Most commercial enterprises constantly work with cash and undertake to transfer the profits received to the bank for safekeeping on time. At the same time, the manager cannot send every penny to the organization’s account - at the end of the work shift, the cash register limit. For whom does it apply, how to calculate it and formalize it correctly?

Are you switching to an online checkout? We will select a cash register for your business in 5 minutes.

Leave a request and get a consultation.

Basic Concepts

The cash balance limit is a certain amount of investment that can be kept in the cash register when the day ends. Phenomena of this plane are also called the remnant of the transitional type.

The set of rules for determining the cash limit is described in detail in one of the instructions of the Central Bank of Russia. This is document number 3210-U, dated March 11, 2014. This calculation procedure requires special attention. It is believed that the cash limit in 2021 is zero if it should be, but is not set. In this case, no one in the organization has the right to keep money in the cash register at the end of the working day. The situation when the limit is underestimated relative to the needs of a particular manager is also considered not very convenient.

Violation – when money is kept in the cash register beyond certain limits. This may result in administrative liability. Legal entities pay a fine of 40-50 thousand rubles. Officials and individual entrepreneurs – from 4 to 5 thousand.

Exceeding the established limit becomes possible only sometimes; its cancellation is acceptable. For example, on days when salaries or scholarships are issued. Or when social payments are made. It is allowed to store “extra” money on weekends or holidays, when many financial institutions themselves do not work.

What are the risks of exceeding the limit?

If you exceed the cash balance limit and do not deposit the difference in a timely manner to the bank, then administrative liability will follow. The fine in this case ranges from 40,000 to 50,000 rubles. for organizations. An official, for example the head of an organization or an entrepreneur, will pay from 4,000 to 5,000 rubles for such a violation. This procedure is established by Articles 2.4 and 15.1 of the Code of the Russian Federation on Administrative Offences.

Important detail. Cases related to violation of the cash balance limit are considered by tax inspectorates (Article 23.5 of the Code of Administrative Offenses of the Russian Federation). Since such a violation is not ongoing, inspectors have the right to hold the organization accountable only within two months from the date of its commission (and not from the date of discovery). This conclusion follows from the provisions of Part 1 of Article 4.5 and Subparagraph 6 of Part 1 of Article 24.5 of the Code of the Russian Federation on Administrative Offenses and is confirmed by arbitration practice (see, for example, resolutions of the Federal Antimonopoly Service of the North-Western District dated June 20, 2006 No. A56-49021/2005, North Caucasus District dated December 13, 2005 No. F08-5915/2005-2341A).

Situation: can an organization be fined for exceeding the cash balance limit? The limit was exceeded due to late arrival of collectors. The collection schedule is established by agreement with the bank.

No you can not.

As a general rule, a guilty action (inaction) of an organization or official is recognized as an offense (Article 2.1 of the Code of Administrative Offenses of the Russian Federation). Consequently, liability for violating the cash balance limit occurs only if the guilt of the organization and (or) its leader is proven (Article 15.1 of the Code of Administrative Offenses of the Russian Federation). Guilt may be expressed in the fact that the organization and (or) its leader:

- sought to accumulate an excess balance (Clause 1, Article 2.2 of the Code of Administrative Offenses of the Russian Federation);

- foresaw the accumulation of an excess balance, but did not prevent it (clause 2 of article 2.2 of the Code of Administrative Offenses of the Russian Federation);

- did not expect the accumulation of an excess balance, although they should have and could have foreseen it (clause 2 of article 2.2 of the Code of Administrative Offenses of the Russian Federation).

Advice: to prove that the organization is not at fault for violating the cash balance limit, record the fact of late arrival of collectors in the act.

In the situation under consideration, the excess balance arose due to the fault of the bank, which did not fulfill the terms of the collection agreement. If the organization documents this fact (indicating the date and time of the violation), it will not be possible to hold it accountable. This conclusion is confirmed by arbitration practice (see, for example, the resolution of the Federal Antimonopoly Service of the North-Western District dated August 17, 2007 No. A56-50165/2006).

About the timing of setting the limit in 2021

It is necessary to issue a corresponding order if the individual entrepreneur was registered in 2021 and plans to work with cash. Limit amounts are calculated based on estimated cash flows for a certain time in the future. If the individual entrepreneur is an experienced company and has been working in the market for some time, it would be a good idea to check the drafting of the previous limit order. It is permissible to extend the validity of an order if the deadline for the limit itself has not yet passed. A separate order is issued for this. It is possible to draw up a new, similar document; it simply indicates the deadline for the current year.

If there are no instructions for a specific period at all, then the individual entrepreneur’s indicators can be applied not only now, but also later, indefinitely. And there is no need to draw up or execute a new order. No one has an obligation to change the limit rules every year.

Cash discipline until June 2014

From June 1, 2014, a new procedure for conducting cash transactions has been applied. For information about the current procedure, read the article in our help.

From 2012 to June 1, 2014, Regulation 373-P was in force, which this article will tell you about.

According to the Regulation of the Central Bank of the Russian Federation dated October 12, 2011 No. 373-P “On the procedure for conducting cash transactions” (hereinafter referred to as the Regulation), from 2012 the old rules for cash management are canceled and new ones come into force.

Since 2012 the following have been cancelled:

- The procedure for conducting cash transactions in the Russian Federation, approved by decision of the Board of Directors of the Bank of Russia on September 22, 1993 N 40;

- Regulation of the Bank of Russia dated January 5, 1998 N 14-P “On the rules for organizing cash circulation on the territory of the Russian Federation.”

The new rules have simplified the procedure for working with cash for organizations, and made it more difficult for entrepreneurs.

Individual entrepreneurs will now be required to keep a cash register on a par with organizations. But this is not difficult at all if you use Contour.Elba!

Control over compliance with cash discipline will be taken over by the tax service, and not by banks, as was the case before.

Let's take a closer look at the main changes in order.

Submit reports without accounting knowledge

Elba will calculate taxes and prepare business reports based on the simplified tax system, UTII and patent. It will also help you create invoices, acts and invoices.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

The cash balance limit is now set by the enterprise itself

Enterprises now independently set the cash register limit - the amount of cash that can not be handed over to the bank and can be stored in the cash register (clause 1.3 of the Regulations). The document does not mention any participation of banks in this procedure. The manager issues a corresponding order in any form. Moreover, the company is not even required to notify the bank about the amount of the established cash balance limit: the document is stored in the company. An order establishing a limit on the organization's cash balance.

It is necessary to determine the cash balance limit in a new way based on previously received revenue, the peak of cash costs or the expected volume of revenue (for newly opened enterprises). The cash balance limit does not include amounts of cash for payments to employees of the enterprise (salaries, stipends, vacation pay and other payments) - they can be kept in the cash register in excess of the established limit, but payments must be made within 5 working days.

The formula for calculating the limit is as follows: Limit = R × N / P , where: R is the volume of revenue for the billing period in the same period of previous years or the estimated volume of revenue or the peak volume of cash withdrawals. P - billing period determined at the discretion of the enterprise, but not more than 92 working days. Working days are considered to be the days on which the enterprise operated. N is the period of time between the days of depositing cash into the bank. It is set at the discretion of the enterprise, but should not exceed 7 working days, and if the bank is far away - 14 working days.

Try Elba 30 days free

Accounting for income and expenses at the cash desk is easy! See for yourself, take advantage of the Elbe.

The regulation does not stipulate for what period the cash limit should be set. This issue is left to the discretion of the enterprise. You can set a limit for a month, quarter, year or other reasonable period. And revise if necessary.

An example of an order to set a limit.

The rules for processing cash transactions have changed

According to the new rules, cash transactions are executed on the basis of six documents:

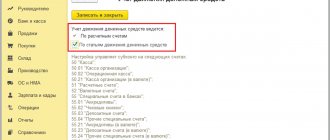

- Cash book (form 0310004) - to summarize information about the company’s cash transactions.

- Receipt (form 0310001) and expense (form 0310002) orders for registering the receipt of cash to the cash desk and the withdrawal of cash from the cash register.

- A book of accounting for cash received and issued by the cashier (form 0310005) to record the movement of cash between the senior cashier and the rest of the company's cashiers during the working day.

- Payroll (form 0301009) for recording time worked, accruals, deductions and payments to company employees.

- Payroll (form 0301011) to record salaries and other payments issued to employees.

The forms of other cash documents are not specified in the new Regulations. Some are no longer needed. For example, the KO-3 journal for registering incoming and outgoing orders is a thing of the past. Previously, at the end of the working day, the cashier had to transfer to the accounting department a second (tear-off) copy of the cash book sheet with the corresponding cash orders and other documents attached. Now you don't need to do this. The Regulations also do not indicate what form the company employees should use to prepare advance reports. However, to avoid unnecessary questions, we recommend using the previous form.

The procedure for storing cash documents is also at the discretion of management. It is only indicated that they must be stored for the periods established by the archival legislation of the Russian Federation (clause 1.9 of the Regulations).

Cash registers

Until 2012, every company that handled cash was required to have an isolated and fortified cash room. It was difficult and sometimes simply impossible to fulfill this requirement. And the inspectors fined those who were guilty.

The good news: the new Regulations do not impose any requirements for the arrangement of a cash register at all. Moreover, the choice of the place where the company will make cash payments is completely left to the discretion of its management (clause 1.2 of the Regulations). That is, the cash register can be a separate room, an accounting department, or a manager’s office. Moreover, it is not required that the cash register be located in any room at all. For example, the Regulations do not prohibit placing it in a car.

The company itself determines how and where to equip the cash register and how to ensure its security. What is stated in paragraph 1.11 of the Regulations. So, starting from the new year, there is no need to equip a small “fortress” in the office in order, for example, to issue a couple of thousand rubles to employees for reporting purposes once a month. The procedure and timing for checking the availability of money in the cash register is also established by the head of the company.

How to install correctly

- The bank servicing the enterprise or individual entrepreneur receives a settlement filled out in form No. 0408020. When served by several banks, the document is submitted to only one of them, the manager himself chooses which one. Everyone else must be informed about the amount in the document and which organization the documents are being submitted to.

- When calculating the revenue of an individual entrepreneur, one must keep in mind not only its amount. But also all the funds that have been credited to the account over the past three months.

- The calculation is made based on the period actually worked, if the enterprise has just been created, there have been no receipts yet. You can take as a basis the revenue that the company plans to receive in the future.

- All incoming IP amounts for three months are divided by the number of hours in the billing period if you need to calculate the average profit by day.

- After this, individual entrepreneur expenses incurred over three months are considered. They are divided by the number of hours during the billing period. This amount does not include scholarships, benefits and salaries.

- The time when the amount is handed over to the main cash desk of the enterprise, to the collector, is indicated separately.

- The limit amount is indicated depending on the average income for one day. But it must be such as to ensure normal operation until the next collection.

- When calculating amounts, enterprise management indicates more than the actual revenue received per day. There are no restrictions for this in banks.

- You can change the set IP limit if it is not enough for normal operation. Then you need to send a covering letter to the bank. In which the reason why changes need to be made must be written.

- No one has the right to leave a large amount in the cash desk after receiving a resolution from the head of the bank under the established limit.

- Excess amounts for individual entrepreneurs are allowed to be issued to accountable persons. But they should have a maximum of 60 thousand rubles at their disposal.

How to avoid a fine for not using a cash register

Law-abiding entrepreneurs are given the opportunity to avoid punishment. This is possible if the individual entrepreneur independently contacted the regulatory authorities and reported a violation before it was discovered by the authorities. To do this, a corresponding application with attached documents is formed, and subsequently the necessary tax is paid.

Summarizing all of the above, we can conclude that a fine for lack of a cash register is a method of dealing with persistent violators who do not want to conduct business transparently. With fair trading or other type of activity, you will receive a lot of benefits from cash registers, gain the trust of customers and never receive fines for not having an online cash register.

Need help choosing an online cash register?

Don’t waste time, we will provide a free consultation and select a suitable online cash register.

An example of a formula for calculating the cash limit

There are formulas for cash calculations.

When receiving proceeds in cash

L=V/P*Nc

The designations are deciphered as follows.

Nc – this is how the time period is designated. On certain days, a person with legal status is engaged in handing over money for the sale of goods. This time is calculated between such days. This period of time usually does not exceed seven business days. The period increases to two working weeks if the legal entity operates in an area where there is no bank branch. Nc is determined separately if there are circumstances of uncertain force.

P – is the designation of the billing period. During this time period, all money received and received is taken into account. Measured in working days. You can take into account periods of time when profits are greatest. The maximum possible value of the billing period is 92 working days.

V – is the total amount of funds received into the account over a certain period of time. If a legal entity has divisions with separate work, they are all taken into account in the total amount.

L - there is a limit on the remaining amount of cash, indicated in rubles

Results

The figure corresponding to the amount above which the cash balance in the legal entity’s operating cash desk at the end of the working day cannot be exceeded should be determined by the legal entity itself, using a legally established formula.

The formula has 2 outwardly identical options, which differ fundamentally in the characteristics of the volume of cash money involved in the calculation: this is either the volume of sales or the volume of payments for a certain period. Other indicators included in the formula are similar in meaning, but their meanings depend on what specific (sales or payments) volume of cash is taken as the basis for the calculation. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What to do if there are no receipts

You must indicate cash in the amount that was issued in 2021, or the expected amount of profit and expenses. Various employee benefits are excluded from this scheme.

L=R/P *Nn

Nn – is a time period, measured in days, between which legal entities receive cash on the basis of a check. Should not be more than one week. Or two working days if the company is located in an area where there are no bank branches. It is separately determined if there is a case of force majeure.

P – is a settlement period determined independently by those who have the status of a legal entity. This is the time during which it is necessary to take into account the amount of cash received. The maximum period in working days is 92. It is necessary to take into account how funds moved and worked over the same period, but in previous years, the time when the issuance was peak.

L - the limit itself in rubles

Limits on withdrawal of funds in payment systems

The limits of payment systems depend on several factors. In most cases, users who have passed the verification procedure are subject to more lenient restrictions than those who have not been verified.

| № | Payment system name | Withdrawal limit with verification | Withdrawal limit without verification |

| 1 | Yandex money | 75,000 rub. from an identified wallet, 15,000 – from a personal wallet to a card | Funds will not be withdrawn without verification |

| 2 | QIWI | 200,000 rub. per month, 60,000 rub. in one operation | 40,000 rub. per month. |

| 3 | Sberbank Online | For cards of international payment systems RUB 5,000,000. per month, through an ATM - no more than 150,000 rubles. per day. For Visa Gold and MasterCard Gold cards RUB 10,000,000. per month, through an ATM no more than 300,000 rubles. per day. With Sbercard cards RUB 300,000. per day, through an ATM - no more than 150,000 rubles. per day. | Withdrawal is not possible |

| 4 | Alpha click | Limits depend on the service package. The minimum limit for a one-time transfer to another bank is 100,000 rubles, a daily transfer is 200,000 rubles, a monthly transfer is 1,500,000 rubles. Higher limits apply for transfers between Alfa Bank cards. | Withdrawal is not possible |

| 5 | PayPal | RUB 550,000 per transaction | 40,000 rub. per month (total volume of financial transactions) |

| 6 | Gold Crown | 5,000 dollars per day, 1,000,000 rubles per month, 1,500,000 rubles per 2 months, 2,000,000 rubles per 90 days | 5,000 dollars per day, 1,000,000 rubles per month, 1,500,000 rubles per 2 months, 2,000,000 rubles per 90 days |

| 7 | VISA | Depends on the issuing bank | Depends on the issuing bank |

| 8 | Western Union | 600,000 rub. per month | Translation is not possible |

| 9 | Privat24 | The limit is set by the user | Withdrawal is not possible |

| 10 | WebMoney | 12,000 per day, 30,000 dollars per week, 60,000 dollars per month | $100 per day, $300 per week, $500 per month |

| 11 | Wallet One | Up to 200,000 rub. per month | Up to 40,000 rub. per month |

| 12 | MasterCard | Depends on the issuing bank | Depends on the issuing bank |

| 13 | Unistream | Sending abroad up to $5,000 per day, up to 900,000 rubles through the Unistream CB cash desk | 3 transfers per day to one card, 300,000 rubles. in one translation |

| 14 | Multicard | Cash withdrawals cumulatively for all debit cards at the bank: up to RUB 350,000. per day, up to 2,000,000 rub. per month | Withdrawal is not possible |

| 15 | BEST | From 1% of the transfer amount | From 1% of the transfer amount |

| 16 | Payeer | 2500 USD per transaction, 4800 USD per card number per day, 20 000 USD per card number per month | 2000 USD per day |

| 17 | Paysend | Up to 5 transfers per day, up to 75,000 rubles from Russia, up to 1000 euros from Europe at a time | Up to 5 transfers per day, up to 75,000 rubles from Russia, up to 1000 euros from Europe at a time |

| 18 | Contact | One-time transfer to neighboring countries – up to 600,000 Russian rubles or 20,000 dollars/euro | One-time transfer to neighboring countries – up to 600,000 Russian rubles or 20,000 dollars/euro |

| 19 | Skrill | Depends on the country. Commission for withdrawing money from an account to a VISA bank card - 7.5%, MasterCard - 4.99% | Withdrawal is not possible |

| 20 | AdvCash | 2500 dollars per day | 500 dollars per day |

| 21 | Neteller | Installed per account | Installed per account |

| 22 | Transferwise | Limits depend on the currency chosen and the country it is sent to, but multiple transfers can be made within the limits | Limits depend on the currency chosen and the country it is sent to, but multiple transfers can be made within the limits |

| 23 | JCB | Depends on the issuing bank | Depends on the issuing bank |

| 24 | UnionPay | Depends on the bank through which the money is withdrawn | Depends on the bank through which the money is withdrawn |

| 25 | Paxum | $2,500 per day at ATM, number of transactions and withdrawal limits by other methods depend on account status | $2,500 per day at ATM, number of transactions and withdrawal limits by other methods depend on account status |

| 26 | American Express | Limits are set by banks issuing cards | Limits are set by banks issuing cards |

| 27 | Belkart | Limits are determined by the bank that issued the card | Limits are determined by the bank that issued the card |

| 28 | Idram | Limits depend on the withdrawal method, in most cases there are no restrictions | Limits depend on the withdrawal method |

| 29 | Paysera | Limits depend on account type | Up to 600 euros per day |

| 30 | Sofort | Limits depend on account type | Limits depend on account type |

| 31 | Ecoin | No limits | Up to $1000 |

How to deal with recalculation

Now each enterprise can choose whether to base its calculations on expenditure items or revenue in the form of cash in the cash register. In any company, the formula can be tied to the amount of cash spent. Previously, this opportunity was available only to representatives of organizations with missing revenue.

The formula is selected depending on which calculation option seems most convenient. After that, the approval of the limit for the new program, with an increased rate, remains. Does the revenue come in small amounts? Then it is profitable for companies to take the expenditure portion of funds as a basis.

But the new order does not differ in any changes in terms of management in companies in which there are no revenues at all. In this case, you still cannot use a formula tied to income.

The limit is set only in ruble equivalent, kopecks are not counted. And no major changes are expected in this part of the rules. From the explanations of the Federal Tax Service it follows that the rounding of the amount of interest is carried out according to general mathematical rules. For example, the balance of the amount less than 50 kopecks is discarded. You can round to the nearest 1 ruble if the balance is 50 kopecks or more.

Approval of a new limit at the cash desk is possible for any period. The period does not necessarily have to be a year, but it is necessary to issue an order. Or you can not indicate the time during which the limit is valid at all. Then you will not need to spend more time re-issuing documents or tracking the rules for their preparation.

Casino withdrawal limits

Online casinos also have certain withdrawal limits. However, there are sites that offer unlimited withdrawals. For example, clients of Casumo casino can take advantage of this opportunity.

However, in most cases, limits are still set, and there are several reasons for this. Firstly, it is unprofitable for a virtual platform to withdraw funds from circulation, especially in large quantities. Secondly, the more money a player has left in his account, the more likely he is to spend it on the game. Thirdly, limits apply to payment systems through which funds are withdrawn.

The following withdrawal limits apply at online casinos:

- At Mister Bit casino, the withdrawal limit is up to $100,000 per month;

- Pokerstars withdrawal limits – from $50 to a Yandex.Money wallet;

- At Europa Casino, the minimum withdrawal limit is 20 euros, the maximum is $9,990. But for players with VIP status, the upper limit increases;

- At SOL Casino the minimum withdrawal limit is 100 rubles. through payment systems and 2000 rubles. to Visa and MasterCard cards, maximum – up to 600,000 rubles. per day, up to RUB 5,000,000. per month;

- In Riobet, the limit is determined by the player’s status. Beginners can withdraw up to 120,000 rubles. per day, up to RUB 1,000,000. per month. VIP status allows you to withdraw up to 240,000 rubles. per day, up to 7,000,000 rub. per month. The minimum limit is 10 dollars or 500 rubles;

- In the Vulcan casino, the minimum withdrawal limit is set at 300 rubles, the maximum is 15,000 rubles. per day;

- 888 Poker casino allows withdrawals from $10 to an e-wallet and from $25 to a bank account up to $50,000 or euros per month.

Withdrawal limits at online casinos largely depend on the player’s status. Most of these sites provide the opportunity to increase your status due to the activity, frequency and size of your account replenishment. The higher the status, the higher the withdrawal limit.

Money from the cash register. What to spend it on

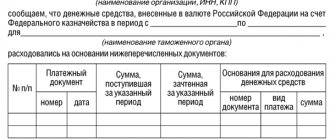

The decision on how the company spends the amount of money from the cash desk is made by the bank every year. It annually reviews the purposes for which certain funds are used. The results of calculations and cash desk decisions are displayed on both copies of the document.

It is easiest to spend money for the purposes specified in legislative acts and regulations if you coordinate your actions with the bank in advance. At the same time, there are no exact instructions for what purposes funds from the cash register can be spent.

The seventh paragraph, which describes the order in which cash transactions are carried out, indicates for what purposes cash proceeds can be spent.

- When things are purchased from the population, container products.

- Purchase of agricultural products.

- Social and labor benefits are paid

- Salary.

Limit for cash payments

In addition, as you know, there is also a limit for cash payments, which is equal to 100,000 rubles per agreement (clause 6 of Bank of Russia Directive No. 3073-U dated October 7, 2013).

Calculations are limited:

- between legal entities;

- between legal entities and individual entrepreneurs;

- between IPs.

Attention:

When making cash payments to individuals, you can use any amount.

The cash limit does not apply when issuing:

- salaries and social benefits;

- money on account;

- money for individual entrepreneurs for personal expenses.

The limit and its compliance: who checks?

Systematic verification of compliance with the rules and obligations for conducting cash transactions is the responsibility of banks. Separate recommendations are drawn up for banks on how such checks should be carried out.

A separate form of certificate is used for those involved in documenting checks carried out by banks. If necessary and upon receipt of a request, these certificates are submitted to the tax authorities. This is necessary to competently take action on liability, financial or under the administrative code, in cases where basic requirements are not met.

Only banks can control how an organization maintains cash records. But tax authorities can impose fines if the rules are not followed.

Who enforces the law?

A fine for violating cash discipline of an individual entrepreneur is usually issued after an inspection by the tax office and the bank providing services to the entrepreneur:

- Federal Tax Service. The fiscal service department works with a special department that carries out operational control of organizations. Employees of the department, upon request, go to entrepreneurs to check accounting documentation and monitor discipline. Failure to comply with the rules entails administrative punishment in the form of a fine. The limitation period is two months from the date of the administrative violation.

- Bank. Once every two years, bank employees go to the site of the organization they serve to check the accounting records. Typically, only the last quarter is reviewed. Bank employees leave the owner a certificate confirming the inspection. The document is presented to the tax office during their next audit. Sanctions for detected violations are imposed by the fiscal authority.

On video: Cash discipline of individual entrepreneurs

If you can’t, but really want to: the right to refuse the cash limit

The law gives some categories of enterprises and organizations, as well as individual entrepreneurs, the right to refuse to maintain the maximum established financial indicators at the cash desk.

Commercial companies classified as small businesses, as well as all individual entrepreneurs, can take advantage of this right, regardless of the tax regime they apply.

Waiving the limit at the cash register does not imply any special actions; it is quite enough to simply meet certain parameters:

- maximum income - no more than 800 thousand excluding VAT for services performed and goods sold;

- limited personnel - for the last calendar year, the number of employees at the enterprise should not exceed 100 people;

- participation in the authorized capital - no more than a quarter of the share of other legal entities.

If a company meets these requirements, then it can safely keep unlimited funds in the cash register.

In cases where the right to no cash limit arises not from the moment of registration of the enterprise, but, for some other reasons, in the course of its activities, then in order to use it, the management of the enterprise needs to take the following steps:

- In a written resolution, cancel the previously issued order establishing a cash limit;

- Issue a new order stating that from such and such a date there is no cash limit.

How to calculate cash limit

This is the question that most interests novice accountants. There is no need to rack your brains over it - calculation options are provided for by law:

- Based on the volume of cash receipts using the formula:

Limit = Revenue / Billing period x Days - By the volume of cash issuance (if there is no cash proceeds) using the formula:

Limit = Issues / Billing period x Days

Explanations:

Revenue is the amount of funds from the sale of services and the sale of goods. If the enterprise has just been created, then here you need to indicate the expected amount of revenue;

The billing period is from 1 to 91 days inclusive. It can be chosen absolutely arbitrarily;

Days – from 7-14 working days between cash deposits. It should be remembered that the fewer the number of days, the less money should remain in the cash register.

Thus, if an enterprise, due to circumstances established by law, is obliged to strictly observe cash discipline, carry out nightly calculations of daily revenue and deposit balances with the bank, then this must be done in accordance with all the rules and regulations established by the legislator. Otherwise, it is unlikely to be able to avoid administrative sanctions from regulatory authorities.

Incorrect storage of cash

In 2021, the fine for violating cash discipline of individual entrepreneurs also applies to the rules for storing funds. A separate room must be allocated for storing cash.

In a specially isolated room, the employee must make exclusively cash payments - accepting money, issuing it and directly storing it.

The absence of such premises serves as grounds for prosecution. What is the fine for violating cash discipline in 2017? The fine for violation of cash discipline in this case is 50 thousand rubles. However, by reading the Instructions of the Central Bank No. 3210-U and 3073-U, you can avoid mistakes and subsequent liability.