments” related to long-term financial investments) ü 55 “Special accounts in banks" subaccount 3 "Deposit accounts" (in terms of long-term investments and deposits for a period of more than a year, if interest is charged on them) ü 73 "Settlements with personnel for other operations" (in terms of interest-bearing loans with a repayment period after 12 months after reporting date) § Account debit balance: ü 60 “Settlements with suppliers and contractors” (suppliers’ receivables for advances paid by the organization are reflected in the balance sheet minus VAT) | |

| Inventories. | § Account balance: ü 10 “Materials” ü 11 “Animals for growing and fattening” ü 20 “Main production” ü 21 “Semi-finished products of own production” ü 23 “Auxiliary production” ü 29 “Service production and farms” ü 41 “Goods” "(minus the credit balance on account 42 "Trade margin", if goods are taken into account in sales prices) ü 43 "Finished products" ü 44 "Sales expenses" ü 45 "Goods shipped" ü 46 "Completed stages of work in progress" ü 97 “Prepaid expenses” ü 15 “Procurement and acquisition of material assets” ü plus (minus) debit (credit) balance on account 16 “Deviation in the cost of material assets” ü minus credit balance on account 14 “Reserves for reduction in the value of material assets” ü 19 “Value added tax on acquired assets” | |

| Cash and cash equivalents | § Account balance: ü 50 “Cash” (except for the balance in the subaccount “Cash documents”) ü 51 “Currency accounts” ü 52 “Currency accounts” ü 55 “Special accounts in banks” (except for amounts included in financial attachments) ü 57 “Transfers on the way” | |

| Financial and other current assets | § Account balance: ü 58 “Financial investments” in terms of short-term investments (minus the balance of account 59 “Provisions for impairment of financial investments” related to short-term financial investments) ü 55 “Special accounts in banks” subaccount 3 “Deposit accounts” ( in terms of short-term investments and deposits for a period of less than a year, if interest is accrued on them) ü 73 “Settlements with personnel for other operations” (in terms of interest-bearing loans with a repayment period of less than 12 months after the reporting date) § Account debit balance: ü 60 “Settlements with suppliers and contractors” (suppliers’ receivables for advances paid by the organization are reflected in the balance sheet minus VAT) ü 62 “Settlements with buyers and customers” ü 71 “Settlements with accountable persons” ü 73 “Settlements with personnel for other operations” ( except interest-bearing loans) ü 75 “Settlements with founders” ü 76 “Settlements with various debtors and creditors” ü 68 “Settlements for taxes and fees” ü 69 “Settlements for social insurance and security” ü minus account balance 63 “Reserves for doubtful debts" ü 50 "Cash" (in terms of the balance of the sub-account "Cash documents") ü 76 "Settlements with various debtors and creditors" (in terms of VAT accrued on the amounts of advance payments) ü 79 "Intra-business settlements" (in terms of settlements for property trust management agreement) ü 94 “Shortages and losses from damage to valuables” other current assets that are not reflected in other groups of articles in the section “Current assets” | |

| Balance | Row sum: 1150 + 1110 + 1210 + 1250 + 1240 | |

| PASSIVE | ||

| Capital and reserves | § Account balance: ü 80 “Authorized capital” ü 82 “Reserve capital” ü 83 “Additional capital” ü 84 “Retained earnings (uncovered loss)” ü 99 “Profits and losses” (in interim reporting) § Account debit balance 81 “Own shares (shares)” | |

| Long-term borrowed funds | § Balance on account 67 “Settlements on long-term loans and borrowings” (minus debts whose repayment period as of the reporting date is less than 12 months) | |

| Other long-term liabilities | § Account credit balance: ü 60 “Settlements with suppliers and contractors” ü 62 “Settlements with buyers and customers” (accounts payable to buyers for advances received by the organization are reflected in the balance sheet minus VAT) ü 73 “Settlements with personnel for other operations” ü 75 “Settlements with founders” ü 76 “Settlements with various debtors and creditors” (in terms of long-term accounts payable) § Account balances: ü 96 “Reserves for future expenses” (in terms of reserves created for events that will occur no earlier than in a year) | |

| Short-term borrowed funds | § Balance on account 66 “Settlements on short-term loans and borrowings” plus the balance on account 67 “Settlements on long-term loans and borrowings” (in terms of debts, the repayment period of which as of the reporting date is no more than 12 months) | |

| Accounts payable | § Account credit balance: ü 60 “Settlements with suppliers and contractors” ü 62 “Settlements with buyers and customers” (accounts payable to customers for advances received by the organization are reflected in the balance sheet minus VAT) ü 70 “Settlements for wages” ü 68 “Settlements for taxes and fees” ü 69 “Settlements for social insurance and security” (in terms of debt) ü 71 “Settlements with accountable persons” ü 73 “Settlements with personnel for other transactions” ü 75 “Settlements with founders” ü 76 “ Settlements with various debtors and creditors" (in terms of short-term accounts payable) | |

| Other current liabilities | § Account balances: ü 96 “Reserves for future expenses” (in terms of reserves created for events that will occur during the year) ü 98 “Deferred income” ü 79 “Intra-business settlements” (in terms of settlements under the property trust management agreement) other short-term liabilities | |

| Balance | Row sum: 1310 + 1410 + 1450 + 1510 + 1520 + 1550 |

Ø How to fill out a simplified balance sheet (sample).

Sample simplified balance sheet for small businesses:

Recommended pages:

Use the site search: