What are profitable investments?

The legislation determines that profitable investments in material assets should be considered financing the purchase of objects with a long period of use, which are endowed with a tangible form and are transferred to other entities for use in their economic activities for a certain period of time for a fee established by the contract.

These include, for example:

- Building.

- Facilities.

- Equipment.

- Vehicles, etc.

That is, in essence, these are fixed assets (fixed assets). But they have a main distinguishing feature - these assets are used in activities not by the owner himself, but by those who lease these assets. Thus, income-generating investments represent leased assets.

The company must carry out separate accounting of fixed assets and income-generating investments, since they have a different nature of use by the entity.

The rules of law require that objects acquired and transferred by an organization to another entity under a rental or leasing agreement must still be reflected in the accounting and reporting of the direct owner.

In this case, it does not matter for what funds the property was acquired - from own sources or from borrowed capital.

These objects must be registered at their original cost, which is the sum of the actual costs incurred for their purchase or construction.

Attention! However, like fixed assets, these assets should be reflected in reporting at their residual value, that is, the amount of depreciation accrued during their use is subtracted from the original cost. A separate line 1160 is provided in the balance sheet to reflect information about these objects.

Renting or leasing – what types of profitable investments are there?

The cost of a leased fixed asset can only be taken into account when it is actually a lease. There are two types of rent - property and financial (leasing). A classic lease means the following transaction:

- the object passes to another person temporarily and not forever;

- the lessor does not lose rights to the property;

- Tenants can use the property, but cannot dispose of it.

If we are talking about financial lease (leasing), the tenant buys the object from the owner only upon completion of the period specified in the agreement. In this case, the parties may decide that during the validity of the agreement the property will be on the balance sheet of the recipient, but ownership will remain with the lessor.

What is taken into account on account 03 of accounting

The current Chart of Accounts provides that income-generating investments must be accounted for separately from fixed assets in a special account 03.

Here you can see the objects that the company receives to generate income from renting them out for temporary use by third parties. These objects have the same cost as an OS and have a useful life of more than one year.

An important characteristic for this kind of objects is also established in the form of the presence of a material form. Thus, intangible assets (intangible assets) cannot be reflected in this account.

Thus, in account 03 it is necessary to take into account the costs of purchasing buildings, structures, equipment, vehicles, inventory, etc.

Attention! In addition, on this account it is necessary to show objects that are transferred to other counterparties under a leasing agreement, in cases where the material value is listed on the lessor’s balance sheet. If, according to the provisions of the concluded agreement, such property is included in the balance sheet of the lessee, then off-balance sheet account 011 is used to reflect such funds.

You might be interested in:

Account 90 in accounting: what is it used for, characteristics, examples of postings

How to determine the amount that should appear on the balance of account 03?

The enterprise's fixed assets are accumulated on account 01. An exception is made only for objects transferred to other persons for temporary use. These buildings, structures and other material assets will be reflected in a separate account 03.

The account is relevant in situations where the assets acquired by the company were not initially planned to be used for its own needs. Thus, we are not talking about fixed assets involved in production, but about property acquired for the purpose of making a profit - this is a special purpose and should be reflected in account 03. The procedure for determining the balance amount is the same as for account 01:

- funds are accepted at the original cost - the indicator consists of all costs that arose when purchasing the object, as well as during its installation or delivery;

- The accounting entries are the same as for account 01, with the only difference being that account 03 must be entered everywhere. Sub-accounts can be opened for the main account, taking into account the types of material objects - buildings, structures, transport, etc.;

- property goes to account 03 from account 08, which is required to determine the initial value of assets.

There are no other features or rules provided, so you should be guided by all those presented. To get a complete understanding of the transactions and features of the formation of the balance of account 03, let's look at a specific example.

Characteristics of account 03 – “Profitable investments in material assets”

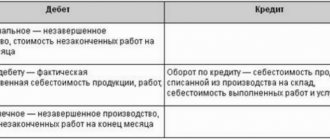

As indicated in the Chart of Accounts, account 03 is active. The debit balance of such an account reflects the presence at the beginning of the period of certain profitable investments in assets. The debit of the account reflects the receipt of objects, and the credit reflects their disposal.

The balance at the end of the period is calculated by adding the balance of profitable investments at the beginning of the period with the turnover on the debit of the account, and subtracting the turnover on the credit of this account from the resulting amount.

Analytics for the account under consideration is built by type of objects of profitable investment in assets, by tenants and lessees, and also by separately accounted assets.

In addition, a sub-account can be created on this account, which can be used to account for the disposal of objects reflected as profitable investments in tangible assets.

The debit of this subaccount must reflect the cost of the retiring material asset, and the credit - the amount of accumulated depreciation for this object. After this, this sub-account is closed, and the result obtained is applied either to other income or to other expenses of the company.

Attention! However, a business entity has the right not to use it, but to determine the financial result from the disposal of such an object directly on account 91. The chosen method must be fixed in the company’s Accounting Policy.

Instruction 03 account

According to the instructions for using the chart of accounts for accounting the financial and economic activities of organizations in accordance with Order No. 94n dated October 31, 2000:

Account 03 “Profitable investments in tangible assets” is intended to summarize information on the availability and movement of the organization’s investments in part of the property, buildings, premises, equipment and other assets that have a material form (hereinafter referred to as tangible assets), provided by the organization for a fee for a temporary use (temporary possession and use) for the purpose of generating income.

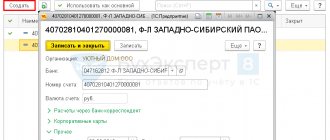

Material assets acquired (received) by an organization for provision for a fee for temporary use (temporary possession and use) are accepted for accounting in account 03 “Profitable investments in material assets” at their original cost based on the actual costs incurred for their acquisition, including expenses for delivery, assembly and installation.

Material assets acquired (received) by an organization for provision for a fee for temporary use (temporary possession and use) for the purpose of generating income are accepted for accounting as the debit of account 03 “Income-generating investments in material assets” in correspondence with account 08 “Investments in non-current assets".

Depreciation of material assets provided for temporary use (temporary possession and use) for the purpose of generating income is accounted for in account 02 “Depreciation of fixed assets” separately.

To account for the disposal (sale, write-off, partial liquidation, transfer free of charge, etc.) of material assets recorded in account 03 “Income-generating investments in material assets,” a subaccount “Retirement of Material Assets” can be opened for it. The cost of the disposed object is transferred to the debit of this subaccount, and the amount of accumulated depreciation is transferred to the credit. Upon completion of the disposal procedure, the residual value of the object is written off from account 03 “Income-generating investments in tangible assets” to account 91 “Other income and expenses.”

Analytical accounting for account 03 “Profitable investments in material assets” is carried out by type of material assets, tenants and individual objects of material assets.

By debit of the account

| Contents of a business transaction | Debit | Credit |

| A land plot purchased for rent has been registered | 03 | 08-1 |

| A natural resource management facility purchased for rental has been capitalized | 03 | 08-2 |

| An object of fixed assets built by an organization and intended for rental has been capitalized | 03 | 08-3 |

| Fixed asset item purchased for rental | 03 | 08-4 |

| The initial cost of property intended for rental, which was recorded incorrectly, has been adjusted | 03 | 76-2 |

| Property intended for rental, received as a contribution under a joint activity agreement, was capitalized (on a separate balance sheet of the joint activity) | 03 | 80 |

By account credit

| Contents of a business transaction | Debit | Credit |

| Property intended for rental was transferred to fixed assets | 01 | 03 |

| Depreciation on retired property intended for rental is written off to reduce its original cost | 02 | 03 |

| The cost of insured property intended for rental as a result of its damage or destruction is written off from insurance compensation | 76-1 | 03 |

| Property intended for rental is transferred to a participant in a simple partnership upon termination of the agreement on joint activity (on a separate balance sheet of the joint activity) | 80 | 03 |

| The residual value of property intended for rental and disposed of as a result of sale, write-off, liquidation is included in other expenses | 91-2 | 03 |

| The cost of property intended for rental due to emergency circumstances is written off as other expenses | 91-2 | 03 |

| There is a shortage of property intended for rental | 94 | 03 |

Tags: wiring

Specifics of profitable investments in real estate

Real estate is a special kind of property. According to the law, it is necessary to register ownership with the issuance of an appropriate certificate.

In this regard, accountants sometimes have a question: in what period of time to transfer the value of an object from account 08 to account 03 - before receiving the certificate, or after that.

There is one more feature associated with real estate objects. The law obliges to calculate and transfer property taxes to the budget. This must be done for the first time on the 1st day of the month, which follows the month of its acceptance for registration in the business entity.

PBU 6/01 establishes the rule that an object begins to be accounted for in account 01 or 03 from the moment it fully meets the criteria of a fixed asset. At the same time, this document does not say a word about the need to wait for official paper from a government agency - a certificate. The Ministry of Finance and the Federal Tax Service adhere to the same position in their letters.

Attention! At the same time, it is recommended that the organization itself does not have any confusion - which object has already received state registration and which has not, and that they be taken into account in different sub-accounts. For example, within the group, open two sub-accounts - “Objects that have passed state registration” and “Objects awaiting state registration”.

How to evaluate profitable investments

When assessing income-generating investments, the same rules are used as for fixed assets.

You might be interested in:

Chart of accounts for [year] with explanations and entries

Initially, the value of such an asset is collected from its direct value, reduced by the amount of taxes, as well as all related expenses.

The latter may include:

- Transportation costs;

- Costs of engaging third-party specialists (for example, appraisers);

- Travel and fuel expenses, if they were associated with the acquisition of this object;

- Mandatory deductions, customs payments and state duties;

- Cost of materials used;

- etc.

Thus, all costs associated with the purchased object are collected in account 08. This is done until it is ready to be rented out or leased to generate income. After completion of all necessary work, the accumulated costs for the facility are transferred in one amount to account 03.

Attention! The state duty, if it was paid before the cost was transferred to account 03, can also be included in the costs of the object. Otherwise, it should be taken into account in account 91.

Which accounts does account 03 correspond to?

From the debit of account 03, postings can be made to the following accounts:

- 08—acceptance of acquired property for accounting as an income-generating investment;

- 76 - the value of the property for rent is being clarified due to a previously made mistake;

- 80 - property for rent was received from the participant as a contribution to the authorized capital.

On the credit of account 03, debit correspondence entries can be made with the following accounts:

- — transfer of property from the category of profitable investments to fixed assets;

- — write-off of depreciation of a retiring income investment;

- 76 - compensation for part of the cost of a profitable investment through insurance due to its damage;

- 80 - property was transferred to the founders upon their withdrawal from the company;

- 91 - the value of property is written off upon disposal or sale;

- 94 - the shortage of income-generating property is reflected;

- 99 - write-off of the value of an income-generating investment as a result of its loss due to an emergency.

Results

Assets intended for rental are recorded by the company in account 03 - Income-generating investments in tangible assets. In the account - Income-generating investments in tangible assets - property is accounted for according to rules similar to those for accounting for assets in account 01: before putting it into operation, you need to take into account all costs related to the property, and subsequently calculate depreciation.

Sources

- https://buhproffi.ru/buhuchet/schet-03.html

- https://assistentus.ru/buhgalterskie-scheta/schet-03-dohodnye-vlozheniya-v-materialnye-cennosti/

- https://nalog-nalog.ru/buhgalterskij_uchet/vedenie_buhgalterskogo_ucheta/schet_03_dohodnye_vlozheniya_v_materialnye_cennosti/

- https://BuhSpravka46.ru/buhgalterskiy-plan-schetov/schet-03-v-buhgalterskom-uchete-dohodnyie-vlozheniya-v-materialnyie-tsennosti.html

- https://superbu.ru/schet-03-dohodnye-vlozheniya-v-materialnye-czennosti/

Accounting entries for account 03

The postings that are made with account 03 are in many ways similar to those made for fixed assets.

| Debit | Credit | Operation description |

| Acquisition of property | ||

| Property purchased for further rental | ||

| 19 | 60 | VAT is deducted from the sales amount |

| 68 | 19 | VAT credited |

| 03/1 | 08 | The acquired property is accounted for as an income-generating investment. |

| Renting, leasing | ||

| 03/2 | 03/1 | Transfer of property for rent or leasing |

| 02 | Depreciation has been calculated | |

| 03/1 | 03/2 | Return of property previously leased, leasing |

| Disposal of property | ||

| 03/Disposal | 03/1 | The value of the property is written off |

| 02 | 03/Disposal | Accrued depreciation on retiring assets was written off |

| 91 | Property sold | |

| 91 | 68 | VAT accrued on the sale of property |

| 91 | 03/Disposal | Residual value written off as expenses |