Long-term and short-term financial investments are investments of cash or other assets in securities of various entities engaged in business activities.

The main goals of all financial investments are to make a profit, transform your savings into securities with high liquidity, establish formal relations with the issuing company or take control over it, gain access to certain market segments, and create corporate integrated structures.

Long-term and short-term financial investments

The placement of an organization's free funds for the purpose of subsequent profit in the form of dividends or interest is called financial investments. The investment periods differ between short-term and long-term investments. The latter include objects with a maturity of more than 1 year. What exactly can the company's funds be invested in? The main forms of long-term financial investments include (clause 3 of PBU 19/02):

- State and/or municipal securities.

- Securities of other companies, including bills and bonds with a precisely defined value and maturity date.

- Deposits in banking institutions.

- Contributions to shareholders or share capital of companies; under simple partnership agreements.

- Interest-bearing loans issued to other organizations.

- Accounts receivable under contracts for the assignment of claims.

- Other long-term investments of a similar nature.

Note! Own securities purchased for the purpose of further cancellation or resale are not recognized as financial investments; investments in precious metals; bills of exchange for mutual settlements with counterparties; investments of the organization in property objects used in rental activities (clauses 3, 4 of PBU 19/02).

FV: essence, types, what to relate to

To begin with, let’s define what financial investments are: this is a purposeful activity of a company, which is not the main one, and is aimed at investing freely available funds in circulation into the financial assets of other enterprises.

However, not every financial asset that enters the balance sheet of an enterprise can be recognized as an investment. It must be acquired solely for the purpose of making a profit or for the purpose of further resale.

At the same time, there are long-term and short-term financial investments (it all depends on the duration of such assets):

- Short-term investments are those assets of an enterprise whose duration in circulation does not exceed one year;

- Long-term investments are those investments whose duration exceeds one year.

Accounting for long-term investments and financial investments is carried out in the context of the types of financial assets in which such investments are made.

Long-term PV include:

- A variety of securities: for example, shares, government bonds;

- Investing cash in the authorized capital of other companies, corporations, etc.;

- Deposits in a variety of current accounts with financial institutions;

- Interest-bearing loans to other enterprises;

- Accounts receivable due to the acquisition of the right to claim the debt from the debtor;

- Other types

Financial investments are reflected in the balance sheet

Accounting for long-term investments and financial investments

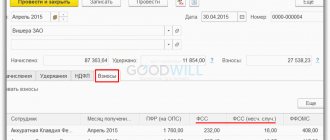

Accounting for long-term and short-term financial investments is carried out on the account. 58 in the manner prescribed by Order of the Ministry of Finance No. 94n dated October 31, 2000. Information on invested funds with the opening of the corresponding sub-accounts is summarized here. Analytical accounting of long-term financial investments is carried out by type of investment, counterparties, and terms.

Subaccounts to the account 58:

- 58.1 – records of shares and shares are kept here.

- 58.2 - to display transactions on investments in securities - both public and private.

- 58.3 – loans provided to other enterprises (individual entrepreneurs, individuals) – cash and others – are taken into account here.

- 58.4 – intended to display contributions based on simple partnership agreements.

Note! Currently, for the correct accounting of long-term financial investments, account 06 of the same name is no longer used. According to Order No. 94n, this account was excluded from the current Chart of Accounts of enterprises and was replaced by an account. 58.

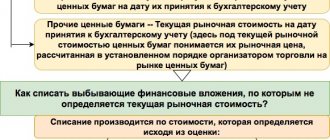

Purchase of securities

Accounting for investments in securities, which are government bonds, promissory notes, deposit and savings certificates and others, is organized on account 58. A security is a document that has a certain form and details. It certifies property rights, and it is possible to use them or transfer them to a third party only by presenting it.

Acquired shares are accounted for in subaccount 58-1 (the procedure is identical to subaccount 58-4), but bonds and bills are accounted for in subaccount 58-2. The Tax Code of the Russian Federation does not contain a list of expenses for the acquisition of securities. When legal entities work with brokers, and this is the only way securities are sold on the stock exchange, VAT is charged exclusively on costs associated with the work of a specialist.

There is no tax on securities. As for the acquisition of assets with borrowed funds, the interest accrued by the company on the loan provided to it before the financial investments are accepted for accounting is included in the initial cost of these investments. Interest accrued after accounting for financial investments is reflected in operating income and must be included in the financial result of the company.

Long-term financial investments - an asset or a liability?

Account 58 is active. The debit reflects the actual investments of the enterprise in correspondence with the accounts of valuables. For example, this is an account. 51, 50, 52, 01, 10, 91, 75, 80, 76, 98. Accordingly, the disposal of investments when the debtor repays obligations is reflected in the loan account. 58 in correspondence with property or other accounts. These are accounts such as - 52, 50, 51, 76, 90, 80, 91, 99, 04, 01.

Note! The procedure for accepting financial investments for accounting is given in clauses 8-17, 18-24 PBU 19/02; upon disposal, you must follow the requirements of clauses 25-33 of the PBU.

Composition of DI in the form of capital investments

Fixed capital is a significant object of DI. These objects form the composition of non-current assets that participate indirectly in the production and support processes of the enterprise. They create the basis for the company’s capitalization and transfer their value to the product with each cycle of its production, gradually wearing out. Capital investments as a type of financial investment are clearly described in Law No. 39-FZ of February 25, 1999.

Extract from Article 1 of Law No. 39-FZ of February 25, 1999

Such long-term investments are made on the basis of a developed strategy and tactical plans in the following areas.

- Purchase of natural resources and land plots. Such objects are not subsequently depreciated.

- Purchase of technological, energy and production equipment requiring installation and specialized assembly.

- Purchase of buildings, structures and equipment that do not require additional construction and installation work and special training for commissioning. Equipment that does not require installation includes vehicles, freely placed machines, construction mechanisms and equipment, production equipment, etc.

- Construction of new capital construction projects, modernization, reconstruction of existing production facilities, expansion of the production capacity of the enterprise.

In the course of organizing and carrying out actions to implement the DI, numerous issues that need to be resolved by the parties are of significant importance. These include:

- contractual value (price) of the property complex of the OS object or construction project;

- design and estimate documentation and terms of approvals with regulatory authorities;

- conditions for installation and transportation of equipment to the installation;

- the number and level of work performed by contract and economic methods;

- terms of delivery and transfer of responsibility for consumables used during the implementation of DI;

- forms of settlements between the parties to the transaction;

- the fact of completion of the capital construction project at the end of the reporting periods;

- procedures for activation and transfer of the facility into operation;

- methodology for determining the initial cost of an object and much more.

Long-term financial investments on the balance sheet

Regardless of the type of investment, long-term financial investments in the balance sheet are line 1170. Information about the balances at the end of the reporting period for issued interest-bearing loans, purchased securities, deposits, contributions to share capital, charter capital and other investment objects with a validity period of more than 12 months Financial investments of a short-term nature, that is, with a repayment (circulation) period of less than a year, must be reflected on line 1240, excluding cash equivalents.

Note! If an enterprise creates a reserve for the depreciation of the value of investments, the value indicator minus the amount of deductions to the reserve is entered on line 1170.

Conditions for recognition in accounting

In order to take financial investments into account, a number of conditions must be met, and only if all of them are met is it possible to account for assets of this type:

- There must be documents that indicate that the organization has the right to engage in investments, confirmation of the right to receive funds or other assets arising from this right.

- Organization of monetary risks that are directly related to financial investments. This may be a liquidity risk, a decrease in value, or the insolvency of the debtor.

- Investments must be able to bring economic benefit to the organization, which is expressed by interest received, increase in value, and dividends.

What is recognized as a unit of accounting object

Companies themselves, by their own decision, choose the unit of accounting for financial investments. This is done in such a way that it is possible to generate complete and reliable information about existing assets and the ability to control their storage and movement. Depending on the nature, order of purchase and use of the PV unit, you can, for example, a batch or a series - everything that meets the classification criteria.

Analysis of long-term financial investments

In order to improve the efficiency of managing an enterprise's available funds, it is necessary to analyze financial investments. The procedure may include a multifactor analysis of the composition and horizontal structure of investments; long-term calculation of investment results; choosing the most profitable direction, etc. At the same time, an increase in long-term financial investments indicates that the company has a significant amount of available funds that can be used for long-term investment.

On the one hand, this indicates the success of the business. But on the other hand, it is fraught with a decrease in business activity in the main work activity, which in the future may cause a decrease in profits for the reporting period. Therefore, it is optimal to analyze indicators over time, and not just over a short period of time.

Basic financial instruments - objects of financial investment

Let's look at the main instruments in which you can invest money in the financial markets discussed above. We will start with such popular securities as stocks and bonds, then move on to precious metals and derivatives (futures and options), and end with currencies and cryptocurrencies.

Investing in shares

A share is a security that certifies the right of its owner to a certain share in the business of the company that issued it. The size of this share is equal to the ratio of the number of shares held by the investor to the total number of all shares of the issuing company. That is, for example, if a company has issued 100,000 shares, and an investor has 10 of them in his hands, then he owns a share of 10/100,000 = 1/10,000 = 0.0001 of the company’s entire business.

Owning a share in a business implies the right to both participate in its management and part of the profits from it. Participation in management implies, for minority shareholders (owning small shares) the right to participate in the general meeting of shareholders, and for majority shareholders (owning relatively large blocks of shares in the company), in addition to this, the opportunity to nominate a candidate to the board of directors, conduct extraordinary inspections and meetings and etc. (depending on the share they have).

It should be borne in mind that not all shares can give the right to manage the company, just as not all shares can receive guaranteed dividends. But you can choose for yourself exactly the type of shares that will give the investor exactly what he needs from them.

There are two main types of shares:

- Ordinary;

- Privileged.

Ordinary shares give their owner the right to vote in the management of the business, but do not guarantee a stable payment of dividends. After all, the decision to pay dividends on ordinary shares is made at a general meeting, which often prefers to direct all the profits received (minus all necessary costs, including the payment of dividends on preferred shares) to the further development of the company.

Preferred shares , on the contrary, give their owner a guaranteed right to receive dividends, but deprive him of the opportunity to take part in management (do not give him voting rights). In general, such shares are most suitable for minority shareholders, who in any case will not be able to fully participate in management, but will receive guaranteed dividends.

Profit on shares can be generated either through simple ownership of them (dividend payments), or through the implementation of exchange rate differences (buy cheaper and, after some time, sell more expensive), or a combination of these two methods (first receive dividends for a while, and then sell at a better price).

Investing in bonds

A bond is a debt financial instrument. By investing in them, you are essentially lending your money to the issuer. And the bond issuer, in turn, undertakes to pay the agreed interest on this debt (coupon income) and return it (repay the bond) within the agreed period.

Bonds are traditionally considered one of the most conservative instruments of the stock market. This is due, first of all, to the reliability of which these securities have. Government bonds are rightfully considered the most reliable, followed by bonds of large blue chip companies.

Bonds of companies not listed on official exchange platforms and traded on the over-the-counter market have, of course, a lower degree of reliability. But they are, nevertheless, still more reliable than shares issued by the same issuing company.

In last place in terms of reliability, but in first place in terms of potential profitability are the so-called junk bonds. This term is usually used to refer to debt securities issued either by very young companies that do not yet have a proper business reputation (Rising stars), or by companies that have lost their previous investment rating (Fallen angels).

Investing in Precious Metals

Precious metals are another traditional object for investing money. Since ancient times, precious metals have been valued for their high chemical resistance (resistance to oxidation and corrosion) and the presentability of products made from them.

You can invest in precious metals either by buying them directly in bullion or by investing money in so-called metal bank accounts. The first of these methods is more reliable, since banks sometimes revoke their license. And the second method is much more convenient, since it does not require the physical purchase/sale of metal, which is also associated with a mandatory procedure for verifying its authenticity.

Such investments are often used to diversify an investment portfolio. After all, metal, whatever one may say, is an eternal asset. It existed yesterday, exists today and will not go away tomorrow. Although its value is subject to fluctuations, it cannot fall to zero (like shares of a bankrupt company).

In addition, precious metals often show a fairly good increase in their market value. Take a look, for example, at this chart showing the dynamics of gold prices:

Gold price dynamics

Or a similar chart of palladium prices:

Palladium price dynamics

Although, of course, not all metals show equal effectiveness as an investment tool. Here, for example, is a platinum price chart (for the period from 2008 to 2021):

Platinum price dynamics

Investing in derivatives

Derivatives are those financial instruments that themselves do not have any physical basis, but are based on some underlying financial instrument. For example, per share, bond or currency pair. Otherwise, they are also called derivatives.

The most common derivatives are futures and options.

A futures is a contract between a seller and a buyer, according to which one undertakes to buy from the other an agreed upon quantity of goods at a certain price and within a specified period. When trading on an exchange, the seller and buyer agree only on the price and delivery time, since the remaining parameters of the futures contract are standard for almost every exchange platform. These parameters include:

- Quantity (transaction volume);

- Quality, packaging, labeling (if the underlying asset for the futures is a commodity).

All this is stipulated in the specification of a standard exchange contract for a particular underlying asset.

Due to their specificity, derivative financial instruments are most suitable not for direct investment in them, but for hedging risks when investing in underlying assets. Indeed, what is the point of investing money, for example, in a futures contract for a stock, if it is much more logical to purchase this stock itself?

It’s another matter when, in order to diversify a portfolio, it is necessary to hedge risks on some of the assets included in it. In this case, a futures contract, in which the asset whose risks are hedged is used as the base one, is the best choice.

As for options, they are in many ways similar to futures. An option also involves the purchase or sale of a specific asset at a predetermined price and within a predetermined time frame. But, unlike a futures contract, an option gives the buyer only the right (and not the obligation) to purchase (or sell) the underlying asset specified in it, which, if desired, he can refuse.

Investing in the foreign exchange market

Ways to invest in the foreign exchange market:

- Direct purchase of currency;

- Independent trading in the currency section of the stock market (futures on currency pairs);

- Independent trading on the FOREX foreign exchange market;

- Investing in PAMM accounts on FOREX.

A simple purchase of US dollars or Euros, as the entire recent history of the domestic economy (with its numerous crises and other Black Tuesdays) shows, is a very effective way to invest Russian rubles. Just take a look at the chart below.

Dynamics of changes in the dollar exchange rate against the Russian ruble

And this is not the whole price history, but only since 2009. Before this, as you probably remember, the dollar was even cheaper.

In addition, it is possible to invest in so-called currency pairs. This can be done both in the currency section of the stock market (through currency futures) and directly in the FOREX market. By definition, doing this through the exchange is safer. After all, exchange trading is a well-established and legally regulated mechanism, in contrast to trading on FOREX, which is carried out through the intermediary of dealing centers (many of which generally operate under a betting license).

In general, it should be noted that currency pairs are a tool for speculation rather than for investment. They can also be used to hedge risks.

Among other things, there is also the opportunity to invest in PAMM accounts of managing traders trading in the foreign exchange market. However, due to the fact that PAMM investing is carried out through the same dealing centers, this tool also cannot be called reliable.