Participation in trading transactions

It’s good that today the law stipulates payment for the execution of a contract for a maximum of 30 days.

Previously, enterprises could generally wait six months or more for payment for work performed or delivery of a contract. An advance payment system for a state-owned enterprise is very rare. And how can a small business operate in such conditions? Take out a loan? Who will cover the interest costs? Let's see what's happening on commercial sites. There is a fee for subscription customer service. Yes, they don’t take money for winning, but you still have to pay. And for small businesses, every penny counts. Whether you win or not is still in question, but get your money back.

Costs of participating in a posting auction

Having considered the issue, we came to the following conclusion: In the accounting of a budgetary institution, the costs of acquiring the right to conclude a water use agreement should be reflected using the expense type code 244 “Other purchase of goods, works and services to meet state (municipal) needs” in connection with the subarticle 224 “Rent for the use of property” KOSGU.

————————————————————————- *(1) The choice of a settlement account depends on the timing of the decision to offset the provided collateral against payment of obligations under the contract. If the decision is made earlier than the date of occurrence of obligations under the contract, then the non-cash transaction is reflected using account 4,206,24,000).

Accounting: failure to fulfill an obligation due to a deposit

Failure to fulfill the contract through the fault of the counterparty who issued the deposit entails the following consequences:

- the received deposit remains with the organization;

- the counterparty who issued the deposit is obliged to compensate the organization for any losses incurred by it, offset by the amount of the deposit (unless otherwise provided by the agreement). In this case, losses are compensated only to the extent that exceeds the previously transferred deposit amount.

This conclusion follows from the provisions of paragraph 2 of Article 381 of the Civil Code of the Russian Federation.

Reflect the amounts due as part of other income on the date of refusal to fulfill obligations under the agreement (clause 7, 10.2, 16 PBU 9/99). If the organization has not incurred losses, make the following entry:

Debit 62 (76) subaccount “Settlements on deposits received” Credit 91-1 - income is reflected in the amount of the deposit received.

If the amount of losses compensated in connection with non-fulfillment of obligations under the contract exceeds the amount of the deposit received earlier, then the amount of income will be equal to the amount of losses compensated in connection with non-fulfillment of obligations under the contract.

If the amount of losses does not exceed the amount of the deposit, then the amount of income will be equal to the amount of the deposit received to fulfill the obligations under the contract.

Reflect the reimbursement of the amount of loss by the counterparty using the following entry:

Debit 62 (76) subaccount “Calculations for claims” Credit 91-1 - income is reflected in the amount of the reimbursable loss.

Accounting for ensuring participation in electronic trading

- Dt 76 Kt 51 - security payment transferred.

- Dt 009 - the amount of security is fixed.

- Dt 51 Kt 76 - security deposit returned.

- Dt 009 - the security amount has been written off.

We recommend reading: Labor Code day off on birthday

Security payments are reflected in accounting using account 76, to which it is recommended to open a “purchases” subaccount. The collateral amount is simultaneously reflected in off-balance sheet account 009. Expenses for using the electronic platform can be reflected in accounts 20, 26, 44, etc.

Expenses for participation in electronic trading

Consequently, a “simplified” person does not have the right to take into account the costs not only of obtaining an electronic digital signature, but also of paying for the services of a certification center and issuing an EDS key certificate, if they were incurred to participate in electronic trading.*

For accounting purposes, the expenses incurred for participation in the auction are, in fact, nothing more than an advance, therefore they are reflected in account 76 “Settlements with various debtors and creditors” until the end of the auction and the announcement of the final decision.

Remuneration for the operator of the electronic platform accounting

However, since these expenses determine the receipt of income for the entire year, the LLC can recognize them by reasonably allocating them between reporting periods. The chosen method for recognizing the expenses in question should be fixed in the accounting policy of the LLC for accounting purposes.

Contents of the page Electronic trading and its provision Accounting for security payments Costs of securing electronic trading. Bidding is one of the effective forms of concluding transactions, which guarantees maximum transparency and maximum benefit for both parties. This applies to both organizers and participants. In some cases, an agreement can only be concluded through participation in the procurement procedure through bidding, for example, if we are talking about buyers: municipal unitary enterprises, government agencies, state corporations.

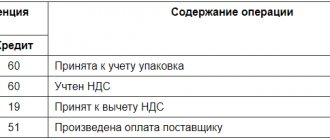

Postings for accounting funds to ensure participation in open auctions

Quote (Elena—): Hello! Please tell me the postings: - to ensure participation in open auctions in electronic form, through the operator of Sberbank - AST CJSC, - and also as security for the execution of a government contract, through a State Treasury Institution.

I read different forums, some say that you need to use the account 55, others 76. My option is this, please tell me if this is correct? 1. 55-4 51 38000 2. 55 (sub-account blocked) - 55-4 37150 3. 55-4 - 55 (sub-account blocked) 37150 4. 76 - 55-4 2000 5 . 51 - 55-4 36000

BASIC

Receipt of a deposit under a contract is not recognized as income when calculating income tax (subclause 2, clause 1, article 251 of the Tax Code of the Russian Federation). When organizations fulfill their obligations under the contract, the amount of the deposit received is counted towards payment for goods (work, services) (Clause 3 of Article 380 of the Civil Code of the Russian Federation, Article 249 of the Tax Code of the Russian Federation). If an organization calculates income tax using the cash method, include the amount of the deposit received in income on the date of fulfillment of obligations under the contract (transfer of ownership of goods (work, services)) (clause 3 of Article 273 of the Tax Code of the Russian Federation). If an organization calculates income tax using the accrual method, then, regardless of receipt of a deposit, recognize income taking into account the provisions of Article 271 of the Tax Code of the Russian Federation (clause 1 of Article 271 of the Tax Code of the Russian Federation).

Failure to fulfill obligations under an agreement for which the organization received a deposit leads to the incurrence of either expenses or income (clause 2 of Article 381 of the Civil Code of the Russian Federation).

If the failure to fulfill obligations occurred due to the fault of the organization that received the deposit, include in non-operating expenses:

- an amount exceeding the amount of the deposit received;

- the amount of compensation for losses in the part exceeding the amount of the deposit received.

The refunded amount of a previously received deposit is not recognized as an expense. The return of this amount does not lead to a decrease in economic benefits for the organization that received the deposit. This procedure follows from the provisions of subparagraph 13 of paragraph 1 of Article 265 and paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

When using the accrual method, take into account the costs on the date of refusal to fulfill obligations under the contract (subclause 8, clause 7, article 272 of the Tax Code of the Russian Federation). With the cash method - on the date of the actual transfer of funds to compensate for losses incurred by the counterparty in connection with the refusal to fulfill the contract (clause 3 of Article 273 of the Tax Code of the Russian Federation).

If the failure to fulfill obligations occurred due to the fault of the organization that issued the deposit, non-operating income must include:

- the amount of the deposit received, which is recognized as property received free of charge (letters of the Ministry of Finance of Russia dated January 18, 2008 No. 03-03-06/1/12, dated September 8, 2005 No. 03-03-04/2/56);

- the amount of losses reimbursed by the counterparty in part exceeding the amount of the deposit received (clause 3 of Article 250 of the Tax Code of the Russian Federation).

The procedure for accounting for the specified income depends on the method that the organization uses when calculating income tax. If an organization calculates income tax using the accrual method, increase the tax base as of the date the counterparty refuses to fulfill its obligations under the agreement (subclause 4, clause 4, article 271 of the Tax Code of the Russian Federation). If an organization uses the cash method, the tax base increases:

- for the amount of the deposit received - on the date of the counterparty’s refusal to fulfill obligations;

- for the amount of losses reimbursed by the counterparty in the part exceeding the amount of the deposit received - on the date of receipt of funds from the counterparty.

This follows from paragraph 2 of Article 273 of the Tax Code of the Russian Federation.

Situation: does the organization need to charge VAT on the amount of the deposit received?

Yes, it is necessary if the deposit is received as security for the fulfillment of obligations under an agreement, the subject of which is a sale subject to VAT.

Representatives of the financial department insist that the main function of the deposit is payment. Therefore, they require that organizations charge VAT on the entire amount in the same manner as on the amount of prepayment received. That is, the tax base for VAT by the amount of the deposit must be increased in the quarter in which the supplier (performer, contractor) received it from the buyer (customer) (letter of the Ministry of Finance of Russia dated February 2, 2011 No. 03-07-11/25).

If a deposit is received as a means of ensuring the fulfillment of obligations on transactions that are not subject to VAT, there is no need to pay tax on it (letter of the Federal Tax Service of Russia dated January 17, 2008 No. 03-1-03/60).

Advice: in order not to charge VAT, instead of a deposit, provide for a security payment in the contract.

A security deposit is an amount that is paid to secure a monetary obligation. For example, the obligation to compensate for losses or pay a penalty.

The peculiarity of such a payment, in contrast to a deposit, is that a security payment secures an obligation that is possible, but not guaranteed , to arise in the future. In addition, if the circumstances for which the payment was made did not occur, then it must be returned. Therefore, there is no need to charge VAT on the security received as an advance. After all, in its essence, a security payment is not an advance payment.

However, VAT will have to be charged if the security payment is offset against the advance payment. After all, this can be established by agreement. Then, in the tax period in which this happened, VAT must be charged on the payment amount as on the prepayment received.

This conclusion follows from the totality of the provisions of Article 381.1 of the Civil Code of the Russian Federation and paragraph 1 of Article 154 of the Tax Code of the Russian Federation.

When paying off penalties, fines, etc. using a security deposit, do not charge VAT. For more information about this, see How to calculate VAT when receiving amounts related to settlements for payment for goods (work, services).

Situation: is it necessary to include the amount of the deposit received in income when calculating income tax? The issuance of the deposit was issued in violation of civil law.

Yes, it is necessary, but only when calculating income tax using the cash method.

If the organization does not comply with the legislation regarding the form of issuance of the deposit (issuance of a deposit in non-monetary form, the absence of a written agreement on the deposit), then the amount received as a deposit is recognized as received as an advance (clause 3 of Article 380 of the Civil Code of the Russian Federation). In this case, organizations that calculate income tax using the cash method take into account the advance received as part of their income (clause 1 of Article 273 of the Tax Code of the Russian Federation). If an organization calculates income tax using the accrual method, do not take into account advances as income (clause 1 of Article 271 of the Tax Code of the Russian Federation).

An example of reflection in accounting and taxation of transactions related to the receipt of a deposit. The parties to the agreement fulfilled their obligations under the agreement in a timely manner and in full.

In April, Torgovaya LLC (supplier) received a deposit in the amount of 30,000 rubles from Alpha LLC (buyer). towards the fulfillment of obligations under a contract for the supply of office equipment. The parties to the contract formalized the issuance of the deposit by an agreement on the deposit. In the same month, Hermes shipped goods worth 118,000 rubles to Alpha. (including VAT – 18,000 rubles). The actual cost of goods sold is 90,000 rubles.

Hermes applies a general taxation system and calculates income tax on a monthly basis using the accrual method.

Operations related to the receipt of a deposit and the fulfillment of obligations under the contract were recorded by the Hermes accountant as follows:

Debit 51 Credit 62 subaccount “Settlements on deposits received” – 30,000 rubles. – the deposit amount has been received from the buyer;

Debit 76 subaccount “Calculations for VAT on deposits received” Credit 68 subaccount “Calculations for VAT” - 4576 rubles. (RUB 30,000 × 18/118) – VAT is charged on the amount of the deposit received;

Debit 008 – 30,000 rub. – reflects the amount of the deposit received;

Debit 62 Credit 90-1 – 118,000 rub. – revenue from the sale of goods is reflected;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 18,000 rubles. – VAT is charged on proceeds from the sale of goods;

Debit 90-2 Credit 41 – 90,000 rub. – the actual cost of goods sold is written off;

Debit 62 subaccount “Settlements on deposits received” Credit 62 – 30,000 rubles. – the amount of the deposit is credited to pay for the cost of goods sold;

Debit 68 subaccount “Calculations for VAT” Credit 76 subaccount “Calculations for VAT on deposits received” – 4576 rubles. – VAT paid upon receipt of the deposit is accepted for deduction;

Debit 51 Credit 62 subaccount “Settlements with buyers and customers” – 88,000 rubles. – payment for goods has been received from the buyer (minus the amount of the deposit);

Credit 008 – 30,000 rub. – the amount of the deposit received is written off.

When calculating income tax in April, the Hermes accountant took into account the proceeds from the sale of goods in the amount of 100,000 rubles as income. (RUB 118,000 – RUB 18,000), and included in expenses the cost of goods sold (RUB 90,000).

An example of how transactions related to the receipt and return of deposits are reflected in accounting and taxation. The deposit is returned by the organization that refused to fulfill its obligations under the supply agreement

In April, Torgovaya LLC (supplier) received a deposit in the amount of 30,000 rubles from Alpha LLC (buyer). towards the fulfillment of obligations under a contract for the supply of office equipment. The parties to the contract formalized the issuance of the deposit by an agreement on the deposit.

Having received the deposit, Hermes refused to fulfill its contractual obligations. Since Alpha had already entered into an agreement for the sale of office equipment with Proizvodstvennaya LLC, it was presented with a claim in the amount of 70,000 rubles for refusal to supply.

The Master's claim was forwarded to Hermes. At the same time, Alpha demanded that Hermes return the previously issued deposit in double the amount (60,000 rubles) and compensate for losses associated with Hermes’ refusal to fulfill the contract. The amount of loss (including the previously issued deposit) was: RUB 70,000. – 30,000 rub. = 40,000 rub.

In April, Hermes satisfied Alpha’s claim and transferred 100,000 rubles to her bank account. (30,000 rub. × 2 + 40,000 rub.).

Hermes applies a general taxation system and calculates income tax on a monthly basis using the accrual method.

The Hermes accountant recorded transactions related to the receipt and return of the deposit as follows:

Debit 51 Credit 62 subaccount “Settlements on deposits received” – 30,000 rubles. – the deposit amount has been received from the buyer;

Debit 76 subaccount “Calculations for VAT on deposits received” Credit 68 subaccount “Calculations for VAT” - 4576 rubles. (RUB 30,000 × 18/118) – VAT is charged on the amount of the deposit received;

Debit 008 – 30,000 rub. – reflects the amount of the deposit received.

After Hermes refused to fulfill the contract, the following entries were made in the organization’s accounting:

Debit 91-2 Credit 62 subaccount “Settlements of claims” – 70,000 rubles. – other expenses are reflected in the amount of the indemnified loss;

Debit 62 subaccount “Settlements on deposits received” Credit 51 – 30,000 rubles. – the return of the previously received deposit is reflected;

Credit 008 – 30,000 rub. – the amount of the deposit received is written off;

Debit 62 subaccount “Calculations for claims” Credit 51 – 70,000 rub. – the claim brought by Alfa has been settled;

Debit 68 subaccount “Calculations for VAT” Credit 76 subaccount “Calculations for VAT on deposits received” – 4576 rubles. – VAT paid upon receipt of the deposit is accepted for deduction.

When calculating income tax in April, the Hermes accountant took into account compensation for losses in the amount of 70,000 rubles as part of non-operating expenses.

An example of reflection in accounting and taxation of transactions related to the receipt of a deposit. The counterparty refused to fulfill its obligations under the contract

In April, Torgovaya LLC (supplier) received a deposit in the amount of 30,000 rubles from Alpha LLC (buyer). towards the fulfillment of obligations under a contract for the supply of office equipment. The parties to the contract formalized the issuance of the deposit by an agreement on the deposit.

Having issued a deposit, Alpha refused to accept the goods. Since Hermes had already entered into an agreement for the transportation of office equipment with Proizvodstvennaya LLC, he was presented with a claim in the amount of 40,000 rubles for refusing the service.

The Master's claim was forwarded to Alpha. Hermes demanded that Alpha compensate for losses associated with the refusal to fulfill the contract. The amount of loss (including the previously issued deposit) was: 40,000 rubles. – 30,000 rub. = 10,000 rub.

In April, Alpha satisfied Hermes’ claim and transferred 10,000 rubles to his bank account.

Hermes applies a general taxation system and calculates income tax on a monthly basis using the accrual method.

The Hermes accountant recorded transactions related to the receipt of the deposit as follows:

Debit 51 Credit 62 subaccount “Settlements on deposits received” – 30,000 rubles. – the deposit amount has been received from the buyer;

Debit 76 subaccount “Calculations for VAT on deposits received” Credit 68 subaccount “Calculations for VAT” - 4576 rubles. (RUB 30,000 × 18/118) – VAT is charged on the amount of the deposit received;

Debit 008 – 30,000 rub. – the amount of the deposit received is reflected on the balance sheet.

After Alpha’s refusal to fulfill its obligations under the contract, the following entries were made in Hermes’ accounting:

Debit 62 subaccount “Calculations for claims” Credit 91-1 – 40,000 rubles. – income is reflected in the amount of the indemnified loss;

Debit 62 subaccount “Settlements on deposits received” Credit 62 subaccount “Settlements on claims” - 30,000 rubles. – the amount of the deposit issued is offset against the claim;

Debit 51 Credit 62 subaccount “Settlements on claims” – 10,000 rubles. – the claim brought against Alfa has been settled;

Credit 008 – 30,000 rub. – the amount of the deposit has been written off;

Debit 68 subaccount “Calculations for VAT” Credit 76 subaccount “Calculations for VAT on deposits received” – 4576 rubles. – VAT paid upon receipt of the deposit is accepted for deduction.

When calculating income tax in April, the Hermes accountant took into account compensation for losses in the amount of 40,000 rubles as part of non-operating income.

How to take into account the costs of participating in an auction

The participant's expenses related to the tender (payment of fees for participation in the competition, purchase of tender documentation, purchase of a bank guarantee, etc.) in accounting before the announcement of the results of the competition are initially taken into account in account 97 “Deferred expenses” as expenses incurred in connection with upcoming sale of goods, performance of work, provision of services. If the participant is recognized as the winner, these costs are recognized as direct expenses under the contract and are written off as a debit to the cost accounts. In case of loss, all expenses associated with the preparation of tender documentation are recognized as other expenses and written off to account 91-2 “Other expenses” in the month of announcing the results of the competition (https://www.5188888.ru/tender/pub_detail.php? >

We recommend reading: Who Can Get 13 Percent From the Purchase of an Apartment

“Until the results of the competition become known, in accounting all costs associated with tenders are attributed to the future. Therefore, they are reflected in account 97 “Future expenses” (clause 65 of the Regulations on accounting and financial reporting, approved by Order of the Ministry of Finance dated July 29, 1998 N 34n). Then, in the month of announcement of the company’s loss, expenses are written off from the credit of account 97 to the debit of account 91 “Other income and expenses”, subaccount 91-2 “Other expenses” (clause 11, 19 PBU 10/99, approved by Order Ministry of Finance dated May 6, 1999 N 33n).

simplified tax system

Receipt of a deposit under a contract is not recognized as income for the purposes of calculating the single tax. Therefore, the deposits received do not increase the tax base either for organizations that pay a single tax on income, or for organizations that pay a single tax on the difference between income and expenses. This follows from the provisions of paragraph 1.1 of Article 346.15, subparagraph 2 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation.

When fulfilling obligations under the contract, the amount of the deposit received can be offset against payment for goods (work, services) (clause 1 of Article 408 of the Civil Code of the Russian Federation, clause 2 of Article 249, clause 1 of Article 346.15 of the Tax Code of the Russian Federation). In this case, include the amount of the deposit in income when calculating the single tax under simplification on the date of offset (withholding) of the amount of the deposit to pay off the debt under the contract. This conclusion follows from paragraph 1 of Article 346.17 of the Tax Code of the Russian Federation and is confirmed in letters of the Ministry of Finance of Russia dated October 24, 2012 No. 03-11-06/2/135, Federal Tax Service of Russia dated December 30, 2014 No. GD-4-3/27235 .

An example of accounting when calculating a single tax when simplifying a deposit received to fulfill an obligation under a contract for the supply of goods. The organization fulfilled its obligations under the contract in full

In April, Torgovaya LLC (supplier) received a deposit in the amount of 30,000 rubles from Alpha LLC (buyer). for the fulfillment of obligations under a contract for the supply of goods. The total cost of goods under the contract is 230,000 rubles. The parties to the contract formalized the issuance of the deposit by an agreement on the deposit.

On April 13, Hermes fulfilled its obligations under the contract in full (shipped the goods).

On the same day, Hermes reflected the amount of the previously received deposit in the amount of 30,000 rubles. as part of income.

On May 13, Alpha transferred to Hermes the remaining amount of debt for the goods supplied in the amount of 200,000 rubles. On the same day, the Hermes accountant took this amount into account as income.

Failure to fulfill obligations under an agreement for which the organization received a deposit leads to the incurrence of either expenses or income (clause 2 of Article 381 of the Civil Code of the Russian Federation).

Expenses that arise if the failure to fulfill the contract was due to the fault of the organization that received the deposit are not taken into account when calculating the single tax:

- for organizations that pay a single tax on income - because the tax base is not reduced by any expenses (clause 1 of Article 346.18 of the Tax Code of the Russian Federation);

- for organizations that pay a single tax on the difference between income and expenses - because in the closed list of expenses, which is given in Article 346.16 of the Tax Code of the Russian Federation, neither deposits subject to return, nor penalties for failure to fulfill the terms of the contract, nor the amount of compensation are mentioned damage caused to the counterparty by refusal to perform the contract.

If the failure to fulfill obligations occurred due to the fault of the counterparty, the following should be included in non-operating income:

- the amount of the deposit withheld;

- the amount of compensation for losses in the part exceeding the amount of the deposit issued.

This procedure follows from the provisions of paragraph 1 of Article 346.15, paragraph 3 of Article 250 of the Tax Code of the Russian Federation. Similar explanations are given by representatives of the tax service (see, for example, letters from the Federal Tax Service for Moscow dated September 28, 2006 No. 18-11/3/85458, dated April 19, 2006 No. 18-12/3/32797).

Regardless of the chosen object of taxation, when calculating the single income tax, take into account:

- in the amount of the retained deposit - on the date of the counterparty’s refusal to fulfill obligations;

- in the amount of compensation for losses (in the part exceeding the amount of the deposit issued) - on the date of receipt of funds from the counterparty.

This follows from paragraph 1 of Article 346.17 of the Tax Code of the Russian Federation.

Bidding: how to take into account the costs of holding or participating

The winning bidder's accounting after signing the contract will depend on what exactly was won. If this is the right to enter into a lease, then you will subsequently record lease transactions. If you win a construction contract, then you will have “construction” transactions.

The auction participant must be prepared to raise the price, and the competition participant must develop some special project, for which it may be necessary to attract new workers and purchase additional materials.

Expenses for participation in open electronic auctions

To become a participant in an electronic auction, an organization must be accredited by the operator of the electronic site. Accreditation is carried out for a period of three years (with the possibility of completing it for a new term). Its presence entitles the ordering participant to participate in all open auctions in electronic form held on such an electronic platform. This follows from parts 9 and 13 of Art. 41.3 of Law No. 94-FZ.

Note! Payment for accreditation on the electronic platform and for participation in an open auction in electronic form is not charged to participants in placing an order (Part 4, Article 41.1 of Law No. 94-FZ). The fee is charged only to the person with whom the contract is concluded, in the cases provided for in Chapter. 3.1 of Law No. 94-FZ.