Types of accounting policies of a motor transport enterprise

Each motor transport enterprise must have its own accounting policy. It is necessary to take into account that the trucking company:

- is obliged to maintain accounting - for this it is necessary to formulate an accounting policy for accounting purposes;

- has the right to choose a tax regime that is beneficial for itself, fixing the nuances of tax accounting in tax accounting policy.

The company has the right to combine these types of accounting policies in a single document (providing separate chapters for this) or draw up 2 documents - the law does not establish strict requirements in this matter.

Study the accounting features reflected in the accounting policies under various tax regimes using the materials posted on our website:

- “Rules for drawing up accounting policies for UTII”;

- “How to draw up an organization’s accounting policy (2021)?”.

You can create an accounting policy using an accounting program. Examples of UE for each tax system can be downloaded in the Typical situation from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Necessity

Many enterprises underestimate the importance of accounting policies, interpreting them formally, and therefore do not take into account the effects that lead to ineffective management of the company, since various indicators of the company’s performance, such as product costs, profits, taxes and others, depend on the chosen option.

The financial and economic activities of an enterprise are considered effective if the result is positive. If the financial result is analyzed from an accounting point of view, then it is the most complex object of analysis, and therefore needs to be improved and updated in accordance with new research.

We are forming an accounting policy for a transport company - what nuances should we take into account?

The accounting methods and methods established in the accounting policy (AP) of a transport company largely depend on the types of transport activities it carries out (transportation of goods, delivery of passengers, leasing of vehicles, repair and maintenance of automotive equipment, etc.).

If a trucking company simultaneously provides different types of services, the accounting policy must provide for separate accounting algorithms.

Learn about the nuances of accounting for motor transport activities from the article “Rules for accounting in a transport company (nuances).”

When developing a transport company’s management program, it is important to take into account the specifics of its work. In particular, reflect the following nuances:

- forms of specific primary information used (waybills, waybills, etc.);

- methodology for rationing fuel consumption (depending on the time of year, degree of wear of vehicles, etc.);

- the procedure for recording and writing off car tires;

- algorithms for accounting for other expenses characteristic of transport activities (motor insurance, recognition of expenses for medical examinations of drivers, etc.).

You can view a sample accounting policy of a motor transport company for accounting purposes on our website:

What types of accounting policies can a merchant create? You will learn about this from the materials on our website:

- “Accounting policies for management accounting purposes”;

- “Accounting policies in IFRS format - main provisions”.

Purpose

When a company prepares a complex report or implements an accounting method, it needs to adhere to guidelines.

Accounting policies for accounting purposes may vary from company to company: but whatever a company does in relation to PM, it must be in accordance with accounting principles (GAAP) or IFRS.

You may be interested in: Sberbank branches in Perm: addresses, opening hours, list of services provided, reviews from visitors and clients

As senior management sets criteria for maintaining the quality of the company's products or services, these policies are also established as criteria for presenting a reliable and accurate picture of accounting practices.

Accounting principles are lenient at times, and specific company policies are very important. Outside accountants hired to review a company's financial statements must review the company's document to ensure that it conforms to standard accounting principles.

PM is important for the following reasons:

- Creating the right basis for accounting. To formulate the financial affairs of a company, it needs to prepare financial statements. And if the financial statements are simply prepared without any guidance, then there will be no consistency in them. Accounting policies help determine consistency between financial statements. It also offers a solid basis for a company to adhere to the correct structure and prepare its financial statements.

- Information disclosure. It is important that the company discloses what accounting policies it has followed. Since accounting standards allow any balance sheet item to be presented in different aspects, proper disclosure of this document is important.

- Providing benefits to investors. If companies mention the accounting policies they have followed to prepare their financial statements, this will also help investors. By setting it out, companies ensure consistency when preparing financial statements. This consistency helps investors look at financial statements and compare them with other companies in similar and different industries.

- The government can influence a company's financial statements. Since such documentation must be generated in accordance with accounting policies, companies always follow the correct structure. These firms should also keep in mind that they can only follow PGs that are made in accordance with GAAP or IFRS. In this way, the government can have a direct influence on the company's financial statements, and the government can protect the interests of investors.

Features for budgetary institutions

The accounting policy for taxation of a budgetary institution has its own specifics:

- depends on the purpose of creating the institution;

- depends on funding sources;

- depends on the type of founders;

- depends on the degree of regulation of financial activities.

These features leave their mark on the formation of a management program for such companies.

The content of the policy for a budget organization is characterized by the following features:

- type and structure of the institution;

- subject, purpose of his activity;

- industry specifics.

Compound

The UP should include:

- working chart of accounts;

- various accounting registers;

- primary forms of documents;

- inventory methodology and procedure;

- methods for assessing assets and liabilities;

- document flow, information processing;

- audit and control of business transactions;

- other elements.

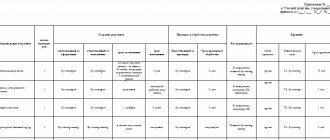

ORGANIZATIONAL ASPECTS OF ACCOUNTING POLICIES

1.1. Organization and tasks of tax accounting of the Company 1.2. The procedure for preparing tax reporting 1.3. Applicable tax accounting registers 1.4. Terms used

METHODOLOGICAL ASPECTS OF ACCOUNTING POLICIES

2.1. INCOME TAX

2.1.1. Procedure for tax accounting of income from sales 2.1.2. The procedure for tax accounting of non-operating income 2.1.3. The procedure for tax accounting of expenses associated with production and sales 2.1.4. The procedure for accounting for material and production costs 2.1.5. Procedure for accounting for labor costs 2.1.6. Method and procedure for calculating depreciation amounts of fixed assets 2.1.7. The procedure for calculating depreciation on intangible assets 2.1.8. The procedure for accounting for expenses for repairs of fixed assets 2.1.9. The procedure for accounting for expenses for the development of natural resources 2.1.10. Procedure for accounting for R&D expenses 2.1.11. Procedure for accounting for expenses on trade operations 2.1.12. The procedure for accounting for costs of compulsory and voluntary property insurance 2.1.13. The procedure for accounting for expenses for the acquisition of rights to land plots 2.1.14. The procedure for attributing interest on debt obligations to expenses 2.1.15. The procedure for maintaining tax accounting for transactions with securities 2.1.16. The procedure for accounting for income received from the transfer of property to the authorized capital of the organization 2.1.17. The procedure for determining the tax base for income received from equity participation in other organizations 2.1.18. The procedure for determining the tax base for income received by participants in a simple partnership 2.1.19. The procedure for determining the tax base upon assignment (assignment) of the right of claim 2.1.20. Non-operating expenses 2.1.21. The procedure for accounting for the sale of depreciable property 2.1.22. The procedure for accounting for expenses and income when liquidating depreciable property 2.1.23. Procedure for making advance payments for income tax

2.2. VALUE ADDED TAX

2.2.1. General aspects 2.2.2. Transactions not subject to taxation (exempt from taxation) 2.2.3. The procedure for determining the date of occurrence of the obligation to pay VAT 2.2.4. The procedure for determining the tax base for revenue in foreign currency 2.2.5. The procedure for determining the tax base for the sale of goods (work, services) 2.2.6. Documents on the basis of which tax deductions are made 2.2.7. The procedure for accounting for amounts of unidentified receipts to the Company's current account 2.2.8. The procedure for applying deductions when using your own property and bills of exchange in payments for goods (work, services) 2.2.9. The procedure for determining and distributing input VAT amounts on purchased raw materials, semi-finished products, components, services for transporting raw materials to the manufacturer, other expenses, production (processing) services 2.2.10. Methodology for maintaining separate accounting of VAT amounts on purchased goods (work, services) used to carry out taxable and non-taxable transactions 2.2.11. The procedure for applying tax deductions for tax amounts presented by suppliers of goods (work, services), property rights that were registered by them before January 1, 20__ 2.2.12. Procedure for recovering tax amounts 2.2.13. Procedure for preparing invoices

2.3. EXCISE

2.4. TRANSPORT TAX

2.5. PROPERTY TAX

2.6. UNIFIED SOCIAL TAX

2.7. INDIVIDUALS INCOME TAX

Aggressive and conservative

Typically, firms operate on the margins of two extremes of accounting policy. Either a firm follows an aggressive approach or a conservative one.

Regardless of which approach a company follows, it must reflect the same in its accounts and in the way accounting policies are followed in preparing financial statements.

The impact on profits is similar. An aggressive approach can ultimately bring more/less profit. And a conservative approach can do the same. A company must adhere to one specific approach to maintain data consistency.

If a company changes its approach from aggressive to conservative or from conservative to aggressive, then it should mention this point and explain why it is doing this to protect the interests of investors.