How are FSS contributions calculated in 1C?

The tariff for automatic calculation and calculation of contributions is set in 1C by the corresponding organization settings:

Salaries and personnel/ Directories and settings/ Salary accounting settings, “Taxes and payroll contributions” tab

As well as the settings of a specific employee (for example, status or disability).

1C Accounting 8.3 calculates insurance premiums for wages, according to the tariff, simultaneously with the salary itself, using the same document. On the “Contributions” tab of the “Payroll” document, you can see the amounts of accrued contributions, including social insurance.

You can see how salaries are calculated in our video:

4-FSS – Table 3

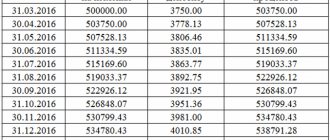

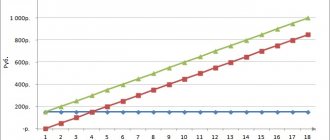

Let’s check Table 3 to see how the basis for calculating contributions has developed. You can check the data using the accrued salary summary or the specialized report “Analysis of contributions to funds”.

The summary of accrued salaries in 1C 8.3 is located:

Select the Complete set of accruals, deductions and payments:

Set the period and click Generate:

Look at the Accrued line:

We see that this amount is reflected in form 4-FSS:

Payments that are not subject to contributions are not included in the 4-FSS reporting. For example,

- payments not related to labor relations or the concluded civil contract agreement,

- gifts under a gift agreement,

- payments to non-employees of the organization,

- dividends.

Analysis of contributions to funds in 1C 8.3 is located in the section Salaries and Personnel - Salary Reports:

Next, set the period and click Generate:

In the window that appears, we look at the amounts Accrued in total, Not taxed, which fall into form 4-FSS:

You can also check the taxable contribution base:

We also check in line 8 those amounts from the base for calculating contributions that are subject to a special tariff. In particular, the amount of payments to foreigners temporarily staying:

If line 8 is completed, then you need to check the completion of Table 3.1:

Read our article on how insurance premiums for foreign workers are calculated in 1C 8.3 programs.

Payment of contributions to the Social Insurance Fund

To register the payment of social insurance contributions in 1C, a bank statement must be entered as a document “Write-off from a current account”, which has the type of transaction “Payment of tax” and the tax details “Insurance contributions to the Social Insurance Fund” (or “Insurance contributions to the Social Insurance Fund from accidents”) and "Contributions".

4-FSS – Table 6

In Table 6, the number of working disabled people and the OKVED code in 1C 8.3 are entered automatically, and the number of employees working with harmful factors is filled in manually, if necessary:

The data in Table 6 is checked using the report Analysis of Social Insurance Fund contributions of the Social Insurance Fund section:

In our example of filling out table 6, all amounts are the same:

Discrepancies between the third and sixth tables may arise if there were payments under GPC agreements. Since these payments are not subject to FSS NS contributions, they are therefore not included in Table 6.

Also, discrepancies between tables 3 and 6 may arise regarding payments to temporarily staying, highly qualified foreigners, since these payments are not subject to FSS contributions, but are subject to FSS NS contributions.

In other cases, the data in tables 3 and 6 must match. It is worth noting that in Table 6 there is no limit on the base for calculating contributions.

In Table 6, lines 5-8 indicate the size of the tariff, since discounts or surcharges can be established to the insurance rates of the Federal Social Insurance Fund, so if necessary, then in 1C 8.3 these lines are filled in manually.

Reporting to the Social Insurance Fund

The regulated form 4-FSS “Calculation of accrued and paid insurance premiums” must be submitted to the FSS on a quarterly basis. In "1C: Accounting 8.3" this form is filled out through a special workplace "1C: Reporting".

The program allows you to connect the paid service “1C: Reporting”, which provides electronic exchange with the government. authorities and submitting reports via the Internet. But even if this service is not connected, in 1C you can create and automatically fill out the required reports, save them in the program and then upload them as a file or print them for paper submission.

Reports/ 1C:Reporting/ Regulated reports

To create a new regulated report, click “Create” and select the type of report in the form that opens. In our case, we need to open the “Reporting to funds” group and select 4-FSS.

After this, a window will appear to select an organization (if there are several) and a reporting period. The selected period cannot be changed subsequently (if the period was selected incorrectly, you will have to create a new report).

After selecting the period, the 4-FSS report itself will open. The tabs on the left panel correspond to sections of the report; when you click on a tab, the section is displayed on the right side. In order for data to appear in the report sections, you must click the “Fill” button; without this, the report will remain empty.

Sections of the report are filled in with data based on the completed documents available in the program. For example, in Table 1 of Section 1, the indicators “Accrued for payment of insurance premiums” will reflect the amount of contributions taken from the payroll documents for the corresponding period.

Please note : if sick leaves were entered during the reporting period, then the amount of benefits accrued for them automatically falls into the indicator “Expenses for compulsory insurance purposes” 4-FSS; no additional actions are required for this.

Paid contributions are also included in the report automatically from bank statements recording the payment of contributions to the Social Insurance Fund. It is also possible to add new lines to reflect the payment of contributions.

In addition, paid benefits are reflected in table 2 of section 1 (“Expenses for compulsory social insurance”), as well as in table 3 of section 1 (“Calculation of the base for calculating contributions”) as non-taxable amounts.

Similarly, the program fills out section 2 related to insurance against industrial accidents.

For some indicators, the report provides a transcript. For example, to see what the amount of temporary disability benefits in Table 2 is made up of, you need to highlight this indicator and click “Decipher”. A window will open displaying employees and the amounts of benefits accrued to them.

Unlike accounting and analytical reports, the user can save all regulated reports in the program, in the “1C: Reporting” list, by clicking the “Record” button. Each report can be downloaded as a file to your hard drive or storage media, or printed using the appropriate buttons.

If necessary, the program allows you to generate not only a 4-FSS report, but also a 4a-FSS report (provided by certain categories of individuals).

4-FSS – Table 5

In our case, in Table 2, Column 5, the amount was filled in, since there was payment for additional days off to care for disabled children, which is reimbursed by the Social Insurance Fund from the federal budget:

Accordingly, Table 5 was automatically filled in in 1C 8.3:

4-FSS – Table 10

Table 10 in 1C 8.3 Accounting 3.0 is filled out manually as of the beginning of the year. In our case, there are 3 certified workplaces for which a special assessment of working conditions was carried out:

Table 10 consists of two blocks:

- The first block is information about the special assessment, which indicates the total number of jobs of the insured and the number of jobs for which a special assessment or certification of jobs was carried out. If a special assessment was not carried out, then “0” is entered in columns 4-6.

- The second block reflects information about medical examinations in connection with “harmfulness”, which indicates how many employees must undergo a medical examination and how many have passed as of the beginning of the year.

After filling out Form 4-FSS in 1C 8.3 and checking all the completed data using the settings:

This way you can leave the completed signs and remove the unnecessary ones:

Next, the generated 4-FSS report can be printed or downloaded and sent to the Fund:

You can check the control ratios in the 1C 8.3 database and on the FSS portal.

On the PROFBUKH8 website you can read other free articles and video tutorials on the 1C Accounting 8.3 (8.2) configuration:

Full list of our offers:

Give your rating to this article: (

2 ratings, average: 5.00 out of 5)

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?