Article 136 of the Labor Code of the Russian Federation establishes the payment of wages at least twice a month.

For the first half of the month worked, the payment is made on a certain date, which must be set between the 16th and the last day of the current month.

This payment is called an “advance” in the accounting profession.

During the production process, there are often cases when the first half of the month is not fully worked out. For example, an employee was on sick leave.

What to do if a person was on sick leave, is he entitled to an advance? Do I need to accrue and pay?

Article 136 of the Labor Code of the Russian Federation establishes the payment of wages at least twice a month.

For the first half of the month worked, the payment is made on a certain date, which must be set between the 16th and the last day of the current month.

This payment is called an “advance” in the accounting profession.

During the production process, there are often cases when the first half of the month is not fully worked out. For example, an employee was on sick leave.

On payment of an advance in a fixed amount.

Sverdlovsk Region Sevastopolseye Ossetia-Alania Rep. Smolensk region. Stavropolskoye region of Tatarstan, responal region of the Tom Tulskiy Region Veteleskaya region of the Udmurt Republic of Ulyanovsk region of the Khanty-Mansi Auto. env. - Yugra, Chelyabinsk region, Chechen Republic, Chuvash Republic, Chukotka Autonomous Region. vicinity of the Yamalo-Nenets Autonomous District. okr. Yaroslavl region.

This is important to know: Sick leave length of service in 2021

What liability will the employer be held accountable for failure to pay the advance? How to correctly determine the amount of the advance?

Although the employee insists that before the onset of incapacity he worked a working week, for which we were obliged to pay him in accordance with the law. Payment of benefits must be made on the same days when the enterprise pays wages to employees.

The question of what deadlines need to be set for payment of wages was also discussed in the article by E.A.

It is worth noting that the norm of Part 6 of Art. 136 of the Labor Code of the Russian Federation is imperative in nature, therefore, its application does not depend on the will of employees. The fact is that in practice there are still situations where employers pay wages once a month based on the relevant statements of employees.

Today we suggest you familiarize yourself with the topic: “is an advance payment due if a person was on sick leave?” We tried to fully cover the topic. If you have any questions, you can ask them in the comments after the article or to our duty lawyer.

This situation will affect the ability to receive temporary disability benefits as soon as possible.

Please tell me I was on sick leave and quit my job. Will I be paid my sick leave right away or will my salary be paid only in the next advance payment?

In particular, these include: settlement (non-advance) and advance method. With the calculation method, wages for the first half of the month are calculated specifically for the days worked.

Is the salary due for the first half of the month if a person is sick?

According to Art. 136 of the Labor Code of the Russian Federation, wages are paid in proportion to the time worked.

If an employee was on sick leave for several days in the first half of the month, then an advance will be credited to him.

The amount is calculated based on the days on which the employee performed his official duties.

The advance amount is calculated in a similar way when the employee was on vacation -.

Example

Condition:

Salary – 10,000.

In March 2021, the standard working time is 20 days.

From March 1 to March 5, the employee was on sick leave.

In fact, in the first half of the month, taking into account weekends and holidays, the employed person worked 3 days.

Calculation:

Average daily earnings for March are: 10,000: 20 = 500.

The advance will be: 500 * 3 = 1500.

When is disability benefits paid?

The answer to this question depends on the period during which the employee was on sick leave.

In accordance with Part 1 of Art. 15 of Law No. 255-FZ, the employer is given 10 days to calculate benefits from the date of submission of sick leave.

Payment must be made on the next payday.

The law does not define such a thing as an “advance”; what is usually called an advance is, in fact, a payment of wages.

The internal regulations of the enterprise may establish a provision on whether to include sick leave in the advance payment or not.

In this case, it is necessary to take into account the deadlines established by law for the payment of temporary disability benefits.

Examples

When paid:

The day of payment of wages for the first half of the month worked is established by the internal regulations of the enterprise on the 20th.

The employee submitted a certificate of incapacity for work on the 7th of the current month.

The law allocates 10 calendar days for calculating benefits, which means that the accounting department must accrue benefits no later than the 17th.

The next pay day is the 20th, which means the benefit should be included in the advance payment.

When not paid:

At the same enterprise, the employee presented a certificate of incapacity for work on the 14th.

The accounting department has the right to accrue benefits until the 24th.

The next payday will come next month, so the benefit amount may not be included in the advance payment.

An economic entity has the right to reduce the timing of benefits accrual in the interests of the employee. For example, set the accrual period to three days.

This situation will affect the ability to receive temporary disability benefits as soon as possible.

It is impossible to increase the time frame for calculating sick pay, as this is contrary to the law and infringes on the rights of employees.

If wages are paid through a credit institution, then it does not matter where the employee is on the day of payment.

If the employee has days worked during the paid period, the advance must be paid.

If payment is made in cash through the enterprise’s cash desk, then the funds will be at the enterprise within five days.

During this period, it will be possible to receive a salary by issuing a power of attorney for your representative.

If the employee has recovered during this period, he can receive his salary personally. While on sick leave, you should not appear in person at production, even for a short time.

Inspecting authorities may regard this as a violation of hospital regulations.

After 5 days, the salary will be transferred to the depositor and returned to the bank. After recovery, the company’s accountant will have to pay wages upon the employee’s first request, returning the amount from the bank.

When is sick leave paid in 2020?

No one is insured against temporary disability. Under such circumstances, many are interested in paying for sick leave, because no one wants to lose their regular income, especially since treatment also requires additional expenses.

There are no significant changes expected in the preparation and financing of sick leave certificates in 2021. Let’s take a closer look at what the Federal Law of Russia says about who and in what order is obliged to pay for a worker’s sick time. Sick leave is paid according to the Labor Code of the Russian Federation and Federal Law No. 255. These are the two main standards in the area under consideration.

According to labor law, sick leave is paid according to the number of years of insurance coverage of a person and his income. Let's talk about payments for the first sick leave of the year, as well as for the second sick leave of the year. Sick leave must be paid when the following circumstances occur:

- caring for a disabled family member;

- illness or injury to a worker;

- follow-up treatment in a sanatorium after being treated in a hospital.

- pregnancy and childbirth;

- the need for prosthetics according to medical recommendations;

- quarantine of the worker or his relative;

- rehabilitation after surgery;

However, it is not always possible to receive money for the time that a person is in a medical institution.

For example, these include the following situations:

- committing a suicide attempt;

- the first 5 days upon receipt of a domestic injury;

The Labor Code establishes that sick time of an officially employed citizen must be paid.

conclusions

If the employee worked during the billing period, then the advance is credited to him regardless of whether he was on sick leave or not.

The benefit is included in the salary for the first half of the month, provided that the day of submitting the certificate of incapacity for work falls within the deadlines established by law.

The employee has been on sick leave for a long time; the last sick leave was closed on 04/29/2019. At the moment, the employee is also on sick leave. There are no hours worked on the time sheet for May. Is an advance payment due to an employee?

June 17, 2019

Having considered the issue, we came to the following conclusion: Since the employee did not fulfill his job duties during the first half of the month during this entire period, he is not entitled to wages (advance) during this time. Temporary disability benefits are assigned and paid to the employee after the certificate of incapacity for work is provided.

Justification for the conclusion: Part six of Art. 136 of the Labor Code of the Russian Federation stipulates that wages are paid at least every half month. The remuneration for the first half of the month is traditionally called an advance. However, the law requires wages to be paid at least every half month. Therefore, the amount paid for the first half of the month cannot be arbitrary and must be determined taking into account the time actually worked by the employee (the work actually performed by him). This is stated in the letter of Rostrud dated 09/08/2006 N 1557-6, as well as in the letters of the Ministry of Labor of Russia dated 08/05/2013 N 14-4-1702 and dated 02/03/2016 N 14-1/10/B-660. According to Art. 129 of the Labor Code of the Russian Federation, wages (employee remuneration) are remuneration for work depending on the employee’s qualifications, complexity, quantity, quality and conditions of the work performed, as well as compensation payments and incentive payments. By virtue of part one of Art. 132 of the Labor Code of the Russian Federation, the salary of each employee depends on his qualifications, the complexity of the work performed, the quantity and quality of labor expended. In turn, temporary disability benefits as a type of insurance coverage for compulsory social insurance are intended to compensate citizens for lost earnings due to the onset of temporary disability (clause 1, part 1, article 1.2, clause 1, part 2, article 1.3, clause 1 Part 1 Article 1.4 of Federal Law No. 255-FZ of December 29, 2006; hereinafter referred to as Law No. 255-FZ). Based on the foregoing, we can conclude that if an employee was temporarily disabled for this entire period in the first half of the month (did not fulfill his job duties), he is not entitled to wages during this time. The basis for the appointment and payment of temporary disability benefits is a certificate of incapacity for work, issued in the form approved by Order of the Ministry of Health and Social Development of Russia dated April 26, 2011 N 347n (Part 5 of Article 13 of Law N 255-FZ). The employer must assign the benefit within 10 calendar days from the date the employee applies with the necessary documents to receive the benefit (Part 1, Article 15 of Law No. 255-FZ). The assigned benefit is paid in the same manner as the employee is paid wages: payment is made on the day closest to the assignment of the benefit, established for the payment of wages (Part 8 of Article 13, Part 1 of Article 15 of Law No. 255-FZ). Consequently, in the absence of a certificate of incapacity for work, the employer cannot assign and pay the appropriate benefit to the employee.

Answer prepared by: Expert of the Legal Consulting Service GARANT Elena Voronova

The answer has passed quality control

Erroneously paid advance to an employee. Personal income tax.

The answer was prepared by experts of the Atlant-law consultation line

Ask your question

01.11.2016

Question: The employee was paid an undeserved advance. There is no way to withhold personal income tax. Tell us what our next steps are and how to correctly reflect this in the 6 personal income tax report. Is it possible to withhold this erroneously paid amount? If we can’t keep it, how can we reflect this in accounting now? Do I need to notify the tax office now about the impossibility of withholding and remitting tax? It was clarified over the phone that the employee had been paid an advance for days not worked (he was absent for unknown reasons and could not yet be contacted). Answer: Based on Part 6 of Article 136 of the Labor Code of the Russian Federation, wages are paid at least every half month. The Labor Code of the Russian Federation does not define the concept of “advance”. In practice, an advance on wages means payment of wages for the first half of the month. According to the explanations of officials (Letters of the Ministry of Labor of Russia dated 02/03/2016 N 14-1/10/В-660, Rostrud dated 09/08/2006 N 1557-6), when determining the amount of the advance, the time actually worked by the employee (actually completed work) should be taken into account. According to Article 137 of the Labor Code of the Russian Federation, deductions from an employee’s salary are made only in cases provided for by the Labor Code of the Russian Federation and other federal laws. In particular, deductions from an employee’s salary may be made to reimburse an unearned advance paid to the employee on account of wages. The employer has the right to decide to deduct from the employee’s salary no later than one month from the date of expiration of the period established for the return of the advance payment, repayment of debt or incorrectly calculated payments, and provided that the employee does not dispute the grounds and amount of the deduction. Since withholding is possible only if the employee does not dispute its grounds and amounts (Part 3 of Article 137 of the Labor Code of the Russian Federation), the employer must obtain the written consent of the employee (for the meaning, see Letter of Rostrud dated 08/09/2007 N 3044-6-0) . Such consent to retention is drawn up in free form. The decision to withhold is formalized by order (instruction). Since there is no unified form for such an order (instruction), it is issued in free form. In this case, the employee is absent for unknown reasons. Before obtaining the appropriate consent from the employee, it is unlawful to make a deduction. In order to obtain consent from the employee to withhold an unearned advance payment, an appropriate request for consent may be sent to him, for example, by registered mail with a list of attachments and acknowledgment of delivery. In addition, in this case, it is necessary to find out the reason for the employee’s absence from the workplace, so in the letter we also recommend asking for an explanation from the employee about the reasons for his absence. In any case, until any information is received from the employee, there is no reason to withhold from him the amount erroneously transferred to him. It is also worth considering here that, by virtue of Part 4 of Article 137 of the Labor Code of the Russian Federation, wages overpaid to an employee (including in the event of incorrect application of labor legislation or other regulatory legal acts containing labor law norms) cannot be recovered from him, except for the following cases: - counting error; — if the body for the consideration of individual labor disputes recognizes the employee’s guilt in failure to comply with labor standards (Part 3 of Article 155 of the Labor Code of the Russian Federation) or downtime (Part 3 of Article 157 of the Labor Code of the Russian Federation); - if the wages were overpaid to the employee in connection with his unlawful actions established by the court. The concept of “counting error” Art. 137 of the Labor Code of the Russian Federation does not disclose. In practice, it is understood as an arithmetic error, i.e. an error made as a result of incorrect application of arithmetic operations (multiplication, addition, subtraction, division) in calculations (letter of Rostrud dated October 1, 2012 N 1286-6-1). Technical errors by the employer, for example, repeated payment of wages for one period, are not recognized as accounting errors (Definition of the Supreme Court of the Russian Federation dated January 20, 2012 N 59-B11-17). Thus, in this case, it is unlikely that it will be possible to withhold the excessively transferred amount under the guise of a counting error. As for the reflection of the overpaid amount in accounting, at the time of payment the following entry is reflected: Debit 70 Credit 51 - reflects the transfer of an advance towards wages. Since the date of actual receipt of income in the form of wages is the last day of the month for which it was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation), personal income tax is not withheld at the time of payment of the advance. If by the end of the month it becomes clear that the employee has not worked a single day, there are no grounds for calculating wages. The procedure for personal income tax on an unearned advance and, accordingly, the procedure for filling out form 6-NDFL depends on further developments: - if the employee agrees to withhold the excess amount transferred to him from a future salary or returns the amount voluntarily, then the income subject to personal income tax will it does not arise. In this case, the excess transferred amount is not reflected in Form 6-NDFL; — if the employee does not agree to withhold the amount transferred to him in excess and refuses to voluntarily return this amount, the company has the right to go to court. However, taking into account the provisions of Article 137 of the Labor Code of the Russian Federation, the company’s chances of winning the case in court are minimal. If the excess transferred amount cannot be recovered from the employee (for example, the court refuses to collect it, or the employee refuses to return the amount and the company decides not to withhold the amount from the salary and not go to court), the employee will have taxable income (Article 41, paragraph. 1 Article 210 of the Tax Code of the Russian Federation). The company can withhold personal income tax from the specified income from the next payments (for example, from the salary for the next month), or, if during the current year the company is unable to make the withholding (the employee is fired or the amount of his income is not enough to withhold), at the end of the year in no later than March 1 of the following year, the organization should notify in writing the taxpayer and the tax authority at the place of its registration about the impossibility of withholding tax, the amount of income from which tax was not withheld, and the amount of unwithheld tax (clause 5 of Article 226 of the Tax Code of the Russian Federation). The procedure for filling out form 6-NDFL (approved by Order of the Federal Tax Service of Russia dated October 14, 2015 N ММВ-7-11/ [email protected] ) does not contain specific instructions on the procedure for including amounts erroneously transferred to an employee in form 6-NDFL. In this case, we recommend that you seek clarification directly from the tax authorities at the place of registration of the organization (clause 1, clause 1, article 21, clause 4, clause 1, article 32 of the Tax Code of the Russian Federation). Thus, in this case, without the employee’s consent, it is unlawful to withhold the excess amount transferred to him. Taxable income will arise for the employee if the amount cannot be returned (voluntarily or through the court). Personal income tax on the specified income may be withheld from the next payments to the employee. If by the end of the year it is not possible to withhold all the tax, the impossibility of withholding should be reported to the tax authorities.

The answer was prepared by experts of the Atlant-law consultation line

Ask your question

Is an advance required if a person was on sick leave?

Having considered the issue, we came to the following conclusion: As an advance, the employee must be paid wages for the first half of the month in proportion to the time actually worked for a given period of time. If one day is worked in the first half of the month, the employee must be paid wages for that day; if there was no time worked in the specified period, the employee is not paid wages. The employer must assign the benefit within 10 calendar days from the date the employee applies with the necessary documents to receive the benefit. The assigned benefit is paid in the same manner as the employee is paid wages: payment is made on the day closest to the date of payment of wages after the benefit is assigned.

Answer prepared by: Expert of the Legal Consulting Service GARANT Troshina Tatyana

Response quality control: Reviewer of the Legal Consulting Service GARANT Sutulin Pavel

October 28, 2021

The material was prepared on the basis of individual written consultation provided as part of the Legal Consulting service.

Taxes and Law

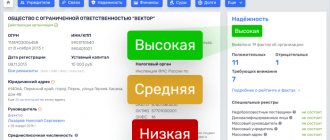

In practice, there are several ways to calculate payroll. In particular, these include: settlement (non-advance) and advance method. With the calculation method, wages for the first half of the month are calculated specifically for the days worked. With the advance method, the number of days worked in the first half of the month does not affect the amount of wages for this period. In this case, wages for the first half of the month are paid in a fixed amount - up to 50% of the salary or tariff rate. The specific method of calculating wages is determined by the employer and is prescribed in local regulations that establish the wage system in the organization.

If an employee is unable to receive wages on the specified day (including due to temporary disability), the funds due to him must be deposited (clause 9 and clause 18 of the Procedure for Conducting Cash Transactions in the Russian Federation, approved by the Decision of the Board of Directors Central Bank of Russia dated September 22, 1993 No. 40). Salaries are paid upon the employee's first request.

Thus, the employer’s obligation to pay wages for the first half of the month in each specific case depends on the wage system established in the organization, the number of days actually worked in the accounting period, as well as the start and end dates of temporary disability (if any).

Ask a free question to a lawyer!

- Nizhny Novgorod region.

- Novgorod region

- Novosibirsk region

- Omsk region

- Orenburg region

- Oryol region

- Penza region

- Perm region

- Primorsky Krai

- Pskov region

- Rostov region

- Ryazan region

- Samara region

- Saint Petersburg

- Saratov region

- Sakha (Yakutia) rep.

- Sakhalin region

- Sverdlovsk region.

- Sevastopol

- North Ossetia-Alania rep.

- Smolensk region

- Stavropol region

- Tambov region

- Tatarstan, rep.

- Tver region

- Tomsk region

- Tula region

- Tyva rep.

- Tyumen region

- Udmurt Republic

- Ulyanovsk region

- Khabarovsk region

- Khakassia rep.

- Khanty-Mansiysk Autonomous Region

How is advance money credited to an employee if he is sick on the payment day?

If wages are paid through a credit institution, then it does not matter where the employee is on the day of payment.

If the employee has days worked during the paid period, the advance must be paid.

If payment is made in cash through the enterprise’s cash desk, then the funds will be at the enterprise within five days.

During this period, it will be possible to receive a salary by issuing a power of attorney for your representative.

If the employee has recovered during this period, he can receive his salary personally. While on sick leave, you should not appear in person at production, even for a short time.

Inspecting authorities may regard this as a violation of hospital regulations.

After 5 days, the salary will be transferred to the depositor and returned to the bank. After recovery, the company’s accountant will have to pay wages upon the employee’s first request, returning the amount from the bank.

An example of calculating temporary disability benefits due to an employee’s illness is discussed in detail in this video:

If the employee worked during the billing period, then the advance is credited to him regardless of whether he was on sick leave or not.

The benefit is included in the salary for the first half of the month, provided that the day of submitting the certificate of incapacity for work falls within the deadlines established by law.

Didn't find the answer to your question in the article?

Get instructions on how to solve your specific problem. Call now:

here - if you live in another region.

Deadlines for paying sick leave in 2020

01 September 2021 at 15:43 Sick leave is a document confirming that a person was absent from work for a good reason.

The law guarantees the preservation of average earnings and a job for a person during his illness, therefore it is important for both employers and employees to know how and when sick leave is paid.

Let's figure out what the law says on this matter.

Related Articles Table of Contents If you find an error in the text, please let us know by highlighting it and pressing Ctrl+Enter Before you understand when payment is due, you need to figure out who makes the payment and how.

Help me find out if an advance is due.

Are there accountants here? Please, tell me whether an advance is due and how much in the following situation: a person went on sick leave on September 24 and will return from sick leave around October 18, whether they will pay him an advance for October or not and how much if they pay (all or part). Usually at this enterprise an advance is paid on the 25th of the current month (that is, an advance for September, for example, was given on September 25) and pay is paid on the 15th of the next month. That is, the person will work for 1 week only until the advance payment is made. Usually they pay on average for sick leave, they just never took such long sick leave, so we don’t know, but we still have a loan.

Woman.ru experts

Find out the opinion of an expert on your topic

Gorfinkel Anna Alexandrovna

Psychologist. Specialist from the site b17.ru

Lukanova Anna Alexandrova

Psychologist. Specialist from the site b17.ru

Erofeeva Valentina Vladimirovna

Psychologist, Online consultant. Specialist from the site b17.ru

Agafonova Evgenia Leontievna

Psychologist, Bioenergy therapist. Specialist from the site b17.ru

Starostina Lyudmila Vasilievna

Psychologist, Practical psychologist. Specialist from the site b17.ru

Klimova Anna Georgievna

Psychologist, Systemic family therapist. Specialist from the site b17.ru

Kostyuzhev Artyom Sergeevich

Psychotherapist, Sexologist. Specialist from the site b17.ru

Lydia Shumina

Psychologist, Clinical Psychology Psychotherapy. Specialist from the site b17.ru

Shiyan Olga Vasilievna

Psychologist, Psychologist-consultant. Specialist from the site b17.ru

Tankova Oksana Vladimirovna

Psychologist, Online consultant. Specialist from the site b17.ru

call your accounting department and ask

Most likely no . An advance is paid if a person at the time of calculation has 6 days worked for the current month. That's how they explained it to me at our bay. True, I found out in connection with the vacation

Unfortunately, the advance will not be paid, since half of the month has not been worked (meaning from the 1st to the 15th). Now there is no concept of “advance”; there is wages for the first half of the month.

They may pay, they may not. You need to read the employee’s employment contract and the company’s remuneration regulations. Personally, I would call the accounting department, explain that I am on sick leave and ask for an advance payment. but it all depends on the employer and the rules for paying advances in the company.

Most likely no . An advance is paid if a person at the time of calculation has 6 days worked for the current month. That's how they explained it to me at our bay. True, I found out in connection with the vacation

Well, okay, who knows, sick leave for September (from September 24 to September 30) - when should this part be paid? Also in November or can this part be paid earlier?

Well, okay, who knows, sick leave for September (from September 24 to September 30) - when should this part be paid? Also in November or can this part be paid earlier?

the advance, on October 25, can be paid in the amount of sick leave, if the accounting department has time to calculate the sick leave. or they may “not make it in time” (many people do this on purpose), because it turns out that the person brought sick leave on October 19th. An accountant can pay within 10 calendar days, i.e. until October 29. which means that 25 people may also receive nothing. and will receive the benefit only on November 15th. it all depends on the accountant. Each accounting department has its own nuances. so it's better to call and ask everything.

Well, okay, who knows, sick leave for September (from September 24 to September 30) - when should this part be paid? Also in November or can this part be paid earlier?

the advance, on October 25, can be paid in the amount of sick leave, if the accounting department has time to calculate the sick leave. or they may “not make it in time” (many people do this on purpose), because it turns out that the person brought sick leave on October 19th. An accountant can pay within 10 calendar days, i.e. until October 29. which means that 25 people may also receive nothing. and will receive the benefit only on November 15th. it all depends on the accountant. Each accounting department has its own nuances. so it's better to call and ask everything.

Advance is the salary for the first half of the month. And since the salary is calculated for the month as a whole, the advance, as a rule, is given either as a percentage of the salary or in a fixed amount. If you were sick for half a month, what is the advance payment for? What if you don’t bring your sick leave because you skipped work? or did they violate the regime and they didn’t give it to you? or were you staying at home according to a certificate? Accounting doesn't take your word for it, bring the document and they'll count it for you. All.

Actually, there is no advance payment required!! But you must pay all sick leave on the day of the advance! That is, from September to October - for all days! This is 100% - I am a salary accountant

Actually, there is no advance payment required!! But you must pay all sick leave on the day of the advance! That is, from September to October - for all days! This is 100% - I am a salary accountant

Are there accountants here? Please, tell me whether an advance is due and how much in the following situation: a person went on sick leave on September 24 and will return from sick leave around October 18, whether they will pay him an advance for October or not and how much if they pay (all or part). Usually at this enterprise an advance is paid on the 25th of the current month (that is, an advance for September, for example, was given on September 25) and pay is paid on the 15th of the next month. That is, the person will work for 1 week only until the advance payment is made. Usually they pay on average for sick leave, they just never took such long sick leave, so we don’t know, but we still have a loan.

I don’t understand why everyone claims that an advance for September is not due if a person worked before the 24th. They will pay the advance on the 25th, then they will pay the rest of the salary for September, after leaving sick leave, they will pay the sick leave. An advance payment for October may or may not be issued. This is not the salary for the first half, but about 40% of the salary. Therefore, look, if you don’t want to be left without a salary later (since the first half of the month you will have paid sick leave, and then they will give you an advance), then take the money in advance. I would prefer to receive them in my salary when they make an accurate calculation. Otherwise you still have to stay.

16 - read carefully, for September the person received everything on the 25th. An advance is exactly the rounded salary for the first half of the month, it can be in any amount - for example, our employees refuse to take more than 2 thousand in interest, but we are obliged to give at least some amount. They have the right not to give money in advance; this is all at the discretion of the authorities.

Lily advance, October 25, can be paid in the amount of sick leave if the accounting department has time to calculate the sick leave. or they may “not make it in time” (many people do this on purpose), because it turns out that the person brought sick leave on October 19th. An accountant can pay within 10 calendar days, i.e. until October 29. which means that 25 people may also receive nothing. and will receive the benefit only on November 15th. it all depends on the accountant. Each accounting department has its own nuances. so it’s better to call and ask everything. That is, it’s better to check out on the 15th, if possible?

Author Lilyavans, October 25, they can pay in the amount of sick leave if the accounting department has time to calculate the sick leave. or they may “not make it in time” (many people do this on purpose), because it turns out that the person brought sick leave on October 19th. An accountant can pay within 10 calendar days, i.e. until October 29. which means that 25 people may also receive nothing. and will receive the benefit only on November 15th. it all depends on the accountant. Each accounting department has its own nuances. so it’s better to call and ask everything. That is, it’s better to check out on the 15th, if possible? If it’s possible, then it’s better yes. and if they don’t give you anything by 10/25, you can safely demand yours, namely sick leave, which falls within these deadlines.

went on sick leave on March 6, left on March 18, is advance payment due?

advance payment on the 25th and since the 18th I have been on vacation, should the advance be paid?

Is an advance required? if you went on sick leave after the New Year holidays

Most likely no . An advance is paid if a person at the time of calculation has 6 days worked for the current month. That's how they explained it to me at our bay. True, I found out in connection with the vacation

I am on vacation from March 16 to March 29 inclusive... I received vacation pay and a salary for February. I am entitled to an advance.

Am I entitled to an advance if I worked from April 1 to April 11 and went on sick leave and left on April 20?

Advance 30. salary - 14. points on vacation from June 5 to 18. and in the same month six shifts were worked (the schedule was 1/1). Is an advance due?

Please tell me I went on sick leave 11, the advance should be 25, the salary was 10, will there be an advance for me?

If you go on vacation from September 1 to September 14, you go back to work on the 15th. Advance on September 29, you are entitled to some percentage for the two weeks worked.

I'm going on vacation from the 1st to the 14th; advance payment on the 25th. Will they give it to me?

Please tell me, I worked 12 shifts for the first month, that is, until the 17th, and from April 17th I went on sick leave. Am I required to pay an advance on April 25th?

Hello! Please tell me, I was on vacation, then I left on December 2 (salary on the 14th, advance on the 27th) - should I receive an advance?

If the salary is 12 and the advance 27 is spent on sick leave, will 13 be an advance? Full or not?

Will there be an advance if I went on sick leave on August 15 and before that I worked until 1-14. And the end of July?

Forum: lifestyle

New for today

Popular today

The user of the Woman.ru website understands and accepts that he is fully responsible for all materials partially or fully published by him using the Woman.ru service. The user of the Woman.ru website guarantees that the placement of materials submitted by him does not violate the rights of third parties (including, but not limited to copyrights), and does not damage their honor and dignity. The user of the Woman.ru site, by sending materials, is thereby interested in their publication on the site and expresses his consent to their further use by the editors of the Woman.ru site.

Use and reprinting of printed materials from the woman.ru website is possible only with an active link to the resource. The use of photographic materials is permitted only with the written consent of the site administration.

Posting intellectual property objects (photos, videos, literary works, trademarks, etc.) on the woman.ru website is permitted only to persons who have all the necessary rights for such posting.

Online publication “WOMAN.RU” (Zhenshchina.RU)

Founder: Limited Liability Company "Hirst Shkulev Publishing"

What will be the advance payment if you are on sick leave?

In accordance with Resolution of the Council of Ministers of the USSR dated May 23, 1957 N 566 “On the procedure for paying wages to workers for the first half of the month,” which is in force insofar as it does not contradict the Labor Code of the Russian Federation, the amount of the advance on workers’ wages for the first half of the month is determined by agreement of the enterprise administration ( organization) with a trade union organization when concluding a collective agreement, however, the minimum amount of the specified advance must not be lower than the worker’s tariff rate for the time worked.

The advance is issued on the 15th. read answers (1) I have been on sick leave since October 25, 2015. Will I receive an advance in November if the sick leave is not closed? read answers (1) I was on sick leave from 7 to 14, should an advance be transferred to me, if he arrives on the 18th? read answers (2) Can the company not pay an advance if I have been on sick leave for a month? read answers (1) If I have been on sick leave since 11.0315, will they give me an advance? read answers (1) If a person is on sick leave on sick leave for the first half of the month, can he be paid an advance? read answers (1) Please explain whether the employer has the right not to give an advance of 5,000 if the employee is on sick leave? At the same time, he works without registration.. read answers (1) An advance is issued for time worked if the employee has gone on sick leave since March 7, 2014. read answers (1) Unified Telephone Legal Service Legal advice on any legal issues. Around the clock.

When sick leave is not paid + 2 examples

The overpayment for salary is essentially part of the payment for sick leave, which the employee brought on February 25, 2016. For sick leave, personal income tax is withheld on the day of payment from the cash register.

Those. It turns out that on January 15, we had to withhold personal income tax (in the amount of 1,170 rubles) from the advance payment (8,241 rubles), which later became part of the sick leave.

Articles on the topic (click to view)

- Is sick leave considered income?

- What to do if you have extended sick leave for pregnancy and childbirth

- What to do if your employer does not accept electronic sick leave

- What to do if you are not given sick leave

- How many days does it take for sick leave to arrive from the Social Insurance Fund?

- What to do if the place of work is not indicated on the sick leave

- Are sick leave taken into account when calculating maternity leave?

Should personal income tax be calculated and transferred from the salary on the day of accrual (01/31/2016)?

The existence of any acts in the organization that establish the payment of wages to employees only once a month.

The better the exchange of information between services is organized and the higher the degree of automation of accounting, the sooner wages can be calculated and paid. After setting the salary payment date, half a month (15 days) must be added to it. This is how the advance payment date is determined in accordance with the requirements of the Labor Code of the Russian Federation. An example of determining the amount of salary advance if the employee was on vacation in the first half of the month Manager of Alpha LLC A.S. Kondratiev took a three-day vacation from November 5 to 7, 2014.

Vote:

I want to draw the moderator’s attention to this message because: A notification is being sent... I really want to be a weak woman, but around me there are horses galloping and huts on fire...

Luka Russian Federation, Krasnoyarsk #3 March 1, 2010, 18:46 That is, in other words, here payment for sick leave actually contradicts Art.

136 of the Labor Code of the Russian Federation, which states that payments to employees must be made at least twice a month.

Right? How will labor inspectorates look at this? Arbitrage practice? Or are there nuances? I want to draw the moderator's attention to this message because: A notification is being sent...

Sometimes moving forward is the result of a kick in the ass...

Yamamadochki 01/14/2009 - 10:15

Something your director did wrong... Firstly, the director should under no circumstances be unauthorized and violate the collective agreement. Since it says at least 40% of the salary, it means that from 5,038 rubles you should have been paid 40% of this amount. Secondly, the days actually worked are not counted until the order is issued, but until the advance is paid. You worked from 8 to 20? It’s during this time that you should receive an advance. Thirdly, in general the management’s position is incomprehensible. If your sick leave is 100 percent paid, what difference does it make when exactly you come off sick leave? This is about the same as if an employer accrues vacation pay incompletely, thinking that suddenly you will immediately leave your vacation and won’t work off your vacation pay. And there will be nothing to keep them from.. Well, this is nonsense..

In other words, you misunderstood how to count the actual time worked. Not until the order (why is this order at all?) about accruing the advance, but until the moment of payment (well, in extreme cases, until the moment of accrual at least). But the most important thing is that, of course, the director should not violate the collective agreement with his orders.