The assignment of debt between legal entities is permitted by current legislation. As a general rule, the transaction is concluded between the original debtor and the person who will subsequently pay in his place. If both parties are participants in entrepreneurial activity, then Article 391 of the Civil Code of the Russian Federation establishes some specifics. Thus, an agreement is concluded between the creditor and the new debtor, who undertakes to pay the debt, in whole or in part.

Definition of the concept

The contract form [sc:year ] is available here.

An assignment agreement is an agreement under which the creditor has the right to collect the debt from the debtor without his consent.

We can say that an assignment agreement is a transfer of the debtor’s material obligations (assignment of claims) to another creditor.

A debtor is a person who needs to fulfill certain obligations on time. A creditor is a person who, based on his rights, can demand that the debtor fulfill these obligations. The Civil Code provides for only two cases of replacing persons in obligations - changing creditors or replacing the debtor (i.e. transfer of debt).

An assignment agreement involves two parties: the “assignor” - the original creditor, and the “assignee” - the new creditor, who receives the right to collect the debt. If a change of creditor and the conclusion of an agreement occurs before the debtor pays money to the original creditor, then the debtor must receive written notification of the change of creditor.

The assignment agreement is used in various fields of activity. However, according to the laws of the Russian Federation, not all material claims can be transferred to another person.

Exceptions are alimony, harm (both moral and material) to a person and its compensation, and some other cases.

The need for an assignment agreement may arise if the lender cannot obtain the required amount from the tenant. And also when financial obligations are divided during the divorce of individuals, and during the reorganization of enterprises. Claims can be transferred free of charge, but, basically, assignment agreements are paid. After the transfer of rights, the debtor receives notification of a change in credit company.

As a rule, the agreement describes in detail the requirement for the transfer of rights, explains why it arose, and provides details of the company that previously acted as a creditor. The document on the transfer of rights is certified by a notary.

When invalid claims are transferred to a debtor from a creditor, the latter becomes liable in accordance with current legislation.

When concluding an assignment agreement, it is possible to transfer the rights of guarantee from the previous lender to the current one, which is a guarantee of the return of funds from the borrower. In current legislation, the assignment agreement is regulated by the Civil Code (paragraph 1, chapter 24, part 1).

Concept and features

The Civil Code, in Article 391, establishes that the transfer of debt from one person to another is permitted. This procedure involves the transfer of obligations to the creditor from one person to another. In simple terms, another person will pay instead of the debtor, and the original debtor will no longer have obligations to the lender (or creditor for other reasons).

In entrepreneurial activities, the procedure is also allowed. This is indicated by the second paragraph of paragraph 1 of Article 391. However, in this case the rules of registration change slightly. If in other cases an agreement is drawn up between debtors, and the creditor is only notified, then in a situation where both parties are participants in business activities, the agreement is concluded between the creditor and the new debtor.

The consent of the creditor is mandatory. The agreement must clearly state that the creditor understands the consequences of the transaction, and his consent must be expressed. Otherwise, the agreement will be considered invalid.

The original debtor and the new one also draw up an agreement between themselves that defines the terms of their cooperation. Unless otherwise provided by the transaction, the new debtor will receive the rights of a creditor and will subsequently be able to demand debt from him in the agreed amount (paragraph 2 of paragraph 3 of Article 391 of the Civil Code of the Russian Federation).

Download for viewing and printing: Chapter 24 of the Civil Code of the Russian Federation “Change of persons in an obligation”

Kinds

Depending on the number of parties to the agreement or the situation that served as the impetus for its signing, the following types of agreements are distinguished:

- An agreement on the distribution and assignment of rights during the reorganization of an enterprise or legal entities.

- Transfer of the debt of a company that is subject to reorganization to an enterprise opened after that. The presence of debt must be confirmed by reconciliation acts.

- An assignment agreement for the division of property between family members after a divorce. In particular, it is issued if one of the spouses has a loan issued.

There are also two types of this agreement depending on the number of participants - bilateral and trilateral. A bilateral assignment is a classic type of agreement in which a change of lender occurs regardless of the wishes of the borrower. A tripartite assignment agreement (a sample is used for drawing up) is different in that upon its conclusion, the debtor gives official consent to the transfer of material obligations to another creditor.

The latter type of assignment has an important advantage, since the debtor’s consent to change the creditor confirms his willingness to repay the debt. A bilateral assignment only involves informing the borrower about a change in credit company.

There are paid and gratuitous assignment agreements.

When a lender transfers the borrower's obligations for a fixed fee, it is a remunerative contract.

However, the assignment of rights can be carried out at a collection agency, where no fee will be charged for the assignment, and the amount of the borrower’s debt to the lender will remain the same.

If no fee is charged for the assignment of rights, then a gratuitous agreement is concluded.

There are also contracts with the transfer of debt on paid or free terms. The debtor can be replaced in the same way as the creditor - on the basis of an agreement that can be free, or paid (in which case an amount that is greater than the original debt is paid).

Often, the transfer of claims to a third party takes place in accordance with a writ of execution; it allows both the sale of rights and the assignment of them free of charge. To do this, you will need an assignment agreement, which is evidence of a change in the credit institution, and an application to the arbitration court. The court's decision often comes down to the fact that the rights are assigned to several assignees.

Maintaining financial records is the responsibility of every entrepreneur. VAT is a tax paid by every company involved in the production and sale of products. What is VAT in simple words? Who is obliged to pay it and how to correctly calculate its amount, read on our website.

A sample power of attorney to receive goods can be found here.

Each entrepreneur is included in the unified state register of legal entities. In some cases, a businessman may need an extract from the register. Here https://businessmonster.ru/buhuchet/dokumentyi/zakazat-vyipisku-iz-egryul-v-nalogovoy.html you will find out what types of statements exist and in what cases the document may be required.

When you need it

There are quite a lot of situations when the parties to a loan agreement change. Let's consider the most common cases of transfer of debt obligations:

| New creditor or assignment of rights | New payer or debt transfer |

| The lender has lost the opportunity to claim the debt for repayment. The emergence of financial problems, the sale of debt obligations in order to obtain financial assets. Risk of non-repayment of debt, recognition of the debtor as insolvent. Lack of time and opportunity to conduct litigation to collect debt. | The borrower loses the ability to pay the loan. The defendant under the debt obligations has been reorganized, and the legal successor acts as the new holder of the obligations. Death of the debtor, transfer of obligations to the heirs. Loss of need for a loan, credit, mortgage. |

Each situation has its own rules and requirements. If legal norms are not followed, the transaction will be declared invalid.

Features of the assignment agreement, which is concluded between legal entities

An assignment agreement can be concluded between individuals and legal entities. This often happens when distributing rights or transferring existing debt in the event of a company reorganization. That is, the name of the debtor company changes, but the activities of the enterprise remain unchanged.

If at the time of reorganization the company has not reset the balance to zero, which can be confirmed by a reconciliation report, then the counterparty is changed to a new name based on the mutual settlement report in 1C. Documents for registration of this type of assignment must be certified with wet seals on both sides.

Things to remember

As discussed above, the assignment is carried out between the assignor (the original lending firm) and the assignee - the one who buys the debt.

The cost of the transaction itself for the assignment of rights is generally lower than the amount of debt. Often the assignment agreement is of a compensatory nature.

If payment is not made, the tax office will regard the transaction as an act of donation. After this, the transferor company may suffer from litigation.

Even if the amount for a transaction for the assignment of material obligations is too low, claims may be brought against the company regarding the unreasonableness of the transaction.

To avoid troubles associated with the assignment of rights, the person involved in the sale of debt must sign a memo from the director of the enterprise justifying the transaction with reasoned reasons for its conclusion. This should be done before concluding an assignment agreement.

There are a number of reasons why a assignor can legally transfer rights to a debt:

- the lender cannot collect the debt from the borrower on its own;

- it is not profitable for the creditor company to receive receivables;

- when trying to collect a debt from a borrower, the lender incurs overhead costs;

The rights of claim are transferred without any obligation to pay VAT (this is confirmed by the Tax Code in Article 155, paragraph 1). And this is logical, since after the sale of the goods to the consumer, the initial creditor has already transferred VAT according to the agreed price.

If the assignment agreement is concluded with a third party, then VAT is defined as the excess of income received by the assignee over the expenses associated with the acquisition of rights.

The date of execution of the agreement is the moment of transfer of rights to the debt from the initial creditor to the new one. If the debtor does not fulfill his obligations and the new creditor does not receive income, then VAT is not deducted due to the lack of income.

If the creditor assigns the right to claim the debt before the debtor is due to pay it according to the contract, then the loss that arises in this case reduces the level of taxation. The loss is easily calculated based on the interest paid by the assignor under the debt obligations, which can be equated to the profit from the assignment agreement for the entire period from the transfer of rights to the payment of the debt (according to Article 269 of the Tax Code).

From an accounting point of view, the exercise of the right of claim on the part of the new creditor is considered as a service of a financial nature.

And for the assignor, the transfer of this right is as “Other income and expenses” (91 accounts). As a rule, there are no difficulties with this.

For the assignee, the purchase of receivables is a financial investment, which is taken onto the balance sheet at its original cost. It will include all costs of acquiring debt, including payments to intermediaries, payments for information services, etc.

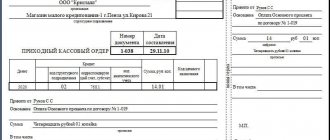

To simplify, let's look at one example. sold goods for a total amount of 153,400 rubles (including VAT at a rate of 18% – 23,400 rubles). Accordingly, the net value of the goods was 90 thousand rubles. did not pay for the goods on time, after which the creditor decided to sell the rights of claim for 120 thousand rubles. In addition to the price paid for the acquisition, the assignee Starstroy paid 4,366 rubles for the assignment agreement (including VAT, which amounted to 666 rubles). After which he pays off the debt in full, i.e. pays the new creditor 153,400 rubles.

In accounting, the transaction is indicated as follows:

- Debit 58 “Assignment of claims” / Credit 60 – 120 thousand rubles.

- Debit 58/Credit 60 – 4366 rubles.

- Debit 60/Credit 51 – 124,366 rubles (120,000+4,366 rubles).

- Debit 51/Credit 91-1 – 153,400 rubles – repayment of debt by the borrower.

- Debit 91-2/Credit 58 – 124366 – write-off of the amount of debt given initially.

The difference between expenses and income was 29,034 rubles (153,400-124,366), VAT is already deducted from this amount, which will be 18%, i.e. 4429 rubles. Net operating income after paying taxes will be - Debit 91-9/Credit 99 - 24,605 rubles (153,400-124366-4429).

The legal status of an entrepreneur is determined by the type of registration with the tax authority. Is an individual entrepreneur an individual or a legal entity? Let's look at this issue in detail.

Read about what outstaffing is and how it differs from outsourcing in this article.

Consequences for the parties

The main consequence is the transfer of the obligation to pay the amount to another person. An agreement is concluded if the original debtor cannot fulfill his obligation to the creditor and another person, as well as the creditor, agree to replace the parties.

The transaction must comply with the provisions of the Civil Code of the Russian Federation, namely Articles 382-392. A document can be declared invalid only if it was concluded without the knowledge of the creditor, that is, his consent was not obtained. Accordingly, concluding a tripartite agreement is the best option .

It is also worth considering some tax consequences that differ for each party:

- Paragraph 3 of Article 170 of the Tax Code of the Russian Federation establishes that there are no tax consequences for the debtor. VAT cannot be restored in such a case;

- the original creditor may also not pay VAT, this is confirmed by judicial practice;

- the person who receives the right to claim the debt, that is, the new debtor to the old creditor, receives the obligation to pay VAT only if the debt relates to transactions that are subject to such tax, for example, the provision of services or the performance of work.

You also need to consider the conditions under which the debt was assigned to the new debtor. If he does not receive the right of claim, then the original debtor actually receives profit, the tax on which is paid based on the applicable taxation system.

Contract structure

Most credit institutions are looking for opportunities to improve efficiency among borrowers, thanks to which they will repay the borrowed funds on time.

An assignment agreement is one of the effective methods in which the rights of claim to a debt are transferred to a third party.

An agreement on the assignment of rights to claim an assignment must have the following mandatory components:

- preamble, which indicates the date and time of conclusion of the contract, and information about the parties;

- subject of the contract;

- fixed contract price and a clear procedure for conducting settlement operations;

- rights and obligations of the assignor and assignee;

- procedure for terminating the contract and resolving disputes;

- act of acceptance/transfer of property.

For most cases, the parties are provided with a ready-made template of this agreement. The assignor assumes responsibility for the veracity of the data provided.

How to draw up an agreement

The transfer of debt is carried out in the same form as the assignment of the right of claim (Article 389 of the Civil Code of the Russian Federation). If the initial transaction was concluded in notarial form, then the assignment of rights should be concluded in the same way. If not, then a simple written agreement is sufficient.

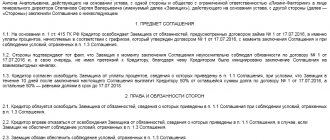

The agreement between debtors must contain the following information:

- details of the parties, including information about persons who act on their behalf and documents confirming their authority;

- reference to the documents on the basis of which the debt to the creditor arose;

- data of the creditor, that is, its full details;

- the volume of obligations that are transferred to the new debtor;

- signatures of the parties and date of conclusion of the agreement.

It is important to understand that the actual assignment of the debt will only take place after an agreement has been concluded between the new debtor and the creditor. Until this point, any agreements between debtors will be only preliminary and apply only to them.

The agreement between the new debtor and the creditor is concluded in the same form as agreements between debtors. The text must indicate:

- details of the parties by analogy with the previous agreement;

- reference to the contract on the basis of which the obligation arose, as well as to the agreement between the debtors;

- other conditions related to debt repayment, for example, the period when the repayment will be made.

At the end of the document, signatures of representatives, seals and date must be placed.