Buyers

62.01 K balance = 0 62.02 D balance = 0 don’t forget to make an account. in advance to buyers! 76.AB K balance = 0, also remember the debit balance (62.2*0.18/1.18=76.AB)

So: 1. receipt of goods from suppliers with invoices has been established. 2. Shipments to customers with invoices have been initiated. 3. Advance invoices are issued for the buyers' prepayments

We begin to study Operations - Closing the period - VAT Accounting Assistant . There is also a useful summary report in 1C, see. Reports - Analysis of VAT accounting If payment and shipment (receipt) are in the same period, then everything is taken into account very simply: all my documents “Receipts of goods” in the invoice received have a checkbox “Reflect the VAT deduction in the purchase book by the date of receipt.” Those. here we immediately make entries for VAT refund ( 68.02

Thus, the document formation of the purchase book and sales book is almost empty. And all sorts of advances and other evil spirits ended up there, which makes the life of an accountant bright and eventful. The problem is that if you give up and don’t deal with the advances, then it will all come out anyway. Therefore, we are looking for algorithms for checking advances.

What logic first tells us is that all options (where there are 2 periods, payment in one, shipment in the other) are divided into:

- 1.

- 1.1 client prepayment

- 1.1a счф. for advance payment (76АВ

- 1.2 shipment of goods to the client + regular invoice (there are no postings here, but see its shipment 90.03

- 1.2a we cancel the SCHF. for an advance payment (occurs when creating a purchase book - oddly enough).

- 2.

- 2.1 shipment of goods to the client

- 2.2 payment by the client

- 3.

- 3.1 prepayment to the supplier

- 3.1a supplier to you SCHF. for advance payment ( 68.02 Purchases - invoice for advance payment

- 3.2 receipt of goods from the supplier + regular invoice (68.02

- 3.2a we cancel the SCHF. for advance payment (76VA

- 4.

- 4.1 receipt of goods from the supplier (19.03

- 4.2 payment to the supplier

Please note that for paragraphs. 2 and 4 no SCHF is created. for advance They only appear if payment is made first.

76AB

God, how can I check all this crap with contractors, since since 2015. Each invoice must contend with the counterparty's accounting department.

Let's look at what the document “formation of a purchase book” contains. Attention ! : the document can only be found like this: Operations - Regulatory VAT reports , it is not in the log of all operations.

- “Creating a purchase book” - there is a division here:

- acquired values 68.02

- advances received 68.02

- Let’s look at what the document “formation of a sales book” contains:

- recovery on advances 76VA

First conclusions: 1. If the transaction went through 2 stages (shipment and payment) in full, then logically this can be seen in account 62 (there are no balances there) and, as a result, all advances are on the account. 76 of this counterparty must close, i.e. There should also be no leftovers. 2. If the client has an advance payment (there is a balance on account 62.2), then accordingly there will be a balance on account 76 in the ratio (62.2*0.18/1.18=76.AB). This is where a report on 62 with additional would be stupid. column according to the formula (62.2*0.18/1.18=76.AB). 3. If we made an advance payment to the supplier, then by law he must make an invoice. for an advance payment and send it to us, but usually this does not happen for obvious reasons: the supplier has made an SSF for himself. for an advance payment (paid VAT), but he doesn’t care about you - your problems, you need it - come for the SCHF yourself. for advance And it can also be understood - invoice documents and regular invoices are handed over with the delivery of goods, usually in boxes. If, after all, there is such a financial system. for an advance payment from the supplier, then it must be handled in Purchases - Invoices received - Invoice for advance payment . 4.

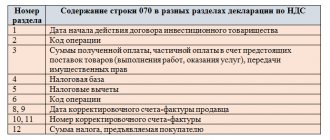

Description of the account “VAT on advances and prepayments issued”

To reflect VAT on the amounts of paid advances and prepayments, use subaccount 76.VA “VAT on advances and prepayments issued.” The account allocates VAT from the amount of advance payment transferred to the supplier (performer) as payment for unshipped goods, unprovided work, and services.

The basis for making payments on a subaccount is an invoice issued by the supplier, an agreement that provides for the payment of an advance. VAT transactions are reflected in account 76.AB upon the transfer of funds to the contractor (based on a payment order).

Rebus Company

But we looked at only one side of the coin - when our company acts as a seller of its own products.

But in order to produce these products, the enterprise buys everything necessary for production (materials, equipment, etc.) and in this case itself acts as an ordinary buyer and pays VAT upon purchase, which the sellers added to the price of their goods. And this is where the “most interesting” part comes in.

Since VAT must flow into the pocket of the state from the buyer through the pocket of the seller, then when our enterprise acts as a buyer, the state returns to it the amount of VAT that it transferred to the seller.

In order not to get confused in complex calculations, the state introduced the following procedure: 1) first, each enterprise calculates the amount of VAT that it must pay to the state directly - that is, the amount from transactions in which our enterprise acted as a seller.

This part of the VAT is reflected in the liability side of the balance sheet.

Fool's method

There is a cool method when, without understanding anything about the algorithms for calculating VAT payable, we focus only on the fact that 1C knows what it is doing.

We take it as a fact that, for example, “Express check of accounting (VAT)” checks everything correctly.

Let’s say our 62.2/6 does not beat 76AB (2019Q2), but there are suspicions that everything was done correctly (during the transition to 20% VAT). Those. “Express VAT check” shows that everything is Gut!

We do this:

We remove one line from the formation of the purchase book and see that “Express VAT check” noticed and began to swear. Aha - that means everything is correct in the document for creating the purchase book .

Next, similarly, we will post one invoice for the advance payment and see that “Express VAT check” noticed and began to swear. The conclusion and invoices for advance payments are also correct.

It's cool isn't it.

And so on …

What is account 76 “Settlements with various debtors and creditors”

This post is dedicated to the wonderful company Simple Solutions. 1C is easy! and Its creators and leaders Andrey Efimov and Irina Efimova. Clearly, professionally, quickly, calmly and, what is very important, with great humane attitude, the professionals of this company saved me today! Thank you a million times!

Other liabilities are usually called everything that does not fit into the format of other balance sheet items and at the same time is too insignificant to be included in a separate line.

Shares from overdue obligations of debtors are accrued to this account. The arrears become overdue after 45 days from the date of formation.

Other liabilities collect information at the end of the reporting period, which is taken into account in accordance with the approved Chart of Accounts. This document is a working guide for an accountant.

How to reflect VAT on advances in the balance sheet

It is unlikely that any organization can manage its activities without an advance payment system. Remember the famous phrase: “money in the morning, chairs in the evening”? Accounting has long adapted to this situation, and accountants operate with separate subaccounts for advance VAT quite confidently.

But there is one issue that has not yet been resolved, and today they continue to break spears about it - how to reflect VAT on advances in the balance sheet? Before we talk about which line of the balance sheet should reflect the amount of VAT on advances, let's remember how this VAT appears and on what accounts it exists.

How does “advance” VAT arise?

Let's start with an example. LLC "Style" is engaged in tailoring women's clothing and is located on OSNO. The organization has just opened. Wherein:

— an advance payment was made to the supplier Tweed LLC for fabrics in the amount of 59,000 rubles, including VAT 18%;

— an advance payment was received from the clothing store Moda LLC in the amount of 141,600 rubles, including VAT 18%.

First, let's deal with the prepayment received from the store. According to the rules of the Tax Code, an organization on OSNO that is not exempt from VAT, when receiving an advance on account of upcoming deliveries of products, works, services upon receipt of them, must calculate VAT (clause 2, clause 1, Article 167 of the Tax Code). Let's do this:

VAT payable = 141,600 / 118 * 18 = 21,600 rubles.

At the moment when the clothes are sewn and shipped to Fashion LLC, VAT must be charged again - already on the cost of the shipped products:

VAT payable = 141,600 / 118 * 18 = 21,600 rubles.

And VAT accrued earlier on the advance payment is accepted for deduction (clause 1, clause 1 and clause 14 of Article 167, clause 8 of Article 171 and clause 6 of Article 172 of the Tax Code).

A deduction is made if, after receiving an advance payment, the terms of the contract are changed or terminated and the corresponding amounts of advance payments are returned (clause 5 of Art.

Input VAT

Line 1220 “VAT on purchased assets”

Line 1220 reflects the amount of tax that the company will be able to deduct in the future. The remaining value (debit balance) for account 19 is transferred to this balance line.

To exercise the right to deduction, a number of conditions must be simultaneously met:

- the acquired assets are intended for the type of activity that is subject to VAT;

- the cost of acquired assets is reflected in accounting;

- there is a correctly issued invoice from the supplier.

You can see how to fill out line 1220 using an example in the Guide from ConsultantPlus. Trial access to the K+ system is provided free of charge.

For many organizations, account 19 is reset to zero at the end of the year, and in this case a dash is added to line 1220 of the balance sheet. The balance on account 19 may arise in such cases (all of them follow from the text of Articles 171 and 172 of the Tax Code of the Russian Federation):

- when exporting raw materials (the delay in accepting VAT for deduction is due to the fact that it is necessary to go through the procedure of confirming the fact of export);

- if the acquired assets are used by a company with a long production cycle (VAT is deductible only after the finished product is shipped to the buyer);

- if the supplier did not provide an invoice or the invoice was issued with significant violations;

- when the taxpayer decides to deduct it at a later period (before the expiration of 3 years from the date of registration of the acquired property).

NOTE! For organizations with large balances on account 19, it is better to detail the value of line 1220. This right is provided for in clause 6 of PBU 4/99 “Accounting statements of an organization” (approved by order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n). This can be done by adding lines 12201, 12202, etc. Detailing is possible in the context of operations (purchase) by fixed assets, inventories, intangible assets and others.

Standardized expenses

A debit balance on account 19 can also be formed when paying expenses, which are normalized when calculating income tax. Thus, there are expenses that cannot be fully taken into account in the tax base when calculating income tax.

Read about what expenses are regulated and what the limits for rationing are in the material “Standards provided for by the Tax Code of the Russian Federation” .

Hand in hand, taking into account standardized expenses, comes the problem of deducting value added tax. That is, if these expenses are normalized, then the right to deduct VAT on them is also curtailed.

In this case, usually the final value of the indicator for calculating the standard becomes known only at the end of the year, and the expenses themselves can be collected throughout the year, and the accountant has the obligation to quarterly adjust the VAT amount as the base from which the standard is determined increases.

At the end of the year, some amounts of undeductible VAT may accumulate. Their last day of the year should be written off as other expenses, since tax amounts exceeding the amount corresponding to the calculated value of the standard will no longer be accepted for deduction.

Where might the discrepancies come from?

To reflect the accrual of VAT on advance payments, the chart of accounts provides a subaccount “VAT on advances received (prepayments)” to account 62 “Settlements with buyers and customers” and account 76 “Settlements with various debtors and creditors”.

AB is not closing I fedotov_andrey At the end of the year there were advances from buyers on account 62.2 and, accordingly, VAT on these advances on account 76.AB.

Debit 76.01 Credit 91.02. Reflection of the amount of income received as the difference between the compensation received and total expenses. Before the defendant recognizes the deficiency and before a court decision is made, the accountant should reflect the amount of the claim under the D account. 94.

Advances received

Line 1520 “Debt to creditors”

The line “Debt to creditors” (balance sheet liability) summarizes the balances (credit) on the following accounts: 60, 62, 68, 69, 70, 71, 73, 75 and 76, including VAT. These are all the debts of the enterprise that it is obliged to repay within a year, or during the production cycle if it exceeds a calendar year.

IMPORTANT! The amounts of debts to the budget must be verified with the fiscal authorities. It is strictly prohibited to arbitrarily calculate unsettled debts to the budget (clause 74 of the PBU on accounting and accounting in the Russian Federation, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n).

When forming line 1520 of the balance sheet, you should take into account a certain nuance with the reflection of advances received. Here there is a situation similar to that of the advances listed. The Russian Ministry of Finance also recommends that advances received be reflected in the balance sheet minus VAT (attachment to the letter of the Russian Ministry of Finance dated January 9, 2013 No. 07-02-18/01).

So on line 1520 you should include:

- accounts payable including VAT,

- advances received minus VAT.

You can see how to fill out line 1520 using an example in the Guide from ConsultantPlus. Trial access to the K+ system is provided free of charge.

Read about the nuances of working with advances received in the material “What is the general procedure for accounting for VAT on advances received .

Example of display in line 1230 of the balance

The materiality level is set at 5%. This means that an indicator is considered significant if without it the information in the report would be undisclosed. An amount that is less than 5% in relation to the total balance sheet section is considered insignificant.

What logic first tells us is that all options (where there are 2 periods, payment in one, shipment in the other) are divided into:

- 1.

- 1.1 client prepayment

- 1.1a счф. for advance payment (76АВ

- 1.2 shipment of goods to the client, a regular invoice (there are no postings here, but see its shipment 90.03

- 1.2a we cancel the SCHF. for an advance payment (occurs when creating a purchase book - oddly enough).

We must transfer the accrued VAT to the budget. We also issue an invoice to our buyer within 5 days after receiving the advance payment.

If the increase occurred in debit, then the balance is debit; if in credit, then the balance is credit. When there is a loan balance on the account, the register itself behaves as passive. Thus, the final balance is formed by the side of position 76 on which the increase was recorded. With a debit increase, the final balance is formed from the Dt of the account, and the credit balance - from the Kt.

In postings to subaccounts. 76.2, as with any other accounts receivable account, it should be remembered that no one can be held liable without consent. If a corresponding entry is made immediately when a claim arises, a debt will arise. At the same time, there is no certainty that the debtor will agree with him.

Account 19 is used for the purpose of separating VAT from an advance, when the issuance of an advance and the deduction of VAT are separated in time. If advance VAT on the reporting date is not accepted for deduction, then the tax reflected in account 19 is recorded in the balance sheet as a current asset separately from the “receivables” for the transferred advance payment.

Related posts:

Advances listed

Line 1230 “Accounts receivable”

This line reflects the full amounts of buyer (debtor) debts remaining at the end of the year, including VAT. Here we summarize the data corresponding to the balances (debit) of accounts 60, 62, 76, as well as the total values for the debit of the “Settlements with ...” accounts: 68, 69, 70, 71, 73 and 75, reduced by the balance (credit) of the account 63.

Starting from 2011, organizations are required to form a reserve for doubtful debts (account 63, the balance of which is subtracted from the value accumulated in line 1230 of the balance sheet). This includes those debts of debtors for which they no longer hope to receive payment.

The organization independently determines such debts by assessing the likelihood of full or partial non-repayment (letter of the Ministry of Finance of Russia dated January 27, 2012 No. 07-02-18/01).

According to the explanations of the Ministry of Finance of Russia, when the buyer transfers an advance to the supplier, receivables are reflected in the balance sheet minus VAT, subject to deduction or accepted for deduction (attachment to the letter of the Ministry of Finance of Russia dated 01/09/2013 No. 07-02-18/01).

This means that in line 1230, in addition to existing accounts receivable with VAT, the amount of advances transferred to suppliers against a future transaction (shipment of goods, provision of work (services), transfer of property rights) is reflected minus VAT.

For a sample of filling out the balance sheet for 2021, see here.