Conditions for receiving a deduction

An individual entrepreneur can reduce UTII or PSN by the amount of expenses for the purchase of cash register equipment included in the cash register register.

At the same time, cash register equipment must be used when making payments in the course of business activities subject to UTII or PSN. The deduction can be obtained subject to registration of the cash register with the tax authorities from February 1, 2021 to July 1, 2021. However, for individual entrepreneurs engaged in retail trade and/or public catering and having employees, a different deadline has been established for registering cash registers to receive a deduction - from February 1, 2021 to July 1, 2021. This is due to the fact that such entrepreneurs did not receive a deferment on the obligation to use cash registers until July 1, 2021.

Deduction for individual entrepreneurs on PSN

PSN involves payment of the cost of the patent after its receipt. This is what will be reduced by the amount of the deduction accepted in connection with the introduction of cash register equipment.

You must first obtain a patent, since its details are indicated in the application for tax reduction. By the way, the document itself has not yet been developed, so an entrepreneur can notify the Federal Tax Service in free form about a decrease in the value of a patent. The main thing is that this message contains all the details specified in Article 2 of Law 349-FZ of November 27, 2021, namely:

- Full name and TIN of the entrepreneur;

- model and serial number of the cash register for which the deduction is claimed;

- the amount of expenses that reduce the tax.

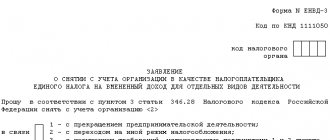

To notify the tax authority, the easiest way is to use the same form of explanatory note that the Federal Tax Service proposed for UTII payers. The following image shows an example of such a form. Please note that the document title needs to be changed:

After submitting this notification to the Federal Tax Service, the individual entrepreneur on the PSN reduces the cost of the patent by the declared amount. However, if the Federal Tax Service considers that the entrepreneur has provided false information, he will be denied a deduction . In this case, he will be sent a corresponding notification, the form of which has not yet been approved.

An entrepreneur reduces the cost of a patent for cash deductions down to zero. But it may happen that the entire amount of the deduction “will not fit” into the amount that the individual entrepreneur must pay for the patent. In this case, the remainder can be written off from the cost of the patent for other activities, if, of course, the entrepreneur receives it.

We recommend reading the article, which answers some practical questions about the possibility of applying a deduction on cash registers.

Deduction from UTII

The tax calculated for the quarter can be reduced on the costs of acquiring cash registers down to zero.

These expenses do not have to be included in the return of only one tax period. Unlike insurance premiums, which reduce the tax only for the period in which they are paid, the cost of CCP can be taken into account for several quarters. Therefore, you first need to reduce the tax on contributions, and then reduce the remaining tax by the amount spent on purchasing cash register equipment. The amount of expenses for cash register systems that did not fit into the tax reduction for one quarter can be taken into account in the next period. To exercise the right of individual entrepreneurs to deduct, the tax authorities planned to change the declaration. However, the new form will definitely not appear by the beginning of the reporting period for the 1st quarter. And therefore, the Federal Tax Service issued a letter dated February 20, 2018 No. SD-4-3/ [email protected] , in which it proposed to take into account the costs of purchasing cash registers in the current declaration form, and the amount of these costs should not be shown anywhere in it, but should be attached to the report explanatory note.

In this case, line 040 of section 3 is calculated taking into account the expenses incurred for the purchase of cash register equipment.

Example:

The individual entrepreneur purchased two copies of the CCP. The expenses for one amounted to 33,000 rubles, for the second 16,045 rubles. You can accept 18,000 rubles as a tax reduction. for the first cash register and 16,045 rubles. on the second. In section 3 of the declaration, expenses for the purchase of cash registers are not indicated, but when calculating line 040, the amount of expenses was taken into account: 16,045 rubles. one cash register and 14,328 rubles. according to the second cash register, therefore, there is no tax to be paid for the 1st quarter. The remaining portion of the amount for the purchase of the second cash register (18,000 - 14,328) will be accepted as a tax reduction in the 2nd quarter.

Deduction amount

It is legally stipulated that the deduction amount cannot exceed 18,000 rubles per unit of cash register equipment . It is impossible to sum up the costs of different copies of CCP. That is, if one cash register cost 20,000 rubles, and the second - 15,000 rubles, then the deduction will be:

- 18,000 rubles for the first cash register;

- 15,000 rubles for the second.

The deduction can include not only the costs of purchasing the device itself, but also related expenses. For example, 15,000 rubles for a cash register plus 3,000 rubles from the cost of a fiscal drive, services for setting up a cash register or updating software.

Business entities can fulfill the obligation to implement cash register equipment not only by purchasing and installing the device. There are services that provide cloud cash registers for rent. So, rent for a cash register as a service is not included in the list of costs that can be deducted from individual entrepreneur tax.

Answers to popular questions

Can an individual entrepreneur using the simplified tax system receive a deduction for purchasing an online cash register?

Only in the case when the individual entrepreneur combines the simplified tax system and UTII / PSN. Then you can offset the costs of those cash desks that are used for imputation or patent. Companies and entrepreneurs using a simplified system are not provided with a cash deduction.

If an online cash register was purchased in 2021, is it possible to receive a deduction?

Yes, but only if you registered it with the Federal Tax Service after February 1. If you registered an online cash register in January 2021, you cannot refund the costs of its purchase.

What are the features of obtaining a deduction for individual entrepreneurs in the field of trade and catering with hired employees?

Trade and catering with hired employees. These entrepreneurs must register a cash register before July 1, 2021. They will receive their deductions only for the 2021 tax periods.

Is it possible to get a tax deduction when upgrading an old cash register purchased second-hand from a cash register?

Only those individual entrepreneurs who purchased a new cash register from the official list of brands, the register of which is posted on the Federal Tax Service website, will be able to count on compensation. Regarding the improved old cash registers, information is not yet available.

Is it possible to receive a deduction for an individual entrepreneur working in an area that is significantly removed from communication networks? The KKM meets all requirements, and current legislation does not force the retailer to work with the OFD.

If the purchased cash register is able to support the mode of sending information through the OFD, but in practice it does not work due to the remoteness of the enterprise from Internet cables, the individual entrepreneur has the right to receive a tax deduction.

What costs can be covered with a CCP deduction?

When calculating compensation, you can take into account expenses for:

- purchasing the cash register itself or modifying it to comply with new legal requirements;

- fiscal storage;

- software;

- works and services related to setup and registration.

Do I need to present receipts for confirmation? In our experience, the Federal Tax Service usually does not request them. However, it is still worth keeping these documents while you use the cash register.

General rules of use

The deduction can be used in one tax period or, if it is greater than the amount due, the balance can be carried forward to other periods. For UTII, the period is equal to 1 quarter, for PSN - the validity period of the patent.

The tax can be cut by 100% and pay nothing in one or even several periods. This distinguishes the cash deduction from other types of compensation (for example, insurance premiums for workers), which allow you to write off no more than 50%.

The first step for registration is purchasing cash register equipment and registering it with the Federal Tax Service. Further actions depend on the taxation system.

How to apply and who is entitled to a tax deduction for an online cash register

Date of publication: 04/23/2018 16:25

In accordance with the law of November 27, 2017 No. 349-FZ “On Amendments to Part Two of the Tax Code of the Russian Federation,” from January 1, 2021, individual entrepreneurs have the right to a tax deduction for online cash registers.

Individual entrepreneurs who use a patent tax system or pay a single tax on imputed income are allowed to deduct the costs of online cash register systems from the tax amount.

Thus, you can return up to 18,000 rubles for each cash register. This amount may include not only the cost of the cash register itself: you can take into account the costs of purchasing a fiscal drive, necessary programs, setup services and other costs for bringing the equipment into working mode.

Tax deduction for the purchase of cash registers: mandatory requirements

The benefit does not apply to all cash registers: there are conditions that must be observed.

- firstly, a tax deduction is provided only for cash registers included in the official register of the Federal Tax Service.

- secondly, the cash register must be registered, otherwise it will not be possible to return the money spent on it.

It is important to register the cash register as soon as possible - preferably immediately after purchase. The tax deduction for online cash registers does not apply to the period before registration.

Whether your expenses will be reimbursed depends on your activities and the date of registration of the cash register:

- Individual entrepreneurs on PSN or UTII in the field of retail trade or public catering who have employees on employment contracts can receive a deduction if they registered a cash register from February 1, 2021 to July 1, 2018. Thus, they can receive a tax deduction when purchasing an online cash register only in 2021.

- Other individual entrepreneurs on UTII and PSN can receive a deduction if they registered the cash register from February 1, 2021 to July 1, 2021.

Thus, if you are an individual entrepreneur on UTII in the catering industry - for example, you have a small cafe - then it would be most profitable to purchase a cash register as soon as possible and immediately register it: you are guaranteed to receive a tax deduction when purchasing an online cash register in 2021. But in 2021, you will be able to claim reimbursement only if you do not have hired employees. If, according to an employment contract, at least one person is employed in your cafe, you will no longer be able to return expenses to the cash register.

If you combine UTII and PSN, you will be able to receive a tax deduction for an online cash register using only one mode.

UTII deduction when purchasing an online cash register

When purchasing an online cash register for UTII, a tax deduction cannot be obtained for the period that preceded the registration of the cash register. The tax amount is reduced when calculated for the tax periods 2021 and 2021, but not earlier than the period in which the device was registered. If the UTII amount is less than the deduction for the online cash register, then you can transfer the balance to the following periods until the end of 2021.

Tax deduction on cash registers for PSN

For individual entrepreneurs on PSN, the tax amount is reduced for periods that begin in 2021 and end after registration of the cash register. If costs exceed the limit, the balance is taken into account when calculating taxes for subsequent periods. And if the tax amount turns out to be less than the costs, you can reduce the patent for other types of activities if a cash register is used for them.

How to get a tax deduction when purchasing an online cash register

To apply for a deduction, individual entrepreneurs on UTII must submit a tax return and reflect the costs of cash register in it.

Entrepreneurs on PSN need to provide the tax office with a notice of a reduction in the amount of payment under the patent.

Entrepreneurs on PSN need to provide the tax office with a notice of a reduction in the amount of payment under the patent. The form of notification of a reduction in tax paid in connection with the use of the patent taxation system for the amount of expenses for the acquisition of cash register equipment is recommended by letter of the Federal Tax Service of Russia dated 04.04.2018 No. SD-4-3/ [email protected] An individual entrepreneur has the right to notify the tax authority about reducing the amount of tax paid in connection with the use of the patent taxation system, in any form with the obligatory indication of information provided for in Article 2 of Federal Law No. 349-FZ of November 27, 2017:

- last name, first name, patronymic (if any) of the taxpayer;

- taxpayer identification number (TIN);

- the number and date of the patent in respect of which the amount of tax paid in connection with the application of the patent taxation system is being reduced, the timing of payment of the reduced payments and the amount of expenses for the purchase of cash register equipment by which they are reduced;

- the model and serial number of the cash register equipment in respect of which the amount of tax paid in connection with the use of the patent taxation system is reduced;

- the amount of expenses incurred to purchase the relevant cash register equipment.

If you have already paid the amount from which you want to receive a deduction, you must submit a tax application for a refund of the overpaid tax.

The declaration or notification must be accompanied by a document confirming the costs of purchasing a cash register, fiscal drive, software, performing work on setting them up and providing related services, including the modernization of the old cash register.

Documents are submitted to the tax authority where the entrepreneur is registered as a taxpayer and where he has paid or is going to pay the tax from which he wants to receive a deduction.

How to apply for a deduction

To obtain a deduction, individual entrepreneurs submit a tax return .

Individual entrepreneurs on PSN write an application in written or electronic form (in this case, an electronic signature is required). The law mentions a special form according to which the application is drawn up. By early December it had not yet been approved. But the law says that until the form is approved, the application is drawn up in free form.

In the application for PSN, you must indicate the taxpayer’s information:

- FULL NAME;

- tax identification number (TIN);

- patent date and number;

- amount of deduction and tax payment date;

- official model name, factory cash register number;

- how much money was spent on the cash register, physical functions, software and setup.

You can submit an application form for a tax deduction for the purchase of an online cash register:

An example of a form for receiving a deduction at an online cash register

The individual entrepreneur submits the documents to the tax office where he is registered and where he will pay (or has already paid) the tax from which he plans to receive a deduction.

Deduction for the purchase of an online cash register for PSN

For individual entrepreneurs on PSN, the tax amount is reduced for periods that begin in 2021 and end after registration of the cash register. If costs exceed the limit, the balance is taken into account when calculating taxes for subsequent periods. And if the tax amount turns out to be less than the costs, you can reduce the patent for other types of activities if a cash register is used for them.

If the entrepreneur has already paid the tax, the cash can still be returned. To do this, it is enough to submit an application and documents to your tax office with a request to return the overpayment or take it into account in future payments. The tax office will return the money within a month or count the overpayment for 10 days (Article 78 of the Tax Code of the Russian Federation).

An entrepreneur must submit an application to the tax office on a special form “Form for KND 1112020”. Application on paper - you can bring it to the tax office in person or send it by mail. Or submit an application electronically.

UTII deduction when purchasing an online cash register

When purchasing an online cash register for UTII, a tax deduction cannot be obtained for the period that preceded the registration of the cash register. The tax amount is reduced when calculated for the tax periods 2021 and 2021, but not earlier than the period in which the device was registered. If the UTII amount is less than the deduction for the online cash register, then you can transfer the balance to the following periods until the end of 2021

The amount of UTII payable at the end of the tax period may be reduced by the amount of the deduction. The individual entrepreneur declares the deduction amount in his UTII declaration. The UTII declaration in the form approved by order of the Federal Tax Service of Russia dated July 4, 2014 No. ММВ-7-3/ [email protected] does not contain a mechanism for reducing the tax payable on the costs of acquiring a cash register. Therefore, along with the declaration, the Federal Tax Service of Russia recommends submitting an explanatory note to the tax office. Information must be indicated separately for each copy of the cash register (letter of the Federal Tax Service of Russia dated February 20, 2018 No. SD-4-3 / [email protected] ).